The 2022 Market Disaster—More Pain to Come

If you think the current market disaster hurts; it’s gonna get worse despite recent dead cat bounces in U.S. equities.

The Big 4: Dead Bonds, Rising Yields, Tanking Stocks & Stagflation

For well over a year before fantasy-pushers and politicized, central-bank mouth pieces like Powell and Yellen were preaching “transitory inflation,” or hinting that “we may never see another financial crisis in our lifetime,” we’ve been patiently and bluntly (rather than “gloomily”) warning investors of the “Big Four.”

That is, we saw an: 1) inevitable liquidity crisis which would take our 2) zombie bond markets to the floor, yields (and hence interest rates) to new highs and 3) debt-soaked nations and markets tanking dangerously south into 4) the dark days of stagflation.

In short, by calmly tracking empirical data and cyclical debt patterns, one does not have to be a market timer, tarot-reader or broken watch of “doom and gloom” to warn of an unavoidable credit, equity, inflation and currency crisis, all of which lead to levels of increasing political and social crisis and ultimately extreme control from the top down.

Such are the currents of history and the tides/fates of broke(n) regimes.

And that is precisely where we are today—no longer warning of a pending convergence of crises, but already well into a market disaster within the worst macro-economic setting (compliments of cornered “central planners”) that I have ever experienced in my post-dot.com career.

But sadly, and I do mean sadly, the worst is yet to come.

As always, facts rather than sensationalism confirm such hard conclusions, and hence we turn now to some equally hard facts behind this market disaster.

The Ignored Hangover

For well over a decade, the post-2008 central bankers of the world have been selling the intoxicating elixir (i.e., lie) that a debt crisis can be solved with more debt, which is then paid for with mouse-click money.

Investors drank this elixir with abandon as markets ripped to unprecedented highs on an inflationary wave of money printed out of thin air by a central bank near you.

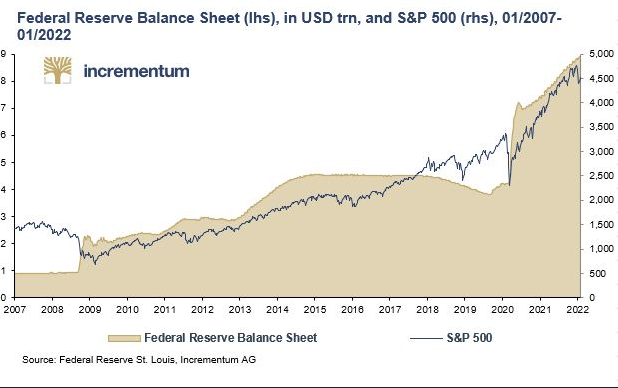

In case you still don’t know what such “correlation” looks like, see below:

But as we’ve warned in interview after interview and report after report, the only thing mouse-click money does is make markets drunker rather than immune from a fatal hangover and market disaster.

For years, such free money from the global central banks ($35T and counting) has merely postponed rather than outlawed the hangover, but as we are seeing below, the hangover, and puking, has already begun in a stock, credit or currency market disaster near you.

Why?

Every Market Crisis is a Liquidity Crisis

Because the money (i.e., “liquidity”) that makes this drunken fantasy go round is drying up (or “tightening”) as the debt levels are piling up.

That is, years and years of issuing IOU’s (i.e., sovereign bonds) has made those IOU’s less attractive, and the solution-myth of creating money out of thin air to pay for those IOUs is becoming less believable as inflation rises like a killer shark from beneath the feet of our money printers.

The Most Important Bond in the World Has Lost Its Shine

As we’ve warned, the UST is experiencing a liquidity problem.

Demand for Uncle Sam’s bar tab (IOU’s) is tanking month, after month, after month.

As a result, the price of those bonds is falling and hence their yields (and our interest rates) are rising, creating massive levels of pain in an already debt-saturated world where rising rates kill drunken credit parties (i.e., markets).

Toward this end, Wall Street is seeing a dangerous rise in what the fancy lads call “omit days,” which basically means days wherein inter-dealer liquidity for UST’s is simply not available.

Such omit days are screaming signs of “uh-oh” which go un-noticed by 99.99% of the consensus-think financial advisors selling traditional stocks and bonds for a fee.

As the repo warnings (as well as our written warnings) have made clear since September of 2019, when liquidity in the credit markets tightens, the entire risk asset bubble (stocks, bonds and property) starts to cough, wheeze and then choke to death.

Unfortunately, the extraordinary levels of global debt in general, and US public debt in particular, means there’s simply no way to avoid more choking to come

The Fed—Tightening into a Debt Crisis?

As all debt-soaked nations or regimes since the days of ancient Rome remind us , once debt levels exceed income levels by 100% or more, the only option left is to “inflate away” that debt by debasing (i.e., expanding/diluting) the currency—which is the very definition of inflation.

And that inflation is only just beginning…

Despite pretending to “control,” “allow” and then “combat” inflation, truth-challenged central bankers like Powell, Kuroda and Lagarde have therefore been actively seeking to create inflation and hence reduce their debt to GDP ratios below the fatal triple digit level.

Unfortunately for the central bankers in general and Powell in particular, this ploy has not worked, as the US public debt to GDP ratio continues to stare down the 120% barrel and the Fed now blindly follows a doomed policy of tightening into a debt crisis.

This can only mean higher costs of debt, which can only mean our already debt-soaked bond and stock markets have much further to go/tank.

Open & Obvious (i.e., Deadly) Bond Dysfunction

In sum, what we are seeing from DC to Brussels, Tokyo and beyond is now an open and obvious (rather than pending, theoretical or warned) bond dysfunction thanks to years of artificial bond “accommodation” (i.e., central-bank bond buying with mouse-click currencies).

As we recently warned, signals from that toxic waste dump (i.e., market sector) known as MBS (“Mortgage-Backed Securities”) provide more objective signs of this bond dysfunction (market disaster) playing out in real-time.

Earlier this month, as the CPI inflation scale went further (and predictably) up rather down, the MBS market went “no bid,” which just means no one wanted to buy those baskets of unloved bonds.

This lack of demand merely sends the yields (and hence rates) for all mortgages higher.

On June 10, the rates for 30-year fixed mortgages in the U.S. went from 5.5% to 6% overnight, signaling one of the many symptoms of a dying property bull as U.S. housing starts reached 13-month lows and building permits across the nation fell like dominoes.

Meanwhile, other warnings in the commercial bond market, from Investment Grade to Junk Bonds, serve as just more symptoms of a dysfunctional “no-income” (as opposed to “fixed income”) U.S. bond market.

And in case you haven’t noticed, the CDS (i.e., “insurance”) market for junk bonds is rising and rising.

Of course, central bankers like Powell will blame the inevitable death of this U.S. credit bubble on inflation caused by Putin alone rather than decades of central bank drunk driving and inflationary broad money supply expansion.

Pointing Fingers Rather than Looking in the Mirror

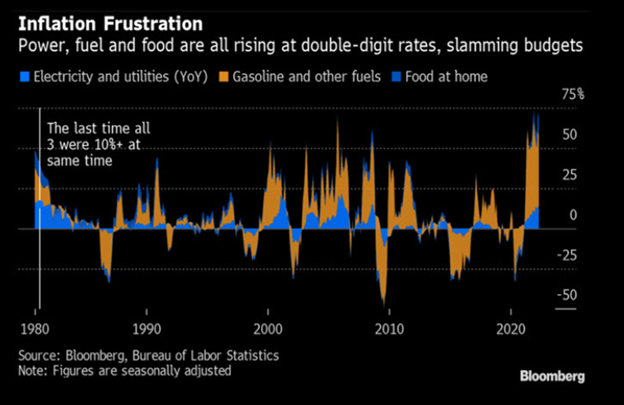

Powell is already confessing that a soft landing from the current inflation crisis is now “out of his hands” as energy prices skyrocket thanks to Putin.

There’s no denying the “Putin effect” on energy prices, but what’s astounding is that Powell, and other central bankers have forgotten to mention how fragile (i.e., bloated) Western financial systems became under his/their watch.

Decades of cramming rates to the floor and printing trillions from thin air has made the U.S. in particular, and the West in general, hyper-fragile; that is: Too weak to withstand pushback from less indebted bullies like Putin.

But as we warned almost from day 1 of the February sanctions against Russia, they were bound to back-fire big time and accelerate an unraveling inflationary disaster in the West.

The West & Japan: Overplaying the Sanction Hand

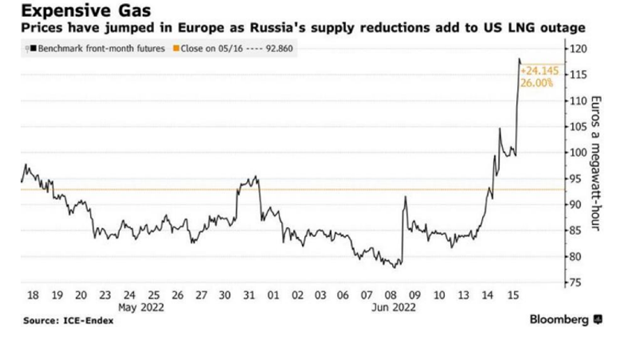

As we warned in February, Russia is squeezing the sanction-makers with greater pain than history-and-math-ignorant “statesmen” like Kamala Harris could ever grasp.

From here in Europe, Western politicians are beginning to wonder if following the U.S. lead (coercion?) in chest-puffing was a wise idea, as gas prices on the continent skyrocket.

In this backdrop of rising energy costs, Germany, whose PPI is already at 30%, has to be asking itself if it can afford tough-talk in the Ukraine as Putin threatens to cut further energy supplies.

In this cold reality, the geniuses at the ECB are realizing that the very “state of their European Union” is at increasing risk of dis-union as citizens from Italy to Austria bend under the weight of higher prices and falling income.

As of this writing, the openly nervous ECB is thus inventing clever plans/titles to “fight fragmentation” within the EU by, you guessed it: Printing more money out of thin air to control bond yields and cap borrowing costs.

Of course, such pre-warned and inevitable (as well as politicized) versions of yield curve controls (YCC) are themselves, just well…Inflationary.

Even outside the EU, the UK’s Prime Minister is discussing the idea of handing out free money to the bottom 30% of its population as a means to combat inflating prices, equally forgetting to recognize that such handouts are by their very nature just, well…Inflationary.

(By the way, such monetary policies are an open signal to short the Euro and GBP against the USD…)

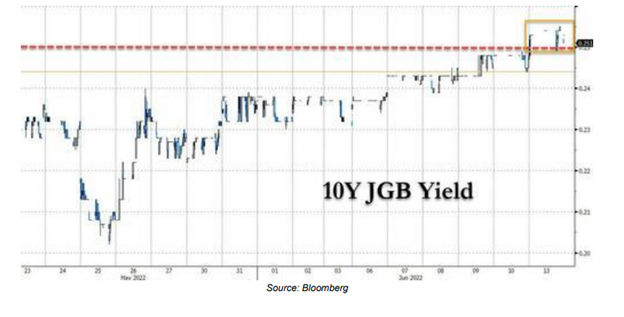

Looking further east to that equally embarrassing state of the union in Japan, we see, as warned countless times, a tanking Yen out of a Japan that knows all too well the inflationary sickness that a non-stop money printer can create.

Like the UST, the Japanese JGB is as unloved as a pig in lipstick. Prices are falling and yields are rising.

As demand for Japanese IOU’s falls, yields and rates are rising, compelling more YCC (i.e., money printing) from the Bank of Japan as the now vicious (and well…inflationary) circle of printing more currencies to pay for more debt/IOUs spins/spirals fatally round and round.

By the way, and as part of our continued warning and theme of the slow process of de-dollarizationwhich the sanctions have only accelerated, it would not surprise us to see Japan making a similar “China-like” move to buy its Russian oil in its own currency rather than the USD.

Just saying…

Don’t Be (or buy) a Dip

As indicated above, trying to combat inflation with rate hikes is not only a joke, it creates a market disaster when a nation’s debt to GDP is at 120%.

To fight inflation, rates need be at a “neutral level,” (i.e., above inflation), and folks, that would mean 9% rates at the current 8%+ CPI level.

That aint gonna happen…

At $30T+ of government debt and rising, the Fed can NEVER use rising rates to fight inflation. End of story. The days of Volcker rate hikes (when public debt was $900B not $30T) are gone.

But the fickle Fed can raise rates high enough to kill a securities bubble and create “asset-bubble deflation,” which is precisely what we are seeing in real time, and this market disaster is only going to get worse.

In short, if you are buying this “dip,” you may want to think again.

As June trade tapes remind, the Dow dipped below 30000, and the S&P 500 reported an ominous 3666, already losing more than 20% despite remaining grossly over-valued as it slides officially into bear territory.

As for the NASDAQ’s -30% YTD loss, well, it’s embarrassing…

Many, of course, will buy this dip, as many forget the data, facts and traps of dead-cat bounces.

Toward this end, it’s worth reminding that 12 of the top 20 one-day rallies in the NASDAQ occurred after that market began a nearly 80% plunge between 2000 and 2003.

Similarly, the S&P saw 9 of its top 20 one-day rallies following the 1929 crash in which that market lost 86% from its highs.

In short: These bear markets are not even close to their bottom, and today’s dip-buy may just be a trap, unless you think you can time a one-day rally amidst years of falling assets.

Markets won’t and don’t recover from the bear’s claws until spikes are well above two standard deviations. We are not there yet, which means we have much further to fall.

Capitulation in U.S. stocks won’t even be a discussion until the DOW is below 28,400 and the S&P blow 3500. Over the course of this bear, I see both falling much further.

As we’ve warned, mean-reversion is a powerful force and we see deeper lows/reversions ahead:

Toward that end, we see an SPX which could easily fall at least 15% lower (i.e., to at least 1850) than the “Covid crash” of March 2020.

Based upon historic ranges, stocks won’t be anywhere near “fair value” until we see a Shiller PE at 16 or a nominal PE of 9-10.

Index bubbles have been driven by ETF inflation which followed the Fed liquidity binge—and those ETF’s will fall far faster in a market disaster than they grew in a Fed tailwind.

And if you still think meme stocks, alt coins or the Fed itself can save you from further market disaster, we’d (again) suggest you think otherwise.

Looking at historical data on prior crashes from 1968 to the present, the average bear crash is at around -33%.

Unfortunately, there’s nothing “average” about this bear or the further falls to come. The Shiller PE, for example, has another 40% to go (down) before stocks approach anything close to “fair value.”

In the 1970’s, for example, when we saw the S&P lose 48%, or even in 2008, when it lost 56%, U.S. debt to GDP levels were ¼ of what they are today. Furthermore, in the 1970’s the average consumer savings rate was 12%; today that rate is 4%.

Stated simply, the U.S., like the EU and Japan, is too debt-crippled and too GDP-broke to make this bear short and sweet. Instead, it will be long and mean, accompanied by stagflation and rising unemployment.

The Fed knows this, and is, in part, raising rates today so that will have something—anything—to cut in the market disaster tomorrow.

But that will be far too little, and far too late.

And, Gold…

Of course, the Fed, the IMF, the Davos crowd, the MSM and the chest-puffing sanction (back-firing) West will blame the current and future global market disaster on a virus with a 99% survival rate and an avoidable war in a corner of Europe that neither Biden nor Harris could find on a map.

Instead, and as most already know, the real cause of the greatest market bubble and bust in the history of modern capital markets lies in the reflection of central bankers and politicians who bought time, votes, market bubbles, wealth disparity and cancerous inflation with a mouse-click.

History reminds us of this, current facts confirm it.

For now, the Fed will tighten, and thereby unleash an even angrier bear.

Then, as we’ve warned, the Fed will likely pivot to more rate cuts and even more printed (inflationary) currencies as the US, the EU and Japan engage in more inflationary YCC and an inevitable as well as disorderly “re-set” already well telegraphed by the IMF.

In either/any scenario, gold gets the last laugh.

Gold, of course, has held its own even as rates and the USD have risen—typically classic gold headwinds. When markets tank and the Fed pivots, yields on the 10Y could fall as global growth weakens—thus providing a gold tailwind.

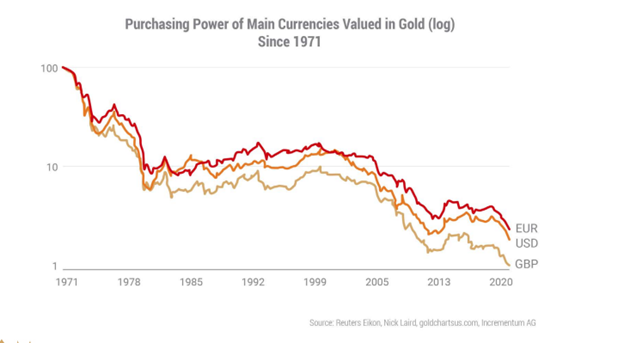

Furthermore, the USD’s days of relative strength are equally numbered, as is the current high demand for US T-Bill-backed collateral for that USD. As the slow trend toward de-dollarization increases, so will the tailwind and hence price of gold increase as the USD’s credibility decreases.

In the interim, the fact that gold has stayed strong despite the temporary spike in the USD speaks volumes.

In the interim, Gold outperforms tanking stocks by a median range of 45%, and when the inflationary pivot to more QE returns, gold protects longer-term investors from grotesquely (and increasingly) debased currencies.

And when (not if) the re-set toward CBDC (central bank digital currencies) finally arrives, that blockchain eYen and eDollar will need a linkage to a neutral commodity not to an empty “faith & trust” in just another new fiat/fantasy with an electronic profile.

As we’ve been saying for decades: Gold Matters.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD