THIS IMPLOSION WILL BE FAST – HOLD ONTO YOUR SEATS

The massive money creation in the 2000s has led to a debt and asset bubble, which is about to burst. Investors will be shocked by the speed of the decline and won’t react before it is too late.

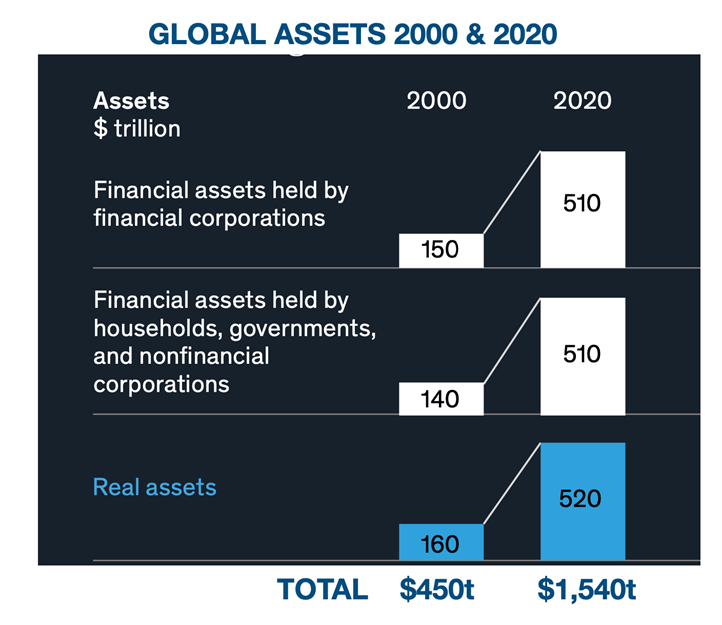

The massive money creation by central and commercial banks in this century has resulted in a growth of global assets from $450 trillion in 2000 to $1,540 trillion in 2020.

DEBT TO GDP GROWTH

As the chart below shows US debt to GDP held well below 25% from 1790 to the 1930s, a period of almost 150 years. The depression with the New Deal followed by WWII pushed debt to GDP up to 125%. Then after the war, the debt came down to around 30% in the early 1970s.

The closing of the gold window in 1971 ended all fiscal and monetary discipline. Since then, the US and much of the Western world has seen debt to GDP surge to well over 100%. In the US, Public Debt to GDP is now 125%. Back in 2000 it was only 54% but since then we have seen a vote buying system with a money printing bonanza and an exponential increase in debt to 125%.

A major part of the debt increase has gone to finance the rapid growth in property values.

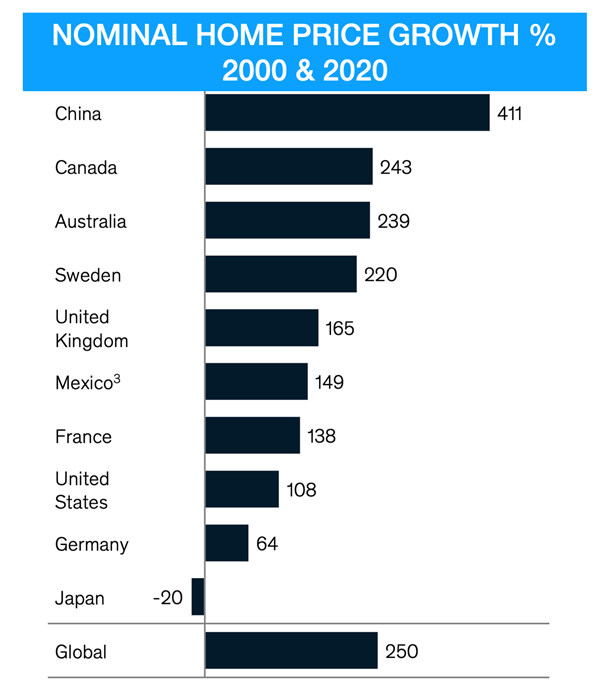

The table below shows that property has grown on average by 250% between 2000 and 2020. So individuals are creating wealth by swapping properties with each other. Hardly a sustainable form of wealth creation.

The exponential growth in property prices has been global although countries like China, Canada, Australia and Sweden stand out with over 200% gains since 2000. Most of the properties bought in the last 20+ years involve massive leverage. When the property bubble soon bursts, many property owners will have negative equity and could easily lose their homes.

So both private and government debt is continuing to grow rapidly. But nobody should believe that it will stop here. The Fed’s intention to reduce the balance sheet is not working and the debt is at best going sideways currently.

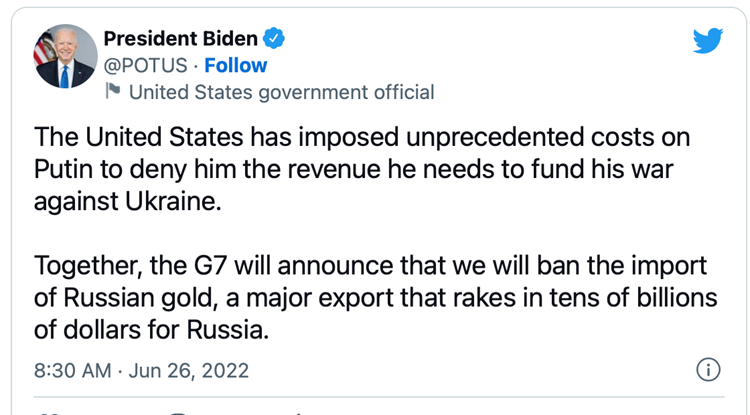

BIDEN BANS RUSSIAN GOLD

So it is happening again. The US has decided to ban imports of Russian gold and told the whole G7 to follow suit. President Biden sent the following Tweet last week:

So what will the consequences be?

Russia is the second biggest gold producer in the world after China. Just like with oil, gas and many other commodities, the effect will be higher gold prices over time. The gold trade is international and the major buyers of gold are China and India. So Russia can continue to sell gold to the Far East, the middle East and South America.

Also, when the EU sanctions started, the LBMA (London Bullion Market Association) decided not to accept gold that had been refined in Russia.

So the effect of the G7 ban will be minimal since gold deliveries from Russian refiners to the bullion banks already stopped in early March.

SANCTIONS ARE COUNTER PRODUCTIVE

Biden also signed an executive order on 15 March this year, prohibiting US persons to be involved with gold trading with Russian parties.

Still, more sanctions by the US and Europe will over time create shortages in gold just as it has in other commodities. So Russia will be able to sell its commodities including gold to other markets at higher prices.

But since Russia by far has the greatest commodity reserves in the world at $75 trillion, the value of these reserves are going to appreciate for years as we are now at the beginning of a major bull market in commodities.

The US and EU sanctions of Russia affect around 15% of the world population so there are still plenty of markets where Russia can trade.

The Roman Empire controlled parts of Europe, North Africa and the Middle East. The Empire prospered primarily due to free trade within the whole area with no sanctions. Sanctions hurt all parties involved. And since Russia is such a major commodity country that can continue to trade with major nations, they will over time suffer less than the sanctioning countries.

The consequences of these sanctions especially for Europe where many countries are dependent on Russian oil and gas will be totally devastating. So the US and Europe have really shot themselves in the foot.

GOLD, THE US DOLLAR & STOCK MARKETS

Coming back to gold, the US and G7 move is more likely to have a beneficial effect on gold over time with demand increasing and supply being restricted.

Gold started an uptrend in year 2001 that lasted for 10 years to 2011 when gold reached $1,920. After a major correction for 3 years until 2016, to $1,060, gold has resumed its exponential uptrend as can be seen in the chart below.

Although gold has not yet made sustained new highs in dollars, we have seen much higher highs in gold against most currencies. The temporarily strong dollar is making gold look weak measured in the US currency but that is unlikely to last for long.

MAJOR GOLD MOVE COMING

As the chart below shows, gold is finishing a Cup and Handle technical pattern. It does allow for a slightly lower price before the next move up although that is not certain. Regardless, the major trend for gold is substantial and I expect a sustained move up to at least 2026 but probably for much longer. Obviously there will be major corrections on the way.

DOLLAR FALL NEXT

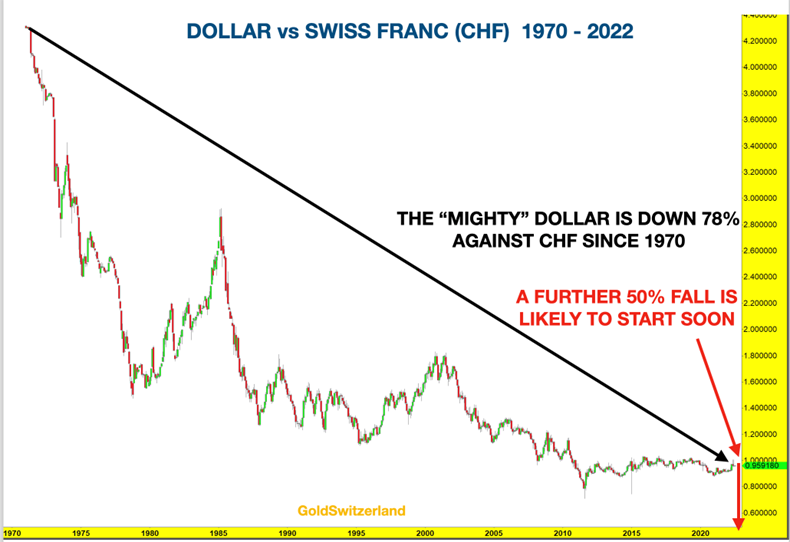

If we look at the chart of the dollar against the Swiss franc since 1970, we can see that the 78% fall so far has gone sideways for 10 years.

The next move down is likely to be another 50% to 0.45-0.50 at least.

So the feeble and temporary dollar correction up is likely to end soon with a strong down move next.

MAJOR STOCK MARKET FALL AHEAD

Stocks globally are down around 20% this year.

The next move down in stocks could happen within the next few weeks. This is likely to be a shocking move which will paralyse investors as they won’t have time to react.

So we could see stocks and dollar strongly down at the same time with the metals up. Even if gold and silver comes down initially, that move will not last. The uptrend in the metals is soon about to resume.

Wealth preservation

Our company made substantial purchases of physical gold at the beginning of 2002 for our investors and ourselves. The price was then $300. We have never sold an ounce since then but added at opportune moments.

There was, as the gold chart above shows, a major move until 2011 and then a vicious 3 year correction to $1,060 before the bull trend resumed. As I mentioned above, gold has made much higher highs above the 2011-12 highs in Euros, Pounds,Yen, Swedish kronor, Australian dollars etc.

US dollar highs are just around the corner.

As we bought gold for wealth preservation purposes, it was essential that it was physical with direct ownership and control for the investor. To be able to inspect your own gold is also a requirement.

It is also imperative to store the gold outside an increasingly fragile financial system. If you buy gold as insurance against such an over-leveraged and weak system, it obviously serves no purpose to store it within that system.

To store your insurance asset in a safe jurisdiction is clearly critical. Especially with the current geopolitical unrest it is essential to take advice on location. Also important is to be able to move the gold quickly if necessary.

The reputation and values of the company that assists you with your gold investments must be impeccable.

It serves no purpose to make your choice based on the lowest cost of storage, insurance and handling when you are protecting one of your most important assets.

BE CAREFUL

So there are likely to be major moves in markets next.

No one can of course time these moves exactly. But what is critical to understand is that risk is now extremely high and investors are not going to be saved by central banks.

And remember that fire insurance can only be bought before the fire starts!

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD