STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

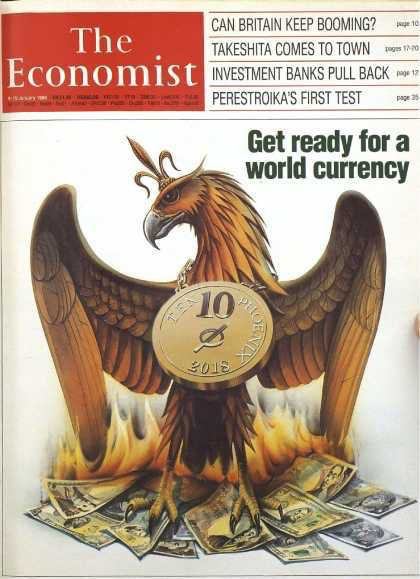

In 1988, the UK magazine, The Economist forecast that 2018 would be the year of a new currency which they named the Phoenix. Quite a mind boggling prediction 30 years ago really, especially since 2018 in fact looks like a year when a major currency upheaval could take place.

For conspiracy theorists, the Economist’s owners consist of a number of elite families and bankers including the Rothschilds. Was this a plan which has been in the making for a very long time? Or is it sheer fluke that a major currency event might take place in the year that the Economist predicted.

So, what could be the events that will lead to a major disruption in currency markets and in the world economy in 2018?

1. DOLLAR COLLAPSE

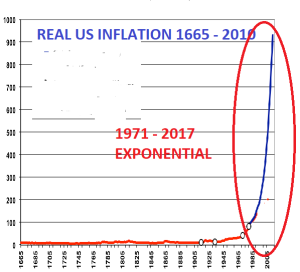

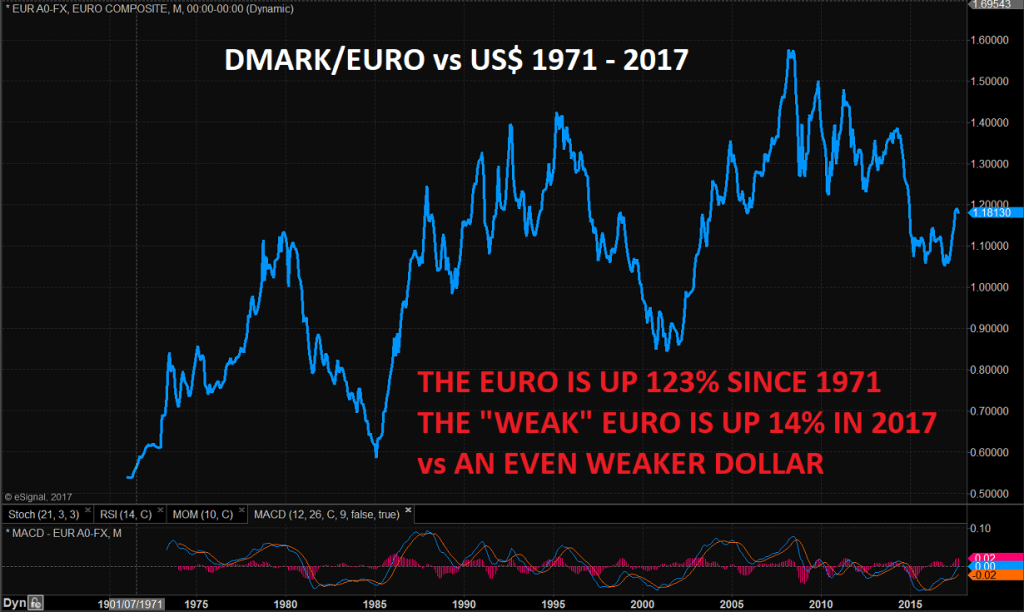

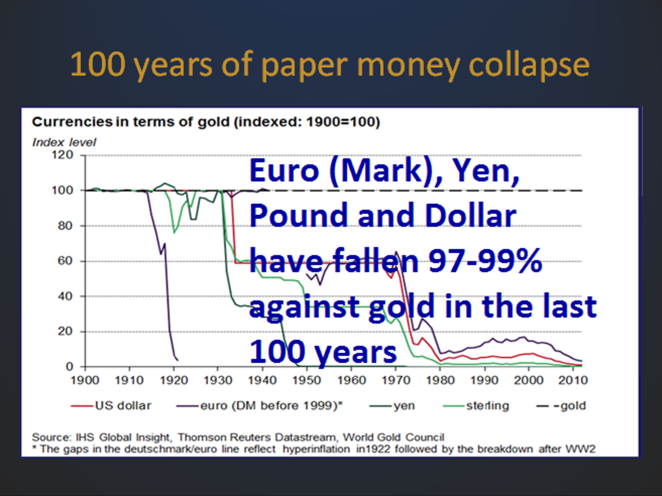

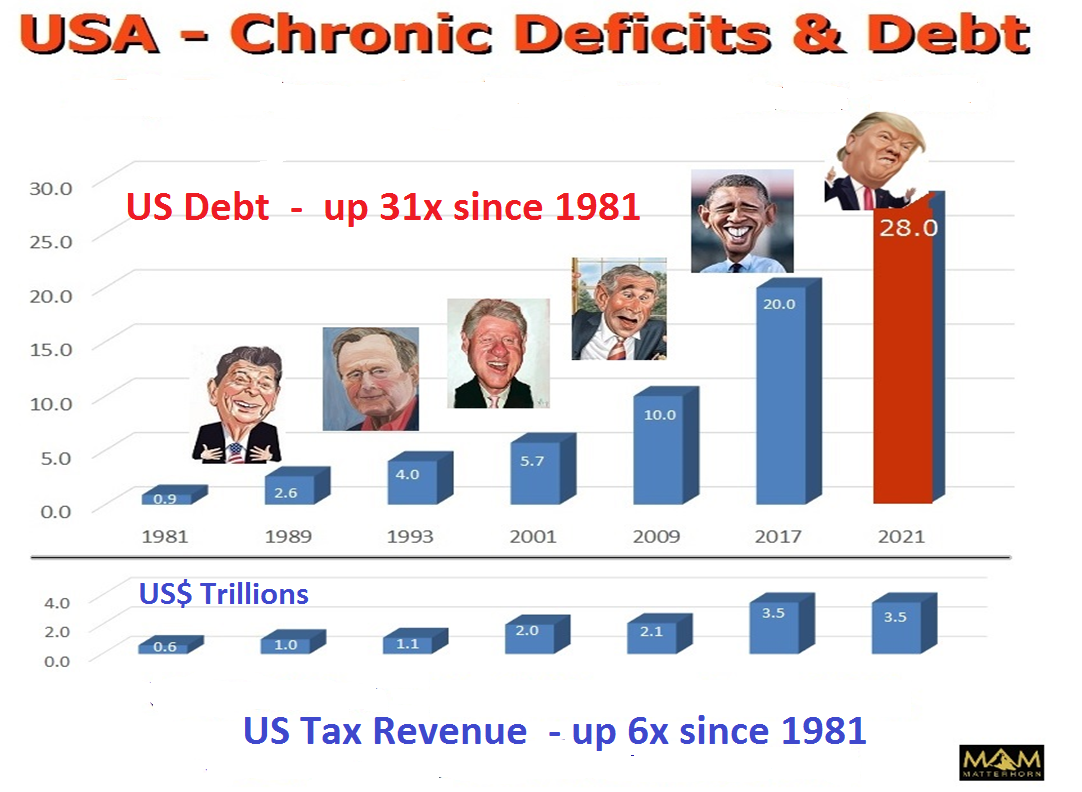

The demise of the dollar as the reserve currency of the world is a certainty. It is only a question of when it will take place. The dollar does not qualify as the rock of the world currency system. Since the gold backing of the dollar ceased in 1971, it has lost 98% in real terms when measured against gold. But also against most other currencies, the dollar has lost greatly. In Swiss francs for example, the dollar is down 77% since 1971. The dollar is backed by massive debts and deficits. The US has not had a real Budget surplus since 1960 and has been running Trade deficits since 1975. The dollar is backed by nothing but debts and a weakening military. It is living on borrowed time.

2. FALL OF PETRODOLLAR AND RISE OF PETROYUAN

In 1974 the US agreed to support Saudi Arabia financially and militarily on the condition that the Saudis priced oil in dollars. Since most of the world bought oil from Saudi Arabia at that time, it led to a major demand for dollars, which is still the case. That was the beginning of the Petrodollar which has enabled the US to live above its means for 44 years. But from 2018, the Petrodollar will gradually be replaced by the Petroyuan and also the Petro ruble. China, the world’s largest oil importer, will, together with Russia and Iran, switch from trading oil in dollars. This will be backed by a futures contract in Petroyuan with a potential convertibility to gold. Except for further military intervention in the Middle East, the US now has little chance of stopping this major strike against the dollar. The US is currently virtually self-sufficient in oil production and is no longer a major trading partner of Saudi Arabia. Therefore, the US neither can nor will stop Saudi Arabia from moving its sphere of activity from West to East.

3. THE CRYPTO BUBBLE AND THE CRYPTO DOLLAR

The major event this year which has convinced many that we have a new currency system which is controlled by no country and no central bank is, of course, the Cryptocurrencies led by Bitcoin. In 2017, we have seen a mania in cryptos of massive proportions. At the beginning of the year, the market cap of all cryptos was $17 billion. As of today, there are 1,360 cryptos with a total value of $588 billion. That is a 34-fold or 3,300% increase in the value of cryptocurrencies in just one year. There are 589 cryptos valued at over $1 million, with Bitcoin being the biggest at $312 billion.

4. BITCOIN A BIGGER BUBBLE THAN TULIP BULBS

How can anyone believe that the world can function with a payment system that has 1,360 currencies which is continuing to grow exponentially with a new ICO (Initial Coin Offering) virtually every day.

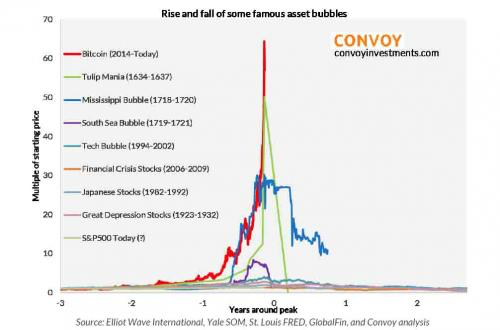

Cryptos, in their present form, will never be accepted as currencies. Bitcoin is up 20X in 2017. If that were a currency, it would indicate a 1,900% inflation or, more precisely, hyperinflation. But Bitcoin is not a currency. Also, it could never be used as a payment system due to the very slow speed of transactions. Bitcoin and other cryptos are just an electronic form of tulip bulbs. Like tulip bulbs, the Bitcoin bubble can get bigger, although the Bitcoin mania is now bigger than Tulipomania, as the chart below Indicates.

