Ukraine War Headlines: Tough Talk + Real Math = Bad Options

In the tragic backdrop of the Ukraine war, we consider the hard yet ignored math of failed financial systems which restrict (and hence weaken) otherwise stronger political options and make the sad road ahead a path straight toward gold.

Despite tough-talking headlines, sanction cries and moral grandstanding, we discover that the West’s policy choices (including a break from Swiss neutrality) are not as strong as they appear.

The Sum of All Evils

War is the sum of all evils; there are few greater tragedies than the clashing of swords.

Carl von Clausewitz famously described war in the 19th century as a mere extension of politics by other means. In my view, war is just a failure of politics by obvious means.

And as the West points a moral figure at Putin, we take no sides, but simply wonder where those same fingers (and headlines or sanctions) were when the U.S. was invading country after country for years. Remember those Iraqi WMD? Or did Uncle Sam get that wrong? Just saying…

In short, those in glass houses should be weary of tossing stones…

And as we see below, failed economic systems, driven by debt, make nations weak and hence reduce their political options precisely when stronger options are most needed—as in times of war.

In a 21st century nuclear era, military realism ala Clausewitz is not only a precursor to “mutually assured destruction” (or “MAD”), but an exercise of simple insanity.

Assuming this is understood by all major powers (Moscow to DC), the real war ahead will be as much financial as it is military; sadly, however, the West is not as financially strong as its headlines would otherwise have us believe.

Get Ready for More Money Printing

First, expect a continuously dovish Fed.

In recent months, we’ve openly argued that any forward-guided Fed taper, once instigated, would inevitably reverse course from hawk to dove the moment risk asset markets began to tank as rates shot higher.

Then came the war in Ukraine.

We believe any escalation of this war will greatly reduce the Fed’s prior options and abilities to taper into a growing conflict.

From the bond pits of M. El-Erian to recent Fed member tweets, it is now generally agreed that even a 50 basis-point Fed rate hike is looking less and less likely for 2022.

Wars, whether fought with tanks or sanctions, have costs; and countries, already up to their ears in record-breaking levels of debt, can’t afford rising rates.

History, moreover, reminds us that monetary policy always loosens rather than tightens as wars drag on.

Get Ready for Tanking Currencies

War, moreover, is not kind to fiat currencies.

Looking first at Ukrainian and Russian currencies against the USD, both are already tanking on cue; the EUR will likely follow this trend, especially if this war in Ukraine drags on, which no one wishes.

In fact, a longer war will be bad news for the entire spectrum of global, mouse-clicked currencies which, as a whole, will continually weaken against harder assets in general and gold in particular.

(Needless to say, a drawn-out conflict will also be a tailwind for industrial and defense stocks.)

Get Ready for More Misleading Headlines from On High

In addition to more money printing and currency debasement, expect a lot more propaganda masquerading as “free world” news.

Last Wednesday’s Russian invasion of the Ukraine, of course, is now replacing the increasingly discredited Covid narrative in every tweet and headline.

As is often the case, more can often be gleaned by what is not said than what is said when it comes to increasingly politicized media sources, West or East.

Ignoring the Hard Math

What the current headlines are missing goes well beyond politics, inflation or national values.

As always, the boring but hard math of global debt is entirely absent from the recent political chest-puffing and tough-talking headlines.

Unfortunately, and as we quickly discover below, financial weakness greatly impacts/constrains policy options, especially, and most importantly, during times of conflict.

Long before Putin began rattling sabers with a potential war in Ukraine, math was still math and debt was still debt, which means the West in general and the US in particular, are not as tough as their talk.

Specifically, the U.S. fiscal nightmare is still a nightmare and the True Interest Expense on Uncle Sam’s bar tab (Treasury spending and entitlements) is still an open yet almost entirely media-ignored cancer as Putin becomes the bad guy de jour.

Whether we like it or not, US tax revenues can’t keep up with Uncle Sam’s spend and borrow addiction, which means the US is not in a particularly strong position to save itself, let alone the Ukraine.

Sadly, debt time bombs like the kind ticking in the land of the world reserve currency makes certain policies (like more money printing and deficit spending) quite easy to predict.

Today, with talk of sanctions and war costs adding to its bar tab, the nearly $90T of total US debt will not allow the Fed even a 50-basis point rate hike, not to mention anything even remotely resembling the “Volcker-like” rate hikes of the past.

Yet to hear pre-war pundits, bankers and even certain Fed members puffing their chests and clamoring for such good ol’ days of hawkish courage was either 1) an open comedy of optics replacing honesty, and/or 2) just plain ignorance replacing math.

(War) Debt Matters

Debt, I’ll repeat and repeat again, limits choices.

Sovereigns in the US and around the world are staring down the barrel of over $300T in global debt. War will only make that suffocating number much higher.

This means already-debt-soaked nations will return to more rather than less QE for the simple and mathematical reason that they have too much debt and not enough GDP, which in turns means more magical, mouse-click money is needed to fill the gap.

