5 Reasons Why The Gold Rally Is Not Over Yet

+28.1%, +27.2%, +28.3% – this is the impressive performance of gold in the first 9 months of the year in US dollars, Euros and Swiss Francs, respectively.

+42.3%, +35.0%, +31.1% – this is the even more impressive year-on-year performance as of the end of September. Given these figures, the question automatically arises: has the gold price reached its ceiling, or is it even in a bubble, as it was in the early 1980s, and is a significant correction imminent? However, there are strong reasons to believe that the gold price is not yet in a region of extreme overvaluation.

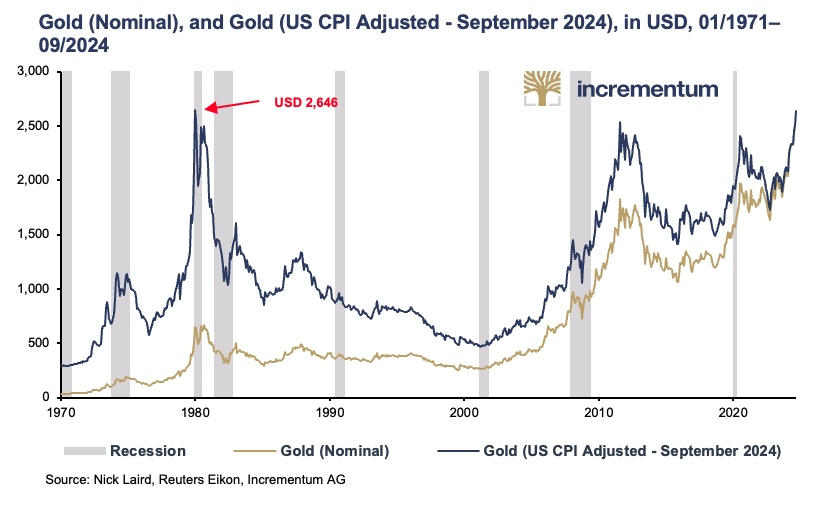

Adjusted for inflation, gold is not yet at its all-time high

Since December 2023 in US dollars and October 2023 in euros, the gold price has been chasing one all-time high after another. It is hard to imagine now that the gold price failed several times to break through the USD 2,000 mark for almost four years, given that it subsequently rose by more than 30% to over USD 2,600 in less than six months.

However, adjusted for inflation, the month-end gold price is still below its record level of USD 2,646 set in January 1980, albeit only slightly. Therefore, concerns that the air may already be thin in the current sphere are unfounded.

Another positive aspect is that the rise in the gold price since 2000 has been much more moderate than the second part of the gold bull market in the 1970s.

It should also be noted that the method of calculating inflation has changed significantly over more than four decades. Based on the calculation method used in the 1970s, the inflation in the subsequent 40+ years would be significantly higher than it is now reported, and so would gold’s inflation-adjusted all-time high. The US Bureau of Labor Statistics, responsible for calculating the CPI, lists three major inflation revisions since 1980 and countless smaller adjustments. Calculations by Shadow Government Statistics now show a difference of around 8 (!) percentage points compared to 1980.

Demand for gold remains high

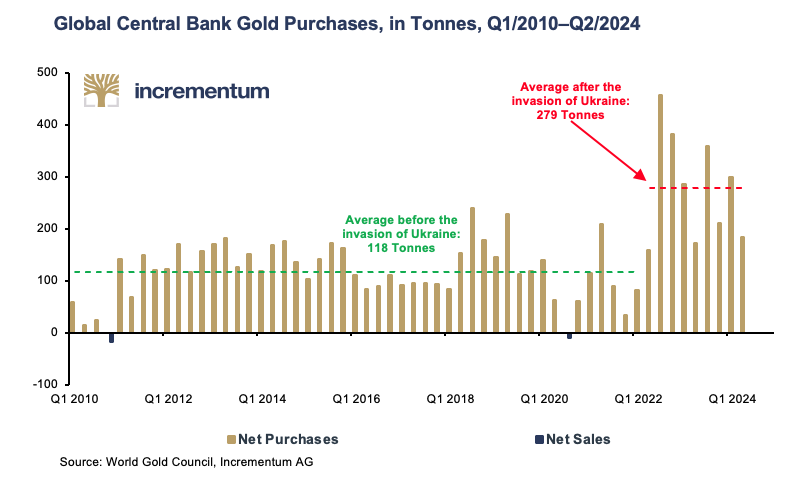

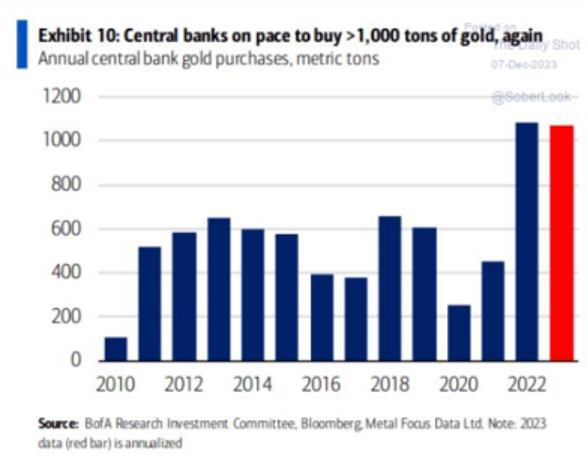

Among central banks, while China noticeably slowed down its pace of accumulation in Q2/2024, India accelerated it just as noticeably. In Q2/2024, India increased its gold reserves by 18.7 tonnes, only slightly less than Poland did. In Q1/2024, India bought only marginally less. The Bank of India thus increased its gold reserves by 4.6% in just half a year.

It is striking that after the severe slump in 2022, OTC gold transactions increased almost eightfold in 2023. This trend has continued so far in 2024. Compared to the first half of 2023, OTC transactions rose by nearly 60% in the first half of 2024. This more than compensated for the other 6% decline in gold demand in Q2/2024, resulting in the highest value for a Q2 since the WGC began recording data in 2000. It is also the highest value for the first half-year in this quarter-century.

However, a central bank’s gold reserves are also an expression of a country’s economic importance. The Polish central bank, NBP, for example, now has a total of 420 tonnes of gold reserves, more than the UK. In Europe, the economic (power) balance is increasingly shifting from West to East.

Poland is one of the fastest-growing economies in Europe. Adam Glapinski, President of the NBP, emphasized that Poland aims to hold 20% of its currency reserves in gold. The current figure is 14.9 %, while at the end of 2020, it was not even 10%. The reason given by Glapinski for the substantial gold purchases speaks for itself: “None of our trading partners and investors can doubt our credibility and solvency, even when a dramatic situation is unfolding around us.”

In other words, in times of severe crisis, i.e. when it matters most, gold is a more credible guarantor of solvency than even the leading fiat currencies, the US dollar and the euro.

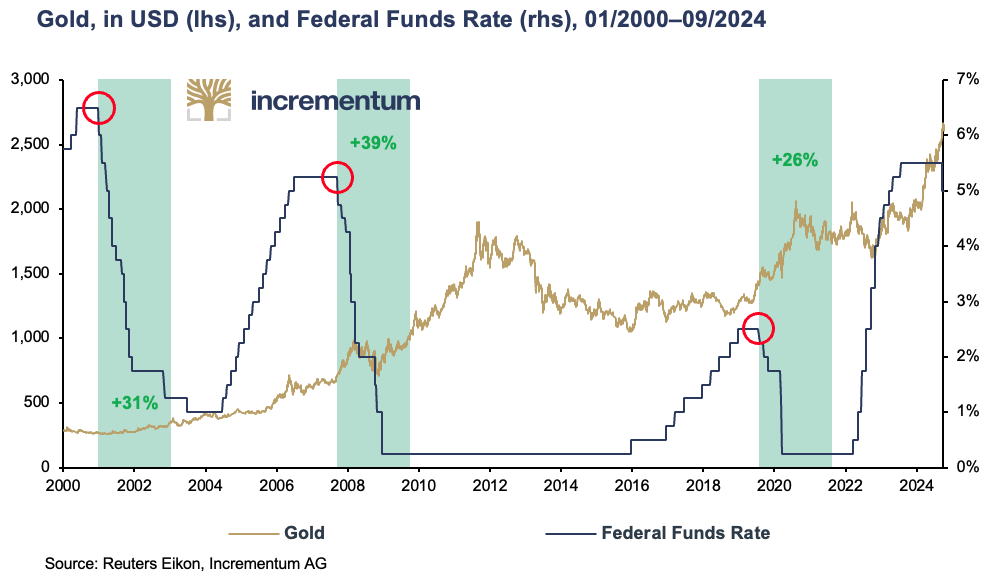

Interest rate cuts boost the gold price

Wednesday, September 18, was the day. Amid intense speculation, the Federal Reserve cut interest rates for the first time since the end of July 2019, and ultimately by a surprising 0.50 percentage points. After all, the last times the Federal Reserve cut interest rates by 0.50 percentage points were in January 2001 and September 2007 amid economic turmoil. The phase of falling interest rates that began with this bombshell should certainly boost the gold price. That has been the case in each of the three phases of interest rate cuts since the turn of the millennium.

At the beginning of the 2000s, the price of gold rose from USD 270 to around USD 420, or by almost 60%, during the cycle of interest rate cuts following the bursting of the dot-com bubble. In the years of interest rate cuts following the global financial crisis of 2007/2008, the gold price soared from around USD 660 to around USD 1,600, or by more than 140%.

During the interest rate cut phase in 2019/2020, the slowdown in the US economy, the trade dispute between the US and China, and the coronavirus pandemic that immediately followed resulted in gold climbing by more than a third, from USD 1,400 to around USD 1,900.

Demand from private and professional investors remains very low

Demand for gold remains very subdued among private and professional investors, particularly in North America and Europe. A Bank of America survey of investment advisors in 2023 found that 71% had invested no more than 1% of their portfolio in gold. A further 27% held between 1% and 5%. The significant underweighting of gold is also reflected in the development of global ETF holdings, especially in North America and Europe.

Global ETF stocks have only been increasing again for a few months and, at a total of 3,200 tonnes, are roughly at the same level as before the outbreak of the Covid-19 pandemic but well below the peaks of just under 4,000 tonnes in October 2020 during the pandemic and in March 2022, immediately after the war in Ukraine began.

While ETF demand from Asia has been slightly positive every month in recent quarters, European ETF holdings were only able to turn their long-lasting losses back into positive territory in May. In September, however, outflows predominated again. In the USA, ETF holdings increased for the third month in a row in September, following a rollercoaster ride in the previous quarters in which months with net outflows dominated. ETF holdings, therefore, have a huge amount of catching up to do.

Given the gold price trend in recent quarters, an increase in ETF holdings in North America and Europe from just over 3,200 tonnes to almost 6,000 tonnes would have been expected if one were to base this calculation on the historical correlation since 2005. There is, therefore, still a lot of room for improvement in this demand segment, especially as Western European investors tend to be pro-cyclical.

Thus, it seems that Western investors initially turned down the invitation to the gold party. Now that the party is gaining momentum, they do not want to admit they were party poopers. Therefore, they could only come to this party when it is already in full swing, and then at a much higher “entrance fee”.

Geopolitical tensions remain high

The war in Ukraine has now been raging for more than 2½ years, and the situation in the Middle East also intensified further at the end of September as a result of Israel’s massive attacks on leading Hezbollah cadres and the invasion of Lebanon by ground troops. The danger of a major conflagration continues to hang like the sword of Damocles over these two conflict regions.

The increasingly fragile geopolitical situation is becoming ever more apparent in central banks’ balance sheets. The massive gold purchases by central banks since 2009 and the rising gold price have led to the precious metal’s share of global international reserves increasing to the detriment of fiat currencies. By the end of 2023, gold will have overtaken the euro. This means that gold now ranks second among central banks’ reserve assets. The US dollar remains undisputed in the first place, although the proportion of US dollars among FX reserves has now fallen well below the 60% mark. In 2015, two-thirds of currency reserves were still accounted for by the world’s reserve currency. The BRICS summit in Kazan (Russia) from October 22-24 will show whether the move away from the US dollar will gain further momentum and whether gold, as a neutral reserve asset, will receive an additional, geopolitically motivated boost in demand.

This development comes as no surprise when you consider the results of the 2024 Central Bank Gold Reserves Survey published by the World Gold Council in June. 66% of the central banks surveyed stated they expect a slightly higher share of gold in total currency reserves in five years. In 2022, the figure was just 46%. The proportion of central banks that expect gold to play a slightly or significantly smaller role has fallen from 24% to 13%. Not a single central bank now expects central bank gold holdings to fall in the coming year. 81% expect them to increase. In 2021, this figure was only 52%.

Remarkably, geopolitical considerations – at least according to this survey – are almost entirely insignificant with regard to the importance of gold as a reserve asset for central banks. Concerns about sanctions are nearly as insignificant. Instead, hedging against inflation, the performance of gold in times of crisis, the lack of default risk, and the high liquidity of gold are among the most critical reasons in favour of gold.

However, according to the Central Bank Gold Reserves Survey, a look at the central banks’ demand for gold in recent quarters does not confirm the relative insignificance of geopolitical considerations and hedging against sanctions. The discrepancy between quarterly gold purchases before the outbreak of the war in Ukraine, at an average of 118 tonnes, and the 279 tonnes afterwards is simply too large. In the end, actions count more than words.

Conclusion

With a value of 61 as of October 10, the Fear and Greed Index for gold is just outside the greed range. In view of the enormous price rally over the past 12 months, a noticeable correction cannot, therefore, be ruled out. However, there are numerous fundamental reasons to believe that gold will continue to rise even after a setback.

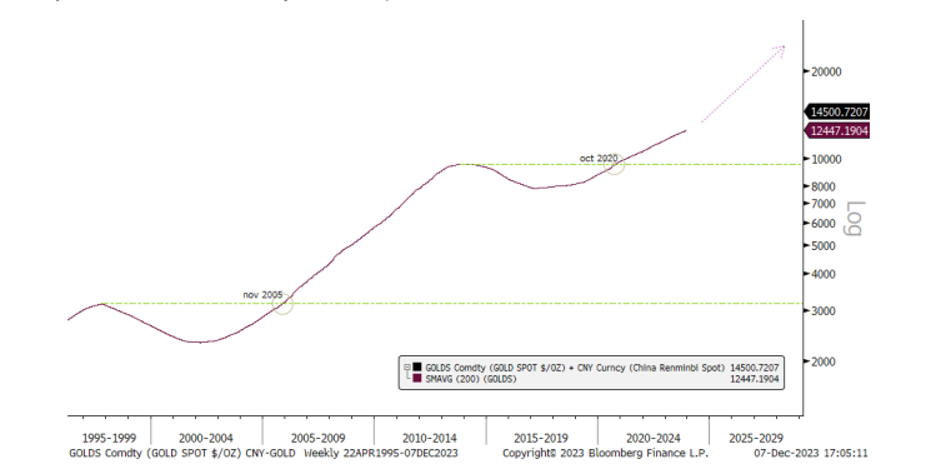

After all, at the beginning of 2024, gold successfully broke out of the cup-and-handle formation that had formed since 2011. With a gold price of just over USD 2,600 at the end of September, the gold price has reached the year-end forecast of our Incrementum Gold Price Forecast Model for 2024. We presented this model for the first time in the In Gold We Trust Report 2020 and have since updated it in every subsequent In Gold We Trust report.

Given the further deterioration in economic and (geo)political conditions, the model’s price target of just over USD 4,800 by the end of 2030 will be considered a conservative projection. Against this background, even gold, which became significantly more expensive last year, is still cheap.

As Michael Kosares once said so aptly: “In a bull market, the sideline is the worst place to be!”

5 Reasons Why The Gold Rally Is Not Over Yet

VON GREYERZ partner, Matthew Piepenburg, joins Nomi Prins with Ted Butler of VRIC Media to separate facts from fiction as to the key themes facing the global financial system, namely: US recession indicators, Fed policy in the face of ongoing inflationary forces, the longer-term direction of the USD, the implications of a Chinese slowdown, US equity market direction and the financial consequences of escalating war drums.

Each of these key theme are the ripple effects of unsustainable national and global debt levels, all of which point toward increasing currency debasement to inflate away sovereign debt with diluted fiat money.

Prins and Piepenburg close the discussion with a look at the gold market as well as the forces impacting supply and demand mismatches in the silver market.

5 Reasons Why The Gold Rally Is Not Over Yet

In this profound discussion held in Singapore, financial experts Egon von Greyerz and Jim Rogers explore the complexities of global economics, investment strategies, and the future of currencies. During the interview, Rogers shares his adventurous past and cautious optimism about the future, emphasising the unpredictability of political and economic landscapes. Both express concerns over the mismanagement of economies and the inherent risks in the current global financial system, especially the decline in the value of major currencies against gold.

Both Greyerz and Rogers discuss their personal investment approaches, favouring tangible assets like gold and silver over volatile currencies and highlighting the protective role these commodities can play in times of economic instability. Rogers and Greyerz also touched on the geopolitical tensions and the historical repetitiveness of nations’ failures to maintain robust economic structures. The dialogue concludes on a personal note, reflecting on the importance of family, stability, and the simple pleasures of life against the backdrop of global economic uncertainty.

- [0:00-1:03] Introduction: Jim Rogers’ reflects on his adventurous past, discussing his motivations for exploring the world despite inherent dangers.

- [1:03-2:08] Discussion on personal safety and the measures taken during travels to ensure vehicle and personal security, highlighting ongoing concerns about potential dangers.

- [2:08-3:12] Rogers talks about the challenges facing younger Americans, including national debt, contrasting with his experiences and choices.

- [3:12-4:19] Egon von Greyerz shares concerns about the global direction, particularly the economic, political, and moral decline observed in Western countries due to poor immigration and crime management.

- [4:19-7:04] The conversation shifts to the stability and safety of living in Singapore, with Rogers expressing a high sense of security compared to Europe. They discuss the economic stability of countries like Switzerland and the changes over time.

- [7:04-10:09] A deep dive into currency depreciation over the decades, with a focus on the Swiss Franc and the US dollar. They discuss central banks’ roles and the shift in reserves from gold to equities.

- [10:09-16:02] Discussion on commodities, particularly gold and silver, and their historical performance against currencies. They emphasize the strategic importance of holding precious metals as a hedge against currency devaluation.

- [16:02-22:48] The dialogue covers investment strategies, the importance of agricultural commodities, and Rogers’ approach to trading and long-term investment.

- [22:48-39:18] They delve into geopolitical risks, the potential for global conflict, and the importance of strategic relocation in extreme scenarios. The discussion also revisits the importance of precious metals in securing financial stability.

- [39:18-41:02] Closing remarks on life philosophies, the importance of family, and maintaining optimism amidst global challenges, along with a reflection on their personal experiences and future outlook.

This conversation offers deep insights into the economic philosophies and personal reflections of two prominent financial thinkers, set against the backdrop of a rapidly changing global environment.

5 Reasons Why The Gold Rally Is Not Over Yet

Below, we soberly assess the lessons of history and math against the current realities of a debt-defined America to ask and answer a painful yet critical question: Is America losing?

The End of History and the Last Man

In 1992, while I was still an undergrad with a seemingly endless optimism in life in general and the American Dream in particular, the American political scientist, Francis Fukuyama, published a much-discussed book entitled, The End of History and the Last Man.

Released in the wake of the wall coming down in Berlin and a backdrop of continually low rates and rising US markets, this best-selling and optimistic work captured the Western mindset with obvious pride.

With its central theme (supported by an overt Hegelian and dialectal framework) of capitalism and liberal democracy’s penultimate and victorious evolution (Aufhebung moment) beyond the Soviet dark ages of a debt-soaked and centralization/autocratic communism, the famous book made headline sense in this Zeitgeist of American exceptionalism.

But even then, amidst all the evidence of Soviet failures (from extended wars, currency destruction, unpayable debts and a clearly dishonest media and police-state leadership), my already history-conscious (and fancy-school) mind could not help but wonder out loud if this book’s optimistic conclusion of the West’s ideological and evolutional end-game was not otherwise a bit, well: naïve.

Had the West truly reached a victorious “end of history” moment?

Pride & An Insult to History?

In fact, and as anyone who truly understands history should know then as now, history is replete with rhyming turning points, but never a victorious and eternal “end-game.”

Stated more simply, the famous book, which made so much sense at that particular moment in time, seemed to me even in 1992 as a classic example of “hubris comes before the fall.”

In other words, it may have been a bit too soon to declare victory for liberal democracy and capitalism, as these fine systems require fine leadership and even finer principles to survive history’s forward flow.

Today’s History…

Fast-forward many decades (grey hairs, advanced degrees and sore muscles) later, and it would seem that my young skepticism (and historical respect) was well-placed.

The evidence around us now suggests that the “victorious” capitalism Fukuyama boasted of in 1992 died long ago, replaced in the interim years by obvious and mathematically-corroborated examples of unprecedented wealth inequality and modern feudalism.

Furthermore, if one were to contrast the principles of America’s founding fathers as evidenced by their first 10 Amendments to the US Constitution (remember our Bill of Rights?) to the current and obvious destruction of the same in what is now a far more centralized, post-9-11 “Patriot Act” USA, the evidence of democracy’s crumbling façade is literally all around us.

In other words, perhaps Fukuyama got a little too ahead of himself.

Or more to the point, perhaps he was dead wrong about the final “victory” of genuine US capitalism and an actual, living/breathing liberal democracy?

Is the USA the Old USSR?

In fact, and with a humble nod to modesty, blunt-speak, current events, simple math and almost tragic irony, the actual evidence of history since 1992 suggests that today’s Divided States of America (DSA) (and Pravda-like media) appears to look far more like the defeated USSR than the victor presented by Mr. Fukuyama…

Such dramatic statements, of course, mean nothing without facts, and we all deserve a careful use of the same if we seek to replace emotion with data and hence see, argue and prepare ourselves politically and financially with more clarity.

Facts Are Stubborn Things

Toward this end, I am once again grateful for the facts and figures which Luke Gromen provides in supporting the otherwise “sensational” conclusion that America may have won the “cold battle” with the USSR, but it is now losing a “cold war” with the Russians and Chinese.

Really?

C’mon.

Really?

Again, let’s look at the facts. Let’s look at the numbers. Let’s look at current events, and let’s look at history, which is anything but at an “end.”

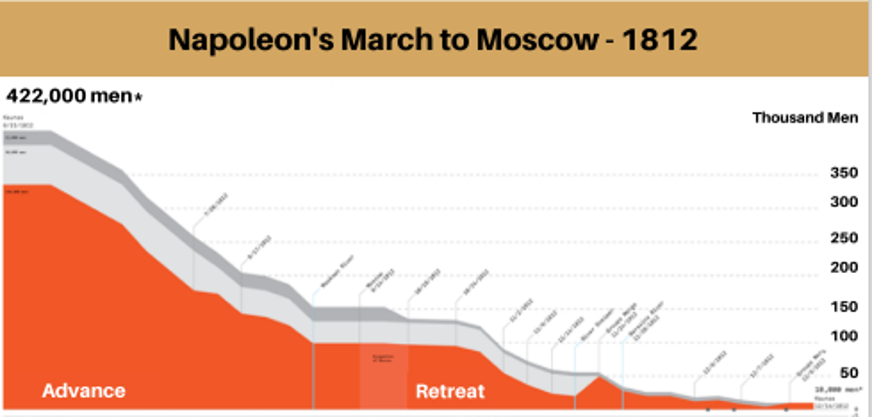

For those whose respect for history goes beyond a twitter-level attention span or the assistance of mainstream media Ken and Barbies (from CNN to The View), none of whom understand anything of history, you will recall that Regan’s successful war against the USSR was won by bankrupting the Soviets.

But as Gromen so eloquently reminds us, “nobody seems to notice that is EXACTLY what the Russians and Chinese are doing to us now.”

This is not fable but fact, and I warned of this in How the West was Lost the moment the US weaponized the USD in 2022. This desperately myopic (i.e., stupid) policy gave a very patient and history-savvy Russia and China just the opportunity they have been waiting for to turn the tables on the DSA.

History’s Fatal Debt Trap Lesson

As I also recently wrote, with the insights of both Niel Ferguson and Luke Gromen, you know (and history confirms) a nation (or empire) is ALWAYS doomed the moment its debt expenses (in interest terms alone) exceed its defense spending.

And as of this writing, the DSA’s gross interest is 40% higher than its military spending.

Nor are we, the Russians, the Chinese or even a select minority of informed Americans alone in this knowledge of the DSA’s fatal debt trap.

No Hiding the Obvious

The current turning point in American debt is now increasingly and more globally understood in what Ben Hunt calls “the Common Knowledge Game.”

Stated more simply, and as evidenced by the now undeniable move away from the US IOU and USD by an ever-increasing (and ever de-Dollarizing) BRICS+ membership roster, the world is catching on to the blunt fact that the American empire (of citizen lions led by political donkeys) is spending fatally more than it earns.

What is far more sickening, however, is that Uncle Sam is then paying its IOUs with debased Dollars literally mouse-clicked into existence at the not-so “federal” and not-so “reserved” Federal Reserve.

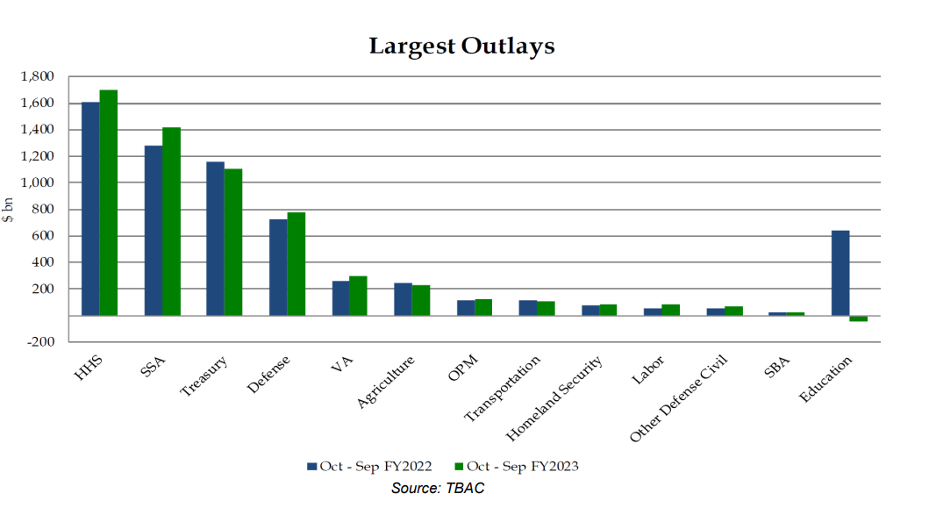

This desperate reality, and completely fantasy-based monetary “solution,” has resulted in an empirically bankrupt nation who quantifiably spends more on entitlements (cashed out by 2030), sovereign IOUs and warfare than it does on transportation, agriculture, veteran benefits and citizen education (our apologies to Thomas Jefferson).

See for yourself:

Returning from simple math to otherwise forgotten (or now increasingly “cancelled) history, it becomes harder to deny Gromen’s observation “that the US appears to be reprising the role of the USSR this time, with a heavy debt load, uncompetitive and hollowed-out industrial base, reliant on a Cold War adversary for imported manufactured goods, and needing ever-higher oil prices in order to keep its oil production from falling.”

Democracy’s Suicide?

In other words, and in the many years since Fukuyama declared victory in 1992, the interim sins/errors of increasingly suicidal (or grotesquely negligent/stupid) US military, financial and foreign policies have irrevocably placed the DSA into a defeated decline rather than victorious “End of History.”

This reality, of course, gives me no pleasure to share, as I was, am and will always remain a patriotic American—or at least patriotic to the ideals for which America originally stood.

But as I’ve said many times, today’s DSA is almost unrecognizable to the American I was when Fukuyama’s book of hubris was released over three decades ago.

As our second US President, John Adams, warned his wife Abigail: “Remember, democracy never lasts long. It soon wastes, exhausts, and murders itself. There never was a democracy yet that did not commit suicide.”

Again, this is history, and it appears to be a history that Fukuyama misunderstood in 1992, when he apparently thought it had reached its happy “end.”

The Past Informs the Future

Looking forward, I/we must be equally capable of looking backward.

History has far more to teach us than the stump-speeches (or pathetic cue cards) of current political opportunists (puppets?) who, with very few exceptions, care far more about preserving their power (via coalitions, the legalized bribery of K-Street lobbyists, the promulgation of mis-information and the deliberate omission of mal-information) than serving their public.

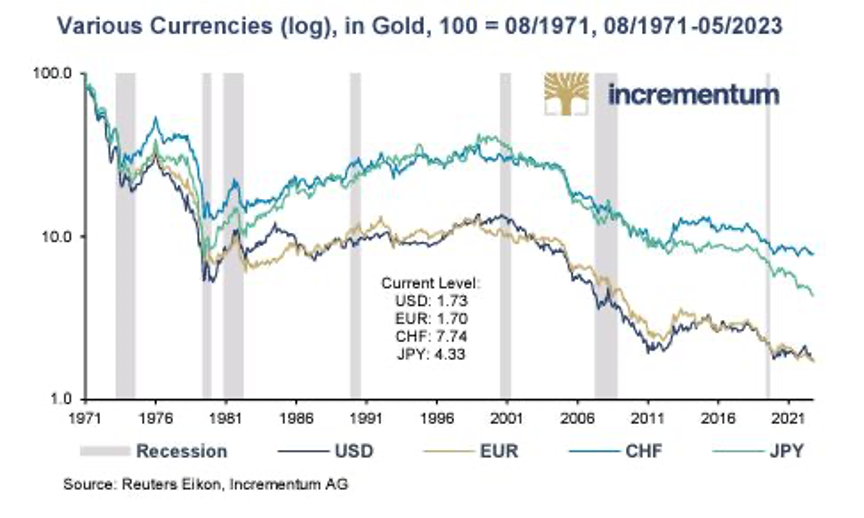

The Sad History of Currency Debasement

History also warns/teaches that the leadership of all debt-soaked and failing regimes will buy time saving their “systems” (and covering their @$$’s) by debasing their currencies to monetize their debts.

Folks, this is true throughout history, and WITHOUT EXCEPTION.

Sadly, the DSA and its hitherto “exceptionalism” is no exception to this otherwise ignored historical lesson.

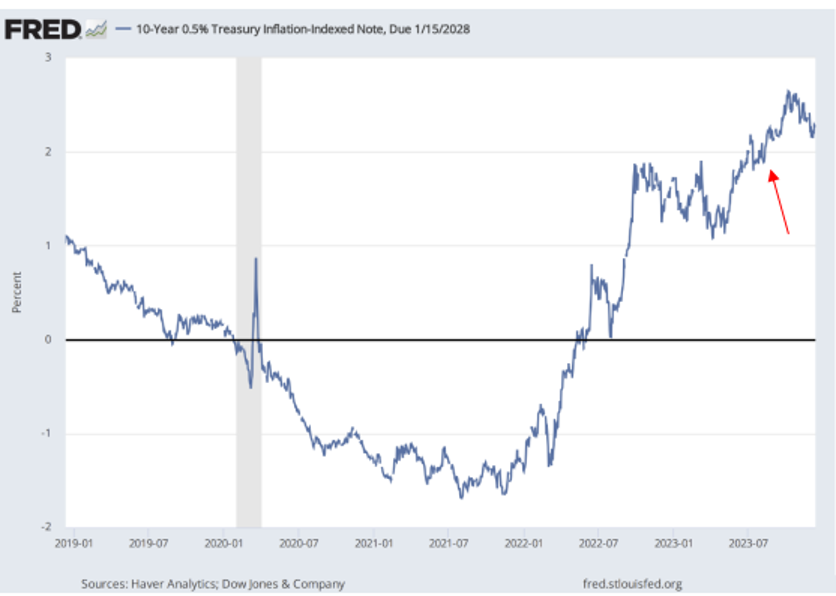

Toward this end, and as Egon and I have argued for years, the DSA will thus pretend to “fight inflation” while simultaneously seeking inflation, as all debt-strapped (and hence failed) regimes need inflation rates to exceed interest rates (as measured by the yield on the US10Y UST) in what the fancy lads call “negative real rates.”

The Sad History of Dishonesty

Inflation, however, is not only politically embarrassing, but stone-cold proof of failed monetary and fiscal leadership.

To get around this embarrassment, politicos from the Fed and the White House to the so-called House of Representatives (and the Don-Lemonish/Chris Cuomo/ 1st Amendment-insulting/hit-driven legacy media which supports them) will do what most children do when faced with making an error, that is: Lie.

And in this case: Lie about inflation data.

Of course, a nation that lies to its people is not best suited for leading its people.

As Hemingway warned, and as I often repeat, those at fault will point the fingers of blame to others (from Eastern bad guys, and man-made viruses to political fear campaigns on everything from global warming, white nationalism or green men from Mars); or worse, leaders will distract their constituents in perpetual wars.

Sound familiar?

In the interim, those “people” will continually and increasingly suffer from the sins of their childish leadership under the crippling yet invisible tax of the debased purchasing power of their so-called “money.”

This too, is nothing new to those who track history…

Golden Solutions?

Gold, of course, cannot and will not solve all of the myriad and “human, all too human” failures of national leadership and the monetary, social and centralized disfunctions which ALWAYS follow in the wake of too much debt.

But as history also confirms (and equally without exception), each of us can at least protect the purchasing power of our wealth by measuring that wealth in ounces and grams rather than openly dying paper/fiat money.

This is not a biased argument. This is not a “gold bug” argument.

It is far more simply a historical argument, which further explains why governments don’t want you to understand the history of money nor the history of gold.

In fact, even Fukuyama’s now embarrassing book ignores this simple lesson of gold lasting and paper money dying, which only adds to my opening observation that history never “ends” it simply teaches and protects the informed.

The same is true of physical gold.

5 Reasons Why The Gold Rally Is Not Over Yet

In this first discussion of a longer series focusing on key risk themes nearing a 2024 breaking point, Matterhorn Asset Management principals, Egon von Greyerz and Matthew Piepenburg, open with a blunt discussion on the critical (as well as controversial) topics of geopolitics, escalating war signals and the key differences between gold and BTC in a global setting of open currency destruction.

Beginning with the topic of war, Egon and Matthew discuss a daisy chain of expensive and ultimately unsuccessful wars with DC origins but global ramifications. Of course, the rising tensions within the middle east form a part of this narrative, one which includes an ongoing (and still unresolved) war in the Ukraine and now headlines of further NATO expansion into Sweden and Finland.

Neither Egon nor Matthew offers easy solutions or predictions for such volatile issues. However, what can be easily foreseen is the simple and historically-confirmed relationship between escalating wars and hence escalating costs, debt levels and hence currency debasement to monetize the same. This relationship between war, inflation, and currency destruction, which even Hemingway foresaw, is anything but fictional and points yet again to the absolute necessity of protecting against such currency risk with real money, namely: Physical gold.

Of course, many crypto investors see BTC as an equally convincing form of “digital gold” to one day emerge as a viable store of value to protect against similar risks. Neither Egon nor Matthew ridicule crypto as an asset nor the investors who trade them. One can be a tenacious proponent of physical gold without having to cast dispersions at BTC, which has been a superlative speculation trade (and risk) for countless investors.

That, however, is precisely how both Egon and Matthew distinguish gold from BTC: With Gold being an undeniably (and historically-confirmed) store of value and hence wealth preservation asset; and BTC being an equally undeniable speculation asset. Egon and Matt track the price moves, for example, in BTC and compare its volatility to gold to make this conclusion objective rather than sensational. Matt, moreover, defends BTC against recent headlines, like SBF’s corruption or Binance’s multi-billion-dollar legal judgements, which are not blockchain failures but human failures. Toward that end, Matt addresses the equally “human” risks which Larry Fink’s Blackrock poses to the BTC narrative.

Although cryptos like BTC have adopted the same narrative as gold to highlight the themes of being an alternative currency outside of an openly failing global banking and fiat monetary system, the more popular (and frankly, actual) use/role of BTC has been as an astonishing speculation asset. The fact, moreover, that numerous crypto millionaires have approached Matterhorn to convert their speculative BTC into wealth-preserving gold adds anecdotal evidence to this conviction. The additional fact that central banks are stacking gold rather than BTC at historical levels suggests that when serious concerns over currency stability are the key drivers, gold is the obvious choice.

Of course, speculation and preservation are each important aspects of wealth, but Egon and Matt remind that gold preserves generational wealth with far greater effect and far less risk.

In the coming weeks, Egon and Matt will address other key risk themes (oil, currencies, BRICs etc.) as we enter a very important 2024.

5 Reasons Why The Gold Rally Is Not Over Yet

Ever since day-one of the predictably disastrous and politically myopic insanity of weaponizing the world reserve currency against a major power like Russia, we warned that the USD had reached an historical turning point of slow demise and increasing de-dollarization.

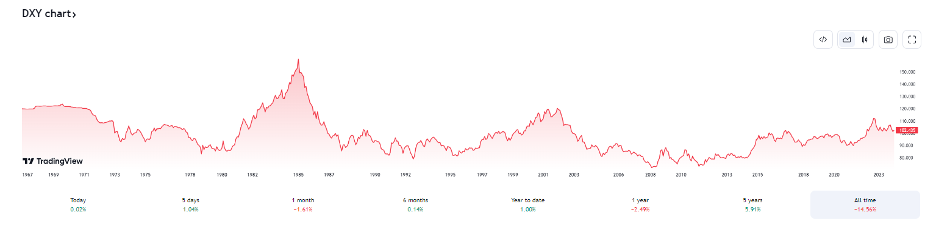

We also warned that this would be a gradual process rather than over-night headline, much like the slow but steady death of the USD’s purchasing power since Nixon left the gold standard in 1971:

But as we’ll discover below, this gyrating process is happening even faster than we could have imagined, and all of this bodes profoundly well for physical gold, yet not so well for the USD.

Bad Actors, Bad Policies & Predictable Patterns

Regardless of what the media-mislead world thinks of Putin, weaponizing the USD was a foreseeable disaster which, naturally, none of DC’s worst-and-dimmest, could fully grasp.

This is because chest-puffing but math-illiterate neocons pushing policy from the Pentagon were pulling the increasingly visible strings of a Biden puppet at the White House.

In short, the dark state of which Mike Lofgren warned is not only dark, but dangerously dumb.

These political opportunists have forgotten that military power is not as wise as financial strength, which is why broke (and increasingly centralized nations) inevitably lead their country toward a state of permanent ruin preceded by cycles of war and currency-destroying inflation.

Sound familiar?

Despite no training in economics, Ernest Hemingway, who witnessed two world wars, saw this pattern clearly:

We also found “Biden’s” sanctions particularly comical, given that his former boss clearly understood the dangers of such a policy for the USD as far back as 2015:

The myopic (i.e., patently stupid) sanctions against Putin simply (and predicably) pushed Russia and China closer together while the BRICS+ nations increasingly began arbitraging gold for oil.

Or stated more bluntly, DC’s plan to weaken the Rubble has only served to put the USD at historical risk.

Does the Petrodollar Suck?

Throughout2022 and 2023, we warned of the weakening respect Saudi Arabia has for the allegedly Biden-“lead” US in general and its increasingly unloved UST and weaponized USD in particular.

Of course, we were specifically warning of the slow, gradual and yet again—inevitable—demise of the oh-so important Petrodollar which has been a critical “straw” of the milkshake theory’s faith in global demand for the USD.

But as the facts are now making increasingly clear, that “straw” is no longer sucking on a USD which much of the world now considers, well, a Dollar that sucks…

Three days after Christmas, the Wall Street Journal confessed what JP Morgan’s head of global commodities strategy had been tracking since 2015, namely that approximately 20% of the global oil bought and sold in 2023 was in currencies other than the USD.

Ouch.

That Dollar-straw appears to be losing its sucking-power, no?

Currently, this is because two nations all too familiar with American sanctions—i.e., Iran and Russia—just happen to have a lot of oil and have cranked up their oil selling in alternative currencies among willing buyers like China and India.

By the Way: This is All VERY Good for Gold

One, for example, can sell oil in London for gold, then transfer that gold to a Yuan trade hub where the gold is converted to CNY, and then use that CNY to buy oil outside of the USD.

Or stated more simply, gold will slowly be filling the delta in a BRICS+ oil trade once ruled by the USD, which mean’s gold’s price, hitherto controlled by NY and London, is about to return to actual fundamentals rather than OTC price fixing.

As gold traded on the Shanghai Exchange gathers greater and greater momentum (and premiums), the 200-day moving average of gold priced in USD will have to keep pace for the 200-day moving average in CNY…

Again, all of this was foreseeable but only now is the math finally making the headlines.

How Much Worse Can It Get for the USD?

Given the rapid pace and percentages of oil trading outside of the USD, the obvious next question is how much worse can it get?

The short answer: A lot worse.

Iran and Russia, for example, are playing hard-ball, but what happens if Saudi Arabia, which is now an official BRICS member (and more prone to fist-pumping Biden while shaking hands with Xi) decides to look more East than West in the coming years?

Saudi Arabia’s increasingly open relations with the Shanghai Cooperation Organization and BRICS New Development Bank suggest that unlike former nations who tried to sell oil outside of the USD (think Iraq and Libya), the Saudi Crown Prince appears far less afraid of meeting the same coincidental fate of say, Saddam Hussein or Muamar Gaddafi…

As we’ve warned numerous times, once the US weaponized the USD, there was no turning back, as nations both friendly or not-so-friendly to the US would never trust a non-neutral reserve currency in the same way they had in prior times.

Thanks to folks like Nixon and now Biden, we are a looonnnggg way from the Bretton Woods USD…

Stated simply, broken trust has made the once tolerated USD less tolerable, and like a genie that can never be put back in the bottle again, the USD will never be fully trusted again, which means demand for that Dollar will never be the same again.

But What About the UAE and Saudi Dollar Peg?

Defenders of the Petrodollar (and hence milkshake theory) will rightfully point out that both the Saudi riyal and UAE dirham are pegged to the USD, which might suggest that both of these mega oil powers have a vested interest in seeing a stronger rather than weaker role of the USD in their critical oil markets.

It’s also worth admitting that Russian oil enterprises are slamming into liquidity issues with Indian rupees and Chinese yuan, which are not nearly as liquid as the USD, which despite its weak legs and twisted back, is still the best horse in the global currency glue factory.

These are fair, very fair points.

This is why we still maintain our belief that the USD’s supremacy, just like it’s post-1971 purchasing power, will die slowly by a thousand cuts rather than an overnight headline.

So yes, the riyal and dirham are both pegged to the USD, but as Luke Gromen recently observed, that’s only true “…for now.”

Gromen makes a compelling case that most investors are underestimating the ability by which both the UAE and Saudis have to de-peg their currencies from a weakening USD and re-peg “their energy to gold… while having their currencies APPRECIATE against the USD.”

Brent Johnson, who argues for a stronger USD, would counter such an argument by reminding us that OPEC considered cutting its link with the USD in 1975, and it never happened.

But like Gromen, I’d argue that we are not in 1975 (or Kansas) anymore.

Much has changed—including the distrust of that post-sanction USD, the subsequent rise of the BRICS+ nations, the aforementioned percentage of oil volumes trading outside the USD and the open decline of US monetary and foreign policy in recent years and headlines.

And like Gromen, I’d remind readers that even the hint of an OPEC link-cut in 1975 with the USD sent the gold price up by 5X in a period of less than five years.

This explains why the Fed of that same period hiked rates from 5.25% to over 18% to make the USD more attractive to OPEC.

BLACK Gold Colliding with Real Gold = A GREENback in the RED

But folks, with public US debt now racing past $34T, the current Fed has no ability to put such rate-hike lipstick on a high-debt pig of the current magnitude, which means Powell, unlike Volcker, simply can’t make the USD attractive to OPEC in 2024 like it could in the late 1970’s.

Or stated more simply, the USD, like the cornered US Fed, is running out of both credibility and options.

And This Again, Is Good for Gold

The implications and ripple effects of a now weaponized Greenback are nothing short of extraordinary as gold slowly rises to the status of an oil currency for the first time since Nixon welched on the gold standard in 1971.

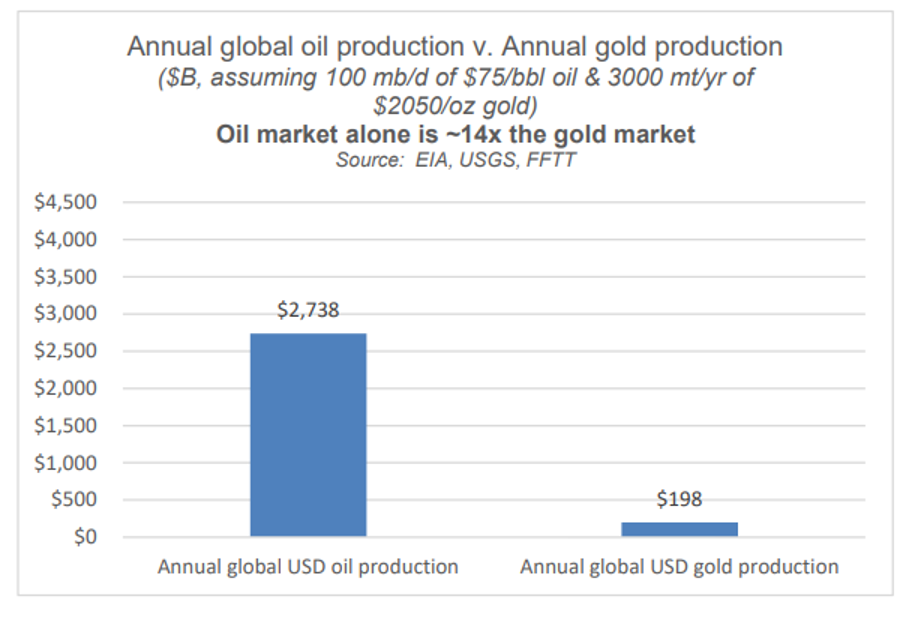

And given the disconnect between current USD oil production (massive) and USD gold production (tiny), the potential for an historically significant repricing of gold is as powerful (and predictable) as good ol’ fashioned supply and demand.

After all, when a golden asset of infinite duration yet finite supply collides with spiking demand, the price of that asset skyrockets.

By contrast, when an unloved asset of finite duration yet infinite supply—like a UST—collides with tanking demand, the price of that asset sinks to the ocean floor…

Don’t Get Too Comfortable with Lower Rates and Defeated Inflation…

Thus, despite recent and openly desperate attempts by the FOMC to project reduced rates while declaring victory over inflation (after having engineered a deflationary, yet unreported and rate-hike-driven recession), we foresee a longer-term scenario of tanking USTs and hence rising yields, which means rising interest rates.

Such bond-market-determined (rather than Fed-set) rate hikes will also be colliding with a US Congressional Budget Office forecasting another $20T of UST issuance in the next 10 years.

This will be a perfect storm of more IOU issuance colliding with even higher rates and hence higher costs, which will in turn only be payable if the Fed prints even more trillions of USDs out of thin air to pay Uncle Sam’s bar tab.

Needless to say, such inevitable synthetic liquidity (i.e., QE to the moon) will lead to further rather than less debasement of an already debased USD (very good for gold…), proving that Hemingway’s predictions above make him a far more deserving recipient of the Nobel Prize in Economics than Bernanke.

Ah, the ironies, they do abound…

Bernanke’s thesis of solving a debt crisis with more debt is far more deserving of a prize in fiction than math, but as per above, it was Papa Hemingway, the novelist, who understood history and math far better than this falsely idolized central banker…

All Signs Point to Gold

In 2023, we saw gold reaching record highs in all currencies including the USD despite a year marked by a relatively strong USD, positive real rates and spiking yields—all traditional headwinds for USD-priced gold.

This disconnect from traditional metrics is based upon the USA’s disconnect from sound monetary and foreign policies, all of which have left the USD, UST and US Government looking more like the island of misfit toys rather than a trusted land of the reserve currency.

Gold will continue to diverge from traditional metrics as its role as a net trade settlement among the growing BRICS+ nations makes the issue of positive or negative US real rates less relevant in a world turning away from, well…the US and its broken/dis-trusted currency.

These hard facts, combined with the inevitable return to mega QE to monetize massive and projected UST issuance (and hence debt) in the coming years, will further debase the USD to support the UST market.

Ludwig von Mises, Ernest Hemingway, and David Hume understood the philosophy of debt long before the first central banker was spawned. They warned that all debt-soaked and failing nations have and will sacrifice their currency to save their rotten “system.”

They were and are correct.

In blunt yet historically and math-confirmed terms, gold, priced in USDs, will continue to rise much higher for the simple reason that the USD, despite its powerful reserve status, will continue to debase itself in real terms.

5 Reasons Why The Gold Rally Is Not Over Yet

As my last report for 2023, I wanted to hit the big issues blunt in the face—from debt and sovereign bond markets to themes on the USD, inflation, risk markets and physical gold.

This will not be short, but hopefully simple.

No one likes hard macro facts, especially at holiday parties, so I’ll sip my champagne in silence and share my views here instead.

Powell: From Hawk to Dove to Jive Turkey in 30 Days

So, hawkish Powell is now talking about dovish rate cuts in 2024.

Powell, however, is neither a hawk nor dove but more of a jive turkey or, in the spirit of Christmas, a cooked goose.

The sad but simple fact of the matter is that our Fed Chairman, like so many of the so-called “experts,” has a genuine problem with admitting failure or speaking honestly—which is why I recommended long ago to bet against the experts…

Looming Rate Cuts? No Surprise at All

For any who have been following my blunt views on US debt markets, bond volatility, interest rate gyrations and Fed-speak vs. Fed-honesty (our first oxymoron), this pivot toward rate cuts should come as zero surprise.

ZERO.

As indicated many times, rising rates break things, and so many things have broken (banks, Gilts, USTs, the middle class…) that even Powell can’t deny this anymore.

Powell, as I wrote earlier this year, has only been raising rates so that when the denied recession that we are already in becomes an official 2024 recession according to the always too-late NBER, at least the Fed will have something to cut.

Powell, of course, is a politician, and like all politicians, has learned the art of bending truth to straighten his career and legacy.

It’s The Recession, Stupid

But even Powell, despite all his rhetoric on (mis) hitting target inflation via his pseudo-Volcker-esque profile of “higher-for-longer,” always knew (and still knows) that America is already in a hard-landing recession thirsty for cheaper rates and even more debt…

The evidence of this recession, as I’ve said, is literally everywhere—from classic economic indicators like the yield curve (inverted), the Conference Board of Leading Indicators (dipped below 4% threshold last December) and a dramatic 4% decrease in the M2 money supply (inherently deflationary), to basic Main Street indicators like record-breaking bankruptcy filings, ongoing lay-offs, equally record-breaking car and credit card delinquencies—all encapsulated by the Oliver Anthony Indicator.

Debt-Rollovers Needed Lower Rates

But there are more reasons these rate cuts are of no surprise…

Never forget this: The Fed serves Wall Street (and capital gain taxes), not Main Street. And Wall Street is screaming for help.

The over-valued and cheap-credit-addicted S&P 500 (led by 7 names only) is riddled with countless zombie enterprises staring down the barrel of $740B in debt rollovers in 2024, and another $1.2T in 2025—all at currently Powell-higher rates.

That is a problem.

And Uncle Sam is looking at 30% of his $34T in IOUs (about $17T worth) re-pricing over the next 36 months at equally higher, Powell-driven rates.

That too is a problem.

And as I warned: Rates would have to be cut to avoid a market bloodbath and sovereign bond debt trap.

Et voila—here comes Powell announcing rate cuts. Real shocker…

A Mug’s Game

Does such foresight make me/us psychic? Blessed with mystical powers?

Hardly.

Predicting any near-term move in the markets or even in the minds of a Fed official (which are essentially now the same thing), is indeed a mug’s game.

No one can pick the day, hour or even month of a watershed move.

But for those who follow deficits, debt markets and hence bond dysfunction, the signals (i.e., basic math) can offer pretty sound ideas of what’s coming.

Such instincts are nothing radical or genius, but boil down to common sense, something most of us own. You know, like how most of us reach for an umbrella on a cloudy day—because, well: Clouds warn of rain ahead.

What the Storm Clouds (and Debt Bubbles) Portend

The clouds we’ve been tracking in the bond markets were easy to see for everyone willing to open their eyes–except perhaps for politicians, who prefer to keep their well-made heads buried in the sand.

For months and months, we’ve been pounding our patient little fists that debt actually matters, and hence by extension, bond markets actually matter.

With this simple, (i.e., common sense) premise in mind, we thus had very little long-term faith in the short-term words or policies of our fork-tonged and financially-trapped central bankers about “higher for longer.”

Like Luke Gromen, and frankly even Charles Calomiris of the St. Louis Fed, we saw (and warned over and over and over) that the cost of Uncle Sam’s own IOUs under Powell’s “higher-for-longer” meme-war against inflation would fail.

Why?

For the simple reason that rising debt costs would force the Fed to reduce rates and eventually print more money just to pay for Uncle Sam’s True Interest Expense.

That’s called “Fiscal Dominance.”

In short, and despite all of Powell’s rate-hiking and chest-puffing, we saw a rate pause, as well as rate cuts, as effectively inevitable.

As warned, Powell then paused the rate hikes. And now, as 2023 winds toward a disastrous end, he is talking of rate cuts for 2024.

Again: Hardly a shocker. And here’s why.

Hitting a Wall of Fiscal Dominance

When official (as opposed to honest) CPI inflation falls while interest rates (as best measured by the yield on the unloved 10Y UST) rise, then “real” (i.e. inflation-adjusted) rates go positive and north.

And when real rates approach 2%, this means debt becomes really painful for companies, individuals, and, of course, broke governments like the U.S.

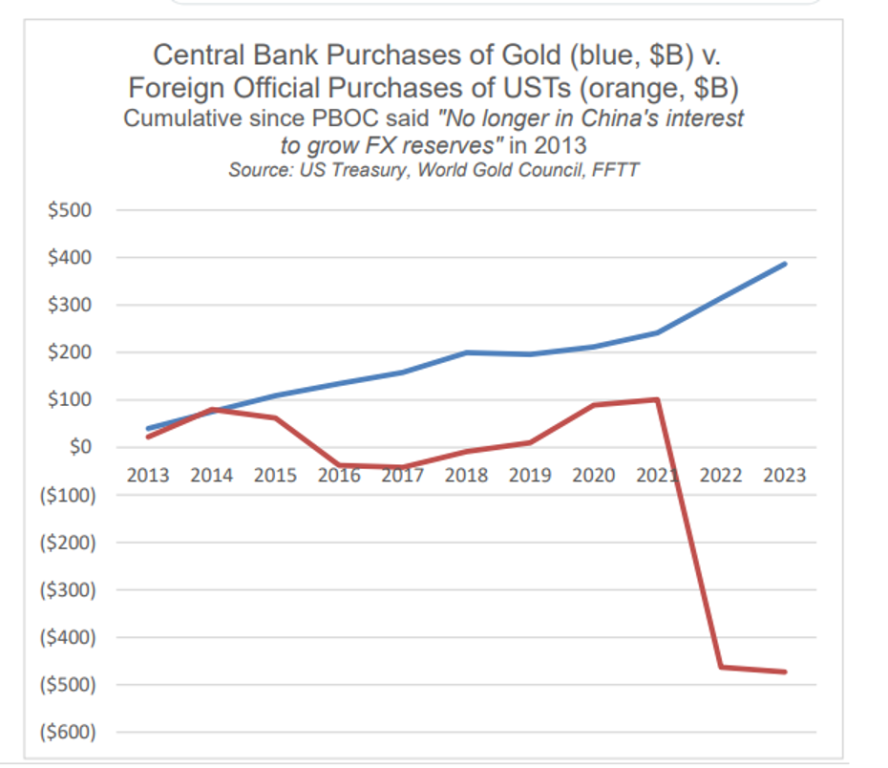

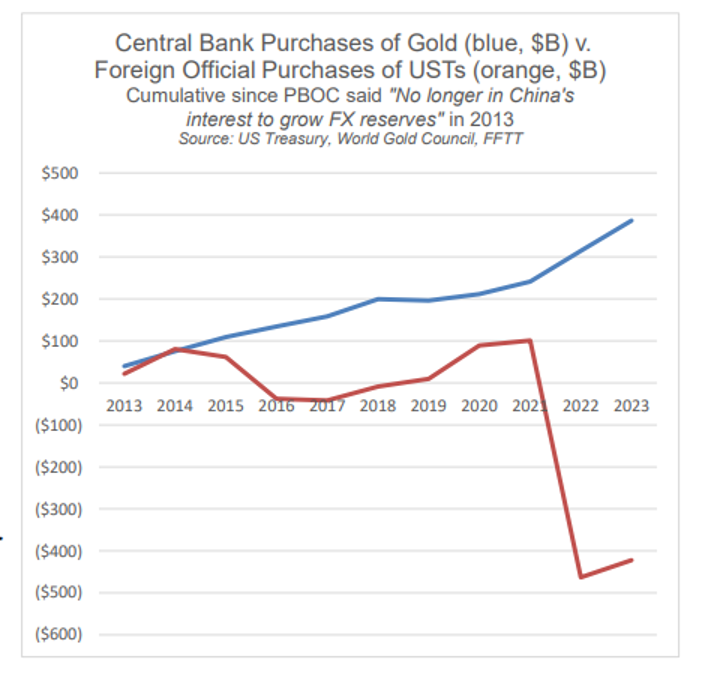

The rest of the world knows this too, which is why central banks have been dumping Uncle Sam’s unloved USTs (red line) and stacking gold (blue line), as they’d rather own real money than a declining asset from a bad credit.

This global dumping of USTs pushed bond prices down and hence yields and rates up, which meant Uncle Sam’s interest payments only got worse—i.e. $1T a year.

That stings.

And even poor old Janet Yellen, having slithered from a position as Fed Chair to Treasury Secretary (how’s that for insider power?) realized there was a real problem with Powell’s rate hikes.

As she confessed just last week: “Rising real rates may impact Fed decision on rate path.”

Well, as we seasoned bond experts say on Wall Street: “Duh.”

Meanwhile, the Financial Media Gets It All Wrong: The Truth About US Bonds

But despite this moment of “duh,” the main stream financial media, which like all media, has simply devolved into a propaganda arm of a centralized government with a weaponized Dollar and a “puppet-ized” president, tried to tell the world that November was a banner month for Uncle Sam’s bonds, which saw its best month in 40 years.

This, they boasted, was proof that America’s IOUs were loved IOUs.

As usual, however, just about everything the mainstream media says is approximately 180 degrees from the facts and hence truth…

November’s historical yield compression and bond price rise, for example, was not the result of resurging natural demand, but rather a spike in un-natural DC intervention at its best and most desperate.

For the fifth time in four years, and reminiscent of the already forgotten Treasury General Account tricks of last October, the Fed and US Treasury Department were hard at work at trickery hiding in plain sight.

That is, panicking central planners saw a need for liquidity that wasn’t coming from the rest of the world.

They thus saved the 10Y UST from an over-supply sky-fall by simply over-issuing more bonds from the short end of the yield curve to buy time.

And at the same time DC was shuffling risk from the 10Y to the 2Y UST, they got even more clever by sucking liquidity out of the Treasury General Account to the monthly tune of $150B to keep bond yields from spiking out of the Fed’s increasingly weakening control.

And that, folks, is what made November an historical month: Not a natural rebirth of global demand for Uncle Sam’s IOUs, but a series of loosening tricks wherein DC drinks its own expensive Kool aide and calls it a national victory.

But if, according to consensus, November was such a Fed and bond victory, why is the December version of a once-hawkish Powell now talking dovishly about more rate cuts in 2024?

From Fake Victory to Open Decline: No Good Options Left at the Fed

The simple answer is because America is not in a period of victory, but one of open and obvious decline clear to everyone but the word-heavy yet math-challenged media, the deficit-popular-politicos and the cornered central-bankers.

And boy do I mean cornered.

Why?

Because as warned month after month, debt destroys nations and hence corners central planners, who have nothing but bad options to address very bad math.

That is, if they don’t cut rates and print more fake money, risk assets tank and the economy falls with it into a hard recession.

But if central bankers loosen policy to save the system, they kill the currency’s inherent purchasing power, which is precisely what Powell will do next—as all broke nations sacrifice their money to cover their butts…

Very Scary Math

To keep this sensational but all too sad point real, just consider the facts rather than the drama of a nation whose debt profile makes growth impossible.

Current US debt to GDP has crossed the Rubicon of 100% well into the 120% range; our deficit to GDP is at 8% and rising; our Net International Investment Position (i.e., piggy bank of foreign assets) is at negative 65%; our public debt is at 34 TRILLION and counting, and according the Congressional Budget Office, Uncle Sam is about to spit out at least another $20T in US IOUs over the next 10 years, and this modest number (?) is assuming no intervening recession…

But who will buy Uncle Sam’s IOUs to cover his skyrocketing deficits?

According to simple math and hard facts, the answer since 2014 is basically no one but the Fed…

Such facts have the global chief economist at Citi Group worried and wondering, and it’s never a good thing when even the beneficiaries of a Fed-driven debt bubble are worried about the size of that bubble…

Meanwhile, combined public, corporate and household debt in the debt-imprisoned land of the free is around $100T.

I don’t even know how to write this number out, but I can assure you that no one in DC knows how to pay it either.

This, of course, is a problem…

Collateral Debt Damage—The Dollar, Inflation, Markets Etc.

All of this debt, alas, brings us to the corollary topics of inflation and the next chapters of the USD, because debt and currencies, like just about everything else, including risk assets, are all connected and inter-twined.

That is, if one understands debt, one can see the patterns of broader markets—past, present and future.

The USD: Relative Strength Aint Enough

When it comes to the USD, let’s not kid ourselves: The world still needs it. 70% of global GDP is measured in USDs and 80% of global trade is settled in Dollars.

And as Brent Johnson’s milkshake theory reminds, there is a great big straw (“sucking sound”?) of global demand for USDs coming from Euro Dollar markets, derivative markets and oil markets.

I agree that this super straw (or better yet, global “sponge”) is enormously powerful, and hence the need for Dollar liquidity is a massive tailwind for the USD.

But… this massive tailwind is not an immortal tailwind.

De-Dollarization: More Than Many Think

Evidence of increasing de-dollarization post-US-Russia sanctioning (and Dollar-weaponization) is not merely a bearish meme but an open and undeniable reality.

China and Russia are moving ever more toward oil purchases in CNY (which Russia then converts into gold on the Shanghai Gold Exchange/SGE) while an exponentially increasing number of bilateral trade agreements among the BRICS+ nations are now happening OUTSIDE of the USD.

Just as Nixon’s de-coupling of the gold-standard in 1971 lead to a slow death by a thousand cuts of the USD’s inherent purchasing power (a 98% loss when measured against gold), the weaponization of the USD will lead to a similar (but slow) death by a thousand cuts of the USD’s global hegemony (when measured against a world turning away from the debt-backed rather than gold-backed USD).

We warned of this from day 1 of the sanctions against Russia.

A Supreme Dollar Losing Respect

For now, however, the USD is still supreme, but unlike Brent Johnson, I don’t see even its relative strength pushing the DXY to 150.

This is for the simple reason that even Uncle Sam knows that the rest of his global friends and enemies can’t afford to pay-back $14T in Dollar-denominated debt at such a level without having to dump more of their foreign held USTs (about $7.6T worth), which would crush UST pricing and lead to skyrocketing (and unsustainable) UST yields and rates for Uncle Sam himself.

In short: Even Uncle Sam fears rising rates and a too-strong USD.

Such a fear of rising rates along with the reality of growing US deficits (and hence a growing need for more US IOUs) will soon lead to an over-supply/issuance of USTs down the road.

And the only buyers of those USTs to control yields/rates will be the Fed, not the rest of the world (See graph above…).

That kind of bond buying with money created out of thin air kills a currency.

No Milkshake Straw for USTs = Mega Money Printing Ahead

Thus, while the milkshake theory correctly sees immortal global demand for USDs, there is no similar straw (or demand) for USTs.

This means the Fed will have to print trillions of more Dollars to buy its own sovereign bonds, an inherently inflationary policy which weakens rather than strengthens the Dollar longer term.

This is why Powell’s “pause,” and now “cutting” in 2024 will eventually be followed, in my opinion, by “mega printing.”

After all, “pause, cut and print” is the pattern of debt- cornered central bankers, and eventually (despite TGA and short-duration bond tricks) Powell will need massive amounts of mouse-click money to monetize Uncle Sam’s sickening (and growing) deficits.

We saw this exact pattern between 2018 (QT) and 2020 (unlimited QE).

The end-game is thus more money creation, more money debasement and hence more inflation.

But First the Deflation

But before then, we are marching into an “official” recession in 2024, and recessions are inherently dis-inflationary if not outright deflationary.

Again, the inflation-deflation debate is not a debate but a cycle.

Historically, moreover, the dramatic declines in M2 ALWAYS result in deflation. Always.

And More Risk Asset Bubbles?

As for our stock and bond bubbles, they certainly like cheaper debt (i.e., lower rates) and mouse-clicked trillions (i.e., QE).

For now, markets are expecting (pricing in) the former and waiting for the latter, which can and will make them giddy.

With about 25% of US GDP sitting in cash equivalents, Powell’s 2024 projected rate cuts will send a lot of that money into the market bubbles, sending asset inflation even higher, which means more needed tax revenues for Uncle Sam.

If the DXY stays low, markets will rise. And if the Fed is accommodative, markets will rise. This includes BTC.

It’s just that simple: Tight policies are a market headwind, loose policies are a market tailwind.

This is because capitalism died long ago and the Fed is essentially the de facto market-maker for the S&P, Dow & NASDAQ.

But trying to determine, or time, how long this charade of Fed-driven asset bubbles can avoid a sickening moment of mean-reversion is the topic of another article.

Gold: The Brightest Star on the Tree

Gold, of course, merely sits back and patiently watches all these debt forces—and hence inflationary and currency debates/reactions–with a calm smile.

Why?

Well, gold loves chaos, and thanks to decades and decades of policy makers who believed they could solve one debt crisis after the next (think Paul Krugman) with more debt, the financial/recessionary chaos (as per above) is literally everywhere.

Thus, even when rates are officially positive, gold reached record highs, despite my own argument that gold loves negative real rates.

And even with a relatively strong USD and DXY, gold has reached record highs, despite the standard view that gold favors a weak USD.

And even with yields spiking, gold has reached record highs, despite another common misconception that investors prefer higher-yielding bonds over zero-yielding “pet rocks.”

Gold, in other words, follows more than just conventional indicators. It has a profile, life and history of its own, one which few investors understand unless their aim is solvency and wealth preservation.

In fact, the easiest way to understand gold is that it’s more loyal than paper money.

Despite all the endless debating, and all the spot-price manipulationsin the OTC markets and all the crypto comparisons and fiat-money apologists, the fact is that informed investors, like a growing list of informed countries, just don’t trust the US, its bonds or its fiat-Dollar like they used do.

They’d rather have gold:

And in the years ahead, they’ll get a fairer gold price on the SGE than in London or New York, which means the West will soon have to behave on actual supply and demand principles rather LBMA bank price manipulations…

Iconic America has devolved from a gold-backed currency and the world’s leading creditor, manufacturer and trade partner to a debt-soaked America with a gold-welched-dollar and is now the world’s biggest debtor, weakest manufacturer and open loser to a trade war with China.

This is hardly a proud evolution from its Greatest Generation…

In short, the iconic America is no more, and there’s a far better Sharpe Ratio in gold than there is in topping risk portfolios…

Like it or not, believe it or not: Gold is rising because the home of the world reserve currency with its shining façade of free market price discovery has lost its way, replacing capitalism with feudalism and altruistic leadership with egotistic opportunism.

If WE know this. So too does gold.

5 Reasons Why The Gold Rally Is Not Over Yet

Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.”

Net conclusion: The real death of the USD will be domestic not foreign.

The Bell Has Been Tolling for Years

When it comes to the “bell tolling for fiat,” we can all hear its loud chimes, but that bell has been tolling since 1971 (or frankly 1968), when the US leadership decoupled the world reserve currency from its golden chaperone.

Like any teenager throwing a house party, the lack of a parental chaperone leads to lots of crazy events and lots of broken furniture.

The same is true of post-71 politicians and central bankers suddenly freed of a gold-backed chaperone and thus suddenly loaded with drunken power to mouse-click currencies and expand deficits.

And since then, all kinds of things have been breaking, from banks to bonds to currencies.

And now, with all the extreme hype (and, yes, some genuine reality) behind the headlines of a revolutionary gold-backed BRICS trade currency, many are making sensational claims that the World Reserve Currency (i.e., USD) is nearing its end and that fiat money from DC to Tokyo is effectively toast.

Hmmm…

Don’t Bury the Dollar Just Yet

Before we start tossing red roses over the shallow grave of an admittedly grotesque US Greenback in general, or fiat fantasy money in general, let’s all take a deep breath.

That is, let’s re-think through this inevitable funeral with a bit more, well, realism, mathematics and even geopolitical common sense before we turn our backs on the USD, and this is coming from an author who has never thought highly of that Dollar, be it fiat, politicized and now weaponized.

So, let’s take a deep breath and engage open, informed and critical minds when it comes to debating many of the still open, un-known and critical issues surrounding the so-called “game changer” event when the BRICS+ nations convene this August in S. Africa.

Needed Context for the “BRICS New Currency” Debate

As made clear literally from Day 1 of the Western sanctions against Putin, the West may have been aiming for Putin’s (or the Ruble’s) chest, but it then shot itself in the foot.

After decades of DC exporting USD inflation from Argentina to Moscow, a large swath of the developing countries of the world who owe greater than $14T in USD-denominated debt were already reeling under the pain of rate-hike gyrations which made their own debt and currency markets flip and flop like a dying fish on the dock.

Needless to say, a 500-basis-point spike in the cost of that debt under Powell didn’t help. In fact, it did little good (or goodwill) for USD friends and enemies alike, from the gilt markets in London to the fruit markets in Santiago.

Adding insult to injury, DC coupled this strong-Dollar policy with a now weaponized-Dollar policy in which a nuclear and economic power like Russia had its FX reserves frozen and access to SDRs and SWIFT transactions blocked.

Like Napoleon at Moscow, this was going a step too far…

The net result was an obvious and immediate distrust of that once neutral world reserve currency, an outcome which economists like Robert Triffin warned our congress against in 1960, and even John Maynard Keyes warned the world against long before.

Heck, even Obama warned against such weaponization of a reserve currency as recently as 2015.

Thus, and as I (and many others) warned from Day 1 of the sanctions, the distrust for the USD unleashed by the sanctions in early 2022 was “a genie that can never go back in the bottle.”

Or more simply stated, the trend toward de-dollarization was now going to come at greater speed and with greater force.

This force, of course, is now being seen, as well as debated, under the highly symbolic as well as substantive example of the BRICS+ nations seeking to usher in a gold-backed trade currency to move openly away from the USD, a move which some maintain will soon de-throne the USD as a world reserve currency and send its value immediately to the ocean floor.

The Trend Away from the USD Is Clear, But It’s Pace Is Not

For me, the trajectory of this de-dollarization trend is fairly obvious; but the speed and knowable magnitude of these changes are where I take a more realistic (i.e., less sensational) stance.

But before I argue why, let’s agree on what we do know.

The BRICS New Currency Is Very Real

We know, for example, that Russian finance experts like Sergei Glasyev have real motives and sound reasons for planning a new (anti-Dollar) financial system which not only seeks a Eurasian Economic Union for cross boarder trade settlements backed by local currencies and commodities, but to which gold will likely be added as a “backer” to the same.

Glasyev has also made headlines with plans regarding the Moscow World Standard as a far more fair-playing and fair-priced gold exchange alternative to the Western LBMA exchange.

If we take his gold backing plans seriously, we must also take seriously the plan to expand such gold-backed trade currency plans into the Shanghai Cooperation Organization which would make the final tally of BRICS+ nations “going gold” as high as 41 country codes.

This could ostensibly mean greater than 50% of the world’s population and GDP would be trading in a gold-backed settlement currency outside of the USD, and that, well, matters to both the demand and strength of that Dollar…

China’s Motives Are Also Anti-Dollar

China, moreover, has invested heavily in the Belt & Road Initiative (152 countries) as well as in massive infrastructure projects in Africa and South America, areas of the world that are all too familiar with America’s intentional (or at least cyclical) modus operandi of developing nations enjoying low US rates and cheaper Dollars to create local credit booms which later crash and burn into a local debt crisis whenever those US rates and Dollars rise.

China therefore has a vested interest in protecting its EM investments as well as EM export markets in a currency outside of a USD monopoly.

Meanwhile, as the US is making less and less friends with EM markets, Crown Princes, French Presidents and EU and UK bond markets, China has been busy brokering peace between Saudi Arabia and Iran, as well as building a literal bridge between the latter and Iraq while simultaneously making Yuan-trade deals with Argentina.

Other Reasons to Take the BRICS+ Currency Seriously

Tag on the fact that Brazil, China and Iran are trading outside the USD-denominated SWIFT payment system, and it seems fairly clear that much of the world is leaning toward what Zoltan Poszar described as a “commodity rather that debt-based trade settlement currency” for which Charles Gave (and the BRICS+ nations) see gold as an “essential element” to that global new trend.

Finally, with a strong Greenback making USD energy and other commodity prices painfully (if not fatally) too expensive for large swaths of the globe, it’s no secret to those same large swaths of the globe (including petrodollar nations…) that gold holds its value far better than a USD.

Given this fact, it’s easy to see why BRICS+ nations wish to settle trades in a gold-backed local currency in order to ease the pressure on commodity prices. This gives them the opportunity, as Luke Gromen reminds, to buy time to pay down their other USD-denominated debt obligations.

In addition to the foregoing arguments, the fact that the BRICS+ nations are cloning IMF and World Bank swing loan and “contingency reserve asset” infrastructure programs under their own Asian Monetary Fund and New Development Bank, it becomes more than clear that a new BRICS+ world, trade currency and institutionalized infrastructure is as real as the trend away from a monopolar hegemony of the USD.

In short, and to repeat: There are many, many reasons to both see and trust the obvious and current trend/trajectory away from the USD as warned over a year ago, all of which, no matter what the slope and degree, will be good, very good for gold (see below).

But here’s the rub: The speed, scope, efficiency and ramifications of this trend in general, and the “BRICS August Game Changer” in particular, are far too complex, fluid and unknown to make any immediate (or “sensational”) funeral plans for the USD today.

And here’s a few reasons as to why.

Why the BRICS New Currency Is No Immediate Threat to the USD

First, we have to ask the very preliminary question as to whether the August BRICS summit will even involve an actual announcement of a new, gold-backed trading currency.

So far, all we have to go on is a leak from a Russian embassy in Kenya, not an official communication from the Kremlin or CCP.

Meanwhile, India, a key BRICS member, has openly denied such a new trade currency as a fixed agenda item for this August.

But notwithstanding such media noise, we must also look a bit deeper into the mechanics, economics and politics of a sudden “game-changer” new currency.

The BRICS New Currency: Many Operational Questions Still Open

Mechanically speaking, for example, who will indeed be the issuing entity of this new currency?

The new BRICS Bank?

What will be the actual gold coverage ratio? 10% 15% 20%?

Will BRICS+ member nations/central banks need to deposit their physical gold in a central depository, or will they enjoy (most likely) the flexibility of pledging their domestically-held gold as an accounting-only-unit?

Cohesion Among the Distrusting?

As important, just how much trust and cohesion is there among the BRICS+ nations?

Sure, this collection of nations may trust gold more than they trust each other or the US (which is why such a gold-backed trade currency may work, as it can’t be “inflated away”), but if a BRICS member country wishes to redeem its gold from say, Russia, years down the road, can it realistically assume it will happen?

What if Russia (or any other trade partner) is in a nastier mood tomorrow than they are today?

Basic Math

In addition, there are certain economic/mathematical issues to consider.

We know, for example, that the collective BRICS+ gold reserve (as of Q1 2023) is just over 5452 tones, valued today at approximately $350B.

Enough, yes to stake a new currency.

But measured against a net global amount of $13T in total physical gold, are the BRICS+ gold reserves enough to make a sizable dent (even at a partial coverage ratio) to tilt the world away from the USD overnight, when the USA, at least officially, has much, much more gold than the BRICS+?

That said, we can’t deny that the actual gold stores in places like Russia and China are far, far higher than officially reported by the World Gold Council.

Additionally, the historically unprecedented rate of central bank gold stacking in 2022-23 seems to suggest that the enemies of the USD are indeed “loading their guns” for a reason.

Expecting, however, all of the BRICS+ members to maintain the discipline to continue to purchase and store more physical gold despite the political temptations to redeem the same for later or unexpected domestic spending needs may be a naive assumption in a real world of ever-shifting national behaviors.

Geopolitical Considerations & the BRICS New Currency

Speaking of such shifting behaviors, we also can’t ignore the various pro and con forces within a geopolitical backdrop wherein much of the world, whether it loves or hates the US, still needs its USDs and USTs.

China, for example, may be letting maturities run and even dumping the USTs it now owns at a fast pace (only years away from total UST liquidation), but for now, China needs to keep the USD from growing too weak to buy all the Chinese exports of those American products made, in well…China.

That said, if the trend is indeed a new world of currency wars, rather than currency cooperation, which is a more than fair assumption, then all such liberal economic cooperation/trade arguments fall to the floor.

Nevertheless, with over $30T worth of USDs held by non-US parties in the form of bonds, stocks, and checking accounts, the collective desire (common interest) to keep those USDs alive and at least relatively strong is a major counter-force to the notion that the world and USD are coming to a sudden change this August.

Furthermore, in such an uncertain world of competing currencies as well as national and individual self-interests, the trillions and trillions of off-shored USTs/USDs tangled up within the foreign as well as US banking and derivative markets is important.

Why?

Because any massive dislocation in risk asset (and even currency) markets emanating from South Africa or elsewhere, in August or much later, would more than likely (and ironically) cause a disruption in foreign markets so dramatic that we could easily see a flow into, rather than away from, USDs for the simple (and again ironic) reason that the mean and ugly Greenback is still the best/most-demanded horse in the global fiat slaughter house.

In other words, even if all the BRICS+ plans for a gold-backed trading currency go flawlessly, the time gap between the accepted rise of such a settlement currency and the open fall of the USD is likely to be long, wide and unknown enough to see the USD actually get stronger rather than weaker before we experience any final fall in the USD as a global reserve currency.

The USD: Supremacy (Still) vs. Hegemony (Gone)

So, no, I don’t think that the USD will fall entirely from grace or even supremacy in August of 2023, even if the trend away from its prior hegemony is becoming increasingly undeniable.

It will take more than sensational BRICS headlines to make such a rapid change, but yes, and as the Sam Cooke song says, “change is gonna come.”

My only point is that for now, and for all the reasons cited above, the trajectory and speed of those changes are likely not as sensational as the trajectory and speed of the current headlines.

No Matter What: Gold Wins

The case for gold, of course, does not change just because the debate about the speed and scope of the new BRICS+ trade currency rages today.

No matter what, the very fact that such a gold-backed trade settlement unit will inevitably come to play will be an equally inevitable tailwind for global gold demand and hence global gold pricing in all currencies, including the USD.

The Dollar Will Die from Within, Not from Without

Furthermore, and despite all the hype as well as substance behind the BRICS headlines, I see the evolution of such a gold-backed trade currency as a reaction to, rather than attack upon, the USD, whose real and ultimate threat comes from within, rather than outside, its borders.

The world is losing trust in the USD because US policy makers killed it from within.

Ever since Nixon took the gold chaperone away, politicians and central bankers have been deficit spending like drunken high school seniors in a room filled with beer but absent of parental consent.

The entire world has long known what many Americans are finally seeing from inside their own walls, namely: The US will never, ever be able to put its fiscal house in order.

Uncle Sam is simply too far in debt and there’s simply no way out as it approaches a wall of open and obvious fiscal dominance in which fighting inflation will only (and again, ironically) cause more inflation.

Or stated simply, Uncle Sam can’t afford his own ever-increasing and entirely unpayable deficit spending habits without having to resort to trillions and trillions of more mouse-clicked Dollars to keep yields in check and IOUs from defaulting.

And that, far more than a BRICS new currency, is what will put the final rose on a fiat system (and Dollar) that is already openly but slowly dying—first slowly, then all at once.

But I don’t think that day will be August 22.