MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

The time has now come for the 99.5% of financial assets which are not invested in gold, silver or precious metals mining stocks to grab both the investment and wealth preservation opportunity of a life time.

Making that decision before it is too late is likely to determine your financial and also general wellbeing for the rest of your life!

If you have already joined that exclusive group of 0.5% of global financial assets which are invested in precious metals, you understand what is coming.

But if you belong to the group that neither understands precious metals nor holds any, it might be worthwhile to continue reading.

More about this opportunity later in the article.

FROM A DEBT BASED WEST TO A COMMODITY BASED EAST AND SOUTH

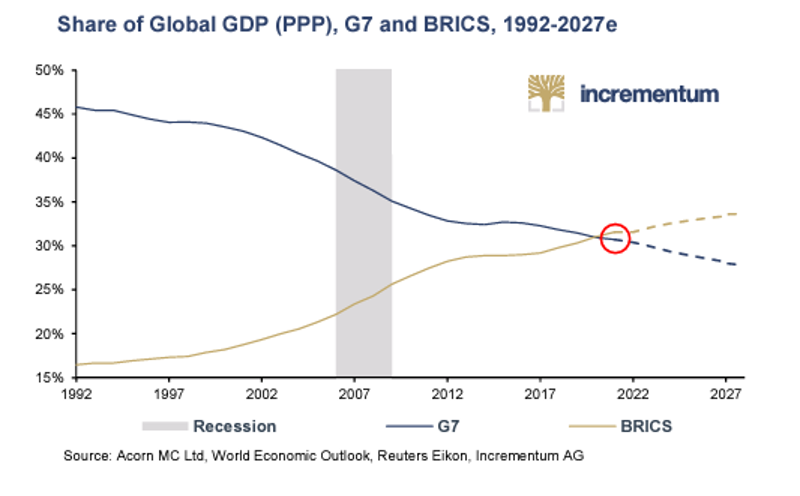

As the Western Empire is breaking up currently, the Eastern & Southern Empire is gaining ever more significance. More than 30 countries want to join the BRICS and many also the SCO (Shanghai Cooperation Organisation). There is also the Eurasian Economic Union (EEU) which exists since 2014 and consists of several ex Soviet Union States.

The enlarged group will consist of more than 40 countries and represent around 2/3 of global population and 1/3 of global GDP. As I have written about in the article “A disorderly reset with gold revalued by multiples”, this is the area which will experience the fastest growth in coming decades as the West gradually declines/collapses under its own deficits and debt burden together with political and moral decay.

The Russian Foreign Minister Lavrov has just announced that Iran will join the SCO on July 4 and that Belarus will also become a full member. There is a virtual SCO meeting on July 4 chaired by India. It seems like more than a coincidence that the meeting takes place on the US Independence Day!

The BRICS meeting in Johannesburg takes place on Aug 22-24 with Macron trying to gatecrash. But he was rejected. Macron is devious and has always tried to ride several horses simultaneously.

But BRICS is not interested in opportunists happy to turn with the wind of success.

At some point, these three groupings might be merged into one, with gold playing a central role. I don’t expect that there will be one gold backed currency at a fixed parity but rather that gold will float at a much higher value than currently with a link to BRICS currencies.

So as the West and especially the US licks its mortal wounds the East is looking forward to the coming feast.

THE DOLLAR IS NO LONGER AS GOOD AS GOLD

There was a time when the US dollar was “As Good as Gold” and until 15 August 1971, sovereign nations could exchange dollars for gold at $35 per ounce.

But sadly most leaders whether of countries or corporations eventually resort to GREED when real money runs out. So this is what Nixon did in 1971 when he closed the gold window.

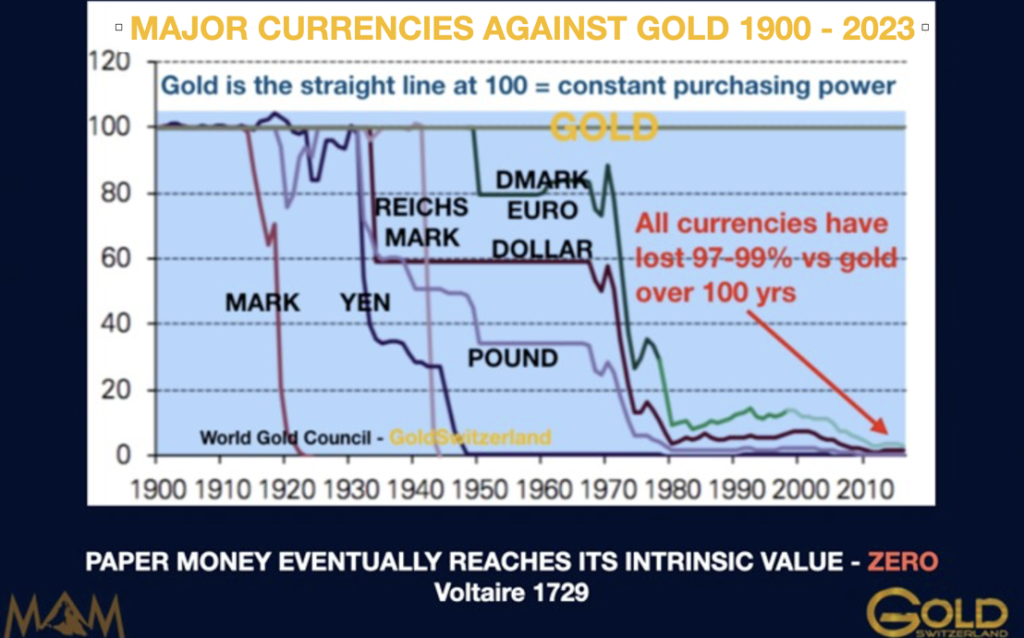

In spite of falling 98% in real terms since 1971, the dollar has remained both the preferred reserve currency and also the currency of choice for global trade.

The two principal reasons why the dollar hasn’t yet died is that virtually all other currencies have declined by similar percentages. Also the astute introduction of the Petrodollar in 1973-4, the brainchild of Nixon’s secretary of state Henry Kissinger, played an important role in convincing Saudi Arabia ( the dominant oil producer at the time) to sell oil in dollars against a package of US weapons and protection.

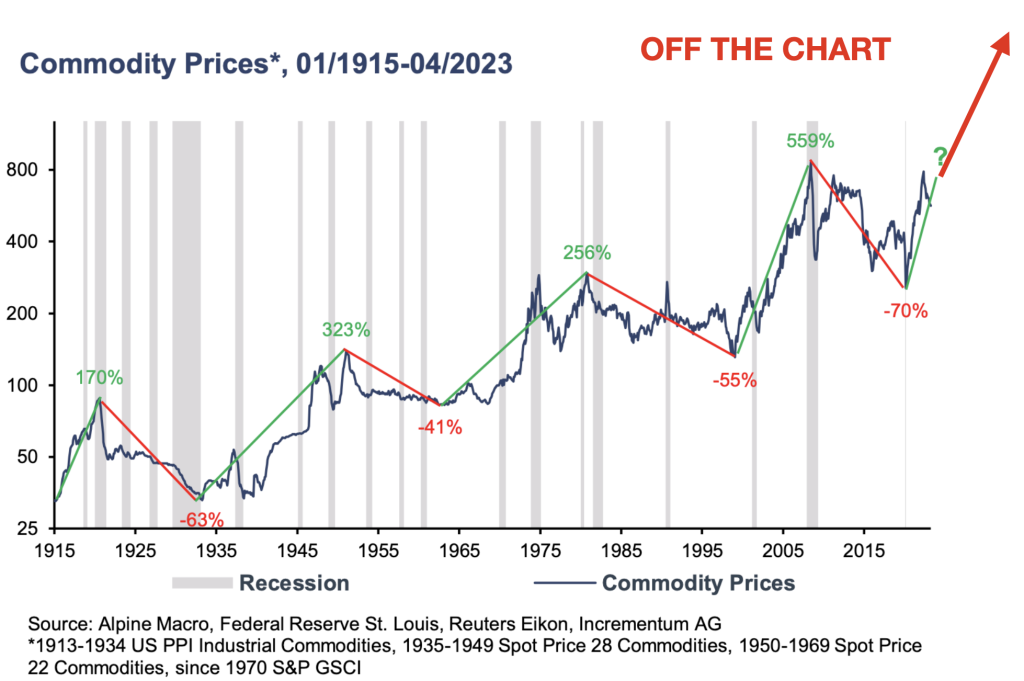

As the West now sinks in a quagmire of debt, corruption and decadence, the world will experience a tectonic shift away from fiat/fake money with zero intrinsic value to currencies backed by commodities with gold playing a central role.

WHERE HAVE ALL THE STATESMEN GONE

The West has not got one single statesman who can pull it out of the swamp. Many countries are now turning to the right like Italy with Meloni and Spain also probably swinging right in July with the Partido Popular and the far right Vox party. Macron is extremely unpopular and Le Pen now leads the opinion polls with 55%. Scholz in Germany has also failed badly and the Nationalist AfD is now ahead of the ruling social democrats in the polls.

The UK is currently the only major country that is likely to turn to the left at the next election in 2025. No one believes in the weak Sunak and Labour leader Kier Starmer is the clear favourite to win. But sadly he is not a statesman either.

So with a motley crew of weak leaders in Europe, things don’t look any better if we look west to the US. Sadly, the US hasn’t got a leader at all. It seems that Biden has got his strings pulled by an unelected and unaccountable team around him. This is an extremely vulnerable situation for what has been the mightiest country in the world. A major military power without a leader is very dangerous.

As President Eisenhower said in the 1950s:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist. We must never let the weight of this combination endanger our liberties or democratic processes.”

As empires die, weak leaders are the norm and seem a necessary condition to exacerbate the inevitable collapse.

So we can all speculate about the outcome of the current crisis in the West and how it will all end. These situations seldom consist of individual events but are normally processes that take a number of years or even decades.

We must remember that we have already seen half a century of decline since 1971 so we are now likely to experience an acceleration of the process. As I have pointed out above, it is not just the decline of the West which is happening in front of our eyes, but also the emergence of an extremely powerful cooperation of 40 plus countries which will drive a global commodity based expansion on a scale never seen before in history.

Just take Russia. With $85 trillion of natural resource reserves, they will play a major role in this real physical asset expansion as long as the country holds together politically, which I would expect.

Remember that the massive global shift which is about to start is not based on personalities. Leaders are instruments of their time and the right leaders will emerge in most countries to bring about this tectonic shift.

DON’T TOUCH SOVEREIGN DEBT, EVEN WITH A BARGEPOLE

So how will ordinary investors in the West protect and enhance their assets in a world which is on the cusp of major shifts financially, economically and politically?

Well let’s first look at what not to do.

As I have stressed for many years, it is not a matter of maximising returns but minimising risk. After the biggest global asset bubble in history, the everything collapse will be vicious and take down many investments that have been regarded as safe as sovereign debt. See my article “First gradually and then suddenly – the Everything Collapse”.

Take US government bonds or treasuries. For years I have never understood how someone can invest in a “security” which is created by just snapping your fingers. This is how a senior Swedish Riksbank (central bank) official described to a journalist where money comes from. So whether we call it mouse-click money like my good colleague Matt Piepenburg or finger-snapping money, both expressions clearly tell us that we live in a hocus-pocus world where money is unlimited and can be created by snapping your fingers.

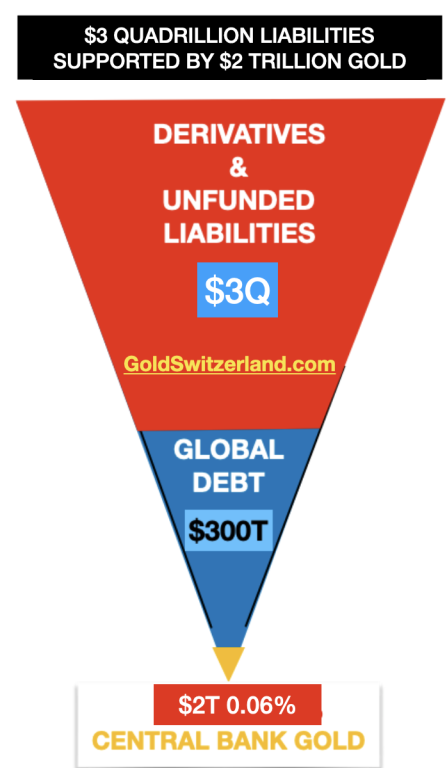

Oh yes, we mustn’t forget the additional $2+ quadrillion of quasi debt or liabilities in the form of derivatives. I have argued many times that a big part of these derivatives are likely to become debt as central banks create liquidity to save the financial system from a an implosion of these financial instruments of mass destruction as Warren Buffett calls them.

I have long argued that holding Western sovereign debt is financial suicide. Lately some big names agree with me whether it is Jamie Dimon of JP Morgan- “Don’t touch US bonds”- or Ray Dalio the very successful hedge fund investor – “It would take 500 years to get the money back”. Yes, but what money I wonder??

Firstly, whether it is the Fed or the ECB, their balance sheets are insolvent and no one can ever get real money back. At best it would be another worthless debt/money instrument like CBDC (Central Bank Digital Currency) that would lose 99-100% over 1 to 50 years. Not the best of odds to say the least.

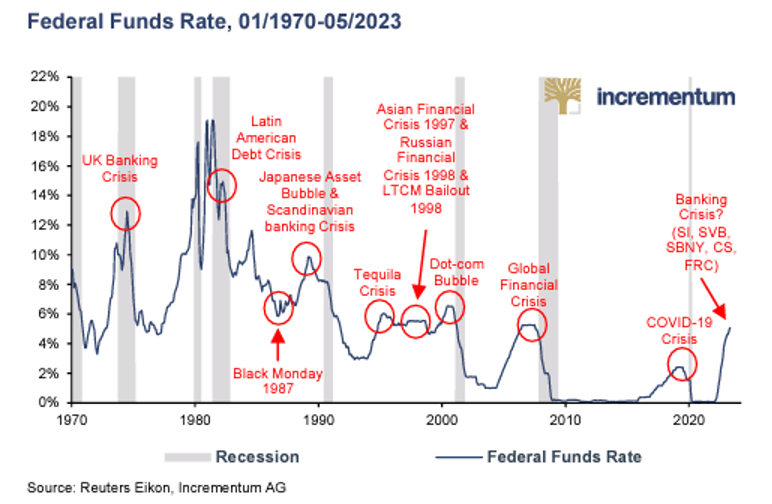

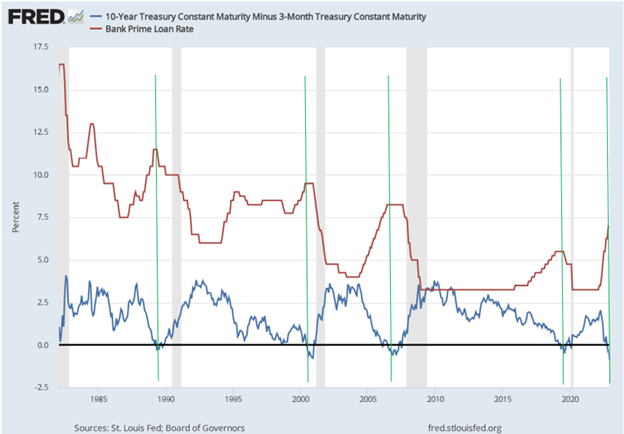

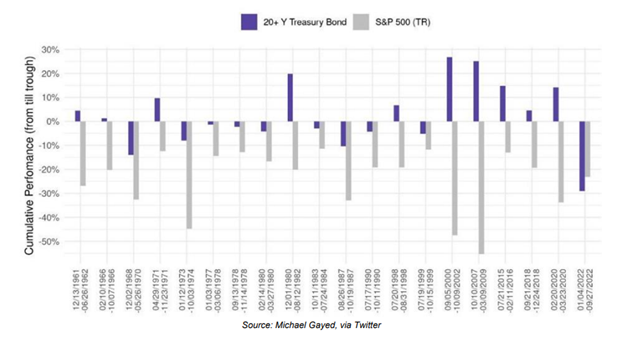

The US 10 year treasury bond peaked in 1981 at just below 16% after a 39 year downtrend it bottomed in 2020 at 0.55%. That was the bottom of the interest and inflation cycle. We will now see higher inflation and rates for decades. But it obviously won’t be a move without major corrections and volatility.

As major central banks are pressing for higher rates, one wonders if they are aware of the consequences. Because in a debt infested world, higher rates mean a high risk of default, both private and sovereign.

But in their normal style, central banks will be behind the curve and realise their misdemeanours once the system has collapsed.

NB: The only buyer of US treasuries will be the Fed as the rest of the world runs away from the US poisonous debt chalice. It’s like passing the parcel when you can only pass it to yourself.

OPPORTUNITIES OF A LIFETIME COMING

So buying anything commodity based will be a clear growth area for decades. In this group is not just commodity businesses but companies that supply the commodity companies with software or hardware.

In addition to the precious metals market whether physical or stocks, we see the potentially most interesting areas being oil and uranium.

We have been in the physical precious metals market for almost 25 years for wealth preservation purposes. During that time gold has gone up 6-12 times in most Western currencies and silver slightly less.

As the premier company for bigger wealth preservation investors in physical gold and silver, outside the financial system, we have had a very exciting journey so far.

But looking at the last 23 years I am very clear that in spite of greater returns in physical gold than most investment classes and much lower risk, the real moves haven’t even started yet.

I have never seen a more obvious situation during my soon 60 years in investment markets.

Although some of the precious metals mining stocks will vastly outperform physical gold and silver, we will stick to what we know best in order to serve our esteemed clients as well as future wealth preservation investors.

In coming years, most investors will lose a major part of their investments and net worth as they hold on to their conventional investments.

For a quarter of a century I have been standing on a soap box, imploring investors to protect their wealth. During that time we have seen The Nasdaq lose 80% in the early 2000s and the financial system being a few minutes from implosion in 2008.

But with the help of finger-snapping $10s of trillions into existence, most markets have remained strong. Still, the (almost) Everything Collapse is hanging over us and this time finger-snapping money into existence is unlikely to help.

WHEN SHOULD YOU NOT HOLD GOLD?

You should not hold gold when:

- There are no deficits and there is a balanced budget

- There is negligible or no inflation

- There is no debasement of currencies

- There is strong statesmanship based on real longterm values

When that day comes, we will also see flying elephants as well as flying central bankers with wings!

But just like Icarus, the son of Daedalus in the Greek mythology, these bankers will crash!

Anyone who has held a major part of his wealth in physical gold, in any country, in this century has achieved an excellent return and still has his gold asset intact. He has also been able to sleep well at night.

Although picking the right precious metals stocks can lead to an opportunity of a lifetime, we will still recommend that investors keep the majority of their funds in physical gold and silver, stored in the right jurisdiction and in the safest vaults with direct access to your metals.

That way investors avoid many risks like:

- Custodial risk, your shares held in a fragile financial system

- Political risk, mines are often in risky countries),

- Fraud, corruption, Doug Casey can tell you about this. Read his book Speculator

- Financial risk, many companies will run out of cash

Still I would advise even the cautious investor to hold some gold and silver stocks or a fund or an index, since the upside is substantial.

NO MAJOR GOLD DISCOVERY FOR YEARS

There has not been a major gold discovery for 4 years.

Major gold discoveries over 1 million ounces:

1990s – 180

2000s – 120

2010 to 2018 – 40

2019 to date – 0

Not only do we have peak oil but also peak gold. So the world is facing a vicious a cycle of increasing energy costs leading to higher costs of extracting precious metals and other commodities.

This confirms that high inflation is here to stay, leading to higher interest rates and very high risk of debt defaults within the private and sovereign sectors.

To hold US dollars is to hand your wealth to the state which is likely to either debase it, lose it, spend it, confiscate it or misappropriate it in any other way.

Why would anyone trust a government like the US which currently is doing all of the above things.

And don’t believe that the Euro will fare better.

The only way to be in control of your own money is to hold it in physical gold outside your country of residence in private vaults.

The trust in the US and the dollar is now coming to an end after the confiscation of all Russian assets. Who would want to hold their assets under the control of a government what can just steal it at will.

So we are not facing a dollar crisis. Instead, the dollar and its issuer is the crisis. No one who is worried about preserving his wealth would ever consider holding it in a crisis currency, controlled by a crisis government.

I find it fascinating that the JP Morgan who has become a joint custodian of the GLD gold ETF is planning to move the gold to Switzerland. This confirms my strong view that Switzerland will further strengthen its position as a major gold hub. Currently 70% of all the gold bars in the world are refined in Switzerland which also have more major private gold vaults than any other country.

Also, as I discussed in a recent article, no central bank will want to hold its reserves in US dollars with to a capricious US government that can steal it at will. The only money that could mantle the role as a reserve asset as the dollar fades away is obviously gold.

TOO LATE TO JUMP ON THE GOLD WAGON?

Nobody should believe that it is too late to jump on the Gold Wagon. It has hardly started yet.

Even if the percentage invested in physical precious metals and precious metals stocks, goes from 0.5% to only 1.5%, there will not be enough metals or stocks available to satisfy a fraction of that increase at current prices for the metals.

So the only way that the increased money flows into metals can be satisfied is through vastly higher prices.

AND AS I HAVE OUTLINED IN THIS ARTICLE, THE SCENE IS NO SET FOR SUCH A MAJOR REVALUATION OF GOLD AND SILVER AND THE WHOLE PRECIOUS METALS SECTOR

MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

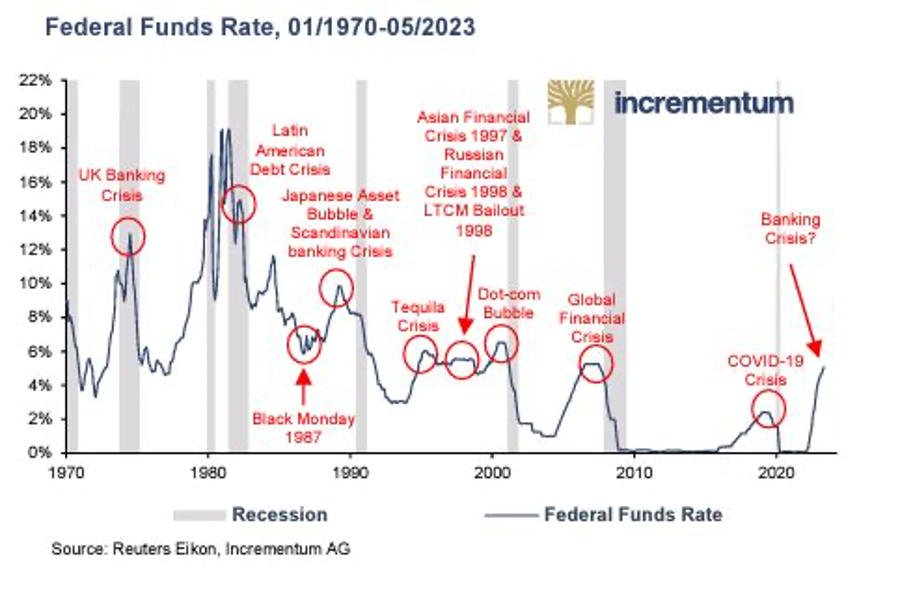

We have hardly been the first nor the last to realize that rising rates “break things.”

We’ve all seen the disastrous credit events in the repo crisis of late 2019, the UST debacle in March of 2020, the gilt implosion of October 2022 and, of course, the banking crisis of March, 2023.

And behind, beneath, above and below each of these debacles lies a bemused central banker.

There’s More “Breaking” to Come

But there’s far more “breaking” to come.

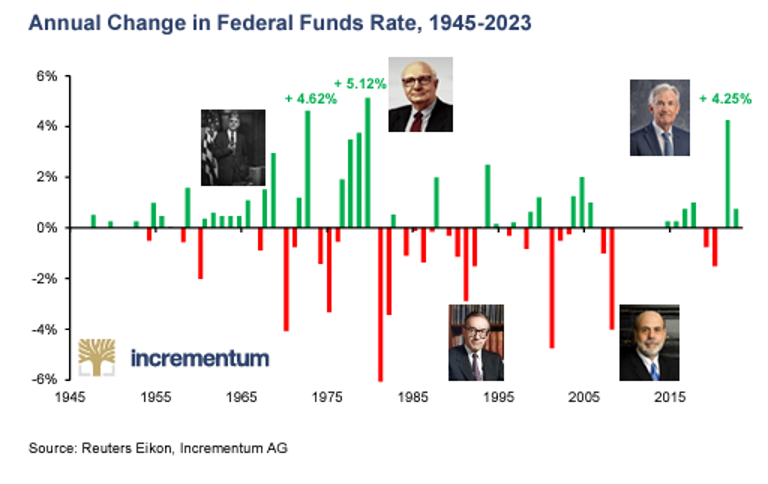

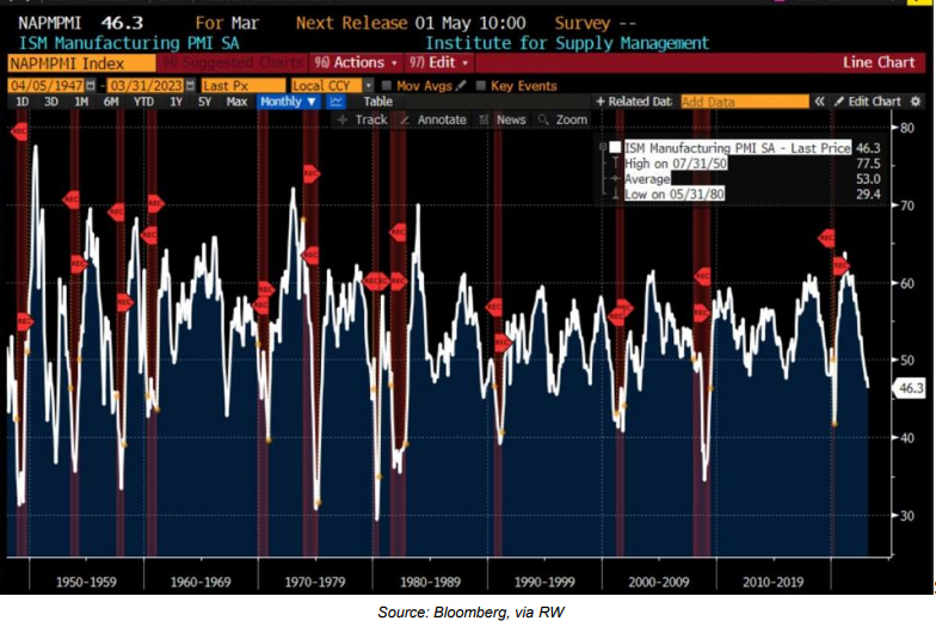

As for recessions, the data is equally (and objectively) abundant that those rising rates (red circles below) tend to correlate directly with recessions, both soft and hard (grey lines below).

Powell can re-define recessions with words, but despite his double speak, he too knows that a recession is already under, or at the very least, directly off, the American bow.

Powell’s Un-Spoken “Plan”?

It has always been my contention that the rate hikes of late have been a public ruse to allegedly “defeat inflation,” when in fact inflation and negative real rates were always part of the unofficial plan to help inflate away portions of Uncle Sam’s openly embarrassing bar tab.

More importantly, Powell’s deeper motive (in my opinion) for the rate hikes of 2022 was done in order to give the Fed something to cut once the mammoth recession they’ve publicly denied becomes, well: mathematically undeniable.

The Past as Prologue

As in 2018, when Powell forward-guided rate hikes simultaneously with QT (Fed balance sheet reduction via UST dumping), the end result was disastrous (remember December 2018 and the days of 10% daily market swings).

This disaster was soon followed by an inevitable/foreseeable rate “pause” and then more QE.

The current pattern is fairly similar.

Although a QT policy of letting the Fed’s reserve of bonds “mature” rather than be dumped into the open market slightly differentiates 2022’s rate hikes from 2018, the end-game of raising rates into an even greater debt bubble will end with even more pain, volatility (and ultimately, QE) than seen in the 2018-2019 debacle/policy.

This pattern is easy to see because the Realpolitik of the bond market is easy to see.

The Bond Market is the Thing

In the most simplistic terms, Uncle Sam survives off debt, which means he survives off of IOUs (i.e., USTs).

If no one buys those IOUs, Uncle Sam falls off his bar stool into a puddle of his own tears as USTs fall further in price and hence yields and rates rise further in interest-expense pain.

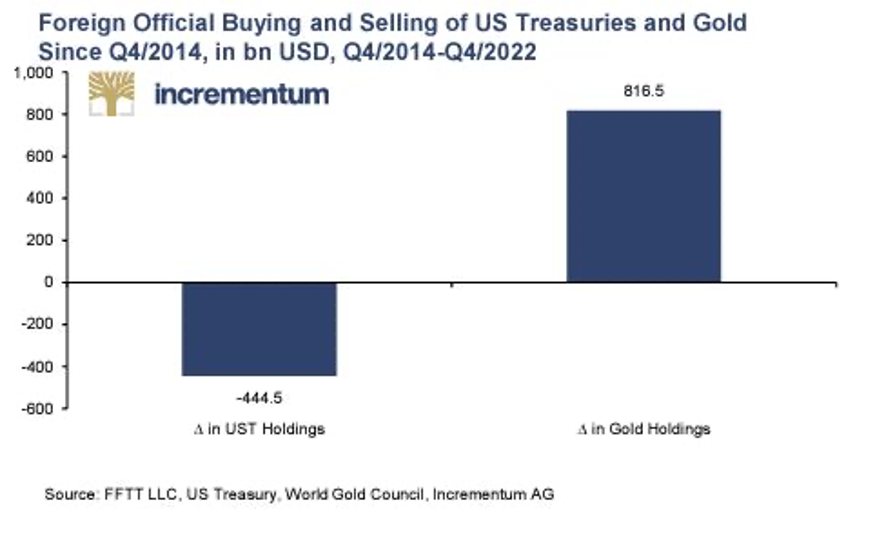

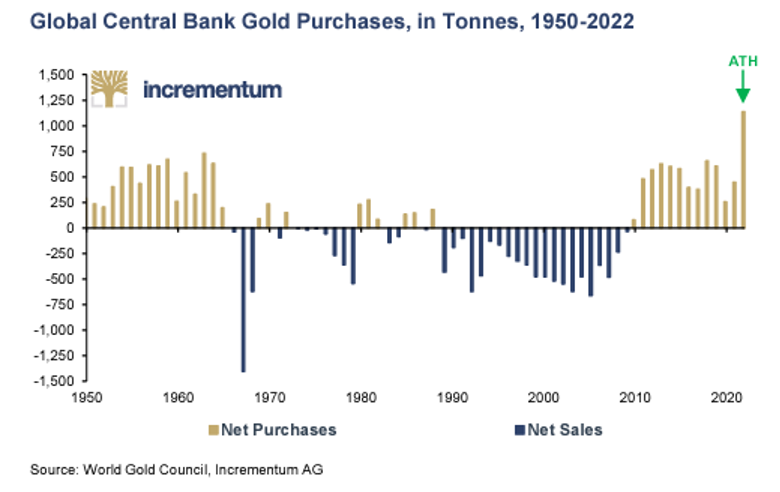

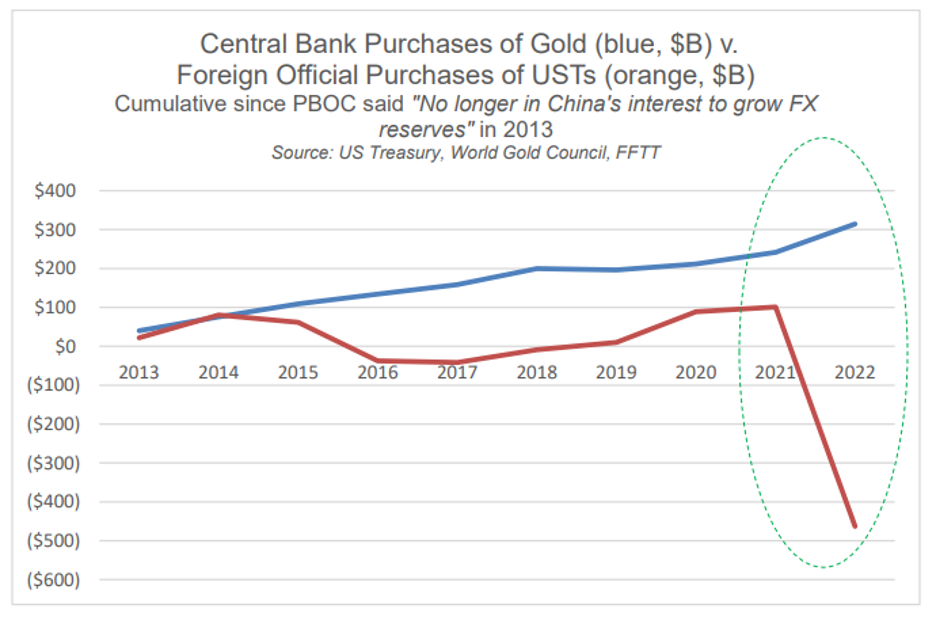

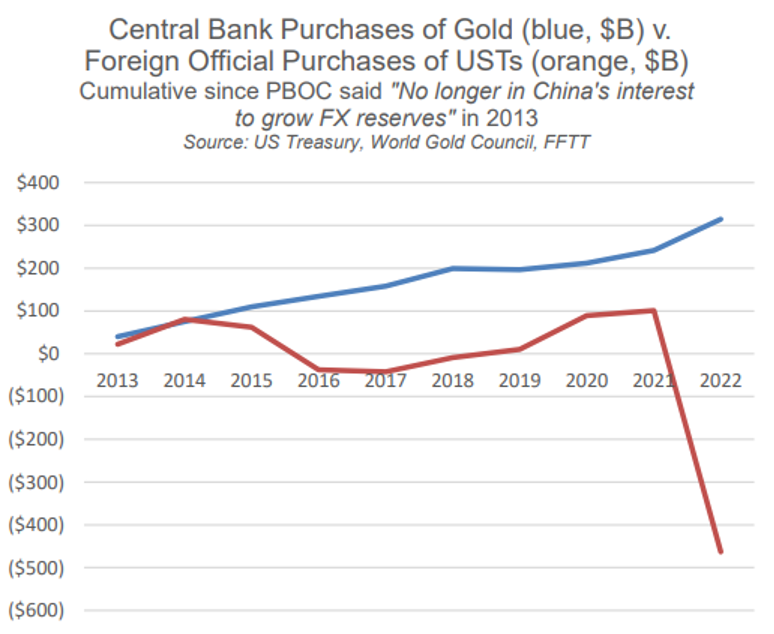

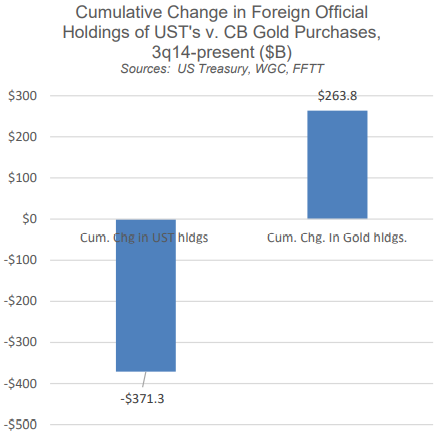

And as 2022 reminds, that weaponized USD led to Uncle Sam’s worst fears coming foreseeably true as the world dumped USTs at the same time central banks made historically unprecedented purchases of gold.

The Next Moves Are Fairly Easy to See…

Needless to say, this bond-dumping scares the “H-E- double-toothpicks” out of Uncle Sam and his cadre of corporatist, number-crunching technocrats at the Treasury Dept and FOMC, as even they know what we all know: Someone or some thing has to buy Uncle Sam’s IOUs or it’s game over.

And who do you think that buyer will be?

All together now: “The Federal Reserve.”

And where will the money needed to buy those unloved USTs ultimately come from?

All together now: “An inflationary mouse-clicker at the Eccles Building.”

Pain, then Pleasure for Stocks, But No Way Out for the Dollar

But between now and that oh-so-foreseeable QE end-game, more things will need to break, which means we are likely to see deflationary forces (tanking market, emerging recession) followed by profoundly inflationary money printing.

Or stated more simply, stocks will tank and then stocks will rise as the currency which measures (and “saves”) them gets more and more diluted by failed policy makers and a Fed which should never have been conceived in 1910.

Why do I believe this?

Well, the markets, rather than Powell, are telling us so.

Let’s dig in.

The Futures Markets: Neon-Flashing Signs of Stock Market “Uh-Oh”

There are a number of signs pointing toward an “uh-oh” moment in risk assets.

The fact, for example, that we are seeing oil futures pricing oil lower despite production cuts (what the fancy lads call “backwardation”) stems from a market anticipating the kind of tanking oil demand that only comes from a much-anticipated stock market fall (mean reversion) in the wake of an equally anticipated recession in 2023.

The Eurodollar futures market is also screaming of a similar market fall in the coming months.

But perhaps most importantly (or obviously), the S&P futures market is now net-short at levels surpassing 2011 and approaching the levels of late 2007.

If I recall, those were not promising times for subsequent stock prices…

Or stated more simply, the big boys at those oh-so clever hedge funds (who are tracking credit crunches, bond flows and Powell’s “higher-for-longer” meme) are betting heavily against the S&P as the “higher-for-longer” Powell soon becomes the “higher-something-broke-again” Powell.

In short: The next thing to “break” will be stocks.

What Goes Naturally Down Then Goes Un-Naturally Up

Then comes the volatility and the dip-buyers after stocks take a hit (driven by more bank failures and rate hikes) which could be worse than 2008.

It’s my view that hedge funds are waiting to buy low and are biding their time like snipers patiently hiding behind a bond-market breastwork.

That is, they have been piling into negative-yielding USTs of late (that is, willingly losing a bit of return) as a holding pattern “asset” which they will then quickly dump to buy discounted equities once the stock market pukes as per above.

Amidst this looming volatility (buy the VIX?), I thus foresee a subsequent move out of anemic bonds and back into discounted stocks.

Of course, if the hedge funds start dumping Uncle Sam’s IOUs, their yields and rates will get dangerously higher (expensive) for Uncle Sam, which means Uncle Fed will have to do what it did in 2019/2020 and start mouse-clicking more instant liquidity to control Treasury yields and monetize America’s increasingly unloved UST market.

Such QE will be good for stocks dying on the field, but bad for the inherent purchasing power of an ever-more debased and diluted USD.

Chess vs. Checkers

Thus, deflationary or inflationary, the end-game for the neutered USD and its checker-level financial planners is fairly foreseeable, which means the end-game for gold is no less so.

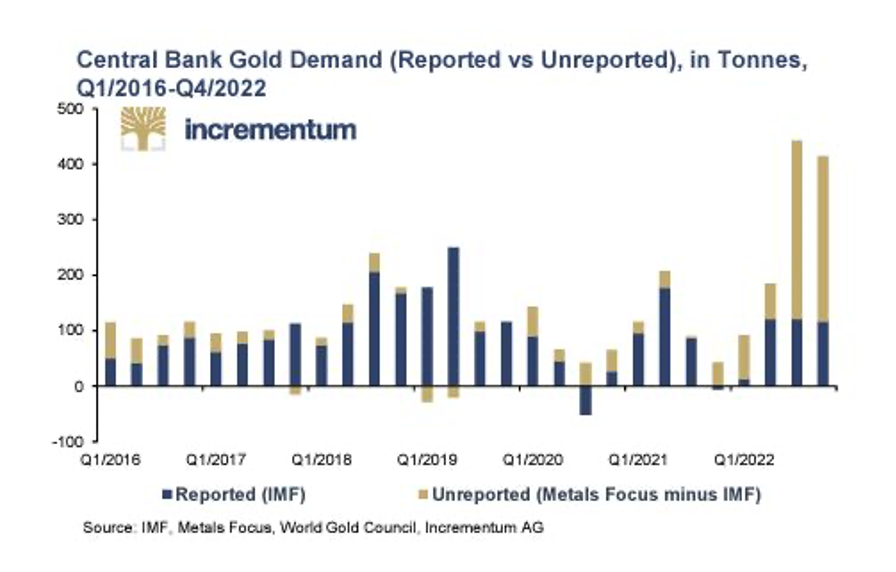

See why the chess-players (mostly Eastern Central Banks) are stacking gold at levels higher than ever recorded?

A Rigged Game

This journey from tanking markets to rising markets is a game which many insiders at the hedge funds know and play well.

Furthermore, it’s a game the Fed has no choice to play, as a rising stock market (and capital gains taxes) is one of the few ways Uncle Sam can get tax receipts at a level high enough to pay its $800B (and climbing) interest expense on debt.

The rise-and-fall stock game is rigged, and ultimately, as I’ve written, “Rigged to Fail,” but regardless of its immoral and capitalism-destroying mandate, one can front-run the Fed if one sees the totally centralized chess-board.

MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

Below, we look at simple facts in the context of complex markets to underscore the dangerous direction of Fed-Speak and Fed policy.

Keep It Simple, Stupid

It’s true that, “the Devil is in the details.”

Anyone familiar with Wall Street in general, or market math in particular, for example, can wax poetic on acronym jargon, Greek math symbols, sigma moves in bond yields, chart contango or derivative market lingo.

Notwithstanding all those “details,” however, is a more fitting phrase for our times, namely: “Keep it simple, stupid.”

The Simple and the Stupid

The simple facts are clear to almost anyone who wishes to see them.

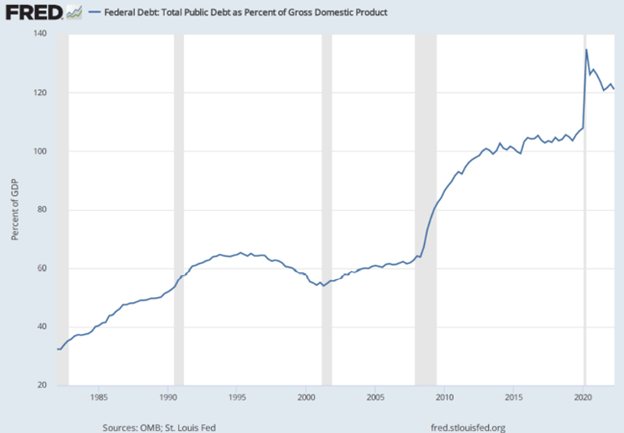

With US debt, for example, at greater than 120% of its GDP, Uncle Sam has a problem.

That is, he’s broke, and not just debt-ceiling broke, but I mean broke, broke.

It’s just THAT simple.

Consequently, no one wants his IOUs, confirmed by the simple/stupid fact that in 2014, foreign Central Banks stopped buying US Treasuries on net, something not seen in five decades.

In short, the US, and its sacred bonds, just aren’t what they used to be.

To fill this gap, that creature from Jekyll Island otherwise known as the Federal Reserve, which is neither Federal nor a reserve, has to mouse-click money to pay the deficit spending of short-sighted and opportunistic administrations (left and right) year after year after year.

Uncle Fed, along with its TBTF nephews, have thus become the largest marginal financiers of US deficits for the last 8 years.

In short, the Fed and big banks are literally drinking Uncle Sam’s debt-laced Kool aide.

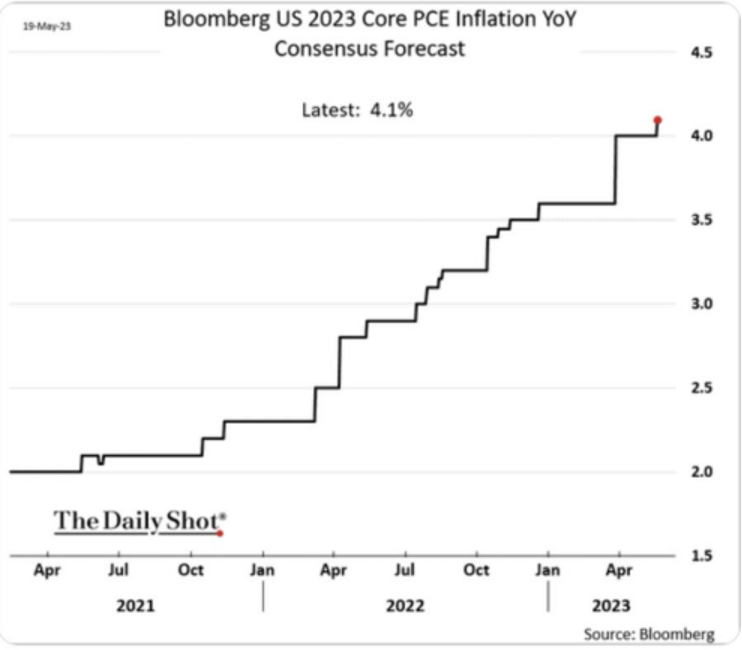

The Fed’s money printer has thus become central to keeping credit markets alive despite the equal fact (paradox) that its rate hikes are simultaneously gutting bonds, banks and small businesses to fight inflation despite the stubborn fact that such inflation is still here.

The Inflation Narrative: Form Over Substance

My view, of course, is that the Fed’s war on inflation is a headline optic rather than policy fact.

Like all debt-soaked and failing regimes, the Fed secretly wants inflation to outpace rates (i.e., it wants “negative real rates”) in order to inflate away some of that aforementioned and embarrassing debt.

But admitting that is akin to political suicide, and the Fed is political, not “independent.”

Thus, the Fed will seek inflation while simultaneously mis/under-reporting CPI inflation by at least 50%. I’ve described this as “having your cake and eating it too.”

All that said, inflation, which was supposed to be transitory, is clearly sticky (as we warned from the beginning), and even its under-reported 6% range has the experts in a tizzy of comical proportions.

Neel Kashkari, for example, is thinking the US may need to get rates to at least 6% to “beat” inflation. James Bullard is asking for more rate hikes too.

But what these “go higher, longer” folks are failing to mention is that rate hikes make Uncle Sam’s bar tab (i.e., debt) even more expensive, a fact which deepens rather than alleviates the US deficit nightmare.

The War on Inflation is a Policy that Actually Adds to Inflation

Ironically, however, few (including Kashkari, Bullard, Powell or just about any economic midget in the House of Representatives) are recognizing the additional paradox that greater deficits only add to (rather than “combat”) the inflation problem, as deficit spending (an economy on debt respirator) keeps artificial demand (and hence) prices rising rather than falling.

Furthermore, these deficits will ultimately be paid for with more fiat fake money created out of thin air at the Eccles building, a policy which is inherently (and by definition): INFLATIONARY.

In short, and as even Warren B. Mosler recently tweeted, “the Fed is chasing its own tail.”

Inflation, in other words, is not only here to stay, the Fed’s “anti-inflationary” rate hike policies are actually making it worse.

Even party-line economists are forecasting higher core inflation this year:

The Real Solution to Inflation? Scorched Earth.

In fact, the only way to truly dis-inflate the inflation problem is to raise rates high enough to destroy the bond market and the economy.

Afterall, major recessions/depressions do “beat” inflation—along with just about everything and everyone else.

The current Fed’s answer to combatting the inflation problem is in many ways the equivalent of combatting a kitchen rodent problem by placing dynamite in the sink.

Meanwhile, the Rate Hikes Keep Blowing Things Up

Buried beneath the headlines of one failing bank (and tax-payer-funded depositor bailout) after the next, is the equally dark picture of US small businesses, all of which rely on loans to stay afloat.

But according to the U.S. Small Business Association, loan rates for the “little guys” have reached double digit levels.

Needless to say, such debt costs don’t just hurt small enterprises, they destroy them.

This credit crunch is only just beginning, as small enterprises borrow less in the face of rising rates.

Real estate, of course, is just another sector for which the “war on inflation” rate hikes are creating collateral damage.

Homeowners enjoying the fixed low rates of days past are naturally remiss to sell current homes only to face the pain of buying a newer one at much higher mortgage rates.

This means the re-sale inventory for older homes is shrinking, which means the market (as well as price) for new construction homes is spiking—serving as yet another and ironic example of how the Fed’s alleged war on inflation is actually adding to price inflation…

In short, Fed rate hikes can make inflation rise, and equally tragic, is that Fed rate cuts can also make inflation rise, as cheaper money only means greater velocity of the same, which, alas, is inflationary…

See the Paradox?

And that, folks, is the paradox, conundrum, corner or trap in which our central planners have placed us and themselves.

As I’ve warned countless times, we must eventually pick our poison: It’s either a depression or an inflation crisis.

Ultimately, Powell’s rate hikes, having already murdered bonds, stocks and banks, will also murder the economy.

Save the System or the Currency?

At that inevitable moment when the financial and social rubble of a national and then global recession is too impossible to ignore, the central planners will have to take a long and hard look at the glowing red buttons on their money printers and decide which is worthing saving: The “system” or the currency?

The answer is simple. They’ll push the red button while swallowing the blue pill.

Ultimately, and not too far off in our horizon, the central planners will “save” the system (bonds and TBTF banks) by mouse-clicking trillions of more USDs.

This simply means that the deflationary recession ahead will be followed by a hyper-inflationary “solution.”

Again, and worth repeating, history confirms in debt crisis after debt crisis, and failed regime after failed regime, that the last bubble to “pop” is always the currency.

A Long History of Stupid

In my ever-growing data base of things Fed-Chairs have said that turned out to be completely and utterly, well…100% WRONG, one of my favorites was Ben Bernanke’s 2010 assertion that QE would be “temporary” and with “no consequence” to the USD.

According to this false idol, QE was safe because the Fed was merely paying out dollars to purchase Treasuries is an even swap of contractually even values.

What Bernanke failed to foresee or consider, however, is that such an elegant “swap” is anything but elegant when the Fed is marred by an operating loss in which its Treasuries are tanking in value.

That is, the “swap” is now a swindle.

As deficits rise, the TBTF banks will require more mouse-clicked (i.e., inflationary) dollars to meet Uncle Sam’s interest expense promise to the banks (“Interest on Excess Reserves”).

In the early days of standard QE operations, at least the Fed’s printed money was “balanced” by its purchased USTs which the TBTF banks then removed from the market and parked “safely” at the Fed.

But today, given the operating losses in play, the Fed’s raw money printing will be like like raw sewage with nowhere to go but straight into the economy with an inflationary odor.

Bad Options, Fluffy Words

Again, the cornered Fed’s options are simple/stupid: It can continue to hawkishly raise rates higher for longer and send the economy into a depression and the markets into a spiral while declaring victory over inflation, or it can print trillions more fiat dollars to prop the system and neuter/debase the dollar.

And for this wonderful set of options, Bernanke won a Nobel Prize?

The ironies do abound…

But as a famous French moralist once said, the highest offices are rarely, if ever, held by the highest minds.

Gold, of course, is not something the Fed (nor anyone else) can print or mouse-click, and gold’s ultimate role as a currency-insurer is not a matter of debate, but a matter of cycles, history and simple/stupid common sense. (See below).

Markets Are Prepping

In the interim, the markets are slowly catching on to the fact that protecting purchasing power is now more of a priority than looking for safety in grossly and un-naturally inflated “fixed income” or “risk-free-return” bonds.

Why?

Because those bonds are now (thanks to Uncle Fed) empirically and mathematically nothing more than “no-income” and “return-free-risk.”

Meanwhile, hedge funds are building their net short positions in S&P futures at levels not seen since 2007 for the simple reason that they foresee a Powell-induced market implosion off the American bow.

Once that foreseeable implosion occurs, get ready for the Fed’s only pathetic tools left: Lower rates and trillions of instant liquidity—the kind that kills a currency.

In Gold We Trust

The case for gold as insurance against such a backdrop of debt, financial fragility and openly dying currencies is, well: Simple stupid and plain to see.

Few on this round earth see the simple among the complex better than our advisor and friend, Ronni Stoeferle, whose most recent In Gold We Trust Report has just been released.

Co-produced with his Incrementum AG colleague, Mark Valek, this annual report has become the seminal report in the precious metal space.

The 2023 edition is replete with not only the most sobering and clear data points and contextual common sense, but also a litany of entertaining quotations from Churchill and the Austrian School to The Grateful Dead and Anchorman …

Ronni and Mark unpack the consequences of a Fed that has raised rates too high, too fast and too late, which is, again a fact plain to see:

Needless to say, hiking rates into an economic setting already historically “debt fragile” tends to break things (from USTs to regional banks) and portends far more pain ahead, as both history and math also plainly confirm:

In a debt-soaked world fully addicted to years of instant liquidity from a central bank near you, Powell’s sudden (but again too late, too much) hiking policies will not “softly” restrain market exuberance nor contain inflation without unleashing the mother of all recessions.

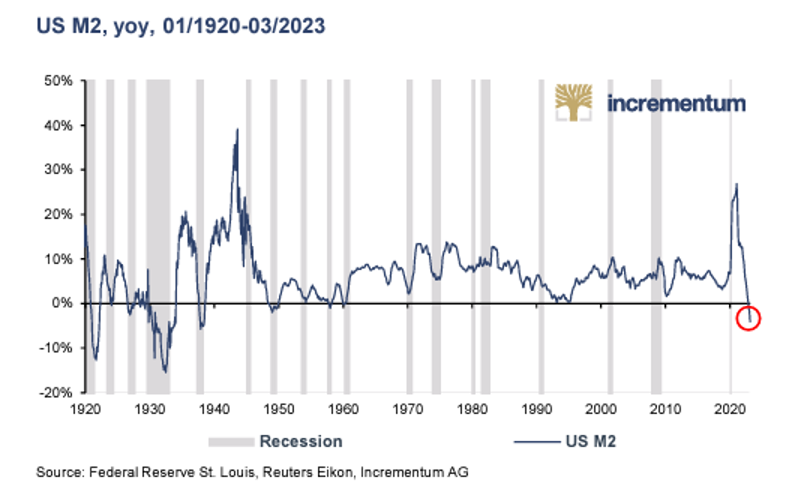

Instead, the subsequent and sudden negative growth of money supply will only hasten a recession as opposed to a “softish” landing:

As the foregoing report warns, the looming approach of this recession is already (and further) confirmed by such basic indicators as the Conference Board of Leading Indicators, an inverted yield curve and the alarming spread between 10Y and 2Y yields.

Self-Inflicted Geopolitical Risks

The report further examines the geopolitical shifts of which we have been warning(and writing) since March of 2022, when Western sanctions against Russia unleashed a watershed trend by the BRICS and other nations to seek settlement payments outside of the weaponized USD.

One would be unwise to ignore the significance of this shift or underestimate the growing power of these BRICS (and BRICS “plus”) alliances, as their combined share of global GDP is rising not falling…

As interest in (and trust for) the now weaponized USD as a payment system declines alongside a weakening faith in Uncle Sam’s IOUs, the world, and its central banks (especially out East) are turning away from USTs and turning toward physical gold.

Again, I give credit to the In Gold We Trust Report:

See a trend?

See why?

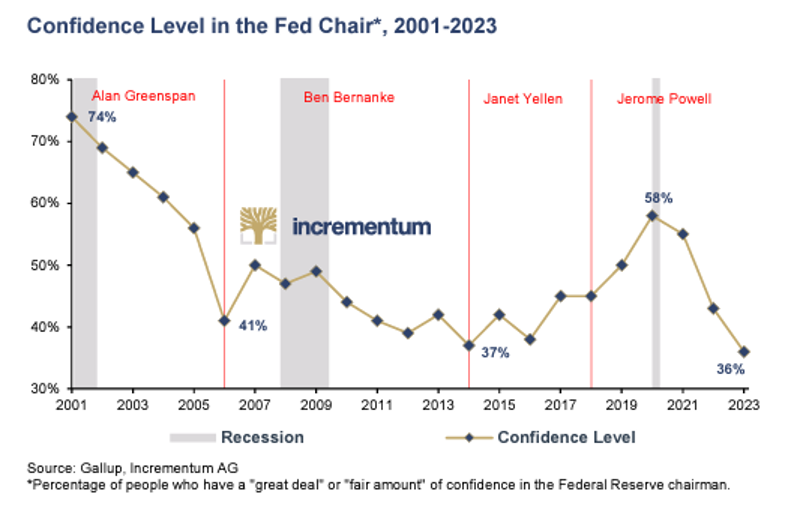

It’s fairly simple, and for this we can thank the fairly stupid policies of the Fed in particular and the declining faith in their prowess in general:

Myths Are Stubborn Things

Many, of course, find it hard to imagine that a Federal Reserve based in DC and within the land of the Great American dream (and world reserve currency) could be anything but wise, efficient and stabilizing, despite an embarrassing Fed track record that is empirically unwise, inefficient and consistently destabilizing…

Myths are hard to break, despite the fact the myth of MMT and QE on demand has been a failed experiment and is sending the US, as well as the global, economy toward a reckoning of historical proportions.

But the messaging of “Keep calm and carry on” from Powell is calming in spirit despite the fact that it hides terrifying math and historically confirmed consequences for the fiat money by which investors still wrongly measure their wealth.

But as Brian Fantana of Anchorman would tell us, trust the central planners.

“They’ve done studies, you know. 60% of the time it works every time.”

As for us, we trust the kind of data Ronni and Mark have gathered and that barbarous relic of gold far more than calming words and debased, fiat currencies.

As history reminds, when currencies die within a backdrop of unsustainable debt, gold in fact does work—and every time.

MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

Below, we see why the USA is screwed.

De-Dollarization: Downplaying the Obvious

De-Dollarization is a real, all too real trend, though it is both fascinating and disturbing to see what is otherwise so obvious being deliberately down-played, excused or ignored from the top down.

But then again, the laundry list of ignored facts and open lies from the top down to hide hard truths in everything from inflation data to recessionary debt traps is nothing new.

Instead, such propaganda replacing blunt transparency is the new normal (and classic trick) for all historical endings to debt-soaked (and failing) nations/systems and their fork-tongued (i.e., guilty) policy makers.

Slow & Steady

De-Dollarization, of course, is a gradual rather than over-night process.

Its origins stem from 1) years of exporting USD inflation overseas (to the painful detriment of friend and foe alike) and 2) the insanely stupid decision to weaponize the world reserve currency (i.e., USD) subsequent to a border war between two local tyrants in the Ukraine.

Whether or not you buy into the Western “media’s” narrative which categorizes Putin as Hitler 2.0 and Zelensky as a modern George Washington, the weaponization of the USD (and freezing of FX reserves) has made an already dollar-tired globe even more distrusting of Uncle Sam’s currency and IOUs.

This trend is confirmed by the profound dumping of USTs throughout 2022 and the undeniable trend among the BRICS (and the 36 other nations) to deliberately seek bilateral trade agreements and settlements outside of the USD.

Furthermore, with Saudi talking to China and Iran, and with China talking to Mexico, Russia and just about everyone else, it’s fairly clear that a move away from the once sacred petrodollar (Pakistan now seeking Russian oil in Yuan) is no longer just the fantasy of conveniently eliminated folks like Saddam Hussein or Muammar Gaddafi…

As I discussed here and here, the petrodollar is under threat, which means longer-term demand for the USD is equally so.

But the USD Still Has Legs—For Now…

That said, there’s also no denying that the USD is still very strong, very important and very much in demand.

After all, and despite welching in 1971 on its 1944 promise to be gold-backed, the USD is still the world reserve currency.

With over 40% of global debt instruments denominated in Greenbacks and over 60% of the reservoir of global currencies composed of USDs, this reserve status (and hence forced demand) aint going anywhere too soon.

Furthermore, and as I have written and agreed, the so-called “milk-shake theory” is not altogether wrong.

That is, demand for USDs (and USTs) within the tangled and levered web of US derivative and Euro Dollar markets is baked into a system which will take years (not days) to unravel, monetize or replace, and this sure as heck won’t be orderly, global nor overnight.

Then Comes Change, Pain and Open Denial

But let’s get real: The days of the USD as a trusted payment system or hegemonic power broker are unwinding right before our very eyes.

And the best way to see the truth of this reality is to catalogue the ever-expanding list of lies from the big boys and their complicit, media ja-sagenders (“yes-sayers”) desperately trying to deny the same.

At first, for example, the centralized economists were blaming de-dollarization and CNY energy transactions on the Russian sanctions.

Gee. Go figure?

Thereafter, the economists said de-dollarization is just the result of Emerging Market (EM) countries momentarily running out of (in fact they’re intentionally dumping) USD reserves.

Western “experts” are trying to convince themselves and the rest of the world that EM nations will implode unless they eventually acquire more USTs and USDs to buy energy.

What these experts are failing to see (or say), however, is that many of those countries are already beginning to buy that energy outside of the USD…

Folks, de-dollarization in global commodity markets is happening already, and will accelerate rather than fade away into some fantasy image of how the “West was Won,” for as argued elsewhere, the West is already losing.

Facts Are Stubborn Things

As for the list of nations, both big and small, de-dollarizing right before our watering eyes, just consider, well…China, Russia, India, Pakistan, Ghana, Bolivia…

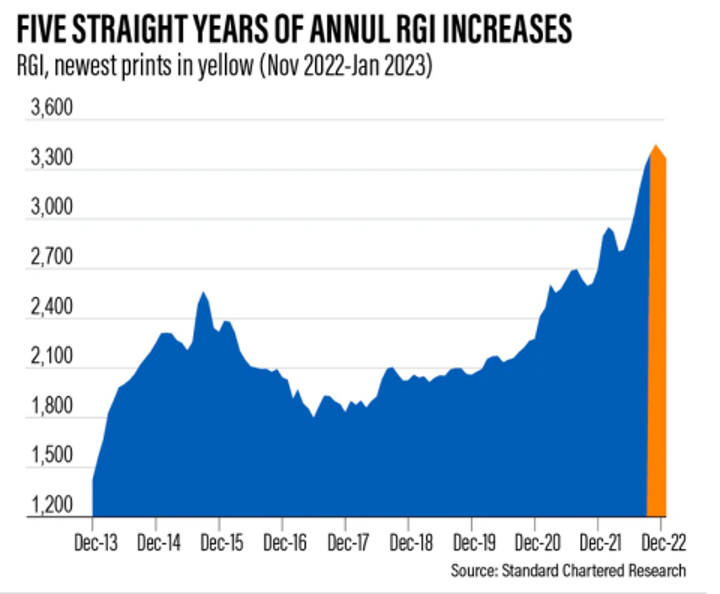

Even the world’s largest hardwood pulp producer, Suzano SA, is in talks with China to trade its commodity in CNY.

This transition from a weaponized USD to an expanding CNY is not just the sensationalism of fiat-haters but the hard math of real events and data, which the following chart of the Renminbi Globalization Index (up 26% in 2022) makes all too clear…

The undeniable trend and rise (which is not the same as “hegemony”) of the CNY is certainly not good news for the fiat-all-too-fiat USD, who is less and less the prettiest girl at the dance.

As trust/demand in the USD falls, so too does its purchasing power, which may explain why China, at the very same time its trade power increases, is simultaneously growing its gold reserves in anticipation for what it knows is coming but what the West still refuses to see, namely: The slow-drip neutering of Uncle Sam’s fiat currency.

See the trend folks?

We Told You So

See why picking a currency-for-energy war against Russia (the world’s biggest commodity exporter and a nuclear power in bed with China, the world’s biggest factory owner and a nuclear power) may have been a bad idea?

As we warned literally from day-1 of the sanctions, this was obviously not the same as picking a sanction fight with say, Iran or Venezuela…

Nope. This scale of this was far more dangerous, and the avoidable casualties still piling up in the West’s proxy war (on Ukrainian soil/rubble) are not just soldiers and civilians, but Greenbacks too.

This was foreseeable.

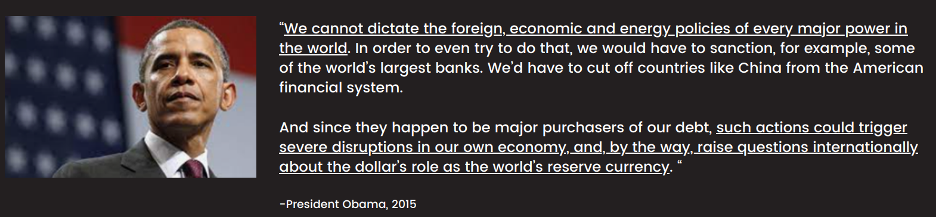

Even Obama foresaw it in 2015:

Clearly, Biden’s handlers, however, didn’t see it in 2022.

They wanted to play war rather than sound economics, and the end result will be a loss of both.

As for the USD: Volatility Before Debasement

As for the fate and price of the USD near-term and long-term, the move will be volatile rather than in a straight line north or south.

The USD can still go higher, much higher, as fewer Greenbacks overseas still face large debt payments.

Ultimately, however, Uncle Sam’s own twin deficits and schoolyard of children masquerading as House Members/”leaders” will deficit spend the USA into a debt spiral whose only “cure” is more mouse-clicked and debased dollars along side more unloved and over-issued USTs (IOUs).

Thereafter, the up and down moves of the USD will eventually just sink, Titanic-like, in one direction as ever-more USD’s collide with a growing debt iceberg.

As argued so many times, but worth repeating: The last bubble to die in a debt-soaked regime is always the currency. Even the increasingly unloved world reserve currency will be no exception to the laws of over-supply and decreasing demand.

Between now and then, all we can expect are more lies from on high and more centralized controls masquerading as efficient payment systems and national emergencies blamed on Eastern bad guys and bat-made (?) virusesrather than the bathroom mirrors of our central planners (happy idiots?).

All Good Until Things Break

We have always warned that Powell’s rate hikes (too much, too fast, too late) would be too expensive for Uncle Sam, and would thus break things here and abroad—from repo markets, gilt markets and Treasury markets to a US fiscal implosion and dying regional banks.

Next to implode are the labor markets.

Six decades of data confirm that rising rates always break things.

But when you place such rising rates into the context of the greatest debt crisis in US (as well as global) history, the “breaking” gets really ugly.

Until the Fed supplies more inflationary liquidity (fiat-fantasy money), the dual forces of a hawkish Powell and a de-dollarizing yet milk-shake world means the USD could rise and squeeze out the dollar short traders nearer term.

Anything but “Softish”

Ultimately, however, and after enough smaller banks have been murdered (more will die) and after the UST market has suffered all it can suffer, too much will break at once, and it won’t be soft, or even “softish.”

This is not fable but fact. The only “tool” the centralizers will have left is more synthetic, fiat (and inflationary) liquidity on demand.

This trend is simple: Uncle Sam is broke and his only solution is a money printer.

In short, a counterfeit answer to a real cancer.

Don’t believe me?

Just ask the US Treasury Dept.

More Ignored Math from DC

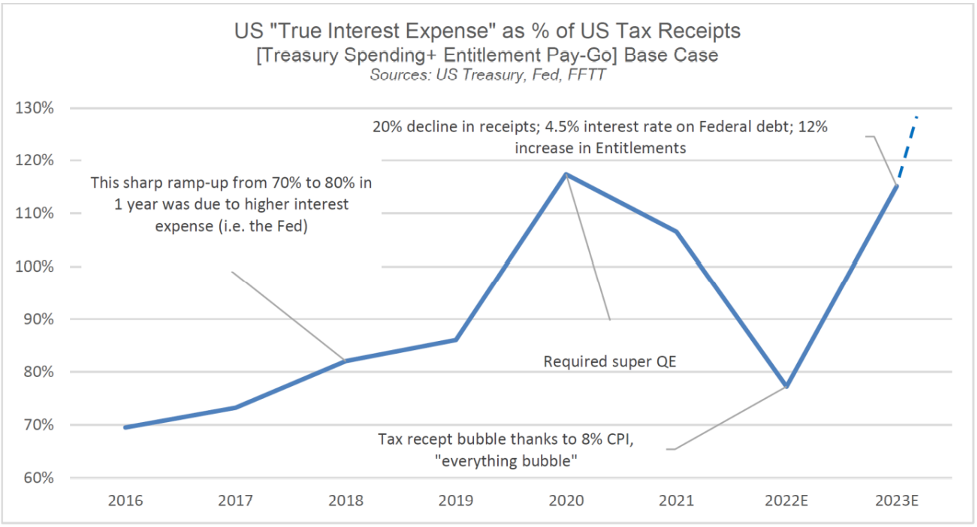

The latest TBAC (Treasury Borrowing Advisory Committee) confirms the US has already deficit spent $2.060T in fiscal 1H23, the interest expense alone of which is 101% of tax receipts.

This effectively puts the USA into a red-zone of imbalance reminiscent of the COVID crisis, only this time they don’t have COVID to blame for a debt addiction that was in play long before Fauci stained our screens or Powell printed more money post-March-of-2020 than was produced in the entire compounded history of our nation.

The TBAC report further indicated that projected US Federal deficits for 2023 to 2025 have risen by 30-50% in just the last 90 days…

And folks, the only way to pay for this embarrassing bar tab in DC is either more open QE (mouse-clicked trillions) and/or a much, much, much weaker USD to inflate away this debt as we head simultaneously into the mother of all recessions.

Such a crisis, of course, could be preceded by temporary (relative, rather than inherent) spikes in the USD until more UST supply/liquidity weakens the Greenback and sends gold higher, regardless of the USD’s relative strength and then subsequent weakness.

Meanwhile the Propaganda from On-High Continues

As I’ve said in interview after interview, you know things are getting really bad when comforting words and de-contextualized data increasingly replace simple (but scary) math.

At $95+T in public, household and corporate debt, the US has irreversibly passed the Rubicon of any easy solutions.

As Egon von Greyerz makes abundantly clear week after week, the US in general and the Fed in particular have irrevocably cornered themselves.

Stated otherwise: The USA is screwed.

DC has to chose between saving its “system” (of insider/TBTF banks, self-interested politicos–from the Maoist “woke” to the neocon “dark” and Wall Street Socialism) or destroying its currency.

Needless to say, it’s ultimately the currency that will fall on the sword for this now openly corrupt and pathetic “system.”

But again, rather than confess their own sins, the message is always “be calm and carry on.”

The Latest Fantasy Chart

Take, for example, the latest puff-tweet regarding Bloomberg’s “US Economic Surprise Index” which paints an oh-so rosy picture of the US economy rising at the fastest pace in over a year.

But as far smarter folks than me (i.e., Luke Gromen) will remind, this so-called data is ignoring a few contextual elephants in the room…

Context Helps

First, the above “good news” ignores a US debt/GDP ratio of 125%, a deficits/GDP ratio of 8% and government spending at 25% of GDP.

Secondly, US Government Outlays (i.e., deficit spending) has been growing at 30% for five of the last seven months.

Spending rates like this have only occurred twice in the last four decades, namely: 1) during the height of the COVID hysteria and 2) during the height of the 2008 GFC.

So, despite the “good news” in puff-charts above, the pundits are ignoring the fact that Uncle Sam (and his mis-fit children in the House of [lobbied] “Representatives”) are spending as if the USA is already in the eye of a financial storm.

And yet we haven’t even seen the recession officially hit or labor and risk markets tank, YET.

Imagine the spending when things get officially far worse than today—and they will; it’s now mathematical.

Out of Sight, Out of (Our) Mind

Sadly, however, very few investors are seeing the bigger picture and the wandering elephants.

In the interim: 1) the military industrial complex will create more profits and jobs here and more casualties overseas; and 2) deficit spending will keep unemployment in check (for now) and GDP “stable” until 3) its deficits (and debts) cancerously metastasize within a nation frog-boiling in debt and fractured by manufactured identity politics over transgender beer ads and slavery reparations from the 1860’s.

Such “woke” trends are ironic, given the fact that middleclass Americans of all colors, sexualities, “privileges” or political bends are already unknowing slaves/serfs in a modern feudalism of fake capitalism fighting against the bogus (yet SJW) “equity” euphemism of a woke (but hidden) re-distribution of social “shares” smacking of modern yet genuine Marxism.

Slowly, Then All at Once

And amidst all this distraction, division and in-fighting, the reality of rising rates colliding into historically unprecedented debt levels will just crush all stripes of Americans in the same manner Hemingway described poverty: “Slowly, then all at once.”

As Egon has often told me: Be careful what you wish for or already know.

Gold will inevitably go higher as the rest of the nation/world slides into its foreseeable debt trap and fiat end-game.

This may be obviously good for gold; but it will be at the expense of so much else, as the disorder ahead is neither fun nor pretty.

And it’s only just beginning…

MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

Below we look at the math, history and current oil environment in the backdrop of a global debt crisis to better predict currency and gold market direction without the need of tarot cards.

Seeing the Future: Math vs. Crystal Balls

Those looking forward only need to look at current and backward math to make relatively clear forecasts without risking the mug’s game of deriving crystal ball predictions.

Not surprisingly, the theme and math of simple (as well as appalling) US debt levels makes such forward-thinking almost too simple.

The Oil Issue: Is Anti-Shale Anti-American?

Although not as fluent as others in the oil trade or the green politics of the extreme US left, I’ve argued in prior reports that the current administration’s anti-shale policies make for some good (debatable?) environmental chest-puffing while ignoring the math, history and science of sound national as well as well as global thinking.

(But then again, the entire woke fiasco of current US policy seems to be on a crusade to cancel such things as math, history and science; so, thinking contextually or globally is beyond their sound-bite-driven stump-speeches.)

Oil, however, still matters.

And when understood in the broader context of the macro-economic themes we’ve tracked for years–namely debt, currencies, inflation, gold, a cornered Fed and a weaponized USD–the current and future trends are already in motion.

And as for the endless debate as to global warming, butterfly-friendly energy policies and the simple reality of fossil fuels as a part of, rather than threat to, our planet, I’m certainly not here to answer or solve the same.

Certainly the Germans (and their solar powered ideas in a part of Europe with very little sun) are not getting it… In fact, they are getting much of their (nuclear) energy from France and are now forced to burn coal to get through the winter.

I am here, however, to lay down some objective facts and ask some blunt questions.

Oil Politics

Biden, it seems fairly clear to all, is not in charge of US policy.

That’s a scary fact. Even more scary, however, is determining who is in charge?

Again, not something I can answer.

But if he were in charge, we’d all be amused to ask how he expected Saudi Arabia to welcome him and his embarrassing pleas for Saudi production increases (to ostensibly ease inflated US fuel costs) after previously telling the world he considered Saudi Arabia a pariah state…

We all remember that embarrassing fist-pump with the Crown Prince.

Meanwhile, Saudi is now spending far more time with the Chinese and Iran…

We’d also love to hear the White House explain how it expects increased US shale production to reduce energy inflation when it has been simultaneously seeking to legislate oil off the American page.

Furthermore, it would be worth reminding Americans and politicians tired of inflated fuel prices that the vast majority of those inflated pump costs are due to US taxes per gallon, not Saudi production cuts.

But I digress.

Oil Math

At the current levels of US oil production and exploration, the US (according to its own Dallas Fed) will have to engage in annual energy price inflation levels of 8-10% just to keep the oil industry’s lights on at a breakeven price level.

Such conservative inflation figures for oil/fuel pricing, when seen in the context of over $31T in US Federal debt, basically means that Uncle Sam’s ability to cover his ever-increasing public debt burden will weaken by at least 8-10% per year at a moment in US history where Uncle Sam needs all the help, rather than weakness, he can get.

Fighting Inflation with Inflation, and Debt with Debt?

Needless to say, the only “solution” to these inflated debt burdens will be the monetary mouse-clicker at the Eccles Building, whose doom-loop (yet now ossified) “solution” to addressing inflated oil prices is the even more inflationary policy of printing more fake money to “fakely” cure an inflation crisis.

You really can’t make this stuff up.

Fed monetary policy, ever since patient-zero Greenspan sold his soul (and sound-money, gold-backed academic thesis) to Wall Street and Washington, boils down to this: We can solve a debt crisis with more debt, and an inflation crisis with more, well…inflation.

Does this seem like “sound monetary policy” to you?

Or, Just Export Your Inflation to the Rest of the World?

But as I’ve warned for years, Uncle Sam’s first instinct (as holder of the world reserve currency) whenever handed a hot-potato of self-inflicted inflation, is to hand it off to the rest of the world—i.e., to export his inflation to friends and foes alike.

Global energy importers in Europe, emerging markets, India, China, and Japan, for example, are facing what accountants call a balance of payments crisis, but what I’ll bluntly call by its real name: A currency crisis.

That is, under the current, but potentially dying petrodollar system, these countries will need more USDs to buy oil.

But that’s where the problem lies.

Why?

Simple: Those USDs are drying up (unless more are printed).

How Long Will Global Currencies (& Leaders) Remain Prisoner to the USD?

Regardless of whether you believe in the perpetual hegemony of the USD as a payment system or not, we can all agree that USD liquidity is drying up (whether it be from the milk-shake theory absorption in euro-dollar and derivative markets or from post-sanction de-dollarization).

Nations facing the double whammy of needing more USDs to pay for inflated oil prices and inflated USD-denominated debts around the globe are going to being crying “uncle!” rather than just “Uncle Sam.”

What can these nations do in the face of that bullying hot potato known as the USD? How can they service these increased USD payment (oil and debt) burdens?

How the US Creates a Global Currency Crisis

Well, short of turning their backs on the USD (not yet), the only current option other nations have is to devalue (i.e., inflate and debase) their own currencies at home, which is how Uncle Sam makes his problem just about everybody else’s problem…

As I often say, with friends like the US, who needs enemies?

Something, however, has to give.

How Physical Gold Offers Better Pricing than Fiat Dollars

This clearly broken system of the US exporting its inflation upon a world forced since the 1970’s to import oil under a broken and inflationary Greenback has a genuine potential to implode.

Already, countries like Ghana have realized that it’s better to trade oil in real gold rather than fake fiat dollars.

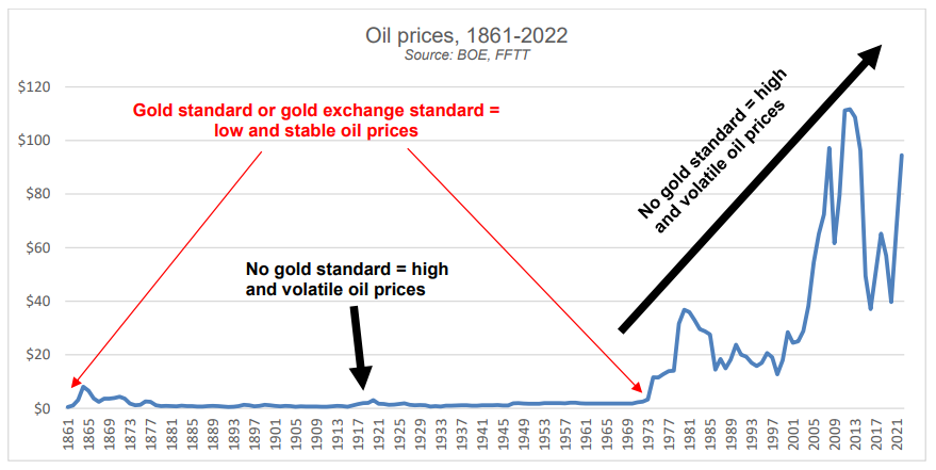

Long before the petrodollar became the mad king, for example, history recognized that physical gold was a far better instrument of payment to settle stable oil pricing.

See for yourself.

As more and more of the world recognizes the currency crisis slowly in play now, and then steadily in greater pain tomorrow, this “Balance of Payments” (i.e., currency) crisis can easily evolve into a “change of payments” reality in which gold re-emerges as a superior payment system for oil.

Think about that.

More Tailwinds for Gold

As of this writing, the physical oil markets are greater than 15X the size of the physical gold markets on an annualized (USD) production basis.

If the world turns slowly (then all at once?) toward settling oil in gold (partially or fully) to avoid a global currency crisis, gold will have to be repriced at levels significantly higher than current pricing.

Hmmm.

Something worth tracking, no?

Well, the Zeitgeist suggests that we are not the only ones tracking these trends…

The Central Banks Are Catching On to (and Stacking) Gold

A recent pole of over 80 central banks holding greater than $7T in FX reserves indicated that 2 out of 3 polled strongly believe that central banks will be making more, not less, purchases of physical gold in 2023.

Again: Are you seeing a trend? Are you seeing the context? Are you seeing why?

As I’ve said countless times and will say countless times more: Debt matters.

Debt matters because debt, once it crosses the Rubicon of insanity and unsustainability, impacts everything we market jocks were supposed to have been taught in school and in the office—namely bonds, currencies, inflation and recessionary cycles follow debt cycles.

In short: It’s all tied together.

Once you understand debt, the policies, reactions, weaknesses, truths, lies, and cycles are far easier to see rather than just “predict.”

The increasing loss of faith in the world reserve currency and its embarrassing IOUs (i.e., USTs) is not merely the domain of “gold bugs” but the simple and historical consequence of the blunt math which always follows broken regimes, of which the US is and will be no exception.

The graph below, is thus worth repeating, as the world is clearly turning away from Uncle Sam’s drunken bar tabof debased dollars and IOUs toward something more finite in supply yet more infinite in duration.

Again: See the trend?

MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

From oil markets to treasury stacking, backdoor QE, investor fantasy and hedge fund prepping, it’s becoming more and more clear that the big boys are bracing for disaster as gold stretches its legs for a rapid run north.

Recently, I dove into the cracks in the petrodollar as yet another symptom of a world turning its back on USTs and USDs.

Gold, of course, has a role in these headlines if one looks deep enough.

So, let’s look deeper.

Diving Deeper into the Oil Story

The headlines of late, for example, are all about “surprise” OPEC production cuts.

Why is this happening and what does it say about gold down the road?

First, let’s face the politics.

As noted many times, it seems US policy, on everything from short-sighted (suicidal?) sanctions to the “green initiative” makes just about zero sense in the real world, which is miles apart from the “keep-me-elected” fantasy-world of DC.

After all, energy, matters, which means oil matters.

But the current regime in DC has been losing friends in Saudi Arabia and cutting its prior and once admirable shale production outputs (think 2016-2020) in the US despite a world that still runs on black gold fighting against green politics.

The DC attack on shale may make the Greta Thunbergs happy, but let’s be blunt: It defies economic common sense.

Saudi, by cutting production, is now showing a still very much oil-dependent world it is not afraid of losing market share to the USA in the face of rising oil for the simple reason that the USA just aint got enough oil to fill the gap or flex its energy muscles.

In the meantime, Chinese demand for crude is peaking while Russian oil flows to the east (including to Japan) are hitting new highs at prices above the US-led price cap of $60/barrel.

If DC has any blunt realists (wrongly castigated as tree-killers) left, it will have to re-think its anti-oil policies and get back toward that recent era when US shale was responsible for 90% of total global oil supply growth.

If not, oil prices can and will spike, making Powell’s war on inflation even more of an open charade.

Speaking of inflation…

Ghana Oil-for-Gold Beats Inflation

When it comes to oil and the decades-long bully-effect of a usurious USD (See: Confessions of an Economic Hitman), we have argued countless times that a strong USD and an imposed petrodollar was gutting developing economies around the world.

We also warned that developing economies (spurned by global distrust of the Greenback in a post-Putin-sanction era of a weaponized reserve currency) would respond by turning their backs on US policies and its dollar.

In the old days, the US could export its inflation abroad. But those days, as we warned as early as March 2022, would be slowly but steadily coming to a hegemonic end.

Again, this does not mean (nod to the Brent Johnson) the end of the USD as a reserve currency, just the slow end of the USD as a trusted, used or effective currency.

Toward that slow but steady end, it’s perhaps worth noting that Ghana’s inflation rate has fallen from 156% to just over 60% since it began trading oil for gold rather than weaponized USDs.

Hmmm.

Gold Works Better than Inflated Greenbacks

The most obvious conclusion we can draw from such a predictable correlation is that gold seems to be working better than fiat dollars to fight/manage inflation, a fact we’ve been arguing for well…decades.

From India to China, Ghana, Malaysia, China and 37 other countries engaged in non-USD bilateral trade agreements, the inflation-infected USD is losing its place in more than just the critical oil trade.

Nations trapped in USD-denominated debt-traps (thanks to a rate-hiked and hence stronger and more expensive USD) are now finding ways to tie their exports (i.e., oil) to a more stable monetary asset (i.e., GOLD).

This, of course, makes me that much more confident that as the world moves closer to its global (and USD-driven) “Uh-Oh” moment, that the already-telegraphed Bretton Woods 2.0 will have to involve a new global order tied to something golden rather than just something fiat.

This, again, explains why so many of the world’s central banks are loading up on gold rather than Uncle Sam’s IOUs.

Gosh. Just see for yourself:

Ouch.

Uh-oh?

US Investors: Still High on Past Fantasy Rather than Current Reality

Sadly, however, the US in general, and US investors in particular, remain trapped in a spiral of cognitive dissonance and still believe today and tomorrow’s America is the America of magical leaders, deficits without tears and the balanced-budget honesty of the Eisenhower era.

That’s why the vast majority (and their consensus-think, safety-in-numbers advisors) are still huddling in correlated 60/40 stock bond allocations rather than physical gold according to a recent BofA survey of wealth “advisors.”

This always reminds me of a phrase circling around Tokyo just before the grotesquely inflated Nikkei bubble lost greater than 80% of its hot air in the crash of 1989, namely: “How can we get hurt if we’re all crossing the road at the same time?”

Well, a large swath of US investors (and their “advisors”) is about to find out how.

Doubling Down on Return Free Risk

This may explain why US households (a statistical term of art which includes hedge funds) have upped their allocations to USTs by 165% ($1.6T) since Q4 of 2022 at the same time that the rest of the world (see above) has been dumping them.

But in all fairness, this does make some sense, as higher rates in the US give investors in USTs (especially in short-duration/money market securities) a greater return than their checking or savings accounts.

Unfortunately, where the masses go is also where bubbles go; but as I like to remind: All bubbles pop.

Of course, when adjusted for inflation, these poor US investors are still getting a negative return on USTs.

Foreigners, of course, have stopped falling for this, but when Americans themselves get suckered en masse into this same bond-trap, they’re basically just paying an invisible tax while chipping away at GDP growth and unknowingly helping Uncle Sam finance his debt for free (namely: at a loss to themselves).

Crazy?

Yep.

Negative Returning IOUs—The Lesser of Evils

But why are hedge funds (i.e., the “smart money”) falling for this? Why are they loading up on USTs?

Because they see trouble ahead, and even a negative returning UST is safer (less evil) than a tanking S&P–and that’s exactly what the pros are bracing for/anticipating.

Waiting for a Market Bottom

In short: The big-boys are safe-havening today in negative-USTs so that they’ll have dry powder at hand to buy a pending and massive market bottom tomorrow.

Once they can buy a bottom, they too will dump Uncle Sam’s IOUs as the QE (along with inflation) kicks back to new highs thereafter.

And speaking of QE…

Backdoor QE: Coordinated and Synthetic Liquidity by Another Name

I have always endeavored to simplify the complex with big-picture common sense.

Toward this end, let’s keep it simple.

And the simple truth is this: With US debt at unprecedented and unsustainable levels, it is a matter of national survival to prevent bond yields—and hence bond-driven rather than Fed- “set” interest rates–from spiking.

Such a natural, and bond-driven spike, after all, would make Uncle Sam’s embarrassing debt too expensive to function.

Survival vs. Debate

Thus, and to repeat: Keeping bond yields controlled is not a matter of pundit debate but national survival.

Since bond yields spike when bond prices fall, it is thus a matter of sovereign survival to keep national bond prices at reasonably high levels.

This, however, is naturally impossible when bond demand (and hence price) is naturally sinking.

This natural reality opens the door to the un-natural “solution” wherein central banks un-naturally print trillions (“synthetic demand”) to buy their own bonds/debt.

Of course, this game is otherwise known as QE, or “Quantitative Easing”–that ironic euphemism for un-natural, anti-capitalist, anti-free market and anti-free-price-discovery Wall Street socialism whose inflationary consequences cause Main Street feudalism.

In short: QE has backstopped a modern system of central-bank-created lords and serfs.

Which one are you?

See why Thomas Jefferson and Andrew Jackson feared a Federal Reserve, which is neither “federal,” nor a solvent “reserve.”

The ironies, they do abound…

How Can there be QE if the Headlines Say QT?

But the official narrative and headlines are still telling us only stories of QT (Quantitative Tightening) rather than QE, so what’s the problem?

Well, as with just about everything from CPI data and transitory inflation memes to recession re-defining, the official narrative is not always the truthful narrative…

In fact, back-door or “hidden QE” is all around us, from the Fed bailing out/funding repo markets and dead regional banks to central banks making secret deals behind the scenes.

Although it’s not officially QE when the central bank of one country is buying the IOUs (bonds) of another country, it is more than likely that leading central banks are acting in a coordinated way to “QE each other’s debt,” a system which former Fed official, Kathleen Tyson, describes as a “Daisy Chain.”

And if we look at the IMF’s own data, we can connect the dots of this Daisy Chain with relative (rather than tin-foil-hatted) clarity.

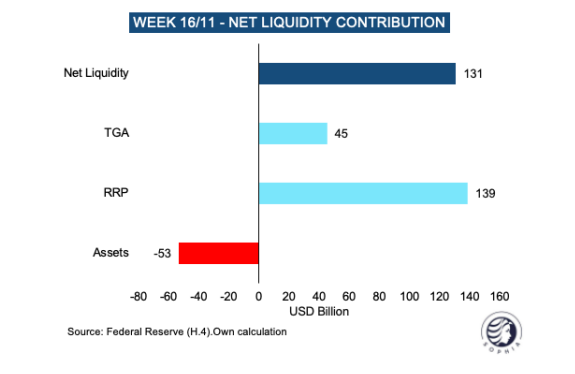

Since Q4 of 2022, for example, overall FX reserves are now up by over $340B, the equivalent of over $100B per month of central bank QE by another name.

Toward that end, the math is simple, with: 1) GBP reserves up 10% (no surprise given the gilt implosion of Oct. 2022), JPY reserves up nearly 8%, EUR reserves up 7% and USD reserves only up only 0.5%.

Not only does this look like backdoor QE masquerading as “building excess reserves,” it looks to me, at least, like a coordinated attempt by DXY central banks to collectively weaken the 2022 USD which Powell’s rate hikes had made painfully too high for the rest of the world, a fact/pivot of which we warned throughout 2022.

Since the above G7 policies kicked in, the USD has fallen 11% into 2023 as the other DXY currencies (JPY, EUR and GBP) gave themselves a little backdoor/QE boost.

It seems, in short, that the need for artificial liquidity in a world thirsty for USDs found a clever way to weaken the relative strength (and cost) of that USD (and confront/tame skyrocketing volatility in USTs) without overtly requiring Powell to mouse-click dollars from his own laptop.

Why Markets Rise into a Recession

This unofficial but likely coordinated play to constructively weaken the USD among the big boys helps explain why the S&P has been rising into 2023 despite open indicators that the country is itself marching toward a recession.

US Manufacturing data (ISM) is now at levels consistent with a recession…

Again: The ironies (and un-natural manipulations) abound.

Meanwhile, the Atlanta Fed’s GDPNow is down 1.5% from March’s 3.2% figure.

But hey, who needs growth, productivity, tax receipts or even a modicum of national economic health to keep a liquidity-supported stock market from defying reality—at least for now…

Waiting to Pay the Debt Piper…

Ultimately, of course, debt will get the last, cruel laugh, and with the US heading toward a deficit that is greater than 50% of GLOBAL GDP (!), I personally believe the Fed will need to return to its own money printer in a big way once this market charade ends in an historical “uh-oh” moment.

This seemingly inevitable return to mouse-click trillions (inflationary) will likely come after a deflationary implosion in equity assets currently supported by the foregoing tricks and fantasy rather than earnings and growth.

In the interim, and like those hedge fund jocks discussed above, we can only wait for things to get S&P ugly as gold, often sympathetic in the first hours of a market crash, rips toward all-time highs thereafter.

MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

The latest headlines, of course, are all pointing toward the ripple effect of Silicon Valley Bank (SVB), and they should be.

This banking metaphor for the tech sector in particular and the previously described disaster in California as a whole or the matter of banking risk as a theme, require understanding and attention, provided below.

Once we get past a forensic look at the data and forces which explain SVB’s demise, we quickly discover that SVB is itself just a symbol of a much larger financial (and banking) crisis which ties together nearly all of the major macro forces we’ve been tracking since Powell began his QE to QT quest to be Volcker-reborn.

That is, we confirm that everything comes back to the Fed and bond market in general and the UST market in particular. But as I’ve argued for years, and will say again now: The bond market is the thing.

By the end of this brief report, we also discover that SVB is just the beginning; contagion inside and outside of the banking sector is about to get worse. Or stated more bluntly: “We aint seen nothing yet.”

But first, let’s look at the banks in Silicon Valley…

Two Failed Banks

The tech-friendly SVB story (i.e. FDIC shutdown) is actually preceded by another failed bank, namely the crypto-friendly Silvergate Capital. Corp, now heading into voluntary liquidation.

Because SVB was a much larger bank (>$170B in deposits) than Silvergate (>$6B in deposits), it got and deserved more headlines as the largest bank failure since well, the 2008 bank failures…

Unlike Lehman or Bear Stearns, the recent disasters at SVB and Silvergate were not the result of concentrated and levered bets/loans negligently packaged as investment-grade credits, but rather the result of a good ol’ fashioned bank run. Bank runs happen when depositors all want to get their money out of the banks at the same time—a scenario of which I’ve warned for years and compared to a burning theater with an exit door the size of a mouse-hole.

Banks, of course, use and lever depositor funds to lend and invest at risk (which is why Henry Ford warned of revolution if folks actually understood what banks actually do). Thus, if a mass of depositors suddenly wants their money at the same time, it’s just not gonna be there.

So, why were depositors in a panic to exit?

It boils down to crypto fears, tech stress and bad banking practices.

No Silver Lining at Silvergate

At Silvergate, they provided loans to crypto enterprises, which were the belle of the speculation ball until Sam Bankman-Fried’s FTX implosion made investors weary of crypto exchanges. Nervous depositors withdrew billions of their crypto-linked deposits at the same time.

Silvergate, of course, didn’t have the billions needed to meet depositor requests, because, well… banks by their operational (fractional reserve) nature never have the money when needed at the same time.

Thus, the bank had to quickly and desperately sell assets, which meant selling billions worth of non-mature Treasuries whose prices had tanked in the interim thanks to the Powell rate hikes.

(See how the Fed lurks, head down and silent, as the source behind nearly every crisis?)

This was selling bank assets at the worst time imaginable and immediately sent Silvergate into the red and toward the cold dark ocean floor.

Once DOJ investigations end and the FDIC insurance runs out, we’ll discover just how “whole” the bigger depositors at Silvergate will be—but this will take time and end in some degree of pain for many of them.

Death Valley for Silicon Valley Bank

As for the bigger disaster at SVB, they mostly serviced start-ups and technology firms with a major focus on life sciences start-ups—i.e., yesterday’s unicorns and tomorrow’s donkeys.

These unicorns, of course, were not only under the cloud of the FTX fears in particular and falling faith in tech miracles in general, but equally under the pressure of Powell’s rate hikes, which made funding (or debt-rollovers) harder and more expensive to obtain for tech names.

In short, the keg party of easy money for questionable tech enterprises was beginning to unwind.

SVB’s slow and then rapid demise came as depositors (at the advice of their VC advisors) withdrew billions at the same time, which SVB (like Silvergate) could not match after selling UST assets at a massive loss to save the first withdrawals while burning the later movers.

In short, and like all Ponzi schemes, banks suffering a bank run can’t and won’t make everyone whole—just the first money out—i.e., the fastest runners in the burning theater.

Burn Victims, Recovery?

Banks, ironically, can’t technically go bank-rupt. Silvergate plans to eventually make all depositors whole as they sift through their assets in liquidation. Hmmm. Good luck with that.

SVB, however, waited too long for voluntary liquidation procedures and was instead taken over by the FDIC as a receiver to manage the sale of assets to return investor deposits as a dividend over time.

Furthermore, the FDIC “insures” investor deposits up to $250K, but that won’t help the vast majority of SVB deposits (95.5%) not covered by this so-called insurance.

The Contagion Effect?

Notwithstanding the pain felt by depositors at Silvergate and SVB, the fear there has spread to the broader banking sector (big bank to regional), which saw expected sell-offs at the end of last week and has prompted the inevitable question, namely: Is this another Lehman moment?

For now, we are talking about bank runs rather than banks failing ala 2008 due to massive derivative exposures and bad loans. In short, this is not (yet at least) a 2008-like banking crisis.

That said, and as we’ve reported countless times, post-2008 banks are still massively over-levered and over-exposed to that toxic waste dump otherwise known as the COMEX and derivatives market.

Each day, the headlines change.

Signature Bank, this time in New York, was just shuttered by New York regulators.

The Fed then announced over the weekend that they will make depositors whole, which is tantamount to confessing yet another Fed bailout of bad banks under the new name of the $25B “Bank Term Funding Program”—or BTFP, an acronym which spurs reminders of the 2009 TARP days…