THE CYCLE OF EVIL

We are on the inevitable road to perdition for the world economy & financial system, ending in a potential global conflict of uncontrollable proportions.

Evil begets evil as The Cycle of Evil hits countries at the end of an uncontrollable debt expansion.

The pattern throughout history has always been the same – countries and empires, without fail, become victims of their own success -failure, whether it was the Mongols, Ottomans or the British.

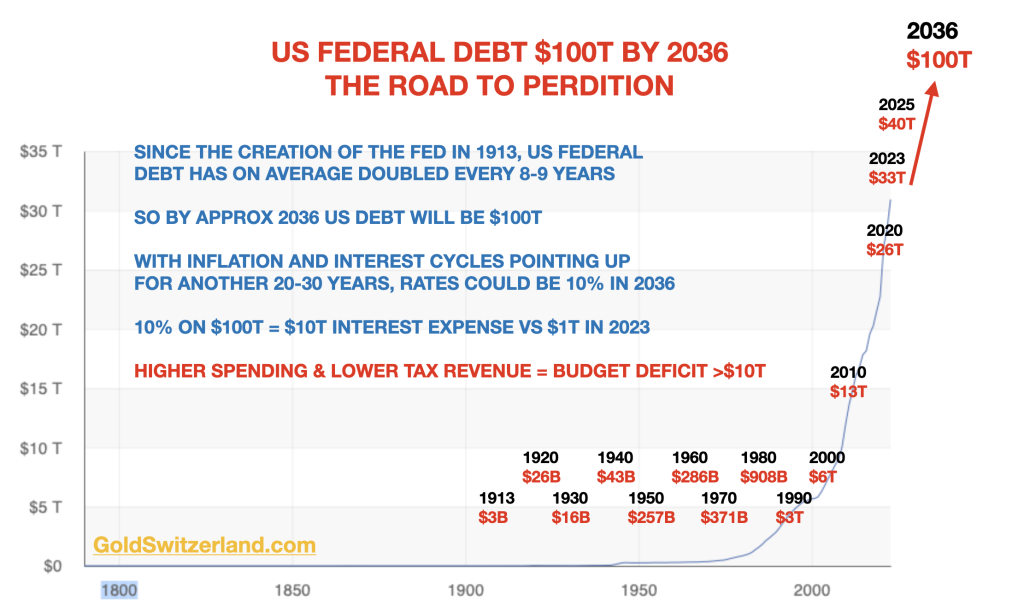

As real growth ceases, a country starts to finance expansion with debt until it cannot even afford the interest on the debt, never mind the capital which it has no intention to repay.

At some point, the people, fearing a war or terrorist attack will approve of the leader’s fear mongering by supporting unlimited debt issuance. This is now happening in the US with regard to Ukraine and Israel.

Neither the US nor Europe is taking a single step to remedy the situation. Both are now in the Cycle of Evil of more deficits, more debt, higher interest costs, leading to more deficits, more debt higher interest costs, leading to ……………..

The Cycle of Evil is also accompanied by decadence and moral decline where leaders invent problems that are not real such as climate change, ESG (environmental, social and governance), forced vaccines and incarcerations, 25 new genders and other woke issues etc.

Few Americans understand that the next stage of the Cycle of Evil is about to hit them.

And even fewer Europeans have a clue that they will be dragged down into the same debt collapse quagmire.

The next stage will involve many banks failing, more than the FDIC or government can afford to save without destroying both the Currency and the Bond Market,

A collapsing currency and sovereign debt paper that no investor wants to touch with a bargepole is hardly the right climate for massive debt issuance.

Most sovereign investors have already realised that they don’t want US debt at any interest rate.

So that means even higher interest rates, more debt issuance as the Cycle of Evil eventually turns to a “Final Collapse” as von Mises described:

THE CYCLE OF EVIL CONTAINS MORE CATACLYSMIC COMPONENTS THAN ANY SIMILAR CYCLE IN HISTORY.

Let us summarise where the world is:

GLOBAL CONFLICT

We have two wars both capable of leading to a major global conflict plus high risk of terrorism and jihads in the West. Just as with most global/world wars, there is no attempt at finding peace solutions.

To make things worse, there is not a single Statesman in the West capable of taking a lead in solving the conflicts.

DEBT COLLAPSE

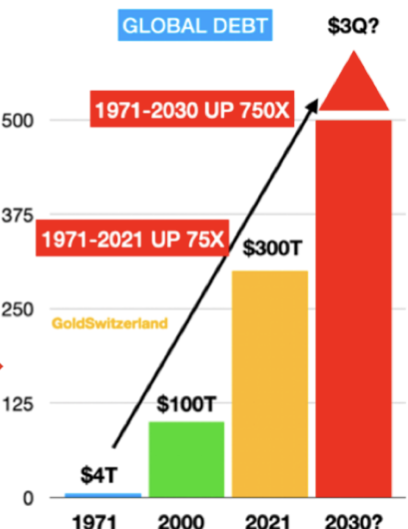

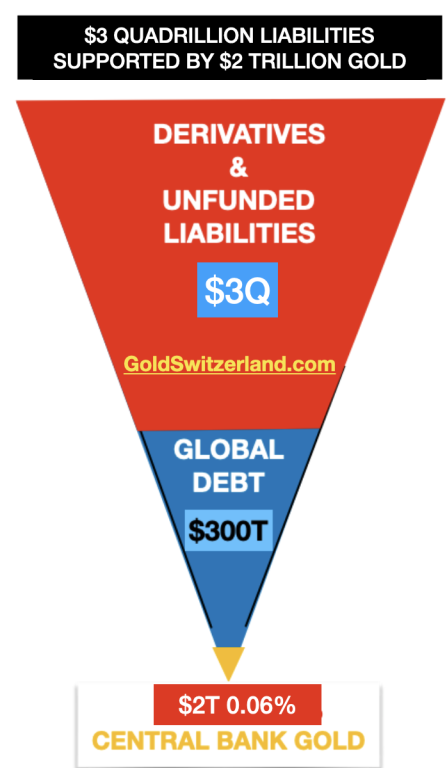

We have a global debt burden of $330 trillion plus derivatives totalling $1.5-3 quadrillion with debt growing exponentially, especially in the US. This will very soon develop into a debt crisis and collapse of a heavily leveraged Western world plus Japan and China and also emerging markets.

CIVIL UNREST and CIVIL WAR

The downturn and eventual collapse in the global economy will lead to poverty, famine and misery for a great number of people in the West and Emerging Markets.

UKRAINE WAR –

This war started as a local conflict but with a US backed putsch in 2014, throwing out the democratically elected Russian friendly leader, this was the beginning of a war between Russia and the US and not a local war.

The Minsk agreement brokered by Germany and France was supposed to settle the matter but as Merkel recently admitted, the intent was never to create peace but to give enough time for Ukraine to arm with the help of the US.

The US forced Europe to take sides, in spite of Europe’s (especially Germany’s) dependence on Russian energy.

We can blame Russia for invading or we can blame the US for provoking Russia.

Rather than to go into all the arguments who is right and who is wrong, best to accept that we now have a global conflict stemming from the Ukraine situation. The US has a reluctant Europe on its side – a Europe which is militarily and economically weak. Russia has China, Iran, North Korea and a few others, most probably a militarily superior group.

A bankrupt USA just sends more money and weapons but has zero intent to send peacekeepers.

Thus there is no end in sight but the independent reporting tells us that Ukraine is unlikely to have a chance against the superior Russian war machine.

In the meantime an estimated 500,000 troops in total have died plus many more wounded and civilian casualties.

And still no peace attempt.

If the warring country’s leaders led from the front, which has been common in history, they would probably be less inclined to sacrifice more lives including their own.

ISRAEL – PALESTINE WAR –

This region has had ongoing conflicts throughout history. It was insoluble before 1948 and has become even more complex since 1948 when Israel was created.

Again, we have major powers involved with primarily the US and Europe supporting Israel and Iran, Turkey and major parts of the Arab-Muslim world supporting Palestine and also Russia.

The US is sending two aircraft carriers to the Mediterranean to assist Israel. But as a military expert pointed out, these are in modern warfare just two floating bathtubs which can be taken out easily by two missiles from for example Iran.

In this conflict there are also many casualties on both sides plus a massive number of Palestinians being homeless with little food or even medical help.

What makes this conflict even more serious is the major support in the West for the plight of the Palestinians. Massive protests in many countries can easily escalate to serious clashes or even civil war.

In addition, we can be certain that the massive migration from Muslim countries to the West will also contain many militant cells which could easily create havoc in the US and in many European countries.

Both Europe and the US basically has an open border policy for any migrant who wants to enter. But neither continent has the ability to properly take care of the migrants. This will risk both continents to be destabilised with both migrants and the native population not accepting the other side.

CHINA – TAIWAN

It is unlikely that China will abandon its claim that Taiwan rightfully belongs to them.

The US is already busy with two wars, assisting with an array of military equipment plus $100s of billions of financial aid. A third conflict with major US military involvement would be extremely unwelcome to the US government.

But that is exactly the right time to strike from China’s point of view.

China knows of course that seizing Taiwan, is likely to involve major US sanctions leading to reduced or no US imports from China leading to a major fall or collapse of global trade. It is doubtful that Europe or the rest of the world would comply with these sanctions.

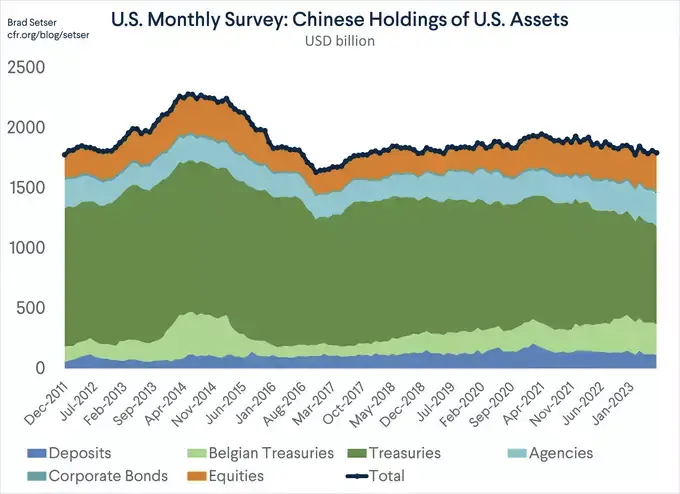

It would also lead to freezing of China’s assets in the US of $1.7 trillion, including treasuries of $850 billion offset by US direct investments in China.

But if China seizes Taiwan, they would control 60% of the world’s semiconductor production and more importantly 90% of advanced semiconductors. This would be a very serious blow to US strategic industries including military equipment.

THE CYCLE OF EVIL HOLDS ALL COMPONENTS TO CREATE HELL ON EARTH

It is intellectually fascinating but humanly depressing to watch how all the pieces fall into place for a global conflict of a magnitude greater than WW1 or WW2.

It is frightening to see how one component after the next falls into place in the Cycle of Evil.

Nobody realised that the shooting of the Archduke of Austria-Hungary Franz Ferdinand in 1914 would be the catalyst for WW1.

Nor did anyone understand that Germany’s invasion of Sudetenland in Czechoslovakia in 1938-9 and of Poland on September 1, 1939 would lead to WW2.

The two major conflicts in Ukraine and Israel-Palestine today with Taiwan looming combined with no attempt of peacemaking plus a likely collapse of the global financial system and world economy is more than enough to create devastation for the world for the next decade or more.

Let us sincerely hope that all these events in the Cycle of Evil will not develop into global havoc.But even if that were to be avoided, it is absolutely certain that global risk today is higher than at any time since the 1930s.

WEALTH PRESERVATION

Most of us have little influence over the geopolitical or global economic situation.

Nor do most people have the flexibility to move to a lower risk area in regards to a conventional or nuclear war.

But anyone who has savings however small or big can at least protect some of their liquid assets.

As we have pointed out in many articles, physical gold and some silver is the only money which has survived and maintained its purchasing power for thousands of years.

Thus gold and silver are the perfect insurance and wealth preservation asset to protect against the coming problems.

It is critical to hold gold and silver outside a fractured financial system in the safest jurisdictions preferably outside your country of residence. It is important to be able to flee to your wealth preservation asset if there are problems in your own country.

It must also be kept in the safest vaults with direct personal access. Nuclear bomb proof vaults are an additional important protection but hard to find. We offer this in Switzerland for bigger investors.

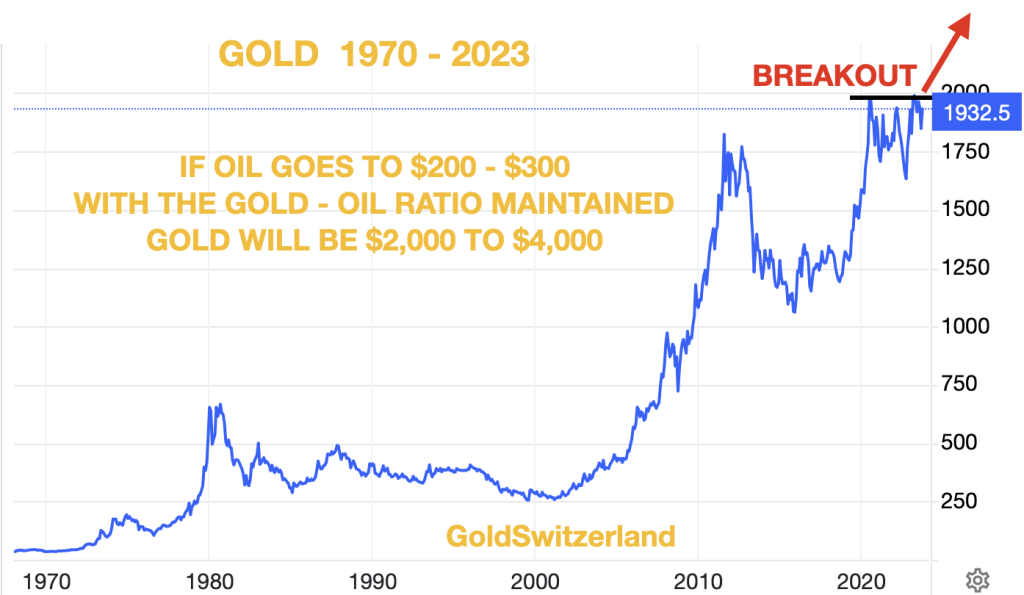

As I have stressed in recent articles, WILL THIS FALL BE THE FALL OF FALLS, gold just fulfilled the technical projection of a small dip and is now on its way to much, much higher levels.

With Central Banks likely to switch their reserve assets from US dollars to gold, we will see a major revaluation of gold to probably multiples of the current price. See my important article: A DISORDERLY RESET WITH GOLD REVALUED BY MULTIPLES

HUMAN SUFFERING – HELP FAMILY AND FRIENDS

Sadly the coming conflict will lead to major human suffering both economically and humanly.

So helping family and friends is very important.

Also, remember that some of the best things in life are virtually free. In addition to family and friends, life offers so many wonderful things like nature, music, books, sports etc.

THE CYCLE OF EVIL

In this extensive conversation with Cambridge House CEO, Jay Martin, Matterhorn Asset Management partner, Matthew Piepenburg, shares his insights on the historical interplay of war, over-indebted nations, broken bond markets, currency debasement and their inflationary consequences, all of which lead toward (and confirm the importance of) physical gold investing.

Martin and Piepenburg step back from the near-term shock of headlines from the Middle East to address the broader issue of war as a component of deteriorating debt and financial conditions. Piepenburg addresses clear evidence of political, financial and social fracturing in the world in general and the US in particular. Unfortunately, such stress-points are part of an historical pattern that often involves the evolution of military conflicts, the risks of which are expanding daily. Particular attention is given to specific signs (economic, political, and social) that the “American empire” is experiencing a clear and downward turning point.

An open symptom of this decline is the post-sanction rise of the BRICS+ nations and the ever-increasing evidence of a shift from a USD-driven mono-polar world to a multi-polar, real-asset-driven world. Piepenburg offers a number of reasons (in currency, energy, credit and trade circles) why this foreseeable trend away from USD hegemony will continue despite the still obvious power/supremacy of the world reserve currency. Ultimately, Piepenburg maintains that currency debasement is the inevitable end-game.

The conversation then turns to what Piepenburg describes as the “absurd” notion that inflation has been contained. He offers numerous and compelling arguments as to why inflation is rampant and growing rather than controlled or defeated. The overt as well as hidden evidence of a recessionary trend toward more synthetic liquidity, and hence inflation, are unpacked in detail. All of this is derived from unimaginable sovereign debt levels which ultimately demand monetization as the Fed loses control of grotesquely inflated bond markets. As more “fake money” is created to “save” these sovereign IOUs, the collapse in purchasing power and hence the case for gold becomes incontrovertible.

THE CYCLE OF EVIL

In his first interview with Dunagun Kaiser of Liberty & Finance, Matterhorn Asset Management founder, Egon von Greyerz, offers his insights on the latest geopolitical and financial headlines.

Von Greyerz opens by discussing the patterns and parallels of debt, currency, geopolitics, oil and gold. Specifically, von Greyerz squarely addresses the historical use of war as a disturbing policy tool to excuse debt and justify further expansion of the same. Oil, of course, is often a protagonist in such an historical stage, and von Greyerz considers the various ways in which current conflicts within the Middle East and the Ukraine can escalate into a more global danger. Western policy, he maintains, has a woeful lack of statesmen. US leadership, in particular, remains mysterious, weak and marked by sending money and weapons rather than sophisticated peace negotiators.

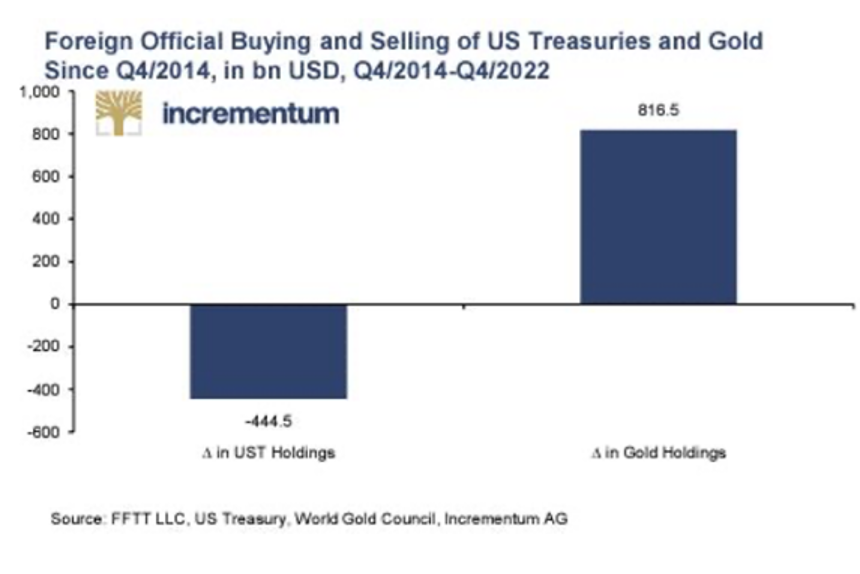

War, of course, has immense implications on financial conditions, at home and globally. Wars, von Greyerz reminds, are costly. But where will the money come from given US debt levels? Sadly, the answer is “out of thin air,” a pattern for which markets and central banks are all too familiar. Ultimately, this makes sovereign bonds and currencies in general, and USTs and USDs in particular, increasingly weaker and unloved. This trend, as well as distrust, away from the Dollar has only been accelerated by the weaponization of the USD following the war in Ukraine. Eastern central banks are thus selling USTs and stacking physical gold as confidence in, and trust for, the world reserve currency openly unwinds. This places pressure on credit markets already cracking under the immense weight of grotesquely over-levered derivative markets.

Taken together, these debt, currency and geopolitical risks have created a setting of risk unlike any von Greyerz has seen before. Money printing can no longer solve this convergence of open deterioration. Informed individuals, however, can protect their own financial conditions by doing what their leaders and 99.5% of their peers have failed to do—namely: Protect their purchasing power via direct investment in physical gold, a timeless asset whose real journey has yet to even begin. History, of course, confirms such a minority of investors are always rewarded for thinking carefully, wisely and differently; but as Egon concludes, gold’s rise will be significant, yet sadly because the fall in global welfare will be equally so.

THE CYCLE OF EVIL

Below, we follow the breadcrumbs of simple math and bond market signals toward an oft-repeated pattern of how once-great nations become, well…not so great any more.

Debt Destroys Nations

Debt, once it passes the Rubicon from extreme to just plain madness, destroys nations.

Just ask the former Spanish, British or Dutch empires. Or ask the inter-war Germans. Ask the Yugoslavians of the 1990’s or ask a historian of Ancient Rome or a merchant in modern Argentina.

It’s all pretty much the same story, just different a different stage or curtain call.

Like Hemingway’s description of poverty, the process begins slowly at first, and then all at once.

Part of this process involves currency debasement needed to pay down more desperate issuance of IOUs, a process evidenced by rising rather than “transitory” inflation.

Thereafter, comes increased social unrest, and hence increased centralization from the political left or right in the name of “what’s best for us.”

Sound familiar?

Centralization—The Last, Failed Act

Centralization never works in the long run, but that has never stopped opportunists from trying.

Just look at our central bankers.

In a centralized rather than free market, the very name “central bank” should be a dead give-away as to their real role and profile.

As private central banks have been slowly increasing their hidden power and control over national markets and hence national welfare, the very notion of free price discovery in bonds, and indirectly in stocks, is now all but an extinct financial creature in the neo-feudalism which long ago replaced genuine capitalism.

How the Central Game is Played—From Temporary Prosperity to Permanent Ruin

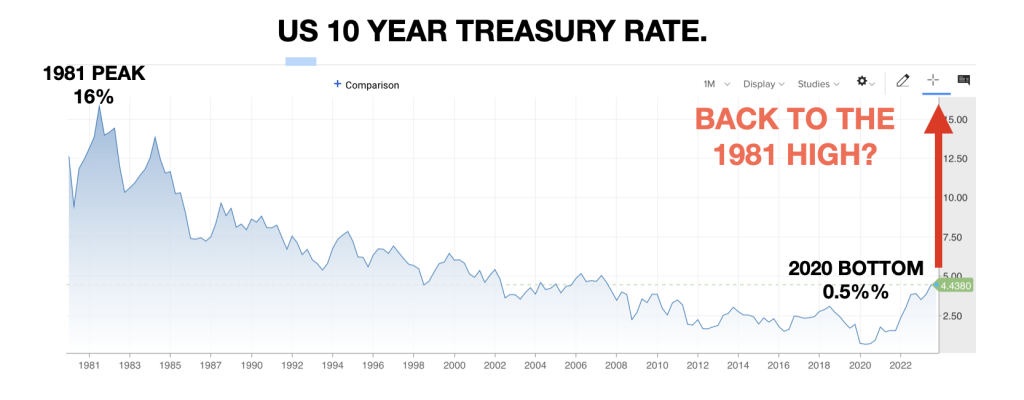

When central banks like the Fed repress rates and print gobs and gobs of money, bonds are artificially supported, which means their prices go up and their yields are compressed.

When yields are low, rates are low, which means the cost of credit is cheap, allowing otherwise profitless names in the stock markets to borrow money and time for years of temporary prosperity—like a 600% rise in a post-08 S&P…

In short: central bank repressed rates are a profound tailwind for otherwise mediocre risk assets.

But when central banks like the Fed raise rates (ostensibly to “fight inflation”), the opposite effect happens—and things break. I mean really break.

I’ve written and spoken ad nauseum about what has broken, is breaking and will continue to break; furthermore, I’ve written and spoken at length about the quantifiable irony that Powell’s so-called war on inflation will only end in more inflation.

Yep, the ironies just abound in this world of so-called experts, which is little more than an island of misfit toys.

Postponing Pain Only Heightens It

In normal, free-market cycles devoid of central bank “support,” bonds and hence rates rise and fall naturally based on natural demand and natural supply.

Imagine that?

This leads to frequent but healthy moments of what von Mises and Schumpeter described as “constructive destruction”—i.e., a cleaning out of debt-soaked and crappy enterprises in naturally occurring recessions and naturally occurring market drawdowns.

But central banks somehow thought they could outlaw recessions by printing money out of thin air to support bonds and repress yields. You know—solve a debt crisis with more debt. Brilliant…

This was hubris at the highest level, and the stupid just became a habit and even received a fancy name to justify it—Modern Monetary Theory.

Natural Market Forces Are Stronger than Central (Bank) Forces

But the longer central banks postponed pain to win Noble Prizes and ego-lifting acclaim from the un-informed, the greater the natural pain (ticking time bomb) these central planners created as they now slowly realize that the bond market, like an ocean, is more powerful than a band of unelected market stewards.

In fact, a bunch of FOMC officials (Kashkari, Bostic, Waller et al.) are now running around like headless chickens and declaring that higher bond yields may now be more powerful than the Fed Funds Rate.

In other words, after months of hawkish chest-puffing, they are saying that perhaps enough is enough with the “higher for longer” meme…

Central bankers, it seems, are beginning to realize what informed credit market jocks have always known, viz: The bond market is stronger than any central bank.

Price Matters

That is, eventually central bankers lose control of artificial bond pricing.

Which means that eventually the great weight of sinking bonds and hence rising yields and rates becomes more powerful than central bank money printers to keep those bonds artificially “supported.”

I’ve been saying this for years despite “journalists” at the WSJ and Financial Times calling math-based realists like me “kooks.”

But recently even the fine folks at the WSJ or Financial Times (FT) are beginning to worry out loud as UST supplies far outstrip natural demand, causing bond prices to fall and yields and rates to rise fatally higher than central bankers once thought safely under their control.

We’ve warned of this for years—and this grotesque supply and demand mis-match has only risen exponentially in recent months.

America: Running Out of Takers/Suckers for Its Ever-Increasing IOUs?

The trillions in spending forecasted for year-end and into 2024 just don’t have any real money behind it, which means more IOUs will be spitting out of DC with less and less love/demand for the same.

This, of course, has been a real problem hiding in plain site for a long, long time.

As supply outpaces demand for sovereign bonds, their prices sink, their yields rise and hence interest rates—the cost of debt—becomes fatal rather than just painful.

The journalists at the FT, most of whom never sat at a trading desk, however, still have a very hard time imaging the unspeakable—i.e., a total implosion of sovereign bonds, and hence a total implosion of the financial system.

Thinking About the Unthinkable

They still see the UST as too big to fail—or to use their own words, any failure of this sacred US Sovereign bond is “unthinkable.”

Well…think again.

But at least the main-stream-financial pundits are crying that any real threat to Uncle Sam’s IOUs “would force the state to act.”

For once, I actually agree with these “journalists.”

But let’s clarify what “forcing the state to act” really means—i.e., in simple speak.

When There’s No Good Acts Left to Take

In short, this means the “state” would have to “act” by saving the bond market in particular and the global financial system in general via trillions and trillions of printed dollars to purchase otherwise unloved IOUs from Uncle Sam.

In other words, the only way to save bonds is to kill currencies.

This, by the way, is a now familiar trajectory to any one paying attention (think of the September 2019 repo crisis, the March 2020 Covid crash or the 2022 Gilt crisis in the UK) the implications of which we’ve been warning well ahead of the pundits.

Such “state action,” of course, slowly kills the USD—but as I’ve also warned for years, the last bubble to pop in every centralized, debt-soaked financial failure throughout history is always the currency.

The once exceptional USD, sadly, is no exception. It just takes longer, a lot longer, to bring down a world reserve currency.

This, by the way, is not “gold bug sensationalism” but simple history supported by simple math—two disciplines our leaders, financial journalists and even bankers either don’t grasp or do their best to ignore, cancel or dismiss.

Again, with the ironies.

Even the Media Can’t Deny the Obvious

But at least the main stream pundits are catching on. This is only because the problem of unprecedented deficits alongside rising bond yields and hence debt costs are now too obvious to ignore.

The WSJ recently wrote that “deficits finally matter.”

Hmmm. They have mattered for a long time—just saying…

Telegraphing a Weaker USD?

In the end, and as warned over and over and over (and as confirmed, it seems, even by the squawking Fed officials above), the facts and Fed-speak all point toward a talking down of the USD in favor of Uncle Sam’s broken IOU.

That is, the media is already planting the seeds for the USD’s painful endgame.

This comes as ZERO surprise, despite the Greenback’s relative status as the best horse in the global glue factory.

And, at least for now, that USD is breaking well off its prior uptrend…

This weaker USD will provide needed liquidity relief for an over-stretched UST market.

But the USD (and DXY) will have to come down much further, in my opinion, to buy sovereign bond markets needed time.

Pick Your Poison: Busted Financial System or Neutered USD?

Eventually a choice will have to be made between saving the system (of which sovereign bonds are the foundation) or sacrificing the currency.

In other words, get ready for more dollar-destroying “state action” from that non-state/private enterprise otherwise known as the Fed—all in the form of direct magical mouse-click money.

The Postponed Pivot Already Began

For over a year, this inevitable Fed pivot toward QE was delayed by back-door QE-like measures from Yellen’s Treasury Department (i.e., refilling the Treasury General Account with T-Bills) or the dual (and multi-trillion) accounting tricks of BTFP bank-bailout (by which Uncle Sam guaranteed par value return to the banks but market value losses to the suckers on Main Street…)

Or War Might Be in Order? Ask Hemingway

In fact, the only thing that could publicly justify (and partially absorb) another massive dose of 2020-like money printing (and hence currency debasement) would be a big, fat, ugly war with war-like “emergency measures” whereby our leaders can blame decades of debt-addiction on battle smoke (or COVID, Putin, and men from Mars) rather than their own bathroom mirrors.

Again, Hemingway was likely onto this trend long before the WSJ or FT:

Around and Round We Go

But with conflicts now red hot in both the Ukraine and Israel, Biden and his broken bond market are hitting an inflection point where the USA just can’t really afford more war support to its allies without thinning the USD and over-stretching its UST.

And so, folks… around and round we go in the ultimate vicious circle within which all debt-soaked nations throughout history ultimately find themselves.

That is: 1) poorly managed nations get too drunk on debt, and then 2) debase their currency to pay their debt; thereafter, 3) inflation comes, followed by 4) rising rates to fight that inflation, which in turn means 5) higher debt service costs, which means 6) more inflationary currency creation is rolled out to pay those higher rates.

Stated more simply, the USA has hit the Fiscal Dominance arc of the debt-cycle vicious circle wherein fighting inflation just creates more inflation.

The World Is Catching On…

We, of course, are not the only ones who see this.

In fact, pretty much the entire world is catching on, with the BRICS+ nations making the first steady moves (de-dollarization) as eastern and other central banks continue to stack physical gold at record-levels in preparation for the slow but steady decline (not death, nod to Brent Johnson) of the World Reserve Currency.

As I recently wrote, just like kings bring horses and canons to their borders to defend against an approaching invader, central banks are stacking physical gold to defend against a debased USD.

It’s just that obvious.

This may explain why gold continues to rise in London and NYC despite so-called “positive real rates” and a still relatively strong USD.

That is, the world, including the Shanghai gold exchange, is seeing the golden lighthouse through the smoke of burning currencies.

Are you?

THE CYCLE OF EVIL

Egon von Greyerz joins his dear friends and Matterhorn Asset Management advisors, Grant Williams and Ronnie Stoeferle, to address the unique risks—economic, geopolitical, military—making headlines at an alarming rate.

This timely and highly important conversation opens with the financial, political and trade moves from West to East as evidenced by the growing BRICS momentum and its near and longer-term impact on the price of gold as prosperity moves from West to East. Consumer gold demand from India and China, increased central bank demand in the East and rising gold premiums on the Shanghai Exchange suggest that the LBMA hegemony over gold pricing is shifting, as Ronnie discusses.

As to rising gold prices, Grant reminds that gold does nothing, currencies just continue to weaken. Strangely, however, investors continue to erroneously wait for gold price spikes before investing in gold, a point which Egon addresses.

Grant unpacks the failure of Western sanctions and the weaponization of the world reserve currency as the key driver away from USDs/USTs and toward physical gold. We are entering a period of tremendous geopolitical shifts for which gold’s role will be central as a wealth preservation asset, a role which Egon has steadily maintained for more than two decades. Despite such a clear direction, many Western individuals fail to make physical gold a core part of their portfolios, an issue which Ronnie addresses at length—giving particular attention to misunderstood bond markets and the total return losses therein.

Grant adds his thoughts on gold allocation percentages in the context of gold’s global market share, which is finite despite fiat money’s infinite (and hence inflationary) range. The West, unlike the East, has not fully understood inflation risk and portfolio reactions to the same.

Egon then asks if we are looking at an existential crisis given increased global conflicts, to which Grant and Ronnie add their insights/concerns. Grant sees a complete failure of diplomacy before, during and after events in Ukraine and Israel made headlines. As Egon argues, it seems the US policy is little more than sending money and weapons at every problem, not statesmen.

Of course, gold can’t protect investors from every risk making headlines today, but it has a clear role in protecting against financial risk, a point which Ronnie, Grant and Egon address at length in the closing minutes of this spirited discussion.

THE CYCLE OF EVIL

What a bloody mess! Well, economic collapses and wars always are.

But sadly it will become a lot messier!

We now have two dangerous wars, maybe we will have a global war. We have a coming collapse of stock markets and debt markets and a banking system which probably will not survive in its present form.

But there is always another side of the coin.

There will be opportunities of a lifetime not just to preserve your wealth but also to amass an incredible fortune. More later.

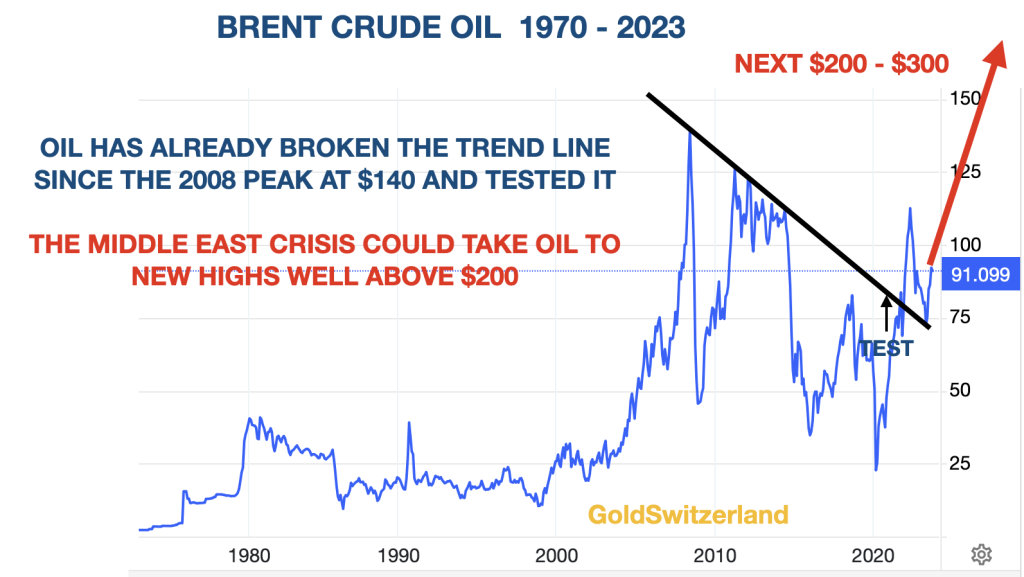

WHERE BLACK GOLD GOES YELLOW GOLD WILL FOLLOW

Oil and gold are best friends. As the chart of the Gold – Oil ratio for 50 years shows, below, gold and oil move very much in tandem within a narrow range. So if oil now goes up due to the Middle East crisis, gold will follow.

AS IF CLIMATE CHANGE, VACCINES, LOCKDOWNS, WOKENESS, STOLEN ELECTIONS, CBDC, DEBT etc WASN’T ENOUGH

As if all the above wasn’t bad enough, adding a Middle East war to this makes the crisis properly global and the step toward a Global or World War is very short even dangerously short.

We thought we had enough trouble with climate change, ESG (Environmental, Social, Governance), wokeness with 27 genders and canceling history, forced vaccines and lockdowns, high taxes, high inflation and debt that can never be repaid.

Hard to understand what happened to the world since I was born 78 years ago.

Add to that incompetent governments in the entire Western World and not a single statesman around. All of that is more than most people can cope with.

The US government and Biden have no policy, no ideology. They have also lost their manufacturing base and their military power is declining rapidly.

On top of that, the US is also spending money like a drunken sailor who will never sober up but only spend or drink more to drown his ever increasing debts and sorrows.

And then we started to get used to the “local” war in Ukraine which the poor Ukrainians could never win against a superpower.

We are now talking about the greatest uncertainties in my 78 year lifetime which started at the end of WWII 1945.

No one can predict where the current two wars will lead, although our worst fears can sadly be realised sooner than anyone could believe.

At this stage we cannot say if these crises will lead to a major destruction of the fabric of the world and the death of many, many people.

But what we can say with much greater certainty is that economic and financial risk is now at a level which is likely to lead to the destruction of wealth on a level never before seen in history.

I was born right in between the end of WWII in Europe and before it ended in the Far East. So I naturally don’t remember anything from that era. My father was an officer in the Swedish army at the time and Sweden unofficially assisted Norway which was occupied by the Germans.

But I can well remember my early life in Sweden which was a prosperous and stable country with a homogenous population. The 1950s were a period when church doors were open and the church silver could be left unprotected. Today, the copper roof, the gates and anything of value is long gone. Obviously the silver is either locked in or stolen. Police and teachers were greatly respected with ethical and moral values very high. Now people swear and spit at them.

But the stability of the early 1950s (except for the Korean War) soon led to wars in Vietnam, Middle East etc with the invasion of Hungary and Czechoslovakia and Yom Kippur in 1973 being the first Palestine conflict I can remember. Petrol prices in the UK where I lived at the time were 7.5 pence per litre.

That was the first major oil crisis I experienced. Today petrol in the UK is £1.90 per litre and unlikely to stay that low for long. But a 26X increase in the last 50 years of petrol (US gasoline) is probably going to be seen as a bargain in a few years time.

let’s start with your most important decision which you need to take toDAY

Buy as much physical gold as you can afford and then buy much more.

We have warned investors for some time that the Everything Bubble will turn into the Everything Collapse.

Well that time is now coming very soon.

The current pattern of the Dow looks very similar to October 1987. If that is correct, a stock market crash could be imminent.

Stocks will be down 70-90% or more, in real terms, before this crisis ends.

Most bonds will become worthless, even Sovereign bonds.

Higher rates and defaults will see to that.

So get out of all general stock and all bond investments if you want to have any money left at the end of the coming calamity.

Interest rates will continue the long term, 20-30 year uptrend, obviously with corrections. No one will want to lend to a drunken sailor who can never get sober. Defaults and a banking crisis will lead to higher debts and higher rates. But the US with record borrowings can’t afford the rising interest costs. The dollar will be sacrificed.

So in all a perfect but vicious debt and currency cycle leading to guaranteed perdition.

The only question is how long it takes.

GOLD WILL BE YOUR SAVIOUR

We have been advising investors to hold important amounts of physical gold for wealth preservation purposes since the beginning of 2002. Since that time gold is up 6-8 times in most major currencies and much more in weaker currencies.

But as I keep telling colleagues and investors, gold’s real journey hasn’t started yet.

What I often tell our clients is that they mustn’t wish for gold to go up substantially.

Because when gold goes to the levels which I now feel certain it will, the quality of our lives will be considerably worse than today.

The factors that will fuel gold’s rapid rise to new substantially higher levels are obvious:

WARS

It is both fascinating and frightening to follow how regional disputes lead to superpowers quickly taking sides and lobbying or forcing its allies to follow suit.

There are always two sides to a dispute. One of my very important principles is that before you judge someone, you must walk three moon laps in his moccasins. (An old American Indian saying). But sadly most people including superpowers totally ignore such advice. The Russian argument is that the Minsk agreement was meant to avoid a deepening of the dispute and should have been followed. The US side is that Russia must be stopped at any price and Germany separated from a dangerous rapprochement with Russia. And Europe was given no choice but to follow the US.

As Bush Jr said to congress in 2001:

“Either you are with us, or you are with the terrorists!”

The sanctions are severely affecting Germany and most of Europe but the worst consequences are still to come this winter. The Middle East conflict is likely to make the consequences exponentially greater.

Like with all wars, ordinary people on either side don’t want it. And democracy doesn’t exist when a nation goes to war. Both Ukraine and the US went to war without the consent of either the people or their parliaments.

THAT IS HOW WARS AND WORLD WARS START – Idiosyncratic leaders with sycophantic lieutenants take erratic decisions without understanding the consequences.

WHO IS ACTUALLY RUNNING THE US?

And when the leader is past his sell by date it makes the whole process utterly dangerous.

Everybody gets old and I am no spring chicken either. But if for whatever reason I don’t have the wits to resign when I should, I hope that my wife and my team will tell me so.

IT IS EXTREMELY DANGEROUS FOR A SUPERPOWER TO BE LEAD BY SOMEONE WHO IS NOT CAPABLE OF LEADING.

Even more dangerous when an unaccountable and unidentifiable group takes all the decisions.

UKRAINE AND PALESTINE – REGIONS UNDER CONSTANT STATE OF CHANGE

As Heraclitus, the greek philosopher said 2,500 years ago:

“Change is the only constant in life.”

Modern Ukraine was occupied by a number of different people throughout history like the Scythians, Greeks, Romans, Goths, Huns and the Slavs as well as the Mongols. Later Poland and Lithuania and the Ottomans were involved. In 1709 the Swedish King Charles the XII lost against Peter the Great of Russia due to the Great Frost (the coldest winter in 500 years) which weakened the Swedish Army just like during the Napoleon and Hitler invasions.

So Ukraine is hardly a stable country with deep roots and a homogenous people.

The same with Palestine, the Land of Israel, the birthplace of Judaism and Christianity which has been controlled by, among all, Ancient Egypt, the Persian Empire, Alexander the Great, the Roman Empire, Muslim Caliphates, the Crusaders, the Ottoman Empire and the British Empire after WWI. In 1948, Britain divided the region into Israel, the West Bank and Gaza.

The history is too long and complex to delve into the details here but suffice it to say that the modern split of the region has created a constant period of dispute (constant change again), misery, wars and deaths.

No one is prepared to wear the other side’s moccasins and the situation could now escalate to a world war between the Muslim world and the West. This is likely to result not just in a major war but also terrorism around the world.

Just like in Ukraine, the US and the West are more likely to send money and weapons to the Middle East rather than to peace makers.

It is unfathomable that the West chooses war over peace. This certainly does not bode well for a peaceful solution to the two conflicts.

OIL

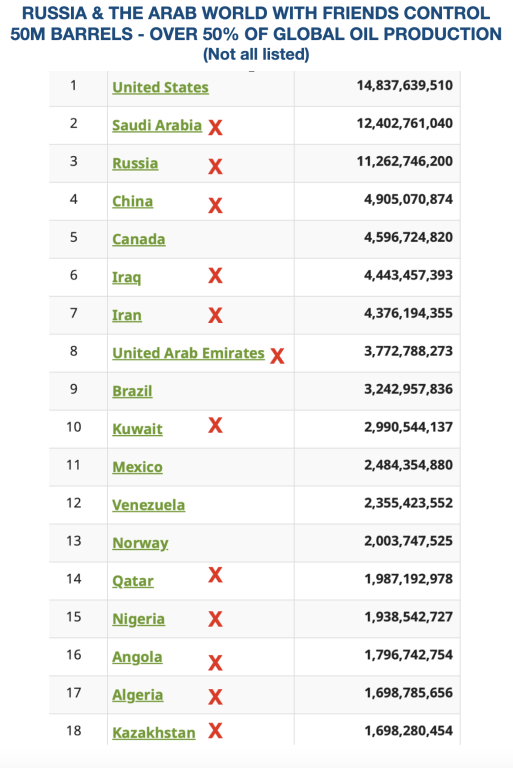

Since most wars in modern times involve oil, the current ones are no exception.

There are two major camps controlling the global oil supply.

Around 22 million barrels of oil go through the Strait of Hormuz between Dubai and Iran.

It would be virtually impossible to prevent Iran from blocking this area off, stopping all shipments of oil and gas, if necessary with the help of Russia.

That would turn off 22 million barrels of oil or 23% of global supply. Enough to make the oil price go to $500 – $1,000 and paralyse the world.

DEBT AND CURRENCY COLLAPSE

I have since the 1990s been certain that the world economy would end in a debt and currency collapse. That is a very obvious projection since history always repeats itself, or rhymes, and every economic period in history ends this way.

The difficulty is to time the cycle but as I often stress, exact timing is less important. The key is to prepare early and buy the fire insurance or protection well before the fire starts.

So whether we call it a Fourth Turning like Neil Howe or a debt and currency collapse like von Mises, the end result is the same and devastating.

When I discuss my economic scenario most people (but obviously not our clients) call me pessimist or a prophet of doom and gloom.

But I am an optimist and consider life to be a wonderful journey. The key is to help other people, family, friends, and clients. Real happiness is making other people happy. It clearly doesn’t always work with people who believe you are a prophet of doom and gloom. But it does work extremely well for people who need help.

So enjoy life with family, friends, nature, music, books etc for as long as you can. Remember that the quality of your life is determined by how you deal with adversity.

JIM SINCLAIR – MR GOLD

Our good friend Jim Sinclair died last week of a heart attack. Since the 1970s he has been one of the foremost gold experts in the world. He traded the whole run from $35 in the early 70s to $850 in 1980 where he got out making substantial returns.

Above all Jim was Mr Gold with a superb understanding of the world economy, markets, politics, wealth preservation and of course gold.

Many people around the world followed his wisdom through his website JS Mineset.

I had the privilege of meeting Jim many times around the world. He was always gracious with his advice and support. He often told investors to “Go to Egon” and posted both my mobile number and private email on his site. At times we were totally inundated with potential clients. He had a tremendous following.

We will miss you greatly, Jim. I know that you wanted to experience the coming surge in gold that took longer than many of us expected. But you always knew that this move was inevitable. Still, your legacy will certainly be with the whole gold community and we will send you thankful thoughts regularly as gold continues to move up.

THE CYCLE OF EVIL

The reshaping of the world economy and the global (political) order is in full swing. It is a long process, the concrete outcome of which is uncertain in advance and associated with numerous imponderables. Nevertheless, there are powerful factors, such as the shift in economic, demographic and military weight, that are driving the readjustment in the (geo)political arena. And this readjustment is also reflected in the change in gold flows. They are increasingly shifting from West to East, since “Gold goes where the money is,” as James Steel pointedly put it.

The central banks of the states of the East are among the strongest buyers of gold – also within the West

This is also reflected in the continuing enthusiasm of central banks for gold, especially in non-Western countries. 2022 saw the largest purchases of gold by central banks since records began more than 70 years ago, at 1,136 tons. The first half of 2023 saw a continuation of this trend. Despite a weaker second quarter, central bank purchases in the first half of the year set a new half-year record. Central banks increased their gold reserves by a total of 378 tons from January to June. The previous half-year record from 2019 was thus slightly exceeded. China made the largest purchases, followed by Singapore, Poland, India and the Czech Republic. So even in the West, it was countries in the East that made additional purchases.

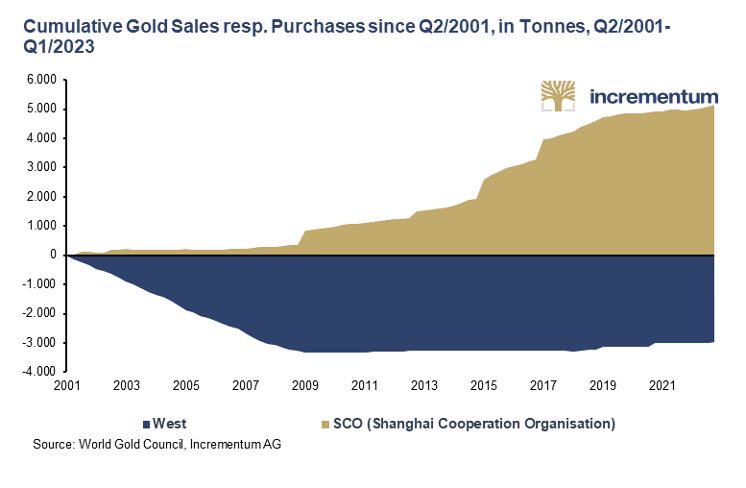

The following chart shows the extent to which institutional demand for gold has shifted to the East. It compares the cumulative gold sales of Western central banks with the cumulative gold purchases of the Shanghai Cooperation Organization (SCO or SOC) since 2001.

Looking at the BRICS, we also see a striking overlap, with central banks from four of the five BRICS countries – Brazil, Russia, India and China – buying a cumulative 2,932 tonnes of gold over 2010–2022.

Holdings of US Treasuries are reduced

In turn, the BRICS continue to reduce their share of the soaring US government debt. In other words, gold is becoming more and more interesting as a reserve asset because US Treasuries have been becoming less and less interesting as a currency reserve for more than a decade. The militarization of money by freezing Russia’s foreign exchange reserves just days after Russia’s invasion of Ukraine in late February 2022 added emphasis to this process, but did not kick it off.

The BRICS now hold only 4.1 percent of all US government debt, compared with 10.4 percent in January 2012. That is a decline of more than 60 percent. The rest of the world has reduced its exposure to US government debt by much less. In January 2012, the rest of the world held 22.0 percent of all US government debt on their books; currently, they hold 19.3 percent. That is a decrease of more than 12 percent.

The East is expanding its infrastructure for gold trading

However, the East is not only stocking up on gold and mining gold itself on a large scale. China and Russia have ranked among the top 3 gold producing nations for years.

Countries such as China, the United Arab Emirates and even Russia are expanding their gold trading infrastructure. This is to establish a permanent infrastructure for the detour of gold trading from gold trading centers in the West such as London, New York and Zurich. This testifies to the changing understanding of roles: The East increasingly no longer sees itself as a customer of Western infrastructures, but offers the infrastructure itself.

Key developments include:

- SGE & SFO NRA: Cooperation between the Chinese and Russian gold markets

For some time now, China and Russia have been working hard to link their gold markets through cooperation between the Shanghai Gold Exchange (SGE) and the Russian financial authority, the National Financial Association (NFA). The NFA is a Russian professional association representing the entire Russian financial sector, including the Russian precious metals market.

In the face of Western sanctions, Russian gold exports to China have already surged since mid-2022. As three Russian banks – VTB, Sberbank and Otkritie – are already members of the SGE International Board of the SGE, which was founded in 2014, this cooperation between the gold markets of Russia and China is likely to intensify in the future.

- Memberships in gold-related institutions

As gold flows from west to east and the importance of eastern gold markets increases, these markets will also have greater representation and influence in the global institutions that represent the gold market, such as the LBMA and the World Gold Council (WGC).

In 2009, only six Chinese refineries were on the LBMA’s Good Delivery List, but now there are thirteen. While just 15 years ago there was only one regular (full) member of the LBMA from China, the Bank of China, there are now seven. China’s growing influence is also reflected in the World Gold Council. In February 2009, only one Chinese gold producer was a member of the WGC; now there are four.

- India International Bullion Exchange (IIBX)

In addition to its sophisticated OTC gold trading market, India has also established a trading infrastructure for gold futures contracts on the Multi Commodity Exchange of India Limited (MCX). In July 2022, the India International Bullion Exchange (IIBX), supported by the Indian government, was officially opened for trading spot gold contracts backed by physical metal. IIBX is located in a special economic zone in GIFT City in the Indian state of Gujarat, and the gold underlying the contracts is stored there. One goal of IIBX is to allow qualified buyers to import gold directly into India without the need for banks or authorized agencies. So far, however, trading volumes have been minimal.

- Establishment of a Moscow World Standard

At the end of February 2022, when sanctions against Russia were imposed by the West immediately after the start of the Ukraine war, the London Bullion Market Association (LBMA) excluded the three Russian banks VTB, Sovkombank and Otkritie. A few days later, the LBMA removed all six Russian precious metals refiners from the LBMA Good Delivery List and the CME Group followed suit, removing the same refiners from the list of approved COMEX refiners.

As a result, Moscow announced in July 2022 that a new infrastructure for precious metals trading independent of the LBMA and COMEX would be established. According to Moscow, this is intended to break the supremacy of London and New York in global precious metals pricing. This proposal calls for the introduction of a Moscow World Standard (MWS) for precious metals trading, similar to the LBMA’s Good Delivery List, the establishment of a new international precious metals exchange in Moscow based on the MWS, the Moscow International Precious Metals Exchange, and the creation of a new gold price fixing based on the MWS so as to establish gold prices and reference prices different from those of the LBMA and COMEX.

Private gold demand shifts to the east

EAST’S increased interest in gold is also evident in the non-governmental sector. Chinese consumer demand, for example, increased from 292.6 tons to 824.9 tons (2022) since the turn of the millennium. This is an increase of 181%. Annual consumer demand in India has also increased since the turn of the millennium, albeit from an already high level in 2000. China and India, which together accounted for only 28.7% of consumer demand in 2000, account for almost half of global consumer demand (48.4%) in 2022 and together acquired 1,600 tons of gold last year.

Consumer Demand for Gold – 2000 vs. 2022

| 2000 | % of Global Demand | 2022 | % of Global Demand | 2022 vs. 2000 in Tonnes | 2022 vs. 2000 in % | |

| India | 723.0 | 20.4% | 774.0 | 23.4% | 50.0 | 7.0% |

| China | 292.6 | 8.3% | 824.9 | 25% | 532.3 | 181.9% |

| Japan | 105.1 | 3.0% | 4.3 | 0.1% | -100.8 | -95.9% |

| Middle East | 457.9 | 12.9% | 268.2 | 8.1% | -189.7 | -41.4% |

| Türkiye | 177.4 | 5.0% | 121.5 | 3.7% | -55.9 | -31.5% |

| United States | 368.5 | 10.4% | 256.6 | 7.8% | -111.9 | -30.4% |

| France | 19.0 | 0.5% | 19.9 | 0.6% | 0.9 | 4.5% |

| Germany | 15.6 | 0.4% | 196.4 | 5.9% | 180.8 | 1,159% |

| Italy | 92.1 | 2.6% | 17.8 | 0.5% | -74.3 | -80.6% |

| UK | 75.0 | 2.1% | 35.6 | 1.1% | -39.4 | -52.5% |

| Rest of Europe | 142.4 | 4.0% | 115.1 | 3.5% | -27.3 | -19.2% |

| Other | 1,076.0 | 30.4% | 669.1 | 20.3% | -406.9 | -37.8% |

| Global Demand | 3,544.6 | 100.0% | 3,303.3 | 100.0% | -241.3 | -6.8% |

Source: World Gold Council, Incrementum AG

Recent developments point in the same direction. In the first eight months of the current year, Asian gold ETFs increased their holdings by 7.7%, while North America and Europe recorded outflows of 2.3% and 6.1%, respectively. Significantly, in the bars and coins demand segment, Turkey and Iran replaced Germany and Switzerland in the top 5 in the first half of the year. China now leads this sub-segment of gold demand – in the first half of 2022, Germany was still in the lead – followed by Turkey, the US, India and Iran. This is because while demand for bars and coins in Turkey shot up from 9.5 tons to 47.6 tons in the second quarter of 2023, it fell by around three quarters in Germany.

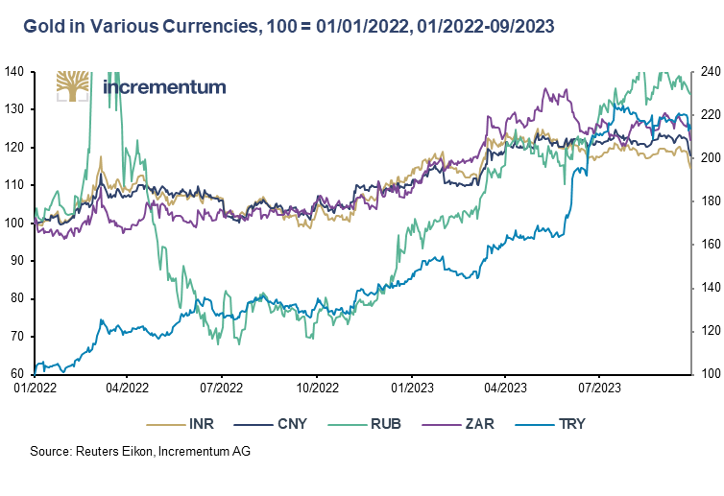

The price of gold in currencies of the East has increased significantly

As of the end of September, gold was 14.6% higher in Indian rupees than at the beginning of 2022, 18.0% higher in Chinese renminbi, 34.3% higher in Russian rubles, 22.1% higher in South African rand (all left-hand side) and 114.0% higher in Turkish lira (right-hand side). Gold thus impressively demonstrates its value-preserving properties in difficult (geo)political and macroeconomic situations in these countries.

The significantly increased premium on the gold price in China since July is an unmistakable sign that there is a structural shortage of gold in the Chinese market and thus an expression of the strong demand for gold in the Middle Kingdom, which is struggling with profound economic problems.

Conclusion

This shift in demand from West to East can be observed not only among governments or government-related entities, but also among institutional and private investors. Gold is flowing to where it is most valued and where economic prosperity and savings rates have increased. In the medium term, the shift in demand should therefore find support from the higher growth prospects in Asia and the Middle East. “Ohne Geld, ka Musi” (“Without money, no music”) – this is how the vernacular formulates this economic truism in German. And as the IMF’s most recent economic growth forecast indicates, the sub-region of emerging and developing Asia will grow at a projected 5.2% this year and 4.8% next year, while the West will grow much less strongly. This will also lead to a shift in influence on pricing from West to East.

THE CYCLE OF EVIL

In this brief yet substantive MAMChat, Matterhorn Asset Management principals, Egon von Greyerz and Matthew Piepenburg, address the overlay of escalating geopolitical tensions, oil markets, currency direction and, of course, gold’s critical and increasingly obvious role in preparing for the same.

Egon opens by asking a repeated question: “Is this fall the fall of falls?” Specifically, he addresses rising risk levels from inflation forces, unsustainable debt levels and toping markets to banging war drums, which sadly, are a fundamental symptom and aspect of debt cycles and debt crises. Naturally, tensions in the middle east will have ripple effects in oil markets which in turn impact the USD and hence gold, a theme which Matthew addresses in greater detail.

Specifically, Matthew discusses the double-barreled stresses on US oil production as a result of increased CAPEX costs on the back of Powell’s rising rate policies and the negative impact Biden’s pro-Green, anti-oil policies have had on US oil production. Strategic Petroleum Reserves, last year at over 650 million barrels, are now clocking in at 350 million barrels, and thus getting dangerously closer to supply-driven price hikes. Adding insult to injury, we are also seeing sanctioned nations like Iran, Venezuela and Russia selling oil outside of the USD to oil-thirsty nations like China, all of which point toward a slow drip away from the Petrodollar, which will impact Dollar-demand. Longer term, this will mean more artificial USD production and hence currency debasement in favor of precious metals.

This all-too-familiar (as well as historically-confirmed) interplay of debt, currency debasement, inflation and war is theme to which Egon returns in the concluding remarks. Gold, of course, can not and will not solve all of the myriad problems—political, military and social—making headlines at increasing speed today. Nevertheless, gold’s role as a preservation asset against undeniably weakening fiat money around the world is now undeniable. As Matthew then adds, once the role of gold is fully understood, it is equally critical for investors to understand the best jurisdictions to store this asset as well as the need to avoid paper gold in ETFs and gold “storage” in fractured and levered commercial banks.

THE CYCLE OF EVIL

In Part II of his conversation with Wealthion founder, Adam Taggart, Matterhorn Asset Management partner, Matthew Piepenburg, transitions from the broader (and increasingly unsettling and fractured) macro themes of Part I to addressing specific portfolio approaches and viable asset classes for concerned and informed investors.

Taggart reminds that despite Piepenburg’s longer-term expectation of debilitating inflationary forces, that nearer-term deflationary or dis-inflationary forces from falling markets and recessionary economies are expected. This view provides a needed context for portfolio preparation today.

Piepenburg, like many clear-eyed portfolio managers, argues that further Fed liquidity, and hence further market support/tailwinds, won’t emerge until after risk asset markets in general, and equity markets in particular, experience at least a 30%-40% mean-reversion/drawdown.

In short, the Fed won’t pivot until markets inevitably puke.

This means investors currently falling for the “soft-landing” narrative and chasing stock market tops are doing so at unacceptable risk.

Piepenburg further reminds that investment advice does not come in a one-size-fits-all package, as there are clear and legitimate differences between those seeking (understandably) to grow wealth and those seeking (understandably) to preserve wealth.

Furthermore, there are those who have the experience to invest on their own; whereas the vast majority rely on third-party advisors. To this later group, Piepenburg underscores the importance of vetting and selecting sober portfolio managers who: 1) prioritize risk management over lofty projections in these topping markets; 2) understand the importance of cash equivalents and short-duration sovereign bonds as an allocation and risk tool; and 3) who have the proven ability to hedge, both long and short. This final skill of active, rather than passive management, is admittedly difficult for even seasoned portfolio managers as volatility twists and turns dramatically.

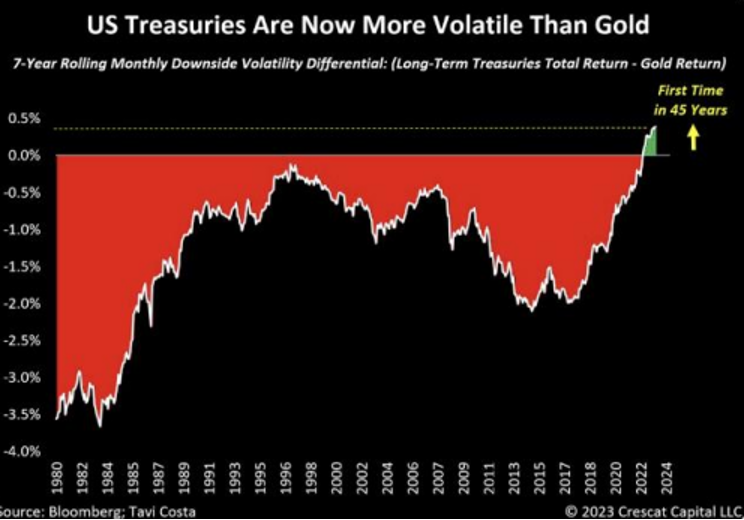

Overall, Piepenburg aggressively warns against the consensus-think faith in traditional risk parity portfolios of de-worsified equities and de-worsified credits. Given unhinged, post-08 monetary policies by all the major central banks, both stock and bonds are simultaneously over-valued. This means bonds, once designed to hedge stock risk, are now correlated assets and hence correlated risks.

Naturally, Piepenburg addresses his preference and style of wealth preservation through real assets in general and precious metals in particular. Although everyone claims to buy low and sell high, nearly no one actually does this. Toward this end, Piepenburg prioritizes longer-term investing and preservation goals, as well as tracking commodity cycles against stock cycles. In the end, the next many years will reward those who understand these relationships.

The conversation briefly returns to, and ends with, current political and financial leadership and the implications going forward, both optimistic and pessimistic.

Watch part 1 here.

THE CYCLE OF EVIL

In his latest (two-part) conversation with Wealthion founder, Adam Taggart, Matterhorn Asset Management partner, Matthew Piepenburg addresses the broader global risks as well as specific market signals to make the complex simple for global investors.

In short, Piepenburg separates the media fog from the clear lighthouse signals of historically unprecedented and unsustainable debt levels. Those who follow the lighthouse, he maintains, are better equipped to make it safely to shore.

Piepenburg discusses the importance of employing empirical facts to make sense of otherwise “Truman Show-like” attempts by global policy makers to replace hard evidence with empty platitudes. In particular, Piepenburg addresses the string cite of data points which show that not only are US and global markets far from a “soft landing,” but already deeply careening into a hard-landing, the ignored evidence of which is literally all around us.

Toward this end, Piepenburg touches upon the sin, as well as orchestrated strategy, of deliberate omission used to hide disturbing market and economic indicators, all of which support inevitable stressors in risk assets as well as Main Street unrest. Piepenburg reminds that such fact-based realism can no longer be disregarded as mere “gold bug” cynicism.

Piepenburg opens with a sober assessment of unsustainable and ever-climbing debt levels at the home of the World’s reserve currency. The mismatch between increasing UST supply (and debt levels) and declining trust and demand for the same points toward greater pressure on falling credit markets, rising bond yields and unpayable (rate-driven) debt costs. In the end, Piepenburg sees an unavoidable reversion to inflationary money creation to monetize sovereign bonds following a deflationary/recessionary fall in global markets. Ultimately, central banks will be forced to chose between saving their “system” or sacrificing their currency. Piepenburg concludes that history, without exception, tells us the last bubble to pop is always the currency.

The conversation eventually turns to declining trust in political and financial leadership as markets, bonds and currencies limp toward a fiscal cliff which can no longer be blamed on a pandemic, Russian bad guy, global warming or little green men from Mars. This leads toward a deeper dive into inflationary/deflationary forces, currency direction, de-dollarization and, of course, physical precious metals. Here, Piepenburg speaks to the obvious implications of the record-breaking stacking of physical gold by global central banks as both a symptom and solution to growing global distrust in fiat money and unloved, over-issued sovereign bonds.

In Part II of this conversation (released tomorrow), Piepenburg then speaks to portfolio and investor responses/solutions to these increasingly difficult macro conditions.

THE CYCLE OF EVIL

The foregoing title may seem a bit sensational, no?

With all the recent hype about a gold-backed BRICS currency emerging from this summer’s South African meet-and-greet vanishing like oar swirls, one can understand the argument that many gold bugs chase (and create) click-bait like teenage bloggers.

And the precious metals space is no stranger to being labeled perma “doom-and-gloomers” to keep the retail trade forever moving.

Fine. Understood. Yep. I get it. We are all “just selling our book.”

The Current Facts are Sensational Enough

But here’s the rub: One doesn’t need to be a doomer or a gloomer to interpret bond signals, basic math, historical lessons, current geopolitics, or openly obvious energy and precious metal flows with common sense.

If so, one sees the writing on the wall of nations going broke, currencies losing faith and sovereign bonds falling like rocks.

In short, one doesn’t need to sensationalize headlines or forecast doom when the current facts and numbers are more than sensational enough.

USTs: Crying Alone in the Corner

Foreigners hold about $18T worth of US assets, of which $7.5T are Uncle Sam’s increasingly embarrassing and unloved IOUs.

But those IOUs are looking a lot less attractive as an increasingly debt-soaked USA ($33T and counting of public debt) seeks to borrow an additional $1.9T (net) into the back-end of 2023 and issue another $5T of USTs into the next year, all of which has even Jamie Dimon pulling at his hair.

But who will buy those IOUs? Be honest.

And if foreigners start simultaneously dumping existing USTs into an already obvious US debt crisis, subsequent pain levels here and abroad, already felt, will only rise exponentially.

This is not fable but fact.

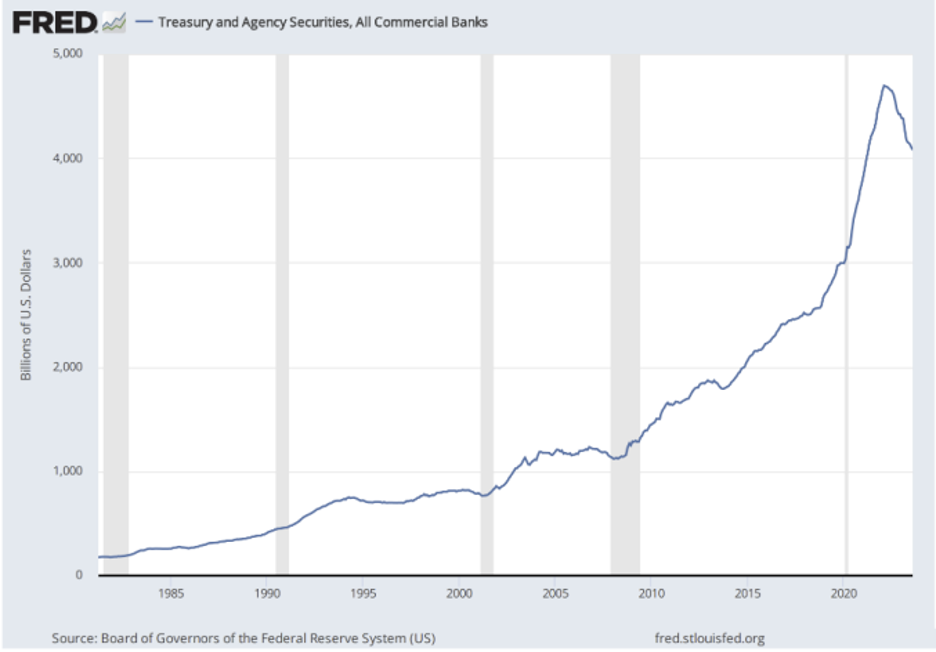

Even American banks, traditionally the biggest buyers of USTs, are now cutting back rather than ramping up their purchases…

And hedge funds, currently marginal buyers of USTs, could easily face liquidity scenarios where they will soon be massive sellers of these unloved IOUs.

Basic Math, Basic Liquidity

Meanwhile, as Powell’s higher-for-longer and (in my opinion) bogus war on inflation pushes the Dollar higher at the same time oil prices are inflating (shale production declining in the Permian, Russia cutting oil exports while US makes deals with Iran?), those foreigners currently holding that $7.5T worth of USTs will need liquidity to buy higher oil and pay-down increasingly more expensive (USD-denominated) debts.

This liquidity crisis mathematically means more dumping (rather than buying) of American sovereign bonds and hence more shark-fin rising yields (as bond prices fall), which, mathematically, will send debt costs fatally higher for companies, individuals, home owners and, yes, governments, already way over their skis in debt.

This is important, because, well… the bond market is important, a theme I’ve been hitting week after week, month after month, and year after year…

Gold Bulls Crying Wolf?

Again, some will still say that such basic math and blunt warnings from boring credit markets are little more than gold bulls crying wolf.

Unfortunately, history confirms that nations spiraling into a debt whirlpool always end with a currency crisis followed by a social crisis followed by increased centralization and less personal and financial freedoms.

Do such centralization trends feel familiar to anyone with their pulse on the current Zeitgeist?

So yeah, desperate bond markets matter, especially when measured in a world reserve currency which, like all currencies marked by unpayable debts, will be the final bubble to pop.

A Broken America Going Broke

The simple, empirical and now increasingly undeniable fact is this: America is writing checks its body can’t cash.

Even the US government is cracking/splitting under the pressure of its debt burdens, as anyone tracking the soap-opera with Kevin McCarthy can attest.

And whatever one thinks of Florida’s Eddie Munster Congressman, Matt Gaetz, it’s hard to disagree with his blunt declaration before a row of cameras outside the nation’s Capital– namely that America, already reeling under de-dollarization and debt woes, is now, as he puts it: “F—ing broke.”

Is he too just crying wolf, or should we consider the foregoing math? You know, basic facts…

No Good Scenarios Left

There are no good scenarios left for a country, currency and sovereign bond which has replaced productivity, balanced budgets, trade surpluses and national income with historically unprecedented debt, twin deficits and a central bank which has become the un-natural and de-facto (yet busted) portfolio manager over our shattered economy and totally centralized markets.

As I’ve been saying/asking for years during this slow and openly-ignored frog-boil toward credit implosion (nod to any lobby-bought politician near you), who will be the final buyer of our fatal debts in a world where no private sector entities have the balance sheets to do so?

The answer is sad, simple and already obvious: The Fed.

And where will the Fed find the money to pay for those increasingly more expensive debts (nod to Powell)?

The answer is sad, simple and already obvious: Out of thin air.

The Inflationary End-Game

Such inevitable monetization (i.e., QE + Yield Curve Controls) of historically unprecedented and drunkenly managed debt levels will, of course, be inherently inflationary despite intermediary disinflationary events (i.e., falling credit and equity markets).

All of this makes me repeat the ironic conclusion (shared by even the St. Louis Fed’s June white paper on Fiscal Dominance) that Powell’s so-called war on inflation (QT + rising rates) will end in historically inevitable inflation in the form of mouse-clicked trillions to “save” our system at the expense of our currency.

Already, the US Treasury Dept (See Josh Frost) is telegraphing its plan to make US bonds more “resilient” (i.e., liquid) via a not-so-clever plan to buy-back its own IOUs.

In other words, the Treasury Dept will be drinking its own (poisoned) Kool Aide with increasingly debased (yet relatively strong) USDs mouse-clicked out of, again…nowhere.

Does this seem like a good plan to any of you already feeling the daily decline of the inherent purchasing power of your greenback?

For Now, The Dumb Gains in Consensus

Yet despite such clear and common-sense signals from the simple math of debt gone wild, consensus still favors the long-duration UST as the relatively safest harbor in an admittedly broken global ocean.

Faith in the TLT today is almost as desperate as faith in Captain John Smith of the unsinkable Titanic.

But if math and history are not altogether ignored, cancelled or forgotten, a 15-point fall in the TLT and subsequent spike in already fatally high rates seems the most probable outcome.

Why? Because there just aren’t enough natural buyers of Uncle Sam’s criminally negligent bar tab other than a magical (and inflationary) money printer.

That’s just how we see it.

Soft Landing? It’s Already Hard

Meanwhile the Pravda-like efforts by policy makers (and the infantry and artillery support from their vertically integrated media platforms) are still pushing the “soft-landing” narrative despite nearly every indicator (bankruptcies, layoffs, yield-curves, YoY M2 growth, Fitch downgrades, Conference Board of Leading Economic Indicators and Oliver Anthony cries) making it painfully obvious that we are ALREADY in a hard-landing.

(And weren’t these the same soft “experts” who told us inflation was “transitory”?)

Folks: Things are already hard, not soft.

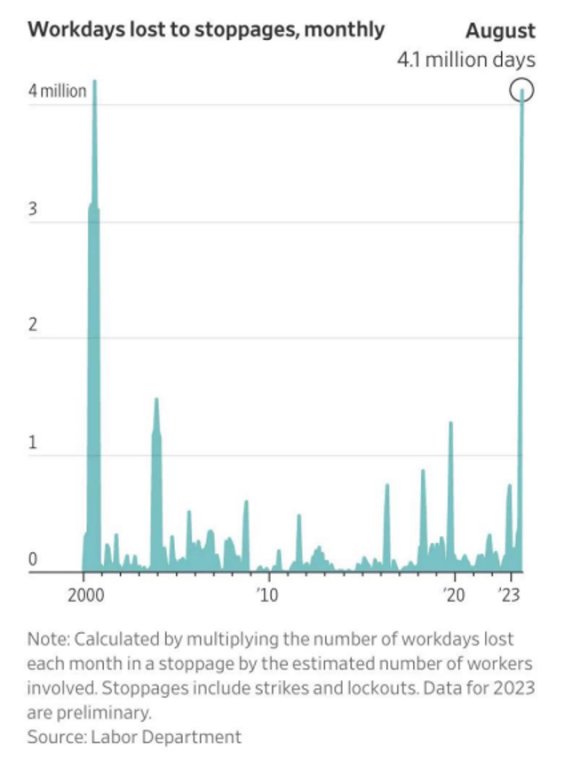

August in America lost 4.1 million days of work due to strikes (think Ford, GM etc.) as the West tries to tell us in one headline after the next that China (with 7 of the world’s 10 largest shipping ports) is the real problem and hence the least investable.

Hmmm.

A Global Problem

If anything, China and the USA suffering together will eventually make 2008 seem like a decent year for capital markets and global economies…

The hard reality is this: All western sovereign bonds are in historically deep trouble at the same time that China is facing real estate and debt bubbles on top of geopolitical shifts and hence supply-chain disruptions which are neon-flashing tailwinds for even greater price inflation in all those American products made in, well: China…

For all of these reasons, we favor assets best positioned to play where the inflationary hockey puck (or polo ball) is heading, not just where it sits today.

China: Changing the Gold Price

One of these assets, of course, is physical gold.

Speaking of China, what it has been doing with this asset is nothing short of extraordinary and foretells a great deal of what we can expect in the months and years ahead in the West when it comes to debt, inflation, rates, currencies and gold.

Or to put it even more simply: China is repricing the gold trade.

Unbeknownst to most who get their market data (and interpretations) from the legacy financial media, China has been quietly evidencing a clear intent (as well as ability) to weaponize gold against a now weaponized USD.

In particular, China’s central bank recently lifted limits on gold imports, whose temporary imposition, according to the Western press, was a failed effort to defend its currency and to curb USD outflows.

But as with most things legacy press-related, the real story is about 180 degrees opposite…

That is, our Google-searching, 30-something “investigative journalists” ignored the fact that: A) gold in China is bought in Yuan not Dollars and B) and that gold premiums in China jumped back to 5%.

In short, it seems that China did not fail to defend their currency but just succeeded in showing the world that their domestic policies can impact gold pricing.

In fact, the import restrictions only caused the gold price to rise within China’s boarders by a spread of over $120 per ounce over London spot.

However, once the import limits ended, the price spread fell to $76/ounce.

Stated more simply, China just proved that it can control gold, and by extension inflation expectations, rates, and even the USD.

This is because there is a clear and obvious correlation between gold flows (West to East) and gold pricing.

In the past, those flows (from London) were greatest when gold was sinking in price. But now, and for the first time in decades, the flow East is happening even as gold is rising.

Why?

The Natural Flow from Worthless Paper to Precious (Monetary) Metals

It was my consistent belief that despite no official gold-backed BRICS currency or explicit arbitrage of gold for oil, gas or other real assets, a more natural and expected trade would be unfolding with nearly the same intent and result, all of which will spur further Chinese gold buying (and Dollar dumping) over time.

Net result? Western gold pricing will be chasing/rising to the levels of domestic Chinese gold.

As the Chairman of the Shanghai Gold Exchange, Xu Luode, said in 2014:

“Shanghai Gold will change the current gold market with its ‘consumed in the East but priced in the West’ arrangement. When China has the right to speak in the international gold market, the true price of gold will be revealed.”

Please read that last line again.

As we warned literally from day-1 of the suicidally myopic sanctionsagainst Russia, the net result would be tighter relations between Russia and China, two countries already openly tired of the USD being the tail that wags the global dog.

If you haven’t noticed, Russia is selling much-needed oil to an openly oil-thirsty China in CNY rather than USD.

As gold, priced in CNY, buys more energy in China than in the west, more of that monetary metal will flow toward Shanghai, whose power over the London pricing of gold is about to ratchet upwards.

This was so easy to foresee, but the Western media likes to hide such foreseeable facts. After all, one of their greatest sins is the sin of omission.

When weaponizing the world reserve currency against Russia, the US-lead West forgot to mention what Luke Gromen described as its “Achilles Heel”—namely, the unallocated gold markets based out of London.

Changing Battle Tactics

By changing the trench lines of the gold-for-energy battlefield, China and Russia are slowly, but predictably, weaponizing gold and energy commodities against a weaponized USD.

In the long run, my bet is on gold and I’m not alone.

Just ask all those central banks stacking the physical metal and dumping America’s paper debt at record levels.

Like an army amassing troops, cannons, horses and supply wagons at the boarder, these central bank gold movements are obvious signs of a coming battle for a new trading system with less focus on Uncle Sam’s debt-based trading model and debt-soaked currency.

Needless to say, this is bullish for gold, which unlike the US markets and economy, is the true “resilient” asset, holding its price power despite positive (though manipulated) real rates and spiking UST yields.

This may further explain why the downside volatility for long-duration USTs is now higher than the downside for physical gold, something not seen in almost half a century.

Just saying…

THE CYCLE OF EVIL

The health of the world economy is clearly linked to the health of global leaders. That clearly raises the question if unhealthy leaders create a diseased economy or if an ailing economy creates sick leaders.

It doesn’t really matter what came first since the Western world economy is now as close to being terminally ill as it has ever been and its population is continuously getting unhealthier.

And weak Western leaders focus on peripheral political issues, whether it is climate, ESG, Covid vaccines, gender and other woke topics.

Nothing new in that. Arranging the deck chairs on a sinking world economy clearly seems meaningful to hapless leaders rather than preventing the ship from sinking.

Gargantua in the picture above/below personifies, gluttony, greed and a self-indulgent world. But we don’t need to turn to a 500 year old story book by the French author Rabelais to study the vices of mankind.

The health of a nation is clearly also reflected in the health of its leaders.

Recent health leaders in the USA, Belgium, Canada and Britain certainly don’t give a signal of “mens sana in corpore sano” or “a healthy mind in a healthy body” as the Roman poet Juvenal wrote 2000 years ago.

Or as the Greek philosopher Thales said 2600 years ago: “What man is happy? He who has a healthy body, a resourceful mind and a docile nature.”

We must also ask if the poor health of the global financial system is linked to the choice of the chief of the Bank of International Settlement (BIS, the central bank of central banks).

The latest BIS quarterly review refers to the opaque off balance sheet derivatives market. I am still of the opinion that total derivatives including the shadow market could easily be $2-3 quadrillion. $2 QUADRILLION DEBT PRECARIOUSLY RESTING ON $2 TRILLION GOLD

Well, it certainly seems like Gargantua was a role model for many of these leaders. But unhealthy living is not just the privilege of leaders. Only 10% of adult US population was obese 50 years ago and today 45% are obese. So the trend is clear and within the next 10 years, over 50% of the US population will be obese. And Western Europe will of course follow the US example as they always do.

So why am I talking about obesity in a financial newsletter? Well because as I said above, it comes from self-indulgence and greed which is the current state of the Western world economy.

As I have discussed many times, we are coming to an end of a major economic and cultural cycle.

Only future historians will know if this is a 100, 300 or 2000 year cycle. If I ventured a guess, I would have thought that it could be a very long cycle like 2000 years.

There are many similarities with the ending of the Roman Empire like, debts, deficits, taxes, decadence, self-indulgence, wokeness etc.

Empires don’t disappear overnight. It is a long outdrawn process. If we take a starting date for the beginning of the decline of the current Western Empire, dominated by the USA, it would probably be the creation of the FED in 1913. This private central bank was the great enabler for bankers and industrialists to control the system. As Mayer Amschel Rothschild said in the late 1700s: “Give me control of a nations’s money and I care not who makes the laws.”

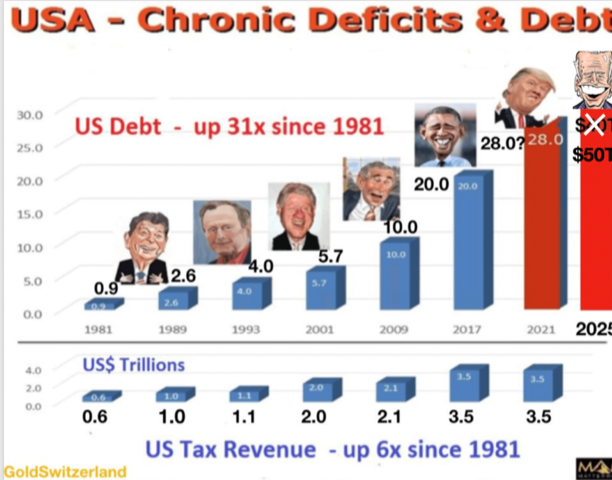

The mighty US economy emerged after WWI as a major economic power whilst the European continent was suffering from the effects of the war. In spite of superior economic performance, the US already started to accumulate budget deficits in the early 1930s. And since then buying the people’s votes was the number one criterion rather than a balanced budget.

So far, in the last 110 years there have been less than 10 years with a real surplus in the US. As I often point out, the Clinton years produced fake surpluses since the debt continued to rise. But plus ça change – things never change.