Getting Emotional: A Bi-Polar Dollar vs. a Sane Precious Metal

The bi-polar US Dollar, like so many market forces of late, is exhibiting some odd behavior.

In recent interviews and reports discussing the year ahead, I specifically cited the movements of the bi-polar US Dollar as one of the most critical market signals to watch.

The case, for example, of a relative strengthening USD was made based (in part) upon demand form the ever-thirsty euro-dollar and US repo market.

Toward this end, bullish bets on the USD by hedge funds are currently the highest since June of 2019.

As we see below, however, the stability of the Fed-contorted US Dollar is akin to a three-legged chair on the deck of the Titanic.

In short, the USD can and will wabble in many emotional directions before sinking.

In fact, recent signs from a bi-polar Greenback suggest its hitherto rising strength may be coming to end, despite: 1) an increasingly hawkish Fed, 2) rising rates and 3) otherwise dollar bullish consensus.

So which way is the USD headed? Up or down?

The answer is yes.

Let’s dig in.

This is What It Sounds Like When Doves Cry

As usual, let’s start by translating the always entertaining Fed-speak—and a little bit of music history.

Minneapolis born Prince, the iconic musician of the 1980’s, famously sang of what it sounds like when doves cry.

But if you want to know what it sounds like in 2022, put away your music collection. Just head to that same Minneapolis and ask for its Federal Reserve Bank President, Neel Kashkari.

For years, Kashkari has been among the most dovish of the Fed doves, arguing that rates should be at or near zero well into 2024—hardly bullish for an overly-“printed,” zero-cost USD.

Reversing Course

But as the 2021 Fed/Kashkari meme (i.e., time-buying lie) of “transitory inflation” finally gave way to the 2022 reality of persistent inflation, Kashkari was compelled to do what the vast majority of double-speaking, math-challenged, history-blind and truth-allergic Fed officials do best: Reverse course.

Recently, Kashkari has been cooing about rate hikes (at least 2 for 2022) and reducing the Fed’s balance sheet (i.e., dumping Treasuries).

Even Joe Biden is asking the Fed to get more hawkish to “fight” the very inflation the Fed otherwise needs to reduce Uncle Sam’s debt to GDP ratio.

Needless to say, all such measures combine to push rates up (30 bps in 4 days for the 10Y UST in early January), which theoretically (see below) should make the USD stronger and send gold and BTC lower.

Don’t Let Appearances Fool You

But as market signals constantly remind: Not everything is as it seems.

What short-sighted investors and knee-jerk markets forget, for example, is that nominal rates may be rising, but not as fast as the currency-debasing inflation and negative real rates, which means (longer term) that gold will get inherently stronger not weaker regardless of the USD’s relative strength.

Of course, dollar-betting hedge funds and gold traders, unlike gold investors, will always sell (or buy) on near-term headlines rather than long-term fundementals. This is nothing new at all.

At the end of the day, however, the USD’s year-end relative strength was a distracting fog compared to the lighthouse of its dying, inherent purchasing power—the real indicator in a world of central bank smoke and mirrors.

As always, this chart of the USD against a milligram of gold can’t be repeated enough…

But even those who think the USD can only go up as the USD gains relative strength, you may wish to think again.

Uh-Oh: The US Bi-Polar Dollar Not Rising with Rates (!)

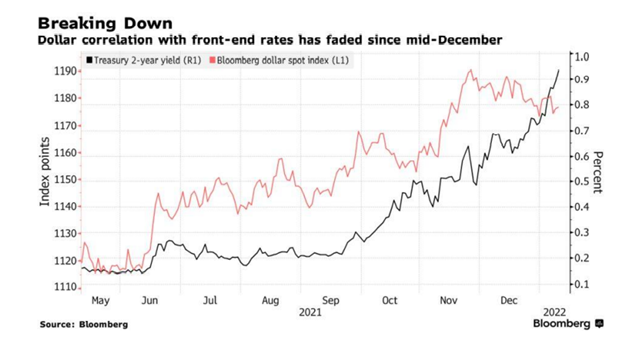

Another market signal ignored by the majority of pundits and day-traders is the recent disconnect between the USD and the rates market.

This may sound boring, but bear with me, for it’s actually quite simple and very important.

Traditionally, for example, as taper (or taper talk) driven bond yields (and hence rates) go up, so too does the USD.

But as we see in the chart below, the US Dollar (falling line) is decoupling from Treasury yields (rising line).

What gives?

Why has the USD (which peaked in November) been in a decline despite a more Hawkish Fed and rising bond yields?

Druckenmiller Told Us So

Well, for those paying attention, legendary FX trader, Stan Druckenmiller, warned of this precise eventuality months ago in May.

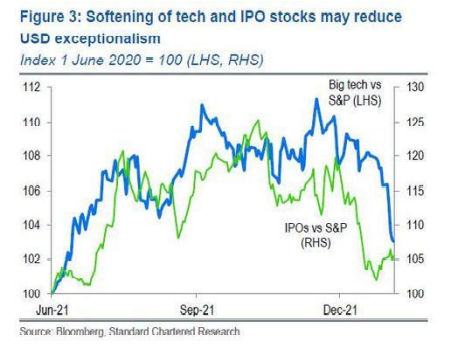

Specifically, Druckenmiller hadn’t forgotten the Balance of Payment (i.e., a $700B current account deficit) problems in the US, made all the worse by the fact that foreigners had stopped buying US Treasuries in favor of COVID-stimulated tech and growth beneficiaries like Google, Zoom, Microsoft etc.

Folks, these changing dollar flows are important.

As that growth/tech wave wanes (like Druckenmiller warned it would in a taper-setting), investors start pouring their money into the safety of commodities and other under-loved cyclicals, which sends the markets and dollar lower rather than higher.

Flows Matter

This ever-increasing sector rotation out of growth/tech (the veritable core of the S&P) and into commodities is now happening in real time.

Most investors, including hedge funds, however, remain bullish on the USD because they are looking at its relative strength and relative interest rates.

What they are ignoring, however, are these changing capital flows, which portend bad rather than good news for the Greenback for the simple reason that the dollar can trade more off flows than relative rates.

Technicals Matter

Furthermore, when we add in the technicals, the plot against the bi-polar dollar thickens.

Lyn Alden, for example, recently reminded her Twitter followers that for decades, whenever the dollar index hit a weekly and highly overbought RSI (relative strength index) of 70 but then trended negative thereafter, this was consistently bearish for the USD.

Interestingly enough, both her and Druckenmiller’s warnings are more than confirmed by the fact that just as tech and growth stocks began to openly underperform the broader S&P in late November…

… the USD stopped rising with US real rates.

In our view, this is not coincidence, but correlation.

When you combine less dollars going into tech and growth stocks with a Hawkish/Rising-Rate Fed, you can get a weakening USD—all of which bodes well for the sectors where those dollars are heading, namely commodities like gold, as well as industrials, energy, banks and Bitcoin.

In short, even rising rates and a much-telegraphed dove-to-hawk Fed pivot can’t hide the debt realities and money flow facts which consistently discredit an increasingly discredited (debased) US Dollar and that band of mediocrity otherwise known as the Fed who is tasked with “managing” (manipulating) it.

Markets in 2022–Getting Emotional

As we’ve also warned for months, rising rates are not exactly fun for the otherwise ignored real economy, broken middle class or debt-saturated risk asset markets, which are about to get, well: Emotional.

Gold, of course, rises as emotions (fears) rise.

Nearer term, if the Fed follows hawkish talk with hawkish policy, we could expect short-term pain in just about everything but the bi-polar dollar and financials.

But think further ahead. A lot of forces are at play.

Another Fed Pivot to Dovish?

Rising rates will pinch stocks, precious metals, commodities and BTC, but a reversal (pivot) from dovish to hawkish back to dovish again is very possible in 2022. We can only wait and see.

Follow the Money—and the Sectors

In the interim, the sector rotation out of growth and tech, discussed above, bodes well for gold and other undervalued assets longer term, which is where the patient money always looks.

If no such Fed reversal rears its dovish head, stocks and bonds will continue to fall and emotions will truly start to rise, which is always and ultimately good for gold even if rising rates are not.

Besides, the rising rates will remain negative in real (inflation-adjusted) terms, and gold’s stubborn, patient and inevitable trend north will continue.

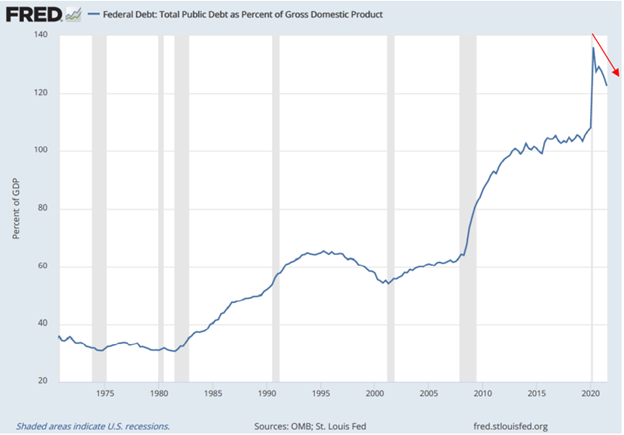

For now, and as warned throughout 2021, the Fed was simply lying all along about temporary inflation as it deliberately pursued aggressive inflation to inflate its way out of its dangerously high debt to GDP ratio.

As expected, this two-faced, fork-tongued policy of deliberate rather than transitory inflation helped bring down that debt to GDP ratio at the expense of ordinary citizens and the real economy.

No shocker there.

Although the Fed may be momentarily proud of the small victory (debt ratio decline) in the chart above, they may want to put the Champagne back in the fridge.

Too Little, Too Late

That is, they did not let inflation run hot and a long enough to make any meaningful deleveraging dent in Uncle Sam’s otherwise enormous and embarrassing bar tab.

2021 tax receipts, we remind, came in at an impressive $565B, but unfortunately the national bar tab for that same year was $922B, as unpaid and rising outlays for Medicare, Social Security and other Veteran benefits outpaced tax receipt inflows.

The subsequent $356B deficit will become more than just a math problem if the Fed hawkishly cuts back on QE-based Treasury support as planned for 2022.

With less USD’s being mouse-clicked out of DC, more folks will have to borrow those needed Greenbacks, which can send the dollar higher.

See what I mean by a “bi-polar dollar?”

Both national and international debtors owing USD’s will thus be selling other assets (i.e., growth and tech stocks) to gather more USD’s to meet debt demands.

Much of this sell-off in search of liquid USD’s will also take place in the Treasury market, which will send bond prices lower and hence yields and interest rates higher—all just added insult to already injured real economy.

Stated more simply: The Fed is handing us more inflation, rising rates, tanking bonds, a nervous equity market and a stagnating economy.

Like I said, things will likely get emotional in 2022, for even the hawks are offering too little, too late.

This is because “tapering” from 10 martinis a day to 9 martinis a day still eventually kills the liver. The same is true of the bi-polar USD and hawkish “tapering” after years of dovish, central bank excess.

Yep: In a backdrop of trillions upon trillions of excessive and addictive monetary and fiscal expansion, the Fed’s “tightening” is too little too late.

Again: Things are about to get emotional.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD