CHAOS AND THE TRIUMPH OF SURVIVAL

One of the most horrifying works of art is Bruegel’s “The Triumph of Death” painted in 1562. The painting depicts the end of life on earth.

I sincerely hope that this is not what the world will literally look like in the next decade or two but metaphorically this is not an unlikely depiction of the chaos that could hit us all.

For a detailed description of the grim painting see here

The Black Death plague of the 14th century, which killed up to half of the world’s population, clearly had a major influence on the painter.

The moral message is that when chaos hits, the destruction will affect everyone, rich and poor, young and old. No one will escape by power or devotion.

The financial, economic and moral devastation which is about to hit the world will for more than 99.5% of the people come out of the blue like a flash from a clear sky.

For most people, coming events will thus be like the definition of the word CHAOS: “A state of total confusion and disorder”.

CHAOS NUMBER 1: COVID

Talking about disorder, just like the Black Death that inspired Bruegel’s painting, the world is now facing a global pandemic. But rather than the nearer 50% of global population that perished in the mid 1300s, today we are looking at total deaths from the current pandemic of 0.06% of the world population! And even that figure might be overestimated due to the classification rules applied.

For that minuscule percentage the world has now been paralysed for the third year soon.

There are lockdowns, quarantines, compulsory vaccines with unlined boosters, covid passports, closed schools, closed offices, major industries like leisure haemorrhaging, airlines going bankrupt, shortages of labour, components, products, closed borders, and for the few people who dare to and can travel across borders, more bureaucracy, paperwork and tests than in a police state. At the same time money printing and credit creation have gone exponential.

The politicians obviously blame the scientists for all the rules that they force upon the people.

It is interesting that with almost 200 countries in the world, each country has different rules how to deal with covid. If all these rules were based on science, you would have thought that the rules would have been the same for all 200 countries.

Or could it be as many observers believe that the politicians use the pandemic to their own advantage.

Or is it more likely that neither the scientists nor the politicians have got a clue how to deal with a disease that creates hardly any deaths in excess of normal deaths?

In Sweden for example, there has been no lockdown, no quarantine, no closed shops, no mask requirement and industry has operated normally. Covid cases and deaths are at the lower range of the European average. Hmmm – so much for all these punishing rules in most countries.

We were told that the vaccines would solve the problem but two shots haven’t so far as we were promised. So now everyone needs a booster every few months. With Big Pharma being both judge and jury plus benefiting from their own advice to the extent 100s of billions of dollars, how do we know the real truth?

As an example, I have a 19 year old vaccinated granddaughter who had Covid in August. Now she has got Covid for the second time, fortunately in the form of a normal cold. The government/scientist solution is clearly more vaccines at ever more frequent intervals. And still no one has properly tested the long term effects the vaccines have on our bodies. There just isn’t time for that!!?

The consequences of these constant changing of rules and shutdowns will clearly have a devastating effect on an already very fragile world economy and financial system.

CHAOS NUMBER 2: GLOBAL DEBT

So if scientists and governments haven’t got a clue how to deal with Covid, we can at least assume that central bankers and governments have got the economy and the financial system under control.

How wrong can we be?

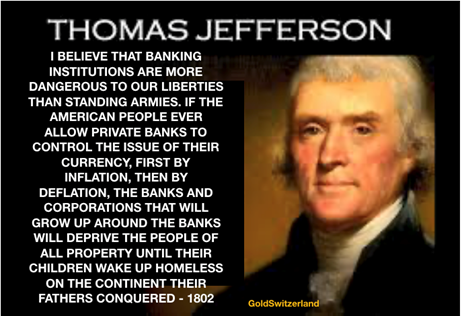

Ever since the Federal Reserve was created in 1913, central and commercial bankers have successfully been running the financial system for their own benefit. But what really gave them carte blanche to print unlimited amounts of money was in August 1971, when Nixon closed the gold window. Since then, President Thomas Jefferson’s cynical view on bankers have really come to pass.

How incredibly prescient the above statement is. We must remember that the Fed is a private bank that totally controls the US financial system. And as long as the US dollar remains the reserve currency of the world, the Fed also controls major parts of the global financial system.

Jefferson will also be right regarding inflation and deflation. The current financial system is now entering a phase of inflation, most probably leading to hyperinflation as I have discussed many times in my articles.

But before this financial system ends, the totally worthless debt must be destroyed through a deflationary implosion not only of the debt, but also the bubble assets financed by printed money created out of thin air.

So a deflationary depression is likely to be the end of yet another failed experiment of a fiat money system which was doomed the day it was created on Jekyll island 111 years ago. Jefferson of course told us this would happen already over 200 years ago.

If history teaches us anything, it is that no one learns from history and everyone thinks it is different today because we are here.

Plus ça change, plus c’est la même chose – The more it changes, the more it stays the same.

So back to Bruegel. An implosion of the financial system and consequently the global economy will clearly have major repercussions for life on earth.

We must remember that NEVER BEFORE IN HISTORY has there been a global debt crisis of this magnitude.

Never before have debt bubbles at this level in Europe, in North and South America, Asia, Africa and Oceania synchronised at the levels we are now experiencing.

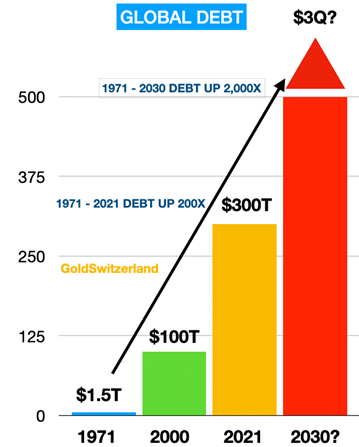

Just look at the magnitude of debt which has been created since 1971.

It took a few thousand years to get to a global debt of $1.5 trillion in 1971. And 29 years later debt had grown 66x to $100 trillion and since then it is up another 3x to $300T.

So when the shackles were thrown off by closing the gold window in 1971, there was a free for all between bankers and governments to create unlimited amounts of money.

And by golly they have succeeded! Global debt is up 200x since Nixon took away the gold backing of the dollar and all other currencies.

As regards the $3 quadrillion debt in 2030, I will comment later in this article.

The very final stage of this monetary era started in 2006 with the Great Financial Crisis. Tens of trillions of dollars printed, lent and guaranteed managed to patch up Humpty Dumpty temporarily.

But it was very clear to me and some other observers that the patch would not last long. So back in September 2019 the financial system came under severe pressure and central banks panicked in an attempt to save the bankrupt banking system with massive liquidity. Conveniently for the banks, they had an excuse for this money printing since Covid started a few weeks later.

Normally governments need to start a war to have an excuse to print serious money. But a pandemic created in a lab works even better.

The world is now in totally unchartered and very precarious waters. A ship in such danger does not require more than a minor storm to be hit by irreparable damage.

Nobody can forecast what will happen since we have nothing to compare with. But what is very likely is that the creature (from Jekyll Island) that has been created by bankers and governments will reach a terrible fate – a fate that only future historians can tell the world about.

CHAOS NUMBER 3: DERIVATIVES

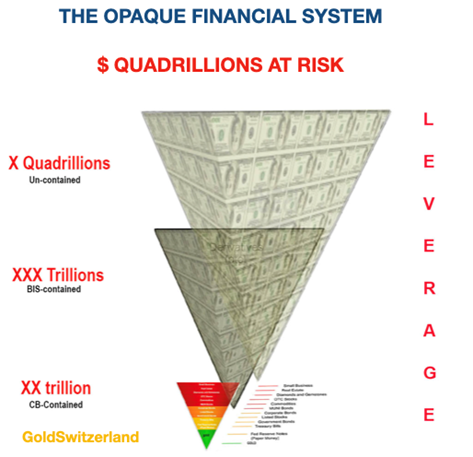

Global derivatives outstanding were reported by the BIS in Basel (Bank of International Settlement) at $1.4 quadrillion in the mid 2000s. That figure was conveniently reduced by the BIS to around $600 trillion at the end of the 2000s by netting positions.

Banks like Deutsche or JP Morgan have reported gross outstanding derivatives of $40-50 trillion.

But all banks net the gross amounts of derivatives down to insignificant levels, arguing that these low and totally misleading amounts are their real exposures.

Well, the bankers can fool some of the people some of the time but in the end we know who the real fools will be!

The problem with netting is that when counterparties fail, gross risk remains gross.

Derivatives have been a most incredible money spinner for banks and other financial entities. There are today so many opaque ways of creating and hiding derivatives from the official reporting that no one has a clue of the real amount outstanding. But it could easily be in the quadrillions of dollars.

Remember that virtually every financial instrument created today consists of derivatives, whether it is ETF stock or bond funds, interest rate swaps, forex swaps, mortgage loans etc, etc, the list is endless.

Derivatives function very well in an manipulated orderly system when there is constant demand. But when the music stops and liquidity dries up, only then will we know the real amounts outstanding.

One of my very good contacts is an excellent interpreter of the risks in the system. He has created these inverse pyramids with the current financial system at the bottom resting on a small amount of gold with massive debt on top. Above that we see the known derivatives reported by the BIS of $600 trillion and on top of that the opaque financial system which is likely to be in the quadrillions of dollars.

No one knows the exact amount but it could easily be $2 quadrillion and probably more.

CHAOS NUMBER 4: TIMEBOMB

So if we look into the next 5-10 years and paint a picture of what could happen to the financial system, the risk the world is facing is horrifying.

Global debt will certainly grow from $300t to at least $500t. That figure is really a gross underestimate.

We add to that global unfunded liabilities (pensions, medicare etc) which are easily $500 trillion.

Finally we add the derivatives of $2 quadrillion – also probably too conservative.

When counterparties fail, central banks will need to print all that money to prevent banks from failing.

So if my assumptions are right, global debt will have grown from $300 trillion to $3 quadrillion in the next 5-10 years.

But I will probably be wrong on many accounts, like it won’t take as long as 10 years. We know from history that hyperinflation goes very fast. Also, most of the estimates of debt and derivatives are probably much too low.

Still, let’s assume that the world is now facing a timebomb of $3 quadrillion. A very frightening prospect indeed.

Warren Buffet knew he was right in 2002 when he called derivatives financial instruments of MASS DESTRUCTION. Sadly, we will soon see the evidence.

Since all monetary systems in history have come to an end, we have to assume that the biggest global bubble ever also will.

And since this morbid system touches all corners of our lives and has led to a decadent world where moral and ethical values have virtually disappeared, the world needs a cleansing in the form of a forest fire for new green shoots to start again.

PREPARE AND ACHIEVE THE TRIUMPH OF SURVIVAL

As I have pointed out in this article, nobody knows exactly how things will play out.

But what we do know is that risk is probably greater than any time in history. So prudence tells us to get out of bubble assets like stocks, bonds and speculative property. Once the fall starts, these assets are likely to lose 90% or more in real terms which means against gold.

The majority of stock investors are likely to buy all the dips as the market falls, not realising that they will ride the fall all the way down to the bottom. And this time the market will not recover for years or probably decades.

Also it is important to get out of debt except for a normal mortgage on your residential property.

Own physical gold and some silver (much more volatile). That will be your insurance against a rotten financial system.

We have owned and recommended physical gold for 20 years. Not once have we worried about the price. History tells us that governments and central banks destroy the value of money without fail.

But for the ones who do look at the gold price, I think that the correction in gold is finished. There is always a chance of a final move down of $50-100. But that would make no difference since the next big move up is soon coming to much higher levels.

Finally, we will have difficult times in the world. So helping family and friends is very important.

It is everyone’s responsibility to resist the Triumph of Death and achieve the Triumph of Survival – both financial and mental – for everybody we can help.

And remember that many of the best things in life are free – friendship, music, books, nature and many hobbies.

I wish all our readers Merry Christmas and Happy Holidays, as well as a Healthy and Harmonious 2022 in spite of the tumultuous era we are entering!

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD