EGON VON GREYERZ INTERVIEWED BY LYNETTE ZANG

“A Crazy World! We have the biggest bubble ever in history and it will all end in tears.”

This is how Egon starts the interview with Lynette. Egon goes on to discuss that we will soon begin a most spectacular secular bear market in stocks and bonds.

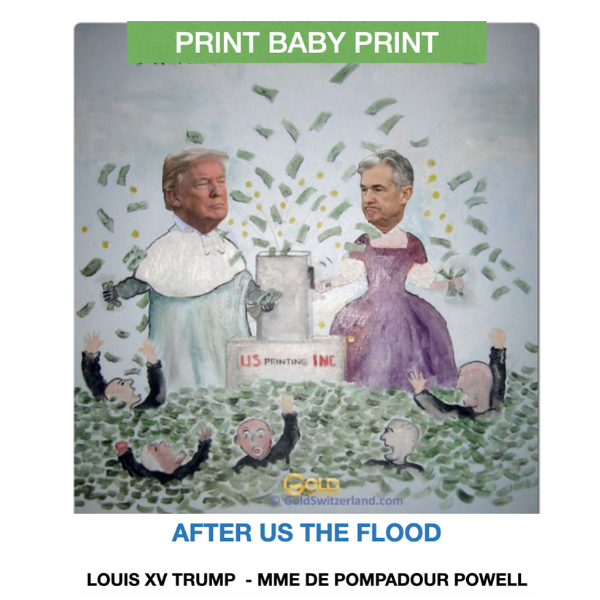

Central banks will panic as they fail with their rescue attempt of the financial system. They can never save a world infested with debt of $250 trillion.

In addition, the real derivatives amount outstanding is at least $1.5 quadrillion and when counterparty fails, the derivative bubble will implode.

Egon also talks about the institutions’ scandalous investment policy of buying government bonds that will never be repaid with real money. Retirees will suffer and end up with no pension.

Lynette and Egon agree that wealth preservation is now critical and the best way to protect wealth is to own physical gold and silver.

But precious metals should not be held for the purpose of price gains but as insurance against a rotten financial system.

As the system comes under pressure, central banks will lose control of interest rates which will go dramatically higher.

When you hold gold for wealth preservation reasons, you should not look at the price. Nevertheless, gold and silver will reach much higher levels which Egon mentions in the interview.

Gold and silver is for everyone, not just for the wealthy says Egon. Anyone could afford 1 gram of gold for $45 or an ounce of silver for $16. When hyperinflation arrives like in Venezuela, small amounts of gold and silver will be life saving.

Egon doesn’t believe in an orderly reset although the US will try. The real reset will be disorderly with bubble assets imploding and gold and silver surging.

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD