Matt's Publications

Telling You What Powell Won’t: He’s Seeking Inflation, Not Fighting It

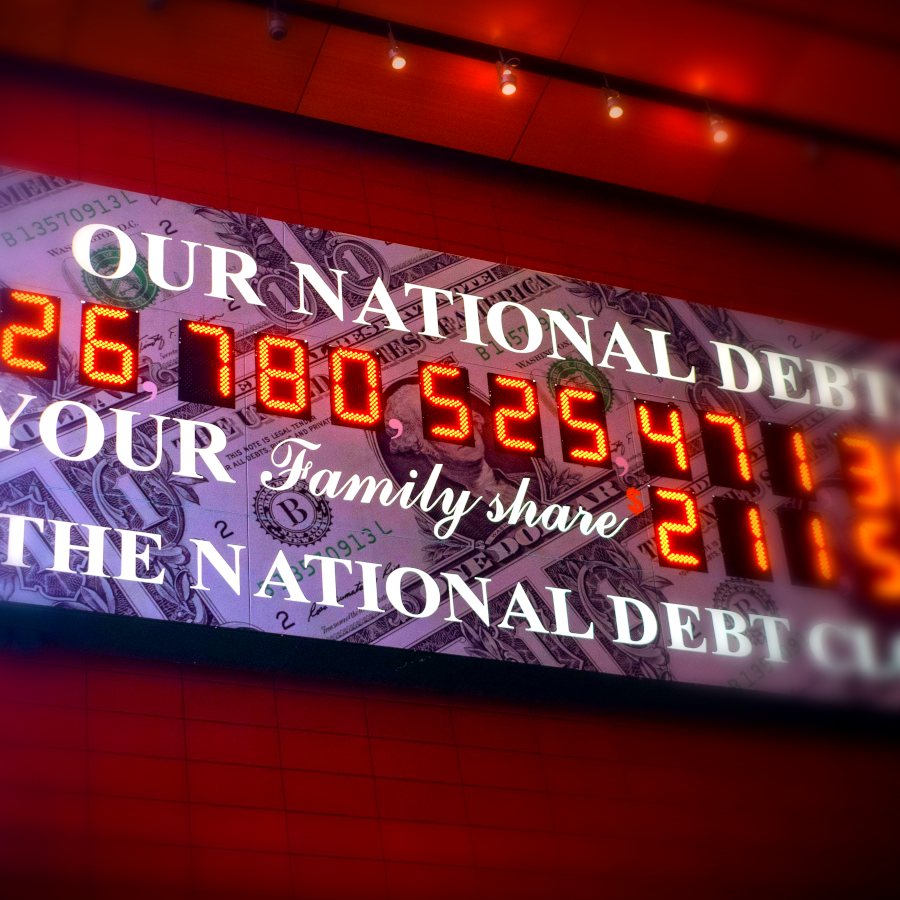

With global debt at $300T+, and combined U.S. corporate, household and public debt well past $90T, the Fed’s “face-saving” attempt to raise rates as a weapon against 9% reported CPI inflation is a fai...

Matthew Piepenburg / July 19, 2022

Read More

Paper Gold Price Manipulation—Rigged to Fail

The current and open fraud regarding the paper gold price in the COMEX market is now as plain to see as the open desperation in the global financial system, which is unraveling in real-time all around...

Matthew Piepenburg / July 11, 2022

Read More

The U.S., Just Another Inflation – Seeking Banana Republic

Whether we wish to admit it or not, the so-called “Developed Economies” in the U.S., Europe and Japan are really nothing more than debt-broke economies, veritable banana republics. This means their e...

Matthew Piepenburg / July 6, 2022

Read More

Fatal Macro Warnings: We’re Gonna Need a Bigger Boat

The 2008 crisis (bubble) was limited to real estate; today, we are in an everything bubble, from meme stocks, inflated bonds and over-priced housing to bloated art, over-paid celebrity chefs and pricy...

Matthew Piepenburg / June 7, 2022

Read More

The Handbook for Debt-Soaked Nations: Lie, Print, Inflate & Finger-Point

As we have warned from the very onset of this otherwise avoidable war in Ukraine, the backfiring of Western sanctions against Putin (de-dollarization, inflationary tailwinds and increasingly discredit...

Matthew Piepenburg / May 24, 2022

Read More

Politicized Money and the Death of Capitalism

Everything, including money, is politically-self-serving rather than economically free-market. Capitalism is dead. The folks in office to “save you” are mostly interested in saving their positions and...

Matthew Piepenburg / May 11, 2022

Read More

Dark Forces, Plain Speak, Brighter Gold & The Fed’s Sick End Game

As usual, the end game will boil down to yield curve controls and more money printing, which means more currency debasement and a central bank system that secretly (and historically) favors inflation...

Matthew Piepenburg / April 22, 2022

Read More

Gold vs. An Openly Failing/Changing World

As central bankers play checkers on a global debt chessboard, we see below how policy hypocrisy, worsening monetary options, failed diplomacy, tanking bonds, rising rates, debt addiction, mismanaged s...

Matthew Piepenburg / April 13, 2022

Read More

Sanctions Spur a Massive Decline in Western Hegemony as the World De-Dollarizes

Matthew Piepenburg, sits down with Tom Bodrovics of Palisades Gold Radio to discuss the seismic shifts in the global financial system now emerging in the wake of Russian sanctions and the implications...

Matthew Piepenburg / April 1, 2022

Watch Now

How the West Was Lost: A Faltering World Reserve Currency

Debt destroys nations, financial systems, markets, and currencies. Always and every time. The inflationary financial system is now failing because its debt levels have rendered it impotent to grow eco...

Matthew Piepenburg / March 30, 2022

Read More

Why Gold Will Rise — The Financial System Has Changed

As the world focused keenly on Ukraine, few noticed the extent and magnitude to which the entire world financial system changed overnight. The consequences of this titanic shift are difficult to overs...

Matthew Piepenburg / March 16, 2022

Read More

Ukraine War Headlines: Tough Talk + Real Math = Bad Options

Taken as a whole, all the chest puffing—from Boris to Biden—ignore the colder realities of the USD’s teetering reserve status, oil market realism (and inflation), Sino-Russian chess skills and record-...

Matthew Piepenburg / March 2, 2022

Read More