Search results

Falling Gold Prices Explained Before They Surge North

In this latest MAMChat, Egon von Greyerz and Matthew Piepenburg discuss recent price moves in gold and the likely trends. Long-term preservation investing (rather than short-term price emotion) has ne...

Egon von Greyerz / July 7, 2022

Watch Now

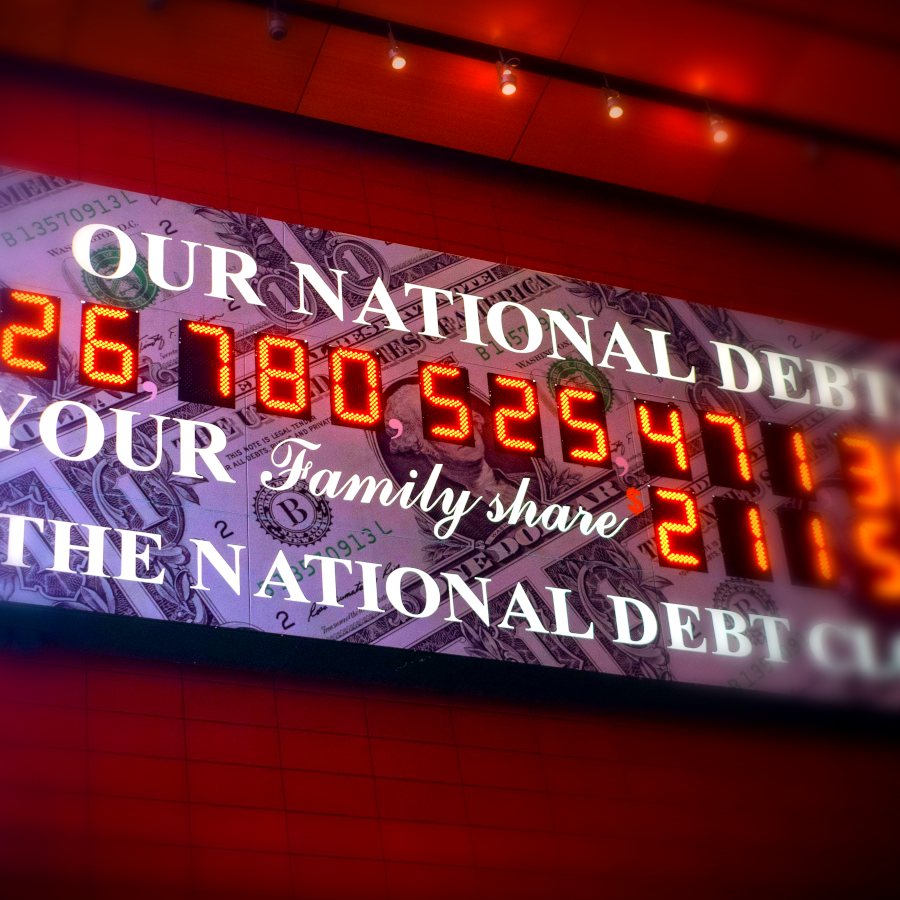

The U.S., Just Another Inflation – Seeking Banana Republic

Whether we wish to admit it or not, the so-called “Developed Economies” in the U.S., Europe and Japan are really nothing more than debt-broke economies, veritable banana republics. This means their e...

Matthew Piepenburg / July 6, 2022

Read More

THIS IMPLOSION WILL BE FAST – HOLD ONTO YOUR SEATS

The massive money creation in the 2000s has led to a debt and asset bubble, which is about to burst. Investors will be shocked by the speed of the decline and won’t react before it is too late.

Egon von Greyerz / July 2, 2022

Read More

VON GREYERZ: INTEREST RATES ABOVE 10%?

Inflation is the big issue. In the USA, the FED is raising key interest rates by 0.75%, but it is largely helpless. It is likely that interest rates will rise as sharply as they did in the UK in the 1...

Egon von Greyerz / July 1, 2022

Watch Now

The 2022 Market Disaster—More Pain to Come

We are no longer warning of a pending convergence of crises. We are now well into a market disaster within the worst macro-economic setting (compliments of cornered “central planners”) that I have eve...

Matthew Piepenburg / June 27, 2022

Read More

CONCURRENT DEFLATION AND HYPERINFLATION WILL RAVAGE THE WORLD

With most asset classes are falling rapidly, the world is now approaching calamities of a proportion not seen before in history. At the same time as bubble assets deflate, prices of goods and servic...

Egon von Greyerz / June 23, 2022

Read More

Piepenburg: Backfiring Sanctions, Tanking Cryptos and Loyal Gold

In this brief interview with Michael McCrae of Kitco Mining, Matterhorn Asset Management principal, Matthew Piepenburg, addresses the interacting ramifications and core themes of the 2022 market econo...

Egon von Greyerz / June 14, 2022

Watch Now

Fatal Macro Warnings: We’re Gonna Need a Bigger Boat

The 2008 crisis (bubble) was limited to real estate; today, we are in an everything bubble, from meme stocks, inflated bonds and over-priced housing to bloated art, over-paid celebrity chefs and pricy...

Matthew Piepenburg / June 7, 2022

Read More

Politisiertes Geld und der Tod des Kapitalismus

Es ist weder ein Geheimnis noch eine große Überraschung, dass unser persönliches Vertrauen in Fiat-Geld (allgemein) und (speziell) Zentralbanker, die dieses Geld entwertet und den Tod des Kapitalismus...

Matthew Piepenburg / June 7, 2022

Read More

IS GOLD HOBSON’S CHOICE?

All you need to do is to follow Hobson's simple rule for selecting a horse when you choose your investment in these very precarious times. This means you have a choice of one, which obviously is GOLD

Egon von Greyerz / June 1, 2022

Read More

The Handbook for Debt-Soaked Nations: Lie, Print, Inflate & Finger-Point

As we have warned from the very onset of this otherwise avoidable war in Ukraine, the backfiring of Western sanctions against Putin (de-dollarization, inflationary tailwinds and increasingly discredit...

Matthew Piepenburg / May 24, 2022

Read More

GOLD AS CHEAP TODAY AS IN 1971 AT $35

As the world economy goes towards an inflationary depression, exacerbated not only by epic debts and deficits but now also by war, the significance of gold takes on a whole different dimension.

Egon von Greyerz / May 17, 2022

Read More