In the US, for example, GDP will never grow fast enough to cover its unprecedented debt levels.

As David Hume reminded us as far back as the 18th century, once a nation’s debt to GDP ratio crosses the 100% Rubicon, growth mathematically stalls by a 1/3.

How Nations Decline: A + B

But if American leaders and CEO’s currently talking tough on war sanctions want to learn even more about the origins of this unprecedented debt to GDP nightmare and American decline, they can start with their bathroom mirrors.

In fact, the history of US economic (and hence global) decline is as simple as A + B (and a little bit of G, D, P, Q and E).

GDP, or Gross Domestic Product, is all about the “P”—namely that once-familiar and now forgotten thing our forefathers called “Production.”

Production, after all, is kind of important, and comes from, well, actually producing things.

A. Corporate Self Interest at the Expense of National Interests

Unfortunately, the vast majority of American CEO’s decided long ago (and with Clinton’s help) to offshore once American-made production/manufacturing to places (think China) where labor was cheaper and hence corporate profits/margins richer.

Net result?

Millions of hard-working Americans lost jobs, millions of underpaid foreigners took them, and a tiny handful of overpaid executives got richer than King Solomon (or Jeff Bezos?) as GDP flatlined.

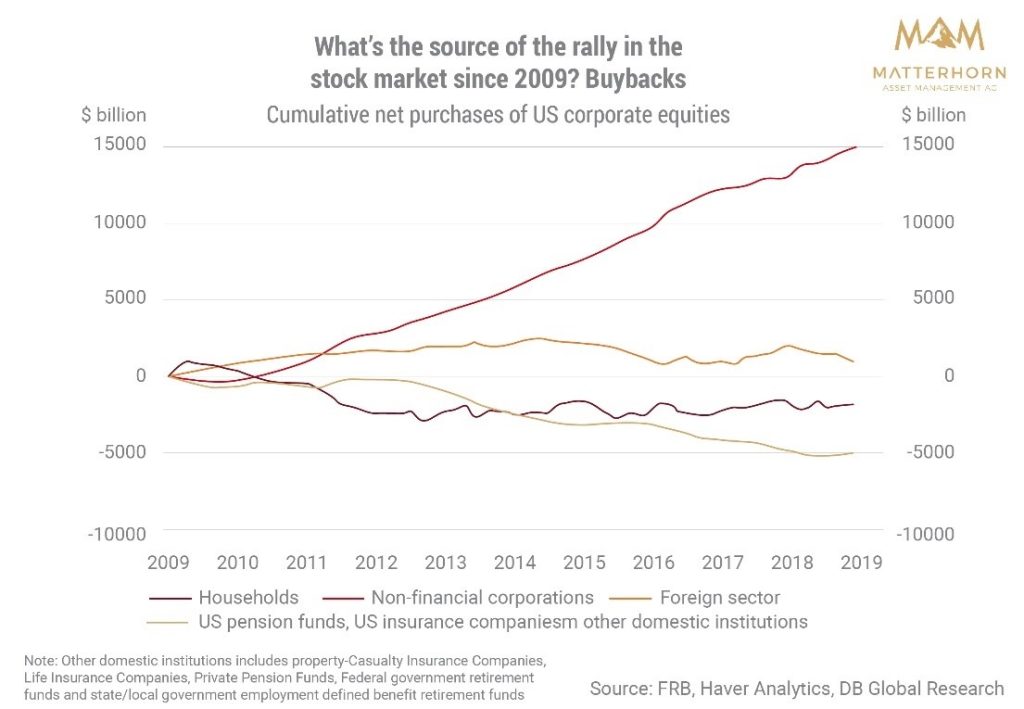

In the meantime, most of those same CEO’s made the equally selfish and short-sighted decision to use cheap debt to borrow free money.

What did they do with this easy/hot money?

Simple: They used it to buy-back their own shares, which did wonders for shrinking the share pool and artificially inflating their bullish earnings per share data—and hence their own salaries, which are driven by share prices.

Such C-Suite greed explains the not-so-honorable motives behind this generational move from US productive leadership to US global decline.

As I’ve written elsewhere, such “leadership” practices are not signs of healthy capitalism (which I adore) but a kind of post-modern feudalism (which I abhor).

B. Central Bank “Accommodation”/Fraud

And if you want to know how debt became so seductive to these self-interested executives, you can thank Alan Greenspan and every Fed Chair that followed for stapling interest rates and the cost of debt to the historical floor for decades.

And that, in a nutshell, is how debt, executive greed and Fed complicity kills GDP and sends nations into decline at a time when the horizon is now filling with gun smoke.

In short, expect more not less money printing down the road—it’s the one thing the debt-soaked U.S. does best as letters like G, D, & P are replaced by more Q and E.

Declining Nations Have Few Options

Turning back to the war in the Ukraine, we now see how our past financial sins have left us weaker precisely at times wherein we needed to be strong.

Despite this cold reality, the woke media channels of the West are all buzzing with reports of how we will out-sanction, out-squeeze and outlast Mr. Putin, who has warned for years that a Ukraine/NATO deal would be a declaration of war.

Now the West acts surprised as Putin does precisely what Kennedy’s advisors wanted him to do in Cuba.

Such chest-puffing feels good, and according to many familiar political faces, also seems possible.

Well, think again.

Boris Johnson Puffs His Chest

Despite recent tough talk from Boris Johnson and other Western leaders to eject Russia from the SWIFT international payments system, certain financial realities rather than just political words need to be considered.

In fact, in 2015, even U.S. President Obama warned that such moves would/could weaken the USD’s global reserve status and the global economy as whole.

That is, kicking Russia out of the USD-denominated SWIFT system would simply give Putin more reason to find other markets and currencies to trade in (think CNY, or even gold, of which Russia and China have been quietly stockpiling).

Such a move would destabilize the USD and hence just about everything else—from inflation data to bond markets.

Just saying…

Condoleezza Rice Puffs Her Chest

Back in 2014, I remember watching the former US Secretary of State (and Russian specialist?), Condoleezza Rice, declare on German TV that “the Russians will run out of cash before the Europeans run out of energy.”

As an American-educated Yank who spent half his life in Europe, such declarations provide moments of both perspective and cynicism, as Americans like Ms. Rice tend to believe that Europeans think and behave as US politicians wish.

Rice’s comforting bravado, of course, is full of that great American pride (arrogance) of which I am all-too familiar.

She sure sounds tough and smart, no?

Unfortunately, however, and almost a decade after making this bold declaration, Ms. Rice may wish to update her Russian math and European Zeitgeist.

For example, Russia’s FX reserves (i.e., “cash”) are sitting at all-time highs today.

Also, while the West spent years going full-on crazy with their money printers, Putin was taking notice.

And being the chess-player that he is, he started buying gold. Lots of gold…

Net result? Rice got her “cash” warnings wrong. Russia’s FX reserves are far stronger than her words:

But what about Rice’s alleged expertise on European energy needs?

Well, wrong again…

Since 2018, for example, the Netherlands began reducing rather than expanding natural gas production in Groningen.

Rice may also want to brush up on her German, or least the latest translations from Reuters, who (along with Robert Habeck) will remind her that Germany (the economic centerpiece of the EU) gets 50% of its coal, 55% of its gas and 35% of its oil from, well…RUSSIA.

For this reason, Germany’s Chancellor, Olaf Scholz, has not been puffing his chest as much as Boris Johnson et al, and, at least as of this writing, will still be purchasing natural gas from Russia’s Gazprom via Ukrainian pipelines.

The fact, moreover, that Germany’s economy recently dipped back into recessionary territory as its PPI inflation levels hit a 40-year high of 25%, leaves it with very few realistic sanctions/options (or tough talk) going forward.

Energy Realpolitik

With the US now at peak debt, can it really afford a financial game of chicken with Russia?

In this regard, Putin may have more leverage than a now completely politicized main stream media (MSM) would otherwise have us believe.

For example, should Biden decide to sanction the word’s biggest energy exporter (i.e., Russia), he may want to ask himself (or at least those who decide for him) if the U.S. can afford such financial warfare and a super-spike in energy markets—and inflation as well?

Putin, of course, understands the debt pickle in which the U.S. has placed itself. As I’ve said elsewhere, Putin is many, many things, but regardless of what the rest of the world may think, he’s not stupid.

Like a chess player, he sees the long game and not the short moves of the checkers board where many of our western journalists (and policy makers) appear most comfortable.

Putin knows, for example, precisely what the President of the Council on Foreign Relations recently admitted, namely: Sanctions against Russia ignores their built-up reserves of foreign currencies, which benefit from higher oil prices.

China’s Open Arms?

The MSM, of course, loves to signal courage, virtue and click-bait at the expense of math, facts, or even a basic understanding of history.

The revered Economist, for example, bravely shows a beleaguered Putin as having painted himself into a corner:

But with all due respect to even The Economist, think again.

Western sanctions against Russian energy will simply push Putin’s oil exports into the arms and currency of the Chinese.

CNY’s (i.e., Yuan) would replace USDs in a large swath of the former Petro-Dollar denominated energy market, which would immediately act as a self-inflected gun-shot wound to the chest of the USD rather than a threat to the Russians.

Taken as a whole, all the chest puffing—from Boris to Biden–ignores these colder realities of the USD’s teetering reserve status, oil market realism (and inflation), Sino-Russian chess skills and record-breaking US debt constraints, all of which act like a cannon-ball chained to the ankles of Western policy options, which can now offer little more than tough words if it wants to avoid a financial Armageddon.

See how debt, math and reality interfere with effective policies and choices in times of war?

Assuming those in power today are at least wise enough to see the insanity of nuclear war, a military conflict in Ukraine and Europe will likely degrade into a financial war, which means an already weak global financial and currency system is about to get weaker.

Got gold?

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD