Real BRICS Threat + The Worst Macros I’ve Ever Seen

In many recent articles and interviews, I’ve warned that Powell’s “higher for longer” war against inflation will actually (and ironically) lead to, well… greater inflation.

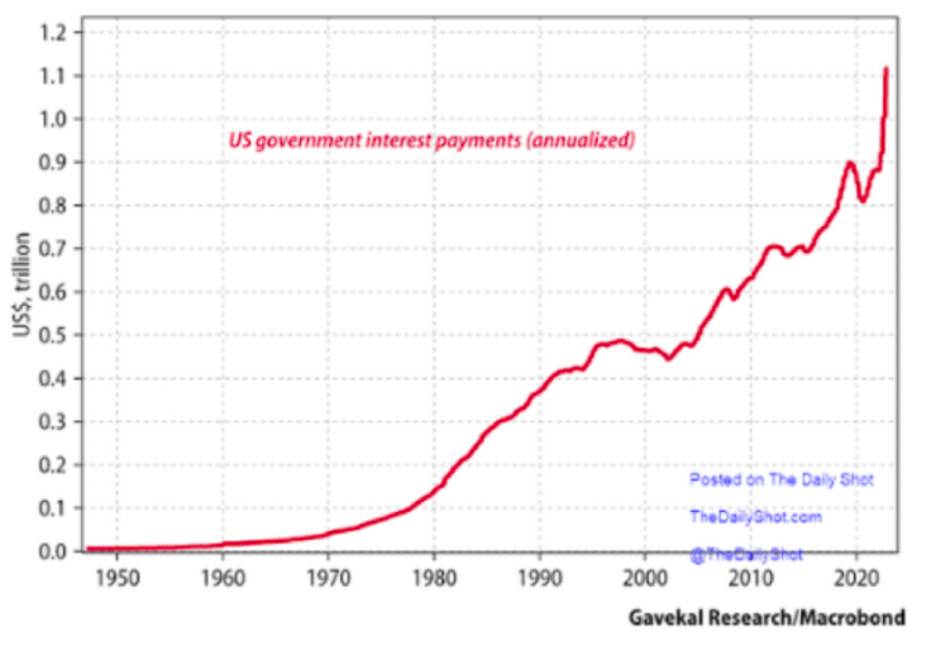

That is, the rising interest expense (nod to Powell) on Uncle Sam’s fatally rising 33T bar tab will inevitably need to be paid with an inflationary mouse-clicker at the Eccles Building.

I’ve also consistently maintained that Powell’s war on inflation is mostly just optics, as he secretly seeks inflation to help pay down that bar tab with an increasingly inflated/debased USD.

Powell achieves this open lie by publicly declaring a steady decline in inflation by simply misreporting the true CPI number.

As John Williams recently argued, true inflation using an honest (rather than the openly bogus BLS) measure is now closer to 11.5% rather than the officially reported headline rate of 3.7%.

This should come as very little surprise to those whose eyes are open to the Modis Operandi of debt-soaked/failed regimes. As former European Commission President, Jean-Claude Juncker confessed: “When the data is too bad, we just lie.”

But even for those who still believe the current Truman Show inflation (and “soft landing”) narrative out of DC, the Bezos Post or legacy media A, B, or C, there’s more fire adding to the inflationary flames than just bogus narratives and calming platitudes.

In particular, I’m talking about oil-driven inflation, and nothing burns faster.

Scary Flames in the Oil Supply

Left or right, the dumb out of DC just keeps getting dumber.

Between rising rates (nod to Powell), which make capex investing untenable for US oil producers, and a Weekend at Bernie’s White House, which has spent years effectively legislating US oil into oblivion, US energy supply is falling, and we all know that weakening supply leads to higher prices—and inflation.

Meanwhile, Saudi Arabia, whom that same White House called a “pariah state,” has not been warming to Biden’s awkward fist-pumps and increased production pleas, but rather joining other OPEC leaders in cutting, rather than expanding, oil production.

Gee, what a geopolitical shocker…

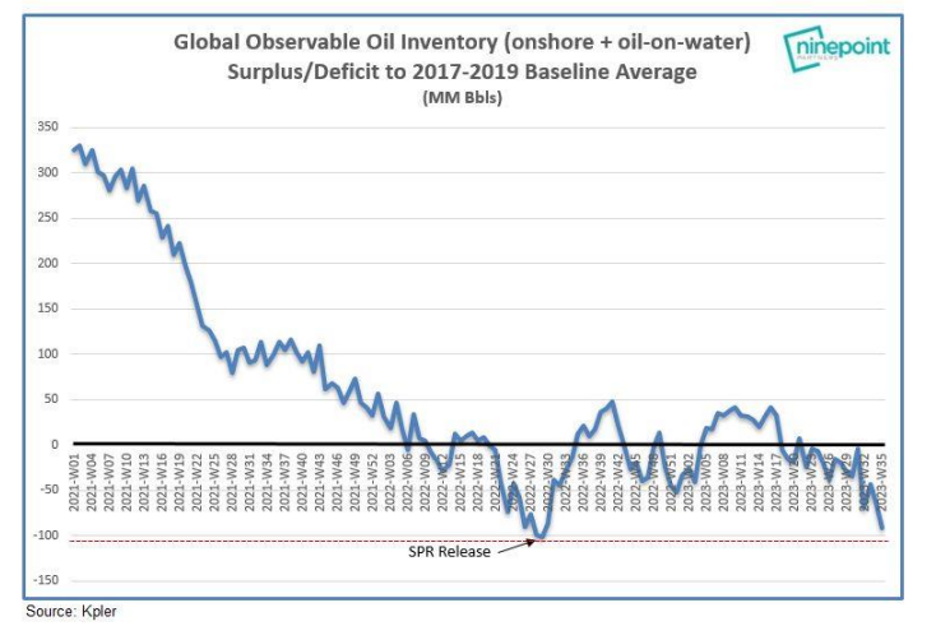

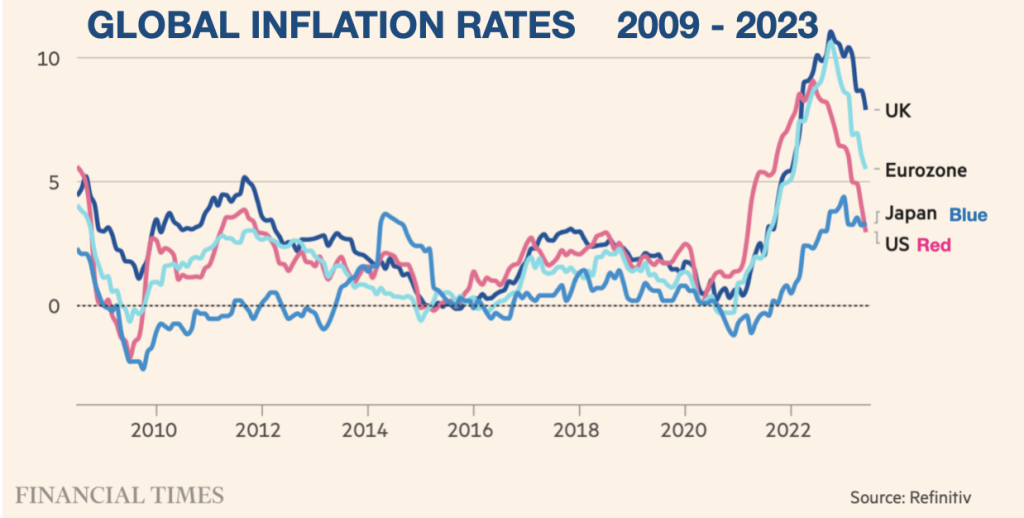

Net result, both national and global oil inventories are falling, and falling hard.

The Awkward Oil Two-Step

The once “go green” White House realized that the world, and inflation scales, still revolves around oil, especially after sanctioning Western Europe’s former energy supplier in one of the most short-sighted (i.e., stupid) policy decisions since the Iraq war.

This may explain why Biden changed his stripes and why there was a sudden pivot toward allowing greater US shale output in 2023 by pumping more cash into those shale fields at a pace not seen in 3 years.

Unfortunately, however, this may be too little too late (like Powell’s QT) to prevent oil price shocks and higher inflation into year end, thus adding insult to an already injured (and rising) US CPI measure of inflation.

As oil supply tightens, oil prices, and hence inflation rates, rise together with bond yields and interest rates—a perfect storm for over-inflated bond, stock, and real estate markets.

Those prices and inflation rates would be even worse if Chinese oil demand rises—which is why current Western headlines are literally praying for China to implode first. This might explain why The Economist has had two consecutive cover stories about an imploding China.

See how big media and big government sleep together?

Tying it Together

Regardless, we need to tie all this together.

If, as I see it, inflation (however misreported) becomes obviously more real and felt, the consequent rising bond yields will make the USD stronger and Uncle Sam’s bar tab more expensive, which hardy bodes well for America’s twin deficit black-hole of unpayable debt unless…

…Unless the Fed starts printing more fake and inflationary money to buy its own IOUs and weaken its export-killing, and BRICS-ignoring, USD.

Again, no matter how I turn the macros, the Fed will eventually have no choice but to pivot toward more instant liquidity and hence more inflationary policies to save/monetize its broke(n) bond markets.

Once this inevitability becomes a headline, the temporarily rising USD will be seen for what most of the informed world already recognizes—just another fiat monster backing a world reserve currency in the hands of a nation whose debt to GDP and deficit to GDP ratios mirror that of any other banana republic.

Reality is Hard to Look at Directly, But not for the BRICS

Many in the US or EU may not wish to see this. Bad news, like death and the sun, is hard to stare into.

But the BRICS nations, no strangers themselves to embarrassing balance sheets, are seeing this clearly.

Although I never bought into the gold-backed BRICS currency hype, I have zero doubt that this amalgam of commodity-heavy nations has a common enemy in the current US-dominated (and USD-driven) international trade system, whose hegemonic days are now numbered and whose alliances, as we warned from day-1 of the Putin sanctions (economic suicide), are forever de-dollarizing away from DC.

Moreover, the BRICS don’t need an “official” gold backed currency to trade their real assets in gold rather than Dollars. All they have to do, as Marcus Krall and I recently discussed, is request payment for their exports in gold.

The BRICS+ nations are hardly the perfect marriage of unlimited trust and efficient coordination. Nevertheless, they share an existential threat from an over-priced USD and negative-returning UST.

Furthermore, and as I recently noted at the Rule Symposium, they may not trust each other completely, but they do trust gold completely.

System Change is Now a Matter of Survival

Never has the phrase the “enemy of my enemy is my friend” found a better home than among the rising list of BRICS+ actors who recognize that their very survival hinges upon escaping the suffocating death of paying > $14T of USD-dominated debts whose rising costs (rates) they can no longer afford lest they become vassals of DC.

As Luke Gromen recently observed, from the perspective of the BRICS nations, it’s “either hang together or hang separately.”

A Changing Petrodollar?

China, for example, can not abide forever by a petrodollar system of oil purchases. As the world’s largest oil importer, it mathematically recognizes that it will eventually run out of dollars to buy that oil.

In short, China needs to come up with a better plan—outside the Greenback.

And they will.

By the way, have you noticed the next BRIC in the wall? It’s Saudi Arabia.

See a trend? See a looming change in oil currencies?

Just saying…

As I warned months ago, this Saudi trend away from DC and closer to Shanghai could eventually be a key driver in slowly unwinding the current petrodollar system between a once “friendly” US-Saudi relationship toward a now weakening relationship which hitherto ensured the global demand (and hence the survival) of an otherwise debased paper Dollar.

If the petrodollar system radically or even slowly unwinds, this will do far more to destroy demand and the inherent purchasing power of the USD (and send gold skyrocketing) than any gold-backed BRICS trade currency.

And yet with all the recent sensationalism preceding the BRICS summit in South Africa, almost no one saw this—at least not in the legacy media.

Imagine that…

Other Tricks Up the BRICS Sleeve: More USD Assets than Liabilities

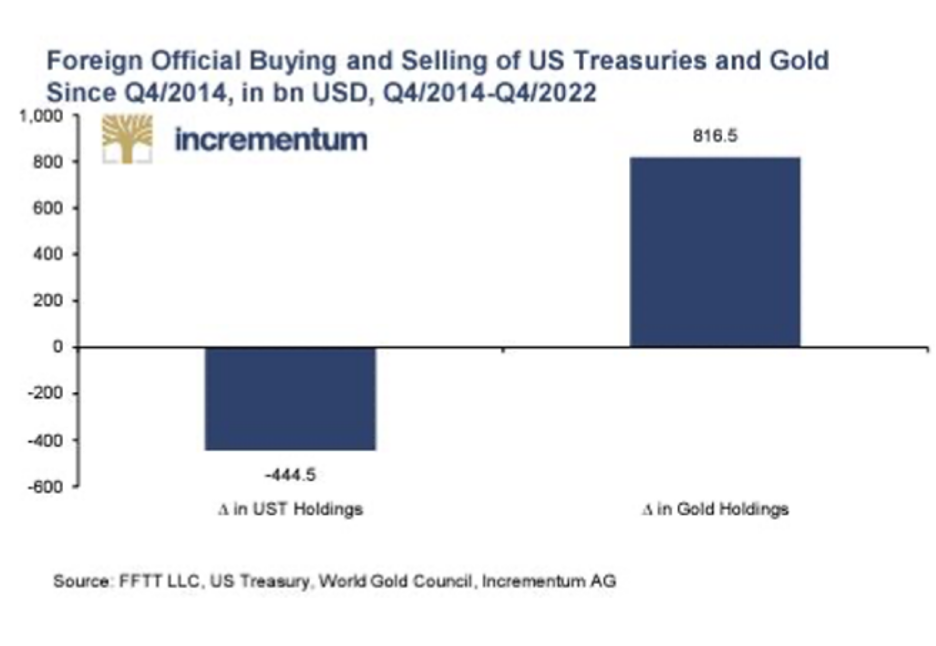

Aside from knee-capping the USD via a shift (gradual or sudden) in the petrodollar trade, it’s worth noting that but for South Africa, the remaining BRICS nations have more USD assets than liabilities, which means they can start dumping USTs to the detriment of Uncle Sam in order to raise USDs.

Many idealogues and US-thinktankers still think the US has all the power over these silly little BRICS nations who allegedly suffer from a dollar shortage.

The chest-puffers still see the USD as all-powerful and all-controlling, after all, just ask Iraq or Libya…

But the dollar-forever crowd is missing the forest for the trees or the basic math of fantasy debt.

If you haven’t noticed, the US just added an extra $1.9 trillion of insane borrowing to the back end of 2023.

And they did this as rates are rising and with the Fed still in full QT/suicide mode.

This mathematically places downward price pressure on bonds and hence upward cost pressure on yields, a scenario America simply can’t play out for much longer at $95T+ in combined public, household and corporate debt.

If the BRICS nations chose to add a layer of US asset dumping to this toxic mix, the ramifications for Uncle Sam would be even more staggering/painful for a debt-based system already on the cliff’s edge.

This is Bad, Really Bad

To repeat: The macros, no matter how I turn them, have never been this bad, this vulnerable and this foreseeable.

The US is now trapped in a vicious circle of debt for which there is no way out other than a currency-destroying return to more artificial, QE “stimulus” and the mother of all inflationary waves.

The horizon is now clear: Yields are up, twin deficits are up, inflation, even the mis-reported kind, is up, and yes, GDP is up too, but as I recently wrote, debt-driven GDP growth is not growth, but just debt.

Unless DC cuts spending at record levels (which kills election results for political opportunists and thus won’t happen), the only tool Washington DC has is more fake money and more real inflation, which means the Dollar in your wallet, checking account or portfolio is about to insult you.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

Have you heard the good news?

The Atlanta Fed GDPNow estimates a 5.9% growth in real GDP for Q3 2023. In nominal terms, we can even boast of an 8.9% surge.

What fantastic news! Growth! Productivity!

This must mean we can all breath a collective sigh of relief as Powell continues his valiant war against inflation as GDP rises, right?

I can almost hear the champagne bottles popping from the Eccles Building to the Bezos-owned Washington Post.

The financial wizards have saved us once again, right?

Wrong.

Oh, so, so, so, so WRONG.

Why?

Debt-Driven Growth is Not Growth, but a Slow Death Trap

As usual, the answer lies in math, history and, of course, THE BOND MARKET.

For years and years, I have tried to make one point (and indicator) almost reflexively clear, namely: The Bond Market Is the Thing.

This is because the bond market reflects debt forces, the most cancerous of all market killers once they metastasize from the acceptable to the fantastical, and the cheap to the unaffordable.

Today, we stare upon the greatest national and global debt bubble in history.

And the cost of that debt is getting higher, not lower.

This should be the key theme of every conversation, but instead, our citizens are arguing over gender neutral bathrooms and exciting politicos (opportunists) scurrying for power like donkeys fighting for hay.

Far better, in my opinion, if the people understood boring things like sovereign bonds…

In particular, they just need to consider and understand yields on Uncle Sam’s IOU (with particular emphasis on his 10-Year UST), which tells us the market’s measurement of the cost of debt.

And given that debt is the sole (rotten) wind beneath the wings of the post-08 American dream, when those yields rise like approaching shark fins, we all need to pause and think deeply, realistically and, hence differently from the consensus pablum which currently passes for financial reporting.

The Open Secret Hiding in Plain Sight (Ignored Shark Fins…)

As Luke Gromen has been warning for quite some time, and as my partner, Egon von Greyerz, has been arguing/expecting for even longer, we are now seeing rising yields on the 10Y UST while inflation rates (intentionally misreported) continue to fall—temporarily.

Folks, this is worth understanding. It’s not hard to do. But it’s critical.

That is, we need to understand how scary it is to see GDP rising alongside 10Y Treasury yields.

So, let’s dig in.

Debt-Based Growth is the Oxymoron of, Well…Morons

GDP is rising because government deficit spending (on everything from yet another preventable yet losing war in the Ukraine to stimmy checks for migrants [“asylum seekers”?] pouring through Texas) is rising well beyond sustainable levels.

Near-term, spending always leads to growth. But when that spending is done on a maxed-out national credit card, the short-term growth (i.e., GDPNow forecasts above) come at a comical, yet serious price.

Stated otherwise, spending, even deficit spending, has quick benefits; the debt consequences, and economic pains, however, take longer to show their economic (moronic) effects.

But when they do, the sickening results are as mathematical as they are historical.

A Tale of the Drunk & Stupid

If one, for example, were to hand a college frat boy his rich uncle’s credit card and permit him unlimited credit, that frat boy would undoubtedly throw the kind of seductive campus parties which would ensure his popularity along side many, many weekends of extravagant bacchanalia and a campus filled with smiling, drunk undergrads.

Soon, the frat house would construct its own elaborate bar, with weekly transports of unlimited beer kegs, a billiards room adorned with flat-screen TVs and 24-hour ESPN.

Others, even from universities miles way, would embark upon a joyous pilgrimage, crowding their Friday-night gatherings with shouts of awe and cries for more vodka shots.

The fun would seemingly never end.

Until, that is, the credit card bill came and the rich Uncle was tapped out.

At that point, the frat house’s growth story devolves into a comical escapade of the drunk and the stupid, which effectively describes the profiles and policies of our so-called financial elite.

The DC Frat House

When GDP spikes on the tailwind of deficit spending, the Fed starts to suffer from the beer-goggle effect of blindness to reality.

It then feels even more pressure (or drunken confidence) to raise short-term interest rates, which also sends the USD higher in the near-term but just about everything else (i.e., stocks, bonds, real estate and tax receipts) lower.

This means the risk of a market implosion in a setting of rising GDP increases exponentially, which is precisely what we saw near the end of 2018 when Powell tried to tighten the Fed’s balance sheet and raise rates at the same time.

Net result?

Markets tanked by Christmas, and as the new year rolled in, the Fed was bailing out the repo markets to the tune of hundreds of billions/week and printing inflationary money quicker than Nolan Ryan’s fastball.

Ignored Patterns, Ignorant Polices

But this otherwise ignored pattern, like a fast-ball, is pretty easy to track. The more the Fed hikes rates, the fatter and more expensive are Uncle Sam’s deficits as GDP rises on drunken (deficit) spending.

This leads to a mathematical case of “fiscal dominance,” which even the St. Louis Fed confessed in June (and of which I recently explained here)—namely, the ironic scenario in which the war on inflation (fought with rising rates) actually causes more inflation.

Why?

Because rising rates don’t just stimulate a GDP frat party (as per above), but they make America’s debt costs (interest expenses) skyrocket into the trillion/year category, which can then only be paid by a Fed mouse-clicker, which is the inevitable inflationary consequence of Powell’s deflationary “higher-for-longer” policy.

Stated otherwise, Powell, like Robert E. Lee, Napoleon, Paulus, Westmorland and Zelensky, is fighting a losing war.

Or for you film buffs who recall Maverick “writing checks [his] body can’t cash,” America is issuing IOUs its Treasury Dept. can’t pay—unless, of course, it prints a lot more fake/fiat money.

And those IOUs (i.e., USTs) are rising at a sickening rate, which means bond prices (which move inversely to supply) will fall and yields (which move inversely to price) will rise.

Read that last sentence again. It’s our bond market (and nightmare) in a nutshell.

And when yields on US 10Y USTs rise, the interest expense on Uncle Sam’s $33T bar tab becomes a bayonet wound to the economy and the market.

Horribly, Horrible Bad News

Thus, when we see GPD growth rising at the same time UST supplies (and hence yields) are climbing at a rate not seen in 55 years, this is not good news—it’s horribly, horribly bad news.

Not only are rates rising along side GDP, but our deficits are growing even deeper and hence this vicious circle of debt just gets deadlier and darker.

And this means the need to cover those deficits by printing trillions out of thin air becomes clearer and clearer, which means inflation is no longer a debate, but as fatally foreseeable as Pickett’s failed charge at Gettysburg.

We Need a Bigger Boat

In the coming months, or early into 2024, Egon and I foresee rising US sovereign bond yields and rising rates which will be near-term deflationary for risk assets and disturbing for Main Street economies no longer able to re-finance their way out of a national debt trap.

At some point thereafter, the cost of those debts will demand a monetary response (money printing to the moon) which will be, by definition, inflationary for regular Joes and no help to mean-reverting markets.

In short: We not only see inflation ahead, but stagflation to boot.

In such a setting, the USD, like the stern of the Titanic, will go from rising, and then temporarily pausing, to sinking fast to the bottom.

Again, the bond market is the thing.

Those yields matter. They are the approaching shark fins racing toward our shores which no one wishes to see.

Instead, we get to watch another billionaire running for office bare his naked chest (and hidden will to power) for the camera…

But as warned already, these shark fins matter, and we are most certainly gonna need a bigger boat…

Real BRICS Threat + The Worst Macros I’ve Ever Seen

Matterhorn Asset Management partner, Matthew Piepenburg, sits down with Rick Rule and Jim Rickards at the recent Rick Rule Precious Metals Symposium to discuss the future of the USD, the rising BRICS tide and the Realpolitik of any realistic (i.e., immediate) gold-backed BRICS trade currency.

Each of the trio share their views on the de-dollarization trend, with Piepenburg and Rule taking a far less optimistic view of any immediate gold-backed trading currency emerging among the BRICS nations in 2023.

Toward this end, Piepenburg argues that not even BRICS nations are ready to limit themselves or their financial powers to a gold-backed trading currency; and certainly not to a gold-backed sovereign currency. That said, all agree that the weaponized USD is losing trust and that the UST is losing demand as a post-sanction world moves further and further away from Dollar-based trade agreements.

For Piepenburg, the end-game is clear. Debt drives policy and debt drives current market directions. This debt will not and cannot be sustained by GDP growth or tax revenues, which means ultimately money printers will continue to de-value that world reserve currency, and hence devalue the once hegemonic respect for the US holder of that currency. All agree that gold’s role in protecting investors from this increasingly beleaguered, self-destructive, debased and less popular US currency is becoming increasingly clear.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

In this extensive presentation by Matterhorn Asset Management partner, Matthew Piepenburg, we separate the iconic America from the current and debt-soaked America to better prepare investors with facts and figures rather than platitudes and nostalgia.

Piepenburg opens with a sober look at US debt to GDP and Debt to Tax Receipts data to underscore the increasingly unsustainable profile of US debt levels and the increasingly ineffective solution of paying for that debt with “mouse-click” money.

Piepenburg addresses the four turning points which placed America in this openly absurd situation. He then turns toward current, yet failed, policies to save a central bank and US system now trapped between a rock and a hard place…

Debt levels monetized with fiat money are naturally inflationary. But now Powell is “fighting” this inflation with rising rates—which are dis-inflationary. Piepenburg explains how such temporary measures are ultimately inflationary, despite desperate attempts in DC to claim a slow victory over inflation. In the meantime, Piepenburg gives example after example of the hard rather than soft consequences of Powell’s “war on inflation,” which he compares to Napoleon’s march on Moscow—that is: You win a battle but lose the war.

In the end, and despite dis-inflationary (and even deflationary market corrections), the end-game for an America with increasingly unloved bonds and increasingly distrusted dollars is more central bank liquidity—which by definition is inflationary. Of course, gold is then discussed as history’s most obvious answer to this equally historical debt and currency trap.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

This 25 minute video with Matthew Piepenburg and myself is probably one of the most important discussions that we have had.

For years we have both warned investors about the consequences of a system based on unlimited money printing, debt creation and money debasement.

The world economy and the financial system is now on the cusp of a precipice.

No one can forecast when the coming violent turn will come.

It can take years or it can happen tomorrow.

Future historians will tell us when it happened.

In the meantime investors have one duty to themselves and their dependents which is to protect their wealth from total destruction.

Money printing and debt creation have taken markets to dizzy and unsustainable levels.

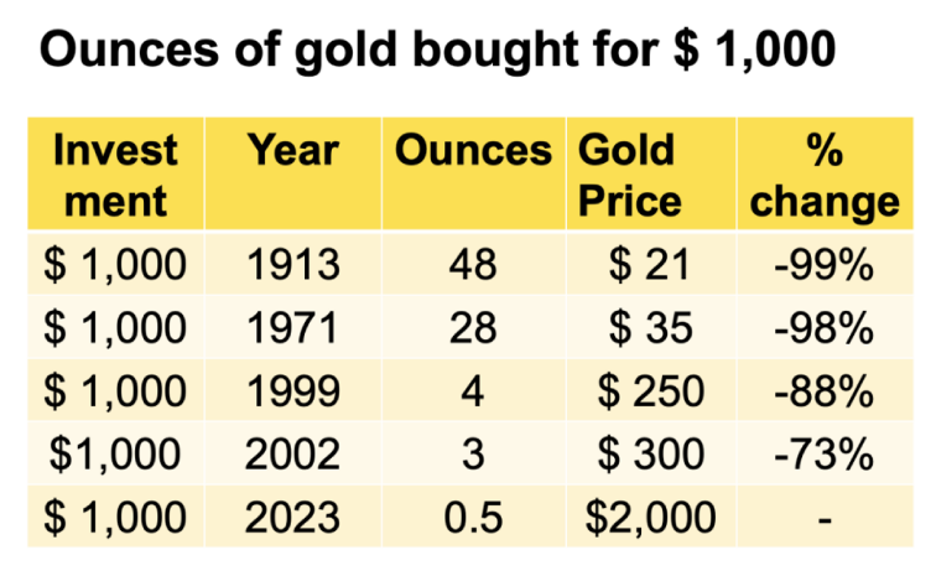

Since Nixon closed the gold window in 1971, both global and US debt is up over 80X!

And asset markets have been inflated by this fake money with the Nasdaq up 120X and the S&P up 44X since 1971.

But the bubbles are not just in stocks but also in bonds, property, art, other collectibles etc, etc.

In our view, the time to pay the Piper is here and now. The consequences will be costly, even very costly for the investors who ignore this major risk.

Just as bubble assets can go up exponentially they can implode even faster.

RISK OF MARKETS FALLING 50-90%

Sustained corrections of 50% to 90% in stocks and bonds are very possible and when the bubble bursts it will go so fast that there won’t be time to get out or to buy insurance.

Whether the Everything Bubble turns to theEverything Collapse today or tomorrow, the time to protect your assets is before it happens which means NOW.

Forecasting the gold price is a Mug’s game . But understanding the significance of gold for protecting against unprecedented risk is not. We had the Ides of March in mid March this year when 4 US banks, led by Silicon Valley Bank and Credit Suisse, Switzerland’s second biggest bank all went under in a matter of days.

That was a rehearsal. Bad debts and rising interest rates are a timebomb for the banking system. So is the $2-3 quadrillion derivatives risk. This gargantuan risks are before us now and could materialise at any time starting this autumn.

The risk ofA Catastrophic Debt Implosion is just too big to ignore.

In our video discussion below Matt and I discuss these risks and most importantly, the best way to protect or insure against this risk.

Owning physical gold outside the banking system is by far the superior method to preserve wealth.

But it is not just about buying physical gold but how you own it, where you store it, in what jurisdictions etc.

This is an area which MAM/GoldSwitzerland has focused on for a quarter of a century and has developed a superior system for HNWIs.

Please watch this important discussion.

Egon von Greyerz

Real BRICS Threat + The Worst Macros I’ve Ever Seen

In this brief yet engaging conversation at the recent Rick Rule Symposium in Florida with Charlotte McLeod of Investing News Network, Matterhorn Asset Management partner, Matthew Piepenburg, calmly separates harsh realities from BRICS hype with regard to the de-dollarization themes of 2023.

After a brief discussion on Piepenburg’s path to precious metals and role at Matterhorn, the conversation turns to Piepenburg’s understanding (and prioritization) of risk management and wealth preservation. Piepenburg sees the lack of such risk thinking as a central concern and open threat to personal wealth in a current backdrop of artificially elevated markets and herd-buying/chasing of unsustainable market tops.

Equally ignored is the hidden risk of currency debasement slow-dripping in real time as debt levels cross the Rubicon of sustainability. Piepenburg argues that “soft-landing” narratives of late are far too soon to call, and that evidence of current and pending “harder landings” are all around us.

Piepenburg keeps it simple. If we assume the US will not allow sovereign bonds to fail or deficits to contract, we can easily foresee more synthetic liquidity, and hence inflation, as the longer-term endgame.

Piepenburg also addresses the “horrifying” profile and slow rollout of CBDC in the years ahead.

As to the BRICS narrative and the rising headlines around a gold-backed trading currency emerging from the August BRICS conference, Piepenburg is far less sensational. Despite his open concerns for the USD and the clear evidence of post-sanction de-dollarization trends, he is not holding his breath for any immediate and gold-backed trading currency to de-throne the USD. Instead, Piepenburg foresees rising inflation forces, continued currency debasement and increasing evidence of centralized controls over our personal and financial lives—all of which make a strong case for owning physical gold outside of the global commercial banking system.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

In this extensive discussion with the Jay Martin Show, Matterhorn Asset Management’s founding partner, Egon von Greyerz, addresses the catastrophic consequences of the current (and historical) debt cycle. History confirms that such debt bubbles inevitably collapse under their own weight, leading to potential hyperinflation and an implosion of assets. While von Greyerz cannot predict the exact timing of these events (no one can), it is essential that investors inform and prepare themselves for the obvious.

- 00:00:00 The Fall of Empires? Jay opens by asking von Greyerz his thoughts on the potential fall of the US Empire and the overlooked risks within Europe. Egon addresses the conditions typical to the end of an economic cycle and warns that the ramifications of such an unprecedented debt cycle could be catastrophic for the world.

- 00:05:00 Debt & Currency Risk. Egon ties currency risks to the debt cycle discussion. He emphasizes that debt is the overwhelming and undeniable danger to the global economy. Despite efforts by governments and central banks to manipulate credit markets and postpone pain, Egon sees no avoiding a global currency crisis. He describes an exponential phase where inflation gradually increases before suddenly skyrocketing, leading to potential hyperinflation. Ultimately, he foresees an implosion of assets in which bond values will be detrimental to the global economy. Rather than predicting exact dates, von Greyerz focuses on protecting himself and others from these risks.

- 00:10:00 Warning Signs. The conversation turns to the warning signs of the looming debt crisis, including the recent banking failures, rising credit defaults and bankruptcies. Egon also points out that inflation may be higher than officially reported, causing increased costs for everyday items. While the signs are not yet causing panic in the market, Egon argues that the continuous stream of money creation has artificially propped up the markets beyond their natural expiration dates. As a result, debt levels have skyrocketed to higher levels, which means the consequences will be greater when they implode.

- 00:15:00 Debt is Global. Von Greyerz reminds that previous debt bubbles were limited to individual countries or continents, but now every country around the world is facing a debt crisis. Global debt, officially reported at $325 trillion, is in fact much larger when factoring in the grotesque expansion of the derivatives and the shadow banking system.

- 00:20:00 What Matters Most. The conversation turns to “safe haven” locales whereby some have the luxury and ability to live in different countries. Most people, of course, don’t have such options. For Egon, the truest safety rests with a strong support system of family and friends rather than material possessions. He suggests that changing our values and focusing on things like nature, books, and music can bring fulfillment and happiness. He also mentions the need for a shift in societal values, as the world is currently focused on materialism.

- 00:25:00 Ignored Realities. The conversation turns to more cracks in the global economy, including nations losing sight of their founding ideals and freedoms at the same time that migration problems and realities are not being realistically addressed. China, in particular, will suffer from its debt situation and speculative bubble; but it is a closed economy and perhaps easier to control, despite immense suffering within its borders. The conversation then pivots to the Ukrainian War, where Egon believes it is not a war between Ukraine and Russia, but rather a classic proxy conflict between the United States and Russia. He points out that the Ukrainian people and the Russian people do not want war; it is the leaders who are pushing for it. Peacekeeping efforts are not being prioritized, worsening the situation. Both speakers conclude that the war is detrimental to the world and Ukraine, and that a resolution is urgently needed.

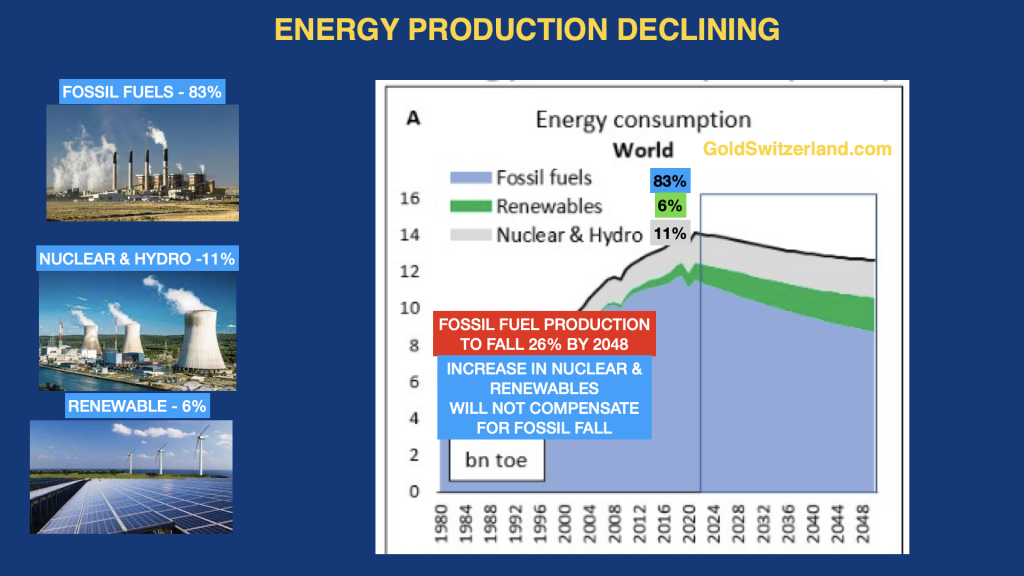

- 00:40:00 War & Energy. In this section, von Greyerz addresses the relationship between the US and Europe, particularly in terms of sanctions against Russia. Von Greyerz argues that Europe is weak and simply follows the instructions of the US, while the rest of the world does not participate in these sanctions. The US has successfully separated Germany from Russia in terms of energy dependence, but this has caused unnecessary suffering for Germany. Toward this end, von Greyerz addresses the global energy crisis, marked by rising energy costs. As a result, the world will have less and more expensive energy in the foreseeable future, as renewable energy cannot fully compensate for the decline in fossil fuels. Von Greyerz reminds that there is currently no viable alternative to fossil fuels in the short term, as renewable energy sources like wind and solar are still decades away from replacing them.

- 00:50:00 Gold Stacking Banks. Egon then explains the trend of central banks stockpiling physical gold. He argues that there is no gold rush yet, but the inflows are gradual and steady. He predicts that the real gold rush is still to come, as the world faces the biggest financial and currency collapse in history. The shift from the West to the East, particularly with the rise of the BRICS countries and the Shanghai Cooperation Organization, will have a major effect on the gold price.

- 00:55:00 The Dying Dollar. Egon closes by highlighting the devaluation of the Dollar and other Western currencies due to excessive printing, prompting a mass move away from the world reserve currency. Von Greyerz suggests that gold will be the most natural replacement for central bank reserves, emphasizing the need for a significant revaluation of gold to accommodate future demand. He believes that those who fail to recognize this shift will be left behind and face costly consequences. Von Greyerz emphasizes the need for individuals to start considering and understanding risk rather than focusing on monetary gains, as he anticipates a major perception shift in the world.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

Before I got the invite to a swank prep-school out East, I used to spend my Spring afternoons on a baseball diamond not too far from the home field of Derek Jeter, who was still playing local ball in Kalamazoo while I was harboring high-school fantasies of playing for the Detroit Tigers.

Glory Days, Simple Lessons

Those were dreamy days of young fantasy. Alas, the Tigers never called, so I hit the books rather than the minor leagues and never looked back.

But like all old men with “glory days” memories, sports taught me a lot of metaphorical lessons.

Like having a team ringer who could hit or pitch years ahead of his time (or for you football/soccer folks, a deadly striker).

Even before the first inning was over, we all knew the harsh pleasure or pain of either: 1) having a “ringer” on our team, or 2) facing one on the other team.

In short, if one team had the most obvious “heat” (or unstoppable striker), it was the team that was going to win.

It was simply the Realpolitik of sports.

Thus, if we were playing against a Derek Jeter (or a Lionel Messi), we all silently knew the game’s outcome before we bravely trotted onto the infield.

Or to put it even more realistically, if my high school baseball team ever had to play the NY Yankees, there was not a snowball’s chance in H.E. double toothpicks that we were going to win that game.

This is fairly easy to grasp. Even our coach (McKenzie) would/could admit such hard truths.

The Debt Endgame is Obvious

Oddly, however, when it comes to US debt levels, and hence the end-game for US credit markets, rates, currencies and Fed policy, almost no one wants to see or admit the obvious.

That is, if we were to compare the Fed’s war against inflation to a baseball game, Powell’s odds are about as good as my Michigan high school team (The Lakeshore Lancers) beating the NY Yankees.

And here’s a few (and otherwise obvious) reasons why.

The Ignored Downgrade

Fitch just downgraded Uncle Sam’s IOUs from AAA to AA+.

For now, it seems no one cares. That is, most still think the Lancers can beat the Yankees.

Why?

Because the NY Times, the Wall Street Journal, Bloomberg and the Financial Times are all doing a wonderful, timely and concerted job of telling average Americans not too worry, as recession and inflation fears are now largely behind us.

Alas, has Powell beaten the Yankees?

Hmmm.

A Lying Chorus

Whenever I see a discredited cabal of media sell-outs all telling me at once not to worry, I start, to well…worry.

After all, when an FBI can have Facebook remove posts about vaccine facts or CNBC starts ignoring alternative views on a neocon war in the East, I tend to get skeptical of the “official version” of just about anything and everything.

What these esteemed financial media “experts” are failing to tell you is that the recent (and ignored) Fitch downgrade was premised upon the fact the America’s debt to GDP ratio (125%) is just too high.

In fact, it suggests that Johnson & Johnson or Microsoft have less a chance for defaulting on their debts than the United States.

What our media guides are also failing to mention is that the Fitch downgrade of 2023 was preceded by a similar S&P Rating downgrade in August of 2011.

Two Downgrades, Different Signals

What’s different about the August downgrade of 2023, however, is that Uncle Sam’s debt levels are much higher (scarier) than in 2011.

In fact, bond demand (as measured by the TLT) actually rose by 25-30% after the 2011 downgrade!

Really?

See for yourself:

This was because folks still believed the US of A and its IOUs were simply too big to fail and that such “risk-free” Treasury bonds were a safe-haven in any storm.

By 2014, however, the rest of the world was singing a different tune.

When adjusted for inflation, then as now, those so called “risk-free-returns” were nothing more than “return-free-risk,” which is why foreigners have been net-sellers of Uncle Sam’s IOUs ever since…

And what is even more interesting about the downgrade of 2023 is the fact that more Americans are finally catching on to this.

That is, and unlike the 2011 response to the S&P downgrade, the 2023 downgrade led to a dumping rather than buying of those very same (and increasingly downgraded) IOUs.

Again, see for yourself:

Main Street Finally Catching On?

What these charts are saying is that Americans are slowly starting to see the end-game of our debt-strapped American baseball team.

For decades, our dads and grand-dads have taught us to seek bonds as protection in dangerous times.

That is why US retail investors and US banks have either been suckered (on Main Street) or forced (at the bank level) to buy Uncle Sam’s promissory notes for decades with blind faith in DC’s ability to, well, beat the NY Yankees…

In 2023, however, more folks are distrusting what is an essence a negative-returning 10Y UST (i.e., what the fancy lads call “negative term premiums”), which means US bonds aint our dad’s (or grand-dad’s) “safe-haven” anymore.

Powell Running Out of Good Pitches

This, of course, poses a real problem for Powell’s baseball game against inflation, for Powell has no good fastballs left, just a weak curve ball (Fed’s balance sheet) and a crappy slider (rate manipulations).

That is, whenever the bond market runs out of liquidity (as he saw in the repo crisis of 2019, the UST crash of 2020 or the recent bank failures of 2023), Powel only has two choices/pitches to work with, namely:

- Do nothing (and watch bonds tank, rates spike, deflation rip, economies crumble and markets frog boil toward implosion), or

- Reach for that magical mouse-clicker at the Eccles Building and print more fiat money (and hence monetize Uncle Sam’s debt with inflationary bravado).

Powell’s Endgame vs. Powell’s Fantasy

For me, the end-game is clear.

In fact, I see it as clearly as if my Lake Shore Lancers were forced to play 9 innings against Jeeter’s Yankees, namely: “We’re gonna lose this game.”

For now, we are only in the first innings of this painful and embarrassing contest.

Powell, having broken the middle class, a number or regional banks and the normal shape of a robust yield curve, is already declaring victory over inflation and recession (along with a chorus of “yes-sayers” from the WSJ to the FT) and continuing his higher-for-longer fantasy of rising rates into the greatest debt bubble of world history.

How’s that for fantasy?

Maybe I should I try out for the Yankees myself?

Ignoring the Ringer (and the Math)

But what Powell (and the consensus-driven markets) aren’t seeing is the ringer on the other team—namely the fast-ball reality of simple math.

That is, as Powell raises rates, the cost of Uncle Sam’s debt has now crossed the Rubicon of payable.

Ironically (and sports are full of ironies), Powell’s war against inflation is in fact going to end up being inflationary, as the only way to inevitably and eventually pay the interest expense alone on Uncle Sam’s $33T deficit is via a money-printer.

And that, folks, is inflationary (what the fancy lads call “fiscal dominance”), which is bad for long-dated IOUs but good for gold.

Thus, and regardless of current headlines, bullish fantasy and media-ignored credit downgrades, I see yields on sovereign 10-years going higher for longer, which is not a view shared by consensus or those who even feel that a great high school team can beat the Yankees.

The Hopeful Crowd

Of course, there are those who may feel and hope that Powell and his squad of weak-armed experts can get US debt to GDP levels from 125% to 80% (which is the only ratio where normalized rate hikes work) by cutting spending costs.

Hmmm.

In that case, Powell and his equally weak teammate at the US Treasury Department (Yellen) or perhaps even Joe Biden, with his 20 MPH mental fast-ball at the White House, can sit down and decide where the USA is willing to tighten its belt.

Will it be by cutting entitlement spending?

Good luck staying in office with that game plan…

Will it be via military cuts?

Those who truly run DC from the Pentagon are not likely to agree…

Or perhaps there are still those deluded fans in those high-school bleachers who think Powell can grow his way out of a 125% debt to GDP ratio?

Hmmm.

Well, mathematically (just saying), such a gameplan would require 6 consecutive years of 20+% GDP growth, something which can (and will) NEVER happen in a high-rate baseball field.

The Angry Crowd

Thus, the only way to “grow,” and the only way to save Uncle Sam’s unloved bond market, is via liquidity, and that liquidity ain’t coming from GDP, tax receipts or 20% economic growth.

Nope.

It’s gonna come from a Fed mouse-clicker. Trillions of fiat Dollars—and that folks, IS gonna be inflationary, and it’s gonna crush the guy on the street, farm or high-school coaching staff.

In short, Powell’s fight against inflation is just in the 3rd inning.

In the end, inflation and negative real rates are the only pitchers/options left in Powell’s weak bullpen (short of a deflationary depression), which means, alas, he won’t be winning this game in the 9th inning.

Of course, such baseball metaphors, math, policy and inflation/deflation cycles aren’t easy to time with precision nor be understood with fancy Wall Street lingo by every Jane or Joe on Main Street.

Afterall, not everyone has the time or luxury to debate monetary policy (or baseball memories) when they are just struggling to make a car payment or fill their gas tanks (and those prices are going to go higher) as the BLS fudges the math on inflation data or the NBER tweaks its comical (and lagging) recession indicatorfor political rather than transparency motives.

But whether one be carrying a baseball bat or a guitar, it’s becoming clear from Farmville Virginia to Stevensville Michigan that something is “broken in the force.”

As distrust of a weaponized media, Dollar and justice system collides with politicized science and rigged markets, Americans are steadily losing faith in the so-called “experts.”

Toward this end, I won’t be the first nor the last to remind readers of the recent viral sensation, and Virginia guitar-picker, Oliver Anthony.

He recently opened his new American anthem by declaring “it’s a damn shame” that he’s “been working overtime-hours for bull-sh— pay” in a new world where “your dollar aint sh– and taxed to no end,” while the rich men North of Richmond “just want total control.”

Sound familiar?

Strike a cord?

More times than not, a baseball or a guitar can say more than a financial blog.

This debt game is going to end badly. They ALWAYS do.

PS: I love Richmond.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

In this latest conversation with Tom Bodrovics of Palisades Gold Radio, Matterhorn Asset Management partner, Matthew Piepenburg, offers his latest assessments on the American economic and political decline.

Piepenburg opens with a sober critique of the slow-drip toward increasing but now undeniable centralization in American markets and society. The net result is an ephemeral yet tragic demise of both classic capitalism and true democracy.

Instead, what Piepenburg sees now and ahead are more signs of a dystopian form of modern feudalism in which a political and financial minority operate behind a façade of liberalism as lords over a middle-class falling deeper into politically ignored serfdom. He unpacks the open marriage between corporate and governmental powers (weaponized/corporatized media, science, justice system, markets, banking, currencies etc.) which more resemble Mussolini’s definition of fascism than the democratic ideals of America’s founding fathers.

Not surprisingly, the foregoing theme of centralization incudes the frog-boil toward more regional bank failures, the duplicity of the Davos crowd and the Trojan horse of CBDC, which Piepenburg describes as “horrifying.” Ultimately, Piepenburg sees an ironic yet undeniably cornered Fed whose alleged war against inflation will only create more inflation. Powell’s “higher-for-longer” policy to fight the CPI is only making Uncle Sam’s grotesque debt levels grow equally “higher for longer.” As a result, more mouse-click money will be needed to monetize this embarrassing bar tab, which by definition, means more inflation and hence currency debasement ahead—all of which is bad for America but good for gold.

Piepenburg dives deeper into current market distortions (over-pricing), including various examples of ignored risks (needles) pointing at the global and national debt balloon. Toward this end, he links ignored risks in the Japanese markets (the “carry trade”) to equally ignored risks in the ticking time-bomb that is the US (and global) credit markets. He also squarely addresses the ongoing recession narrative and beleaguered US labor markets with sober facts.

The conversation closes with an equally sober (i.e., non-hyped) analysis of the BRICS headlines regarding a potential gold-backed trading currency. Although Piepenburg was among the first to warn of watershed de-dollarization trends last year, he does not see a gold-backed trading currency suddenly emerging from the BRICS conference this month in South Africa. Ultimately, the trend away from the USD is now inevitable, but the process will be slow at first and then all at once. Piepenburg is also keeping a careful eye on Saudi Arabia and the Petrodollar as another risk hiding in plain sight.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

The Fed has two mandates – Maximum Employment and Price Stability

If we look at price stability, the Fed has failed miserably.

The Fed employs 3,000 people in Washington DC of which 300 have a Ph.D. degree.

Their mission is “to provide our nation with a safer and more flexible and more stable monetary and financial system” with the overall mandate being price stability.

In addition to discussing the Fed’s total failure in controlling inflation, in this article I will also stick my neck out in the climate debate before I go on to the likely disastrous effects of debts, deficits and inflation will have on investment markets.

POWELL’S ABRACADABRA INFLATION TARGETING

Last week the Fed chairman explained, in the Senate, the method the 300 Fed PhDs and many of the 3,000 Fed staff apply for inflation targeting.

Senator Cortez asked Powell:

Cortez:

“Why 2% inflation?”

Powell:

“The 2% is globally agreed between all major central banks as a target.”

EvG question: So for this Lemming system 300 PhDs are required?

Cortez:

“How does it help people?”

EvG: The contorted Fed Speak reply which Powell utters summarises the entire wisdom of the Fed.

Powell:

“I will tell you how it does, I guess it is obviously not obvious how that is.”

EvG: Hmmmm… Powell obviously doesn’t have a clue – “OBVIOUSLY NOT OBVIOUS!”

Powell continues:

“To have people believe that it will go back to 2% anchors inflation there.

Evidence is that the modern belief is that people’s expectation has an effect on inflation. If we expect inflation to go up to 5%, then it will because businesses and households expect it.”

So there we have the inner secrets of the Fed’s inflation policy and targeting.

Firstly, the 2% target is just a Lemming system. Every other central bank does it, so we the Fed must follow the system of mediocrity.

Secondly, it is only a matter of making people believe that inflation goes to 2% and it will. What about if the people believe inflation will go to 20%?

This is where Powell the magician comes in to hypnotise businesses and household into believing in 2% inflation:

I agree with senator Cortez’ question: Why 2%? There is nothing desirable about the 2% at all. With 2% inflation, prices double every 36 years. The aim should really be to have no inflation.

The problem with an arbitrary Lemming system targeting 2% is that it doesn’t work. Neither the Fed nor any other central bank have managed to hold it at that level except for accidentally on the way to higher or lower inflation.

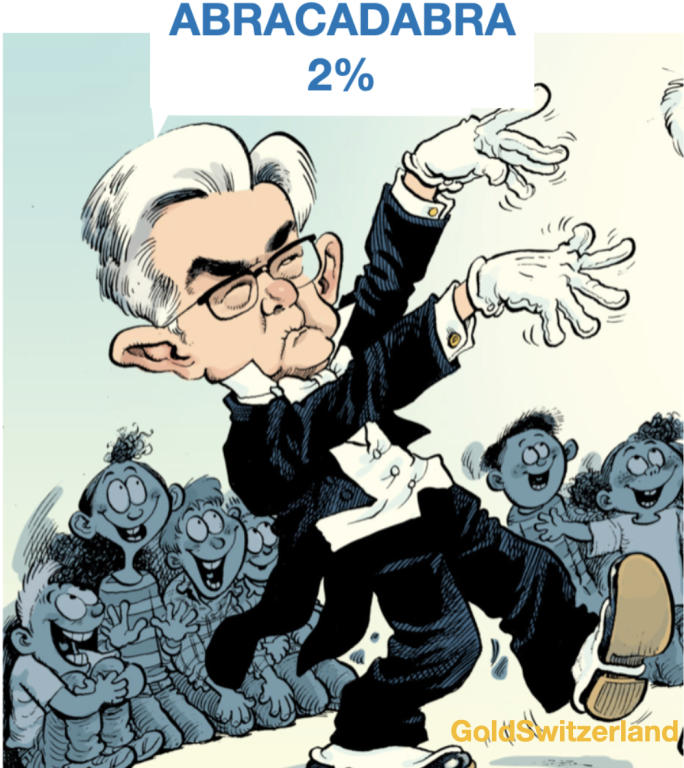

INFLATION WILL TURN BACK UP

Between 2015 and 2021 inflation in most industrialised countries was between 0% and 3%.

When inflation in 2021 shot up significantly, Powell and Lagarde (ECB) proclaimed that that was only “transitory”. Still inflation went up to around 10% before it started to retreat in 2022.

As I have explained in previous articles, the world is gradually moving from a financial and debt based economy to a one based on real assets and commodities.

This will lead to a shift from a financially and morally bankrupt Western system to the East and South based on commodities and manufacturing.

An upmove in commodity prices normally lead inflation by 6-9 months. So when commodity prices turned up in late 2019, inflation followed in most countries in early to mid 2020.

After a correction, commodity prices bottomed in March-May 2023 so we could see inflation in the US and Europe turning during the autumn 2023.

So sadly for Powell and Lagarde, their 2% inflation targeting is going to fail again, however much they hypnotise the people to believe it!

Instead high inflation and high interest rates will prevail for decades. But it will most certainly involve a very high level of volatility with fast up moves and violent corrections.

Before I move on to the dire effects that inflation deficits and debts will have for the US and global economy, I will stick my neck out in the heated climate debate.

CLIMATE EMERGENCY – HYSTERIA OR REALITY

The climate debate is totally polarised and dominated by powerful interest groups.

Since Al Gore politicised this issue at a heightened level at the Copenhagen Climate conference in 2009, the trend has been clear.

Just like with Covid, it has suited Western governments to use the climate debate as a means of controlling the people and protecting special interests.

The official climate debate is totally one sided. Any money for research is only granted to scientists who support the notion of man-made global warming caused mainly by fossil fuels.

The fact that fossil fuels account for 83% of all energy and most probably cannot be reduced more than marginally for the next several decades is totally ignored in the debate.

A further problem is that the world has reached peak energy by way of fossil fuels and there is no serious alternative in sight for decades.

In addition, the energy cost of producing energy is increasing fast. The consequence will be falling standards of living for a foreseeable future. (SEEDS – Surplus Energy Economics)

The fact that the Holocene period which started 11,700 years ago has been the coldest in geological history is totally ignored. All the climate activists are just looking at figures for the last couple of hundred years.

Also, the fact that CO2 has been declining for 1 billion years is totally ignored. Without CO2 there would be no life on earth. Total CO2 in the atmosphere is today 0.04%. If that percentage declines below 0.02% there would be no life on earth.

Dr John Clauser, the 2022 physics Noble Prize winner, criticises the climate models as unreliable and not accounting for the dramatic temperature-stabilising feedback of clouds. Clauser says that clouds are more than 50X as powerful as the radiative effect of CO2. In summary he says that there is no climate crisis and that increasing CO2 concentrations will benefit the world.

A leading nuclear physicist Dr. Wallace Manheimer warned that Net Zero would end modern civilisation. He observed that the new wind and solar infrastructure would fail, cost trillions, trash large portions of the environment “and be entirely unnecessary”.

I am not a Covid expert. But in the case of Covid, the debate was totally skewed by the hundreds of billions of dollars spent on propaganda and corruption by the pharmaceutical companies. A small censored scientific minority were totally against an untested gene-manipulating vaccine and warned about its severe dangers. Three years later the fears of this minority have been vindicated.

I am obviously not a Climate expert either. But having studied economic cycles for many years, I am a great believer in understanding history and very long trends rather than basing my opinion on short term opportunism.

Thus studying very long climate cycles, it is clear to me that they are much more powerful than whatever effect that mankind has had on climate in the last 150 years.

To take an example, just look at the 11,000 year climate cycle graph above. It shows a Roman Climate Optimum 2,000 years ago. At that time Rome had a tropical climate. As far as I am aware, there were no cars or other manmade CO2 producing matters at that time.

Of course we all want a world with less pollution in the air and in the oceans and should strive for that globally.

But to believe that we can achieve Net Zero CO2 Emissions by 2050 is as unrealistic as believing that mankind can limit the temperature increase by 1.5 degrees by 2050.

Let me just take some examples. Many Western countries are legislating that only electric vehicles (EVs) can be produced after 2030 or 2035.

What the climate activists ignore is that EVs are costlier to produce than ordinary cars and have a major CO2 effect.

To produce ONE battery takes 250 tons of rock and minerals. The effect is 10-20 tons of CO2 from mining and manufacturing even before has been driven 1 meter.

Also, car batteries cannot be recycled but go to landfill which has major implications.

But that’s not the only problem. For the first 60-70,000 miles an EV produces more CO2 than an ordinary vehicle.

Hopefully the CO2 and cost efficiency of EVs will be improved but so far progress is very slow.

US DEFICITS ARE SURGING

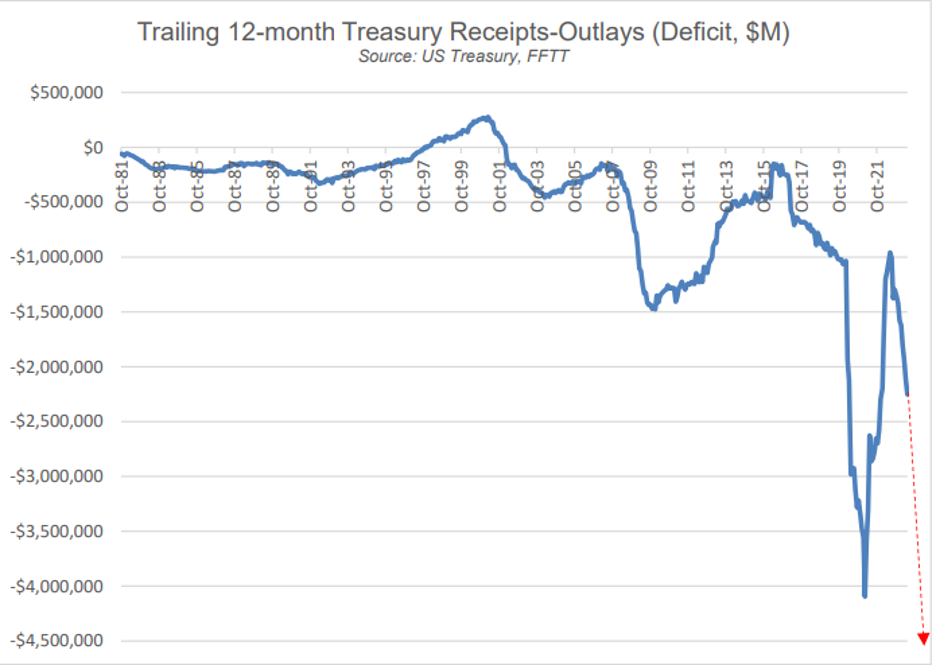

The borrowing requirements of the US treasury is reflecting the total lack of fiscal discipline which is typical for a Banana Republic.

From January to the end of December 2023, the Treasury expects to borrow $3.3 trillion. With some extra bad news, including higher interest rates, the $3.3 trillion could easily rise to $4 – 4.5 trillion. This deficit plus the ongoing QT (quantitative tightening) is likely to put upward pressure on rates.

Except for the Fed, there will be no buyer of an ever increasing amount of US debt.

And so the vicious circle of higher debts, higher inflation, higher deficits starts to spin ever faster.

Sadly, such a dire scenario can never have a happy ending.

For the banks, higher rates mean much higher defaults and a constant squeeze to reduce lending, also mandated by the Fed.

With massively increasing borrowing requirements from the US Government and the Fed as well from the banking sector with dwindling sources of funding, the likelihood of drastic measures are obvious.

After the subprime crises 2006-9, governments agreed that bailouts would be replaced by bail-ins at the next crisis. So far this didn’t happen in mid-March when 4 US banks and Credit Suisse collapsed.

But the coming pressures on both public and private funding are likely to lead to draconian actions by governments next time around. This will probably involve forced savings in government debt for most Western countries, including US, Europe and Japan.

It could involve compulsory purchases by bank depositors of say 10 year bonds with interest rolled up for 25-50% of customer liquidity in the bank.

My old forecast of future US debt made in 2016 is so far looking on target. Whether the debt will be my original $40 trillion forecast or the revised $50 trillion, time will tell.

Major bank and derivatives defaults could easily push it up to $50t.

HOLD TANGIBLE ASSETS

The main beneficiaries of the Western debt and deficit problems are of course:

- Precious Metals – especially gold and silver

- Commodities – especially oil and uranium

Stocks might benefit short term from higher inflation but over the medium and long term they will collapse.

Buffett’s favourite indicator, Stocks to GDP is massively overvalued. To decline to the mean would involve a 50% fall. But overbought markets always overshoot. So a 70-90% decline would not be unrealistic. In such scenario, it won’t only be stock prices that decline but GDP could easily fall 10-20% in real terms.

Bonds, especially issued by governments, should be avoided like the plague. Inflation and potential defaults or moratoria will make them the worst investment ever. In addition the debasement of currencies will lead to the value of bonds in real terms reaching ZERO very quickly.

So is my forecast too pessimistic. Maybe but I doubt it. No one can of course predict the exact timing.

But what we can evaluate is the risk.

And with global risk being more elevated than at any point in history (and I haven’t even discussed political or geopolitical risks), why not protect your assets today from potentially the biggest wealth destruction ever.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

- 00:00 In this section, Matthew Piepenburg, partner at Matterhorn Asset Management, discusses the growing distrust of the US dollar and the trend of de-dollarization. He highlights how the Western sanctions against Russia have caused ripple effects and raised eyebrows for other countries, as the weaponization of the world reserve currency has created a sense of distrust. He also mentions the recent BRICS summit in South Africa and the discussion of a gold-backed trading currency as further symptoms of this growing trend. While he believes this is not yet the end of the US dollar as a world reserve currency or fiat money, he emphasizes that the trend of de-dollarization is clearly underway and warns that once the genie of weaponized currency is out of the bottle, it cannot be put back in.

- 05:00 In this section, the speaker discusses the world reserve currency status of the U.S. dollar and the upcoming BRICS meeting. They mention the importance of trust in determining which countries developing nations will choose to align with, highlighting the question of trust in countries like China, Russia, Indonesia, Brazil, and India. Moving on to the U.S. Federal Reserve, the speaker suggests that the Fed realized they raised rates too fast and too high, leading to a pseudo-recession and a break in trust in bond markets. As a result, they took a pause in their tightening policy to give the banks and credit markets a break. The speaker emphasizes that the market’s reaction to the Fed’s actions will determine whether this pause is a precursor to more heightening or an eventual pivot towards liquidity infusion. They also question the reliance of the markets on the Fed and why the central bank has such a significant impact on stock and bond markets.

- 10:00 In this section, the speaker discusses his belief that the US is already in a recession, citing indicators such as the yield curve, the change in the M2 money supply, and the inflation to deflationary moves. Piepenburg also mentions that the labor market will be the next to crack. When asked about gold not keeping up with the equity market rally, the speaker explains that gold is seen as insurance against dying currencies and a hedge against the weakening purchasing power of the US dollar. He attributes the rally in equities to the market’s expectation of the Federal Reserve adopting a more dovish stance in response to a recession. However, he also highlights the stress on the banking system and the potential for more liquidity crises. He suggests that as people realize their currency is getting weaker, they will turn to gold as a means to deal with the low purchasing power of their currency, all of which is held in increasingly beleaguered banks.

- 15:00 In this section, Matthew Piepenburg explains that building investor interest in gold is a subjective matter, as it relies on trust and a loss of faith in fiat currencies. He argues that gold becomes more attractive when it becomes obvious that the purchasing power of the currency in one’s wallet is diminishing, regardless of reported CPI or market discussions. Piepenburg suggests that when countries reach a point of fiscal dominance, where they are unable to effectively fight inflation due to excessive debt, investors will seek an alternative to weak money. For many, this alternative is physical gold, while others turn to more volatile and speculative cryptocurrencies like Bitcoin.

Real BRICS Threat + The Worst Macros I’ve Ever Seen

I recently blew the dust off an old Rudyard Kipling poem, “If,” which many have castigated as a bit overly romantic, despite its high praise from Mark Twain and T.S. Eliot to India’s Khushwant Singh.

The fact, moreover, that “If” was written by a Victorian era colonial in 1895 as a father’s advice to a son, could easily put its otherwise timeless insights at risk of being cancelled by the woke elite as potentially misogynistic or regionally insensitive…

Notwithstanding such critiques, financial readers might equally be asking what Kipling has to do with global markets, the currency wars, inflation/deflation tensions or the US bond market?

Well, given the fact that each of these financial topics, when examined closely or even broadly, are now signs of open madness, yet still consistently ignored or down-played by our leaders and media midgets, I could not help but consider the following (and opening) line of advice:

“If You can keep your head when all about you

Are losing theirs…”

Well: Can we?

What is Happening All About You? A Complete Denial of Debt’s End-Game

As headlines from an increasingly distrusted 4th Estate debate everything from a challenged USD (the recent BRICS gold hysteria) and weaponized State Department (Raytheon’s war in the Ukraine graveyard) to an equally weaponized/politicized justice system (Hunter vs. Trump’s legal woes), most of America seems blind to a ticking time bomb.

That is, amidst all the political and social distractions of late, the financial wizards leading an increasingly splintered America have been quietly doing what they do best: Sending the USA into a fatal debt spiral.

I recognize, of course, that bonds, budgets, deficits and yield curves don’t excite the same immediate reactions as, say, Joe Biden’s now undeniably compromised mental state or who or what’s image adorns a can of Bud Light, but as I’ve said so many ways and times: Debt matters.

In fact, debt destroys nations. And not just sometimes, but every time.

Such destruction, hiding in plain sight, is creepy, because, well…it creeps up on us slowly, and then—all at once.

The Latest Creepy Numbers Creeping out of DC

But sadly, debt data and bond markets bore most citizens.

This is why the majority of invisibly taxed and intentionally enslaved American serfs probably haven’t noticed that the US Treasury Department’s quarterly net-borrowing estimates for the second half of 2023 just came out, and that number is a sickening $1.85 TRILLION.

Read that again. $1.85T in 6 months.

This is openly ignored madness. Our experts having officially lost their minds.

We are talking about nearly 2000 billion (or 2 million millions) of new debt to be created/issued in the span of months, the implications of which are staggering.

This is especially scary when you add Powell’s 525 basis point rate hikes into the borrowing equation, which only makes the interest-expense of this appalling debt (cess) pool beyond payable without, well…more debt creation.

So, there you have it, American monetary genius: “We can solve a debt problem with more debt.”

Keeping Our Heads When All About Us Are Losing Theirs

But just because the “experts” in DC (who made Faustian bargains with their common sense and advanced degrees in exchange for a DC job title) may have completely lost their ambitious little minds/heads, it doesn’t mean the rest of us can’t hold on to ours.

Fighting Inflation Will Increase Inflation

Powell’s comical, and ultimately disingenuous, war on inflation, for example, is actually poised to end in far greater inflation, something understandable to any whose market attention span is greater than a typical tweet or YouTube short.

As a June white paper from even the St. Louis Fed recently confessed (and folks like Luke Gromen better explained), the US is approaching a grossly paradoxical point called “Fiscal Dominance,” a sober concept of basic math which I boil down to this:

“When a debt-strapped nation with nearly $33T in public debt raises rates to ‘fight’ inflation, the increased cost of servicing that debt becomes so egregious that the only way to ‘pay’ for it will come from a re-ignited mouse-click money-maker at the Fed, which is inherently, well: Inflationary.”

In other words, at some point (and don’t ask me when, but it’s looming), the Fed will pivot from dis-inflationary QT to mega-inflationary QE—all to be conveniently blamed on COVID, Putin and/or the climate.

It has always been my personal view, however, that Powell’s Volcker 2.0 charade of raising rates and trimming (barely) the Fed’s balance sheet to “fight” inflation has been a deliberate ruse.

His hawkish narrative buys him time to replenish the ammunition of his only two monetary weapons (rates and money supply) so that he’ll have more to cut (rates) and expand (Fed balance sheet) once overly-stretched credit markets blow to shreds.

At that point we’ll see: 1) QE to the moon and/or 2) a monetary re-set that will make Bretton Woods look like a pleasant game of international snooker.

Credit Markets, Death by a Thousand Cuts

In fact, this “blowing to shreds” process in the credit markets has already begun, in a kind of death by a thousand cuts.

Just ask all those nations dumping USTs, or all those regional banks that have failed and all those bigger banks consolidating (i.e., centralizing); or ask all those mutual fund managers who lost greater than 20% in 2022, or the repo markets back-firing since 2019, or all those foreign sovereign bonds (from gilts to JGB’s) tanking and all those wannabe BRICS+ nations looking for anyway they can to join a sanctioned Russia and patient China to trade outside of an openly weaponized USD.

In other words, it’s not just that change is gonna come, it’s literally all around us, hiding (or ticking) right before our media-distracted eyes.

Buying Time Today as More Things Break Tomorrow

Powell, in the meantime, will stick to his “data dependence” and bide his time going higher for longer until something, i.e., topping markets now riding the AI tailwind (narrative), finally break under their own grotesque weight.

So yes, debt matters. Deficits matter. And supporting Uncle Sam’s otherwise unloved IOUs matters.

This is because, and I’ll say it again and again and again: The bond markets matter.

Why?

Repeat: The Bond Market Matters

Because if no one is buying those over-supplied bonds (see above), their yields spike in a simple supply & demand mismatch, which means the cost of serving US debt—which is the only wind beneath our national/financial wings—spikes too.

Spiking debt costs, of course, are a death knell to a system (from banks, bonds, stocks and Treasury Departments) already drowning in historically unprecedented (and unpayable) debt.

Thus, without more inflationary mouse-click money (QE) to stave off more credit contraction, bank deaths, failed UST auctions, and all those low-rate, extend-and-pretend-addicted companies on an S&P 500 (which is nothing more than an S&P 7 in terms of real market cap), the slow implosion discussed above becomes a sudden implosion.

Recession Denial

And that’s not even factoring in a looming but now Powell-ignored and media-down-played recession, that malleable term of economic art, which, like inflation and employment data, those fiction writers at the BLS and Eccles Building can redefine at their convenience.

Facts, after all, are like math. They are stubborn. This is why the experts are apt to distort them, like a corrupt lawyer who tampers with evidence to win a jury trial. That is, even a witch looks pretty when you hide the warts.

As I’ve argued many times, and based upon recent on-the-ground experience in USA main streets as well as a neon-flashing yield curve, the conference board of leading indicators and the year-over-year change in the M2 money supply, America is already in a recession.

At some point, even Powell’s forked tongue and the DC data manipulators won’t be able to hide a recession which citizens feel despite CNN, The View or their politicos telling them otherwise, especially as gas prices and lay-offs continue to rise into year-end.

Recession, Banana Republic America and the Inflation/Deflation Cycle

Toward this end, we need to keep our heads and think for ourselves about what recessions can do to countries like the USA whose balance sheet and debt levels are quantifiably no better than your average, and once mocked, banana republic.

Like any banana republic, extreme debt and embarrassing deficits spell their doom, as over time such heavy debt tides are inherently inflationary, despite the current (and expected) dis-inflationary period.

After all, crushing the middle class and small business sector with a record-breaking rate hike is dis-inflationary.

In a recession, for example, a nation’s already weakened ability to produce goods and services (thanks to Powell’s rate hikes) at levels high enough to sustain those deficits only gets even weaker.

As Luke Gromen again argued, and illustrated below, a recession could easily send the US deficit to $4.5T, or 8% of GDP.

In such an all-too-likely deficit scenario (and all we really have today are bad scenarios), we could see bonds fall into the next official recession (always announced too late), as we saw them fall along side stocks in the 2020 COVID crash.

If bonds fall in a similar manner, this means bond yields, and hence rates, would rise, which would only add more pressure on the Fed to issue more US IOUs then paid for with more inflationary mouse-click Dollars to control their yields.

For now, and as Gromen, and myself, would confess, such a view is still a minority view—but that doesn’t necessarily make it a wrong view, especially in a world figuratively losing it head.

Alternative Scenarios Are No Better

But even the most sober convictions must consider alternative scenarios and views.

Like Brent Johnson, I agree that we could easily see an implosion in the EU markets (Germany now in recession) or even in Japan long before the US markets raise their white flags and surrender to instant, mouse-click liquidity measures.

In such a “foreigners-first” scenario, we could indeed see a flight into the perceived “safety” of the UST and hence USD as the best horse in the global slaughter house.

Such a “milk-shake inflow” (or straw-sucking sound) into USTs could take some temporary pressure off the Fed’s inflationary QE gas pedal. It could also make the USD stronger rather than weaker in the interim.

The End-Game Stays the Same

But no matter which white flag goes up first, from Tokyo to Berlin to DC, the end-game for all debt-soaked nations, regions, currencies and systems is ultimately the same.

That is, and to repeat, there really are no good scenarios left, just more desperate measures to buy time and postpone the inevitable.

As I wrote elsewhere, even the most proud and victory-accustomed armies, from Napoleon’s Grande Armee in 1812 to Lee’s Army of Northern Virginia in 1863, eventually extend themselves too far and suffer a “Gettysburg Moment.”

Nations whose debt levels are too far extended offer no exception to this rule or metaphor.

That is, no brave cavalry or infantry charge by Marshal Ney or General Picket can defy the simple law of too many bullets against too few men.

Too Many Debts, Not Enough Liquidity

Like Japan, the EU and the UK, America has too many debts and not enough natural liquidity to sustain them.

Powell can buy time and headlines, and he can even print trillions of more fake fiat dollars to “save the system,” but in the end, it is always the currency which is left dying last on the field.

For those who understand the stubborn math, history and cycles of fiat currencies, the precise timing of such final currency defeats is impossible to predict with precision, but easy enough to see coming, and thus easy enough to prepare for in advance.

Advanced Preparation—The Minority Which Kept Their Heads

Gold, which is an obvious and historically-confirmed weapon (as opposed to barbarous relic) against such open currency destruction, is an equally obvious and historically-confirmed means of achieving such advanced preparation.

Despite such objective facts (and the media-ignored power of gold as an open threat to fiat money), gold makes up only 0.5% of the global investments.

This, it might be said, makes such lonely “gold bugs” crazy, but as alluded to above, sometimes one must keep their heads when all about them are losing theirs.

The question, then, like the title of Kipling’s poem, is not “If” fiat money dies, but “When.”

The former is obvious, the latter is approaching.

Got gold?