5. CRYPTODOLLAR

So, if there will be a new currency in 2018, as the Economist forecast, it is unlikely to be Bitcoin or any of the 1,360 cryptos. It is, of course, possible that Bitcoin was constructed by a government in order to experiment with how a cryptocurrency would work. Or it could be as Catherine Austin-Fitts believes that governments are closely watching the crypto mania and letting private enterprise develop the market before they step in and ban all cryptos in order to install their own.

I would not be surprised to see the US government introducing a Cryptodollar in 2018 or later to replace the current dollar which they know will soon collapse. All existing debt would remain in the Old Dollar. The US government would then encourage and assist a fast appreciation of the Cryptodollar, just like Bitcoin. This would enable repayment of the Old Dollar with the new inflated Crypto$. Obviously, this scheme would not work, but for a while, a euphoric crypto world might buy it hook, line and sinker.

6. CHINA – RUSSIA AND GOLD

Neither China, nor Russia would fall for this trick. China would lose massively on their US treasury holdings. This would drive these two countries to introduce some form of gold backing of their currencies or payment system. If the paper gold trading exchanges are still standing a that point, China and Russia will use all their resources to break the gold and silver paper market. This would drive up the price of gold and silver into a mania that the world has not seen before.

WILL WE SEE A NEW PHOENIX CURRENCY IN 2018

So will the Phoenix currency, (which the Economist forecast in 1988 would rise in 2018), be a Crypto$. Or will it be gold backed trading in Yuan and Ruble. Or will it be the Bitcoin mania going to $1million? We don’t know of course. But what we do know is that 2018 is likely to contain many surprises on the currency front with massive volatility not only in currencies but also in most other markets.

What we also know is that although cryptos can go a lot higher before they collapse, they offer no protection for investors seeking wealth preservation. Very few of the holders of the current $588 billion in cryptos will be able to get out before these reach zero. Greed is one of the 7 deadly sins and it always punishes mania investors.

Gold will continue to be the only currency to survive in history just as it has for almost 5,000 years. Physical gold and silver is the ultimate form of wealth preservation as well as insurance against the economic and financial calamities that the world will experience in coming years.

Whether there will be a new world currency in 2018 or not is irrelevant since all fiat currencies always fail. Gold and silver are today as unloved and undervalued as they were in 2000. It is very likely that the precious metals cycle bottomed in December for the third year running. Importantly every bottom has been higher. At $1265 we are today $220 above the Dec 2015 and $130 above the Dec 2016 bottoms.

A new currency would only be a temporary phenomenon, whilst gold would continue to be the only constant money in history. The very strong up-move of gold and silver in 2018 will take the investment world by surprise. Investors must pay heed and not be left behind.

STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

What is absolutely certain is that global wealth will be totally decimated in the next 4-8 years. It doesn’t matter if you are very rich or “just own a house” with some equity left. Most of it will come down in value by 75-95% in the next few years as the debt and asset bubbles implode.

But what very few people realise or plan for is the confiscation of wealth that will take place in the coming years. There will be confiscation on many levels.

With times deteriorating, governments will be thrown out as ordinary people become dissatisfied with their rapidly declining ability to survive. Many people will lose their jobs, and governments’ ability to help the poor and hungry will decline rapidly due to falling tax revenues. During that process, opposition parties will promise the earth. Thus, we will see a society in upheaval due to political turbulence, social unrest, dire economic circumstances, and anarchy.

TAXES WILL BE PUNITIVE

Many countries in the West have turned socialist in latter years, and this trend will continue as the climate deteriorates. With the ruling party desperately fighting for its own survival, their task becomes increasingly impossible as there is no money left in the coffer and printed money no longer has any value.

Opposition parties will promise solutions to all the problems and will have no difficulty becoming elected. But as they get into power they will also fail desperately. In most Western countries there will be left wing parties ruling but we might also see far right leaders emerging due to the anarchic situation.

As tax revenues decline rapidly, governments will desperately look for new ways of increasing the state’s income. Normal people will, at this stage, be very poor, so it will serve no purpose to tax them. The obvious target will, of course, be the wealthy, but also the middle classes. At that stage, the wealthy might already have lost half of their fortune or more, but socialist governments looking for revenue will ensure that most of their remaining wealth also disappears.

CONFISCATION BY TAXATION

Wealth taxes will be confiscatory and reach levels of 75% at least and possibly up to 90%. This will not only be popular with ordinary people who at that point are poor and suffering. It will also be what the desperate masses will demand, whether it is done peacefully or with violence.

What is happening in Saudi Arabia presently with the Saudi Crown Prince Mohammed bin Salman confiscating the wealth of other Saudi Princes and Saudi businessmen might set an example.

Governments in the US, UK or Germany, for example, could just decide to freeze the assets of the wealthy and issue arrest warrants demanding transfer of say 85% of their wealth. Refusal would not be an option since it would lead to a long prison sentence plus confiscation of 100% of the wealth.

Now is the time to plan for the risks of confiscation and punitive taxation. Soon it will be too late.

All this sounds totally draconian and unrealistic in today’s “civilised” society. But anyone who doubts that these measures could happen only needs to study history. There are endless examples of confiscation of wealth. Often it is linked to periods of excess and decadence, with major gaps between the rich and the poor, just as today. During the French Revolution in 1789, the aristocracy not only lost much of their wealth, but they also lost their lives. Same in the Russian Revolution in 1918 when both wealth and lives of the aristocracy were extinguished.

DANGEROUS TO FLAUNT WEALTH

We could easily then reach a state of anarchy due to the suffering of the masses. At that point they would turn against banks, governments and the wealthy leading to major violence as history repeats itself. Anything representing wealth will be despised by the masses, whether it is houses, cars, jewellery or clothes or other luxury assets. The flaunting of wealth that we see all over the world today could be very dangerous or even fatal at times.

The majority of people would call all this scaremongering and sensationalism. The problem is that because we live today, we think it is different now. Many believe it is totally acceptable to see bespoke Rolls-Royces, or Ferraris in New York, London or Hong Kong costing $250,000 or more. Today, very few protest against the enormous top prices paid for a house in the above cities, costing $100 million or more. And buying a painting for over $100 million happens regularly.

1/2 BILLION DOLLARS FOR A PAINTING

But if you want a Leonardo da Vinci, you must pay the neat sum of $450 million as an anonymous buyer did this week at the Christie’s auction in New York. A price level which very few can fathom.

Will almost $1/2 trillion be the record for a painting for decades or longer? Yes, in today’s money, that could certainly be the case. 11 tonnes of gold for a painting will probably not be beaten for the next 100 years or more. In the next 4-8 years, that painting can probably be bought for much less than 1 tonne of gold, more probably for 110 kilos or less (110 kg gold is today worth $4.5 million).

LAW AND ORDER WILL BREAK DOWN

For ordinary people, most of whom are not aware of these excesses, $1/2 billion for a painting is the ultimate decadence. This dangerous trend will not go unpunished in the future. And nobody must believe that law and order including police or military will function when society breaks down. Sadly, there will be no protection for the target groups.

Weapons will hardly help against the crowd. Best is to live in a place where you are surrounded by like minded or in a country which is less exposed. All this is not an option for many people but worth thinking about when there is still time.

Let me stress that I sincerely hope that none of what I have outlined will happen. But looking at risk and probabilities, we are now at a point in history when these events are likely to take place whether it is in the next few years or at some later point. Excesses of the magnitude we are seeing today as well as the gap between rich and poor will not continue without returning to the mean at least.

SWISS BANK REFUSES TO GIVE CLIENT HIS GOLD

Coming back to confiscation, it looks like banks are already playing that game. In a recent article (Don’t Store Gold in a Swiss Bank), I discussed how Swiss banks don’t have the physical gold that their clients have bought. I also mentioned how banks are refusing to release the gold that the client holds in the bank.

This week I was contacted by a person who went to his bank in Zurich, one of the two largest in Switzerland, to get his physical gold out. He had seen my article on the subject. The bank, one of the biggest Asset Management banks in the world, told him that he couldn’t have his own gold because of new rules within the bank.

But this man did not give up that easily. He asked for a letter from the bank confirming that they refused to hand over his gold to him. He told the bank that he would take this letter to the police. The bank clearly got scared and after three hours’ wait, the gentleman was told by the bank that they would hand his gold to him. So very generous of the bank to hand the client’s asset back to him!

This is yet another confirmation that banks are not going to give the clients their assets back without a major legal fight. But that is just the first stage, in my view. Soon, banks will be under such pressure that they will hold on to clients’ assets. Few people believe that this is possible, but it is guaranteed that, in the not-too-distant future, insolvent banks will not be in a position to hand anything back to clients. Again, I urge people to get assets out of the banks, in Switzerland or any other country. The financial system is already bankrupt, whatever central bank chiefs say.

Holding physical gold outside the banking system and in the right jurisdiction is the best insurance against these risks. But as I said above, tax planning is just as important as holding the right investment.

Not that the short term moves in the gold price are important since we we will see multiples of today’s price. But in spite of the normal shenanigans of the BIS and the bullion banks, dumping billions of paper gold after hours, gold is holding very well.

It looks like the latest small correction is finished and the uptrend has resumed. Possibly we need to wait for the Fed decision in December before a major move up of gold. Whatever the Fed does will only have a very short term effect.

Gold is going substantially higher regardless of central bank policy or paper gold manipulation.

5,000 YEARS’ HISTORY IS MUCH MORE POWERFUL THAN EPHEMERAL CENTRAL BANKERS AND MANIPULATORS.

STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

What will happen between now and 2025? Nobody knows of course but I will later in this article have a little peek into the next 4-8 years.

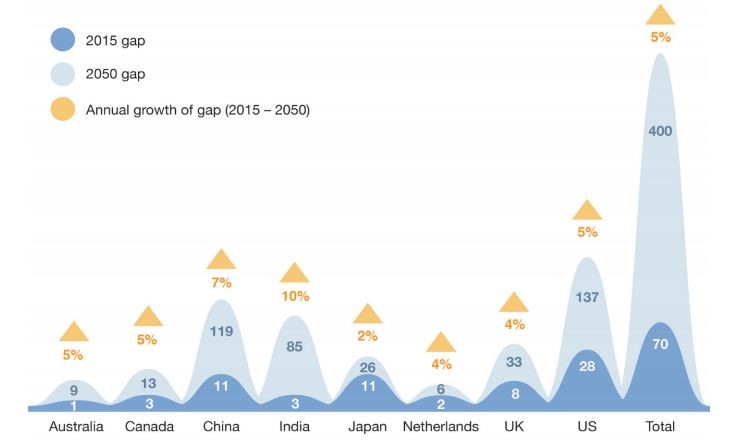

The concentration of wealth in the world has now reached dangerous proportions. The three richest people in the world have a greater wealth than the bottom 50%. The top 1% have a wealth of $33 trillion whilst the bottom 1% have a debt $196 billion.

The interesting point is not just that the rich are getting richer and the poor poorer. More interesting is to understand: How did we get there? and what will be the consequences?

Panama & Paradise Papers – Sensationalism

As the socialist dominated media dig into the Panama Papers and now recently the Paradise Papers to attack the rich and tell governments to tackle the unacceptable face of capitalism, nobody understands the real reasons for this enormous concentration of wealth. Sadly no journalist does any serious analysis of any issue, whether it is fake economic figures or the state of the world economy.

Instead, all news is accepted as the truth, while in fact, a lot of news is fake or propaganda. The media is revelling in all the disclosures of offshore trusts and companies. The British Queen is being accused of having “hidden” funds. The fact that offshore entities have been used legally for centuries for privacy, wealth preservation and creditor protection purposes is never mentioned. The media sells more news by being sensational rather than factual.

Inequality is due to irresponsible monetary policy

Let me first put the facts right. It is not capitalism in its traditional sense which has created this enormous concentration. One definition of capitalism is:

“An economic and political system in which a country’s trade and industry are controlled by private owners for profit, rather than by the state”

The “controlled by private owners” part of the definition fits our current Western system. But what is missing is that the current economic system could not function without complete state sponsorship and interference. This is the clever construction that a group of top bankers devised on Jekyll Island in the US in November 1910. This was the meeting that led to the creation of the Fed in 1913. The Central Bank of the US was set up as a private bank, and thus controlled by private bankers for their own benefit.

The bankers devised what one of their forefathers, Mayer Amshel Rothschild,had preached:

From the bankers’ point of view, this was a brilliant idea. They now had total control of the money without having to risk more than a smaller part of their own capital. And the government found this system perfect for buying the people’s votes. By issuing more and more debt and allowing banks to leverage their balance sheets, the nation saw its standard of living increase significantly. More cars, televisions, holidays, iPhones, etc. Little did the people realise that their improved standards were all at the expense of massive increases in government debt and personal debt.

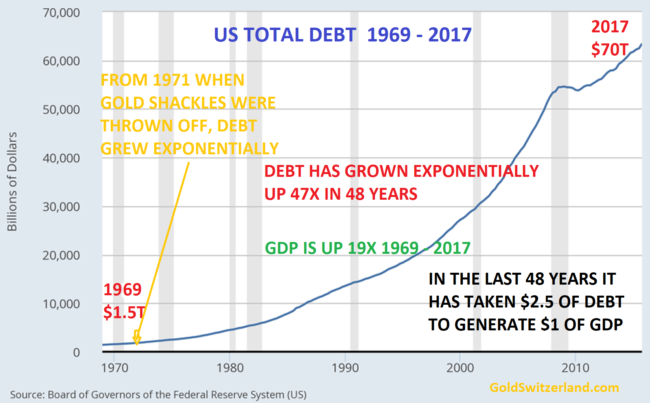

US debt up 1800x in 100 years

Total US debt in 1913 was $39 billion. Today it is $70 trillion, up 1,800X. But that only tells part of the story. There were virtually no unfunded liabilities in 1913. Today they are $130 trillion. So adding the $70 trillion debt to the unfunded liabilities gives a total liability of $200 trillion.

In 1913, the US debt-to-GDP ratio was 150%. Today, including unfunded liabilities, the figure becomes almost 1,000%. This is the burden that ordinary Americans are responsible for, a burden that will break the US people and the US economy as well as the dollar.

Whilst ordinary people have been landed with liabilities that they can never repay, the bankers and the 1% elite have profitably (ab)used the leverage that the debt expansion has created and thus amassed massive fortunes.

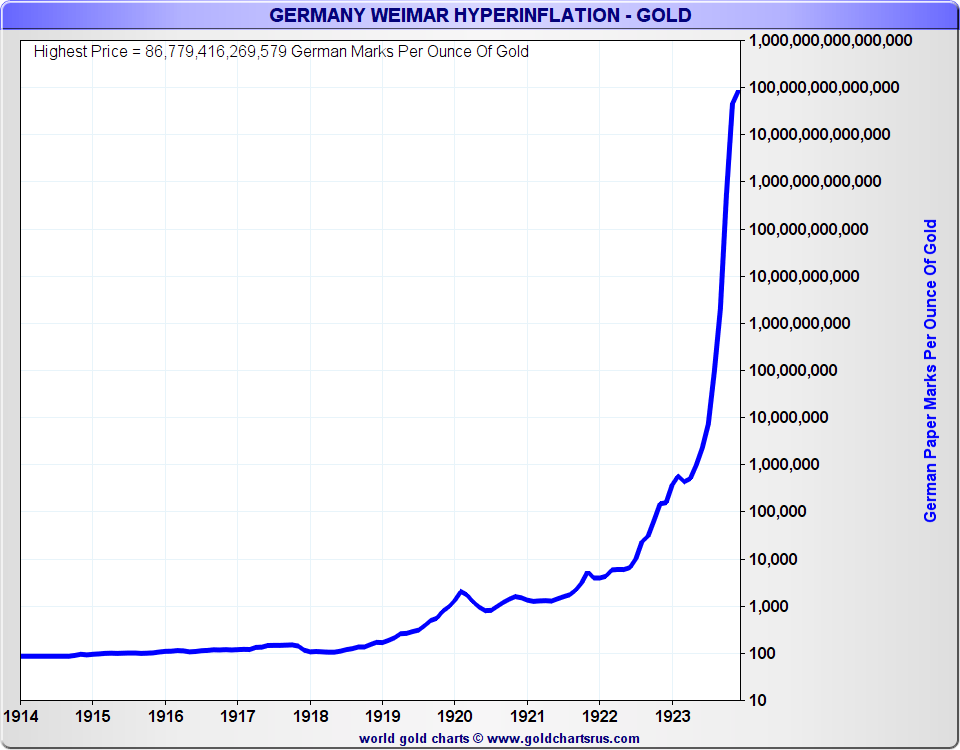

That is why we are seeing this enormous inequality in wealth. Ordinary people have not yet realised that they are liable for this debt. They will of course never repay it, nor will anyone else. Governments will try to solve the problem by printing even more money, thus exacerbating the problem. Eventually this will lead to high inflation turning to hyperinflation with interest rates going to at least 15-20% but probably higher. At that point central banks have lost total control of their interest rate manipulation.

The world will then discover that this time the money printing will have no effect as manufactured money can never create wealth.

The biggest wealth transfer in history

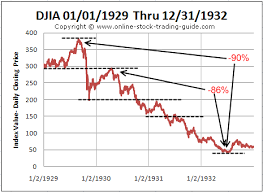

The consequences of the implosion of debt and assets will lead to the biggest transfer of wealth in history. As debt implodes, so will all the bubble assets. Stocks, bonds and property will decline between 80% and 100%. This is difficult for most people to accept but just remember that the Dow declined by 90% between 1929 and 1932. And 2000 to 2002, the Nasdaq declined by 80%.

Neither of these examples involved a global debt situation or asset bubble that we are in now. This time the world must unwind $2 quadrillion of debt, unfunded liabilities and derivatives. That is 29X global GDP of $70 trillion and therefore of a magnitude that will lead to a collapse of the financial system.

Higher taxes will not solve the problem

Governments, as well as members of the media, are discussing taxing the wealthy to create more equality. Since the wealthy, especially in the US, control the system, higher taxation will be difficult to achieve. In Europe, the socialists will most likely increase taxes for the wealthy. But higher taxes are not going to be required to solve the problem. The coming asset implosion will tax the rich much more than any politician could ever achieve. On average, the wealthy are likely to lose up to 90% of their wealth. At the same time the debt, either personal or public, that the average person is responsible for will also implode. Thus, the wealthy could lose 90% or more of their wealth, and the poor could lose their debt.

This will be the biggest wealth transfer in history. But it won’t happen without strife. There will be social unrest and possible civil war before all this is over. This was not the case during the 1930s depression, except for in Germany with the persecution of the Jews. Today, the population in the US and most European countries is not as homogenous as it was in the 1930s. The great number of immigrants in many Western countries will lead to much greater conflict and unrest than in the 1930s.

Except for the average person who is likely to become debt free after the implosion of the financial system, the major beneficiaries will be the investors who have no debt and hold hard assets such as agricultural land, commodity investments, including precious metals of course and also certain food sector investments which will benefit from food shortages and food price inflation.

A peek into the next 4-8 years

If we look at levels that various markets could reach in the coming years, they might seem totally unrealistic in today’s euphoric and exponential phase.

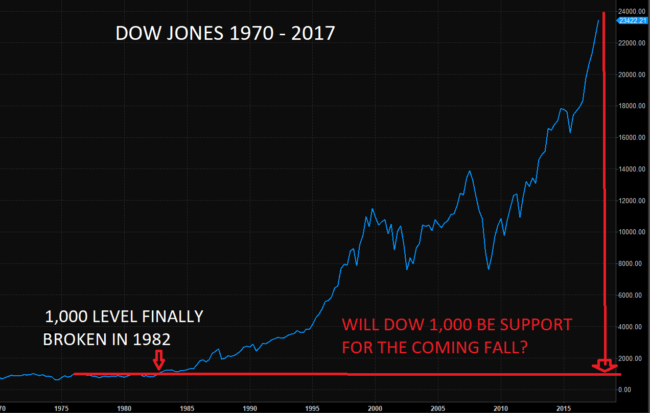

The Dow is today around 23,400. We are now in a melt-up phase that could see markets continue to go up substantially before they top. But the risk is very high, and any surprise will be to the downside.

Once the top is in we are likely to see a long and sustained secular bear market lasting many years. In the early 1980s, the Dow broke out from the 800 to 1,000 level where it had been for over 10 years. This is such a major long term support level that it seems likely to be reached in coming years. That is a 95% fall from here which is just slightly more than the fall in the 1930s.

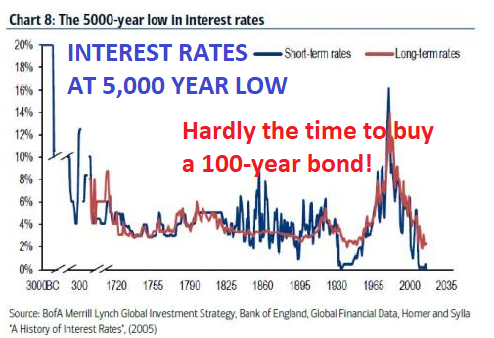

Interest rates to reach 20%

Interest rates were in the high teens in the 1970s and early 1980s, for example, in the UK and the USA. It is probable that we will see those levels again, and much higher if sovereign and private borrowers default, which is highly likely. Unlimited money printing, which will certainly take place, is also a form of default since it makes the currency worthless.

Currencies to reach ZERO

Currencies will soon start their final move to the bottom. It is not easy to forecast which country’s currency will win this race, but it could very well be the dollar since it is the most overvalued of all currencies. But it serves no purpose to measure one fiat (paper) currency against another. They are all likely to reach their intrinsic value of zero.

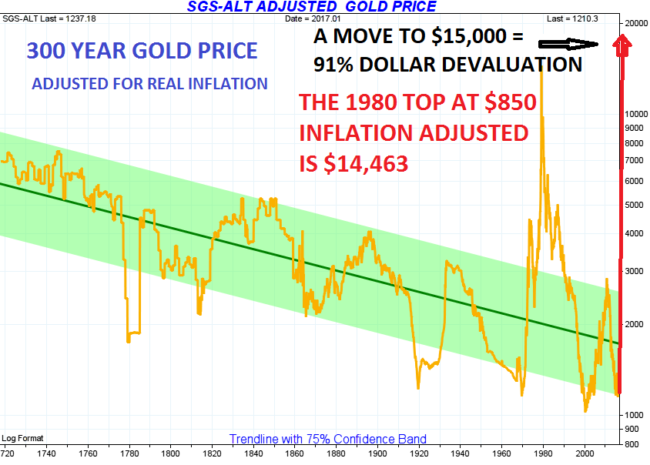

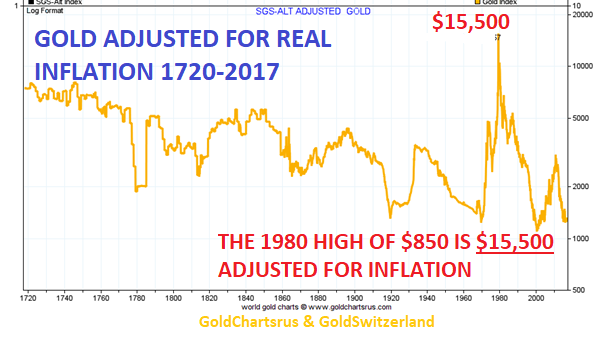

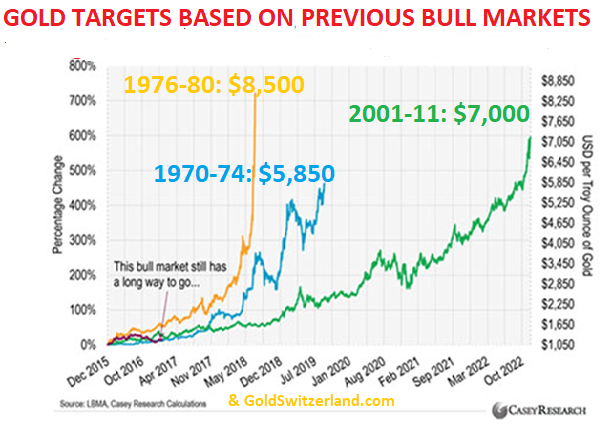

Gold $15,000 or $80,000?

The current era’s currency debasement started in 1913 and is now in its final stage. Measured in gold, the dollar has lost 98.3% since 1913. Let’s say that the dollar now starts an inverted exponential move of the same magnitude as the move in the last 114 years. As I explained in my article about exponential moves (ONLY CONTRARIANS WILL SURVIVE), these are final moves and normally happen very fast. Another 98.3% drop in the dollar would mean $80,000 for one ounce of gold. Part of that price increase is likely to be inflation, although I believe that gold should reach at least $10,000 – $15,000 in today’s money. $15,000 would be a 91% fall from here of the dollar. With hyperinflation, we can add many zeros.

When our company invested heavily in physical gold for our investors and ourselves in early 2002, gold was $300. We have obviously held on to the positions. We certainly have been right about the direction of the move, but did not expect that the final move up would happen quicker than the almost 16 years so far. Nevertheless, we are convinced that this move is still to come, and it is likely to be exponential, as I explained in my recent article.

How long this will take is obviously impossible to forecast. There are a number of factors which indicate that these major moves and changes will have happened by 2025. Cycles also point to gold having a major move into 2021. So the moves could happen within 4 years but it could take as long as 8.

Forecasting exact time and price is a mug’s (British for fool’s) game, and therefore likely to be wrong. However, what is indisputable is that global risk is currently greater than at any time in history. What is also certain is that gold is the best insurance against these risks, just as it has been for thousands of years.

STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

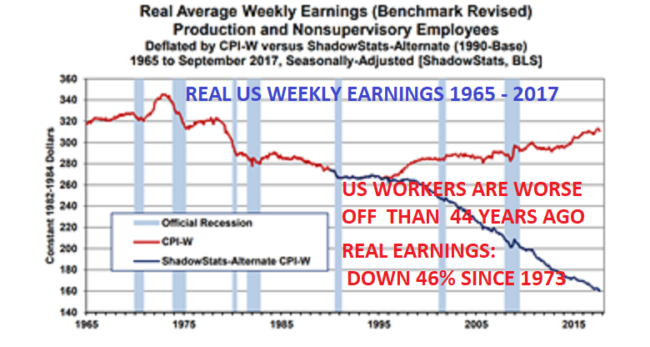

The facts just don’t add up. US wages are falling, trade deficit is at 10 year high, debt is surging so are stocks and the US Government has again managed to publish a number of contradicting employment figures that make no sense whatsoever.

A CONFIDENT BUT UNEMPLOYED CONSUMER

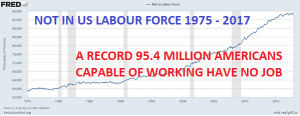

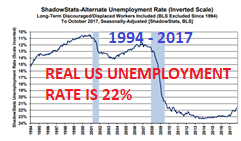

US Consumer Sentiment is the highest in 13 years. At the same time US October Household Employment Survey dropped 484,000 and the Labour Force shrank by 765,000. But due to manipulation of the figures, October payroll increased by 261,000 and the Unemployment Rate declined to 4.0% from 4.2%. The Labour Participation Rate is down to the 1977 level with only 62% of the population employed or looking for work.

How can anyone believe any of these figures which tell us Payroll increased and Unemployment declined at the same time as Employment and Labour force went down substantially. It must all be pure fantasy.

The Labour Participation rate is down from 67% in 1999 to 62% currently. The problem with the US labour statistics is that it conveniently disregards the 95.4 million people, a record level, who are able to work but are not working. The total US labour force capable of working is 256 million. Of those 161 million are actually working or actively looking for a job.

So the 95.4 million not working, many of which have given up looking for a job, represent 36% of the all those capable of working. So with fewer people working and with average workers’ real pay having declined since 1975, it is hard to understand that people in the US are feeling so optimistic.

THE CONFIDENT CONSUMER HAS STOPPED SHOPPING

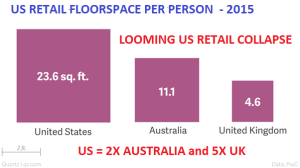

Having recently visited the US, it is difficult to understand that the US consumer is the most confident in 13 years. I visited a few shopping malls, including a major mall in Boca Raton, Florida, with all the major department store chains plus all the speciality chains. Boca is an affluent area, but still, virtually all stores were dead, with lots of staff who had nothing to do. There was only one store which was packed, which was Apple. The Microsoft store was also totally empty. The state of US retailing is clearly dire, with 5x as much retail space per person as in the UK, a country which is also over-shopped. With 6,700 planned closures so far in 2017, this industry is clearly haemorrhaging.

Retail is hit by the decline in real disposable income and also the development of online sales. Although the Amazon valuation has looked ridiculous for many years, maybe it is justified as this company eventually will have a total monopoly in many areas of retail with the exception of some specialty chains such as non-branded fashion.

THE US IS CONTINUING TO LIVE ABOVE ITS MEANS

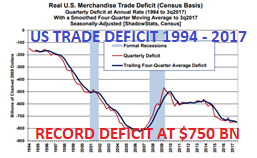

But the problem is not just retailing. The US Trade Deficit is continuing to balloon and is now at an annualised $750 billion which is the worst since 2007. Real construction spending is also declining and is the worst since 2011.

ALICE IN WONDERLAND FANTASY

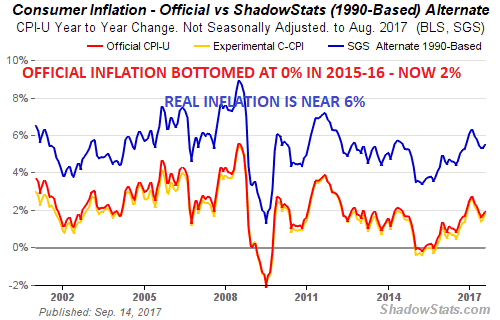

Either Americans are misled by the continuous bubble highs in stock markets or by the government propaganda, which the media, without analysis, just publishes as fact, although virtually all of it is Alice in Wonderland Fantasy. Or maybe the bullish Consumer Sentiment figures are just as fake as most of the figures produced by the government. How else can the official unemployment figures be 4% when according to proper analysis by John Williams of Shadowstatistics, it is 22%.

As the British Prime Minister Disraeli stated: “There are Lies, Damned Lies and Statistics”. But markets love these lies since they continue to drive valuations exponentially higher, whether it is the FAANG stocks or Cryptocurrencies.

EVERY WORKING AMERICAN OWES $1.5 MILLION

The US working population of 154 million have the responsibility for the US total debt which currently is $70 trillion. That excludes unfunded liabilities of anywhere from $120 trillion to $200 trillion which also must be funded.

But if we just take the $70 trillion debt, that amounts to $454,000 of debt for each person working. Adding the unfunded liabilities, we are looking at anywhere between $1.2 and $1.7 million in debt per US working citizen. Since the average US person is one wage check from bankruptcy, he is hardly in a position to pay anywhere from $454,000 to $1.7 million on an average gross wage of less than $50,000. If every working American used their gross wage to pay off this debt, it would take over 50 years to pay off, including interest and inflation. But the average American couldn’t even afford to allocate 10% of their wage to repay the debt and liabilities. Thus, Americans couldn’t even afford a 500-year repayment plan.

But the US isn’t alone. Japan and many countries in Europe are in the same situation. Global debt can never be repaid. And when interest rates increase to 10%, 15%, or 20%, which is very likely, the financial system will implode.

ELEPHANTS WILL FLY

So everyone knows that the US, like the rest of the world is bankrupt. But who cares with stock markets and Consumer Sentiment at highs. Every new President or Chairman of the Fed just hopes that nothing will happen on their watch. In the meantime, they will just print as much money as possible, so they can pass the parcel to their successors.

But at some point, the music will stop, and someone will get stuck with the parcel. And this parcel includes total debt and liabilities, including derivatives, of $2 quadrillion. Anyone who gets landed with such a parcel will print money in the quadrillions. Or perhaps he will just issue cryptocurrency-backed SDRS. Maybe the world at that point will value the 21 million bitcoins at $95 million each. This would take care of the $2 quadrillion debt. At that point, we will most likely also see elephants fly and many other miracles.

IT JUST DOESN’T ADD UP

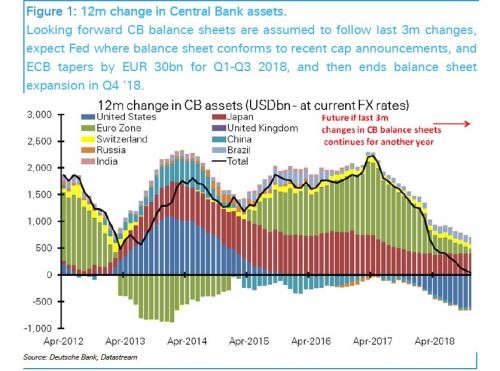

The coming global financing requirement hardly rhymes with central banks reducing global liquidity by $2 trillion by the end of 2018 and more thereafter. The coming collapse of stock and bond markets, probably starting in 2018, will force central banks to a massive about-face. But at that point, the added liquidity will have no effect. The world will then have reached a point when printing worthless fiat money will no longer have any effect. And why should it? If money printing could create real wealth, why would anyone ever work?

THE WORLD’S LARGEST HEDGE FUND

The Fed is of course not the only Central Bank that is conducting a disastrous policy. The Swiss National Bank (SNB), which used to be a bastion of safety and conservatism, is now the world’s biggest hedge fund. The balance sheet of the SNB continues to explode and is up 9% so far in 2017 as at the end of September.

The total assets of the SNB are now CHF 813 billion (same in $). That is 123% of the Swiss GDP and, on a relative basis, bigger than the central bank of Cyprus when it went under.

A massive CHF 760 billion is held in foreign currency positions. CHF 90 billion of that is in stocks, most of it in US stocks such as Apple, Alphabet (Google), Microsoft, Facebook and Amazon. CHF 670 billion is in currency speculation, mainly Euros and dollars. With stocks rising and the Swiss Franc weakening against the Euro and the Dollar, the SNB has done well in 2017 so far. But they are unlikely to get out of these positions when stocks, the Euro, and the dollar collapse, creating massive losses and more money printing. At that point, the Swiss Franc will compete in earnest with other major currencies in the race to the bottom.

No wonder stocks are going up when most central banks, including the ECB, SNB and the Bank of Japan, are printing masses of fake money and buying stocks in the $100s of billions. What they are doing should be classified as criminal, but Central Banks stand above any law, like many US investment bank chiefs.

EDGE OF THE PRECIPICE

We are standing at the edge of a precipice, and very little is required to push the world over the edge. Just like in 1929 or in 1987, it will come out of the blue with no one being prepared or having the time to react. Since markets for decades have been saved by central bank printing, investors will initially see any decline as a buying opportunity. However, any liquidity injection by central banks will have a very short-term effect. The fall in the next few years will be of the same magnitude and the reverse of the exponential moves that I discussed in last week’s article (ONLY CONTRARIANS WILL SURVIVE).

With most markets at highs, gold buying is very subdued in many countries, like the US. It is hard for investors to avoid the seductive powers of surging stocks and cryptocurrencies. But German gold buying is very strong. As usual, Russia and the East continue to absorb most of the annual scrap and mine production regardless of price.

When confidence turns, and fear returns to markets sometime between now and 2018, gold and silver will surge. Due to a lack of supply, very few investors will be able to get hold of physical gold and silver at that point. For the few who will then be fortunate enough to acquire precious metals, it will be at prices which are multiples of current prices. The time to think of wealth preservation and to buy insurance is, of course, today,y when physical gold and silver can be found at very low prices. At some point, the gold and silver price rises will dwarf the current surge of Bitcoin.

To be left behind will be a fatal mistake…

STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

We are currently standing before one of the most unique and frightening periods in history. Never have there been so many extremes in so many different areas. In the last 100 years, everything seems to have developed so much faster, including population, technology, inflation, debt, money printing, budget deficits, stock, bond and property prices, cryptocurrencies, etc.

All of these areas are now in an exponential growth phase. The final stage of exponential growth is explosive and looks like a spike that goes straight up. A spike for a major sample like the global population or the Dow never finishes with just a sideways move. Once a spike move has finished, it always results in a spike move down.

It seems that everything in the world is developing much faster today like computers and mobile phones or robots. The world assumes that this exponential growth in so many areas will continue or even accelerate further. But sadly, that is unlikely to be the case.

Exponential moves are terminal

There is a more scientific illustration of how these exponential moves occur and also how they end.

Imagine a football stadium which is filled with water. Every minute, one drop is added. The number of drops doubles every minute. Thus, it goes from 1 to 2, 4, 8, 16, etc. So, how long would it take to fill the entire stadium? One day, one month or a year? No, it would be a lot quicker and only take 50 minutes! That in itself is hard to understand, but even more interestingly, how full is the stadium after 45 minutes? Most people would guess 75-90%. Totally wrong. After 45 minutes, the stadium is only 7% full! In the final 5 minutes, the stadium goes from 7% full to 100% full.

That is the simple explanation why we are seeing this very fast exponential move in so many areas. It is, of course, impossible to say exactly when the global stadium or individual stadiums will be filled, especially since we don’t know the size of these stadiums. What we do know is that when it is full, the water level will not only stop rising, but the stadium will collapse.

We are probably now in the final minute, or probably seconds, of the move since we are in the exponential phase that has lasted around 100 years.

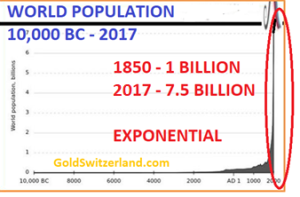

The world population do decline by 2-3 billion

If we look at a few examples of exponential growth, we can start with world population. For thousands of years global population grew very slowly but finally reached 1 billion in the 1850s. Since then it has gone up over 7x to 7.5 billion. Many “experts” now forecast that we will soon reach 15 or 20 billion.

Yes, the global population could grow slightly from here, but it is more likely that we will see a major reduction in the coming decades. It could even happen a lot faster, depending on the type of event that the world is facing. Looking at the size of the exponential move, 6.5 billion people have been added to the world population since the mid-1850s. A normal correction to such exponential growth would be 38% to 50%. This would mean that the world population could go down between 2.5 and 3.7 billion to 3.8 and 5 billion people. This clearly sounds horrendous and improbable, but looking at the chart, it is likely to happen. It is, of course, possible that we could see some further growth before the global population goes down. But the risk of the downturn starting soon is much greater than a significant further increase.

The triggers for such a major reduction could be manifold like war, epidemic disease, economic collapse leading to poverty and famine or a combination of these events.

For example, around 1340-50 there was the Black Plague that reduced the European population by up to 60% and world population by an estimated 30 to 50%.

A nuclear war between North Korea and the US would eventually involve China, Russia, Iran, Pakistan, India and many other countries and would be just as devastating, probably leading to the world population going down by much more than 60%

Likewise, a collapse of the financial system, which is not improbable, would be cataclysmic for the world.

It is absolutely clear that one or several of these events will take place in the coming years, but when exactly is, of course, impossible to say.

Eternal wealth portfolio

Depending on the magnitude of the problem, including the geographical spread, it is very difficult for normal people to prepare for it. Very few have their private jet and residences in many parts of the world. However, for people who have savings, now is the time to take defensive measures if you haven’t already. I know of a very old family wealth that, for hundreds of years, has kept their wealth in property, art and gold, with 1/3 in each. With productive land, this has, of course, been a superb portfolio and will continue to do very well during the coming downturn. Gold and agricultural land are real wealth preservation assets, whilst some art today is a bubble asset and, therefore, will suffer. However, 2/3 of the assets in this family’s portfolio are likely to perform extremely well in the coming years.

A contrarian or a risk-averse investor can today look at any chart of stocks, bonds or property, which will all tell him that we are now at extremes. On a risk/reward basis, very few investors make money by buying in the very final stages of a move. Yes, it is true that anyone who bought into the Nasdaq in early 1999 had more than doubled his money by March 2000. The problem is that more than 95% of investors stayed in at that point, and most did not get out until they had lost 50-80%.

Don’t be a victim

As the superb Chairman of Sprott USA, Rick Rule, stated at the New Orleans Investment Conference last week: “Either you are a contrarian, or you will be a victim”. The reality is that most people will be victims in the coming years. Very few will realise that what we will see next is the end of a major era or cycle of a major degree. Whether it is a 300-year cycle or a 2,000-year cycle doesn’t really matter. Historians will know afterwards. What we need to focus on today is to protect ourselves against these risks rather than to become victims.

Buy unloved and undervalued assets

Back in 2002, we decided as a company that risk in the world would accelerate in coming years and it was the right time to protect ourselves and our clients. Gold was at that time unloved and undervalued. It had been going down for 20 years and nobody was interested. Gold bottomed in 1999 at $250, having gone down from the $850 peak in January 1980.

The average investor obviously did not get very excited that gold had gone up $50 since 1999 and was $300 in February 2002. That was when we decided to put a significant percentage of our own funds as well to recommend to our investors to do the same.

This is a typical contrarian investment. You buy an asset that is on nobody’s radar screen, and in the case of gold in 2002, 65% below its peak price 22 years earlier. But it is, of course, not enough just to buy something which is cheap. What you buy must also have an intrinsic value and the potential to grow substantially. Gold’s role as the only money that has existed and survived for almost 5,000 years makes it clear that its function is likely to continue for many thousands of years to come.

Rates going from 18% to zero = credit bubble

Also, Greenspan’s easy money policy started in 1987 when Fed Funds reached 10%. With a weak economy and weak asset markets, Greenspan started his stimulative policy and lowered rates to 3% in 1992. They had gone under 2% in early 2002 when we bought gold. Eventually, rates came down to 1% on Greenspan’s watch. When Bernanke then needed to sort out the mess during the great financial crisis, rates were lowered from 5% in 2007 to 0% in 2009, where they stayed until 2015.

The continual reduction of rates from when Greenspan took over in 1987 had already started in 1981 when the Fed Funds rate was 18.5%. That was the top of a 35 year up cycle since WWII. This policy of lower interest rates for 35 years combined with credit expansion and money printing has created the biggest global asset bubble in the history of the world.

Massive excesses will be punished

We are now at the point when the world will be punished for 35 years of excesses, which is the culmination of the 100-year experiment of Fiat money started by the Fed in 1913. The $2.5 quadrillion bubble of debt and liabilities (including derivatives and unfunded liabilities) is 35x greater than global GDP and can, of course, never be repaid. The 2006-9 crisis was a serious rehearsal of what is still to come. Governments and central banks managed to deal with the inevitable collapse for a few years with a massive stimulative package.

Looking at the exponential nature of where we are now in history, it is clear that next time around, the central banks will not succeed in saving the system. Interest rates are now so low and still negative in many countries that there is very little flexibility to stimulate by lowering rates. The only tool that remains is money printing. Interestingly, central banks, who are always behind the curve, now believe that they can withdraw liquidity from markets rather than needing to add.

Central banks to drain liquidity by $2 trillion

From having added $2 trillion a year, the proposed tapering in 2019 will mean that all of this added liquidity will be withdrawn and eventually turn negative. In addition, central banks are planning to increase interest rates as inflation is starting to rise.

Anyone who has the slightest knowledge of markets knows that it is the trillions of dollars of credit expansion and money printing that have created the biggest asset bubbles in history, especially inflated stock markets. To stop feeding an addicted world with debt will not only kill stock markets but also all the other bubble markets. Addicts don’t just stop feeling good when they no longer receive their daily injections. No, they start feeling absolutely awful and go into a crisis that they seldom recover from. It is the same with the world economy. It is today totally dependent on continuous injections of credit and liquidity. Taking $2 trillion of liquidity away from a liquidity-needy world will make it permanently sick.

The biggest About Turn in history

The effect will be collapsing stock, property and credit markets, leading to panic in the financial system. That will lead to the biggest volte-face ever in global monetary history in the next 6-18 months. Central banks will panic and start printing more money than ever before. First, in the tens of trillions of dollars, leading to hundreds of trillions and eventually quadrillions of dollars as the derivative bubble blows up. The initial printing might have some short-term beneficial effects on markets. But soon, the world will realise that worthless pieces of paper or zeros on a computer can never create wealth or save the world, whatever the Keynesians or Krugman say.

Eventually, this will lead the world to hyperinflation, followed by a deflationary implosion. But the course of events will not be straight forward in this process because we will have a combination of hyperinflation and deflation simultaneously. The value of real assets, including many commodities like precious metals, food and agricultural land, will increase in value. Money will, of course, hyperinflate as it is printed in unlimited quantities, whilst stocks, bonds, and property will collapse in real-time.

Now is the time to buy what nobody is looking at

For anyone with capital to invest, this is probably one of the most interesting opportunities in history. But that presupposes that the investor is prepared to take the contrarian position. Now is the time to buy what nobody wants but which has a high intrinsic value and will benefit from the coming collapse of conventional bubble assets.

We particularly favour:

- Physical precious metals stored outside the financial system

- Precious metals mining stocks, which are of incredible value, currently

- Agricultural land in politically stable countries

- Defence industry stocks

From a wealth preservation point of view, precious metals are our favourite. When buying stocks, an investor is exposed to the financial system, the survival of which is doubtful. The only way to avoid that is through direct registration, which is difficult for most investors. Also, direct ownership of agricultural land is not practical for everyone. And if it is bought via a fund, it entails exposure to the financial system.

Thus, in our view, the biggest exposure should be in physical gold and silver, with a smaller allocation to the other areas above.

Anyone who is not prepared to take a contrarian view today, risks to be a real victim in the next 5-7 years.

STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

In the last 48 years, since 1969, an investor who put $1,000 into the Dow would today have $33,000. That is a gain of 3,200% or 7.6% annually. On the other hand, someone who put $1,000 into gold in 1969 would today have $37,000 or a 7.8% annual return. But if you add dividends to the Dow, the return is far superior at 10.7% with the dividends reinvested.

1969 seems like an arbitrary start year, but it happens to be the year that I started my first job. No one could, of course, have predicted any of those returns. The previous 48 years from 1921 to 1969, the Dow only went up 9x, but with higher dividends in that period, the total return would still have been 10% annually. Gold, on the other hand, only had one move up during that period, from $31 to $45 in 1933, when the dollar was devalued. That is a meagre 1.5x increase. Due to the gold standard, those 48 years had relatively sound money and therefore limited credit creation, except for WWII.

Although history can be an excellent teacher, it tells us nothing about the future. Very few would have predicted a 23,000 Dow 48 years ago. So, what will happen in the next 48 years? I certainly will not have to worry about that, but my children might, and my grandchildren certainly will. If I today gave my grandchildren a gift, would it be stocks or gold?

Dow 1,000 next

During the last 48 years, there were four horrendous drawdowns in the Dow of between 39% and 54%. See the chart below. Anyone who was invested in the Nasdaq 2000-02 will most certainly remember the 80% drawdown, with many stocks going to zero. Looking back 30 years at the 1987 crash, for example, I remember that day vividly. I was in Tokyo to list a UK company, Dixons (I was Vice-Chairman), on the Tokyo Stock Exchange. Not the best day for a Japanese listing. It was Monday, October 19, and became known as Black Monday. Looking back today on the chart, the 1987 41% collapse looks like a little blip. That is certainly not how it felt at the time, especially since it happened in a matter of days.

In spite of major drawdowns during the 1969 to 2017 period, the long term bull market in the Dow has continued until today when the money invested had multiplied 33X.

Back then in 1969 with the Dow at 700, if someone had said that I would experience the Dow at over 23,000 I would of course had said that’s ridiculous. Had I looked back 48 years from 1969, I would have found a Dow at 80. So the 48 years from 1921 to 1969 the Dow grew just under 9X or 4.5% per annum.

Thus based on history, the Dow should be 9X higher today than in 1969 or 6,300! So how is it possible that we are now seeing a Dow at over 23,000? Well, we have had the Wizards of Fake Money in the meantime who, with their hocus pocus, have created money out of thin air.

Debt has grown 2.5x faster than GDP

Little did I know in 1969 that Nixon two years later would change the destiny of the world for decades to come as the US came off the gold standard. By throwing off the shackles of a gold backed currency, there was no longer anything stopping the US government and the financial system from creating unlimited credit and printing infinite money.

The consequences have been a US and global credit expansion of gigantic proportions. Just in the US, credit has grown 47X from $1.5 trillion to $70 trillion.

As the chart shows, more and more printed money is needed to grow GDP. The US is now running on empty. No wonder that stocks have gone up 33x since 1969. All this manufactured money has not benefited the real economy. Instead, it has gone to the bankers and the 1% elite.

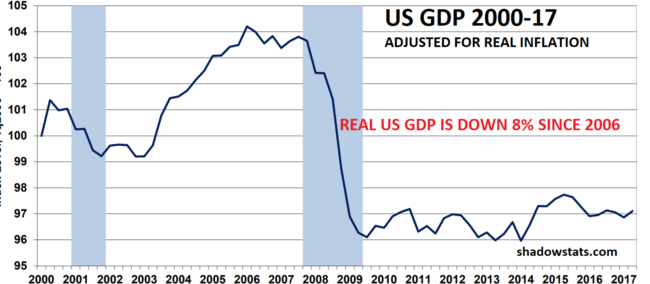

Real GDP is down 8% since 2006

But if we adjust GDP for real inflation based on Shadowstats, it looks even worse. As the chart below shows, real US GDP has declined 8% since 2006, rather than the 16% increase that the official figures show.

The US total debt in 2006 was $45 trillion and is now $70 trillion, a 55% increase. If we compare that to the Shadowstats real GDP growth, we then have an 8% GDP reduction in the last 11 years against a 55% increase in debt. Thus, however much money the US prints, it no longer has an effect.

Based on the laws of nature, this makes total sense. If you print money which is not a substitute for services or goods, it has zero value and cannot generate any growth in GDP. This has nothing to do with real money but is a certificate of fraud and deceit. The majority of the $2.5 quadrillion of debt, derivatives and liabilities outstanding today belong to that category.

Once the bluff of the world monetary system is called, all that $2.5 quadrillion will disappear into a black hole, together with all the assets that were inflated by this debt.

Gold to outperform all assets over the next 10 years

Coming back to the question of what the best investment is for the next 48 years, I have no idea. One thing is certain: gold will continue to preserve wealth and maintain purchasing power as it has done in the last few thousand years. It might not be the best investment for the next half a century, but it will certainly be a very safe investment.

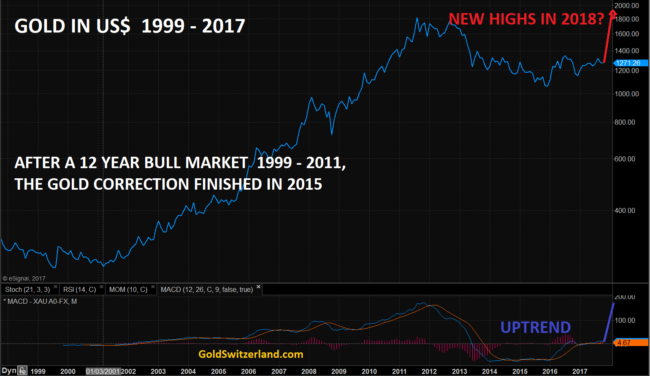

But if we take the next 10 years, gold (and silver) is likely to vastly outperform most conventional assets like stocks, bonds and property. The Dow is now the most overbought it has been in over 60 years, with gold and silver depressed by a fake paper market.

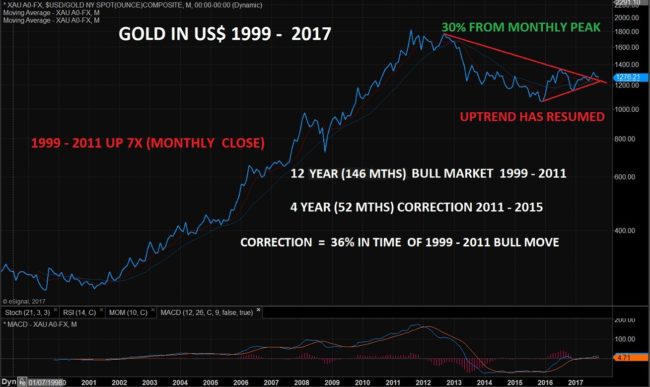

Gold has been in an uptrend for 18 years from 1999, with a 4-year correction ending in 2015. The uptrend has resumed and will soon accelerate with gold reaching at least $10,000 in today’s money. But we are likely to have funny money in the next few years as governments print 100s of trillions or quadrillions of dollars in their futile attempt to save the financial system. This will take the gold price to levels which seem unreal today, whether that is $100s of millions or trillions. In real terms, those levels are meaningless. What is more important is that gold will preserve purchasing power and save people from total wealth destruction by holding bubble assets or money in the bank.

So to me it is totally clear that I would advise everyone who has capital to preserve to put it into gold today. This is also the best gift to give to your children and grandchildren as long as they save the gold for at least 5 years or longer.

Dow to fall 97% against gold

Finally, the chart confirms that this is a unique point in history to turn a massively overvalued stock market into the best wealth preservation insurance that anyone can buy.

The Dow / Gold ratio crashed by 87% from 1999 to 2011. After a weak correction, the ratio is still down 60% since 1999. Thus, gold has vastly outperformed the Dow over the last 18 years.

The current correction up of the ratio could go slightly higher but it is now very stretched and the downside risk is massive. I expect the ratio going below the 1980 level of 1:1 and probable overshooting to 0.5. That means a further fall of the Dow against gold of 97%.

Most major stock markets around the world are now more overbought than ever in history. Exponential moves of this nature can extend but when it turns, the move down is likely to come out of the blue, like in 1987, and be very fast and extremely punishing.

Thus, the decision is really easy. The risk of holding bubble assets like stocks, bonds, and property is now at a historical extreme. The easy and correct contrarian investment is to hold gold (and some silver). This will not only save investors from total wealth destruction but also create incredible opportunities to buy bombed-out assets with gold at 3 cents on the dollar.

Investors must not miss this opportunity of a lifetime.

STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

The dollar is dead, but the world doesn’t know it.

It has been a slow death, and the final stages will be very painful for the US and for the rest of the world. The US empire is finished financially and militarily.

Nixon was convicted of the wrong crime

It all started with the establishment of the Fed in 1913 and escalated with Nixon. For anyone old enough to still remember him, they will think about the Watergate scandal. This was corruption and bribery at the highest level in the Nixon administration, including the president himself. In order to avoid impeachment, which would have been a certainty, Nixon resigned. All this broke out 11 months after Nixon’s disastrous decision to take away the gold backing of the dollar on Aug 15, 1971. Nixon should not have been impeached for the Watergate scandal, but for his decision to end the gold backing of the dollar. That disastrous decision is what will lead to a total collapse of the world economy and the financial system, starting sooner than anyone can imagine.

De Gaulle understood gold

By 1971, the US had already been running chronic budget deficits for 10 years consecutively. At the end of the 1960s, President de Gaulle of France realised what would happen to the dollar and demanded payment in gold instead, which was his right. This led to Nixon closing the gold window since this was the only way that the US could continue to live above its means. And this is exactly what the US has done for more than half a century now. Not only have they run a real budget deficit every year since 1961, but also a trade deficit every year since 1975.

The unholy trinity

Three things have allowed the US to do this: 1) The dollar being the reserve currency of the world, 2) The Petrodollar system. 3) Having a mighty military machine.

But the rest of the world now knows that the weakening US empire is losing out on all three fronts. The dollar has lost 50-70% against most major currencies in the last 46 years. And against gold, nature’s only permanent money, the dollar has lost 97% since Nixon’s fatal decision.

The US military’s superiority has been crumbling for many years. In spite of military spending higher than the next eight biggest countries together, the US has not been successful in any military action for decades, from Vietnam, Afghanistan, Iraq, Libya and many, many more. This weakening of the US military power will make it impossible in future to enforce the petrodollar. The US attacks on Iraq and Libya were a result of these countries’ intention to abandon the petrodollar.

China and Russia understand gold

China and Russia are now seeing what de Gaulle saw in the late 1960s. They know that it is only a matter of time before the dollar will lose its status as reserve currency. They also know that before this happens, the dollar will start crumbling and eventually disappear into a black hole resulting in an implosion of all the dollar assets and debts.

China and Russia will orchestrate the end of the dollar

China and Russia are not waiting for this to happen. They are actually going to orchestrate the fall of the dollar, not by attacking the dollar itself but by killing the petrodollar. China will start to trade oil in yuan with Russia, Saudi Arabia, Iran, Turkey, etc. All these countries are now negotiating a number of agreements to facilitate the trading of oil and other commodities in yuan and rubles. These agreements cover a wide area, such as a new payment system and Forex trading between Russia and China, as well as gold imports by China from Russia.

The intention of the Trump administration to repudiate the Iran nuclear agreement and to impose new sanctions will further strengthen the resolve of these countries to abandon the petrodollar. Sadly, it is also likely to lead to yet more terrorism in the West.

This is all happening at a much faster pace than the world is realising. And this time, the US cannot do anything about it. Because the US is unlikely to attack China, Russia or Iran. A US attack with conventional weapons on any of these countries would be guaranteed to fail. The US wouldn’t stand a chance except in a nuclear war, which would be the end of the world as we know it.

A bankrupt Europe

But it is not only the US empire which is crumbling. The decadent socialist system in Europe will not survive either. Socialism works until you run out of Other People’s Money. And this is happening fast in many European countries. Greece is totally bankrupt and should have defaulted on its debts many years ago and introduced a new devalued Drachma. This is the only way that Greece can ever progress and prosper. Instead, the EU insisted on them staying and imposed yet more loans that Greece will never repay, leading to massive poverty and misery for the Greek people.

In addition, Brussels has forced them to process a massive number of migrants, which Greece can ill afford. The same goes for Italy with its massive debt-to-GDP ratio and crumbling economy. But it doesn’t stop there, Spain, Portugal, France, Ireland, and the UK are all economies with massive debts. Since these debts can never be repaid, there are only two alternatives: either a default by the ECB and most European countries or money printing on a scale that the world has never seen. The likely outcome is that we will see both options. First money printing by the ECB in the €100s of trillions and then default, as the Euro becomes worthless.

The Eurocrats in Brussels, including the European Commission, are only interested in protecting their own position. Their main concern as unelected and unaccountable representatives of 500 million people is to hold their empire together at any cost. What they are doing is not for the good of the European people, but rather to serve these bureaucrats’ self-interest. The Brussels elite is more concerned about their own massive expense accounts and pensions than the Greek or Irish people.

The saboteurs in Brussels

The European Commission in Brussels, with Junker leading, is now doing all it can to sabotage the Brexit decision by the UK electorate. They just can’t stand that anyone breaks ranks in this very unholy alliance. Interestingly, the word sabotage, derives from the industrial revolution in Belgium when the workers threw their “sabots” (clogs) into the new machines that were taking their jobs away. So the Brussels tradition of sabotage is not a new phenomenon.

The EU – a failed experiment

The EU is a failed experiment that will eventually collapse. So will the Euro which is an artificial currency that can never work for 19 Countries with different backgrounds such as growth and inflation rates, productivity, industrialisation and cultures.

The dollar is likely to fall before the Euro as they both compete in the race to the bottom. Just think about it, here we have the two richest regions in the World, North America and Europe, both on the verge of collapse, economically, financially, politically and morally. How can anyone ever believe that all the bubble assets can survive under those circumstances? Well, they won’t. That is absolutely guaranteed. It is only a question of how soon it starts and how deep it will be. The sad thing is that no one is prepared for it, and it will be a devastating shock to the whole world.

A world of lies

Having just flown from Europe to the US, I watched “The Wizard of Lies”, the film about Bernie Madoff. This was a $65 billion Ponzi scheme that went on for at least 20 years without being discovered. The combination of gullibility (returns 10-12% every year without fluctuations), greed and vested interest led to very few ever questioning this massive fraud. Banks, brokers, asset managers, introducers and investors all loved it and therefore no one suspected foul play.

Just like the world never questioned the massive Madoff Ponzi scheme, no one ever questions the $2 quadrillion (including derivatives and unfounded liabilities) Ponzi scheme in which the world is now involved. Madoff was a saint compared to what the world is now being subjected to. So why is no one protesting, and why does everyone believe that this will continue? Well, for exactly the same reasons that they believed in Madoff – Greed and Vested Interest. Governments, central bankers, bankers, fund and asset managers and investors don’t want anyone to cry wolf. The whole world wants this wonderful Ponzi fraud to go on forever. But it won’t. Instead, it will come to a very abrupt end in the next few years, and no one will be prepared.

Investing with the herd – the road to the precipice

Currently, investors love the stock markets around the world, and why shouldn’t they? Everyone is making so much money, just like with Madoff, that their greed prevents them from looking at the risk.

For investors who don’t worry about risk, the current period is absolute heaven. Stocks, bonds, property and bitcoin just go up and up and up. You just can’t lose! Whatever investors touch today turns into gold. But it isn’t real gold. The winnings today are fake gold in the form of inflated and heavily leveraged paper assets. Like all bubbles, this can continue further. But whenever it turns, and we are not far from that point, the move in the opposite direction will be so fast that it will be impossible to get out. Also, like for most of the last 30 years, investors will be certain that central banks will save them. But this time it will really be different because the next round of trillions or quadrillions of paper money will only have a very short-lived effect. At last, the world will understand that printed pieces of paper that governments call money are really worthless.

The coming collapse in all bubble asset markets will therefore be greater than the 80% fall of the Nasdaq in the early 2000s and greater than the 90% fall of the Dow in the 1930s.

Most investors will laugh at this in disbelief. We will see who has the last laugh.

The contrarian road to wealth protection

With Nasdaq up 5x since 2009, investors are oblivious of risk. Silver on the other hand is down 65% since 2011. The chart below shows the Silver / Nasdaq spread. Silver has crashed against the Nasdaq since 2011 and is almost down to the 2001 level when the silver price was $4. This spread is likely to have bottomed and the next move should be back to the 2011 high – a 450% move.

Wealth preservation investors should, of course, not go short Nasdaq (the bubble can get bigger), but if they get out of their stocks and buy silver, they are likely to avoid the most massive wealth destruction in the next few years.

Gold is expected to vastly outperform Bitcoin

Bitcoin is continuing its meteoric rise and is almost at $6,000. This is a massive speculative bubble and like all bubbles, it can get bigger before it bursts. But this has nothing to do with wealth preservation. The price explosion in Bitcoin has been spectacular. Just in the last two years it is up 25x! Once gold and silver start to move, we are likely to see a similar price explosion. But the big difference is that the precious metals represent real wealth preservation and tangible wealth.

I might sound like the Roman Senator Cato, who always finished every speech with “Praeterea censeo Carthaginem delendam esse.” – “Furthermore, I consider that Carthage should be destroyed.”

I also always have the same message for an oblivious world, which doesn’t realise what will hit them:

To avoid total wealth destruction, buy insurance in the form of physical gold and silver while there is still time. When history’s biggest Ponzi scheme is found out, it will probably be impossible to get hold of physical gold and silver at any price.

STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

Don’t store gold in a Swiss Bank or in any bank in any country. We regularly see examples both in medium-sized and large Swiss banks that should make bank clients very concerned. Here are some examples:

- A client stores gold in a Swiss bank, but when he wants us to organise a transfer to private vaults, the gold doesn’t exist, and the bank must acquire it.

- 400 oz gold bars that were bought by the bank for the client in 2005, were cast in 2011, so the gold never existed.

- A client stores gold in a Swiss bank of the highest reputation. The client has a statement that he owns physical gold. When he asks to inspect the gold, he is told that he can’t.

- The client is told he owns physical gold and silver, but actually only has paper metals.

- Swiss banks are also doing all they can to stop clients taking their gold out. One major bank refuses to transfer gold out if the client isn’t present. Another major bank recently told the client that they don’t transfer client gold out of the bank to anyone, even if the client demands it.

- Swiss banks tell their clients that physical gold and silver stored in the bank vaults on behalf of clients is not on the bank’s balance sheet and based on Swiss law it belongs to the client. Yes, that is correct but how many times have we not seen that banks under pressure use client assets as security for their trading, especially when they are under pressure?

All of the above examples are first hand direct experiences by our company and therefore totally factual. It is not hearsay or rumour spreading – it is all fact.

We are obviously not saying that our experiences above are the norm for gold storage in Swiss banks. But what we are saying is that we have seen too many examples from many reputable banks to trust any bank, Swiss or foreign, or to feel comfortable with risking storing gold inside the commercial banking system.

Store gold and silver outside the banking system

Gold and silver are wealth preservation assets. Therefore, they must not be held within a rotten and massively leveraged financial system. Physical gold and silver must be held in the most secure private, segregated vaults outside the banking system and with personal access to the metals by the beneficial owner.

It is obviously no use to own a share in one or many 400 oz gold bars. Gold investors must have their own bars and preferably of smaller denominations like 100 grams or 1 oz. If gold is ever needed as money or barter, 400 ounce or even 1 kilo bars are just too big.

Switzerland probably has the best political system in the world, and the economy is very well run. Just a pity that the Swiss National Bank and the Swiss banking system have totally abandoned the old type of Swiss Banking, which was based on conservatism, service and personal liability. Previously, the partners in the Swiss private banks were personally liable for the bank’s balance sheet. If all banks in the world were run on that model, there would seldom be a financial crisis. Banks would be run with prudence and conservatism. But instead, we have a system with bank management leveraging the capital hundreds of times, if derivatives are included. Profits are then privatised and losses are socialised, i.e. picked up by government or depositors. The old Swiss banking model was superb, but was totally destroyed by the US government going after many Swiss bankers and asset managers. Interestingly, no one has gone after the management of all the major US banks, which have cost the world $10s of billions in 2007-9.

As I discussed in a recent article (PHYSICAL GOLD – THE ONLY PENSION FUND TO SURVIVE), the Swiss National Bank is the world’s biggest hedge fund, and the Swiss Banks are too big for the country. This is sadly the result of the US model, as well as greed, having taken over the Western financial system.

The Swiss banking system is 5- 6 times the Swiss GDP, which is too big for the country. This was the size of the Cypriot banking system when it collapsed in 2013. Sadly, Swiss banks are as risky as all major international banks and not the place to store gold and silver.

Swiss economy – the best in the world

On the other hand, if you look at the Swiss economy and political system, it is probably the best-managed country in the world. Just recently I had real evidence of events that happen in no other country. The Swiss VAT (value added tax) rate will be reduced from 8% to 7.7% as of January 1st, 2018. We also received a letter from our office landlord in Zurich stating that the rent would be reduced. In what other country in the world are taxes and rent reduced? None of course, since everything goes up in line with debt creation and money printing. But not in Switzerland because it is a well-managed country, ruled by the people and not by an irresponsible government.

The VAT reduction was the result of a recent referendum, rejecting a VAT increase to finance state pensions. The government-backed proposal was kicked out by the Swiss people, and as a result, rather than increasing VAT to 8.3%, it was reduced to 7.7%. In the rest of Europe, a VAT reduction is unheard of. VAT started as a low sales tax in many European countries and gradually increased to levels of 20-27%. Not only has no other country lowered VAT, but every time any tax is increased, the people have no say. Taxation is decided by parliament in most countries.

The system of direct, but decentralized democracy in Switzerland makes it the best managed country in the world. Government has less power than in any other Western country. The position of President changes every year among the 7-member coalition cabinet. The Role of the President is ceremonial.

The Swiss Parliament meets 4 times per year for three weeks. The daily sessions during that time are relatively short. That is a total of 12 weeks that the elected members need to “run” the country. This is refreshingly short compared to most other nations in the world. Much of the political and fiscal direction of the country is determined by the Cantons (local States), which also receive most of the tax revenues. Therefore, Switzerland is an excellent geo-political choice for holding safe-haven assets, but these benefits cannot be seen by simply storing gold in a Swiss bank.

The gold correction has finished

For many people who own gold, the wait seems very long for the gold price to reflect the massive money printing we have seen since 2007. Yes, it is true that gold in US dollars has looked lacklustre since 2012-2013. But we must put that into perspective. The dollar has since 2014 strengthened within its long-term downtrend. The dollar’s temporary rise most probably finished at the beginning of 2017, and at some point, in the next few years, it is likely to hit a black hole and disappear into oblivion as China, Russia, and other countries kill the Petrodollar.

But even with a temporarily strong dollar, gold has performed very well, even when measured in dollars. After having gone up 7x (monthly close) between 1999 and 2011, there was a 4-year correction to 2015. In time, this correction was 36% of the 1999-2011 period which is very near the normal Fibonacci 38% period that would be expected. So although it has seemed long, it is timewise what would be expected.

Gold in dollars is still 30% off the monthly high close but that gap is likely to be closed fairly quickly.

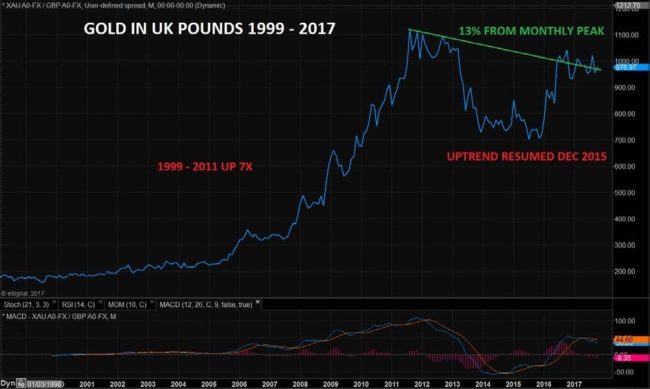

If we look at gold in other currencies, the correction was both shorter and smaller.

In Canadian dollars for example, the correction took only 2 years to 2013. The gold price in Canadian dollars is today only 11% off the monthly closing all-time high.

The picture is the same for gold in UK Pounds. The price is only 13% from the monthly peak in 2011, and gold in pounds is now on the way to new highs.

Thus in most currencies, except for in dollars, gold has performed very strongly both in time and in price. The uptrend is clear and it is not a question of if but when gold will break out to new highs. Whether that happens in 2017 or 2018 is really irrelevant. What is certain is that this next move up is virtually guaranteed to happen.

Gold is massively outperforming the Nasdaq

Finally, let’s look at gold vs the Nasdaq. Between 2000 and 2009, Nasdaq fell 93% vs gold. In spite of a 5-fold increase in the Nasdaq index since 2009, the correction against gold is minimal since the Nasdaq vs gold is still down 70% from the 2000 peak. Whether this cross turns down this year or next, once it turns, we will see a fall of at least another 93% and probably more, just like in 2000-2003.

Clearly, no stock market investor believes that such a dramatic fall is possible. But back in January 2000 nobody believed that the Nasdaq index would fall 80% within 2 years either, or that it would fall 93% vs gold.

The shock that will hit investors in stocks, bonds and property in the next decade will be totally devastating. It is sad that so few understand that there is insurance available that will totally protect them from this shock.

There is no better insurance against the coming calamities than physical gold. Don’t store gold in a Swiss bank, though.

STRONG GOLD IN 2018 vs NEW WORLD CURRENCY

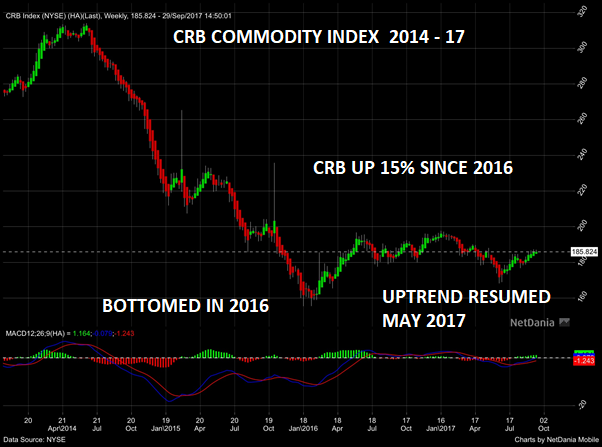

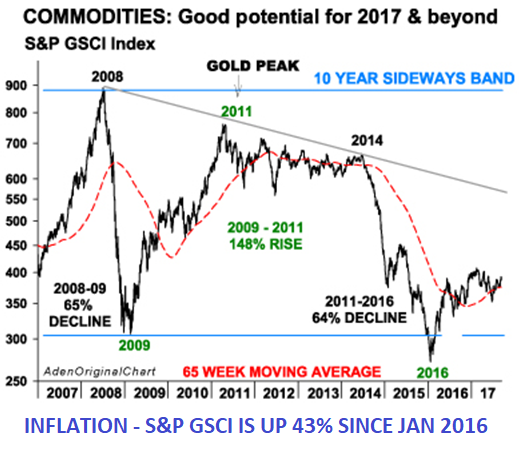

Inflation is coming and it will have a major effect on the world economy and financial markets. This is one of the factors that will drive gold to levels which few can imagine today. Later in this piece, I am discussing 10 Factors which will make gold surge.

No fear

Markets are expressing no fear and seem very comfortable at or near all-time tops. There is no concern that stocks are massively overvalued or that bond rates are at historical lows and only have one way to go. Nor is anyone worried that house prices are at levels which most people can’t afford. Money printing and interest rate manipulation have created such cheap financing that most people don’t look at the price of the property but only at the financing costs. In many European countries, mortgages are around 1%. At that level, the monthly cost is negligible for many people. Neither the banks nor the borrowers worry about interest rates going back to the teens as in the 1970s.

So whilst we are waiting for markets to wake up from the dream state they are in now, what signals should we look for and what about timing.

These are the areas that we see as critical, and below are our near-term and long-term views on: