Power Shifts, Gold’s Resurgence and the Signals Family Offices Should Heed

In an insightful interview, Jonny Haycock, Partner at VON GREYERZ, explores critical topics shaping the global financial landscape and the signals family offices must not ignore.

Jonny explores the power shift from West to East, underscored by the systematic gold buying by BRICS countries, increasing geopolitical risk, unsustainable levels of debt, de-dollarisation, extreme levels of gold under-ownership and the constant debasement of paper money.

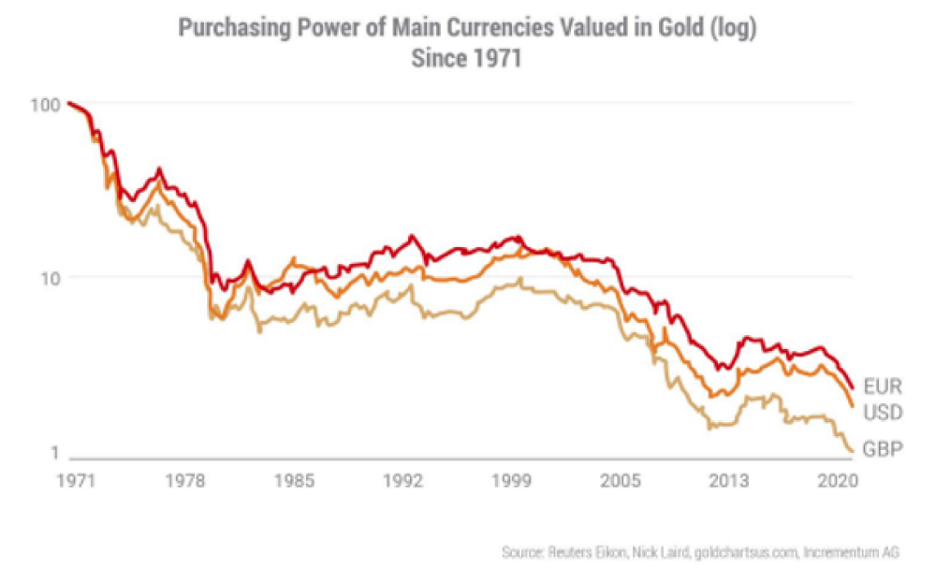

In a historical context, Jonny highlights the pivotal moment when Nixon abandoned the gold standard in 1971, an event that set the stage for today’s economic imbalances. By comparing gold’s value against debased currencies – citing the UK and US as prime examples – he shows how gold has maintained its purchasing power against all paper currencies.

The conversation also delves into gold’s exceptional performance during stagflationary periods and how central banks have manipulated markets to control perceptions. With the BRICS nations potentially backing their currencies with commodities, Jonny outlines the inflation risks and far-reaching implications for global investors, particularly family offices seeking to protect part of their wealth against looming financial uncertainties.

Watch now to learn more about how family offices can prepare for the power shift from West to East.

Power Shifts, Gold’s Resurgence and the Signals Family Offices Should Heed

Between politics (driven by self rather than public servants), markets (driven by debt rather than profits) and currencies (diluted by over-creation rather than chaperoned by a real asset), it is fair to say we live in not interesting but surreal times.

But amidst the surreal, the dollar, as many believe, is our rock, our immortal albeit often unloved constant.

The USD: Too Big to Fail?

Whatever one thinks of the dollar, we can’t deny its centrifugal force, exorbitant privilege and entirely unequaled market power (from the current SWIFT and Eurodollar systems to the derivative and petrodollar markets).

And even as broken, debased, inflated (and inflation-exporting) as the USD is, its place as a world reserve currency (with 80%+ of global FX transactions) is firm.

More importantly, the USD is a currency (base money) that only the Fed can print into existence and which the rest of the dollar-thirsty and dollar-indebted world (i.e. Eurodollar markets) can only lend into existence (like a second derivative credit currency) in a perpetual dollar-roulette of “debt and print” or “debt and lend.”

This effectively makes the USD the world’s base money (and denomination) for the vast majority of derivative global debt instruments, which means everything else (including Eurodollar lending) is essentially just credit-related.

And because credit makes the $330T debt-world spin, the USD, by extension, makes the world spin.

In short, one might argue the USD is too big to fail, right?

The Immortal Greenback?

Given the baked-in global demand and credit role for this otherwise diluted super-dollar, the national and global system which it has ruled since 1944 will thus likely and only end (save for a miraculously peaceful Plaza Accord 2.0) in some form of what Brent Johnson rightfully described as “profound violence—economic and/or military.”

But according to the dollar bulls, even a collapsing system and, hence, tanking US bond market, would send UST yields to the moon and, hence, the USD (ironically) even higher.

In short, no matter how some spin it—the dollar is king, and every central banker in DC knows this, right?

After all, such dollar realists have discovered the hard truth through the lens of realpolitik global finance: The dollar, love or hate it, is the base money of the global financial system and, as such, will be “the last to fall.”

Gold Backing?

As for any return to a gold-backed dollar, those same realists would remind us of the infamous 1896 “Cross of Gold” case laid out by William Jennings Bryan, who warned that with a dollar tied to gold, credit would eventually tighten to such levels that the average citizen and small business would be left bleeding credit-dry in the streets.

Furthermore, there’s the equally realistic stance that no country would want to be tied to a gold chaperone (or “standard”) for long, as this would only impede their sovereign ability to mouse-click their own currencies into existence when needed (i.e., whenever backed into a self-created debt wall).

Money, and hence the USD, they ruefully conclude, will therefore be whatever the strongest country (bully) on the block says it is, and like it or not, the US and USD are still flexing the strongest biceps in the global neighborhood, right?

Assuming Nothing (or History) Ever Changes

But each of the foregoing (and reasonable) conclusions only hold true if one assumes that the US is and remains the strongest bully (and money) on the block.

The evidence of history, however, which is dynamic rather than static, may suggest otherwise.

For now, however, the dollar matters most to many.

China, Russia, or India, for example, may be important, but few of us can or would predict that the yuan, ruble, or rupee will replace the greenback.

I certainly don’t.

So again, the USD will remain the king of liquidity.

And even for those who take de-dollarization seriously, will the BRICS+ nations really be able to agree to a gold-backed BRICS+ currency redeemable in, say, Moscow or Shanghai?

I have my doubts—for the simple reason that as much as the BRICS+ nations collectively distrust the now weaponized USD, they don’t trust each other enough to relinquish their option to print their own currencies at will.

But that doesn’t end the discussion on gold’s new and rising role in a changing dollar/world.

Going Around Rather than Replacing the Dollar

For me, debating a gold-backed new currency or “end of the dollar” drama thesis is missing the bullseye.

The facts and evolving history of today and tomorrow suggest that the real story is not about replacing the dollar, but simply going around it in a new price direction paved in both black and real gold.

Toward that end, look at what the rest of the world and its central banks are doing, not what they (or our financial leadership) are saying:

- Since 2008’s GFC, Putin has been hoarding gold;

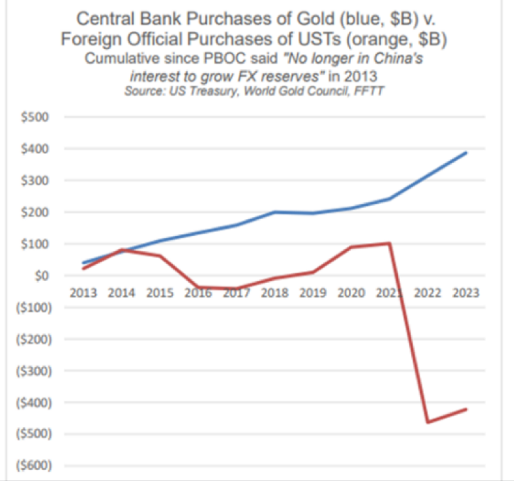

- Since 2014, global central banks have been net-sellers of USTs and net buyers of physical gold;

- In 2023, 20% of global oil sales were outside of the USD;

- Despite being pegged to the USD, Saudi Arabia, the UAE, and other GCC nations’ favorite import out of Switzerland this year is physical gold;

- More than 44 nations are currently executing trade settlements outside of the USD;

- Both Japan and China, historically the most reliable buyers of Uncle Sam’s IOUs, are now dumping billions and billions worth of them;

- Russia is the world’s greatest commodity exporter, and China is the world’s greatest commodity importer—and they like each other far more than they do Biden or the next White House resident; more importantly, it is a matter of national survival for China to buy oil outside the USD;

- Russia is now selling oil to China in yuan, which the Russians then use to buy Chinese goods (once made in America); thereafter, any delta in the trade is net settled in gold (not dollars) on the Shanghai Exchange. This, folks, is BRICS scalable (think India…);

- Between swap lines, the CIPS alternative to the SWIFT system and rising negotiations between Gulf oil nations and other BRICS+ big-whigs, the current move away from dollar-denominated oil trades is real rather than imaginary;

- Given the growing decline of physical gold and silver levels in the New York and London exchanges, they can no longer price fix gold as in the days of yore, nor can they justify a different 200 moving day gold price than one more fairly priced in China’s exchange;

- The BRICS+ nations are no longer USD pawns but rising rooks. Their share of global GDP is surpassing that of the G-7;

- In 2023, the Bank of International Settlements declared physical gold a tier-one asset alongside the 10Y UST;

- Nations are openly (and naturally) preferring gold as a reserve asset over the other “tier-one” option–a dollar-based IOU of “risk-free-return,” which by any honest (current and future) measure of inflation offers a negative real yield, in other words: “return-free-risk;”

- No matter how enamored the green crowd is of ESG, we are decades and decades (as well as trillions and trillions) away from carbon-neutral, and like it or not, energy matters and fossil fuels literally fuel the world;

- China and India each have populations of over 1.4B. If oil demand increases even slightly in either of these BRICS countries, oil prices in rupees and yuan (and every other fiat currency) will explode—and two of the biggest players in the oil space don’t want to use dollars to pay for it. Instead, they’d prefer to net settle their oil and gas in gold, which buys more energy than dollars can;

- Given that the annual production capacity for oil is 12-15X that of global gold, and with gold increasingly becoming the favored oil payment, gold’s price relative to oil can only go up;

- This explains why gold is openly (not theoretically) becoming a more trusted reserve asset than the UST:

In short, Energy matters, and rather than the USD being the base layer of money (see above), energy very well could be.

And THAT, folks, is how a system changes “violently and or militarily,” as most US direct and proxy wars have something to do with…oil.

And that oil, by the way, is increasingly being net-settled in gold—day by day, and minute by minute, for the simple reason that history is like a hockey puck: You play where it is headed (gold), not where it sits (the USD).

The Other Bullies Are Coming Together

Returning to the prior assumptions of the Immortal Dollar thesis above, if money is whatever the strongest bully/power says it is, what happens to the previous notion of “money” when a collection of rising and resource-rich bullies/powers (BRICS+) is growing stronger, and their preferred focus is oil and not the dollar?

What happens after a neutral reserve asset is weaponized against a major nuclear power and energy exporter (Russia) already in financial bed with the world’s largest energy importer (China)?

The answer is simple: That once “immortal” reserve currency is less trusted and hence less in demand.

Is it any coincidence, for example, that after DC weaponized the USD, the BRICS+ roster of nations increased to include the major oil exporters?

Is it a coincidence that Saudi Arabia’s crown prince, whatever you think of him, gave Biden a fist-pump and Xi a warm handshake?

And let’s be blunt: Does anyone truly believe oil is irrelevant? That American wars (direct or indirect) with Iraq, Libya and Syria were about protecting freedom and democracy?

Or might these conflicts have had something a bit more to do with energy in general and oil in particular?

What the US elite doesn’t want you to know is that oil matters more than dollars, and that more countries today would rather pay for that oil in gold.

And do we think the Saudis haven’t noticed that gold-backed oil sales are significantly and historically more stable than dollar-backed oil?

Is it, therefore, a coincidence that since DC weaponized the USD, global central banks have been stacking gold at historical levels?

Is it a coincidence that more and more nations are net settling commodities and other trade deals in gold rather than dollars?

Is it a coincidence that nations and their central banks would rather save in gold (a finite asset of infinite duration) rather than US IOU’s (an infinite asset of finite duration), whose returns can’t beat inflation and whose purchasing power, even in dollar terms, has fallen greater than 98% when measured against a milligram of gold since 1971?

Is it a coincidence that within 2 years of de-coupling the USD from gold in 1971, DC desperately raised its interest rates and strengthened its dollar so that Saudi Arabia et al. would agree to force the world to buy oil in strong dollars, thereby creating forced demand for an otherwise over-supplied/printed USD?

But is it also just a coincidence that 50+ years (and a 98% weaker dollar later), Gulf nations like Saudi Arabia are now slowly turning away from that petrodollar after a generation of seeing it debased by over $100T in US public, private, and household debt—all of which has made an increasingly unloved UST increasingly unable to withstand further rate hikes and hence dollar-strength?

It’s Good to Be the King

But as per above, the smart bankers at the Fed and big banks still want us to believe the dollar is king, and that despite all its flaws, the great straw-sucking demand from a dollar-centric world is precisely what makes the greenback too big to fail.

But what if the world is energy rather than dollar-centric? And what if the BRICS rise is more than a chimera but a new puck direction?

Think about that. No one in DC or Wall Street wants you to.

Pride Comes Before the Fall

The certainty that tomorrow’s dollar will remain yesterday’s dollar is, in fact, a dangerous sign of hubris (and historical ignorance) before the fall.

After all, if we can see the decline of the USD’s purchasing power since 1971, can’t others?

And if we can see that UST returns are losing (technically defaulting) to current and future inflation, can’t others?

And if we can see that the fake liquidity (QE or other) required to pay Uncle Sam’s rising bar tab will continue to be highly inflationary (and dollar-debasing), is it not reasonable to assume that the rest of the world can see this too?

Going Around Rather than Against

In fact, and based on what is being done rather than said, the rest of the world appears to see precisely what we are seeing.

The BRICS nations are not seeking to destroy or replace the dollar. Instead, and like the Germans facing the Maginot line, they are already and openly going around it.

How?

By using local currencies for local goods which are then net settled in a timeless asset: Gold.

And if we can see that holders of gold can purchase significantly more energy (i.e., oil or gas) with gold ounces and kilos than they can with American dollars and USTs, is not at least reasonable to assume that gold’s role as a trade settlement asset will have higher demand as the USD suffers declining demand?

And if demand for the USD as a net trade settlement asset continues to fall rather than rise, is it not equally plausible (if supply and demand forces still apply) to suggest that tomorrow’s dollar may be weaker rather than stronger?

Two Crowns: The Timeless vs. The Temporary

And even if we were to concede the milk-shake theory’s reasonable postulate that despite all its blemishes, the dollar will be “the last to fall,” the simple fact remains that regardless of whether it falls or fails “last,” it is already being repriced, even if it may never be fully replaced?

Finally, and perhaps most importantly (and obviously), even if the USD remains “king” relative to all other fiat currencies (and this matters if you live in countries—like Turkey or Argentina-where your currency is far weaker), we can still objectively see, again, that gold holds its value even better than that USD “king.”

In short, there’s a far better “king” than the USD—it was always there.

The central bankers just don’t want you to see it.

And this precious king has a crown of gold rather than paper.

Which king will you choose?

Power Shifts, Gold’s Resurgence and the Signals Family Offices Should Heed

Needless to say, we at VON GREYERZ spend a good deal of time thinking about, well… gold.

The Complex, the Simple, the Math and the History

Year after year, and week after week, there is always a new way to examine gold price moves and decipher the obvious and not-so obvious forces which flow behind, ahead, above and below its monetary and, yes, metallic, move through time.

Today, deep into the early decades of the 21st century, and well over 100 years since the not-so immaculate conception of the Fed in the early 20th century, we could (and have) spent pages and paragraphs on key turning points in the rigged to fail history of paper vs. metallic money.

At times, this effort can and has seemed intense and even complex, with all kinds of historical facts, mathematical comparisons and “big events.”

The turning points of gold’s relationship with fiat currencies, and its role in preserving wealth, for example, are known to an admitted minority—as only about 0.5% of global financial allocations include physical gold.

Gold’s Language

Yet the need, role and direction of gold is fairly blunt, at least for those with eyes to see and ears to hear.

History, for example, has some clear things to say about paper money.

And so does gold.

From the Bretton Woods promises of 1944 and Nixon’s open and subsequent welch on the same in 1971 to the 2001 outsourcing of the American dream to China under Clinton (and the WTO) or the recent weaponization of USD in Q1 of 2022, gold has been watching, acting and speaking to those who understand her language.

The Big Question: Why Is Gold Rising Now?

And this year, with gold reaching all-time-highs, piercing resistance lines and racing toward what the Wall Street fancy lads call “price discovery,” we are understandably getting a lot of interview requests, phone calls and even emails from friends otherwise silent for years and now suddenly asking the same thing:

“Why is gold rising now?”

The Wall Street side of my odd brain, like it or not, gets all excited by such questions.

Never at a loss for words, my pen and mouth rapidly seek to wax poetic on the many answers to why gold matters forever in general, and why it is rising in particular now.

Toward that end, the list of the fancy and not-so-fancy answers to this question in recent years, articles and interviews could look as simple (or as complex) as the following list of 7 key factors:

The Malignant Seven

- Every debt crisis leads to a currency crisis—hence: Good for gold.

- All paper currencies, as Voltaire quipped, eventually revert to their paper value of zero, and all debt-soaked nations, as von Mises, David Hume and even Ernest Hemingway warned, debase their currencies to retain power—hence: Good for gold.

- Rising rates (and fiscal dominance) used to “fight inflation” are too expensive for even Uncle Sam’s wallet, thus he, like all debt-soaked nations, will debase his currency to pay his own IOUs—hence: Good for gold.

- Global central banks are dumping unloved and untrusted USTs and stacking gold at undeniably important levels—hence: Good for gold.

- After generations of importing US inflation and being the dog wagged by the tail of the USD, the BRICS+ nations, prompted by a weaponized Greenback, are now turning their tails slowly but surely away from the USD dog—hence: Good for gold.

- The Gulf Cooperation Council oil powers, once seduced (circa 1973) into a Petrodollar arrangement by a high-yielding UST and globally revered USD, are now openly selling oil outside of the 2024 version of that far less-yielding UST and far less-trusted USD—hence: Good for gold.

- That legalized price-fixing sham otherwise known as the COMEX employed in 1974 to keep a permanent boot to the neck of the gold price, is running out of the physical gold needed to, well…price fix gold—hence: Good for gold.

In short, each of these themes–from sovereign (and unprecedented) debt levels, historical debt lessons, the secrets of the rate markets, global central banks dumping USTs or the implications of changing oil markets to the OTC derivatives scam masquerading as capitalism–all DO explain why gold is rising now.

This list, of course, may be simple, but the forces, indicators, lingo, math and trends within each theme can be admittedly complex, as each theme is in fact worthy of its own text book rather than bullet point.

Indeed, currencies, markets, history, bonds, geopolitics, energy moves and derivative desks are complicated little creatures.

But despite all this complexity, study and deliberation, if you really want to address the question of “why is gold rising now?”—the answer is almost too simple for those of us who wish to appear, well… “complex.”

The Too-Simple Answer to the Big Question

In other words, the simple answer—the answer that cuts through all the fog, lingo and math of “sophisticated” financial markets–boils down to this:

GOLD IS NOT RISING AT ALL. THE USD IS JUST GETTING WEAKER AND WEAKER.

At VON GREYERZ, we never measure gold’s value in dollars, yen, euros or any other fiat currency. We measure gold in ounces and grams.

Why?

Because history and math (as well as all the current and insane financial, geopolitical, and social events staring us straight in the eyes today) teach us not to trust a currency backed by man (or the “full faith in trust” of the UST or a Fed’s mouse-clicked currency), but instead to seek value in monetary metals created by nature.

Fake Money & Empty Promises

Once a currency loses a gold backing (nod to Nixon), it is nothing more than the empty promise of a government now free to print and spend without a chaperone to buy votes, market bubbles and even a Nobel Prize (i.e., what Hemingway called “temporary prosperity”) but then hand the bill and inflation to future generations (what Hemingway then called “permanent ruin”).

Gold Does Nothing

So yes, gold, as Buffet and others have quipped, “does nothing.” It just sits there and stares at you.

But while this yield-less pet rock sits there “doing nothing,” the currency by which you measure your wealth is in fact quite busy melting like an ice cube–one day, month and year at a time.

Here’s to Doing Nothing: Price vs. Value

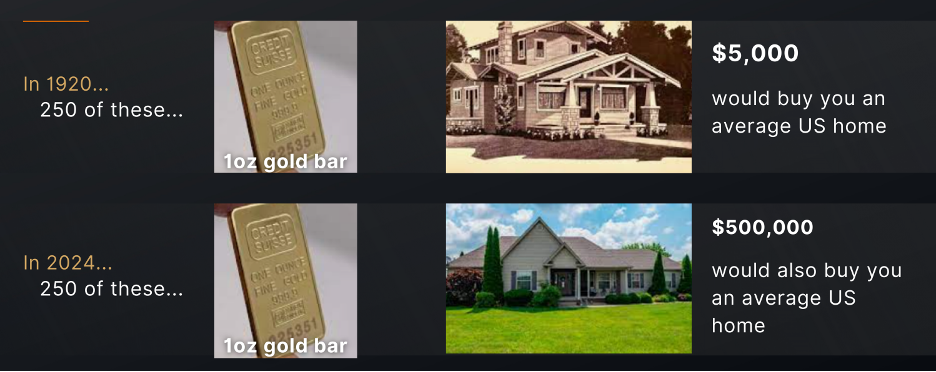

Sometimes a picture can say a thousand words and make the most complex economic topics or themes, like “price vs. value” or “store of value,” make immediate sense.

Think, for example, about a 1-ounce bar of gold just doing nothing in say… 1920.

Well, if you had 250 of those do-nothing ounces in a shoe box in 1920, which was “priced” then at around $20 USD per ounce, you could afford the average US home, then priced at $5000.

Today, however, the average price of a US home is $500,000.

So, if your grandfather left you a shoebox with 5000 crumpled Dollars inside, it would not even pay for the landscaping needed for that same house today.

But if your grandfather had instead handed you a shoebox with those same 250 singe-ounce bars of gold (today “priced” at 2300/ounce), you could buy the same average home and the landscaper too—with a nice tip for the latter.

So, do you still think those little gold bars just stared back at you, doing nothing?

After all, the shoe box with the 5000 USDs inside was very busy doing one thing very well, namely: Losing its value like snow melting off a spring mountainside…

So, which shoebox would you want to measure your wealth?

The one measured in fiat dollars actively losing value? Or the one measured in gold ounces “doing nothing” but retaining its value?

Sometimes the complex really is that simple.

The Next Big Question: Where’s Gold Headed Tomorrow?

The pathway to answering such a question is just as clear as the one we just traveled.

The aforementioned “Malignant Seven” are each factors which we believe will continue to push the USD down and hence gold higher, because, and to repeat: It’s not that gold will get stronger, it’s just that all fiat currencies in general, and the weaponized, distrusted and over-indebted USD in particular, get weaker.

But for those still understandably and realistically convinced that despite its myriad and almost endless flaws, the US (and its Dollar) is still, for now at least, the best horse in the glue factory, a case can be made that measured relative to other currencies (i.e., the DXY), that the USD is supreme, and that when and as financial markets weaken, investors will flock to it like a lifeboat in a tempest.

Milkshake Theory?

Such a credible view is held by very smart folks like Brent Johnson, with whom I have discussed the USD at length.

Brent’s “milkshake theory” intelligently argues that powerful demand forces from the euro dollar, SWIFT and derivative markets, for example, create a massive, “straw-like” sucking sound for the “milky” USD, which demand will keep it strong, and send it stronger, in the seasons ahead.

He may in fact be right.

But I think differently.

Why?

Two primary reasons stick out.

No “Straw” for the UST

First, despite the undeniably powerful demand forces at play for the USD, demand for USTs is, and has been, tanking around the world since 2014. That is, foreigners don’t trust the US IOUs as much as they did before America became a debt trap.

Ever since foreign (central bank) interest in USTs began net-selling in 2014, and gold interest began net-buying in 2010, the only buyer of last resort for US public debt has been the US Fed, and the only tool the US Fed has to purchase that debt is a mouse-clicker (“money printer”) at the Eccles Building.

Unfortunately, creating money out of thin air is not a sustainable policy but a near-term fantasy. More importantly, such a policy is inherently, and by definition: Inflationary.

My US Realpolitik Theory…

The second, and perhaps more important reason the USD’s declining future is fairly easy to see (or argue), is this:

EVEN UNCLE SAM WANTS AND NEEDS A WEAKER DOLLAR.

Why?

Because the only way out of the biggest debt hole the US has ever seen is to inflate its way out of it by debasing the currency to “save” an otherwise rotten system.

We’ve argued this for years, and the facts supporting this historically-repeated pattern (and view) haven’t changed; they’ve just grown worse.

That is why it was easy to foresee that inflation would not be “transitory” despite all the useless commentary (and Fed-speak) arguing to the contrary.

That is also why it was easy to see that Powell’s “war on inflation” was a political ruse—an optics play.

Powell’s real aim was (and remains) inflationary via negative real rates (i.e., inflation higher than 10Y bond yields).

Thus, even while pursuing his “higher-for-longer” and anti-inflationary rate hikes, actual inflation, which Powell needed, was still ripping.

But he (and the BLS) was able get around this embarrassing CPI reality by simply lying about the actual inflation…

In other words: Classic DC fork-tonguing…

China is Not Turning Japanese

But in case you still need further proof that the US wants and needs a weaker USD to fake its way out of their self-created debt disaster via an increasingly diluted USD at YOUR expense, just consider what’s happening with China.

Unbeknownst to many, Yellen has been scurrying off to Asia to convince, cajole or even threaten China into accepting a weaker USD vs the CNY.

Why?

Because the prior, “stronger” 40-year version of the Dollar has rendered expensive US exports (and trade deficits) unable to compete with cheaper Chinese goods.

This floating currency game was a trick the US played on Japan when I was a kid—i.e., weaken the USD to fight the then-rising Sun of Japan’s then rising power.

But China ain’t Japan. It won’t float its currency in dollar terms.

So, what then can the US do to weaken the USD without upsetting China?

Does DC Finally Want Higher Gold Prices?

Well, as Luke Gromen once again makes beautifully clear, the easiest path forward for all parties concerned is to simply (and finally) let gold go much, much higher.

The surest and steadiest path to a weaker USD is higher gold.

Yellen’s Treasury Department could use its Exchange Stabilization Fund to buy/sell gold and other financial securities to control the USD without having to rely so much on the Fed’s now embarrassing money printer.

Gold is now a critical pivot point and tool for the US. If gold went, for example, to $4000 while CNY gold sits at 16,000, China’s central bank would have to re-rate higher in Dollar terms, pushing the CNY higher.

But such an arrangement won’t upset China, as it holds a lot more gold than the World Gold Council reports.

Rather than float the CNY in Dollar terms, China could instead float its CNY in GOLD terms.

In short: A veritable win-win for the China and the US, with gold now leading the way.

Or stated otherwise, you know it’s gonna be a gold tailwind, when both China and DC are seeking higher gold.

Based on the foregoing, do you still think gold does nothing?

Think harder.

Power Shifts, Gold’s Resurgence and the Signals Family Offices Should Heed

The best way to own precious metals is outside of the banking system. Because ETF vehicles used for precious metal ownership are integrally tied to this system, they too are another all-too-common, yet clearly inferior approach, to informed precious metal ownership.

For many investors, gold and other metal ETFs are the most convenient instruments for a theoretically simple, immediate and liquid avenue to precious metal ownership. Upon closer examination, however, such instruments, including those vehicles promising direct ownership in physical gold, are ultimately just an investment in a paper promise rather than actual gold and assured delivery. In the end, the paper holder has no security in the physical gold.

Total global investment into gold ETFs and gold funds can vacillate wildly based upon the prevailing trends in gold price. In 2020, for example, gold ETFs saw record inflows into what became a $316 billion market representing 4,878 tonnes. Within one year, however, as gold experienced temporary headwinds from a record-high USD, that same industry fell to $191B and 3548 tonnes.

If we compare even the record-high ETF levels above to that of the S&P 500’s total market cap of $27 trillion, one quickly sees how relatively small, if not insignificant, this ETF gold market truly is. The top 5 companies in the S&P index, for example, are worth $6 trillion. Apple, with a nearly $200 billion cash pile and some stock, could easily acquire all the gold funds and ETFs. During equity bull markets, one can easily see how small the gold ETF universe truly is. Looking ahead, however, as stock markets race into bear territory and a mean-reverting implosion, the subsequent surge in gold and, hence, the relative sizes of stocks versus gold will look very different.

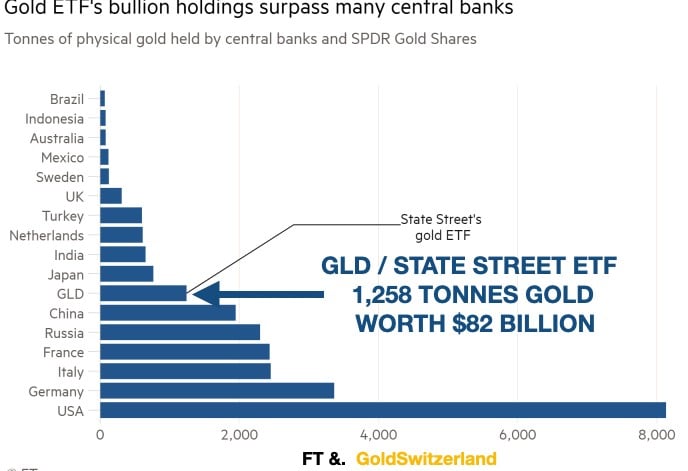

Despite such shifting flows and market caps, the simple fact remains that gold and other precious metal ETFs are instruments of speculation and not vehicles for serious and informed gold investors. To illustrate why, let us consider the most popular gold ETF in the current landscape, namely GLD.

The State Street GLD ETF—An Investment in Paper Gold

The largest gold ETF is GLD or State Street. At its height, GLD held a total 1,258 tonnes (under 900 tonnes as of this writing) with a value of $82 billion. This made GLD the 7th largest holder of gold in the world.

This ETF is the primary vehicle that investors use when they want exposure to gold. What most investors don’t understand, however, is that to own a gold ETF like GLD is effectively no better than having a futures contract in gold.

Why?

Because GLD, like other gold ETFs, is a tracking vehicle and doesn’t fully own the gold listed under its holdings column. The gold is not bought outright by GLD but is instead borrowed. The holder of a GLD share, therefore, has no claim on the borrowed gold and, hence, does not own anything tangible. Instead, the ETF participant holds a piece of paper with no underlying security in the form of physical gold in the event of ETF insolvency.

The ETF’s gold is borrowed or leased from a central bank and not bought with a clear title. Of course, such a paper claim on gold is very different from owning genuine physical gold in the manner recommended/described above. In fact, the gold price could surge, but the ETF could still go bankrupt.

When an investor in an ETF like GLD buys gold, the gold doesn’t come from the Swiss refiners. Instead, it travels downhill from a daisy-chain of bullion banks who borrowed the gold from a central bank. Yes, the GLD ETF has an official audit with bar lists and numbers. But since central banks never publish a full physical audit, there is no way of ever knowing or verifying if the same gold has been rehypothecated several times by the central bank, which we know is the case.

In sum, the ETF doesn’t own the gold outright and even the gold that it doesn’t own might have been lent multiple times by central banks.

Gold ETF’s–Extreme Counterparty Risk

One of the major advantages with owning segregated physical gold (as opposed to “ETF gold”) is that it is the only asset which is not someone else’s liability. But buying a gold ETF like GLD involves multiple counterparty risks with no ownership of the underlying metal.

For example, investors in GLD or other similar vehicles, buy shares in the fund’s trustee, in this case, the SPDR Gold Trust. The custodian of the gold is HSBC, who sources and stores the gold for the Trust. This obviously makes HSBC a major counterparty and hence risk— as any who tracks the extraordinary risks in the banking sector in general (or HSBC in particular) would and should know.

But the risks do not end there. HSBC also uses sub-custodians, other bullion banks and even the Bank of England to source and store the gold. This means that ETF investors are subject to additional and multiple levels of sub-custodian risk.

Furthermore, there are no contractual agreements between the Trustee and the sub-custodians or the custodian. This means that the ability of the trustees or the custodian to take legal action against the sub-custodians is limited. The Trustee is not insured. That is left to the custodians. Gold held in the Trust’s unallocated gold account is not segregated from the custodian’s assets. If a custodian becomes insolvent, its assets may not be adequate to satisfy the claim of the trust.

The foregoing risk factors for ETF gold “ownership” are clear and shall hopefully serve to enlighten otherwise prospective gold ETF investors toward physical rather than paper gold. ETF vehicles like GLD are far better suited as a vehicle of choice for traders and speculators rather than informed, long-term precious metal investors who recognize and understand gold’s historical and now timely role as a wealth preservation asset.

For wealth preservation investors, ETF vehicles like GLD do not satisfy any of the criteria of holding a reserve asset like gold totally risk free.

To summarize, the primary problems with buying gold through an ETF vehicle are the following:

- It is a paper security held within the financial system

- It has multiple counterparty risk

- The gold holdings are not segregated from custodians’ assets

- It owns no gold directly

- The gold is stored within the banking system

- The gold held is probably rehypothecated

- The gold is not fully insured

- Investors have no access to their gold

In short, and to repeat, holding gold through an ETF vehicle is effectively no better than holding gold futures contracts rather than actual gold. For wealth preservation purposes, gold must be held outside the banking system in the safest private vaults in the world. The gold must be controlled directly by the investor with direct access to their gold in the vault. No other party must be allowed to touch this gold without the owner’s authorization.

Final Thoughts

Despite a long history of client mismanagement (deposit freezes, illiquidity, non-transparency, counterparty risk, operational failures, “tainted” assets, bank emergencies, changing regulations etc.) and the open systemic distortions in the global financial system, traditional bullion banks remain the go-to-choice for many bullion owners and ETF vehicles for no other reason than they “trust the TBTF names.”

Naturally, this perplexes but does not surprise us. Pack-thinking, even among bank clients and ETF sponsors, is nothing new.

Should the major global banks experience another “emergency,” no one can foresee its length or depth with certainty, but what we can say with certainty is that the banks will own these bullion assets ahead of their customers—and will do their best to hold (restrict) the precious metals for as long as they can, as that… after all, is what banks do.

What will tomorrow’s banking rules be? How long will the next “emergency” last? What liquidity limits will be imposed? Will delivery be partial or full? No one can predict the next catalyst of the next banking crisis, which are the very reasons informed investors invest in gold. As veteran market experts with long personal and professional experience with global banks, we can confirm that global banking risks have never been higher than they are today.

Given these facts, why would any serious gold investor hold his/her precious metals within the very system against which their metals were acquired to protect them?

For those wishing to avoid such known and unknown risks, the clear path forward is one that leads investors away from commercial bullion banking pitfalls and toward the most transparent and trusted private vault services in the safest jurisdictions. Core assets like physical gold and silver must be given the greatest attention and protection, something which commercial banks have historically failed to deliver. The burden is, therefore, on the informed and sophisticated precious metal investor to vet and engage the world’s premier vaulting facilities in the safest, wealth-friendly and politically stable jurisdictions.

Power Shifts, Gold’s Resurgence and the Signals Family Offices Should Heed

For informed investors who have successfully traversed the tired Bitcoin vs. Gold debate and recognized the critical importance of owning physical (as opposed to paper/ETF) gold as an obvious antidote to globally debased currencies and openly systemic financial and banking risk, you have, thankfully, recognized precious metals as historically unmatched safe-haven assets. Gold storage, however, presents more questions that must be addressed by investors.

For years, we have bluntly explained why precious metal ownership is so essential to the far-sighted wealth preservation objectives of sophisticated investors, both individual and institutional. But on the wise and hence contrarian road to precious metal ownership, what good is the journey if the destination itself is unsound?

That is, does it make any sense if your safe-haven assets are then stored/held in unsafe institutions (i.e., commercial bullion banks and/or other precious metal dealers) who are themselves integral parties to the very broken system (and systemic risk) you originally set out to avoid?

Below, we therefore look at the many and all-too real (yet all-too carefully hidden) risks of storing gold within a fractured banking system, and underscore the need to select only the safest private vault options for serious gold storage and liquidity.

Bullion Storage in Big Banks—Anything but Safe

As our recent report on the Basel III regulations suggested, the world’s major commercial banks are virtue-signalling the need to avoid (or more likely, prepare for) another banking crisis.

Imagine that?

Specifically, the latest regulations require (among other things) that banks hold greater percentages of safe, “allocated” tier 1 gold (i.e., physical gold) on their balance sheets and reduce their levels of unsafe (i.e., fake) “unallocated” tier 3 paper gold.

Imagine that?

But if you think the recent regulatory lipstick on the pig of big-bank balance sheets makes such name-brand institutions safer in general (and for gold in particular), we’d humbly suggest you think again.

Decades ago, we created Matterhorn Asset Management to protect our own (and partners) wealth preservation assets, developing the safest system in the world for precious metal acquisition, handling and storage.

Only a few years later, we extended our services to outside investors. The evolution of Matterhorn came not from being gold bugs, natural pessimists nor even anti-bankers.

Instead, we were simply clear-eyed witnesses to real events in global debt, currency, risk-asset and banking markets; for this reason alone, private metal vaulting, done correctly, is not a niche opportunity, but an absolute necessity. Period.

We further understood and accepted the powers of collective thinking, even collective madness.

Toward this end, there is an understandable sense of safety in numbers as well as faith in the familiar, which includes the leading commercial banks and their highly-credentialed big brothers—from the Bank of International Settlements and the IMF to national central banks.

But it’s also worth noting that those very same banks have been disappointing and mismanaging their clients (and global financial systems) with tragic consistency for years, as the Great Financial Crisis (GFC) of 2008 is only one of so many recent reminders.

In short, for those trusting familiar banking names (rather than blunt banking facts) for storing their precious metals, we feel they are doing so at great and quantifiable risk.

Here’s why.

The Allocated vs. Unallocated Shell Game

Many well-meaning and high-ticket private bank clients will be warmly welcomed to open bullion accounts at Bank A, Bank B, C, or D, etc.

In fact, the private bankers will often sweeten the deal by charging only a “general fee,” yet foregoing any gold storage fees, because, hey, you’re such an important client, right?

Well, not really.

First, it’s important to understand that modern banks are not in the silver and gold storage business—they are in the credit and fee-churn business; they make their margins executing paper transactions.

Gold storage, however, is a lower margin business, which means hardly any big banks manage their own vaults; instead, they sub-contract out the work, smile and then lever client assets.

The reason there’s no storage fees for such “bullion accounts” is largely because there’s no actual gold or silver to store within that glossy-brochured and well-known bank account.

–The Unallocated Bullion

This is because the banks are placing your precious metals in “unallocated” paper/transactional (i.e., levered accounts), which despite Basel III, are still very much in vogue.

Within the fine-print of the offering documents to these “unallocated” bullion accounts is the buried reality that the precious metals are not in fact individually owned by the client, but by the bank first.

Stated otherwise, there are no gold bars or coins with your names assigned to them waiting for delivery when needed.

This makes the client an unsecured creditor to the bank, not a direct owner of the gold that the bank is allegedly “storing” for him/her.

Thus, should another banking crisis, bank holiday or depositor-freeze occur for any number of likely reasons/scenarios, bullion clients will be standing in line behind other bank creditors rather than taking immediate delivery of their gold and silver.

And if the bank tanks, well, they’re really out of luck, aren’t they?

If this seems unimaginable, then just imagine Morgan Stanley’s “silver program,” which had no silver precisely when clients needed it the most.

It took clients a lot of lawyers and a lot of months to finally get the very metals they “owned.”

Or imagine HSBC.

In 2008, clients suddenly asked for delivery of the metals they’d hitherto thought they’d never need, until, of course, an actual banking (i.e., liquidity) crisis reared its inevitable yet ignored head.

During the GFC of 2008, HSBC closed its retail vaults, requiring gold clients to wait months for actual delivery.

Imagine that?

–The Allocated Bullion

For those aware of such unallocated account risks, the same banks will admire your sophistication and offer a better option, namely “allocated” bullion accounts in which clients are promised specific ownership of specific physical metals.

Good stuff, right?

Well, not so fast…

Even these allocated bullion accounts are riddled with risk.

That is, the bankers will likely overlook mentioning the various 3rd-party custodial vault contracts and intermediary middleman agreements they are often tied to in the long daisy-chain between your precious metal master account documents and the final resting place of your actual gold and silver.

The ubiquitous use of such middlemen and third-party custodian/vault services in even allocated bullion accounts creates a number of problems.

First, there is the inherent counterparty and operational risks associated with the potential failure, insolvency or mismanagement of any of the intervening middlemen, custodians and sub-custodians—from outright fraud to inadequate (i.e., loophole-heavy) insurance coverage.

By the way, if 2008 taught us anything, it’s that the big banks are loaded with middlemen, counterparty and operational risks…

Secondly, the number of intervening parties between your account name and the final vault (which can change without your knowledge) means as a bank client, you cannot speak to (or access) your vault (i.e., your stored gold and silver) directly; only your bank or its contractual middleman can do so.

But what if that banker or middleman is not picking up the phone in the midst of the next banking crisis, assuming you recognize that such crises are anything but extinct?

Thirdly, even in an “allocated bullion account” wherein you are promised direct ownership of say 100 ounces of gold, your 100 ounces are likely part of (i.e., comingled with) a 400-ounce bar of which you only own a ¼ interest/claim.

How long do you think it will take to get that shared, 400-ounce bar refined to ensure your immediate delivery/liquidity of the 100 ounces you own and need?

In short, if you are concerned about unallocated and even allocated bullion accounts in a big bank near you, what better options are available?

Fair question. Here’s a fair answer.

Segregated Bullion Accounts—The Superior Option

For sophisticated (i.e., serious) precious metal investors seeking direct ownership of the highest-grade precious metal assets in specified sizes, owned entirely in their names (and with direct access to the private vaults that store their silver and gold), segregated accounts held outside of this openly fractured and highly risk-heavy banking system are the superior option.

That said, not every private and segregated bullion account service or vault is the same, and a number of critical due diligence concerns need to be addressed and confirmed.

First, most bullion banks, especially in the EU, don’t even offer segregated bullion accounts.

Again, their primary goals are high fees and high margins, for which gold storage is not compelling enough to their bottom-line.

When selecting segregated bullion accounts in private vaults, the key and primary considerations to tackle first are jurisdiction and vault reputation.

1. Jurisdiction

Precious metal owners understand that such wealth preservation assets shine brightest in times of crisis.

They also understand that in times of crisis, banks (and the governments with which they collude) will throw out the old rule books and create new rules mid-game, typically at the expense of their clients.

In times of crisis, money and metals “on deposit” at traditional banks will be at the most risk.

Even if the bank stores your bullion in their own vaults, we have seen many examples of the gold not being there when the client wanted to transfer the same to a private vault.

So far, the banks have always replaced the missing bars with other bars but in the event of bank insolvency or other “shocks,” that would obviously not happen, meaning delivery, at best, would be blocked for months, and at worst, totally lost.

Thus, when selecting a jurisdiction for private gold vaulting outside the banking system, one must select a jurisdiction with the best available laws and historical reputation for investor protection, foreign or domestic.

Given that many precious metal realists hope for the best yet prepare for the worst, they further recognize the admittedly real possibility of confiscation risk in the otherwise unwanted yet real event of a shock to the global monetary system.

In the event of such confiscation, be it physical or via tax methods, holding actual precious metals outside of government-controlled banking systems provides added time and protection to segregated bullion account holders.

Toward this end, client privacy is an equally important component of the jurisdictional choice.

In superior bullion jurisdictions like Switzerland, for example, physical gold storage in Swiss-owned vaults represented by Swiss-originated wealth managers is not considered a “financial account” subject to tax reporting under IRS rules or the Common Reporting Standards of the OECD.

In short, client privacy is fully and legally preserved in such a jurisdiction.

Such privacy, however, must not be confused as an open-door to (or assistance for) nefarious clientele.

The most credible offshore vault management services strictly adhere to all necessary compliance laws, namely: KYC (Know Your Client), AML (Anti Money Laundering) and full source-of-funds declarations.

In this way, private clients can be confident that their precious metals are held in fully compliant (i.e., “clean company”) vaults.

Finally, in times of equally unwanted but equally possible social chaos, one needs a vault jurisdiction which provides reliable access to a major international airport, as well as, ideally, similar access to a private air strip.

2. Private Vault & Service Reputation

As to private vaulting services, no two are alike and informed investors must carefully consider the following factors.

– Security

Once jurisdiction is determined, it’s equally critical to select a private vault service which has the most reputable gold storage history as well as military-grade security systems, addressing everything from fully safe-guarded (backed-up) client data, direct 24/7 metals access and IT protocols against malware to protection against natural disasters or even EMP threats.

Investors, moreover, should ascertain that the private vaults and service providers are storing actual metals as opposed to mere “contracts on demand” for the same.

– Focus and Ownership Structure

Unlike banks, the most reputable client managers for segregated private, vaulted gold storage are exclusively engaged in that service, and that service only.

In fact, such singular yet professional focus on private vaulting for gold storage and other specified client assets was once the sole domain of the classic banking services of the past, before modern banking became distorted by leverage, derivative desks, fractional reserve banking and other such high-risk, high-profit and high-consequence behavior.

In selecting segregated, private bullion services, investors should also confirm that the wealth advisory service is fully-owned and independent, as opposed to being a subsidiary of some larger, and potentially compromised entity.

Again, the entire aim of segregated bullion ownership is to avoid the very counterparty and operational risks otherwise attendant to commercial bank bullion accounts.

– Liquidity Options

For larger accounts, you will also wish to work with private bullion storage providers who offer instant liquidity options for two-way transfers in all major currencies in the event you choose to liquify all or a portion of your metal assets into actual currencies when and if needed.

-Enterprise Solvency

When selecting the best private bullion vaulting services, it is equally necessary to consider the same insolvency risks which prompted similar concerns for avoiding the traditional banks.

That is, what if the private service itself becomes insolvent?

Toward that end, it is critical to first understand and confirm the service’s own, and hopefully robust, balance sheet. Ask and you shall (or should) receive.

Additionally, any onboarding documentation must be explicit that all segregated bullion is held in the client’s name, not the service provider; thus, even in an event of facility insolvency, this would in no way impair the client’s vault access, given that the precious metals are always stored as the client’s asset, not the service provider’s.

-Fully Insured or Just “Insured”?

Fully insured bullion is the only bullion worth holding in private vaults, but look carefully at the fine print. Is the bullion insured against mysterious disappearance? Are you, the client, added as a loss-payee, which means are you (or just the vault or client representative) the ultimate insured party?

What are the coverage exclusions? The coverage maximums? Who are the underwriters? Lloyd’s or someone you’ve never heard of? Is the transporting of the metals to or from your vault fully insured as well, and if so, by whom and how much?

-Metal Quality

Traditional bullion banks may seem like the safest source of authenticated precious metals with clean chains of integrity, but counterfeit gold is an issue that even JP Morgan, for example, is all too familiar…

Sophisticated bullion investors should work only with private vaults and services that acquire client precious metals directly from the most reputed sources and refiners; greater than 70% of all gold bars worldwide are in fact refined out of Switzerland.

Not only must such metals be marked, recorded and warehouse-receipted in the client’s name from inception, but acquired in the bar size selected by the client.

-Transport

Secure delivery of client precious metals is an integral component of any credible private vaulting service, and the premier services will engage only the most reputable and fully-insured carriers (i.e., Brinks, Loomis etc.).

Regardless of one’s domicile nation, your private vault service should also possess the full logistical sophistication to arrange pick-up and delivery (as well as all cross-border protocols covering any applicable duties or Value Added Tax) of your metals to any location in the world upon immediate request.

–Bullion Storage Fees

For the manifold reasons discussed above, superior private vaulting of segregated bullion is typically priced higher than the fees of traditional bullion banks.

Each private bullion service will charge based on the extent of its services (vault quality, logistical sophistication, transportation services, liquidity capabilities, insurance range, refiner relationships, etc.).

Although it’s often true that “you get what you pay for,” the slightly higher fees for higher security and superior service can only be justified if the foregoing service advantages are verified.

Superior vaulting and security are costly; anyone charging nominal fees is either skimping on these two critical areas or subsidising the cost from trading activities rather than gold storage.

Given the immense importance of wealth preservation via carefully owned precious metals, higher fees more than justify the higher service and security of the premier vaulting services.

A Summing Up

Despite a long and sordid history of client mismanagement (deposit freezes, illiquidity, non-transparency, counterparty risk, operational failures, “tainted” assets, bank emergencies, changing regulations etc.) and the open systemic distortions in the global financial system, traditional bullion banks remain the go-to choice for many bullion owners for no other reason than they “trust the TBTF names.”

Naturally, this perplexes but does not surprise us. Pack-thinking, even among bank clients, is nothing new.

Should the major global banks experience another “emergency,” no one can foresee its length or depth with certainty, but what we can say with certainty is that the banks will own these bullion assets ahead of their customers—and will do their best to hold (restrict) them as long as they can, as that… after all, is what banks do.

What will tomorrow’s banking rules be? How long will the next “emergency” last? What liquidity limits will be imposed? Will delivery be partial or full?

For those wishing to avoid such known and unknown risks, the clear path forward is one that leads investors away from commercial bullion banking pitfalls and toward the most transparent and trusted private vault services in the safest jurisdictions.