Articles

5 Signs that Gold Will increasingly Flow to the East

The reshaping of the world economy and the global (political) order is in full swing. It is a long process, the concrete outcome of which is uncertain in advance and associated with numerous impondera...

Ronnie Stoeferle / October 13, 2023

Read More

The Economic Future is Sad, Simple & Already Obvious

The foregoing title may seem a bit sensational, no? With all the recent hype about a gold-backed BRICS currency emerging from this summer’s South African meet-and-greet vanishing like oar swirls, one...

Matthew Piepenburg / October 8, 2023

Read More

A SICK US PATIENT WITH A $100 TRILLION DEBT

The health of the world economy is clearly linked to the health of global leaders. That clearly raises the question if unhealthy leaders create a diseased economy or if an ailing economy creates sick...

Egon von Greyerz / September 25, 2023

Read More

Real BRICS Threat + The Worst Macros I’ve Ever Seen

In many recent articles and interviews, I’ve warned that Powell’s “higher for longer” war against inflation will actually (and ironically) lead to, well… greater inflation. That is, the rising intere...

Matthew Piepenburg / September 17, 2023

Read More

Rising GDP + Rising Yields = A MAJOR Sign of “Uh-Oh”

Have you heard the good news? The Atlanta Fed GDPNow estimates a 5.9% growth in real GDP for Q3 2023. In nominal terms, we can even boast of an 8.9% surge. What fantastic news! Growth! Productivity!...

Matthew Piepenburg / September 3, 2023

Read More

When Baseballs & Guitars Say More Than Pundits

Before I got the invite to a swank prep-school out East, I used to spend my Spring afternoons on a baseball diamond not too far from the home field of Derek Jeter, who was still playing local ball in...

Matthew Piepenburg / August 20, 2023

Read More

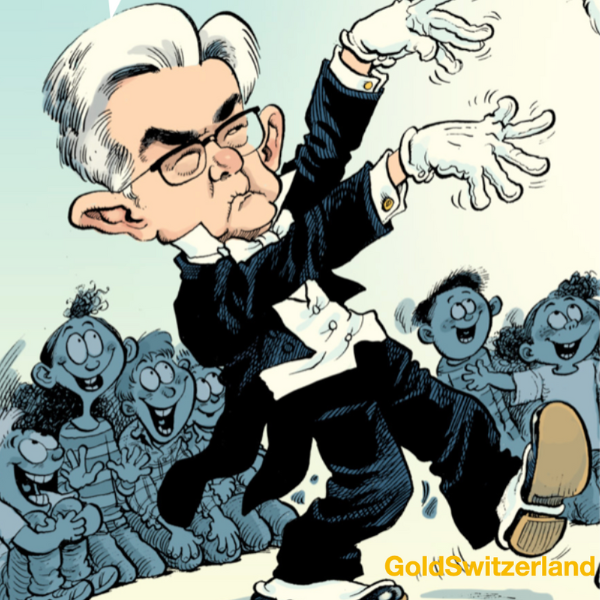

POWELL’S ABRACADABRA INFLATION TARGETING

The Fed has two mandates - Maximum Employment and Price Stability If we look at price stability, the Fed has failed miserably. The Fed employs 3,000 people in Washington DC of which 300 have a Ph.D...

Egon von Greyerz / August 13, 2023

Read More

Keeping Your Head Amidst Debt-Blind Madness

I recently blew the dust off an old Rudyard Kipling poem, “If,” which many have castigated as a bit overly romantic, despite its high praise from Mark Twain and T.S. Eliot to India’s Khushwant Singh....

Matthew Piepenburg / August 6, 2023

Read More

The BRICS Won’t Kill the Dollar, US Policy Will

Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.” Net conclusion: The real death of the USD will be domestic not foreign.

Matthew Piepenburg / July 24, 2023

Read More

A CATASTROPHIC DEBT IMPLOSION CAN BE INCREDIBLY QUICK

Will the world experience a catastrophic debt implosion? Just like the Titanic Submersible that recently imploded, the global debt bubble can implode “within just a fraction of a millisecond”. More l...

Egon von Greyerz / July 17, 2023

Read More