The End of a Historical Debt Cycle: Prepare or Suffer

In this extensive discussion with the Jay Martin Show, Matterhorn Asset Management’s founding partner, Egon von Greyerz, addresses the catastrophic consequences of the current (and historical) debt cycle. History confirms that such debt bubbles inevitably collapse under their own weight, leading to potential hyperinflation and an implosion of assets. While von Greyerz cannot predict the exact timing of these events (no one can), it is essential that investors inform and prepare themselves for the obvious.

- 00:00:00 The Fall of Empires? Jay opens by asking von Greyerz his thoughts on the potential fall of the US Empire and the overlooked risks within Europe. Egon addresses the conditions typical to the end of an economic cycle and warns that the ramifications of such an unprecedented debt cycle could be catastrophic for the world.

- 00:05:00 Debt & Currency Risk. Egon ties currency risks to the debt cycle discussion. He emphasizes that debt is the overwhelming and undeniable danger to the global economy. Despite efforts by governments and central banks to manipulate credit markets and postpone pain, Egon sees no avoiding a global currency crisis. He describes an exponential phase where inflation gradually increases before suddenly skyrocketing, leading to potential hyperinflation. Ultimately, he foresees an implosion of assets in which bond values will be detrimental to the global economy. Rather than predicting exact dates, von Greyerz focuses on protecting himself and others from these risks.

- 00:10:00 Warning Signs. The conversation turns to the warning signs of the looming debt crisis, including the recent banking failures, rising credit defaults and bankruptcies. Egon also points out that inflation may be higher than officially reported, causing increased costs for everyday items. While the signs are not yet causing panic in the market, Egon argues that the continuous stream of money creation has artificially propped up the markets beyond their natural expiration dates. As a result, debt levels have skyrocketed to higher levels, which means the consequences will be greater when they implode.

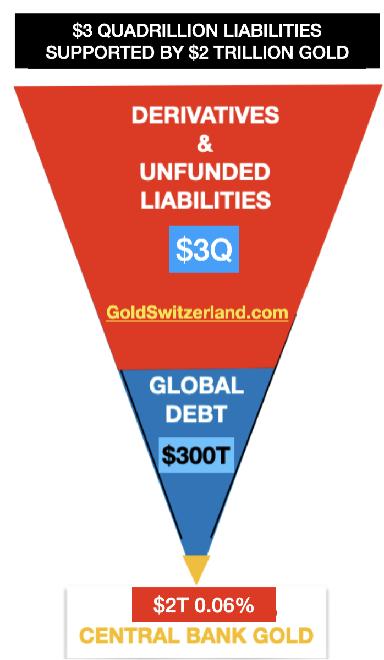

- 00:15:00 Debt is Global. Von Greyerz reminds that previous debt bubbles were limited to individual countries or continents, but now every country around the world is facing a debt crisis. Global debt, officially reported at $325 trillion, is in fact much larger when factoring in the grotesque expansion of the derivatives and the shadow banking system.

- 00:20:00 What Matters Most. The conversation turns to “safe haven” locales whereby some have the luxury and ability to live in different countries. Most people, of course, don’t have such options. For Egon, the truest safety rests with a strong support system of family and friends rather than material possessions. He suggests that changing our values and focusing on things like nature, books, and music can bring fulfillment and happiness. He also mentions the need for a shift in societal values, as the world is currently focused on materialism.

- 00:25:00 Ignored Realities. The conversation turns to more cracks in the global economy, including nations losing sight of their founding ideals and freedoms at the same time that migration problems and realities are not being realistically addressed. China, in particular, will suffer from its debt situation and speculative bubble; but it is a closed economy and perhaps easier to control, despite immense suffering within its borders. The conversation then pivots to the Ukrainian War, where Egon believes it is not a war between Ukraine and Russia, but rather a classic proxy conflict between the United States and Russia. He points out that the Ukrainian people and the Russian people do not want war; it is the leaders who are pushing for it. Peacekeeping efforts are not being prioritized, worsening the situation. Both speakers conclude that the war is detrimental to the world and Ukraine, and that a resolution is urgently needed.

- 00:40:00 War & Energy. In this section, von Greyerz addresses the relationship between the US and Europe, particularly in terms of sanctions against Russia. Von Greyerz argues that Europe is weak and simply follows the instructions of the US, while the rest of the world does not participate in these sanctions. The US has successfully separated Germany from Russia in terms of energy dependence, but this has caused unnecessary suffering for Germany. Toward this end, von Greyerz addresses the global energy crisis, marked by rising energy costs. As a result, the world will have less and more expensive energy in the foreseeable future, as renewable energy cannot fully compensate for the decline in fossil fuels. Von Greyerz reminds that there is currently no viable alternative to fossil fuels in the short term, as renewable energy sources like wind and solar are still decades away from replacing them.

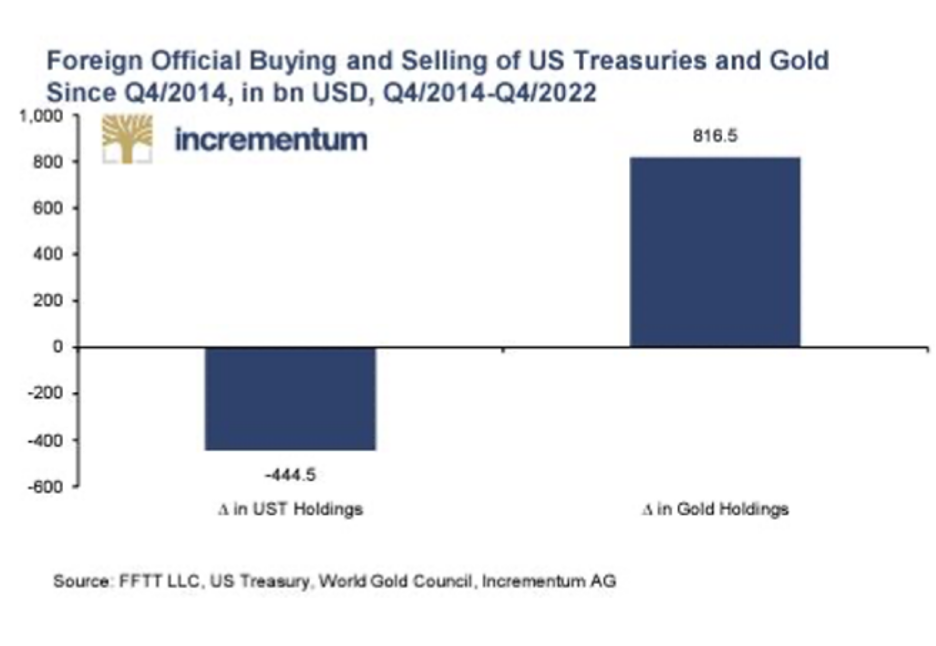

- 00:50:00 Gold Stacking Banks. Egon then explains the trend of central banks stockpiling physical gold. He argues that there is no gold rush yet, but the inflows are gradual and steady. He predicts that the real gold rush is still to come, as the world faces the biggest financial and currency collapse in history. The shift from the West to the East, particularly with the rise of the BRICS countries and the Shanghai Cooperation Organization, will have a major effect on the gold price.

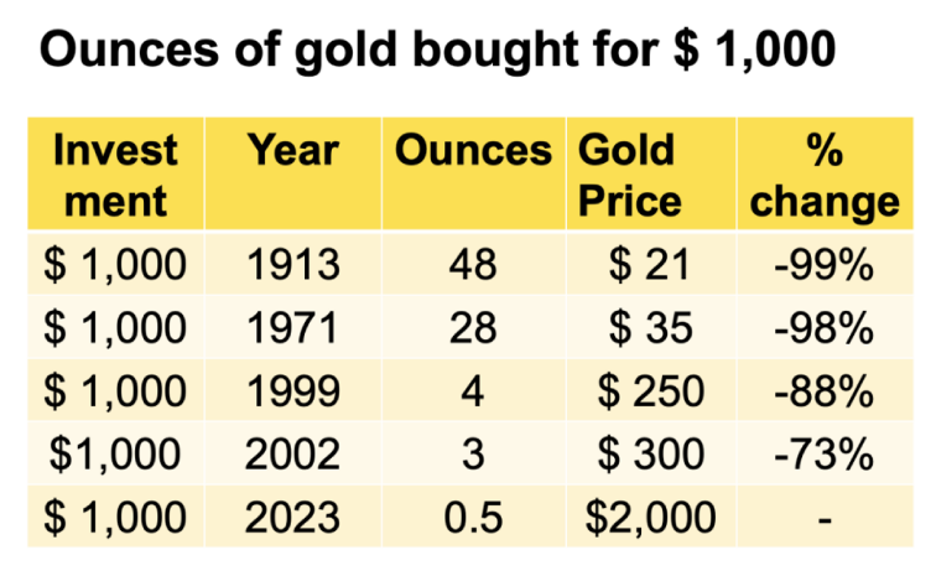

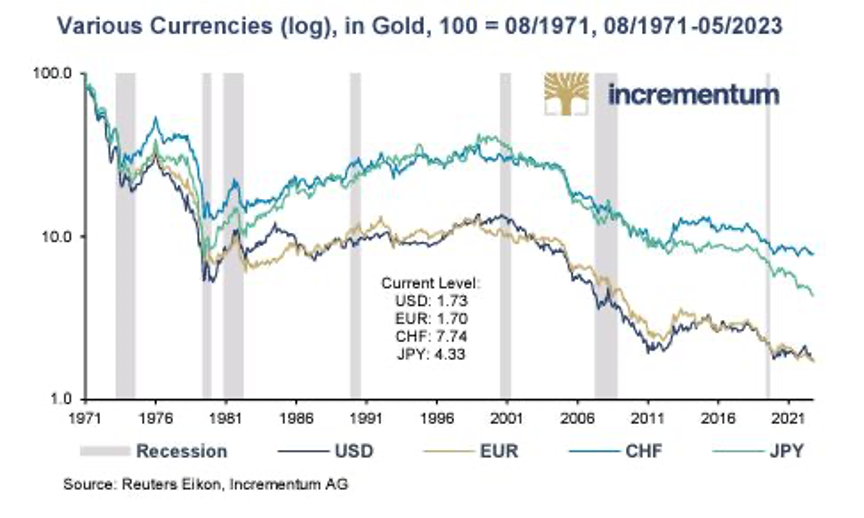

- 00:55:00 The Dying Dollar. Egon closes by highlighting the devaluation of the Dollar and other Western currencies due to excessive printing, prompting a mass move away from the world reserve currency. Von Greyerz suggests that gold will be the most natural replacement for central bank reserves, emphasizing the need for a significant revaluation of gold to accommodate future demand. He believes that those who fail to recognize this shift will be left behind and face costly consequences. Von Greyerz emphasizes the need for individuals to start considering and understanding risk rather than focusing on monetary gains, as he anticipates a major perception shift in the world.

The End of a Historical Debt Cycle: Prepare or Suffer

Before I got the invite to a swank prep-school out East, I used to spend my Spring afternoons on a baseball diamond not too far from the home field of Derek Jeter, who was still playing local ball in Kalamazoo while I was harboring high-school fantasies of playing for the Detroit Tigers.

Glory Days, Simple Lessons

Those were dreamy days of young fantasy. Alas, the Tigers never called, so I hit the books rather than the minor leagues and never looked back.

But like all old men with “glory days” memories, sports taught me a lot of metaphorical lessons.

Like having a team ringer who could hit or pitch years ahead of his time (or for you football/soccer folks, a deadly striker).

Even before the first inning was over, we all knew the harsh pleasure or pain of either: 1) having a “ringer” on our team, or 2) facing one on the other team.

In short, if one team had the most obvious “heat” (or unstoppable striker), it was the team that was going to win.

It was simply the Realpolitik of sports.

Thus, if we were playing against a Derek Jeter (or a Lionel Messi), we all silently knew the game’s outcome before we bravely trotted onto the infield.

Or to put it even more realistically, if my high school baseball team ever had to play the NY Yankees, there was not a snowball’s chance in H.E. double toothpicks that we were going to win that game.

This is fairly easy to grasp. Even our coach (McKenzie) would/could admit such hard truths.

The Debt Endgame is Obvious

Oddly, however, when it comes to US debt levels, and hence the end-game for US credit markets, rates, currencies and Fed policy, almost no one wants to see or admit the obvious.

That is, if we were to compare the Fed’s war against inflation to a baseball game, Powell’s odds are about as good as my Michigan high school team (The Lakeshore Lancers) beating the NY Yankees.

And here’s a few (and otherwise obvious) reasons why.

The Ignored Downgrade

Fitch just downgraded Uncle Sam’s IOUs from AAA to AA+.

For now, it seems no one cares. That is, most still think the Lancers can beat the Yankees.

Why?

Because the NY Times, the Wall Street Journal, Bloomberg and the Financial Times are all doing a wonderful, timely and concerted job of telling average Americans not too worry, as recession and inflation fears are now largely behind us.

Alas, has Powell beaten the Yankees?

Hmmm.

A Lying Chorus

Whenever I see a discredited cabal of media sell-outs all telling me at once not to worry, I start, to well…worry.

After all, when an FBI can have Facebook remove posts about vaccine facts or CNBC starts ignoring alternative views on a neocon war in the East, I tend to get skeptical of the “official version” of just about anything and everything.

What these esteemed financial media “experts” are failing to tell you is that the recent (and ignored) Fitch downgrade was premised upon the fact the America’s debt to GDP ratio (125%) is just too high.

In fact, it suggests that Johnson & Johnson or Microsoft have less a chance for defaulting on their debts than the United States.

What our media guides are also failing to mention is that the Fitch downgrade of 2023 was preceded by a similar S&P Rating downgrade in August of 2011.

Two Downgrades, Different Signals

What’s different about the August downgrade of 2023, however, is that Uncle Sam’s debt levels are much higher (scarier) than in 2011.

In fact, bond demand (as measured by the TLT) actually rose by 25-30% after the 2011 downgrade!

Really?

See for yourself:

This was because folks still believed the US of A and its IOUs were simply too big to fail and that such “risk-free” Treasury bonds were a safe-haven in any storm.

By 2014, however, the rest of the world was singing a different tune.

When adjusted for inflation, then as now, those so called “risk-free-returns” were nothing more than “return-free-risk,” which is why foreigners have been net-sellers of Uncle Sam’s IOUs ever since…

And what is even more interesting about the downgrade of 2023 is the fact that more Americans are finally catching on to this.

That is, and unlike the 2011 response to the S&P downgrade, the 2023 downgrade led to a dumping rather than buying of those very same (and increasingly downgraded) IOUs.

Again, see for yourself:

Main Street Finally Catching On?

What these charts are saying is that Americans are slowly starting to see the end-game of our debt-strapped American baseball team.

For decades, our dads and grand-dads have taught us to seek bonds as protection in dangerous times.

That is why US retail investors and US banks have either been suckered (on Main Street) or forced (at the bank level) to buy Uncle Sam’s promissory notes for decades with blind faith in DC’s ability to, well, beat the NY Yankees…

In 2023, however, more folks are distrusting what is an essence a negative-returning 10Y UST (i.e., what the fancy lads call “negative term premiums”), which means US bonds aint our dad’s (or grand-dad’s) “safe-haven” anymore.

Powell Running Out of Good Pitches

This, of course, poses a real problem for Powell’s baseball game against inflation, for Powell has no good fastballs left, just a weak curve ball (Fed’s balance sheet) and a crappy slider (rate manipulations).

That is, whenever the bond market runs out of liquidity (as he saw in the repo crisis of 2019, the UST crash of 2020 or the recent bank failures of 2023), Powel only has two choices/pitches to work with, namely:

- Do nothing (and watch bonds tank, rates spike, deflation rip, economies crumble and markets frog boil toward implosion), or

- Reach for that magical mouse-clicker at the Eccles Building and print more fiat money (and hence monetize Uncle Sam’s debt with inflationary bravado).

Powell’s Endgame vs. Powell’s Fantasy

For me, the end-game is clear.

In fact, I see it as clearly as if my Lake Shore Lancers were forced to play 9 innings against Jeeter’s Yankees, namely: “We’re gonna lose this game.”

For now, we are only in the first innings of this painful and embarrassing contest.

Powell, having broken the middle class, a number or regional banks and the normal shape of a robust yield curve, is already declaring victory over inflation and recession (along with a chorus of “yes-sayers” from the WSJ to the FT) and continuing his higher-for-longer fantasy of rising rates into the greatest debt bubble of world history.

How’s that for fantasy?

Maybe I should I try out for the Yankees myself?

Ignoring the Ringer (and the Math)

But what Powell (and the consensus-driven markets) aren’t seeing is the ringer on the other team—namely the fast-ball reality of simple math.

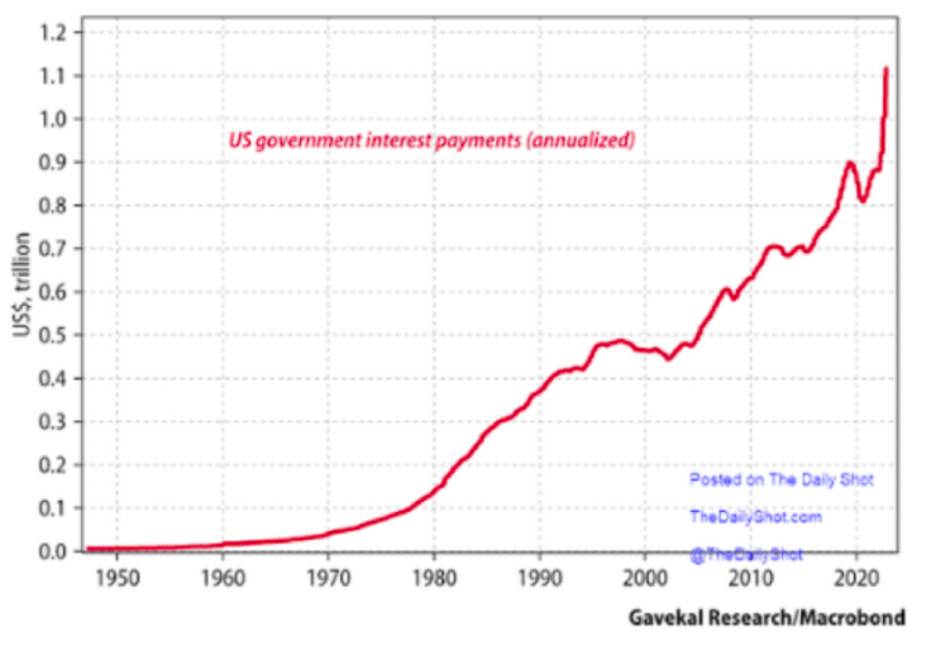

That is, as Powell raises rates, the cost of Uncle Sam’s debt has now crossed the Rubicon of payable.

Ironically (and sports are full of ironies), Powell’s war against inflation is in fact going to end up being inflationary, as the only way to inevitably and eventually pay the interest expense alone on Uncle Sam’s $33T deficit is via a money-printer.

And that, folks, is inflationary (what the fancy lads call “fiscal dominance”), which is bad for long-dated IOUs but good for gold.

Thus, and regardless of current headlines, bullish fantasy and media-ignored credit downgrades, I see yields on sovereign 10-years going higher for longer, which is not a view shared by consensus or those who even feel that a great high school team can beat the Yankees.

The Hopeful Crowd

Of course, there are those who may feel and hope that Powell and his squad of weak-armed experts can get US debt to GDP levels from 125% to 80% (which is the only ratio where normalized rate hikes work) by cutting spending costs.

Hmmm.

In that case, Powell and his equally weak teammate at the US Treasury Department (Yellen) or perhaps even Joe Biden, with his 20 MPH mental fast-ball at the White House, can sit down and decide where the USA is willing to tighten its belt.

Will it be by cutting entitlement spending?

Good luck staying in office with that game plan…

Will it be via military cuts?

Those who truly run DC from the Pentagon are not likely to agree…

Or perhaps there are still those deluded fans in those high-school bleachers who think Powell can grow his way out of a 125% debt to GDP ratio?

Hmmm.

Well, mathematically (just saying), such a gameplan would require 6 consecutive years of 20+% GDP growth, something which can (and will) NEVER happen in a high-rate baseball field.

The Angry Crowd

Thus, the only way to “grow,” and the only way to save Uncle Sam’s unloved bond market, is via liquidity, and that liquidity ain’t coming from GDP, tax receipts or 20% economic growth.

Nope.

It’s gonna come from a Fed mouse-clicker. Trillions of fiat Dollars—and that folks, IS gonna be inflationary, and it’s gonna crush the guy on the street, farm or high-school coaching staff.

In short, Powell’s fight against inflation is just in the 3rd inning.

In the end, inflation and negative real rates are the only pitchers/options left in Powell’s weak bullpen (short of a deflationary depression), which means, alas, he won’t be winning this game in the 9th inning.

Of course, such baseball metaphors, math, policy and inflation/deflation cycles aren’t easy to time with precision nor be understood with fancy Wall Street lingo by every Jane or Joe on Main Street.

Afterall, not everyone has the time or luxury to debate monetary policy (or baseball memories) when they are just struggling to make a car payment or fill their gas tanks (and those prices are going to go higher) as the BLS fudges the math on inflation data or the NBER tweaks its comical (and lagging) recession indicatorfor political rather than transparency motives.

But whether one be carrying a baseball bat or a guitar, it’s becoming clear from Farmville Virginia to Stevensville Michigan that something is “broken in the force.”

As distrust of a weaponized media, Dollar and justice system collides with politicized science and rigged markets, Americans are steadily losing faith in the so-called “experts.”

Toward this end, I won’t be the first nor the last to remind readers of the recent viral sensation, and Virginia guitar-picker, Oliver Anthony.

He recently opened his new American anthem by declaring “it’s a damn shame” that he’s “been working overtime-hours for bull-sh— pay” in a new world where “your dollar aint sh– and taxed to no end,” while the rich men North of Richmond “just want total control.”

Sound familiar?

Strike a cord?

More times than not, a baseball or a guitar can say more than a financial blog.

This debt game is going to end badly. They ALWAYS do.

PS: I love Richmond.

The End of a Historical Debt Cycle: Prepare or Suffer

In this latest conversation with Tom Bodrovics of Palisades Gold Radio, Matterhorn Asset Management partner, Matthew Piepenburg, offers his latest assessments on the American economic and political decline.

Piepenburg opens with a sober critique of the slow-drip toward increasing but now undeniable centralization in American markets and society. The net result is an ephemeral yet tragic demise of both classic capitalism and true democracy.

Instead, what Piepenburg sees now and ahead are more signs of a dystopian form of modern feudalism in which a political and financial minority operate behind a façade of liberalism as lords over a middle-class falling deeper into politically ignored serfdom. He unpacks the open marriage between corporate and governmental powers (weaponized/corporatized media, science, justice system, markets, banking, currencies etc.) which more resemble Mussolini’s definition of fascism than the democratic ideals of America’s founding fathers.

Not surprisingly, the foregoing theme of centralization incudes the frog-boil toward more regional bank failures, the duplicity of the Davos crowd and the Trojan horse of CBDC, which Piepenburg describes as “horrifying.” Ultimately, Piepenburg sees an ironic yet undeniably cornered Fed whose alleged war against inflation will only create more inflation. Powell’s “higher-for-longer” policy to fight the CPI is only making Uncle Sam’s grotesque debt levels grow equally “higher for longer.” As a result, more mouse-click money will be needed to monetize this embarrassing bar tab, which by definition, means more inflation and hence currency debasement ahead—all of which is bad for America but good for gold.

Piepenburg dives deeper into current market distortions (over-pricing), including various examples of ignored risks (needles) pointing at the global and national debt balloon. Toward this end, he links ignored risks in the Japanese markets (the “carry trade”) to equally ignored risks in the ticking time-bomb that is the US (and global) credit markets. He also squarely addresses the ongoing recession narrative and beleaguered US labor markets with sober facts.

The conversation closes with an equally sober (i.e., non-hyped) analysis of the BRICS headlines regarding a potential gold-backed trading currency. Although Piepenburg was among the first to warn of watershed de-dollarization trends last year, he does not see a gold-backed trading currency suddenly emerging from the BRICS conference this month in South Africa. Ultimately, the trend away from the USD is now inevitable, but the process will be slow at first and then all at once. Piepenburg is also keeping a careful eye on Saudi Arabia and the Petrodollar as another risk hiding in plain sight.

The End of a Historical Debt Cycle: Prepare or Suffer

The Fed has two mandates – Maximum Employment and Price Stability

If we look at price stability, the Fed has failed miserably.

The Fed employs 3,000 people in Washington DC of which 300 have a Ph.D. degree.

Their mission is “to provide our nation with a safer and more flexible and more stable monetary and financial system” with the overall mandate being price stability.

In addition to discussing the Fed’s total failure in controlling inflation, in this article I will also stick my neck out in the climate debate before I go on to the likely disastrous effects of debts, deficits and inflation will have on investment markets.

POWELL’S ABRACADABRA INFLATION TARGETING

Last week the Fed chairman explained, in the Senate, the method the 300 Fed PhDs and many of the 3,000 Fed staff apply for inflation targeting.

Senator Cortez asked Powell:

Cortez:

“Why 2% inflation?”

Powell:

“The 2% is globally agreed between all major central banks as a target.”

EvG question: So for this Lemming system 300 PhDs are required?

Cortez:

“How does it help people?”

EvG: The contorted Fed Speak reply which Powell utters summarises the entire wisdom of the Fed.

Powell:

“I will tell you how it does, I guess it is obviously not obvious how that is.”

EvG: Hmmmm… Powell obviously doesn’t have a clue – “OBVIOUSLY NOT OBVIOUS!”

Powell continues:

“To have people believe that it will go back to 2% anchors inflation there.

Evidence is that the modern belief is that people’s expectation has an effect on inflation. If we expect inflation to go up to 5%, then it will because businesses and households expect it.”

So there we have the inner secrets of the Fed’s inflation policy and targeting.

Firstly, the 2% target is just a Lemming system. Every other central bank does it, so we the Fed must follow the system of mediocrity.

Secondly, it is only a matter of making people believe that inflation goes to 2% and it will. What about if the people believe inflation will go to 20%?

This is where Powell the magician comes in to hypnotise businesses and household into believing in 2% inflation:

I agree with senator Cortez’ question: Why 2%? There is nothing desirable about the 2% at all. With 2% inflation, prices double every 36 years. The aim should really be to have no inflation.

The problem with an arbitrary Lemming system targeting 2% is that it doesn’t work. Neither the Fed nor any other central bank have managed to hold it at that level except for accidentally on the way to higher or lower inflation.

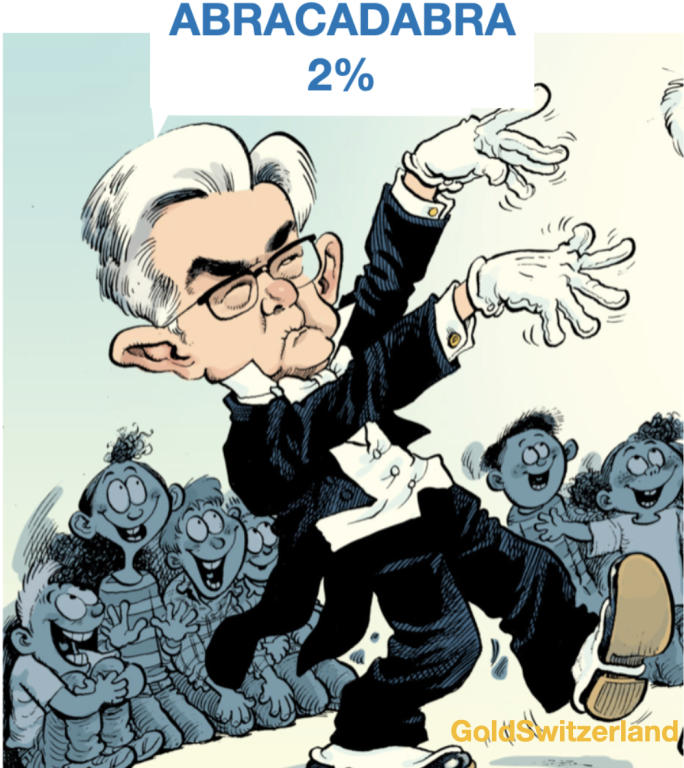

INFLATION WILL TURN BACK UP

Between 2015 and 2021 inflation in most industrialised countries was between 0% and 3%.

When inflation in 2021 shot up significantly, Powell and Lagarde (ECB) proclaimed that that was only “transitory”. Still inflation went up to around 10% before it started to retreat in 2022.

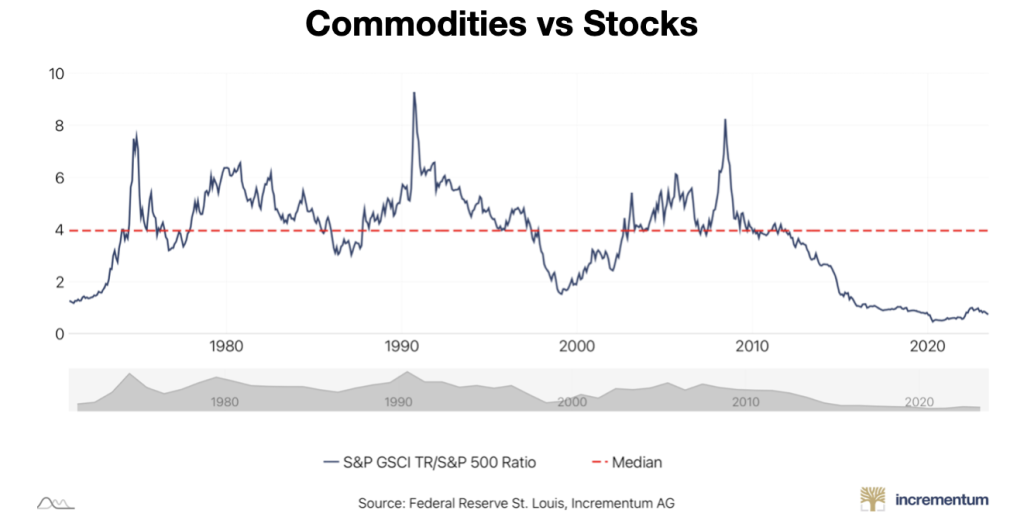

As I have explained in previous articles, the world is gradually moving from a financial and debt based economy to a one based on real assets and commodities.

This will lead to a shift from a financially and morally bankrupt Western system to the East and South based on commodities and manufacturing.

An upmove in commodity prices normally lead inflation by 6-9 months. So when commodity prices turned up in late 2019, inflation followed in most countries in early to mid 2020.

After a correction, commodity prices bottomed in March-May 2023 so we could see inflation in the US and Europe turning during the autumn 2023.

So sadly for Powell and Lagarde, their 2% inflation targeting is going to fail again, however much they hypnotise the people to believe it!

Instead high inflation and high interest rates will prevail for decades. But it will most certainly involve a very high level of volatility with fast up moves and violent corrections.

Before I move on to the dire effects that inflation deficits and debts will have for the US and global economy, I will stick my neck out in the heated climate debate.

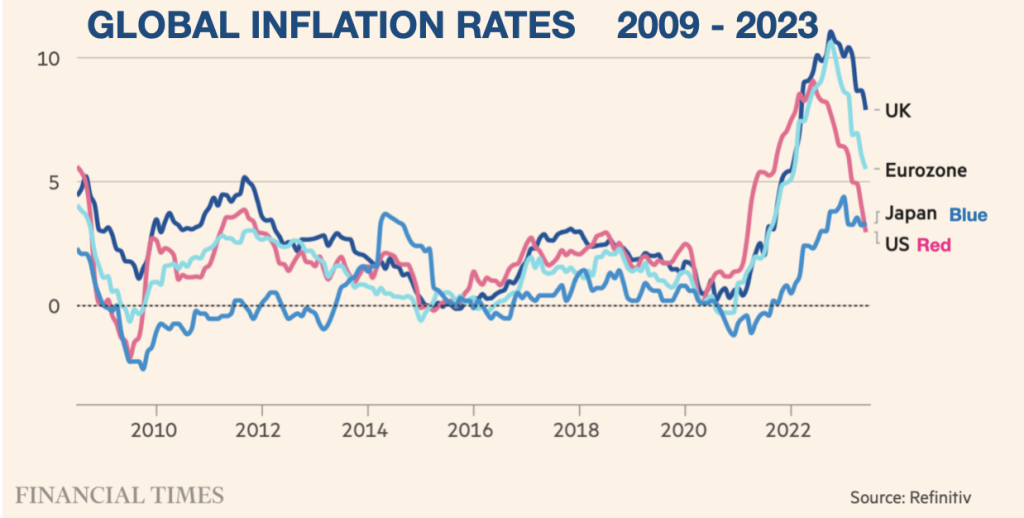

CLIMATE EMERGENCY – HYSTERIA OR REALITY

The climate debate is totally polarised and dominated by powerful interest groups.

Since Al Gore politicised this issue at a heightened level at the Copenhagen Climate conference in 2009, the trend has been clear.

Just like with Covid, it has suited Western governments to use the climate debate as a means of controlling the people and protecting special interests.

The official climate debate is totally one sided. Any money for research is only granted to scientists who support the notion of man-made global warming caused mainly by fossil fuels.

The fact that fossil fuels account for 83% of all energy and most probably cannot be reduced more than marginally for the next several decades is totally ignored in the debate.

A further problem is that the world has reached peak energy by way of fossil fuels and there is no serious alternative in sight for decades.

In addition, the energy cost of producing energy is increasing fast. The consequence will be falling standards of living for a foreseeable future. (SEEDS – Surplus Energy Economics)

The fact that the Holocene period which started 11,700 years ago has been the coldest in geological history is totally ignored. All the climate activists are just looking at figures for the last couple of hundred years.

Also, the fact that CO2 has been declining for 1 billion years is totally ignored. Without CO2 there would be no life on earth. Total CO2 in the atmosphere is today 0.04%. If that percentage declines below 0.02% there would be no life on earth.

Dr John Clauser, the 2022 physics Noble Prize winner, criticises the climate models as unreliable and not accounting for the dramatic temperature-stabilising feedback of clouds. Clauser says that clouds are more than 50X as powerful as the radiative effect of CO2. In summary he says that there is no climate crisis and that increasing CO2 concentrations will benefit the world.

A leading nuclear physicist Dr. Wallace Manheimer warned that Net Zero would end modern civilisation. He observed that the new wind and solar infrastructure would fail, cost trillions, trash large portions of the environment “and be entirely unnecessary”.

I am not a Covid expert. But in the case of Covid, the debate was totally skewed by the hundreds of billions of dollars spent on propaganda and corruption by the pharmaceutical companies. A small censored scientific minority were totally against an untested gene-manipulating vaccine and warned about its severe dangers. Three years later the fears of this minority have been vindicated.

I am obviously not a Climate expert either. But having studied economic cycles for many years, I am a great believer in understanding history and very long trends rather than basing my opinion on short term opportunism.

Thus studying very long climate cycles, it is clear to me that they are much more powerful than whatever effect that mankind has had on climate in the last 150 years.

To take an example, just look at the 11,000 year climate cycle graph above. It shows a Roman Climate Optimum 2,000 years ago. At that time Rome had a tropical climate. As far as I am aware, there were no cars or other manmade CO2 producing matters at that time.

Of course we all want a world with less pollution in the air and in the oceans and should strive for that globally.

But to believe that we can achieve Net Zero CO2 Emissions by 2050 is as unrealistic as believing that mankind can limit the temperature increase by 1.5 degrees by 2050.

Let me just take some examples. Many Western countries are legislating that only electric vehicles (EVs) can be produced after 2030 or 2035.

What the climate activists ignore is that EVs are costlier to produce than ordinary cars and have a major CO2 effect.

To produce ONE battery takes 250 tons of rock and minerals. The effect is 10-20 tons of CO2 from mining and manufacturing even before has been driven 1 meter.

Also, car batteries cannot be recycled but go to landfill which has major implications.

But that’s not the only problem. For the first 60-70,000 miles an EV produces more CO2 than an ordinary vehicle.

Hopefully the CO2 and cost efficiency of EVs will be improved but so far progress is very slow.

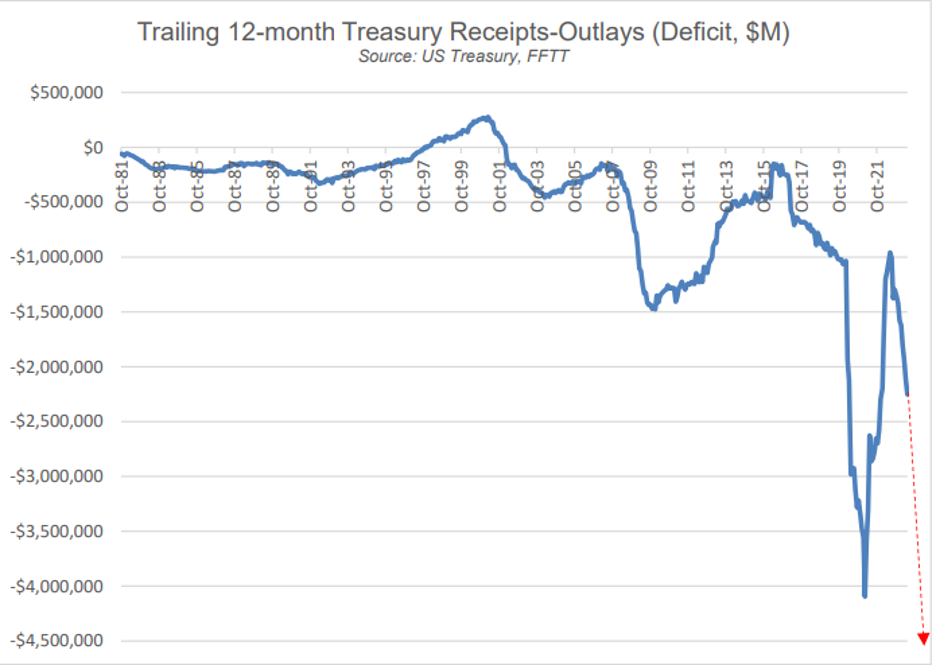

US DEFICITS ARE SURGING

The borrowing requirements of the US treasury is reflecting the total lack of fiscal discipline which is typical for a Banana Republic.

From January to the end of December 2023, the Treasury expects to borrow $3.3 trillion. With some extra bad news, including higher interest rates, the $3.3 trillion could easily rise to $4 – 4.5 trillion. This deficit plus the ongoing QT (quantitative tightening) is likely to put upward pressure on rates.

Except for the Fed, there will be no buyer of an ever increasing amount of US debt.

And so the vicious circle of higher debts, higher inflation, higher deficits starts to spin ever faster.

Sadly, such a dire scenario can never have a happy ending.

For the banks, higher rates mean much higher defaults and a constant squeeze to reduce lending, also mandated by the Fed.

With massively increasing borrowing requirements from the US Government and the Fed as well from the banking sector with dwindling sources of funding, the likelihood of drastic measures are obvious.

After the subprime crises 2006-9, governments agreed that bailouts would be replaced by bail-ins at the next crisis. So far this didn’t happen in mid-March when 4 US banks and Credit Suisse collapsed.

But the coming pressures on both public and private funding are likely to lead to draconian actions by governments next time around. This will probably involve forced savings in government debt for most Western countries, including US, Europe and Japan.

It could involve compulsory purchases by bank depositors of say 10 year bonds with interest rolled up for 25-50% of customer liquidity in the bank.

My old forecast of future US debt made in 2016 is so far looking on target. Whether the debt will be my original $40 trillion forecast or the revised $50 trillion, time will tell.

Major bank and derivatives defaults could easily push it up to $50t.

HOLD TANGIBLE ASSETS

The main beneficiaries of the Western debt and deficit problems are of course:

- Precious Metals – especially gold and silver

- Commodities – especially oil and uranium

Stocks might benefit short term from higher inflation but over the medium and long term they will collapse.

Buffett’s favourite indicator, Stocks to GDP is massively overvalued. To decline to the mean would involve a 50% fall. But overbought markets always overshoot. So a 70-90% decline would not be unrealistic. In such scenario, it won’t only be stock prices that decline but GDP could easily fall 10-20% in real terms.

Bonds, especially issued by governments, should be avoided like the plague. Inflation and potential defaults or moratoria will make them the worst investment ever. In addition the debasement of currencies will lead to the value of bonds in real terms reaching ZERO very quickly.

So is my forecast too pessimistic. Maybe but I doubt it. No one can of course predict the exact timing.

But what we can evaluate is the risk.

And with global risk being more elevated than at any point in history (and I haven’t even discussed political or geopolitical risks), why not protect your assets today from potentially the biggest wealth destruction ever.

The End of a Historical Debt Cycle: Prepare or Suffer

- 00:00 In this section, Matthew Piepenburg, partner at Matterhorn Asset Management, discusses the growing distrust of the US dollar and the trend of de-dollarization. He highlights how the Western sanctions against Russia have caused ripple effects and raised eyebrows for other countries, as the weaponization of the world reserve currency has created a sense of distrust. He also mentions the recent BRICS summit in South Africa and the discussion of a gold-backed trading currency as further symptoms of this growing trend. While he believes this is not yet the end of the US dollar as a world reserve currency or fiat money, he emphasizes that the trend of de-dollarization is clearly underway and warns that once the genie of weaponized currency is out of the bottle, it cannot be put back in.

- 05:00 In this section, the speaker discusses the world reserve currency status of the U.S. dollar and the upcoming BRICS meeting. They mention the importance of trust in determining which countries developing nations will choose to align with, highlighting the question of trust in countries like China, Russia, Indonesia, Brazil, and India. Moving on to the U.S. Federal Reserve, the speaker suggests that the Fed realized they raised rates too fast and too high, leading to a pseudo-recession and a break in trust in bond markets. As a result, they took a pause in their tightening policy to give the banks and credit markets a break. The speaker emphasizes that the market’s reaction to the Fed’s actions will determine whether this pause is a precursor to more heightening or an eventual pivot towards liquidity infusion. They also question the reliance of the markets on the Fed and why the central bank has such a significant impact on stock and bond markets.

- 10:00 In this section, the speaker discusses his belief that the US is already in a recession, citing indicators such as the yield curve, the change in the M2 money supply, and the inflation to deflationary moves. Piepenburg also mentions that the labor market will be the next to crack. When asked about gold not keeping up with the equity market rally, the speaker explains that gold is seen as insurance against dying currencies and a hedge against the weakening purchasing power of the US dollar. He attributes the rally in equities to the market’s expectation of the Federal Reserve adopting a more dovish stance in response to a recession. However, he also highlights the stress on the banking system and the potential for more liquidity crises. He suggests that as people realize their currency is getting weaker, they will turn to gold as a means to deal with the low purchasing power of their currency, all of which is held in increasingly beleaguered banks.

- 15:00 In this section, Matthew Piepenburg explains that building investor interest in gold is a subjective matter, as it relies on trust and a loss of faith in fiat currencies. He argues that gold becomes more attractive when it becomes obvious that the purchasing power of the currency in one’s wallet is diminishing, regardless of reported CPI or market discussions. Piepenburg suggests that when countries reach a point of fiscal dominance, where they are unable to effectively fight inflation due to excessive debt, investors will seek an alternative to weak money. For many, this alternative is physical gold, while others turn to more volatile and speculative cryptocurrencies like Bitcoin.

The End of a Historical Debt Cycle: Prepare or Suffer

I recently blew the dust off an old Rudyard Kipling poem, “If,” which many have castigated as a bit overly romantic, despite its high praise from Mark Twain and T.S. Eliot to India’s Khushwant Singh.

The fact, moreover, that “If” was written by a Victorian era colonial in 1895 as a father’s advice to a son, could easily put its otherwise timeless insights at risk of being cancelled by the woke elite as potentially misogynistic or regionally insensitive…

Notwithstanding such critiques, financial readers might equally be asking what Kipling has to do with global markets, the currency wars, inflation/deflation tensions or the US bond market?

Well, given the fact that each of these financial topics, when examined closely or even broadly, are now signs of open madness, yet still consistently ignored or down-played by our leaders and media midgets, I could not help but consider the following (and opening) line of advice:

“If You can keep your head when all about you

Are losing theirs…”

Well: Can we?

What is Happening All About You? A Complete Denial of Debt’s End-Game

As headlines from an increasingly distrusted 4th Estate debate everything from a challenged USD (the recent BRICS gold hysteria) and weaponized State Department (Raytheon’s war in the Ukraine graveyard) to an equally weaponized/politicized justice system (Hunter vs. Trump’s legal woes), most of America seems blind to a ticking time bomb.

That is, amidst all the political and social distractions of late, the financial wizards leading an increasingly splintered America have been quietly doing what they do best: Sending the USA into a fatal debt spiral.

I recognize, of course, that bonds, budgets, deficits and yield curves don’t excite the same immediate reactions as, say, Joe Biden’s now undeniably compromised mental state or who or what’s image adorns a can of Bud Light, but as I’ve said so many ways and times: Debt matters.

In fact, debt destroys nations. And not just sometimes, but every time.

Such destruction, hiding in plain sight, is creepy, because, well…it creeps up on us slowly, and then—all at once.

The Latest Creepy Numbers Creeping out of DC

But sadly, debt data and bond markets bore most citizens.

This is why the majority of invisibly taxed and intentionally enslaved American serfs probably haven’t noticed that the US Treasury Department’s quarterly net-borrowing estimates for the second half of 2023 just came out, and that number is a sickening $1.85 TRILLION.

Read that again. $1.85T in 6 months.

This is openly ignored madness. Our experts having officially lost their minds.

We are talking about nearly 2000 billion (or 2 million millions) of new debt to be created/issued in the span of months, the implications of which are staggering.

This is especially scary when you add Powell’s 525 basis point rate hikes into the borrowing equation, which only makes the interest-expense of this appalling debt (cess) pool beyond payable without, well…more debt creation.

So, there you have it, American monetary genius: “We can solve a debt problem with more debt.”

Keeping Our Heads When All About Us Are Losing Theirs

But just because the “experts” in DC (who made Faustian bargains with their common sense and advanced degrees in exchange for a DC job title) may have completely lost their ambitious little minds/heads, it doesn’t mean the rest of us can’t hold on to ours.

Fighting Inflation Will Increase Inflation

Powell’s comical, and ultimately disingenuous, war on inflation, for example, is actually poised to end in far greater inflation, something understandable to any whose market attention span is greater than a typical tweet or YouTube short.

As a June white paper from even the St. Louis Fed recently confessed (and folks like Luke Gromen better explained), the US is approaching a grossly paradoxical point called “Fiscal Dominance,” a sober concept of basic math which I boil down to this:

“When a debt-strapped nation with nearly $33T in public debt raises rates to ‘fight’ inflation, the increased cost of servicing that debt becomes so egregious that the only way to ‘pay’ for it will come from a re-ignited mouse-click money-maker at the Fed, which is inherently, well: Inflationary.”

In other words, at some point (and don’t ask me when, but it’s looming), the Fed will pivot from dis-inflationary QT to mega-inflationary QE—all to be conveniently blamed on COVID, Putin and/or the climate.

It has always been my personal view, however, that Powell’s Volcker 2.0 charade of raising rates and trimming (barely) the Fed’s balance sheet to “fight” inflation has been a deliberate ruse.

His hawkish narrative buys him time to replenish the ammunition of his only two monetary weapons (rates and money supply) so that he’ll have more to cut (rates) and expand (Fed balance sheet) once overly-stretched credit markets blow to shreds.

At that point we’ll see: 1) QE to the moon and/or 2) a monetary re-set that will make Bretton Woods look like a pleasant game of international snooker.

Credit Markets, Death by a Thousand Cuts

In fact, this “blowing to shreds” process in the credit markets has already begun, in a kind of death by a thousand cuts.

Just ask all those nations dumping USTs, or all those regional banks that have failed and all those bigger banks consolidating (i.e., centralizing); or ask all those mutual fund managers who lost greater than 20% in 2022, or the repo markets back-firing since 2019, or all those foreign sovereign bonds (from gilts to JGB’s) tanking and all those wannabe BRICS+ nations looking for anyway they can to join a sanctioned Russia and patient China to trade outside of an openly weaponized USD.

In other words, it’s not just that change is gonna come, it’s literally all around us, hiding (or ticking) right before our media-distracted eyes.

Buying Time Today as More Things Break Tomorrow

Powell, in the meantime, will stick to his “data dependence” and bide his time going higher for longer until something, i.e., topping markets now riding the AI tailwind (narrative), finally break under their own grotesque weight.

So yes, debt matters. Deficits matter. And supporting Uncle Sam’s otherwise unloved IOUs matters.

This is because, and I’ll say it again and again and again: The bond markets matter.

Why?

Repeat: The Bond Market Matters

Because if no one is buying those over-supplied bonds (see above), their yields spike in a simple supply & demand mismatch, which means the cost of serving US debt—which is the only wind beneath our national/financial wings—spikes too.

Spiking debt costs, of course, are a death knell to a system (from banks, bonds, stocks and Treasury Departments) already drowning in historically unprecedented (and unpayable) debt.

Thus, without more inflationary mouse-click money (QE) to stave off more credit contraction, bank deaths, failed UST auctions, and all those low-rate, extend-and-pretend-addicted companies on an S&P 500 (which is nothing more than an S&P 7 in terms of real market cap), the slow implosion discussed above becomes a sudden implosion.

Recession Denial

And that’s not even factoring in a looming but now Powell-ignored and media-down-played recession, that malleable term of economic art, which, like inflation and employment data, those fiction writers at the BLS and Eccles Building can redefine at their convenience.

Facts, after all, are like math. They are stubborn. This is why the experts are apt to distort them, like a corrupt lawyer who tampers with evidence to win a jury trial. That is, even a witch looks pretty when you hide the warts.

As I’ve argued many times, and based upon recent on-the-ground experience in USA main streets as well as a neon-flashing yield curve, the conference board of leading indicators and the year-over-year change in the M2 money supply, America is already in a recession.

At some point, even Powell’s forked tongue and the DC data manipulators won’t be able to hide a recession which citizens feel despite CNN, The View or their politicos telling them otherwise, especially as gas prices and lay-offs continue to rise into year-end.

Recession, Banana Republic America and the Inflation/Deflation Cycle

Toward this end, we need to keep our heads and think for ourselves about what recessions can do to countries like the USA whose balance sheet and debt levels are quantifiably no better than your average, and once mocked, banana republic.

Like any banana republic, extreme debt and embarrassing deficits spell their doom, as over time such heavy debt tides are inherently inflationary, despite the current (and expected) dis-inflationary period.

After all, crushing the middle class and small business sector with a record-breaking rate hike is dis-inflationary.

In a recession, for example, a nation’s already weakened ability to produce goods and services (thanks to Powell’s rate hikes) at levels high enough to sustain those deficits only gets even weaker.

As Luke Gromen again argued, and illustrated below, a recession could easily send the US deficit to $4.5T, or 8% of GDP.

In such an all-too-likely deficit scenario (and all we really have today are bad scenarios), we could see bonds fall into the next official recession (always announced too late), as we saw them fall along side stocks in the 2020 COVID crash.

If bonds fall in a similar manner, this means bond yields, and hence rates, would rise, which would only add more pressure on the Fed to issue more US IOUs then paid for with more inflationary mouse-click Dollars to control their yields.

For now, and as Gromen, and myself, would confess, such a view is still a minority view—but that doesn’t necessarily make it a wrong view, especially in a world figuratively losing it head.

Alternative Scenarios Are No Better

But even the most sober convictions must consider alternative scenarios and views.

Like Brent Johnson, I agree that we could easily see an implosion in the EU markets (Germany now in recession) or even in Japan long before the US markets raise their white flags and surrender to instant, mouse-click liquidity measures.

In such a “foreigners-first” scenario, we could indeed see a flight into the perceived “safety” of the UST and hence USD as the best horse in the global slaughter house.

Such a “milk-shake inflow” (or straw-sucking sound) into USTs could take some temporary pressure off the Fed’s inflationary QE gas pedal. It could also make the USD stronger rather than weaker in the interim.

The End-Game Stays the Same

But no matter which white flag goes up first, from Tokyo to Berlin to DC, the end-game for all debt-soaked nations, regions, currencies and systems is ultimately the same.

That is, and to repeat, there really are no good scenarios left, just more desperate measures to buy time and postpone the inevitable.

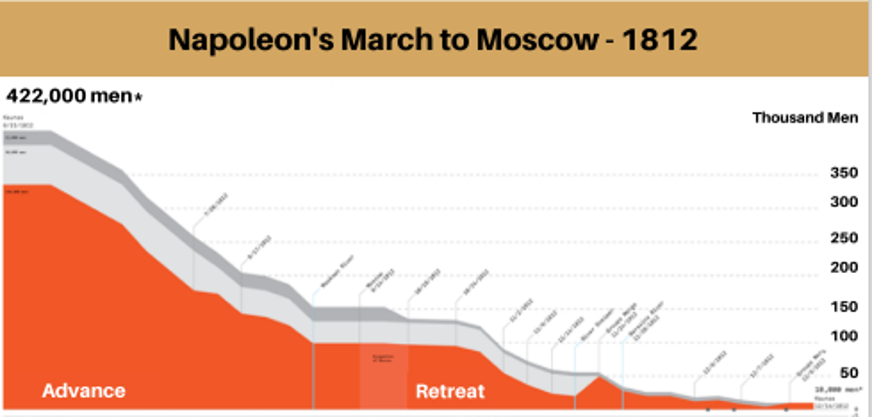

As I wrote elsewhere, even the most proud and victory-accustomed armies, from Napoleon’s Grande Armee in 1812 to Lee’s Army of Northern Virginia in 1863, eventually extend themselves too far and suffer a “Gettysburg Moment.”

Nations whose debt levels are too far extended offer no exception to this rule or metaphor.

That is, no brave cavalry or infantry charge by Marshal Ney or General Picket can defy the simple law of too many bullets against too few men.

Too Many Debts, Not Enough Liquidity

Like Japan, the EU and the UK, America has too many debts and not enough natural liquidity to sustain them.

Powell can buy time and headlines, and he can even print trillions of more fake fiat dollars to “save the system,” but in the end, it is always the currency which is left dying last on the field.

For those who understand the stubborn math, history and cycles of fiat currencies, the precise timing of such final currency defeats is impossible to predict with precision, but easy enough to see coming, and thus easy enough to prepare for in advance.

Advanced Preparation—The Minority Which Kept Their Heads

Gold, which is an obvious and historically-confirmed weapon (as opposed to barbarous relic) against such open currency destruction, is an equally obvious and historically-confirmed means of achieving such advanced preparation.

Despite such objective facts (and the media-ignored power of gold as an open threat to fiat money), gold makes up only 0.5% of the global investments.

This, it might be said, makes such lonely “gold bugs” crazy, but as alluded to above, sometimes one must keep their heads when all about them are losing theirs.

The question, then, like the title of Kipling’s poem, is not “If” fiat money dies, but “When.”

The former is obvious, the latter is approaching.

Got gold?

The End of a Historical Debt Cycle: Prepare or Suffer

Timestamps:

0:00 Wealth Preservation Highlight

0:16 Introductions – Egon von Greyerz Background

3:15 ECB Rising Rates

5:20 High Inflation

9:12 The Looming Recession

15:26 Credit Suisse Collapse

22:00 Protecting Your Assets Now!

22:32 BRICS Gold-backed $

24:26 Dollars, Gold and Wealth Preservation

In this brief (33-minute), yet engaging, conversation with Silver Bullion TV, Matterhorn Asset Management Founder, Egon von Greyerz, addresses the importance of balance and meaning in a global financial backdrop increasingly absent of both.

The conversation opens with the ECB’s latest rate hikes in its ever-comical dance to fight an inflationary tide which the central banks alone created. Von Greyerz addresses the fiction of “target 2%.” He sees rates (as well as energy pricing) going higher, which will ultimately add to the inflationary pressures. As rates (and hence the cost of debt) go higher, the need for more synthetic liquidity to cover that debt will end up being inflationary.

Of course, the impact of such poor policies (rising rates and inflation) will affect the man on the street the hardest. This is a gradual but real pain evident across Europe, which is simultaneously (and sadly) suffering from extremely poor leadership. Net result: Citizens will have to pay the recessionary Piper for the financial negligence of their policy makers.

Von Greyerz confirms that banks and policy makers have very few tools left other than empty words to hide embarrassingly poor math, an undeniable embarrassment as evidenced by the recent implosion at Credit Suisse for massive leverage and poor loan underwriting. Unfortunately, such poor banking practices are hardly unique to Credit Suisse. The entire banking system, as argued herein and warned for years, is under extreme pressure. Bail-ins are very likely especially in the US but also in Europe.

As to de-dollarization and the recent headlines as to a gold-backed trading currency among the BRICS, von Greyerz sees the trend away from the USD but is not expecting any complex gold-backed currency in the near or even medium term. The case for gold, however, is rising among central bank reserves. Most importantly, such trends and signs make a far stronger case for informed investors to protect their wealth with physical gold rather than fiat dollars and increasingly unloved sovereign bonds.

As von Greyerz consistently reminds, gold as a wealth preservation asset has never been more important.

The End of a Historical Debt Cycle: Prepare or Suffer

The Everything Bubble is about to turn to the Everything Collapse!

This is the inescapable outcome for the Western world.

The world economy should have collapsed in 2008 were it not for a massive Hocus Pocus exercise by Western central banks. At that time, global debt was $125 trillion plus derivatives. Today debt is $325 trillion plus quasi-debt or derivatives of probably $2+ quadrillion.

The US is today running bigger deficits than ever at a time when:

- The interest rate cycle is strongly up

- There is only one buyer of US debt – the Fed

- Dedollarisation will lead to a rapid decline of the dollar.

The financial system should have been allowed to collapse 15 years ago when the problem was 1/3 of today. But governments and central bankers prefer to postpone the inevitable and thus passing the batten to their successors thereby exacerbating the problem.

FALSEHOOD IS THE MOTTO

The world is now desperately clinging on to a false prosperity, based on false money, false moral values, false financial values, false politics and politicians, false media, false reporting of reality whether vaccines, climate, genders or history etc.

Let’s look at some synonyms to false or falsehood according to Thesaurus:

Cover-up, deceit, deception, dishonesty,

fabrication, fakery, perjury, sham etc.

Yes, all of the above fits today’s West and especially the US. But as I often point out, history repeats itself so this is nothing new. But since most major cycles can take 100 years from boom to bust and back again, very few people experience a severe depression in their lifetime.

In the West, the last major depression was in the 1930s followed by WWII.

Yes, I have repeated a similar message for quite a while. My purpose with this repetition is obvious. The world and in particular the Western economies are facing a wealth destruction never before seen in history and very few people are prepared for it.

As the Romans said: “Repetition is the mother of learning”.

Let’s just look at a couple of quotes from the Greek philosopher Plato 2,500 years ago.

DEBT IS THE CONSEQUENCE NOT THE CAUSE

So nothing has changed but just as we have climate cycles, there are also well defined economic cycles of boom and bust.

Major economic cycles normally have a similar ending as von Mises said:

“a final and total catastrophe of the currency system involved.”

Or as Voltaire expressed it: “Paper money eventually returns to its intrinsic value – ZERO.”

Debt is not the reason for the problems which the world is now facing. Instead debt is a consequence of the falsehood culture that that is toxifying the world.

Unacceptable increases in sovereign debt arises when governments can no longer tell the truth, if they ever could!

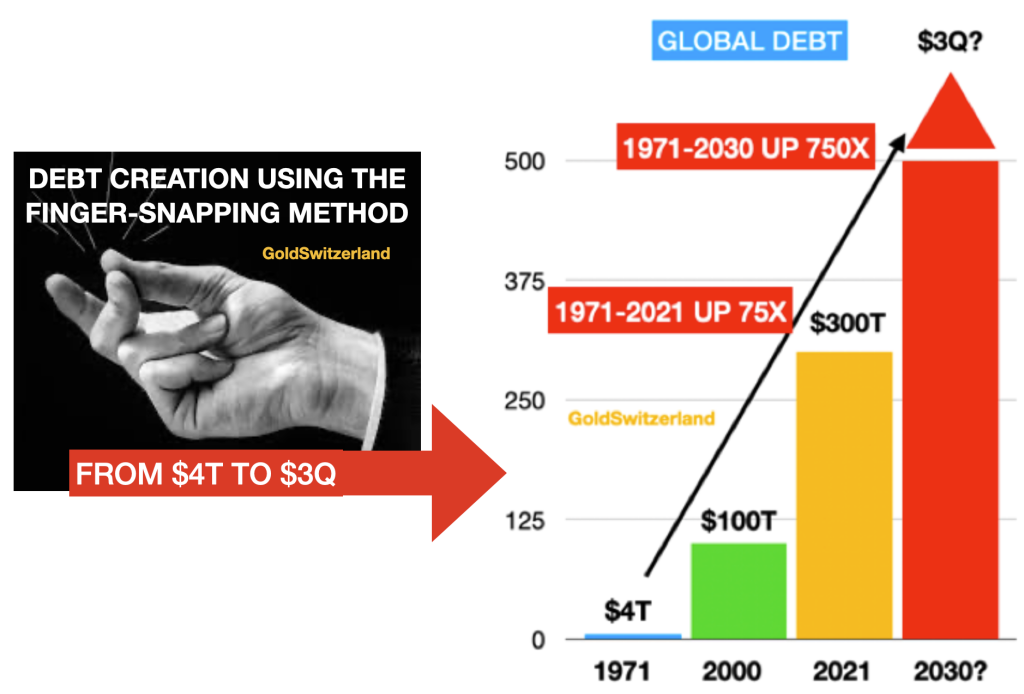

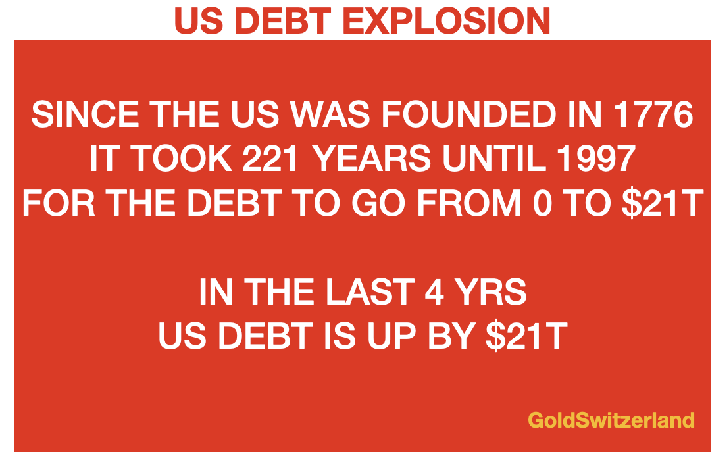

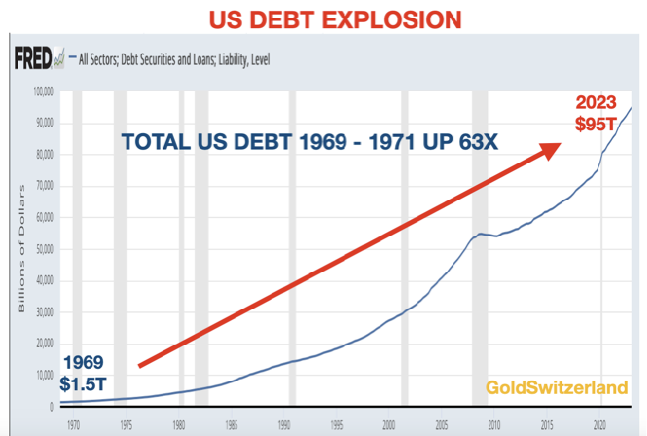

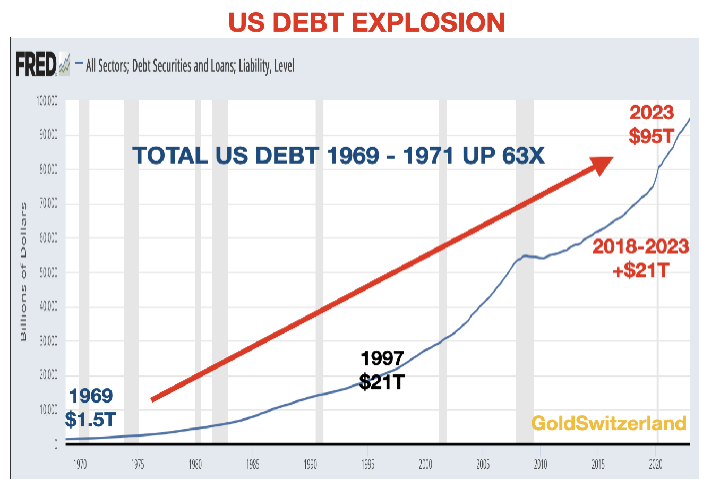

So the end of the current economic cycle started when Nixon closed the gold window on August 15,1971. At that point, he realised that the US could no longer continue to run budget deficits as they had done since the early 1930s. To get rid of the disciplinary shackles of gold allowed the US government and most central banks to create “finger-snapping” money. This is what a Swedish Riksbank official called creating money out of thin air.

When In 1971, global debt was a “mere” $4 trillion. In 2023 global debt is $325T excluding derivatives. This is clearly a major timebomb as I wrote about recently.

By 2030, debt could be as high as $3 quadrillion. This assumes that the quasi debt of global derivatives of $2 – $2.5 quadrillion has been “rescued” by central banks in order to stop the financial system from imploding.

First we will obviously see major pressures in the on balance sheet credit market. Corporate bankruptcy filings are increasing in most countries. In the US it is on a 13 year high for example, up 53% from 2022. Moody expects global corporate defaults to keep surging as financial conditions tighten.

The US banks are grappling with deposit flight, higher rates and major risks in the property sector.

The pressures in the commercial property market and in housing will lead to a wave of defaults necessitating further money printing. S&P reports that 576 banks are at risk of overexposure to commercial property loans and surpassing regulatory guidelines.

BORROWERS WILL DEFAULT AND BANKS GO BANKRUPT

The bank failures in mid-March starting with Silicon Valley Bank were just a warning shot.

Banks need high rates and a reduction in the loan portfolio to survive.

But borrowers, both commercial and private, need lower rates and more credit to survive.

This is a dilemma without solution. It will end up with both sides losing. Borrowers will default and banks will go bankrupt.

Before that there will be the biggest debt feast in the history of the world.

Luckily it requires no skill, no assets, no security to create the quadrillions of dollars which will temporarily defer the problem.

All that is needed is a bit more finger-snapping.

It will all happen first gradually and then suddenly as Hemingway described the process of going bankrupt. I have described this gradual/sudden process in previous articles, the first time I believe in 2017 when I talk about “Exponential moves as terminal”

Imagine a football stadium which is filled with water. Every minute one drop is added. The number of drops doubles every minute. Thus it goes from 1 to 2, 4, 8 16 etc. So how long would it take to fill the entire stadium? One day, one month or a year? No it would be a lot quicker and only take 50 minutes! That in itself is hard to understand but even more interestingly, how full is the stadium after 45 minutes? Most people would guess 75-90%. Totally wrong. After 45 minutes the stadium is only 7% full! In the final 5 minutes the stadium goes from 7% full to 100% full.

So if we take 1971 as the beginning of the debt explosion we can see that the real exponential phase happens in the final 5 minutes which are still to come.

And this is how global debt can explode in the final phase of a credit boom.

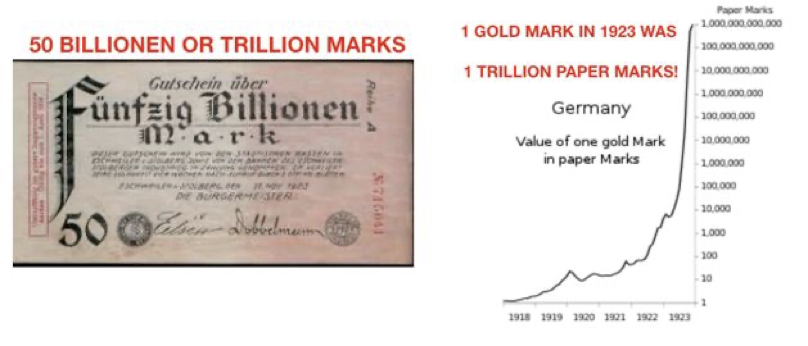

The hyperinflation in Weimar Germany in the early 1920s show a similar pattern:

As the graph above of the gold price in marks shows, the price of an ounce of gold went from below 10,000 marks at the beginning of 1923 to over 1 trillion by the end of the year.

No one should expect gold to go to $1 trillion but everyone should expect the dollar and most currencies to fall precipitously.

THE PERFECT WEALTH DESTRUCTION SCENARIO

So we now have a perfect setup for the coming wealth destruction scenario:

- Global debt has gone up 80X between $4T in 1971 to $325 trillion in 2023

- Bursting of the derivatives bubble could push debt to $3+ quadrillion

- High interest rates and high inflation lead to sovereign and private defaults

- Bubble assets like stocks, bonds and property will fall dramatically in real terms

- Major debasement of USD and most currencies

- Real assets – commodities, metals, oil, gas, uranium etc will rise strongly

- Higher taxes, bail-ins, failure of pension and social security system

- Central banks will fail to save the system leading to debt implosion and defaults

- A deflationary depression will hit the West worst in a long term decline

- The East and South (BRICS, SCO etc) will also suffer but emerge much stronger

So we now have a perfect vicious circle of debt eventual leading to default:

DESPERATE GOVERNMENTS TAKE DESPERATE ACTIONS

Yes, the West led by a bankrupt USA will try all tricks in the books. That will include CBDCs (Central Bank Digital Currencies), much higher taxes especially for the wealthy, bank bail-ins (forcing depositors to buy 10-30 year government bonds), martial law and many more measures to restrict people’s everyday lives.

These government bonds will have zero value since there will be no buyers.

CBDCs will also soon become worthless as they are just another form of unlimited paper or finger-snapping money.

I doubt ordinary people will accept these draconian measures. Thus there will be civil unrest which governments will be unable to control. Neither police nor the military will accept to turn against suffering fellow citizens.

PROTECTING RISK IS ESSENTIAL – TIMING IS NOT

I am obviously aware that the consequences I have outlined above of the biggest global debt bubble in history can be wrong.

I have not specified the timing of these events. I have learnt that forecasting timing is a mug’s game.

Interestingly mug comes from the Swedish MUGG which is a drinking cup with the alcohol turning you to a mug or fool.

Personally I believed that the system was ready to collapse after the 2006-9 subprime crisis but today 14 years later, the system is still standing but only JUST!

But since we are most probably in the final 5 minutes as I explained above, timing becomes irrelevant. We need to take all the measures we can before events start to unravel.

We are now talking about financial survival and for many also physical survival.

In a world with financial and economic misery, high unemployment, a collapsing support system whether social security or pensions, a failing health system, social unrest and possibly war, we are all going to suffer.

HOW TO PROTECT YOUR WEALTH

Since we can’t forecast when the greatest wealth destruction in history will start, we need to prepare today. As I often repeat, you can’t buy fire insurance after the fire has started.

So now is the time to put your house in order.

Forget about gluttony or greed. Forget about trying to get out of stocks at the top. Forget about the old axioms that stocks and property always go up. Forget about the notion that sovereign debt is always safe.

Just remember one thing the next however many years is all about economic survival.

If you haven’t made your money from ordinary investments in the last 20+ years, you are very unlikely to make it now.

And if you hang on to your portfolio of conventional investments like stocks, bonds and investment properties, you are standing the risk of a severe decline of 50-90% of your portfolio for a very, very long period.

More safe investments in the current climate are commodities.

Look at the chart below showing Commodities versus Stocks (S&P) years. We are looking at a 50+ year low.

Best stocks to hold would be in precious metals, oil, and uranium.

The king of wealth preservation is gold. Silver is very undervalued and thus has more upside potential than gold but is much more volatile.

For the best protection, gold and silver should be held in physical form directly by the investor and stored in the safest private vaults in the safest jurisdictions.

After having organised our financial affairs, we must think about the people that need our help in whatever form.

Then enjoy life with family, friends as well as nature, books, music etc which are all free pleasures.

The End of a Historical Debt Cycle: Prepare or Suffer

“When elephants and central bankers (with wings) fly, don’t hold gold”

This is what Egon von Greyerz recommends in this 25 min. interview with Jan Kneist of Investor Talk.

Egon suggests that they will all fly when: “There are no deficits……, no inflation….., no debasement of currencies ….., strong statesmanship based on real values”!

All very unlikely in the foreseeable future according to Egon. Thus the case for gold and wealth preservation is stronger than ever.

Jan and Egon also discuss increasing pressures on ordinary people with declining food sales in Germany and France due to price increases around 20% and the increasing in housing costs both in Europe and the US, leading to a major increase in evictions. The commercial property sector is also under tremendous pressure in Europe and the US due to higher rates and lower occupancy.

Also credit portfolios are deteriorating rapidly, with a high risk of the banking crisis, which started in mid March, resuming with a vengeance.

The BRICS meeting at the end of August in Johannesburg is much discussed in the media. Egon believes that it is premature to expect a gold backed BRICS currency at the August meeting. What is probable is that the commodity rich BRICS countries will no longer hold the dollar as a reserve asset but instead gold.

The consequences of these events make the case for physical gold as a reserve asset for investors self-evident.

Timestamps:

0:00 Introductions

0:55 Egon’s views on Crypto news

3:05 Inflation will remain high, forcing consumers to save

6:32 Housing and Property Cost increases, USA evictions exceeding pre-pandemic levels

10:20 Payroll employment – The US jobs market is still being equated with the strength of the US economy. a fake?

13:21 According to official figures, the USA has grown much faster than Europe since 2008

15:15 Are Banks Still in Shambles? The US banking crisis is far from over

18:43 A gold-backed BRICS currency is doubtful, the dollar nevertheless continues to lose

24:10 When should you NOT hold gold?

The End of a Historical Debt Cycle: Prepare or Suffer

Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.”

Net conclusion: The real death of the USD will be domestic not foreign.

The Bell Has Been Tolling for Years

When it comes to the “bell tolling for fiat,” we can all hear its loud chimes, but that bell has been tolling since 1971 (or frankly 1968), when the US leadership decoupled the world reserve currency from its golden chaperone.

Like any teenager throwing a house party, the lack of a parental chaperone leads to lots of crazy events and lots of broken furniture.

The same is true of post-71 politicians and central bankers suddenly freed of a gold-backed chaperone and thus suddenly loaded with drunken power to mouse-click currencies and expand deficits.

And since then, all kinds of things have been breaking, from banks to bonds to currencies.

And now, with all the extreme hype (and, yes, some genuine reality) behind the headlines of a revolutionary gold-backed BRICS trade currency, many are making sensational claims that the World Reserve Currency (i.e., USD) is nearing its end and that fiat money from DC to Tokyo is effectively toast.

Hmmm…

Don’t Bury the Dollar Just Yet

Before we start tossing red roses over the shallow grave of an admittedly grotesque US Greenback in general, or fiat fantasy money in general, let’s all take a deep breath.

That is, let’s re-think through this inevitable funeral with a bit more, well, realism, mathematics and even geopolitical common sense before we turn our backs on the USD, and this is coming from an author who has never thought highly of that Dollar, be it fiat, politicized and now weaponized.

So, let’s take a deep breath and engage open, informed and critical minds when it comes to debating many of the still open, un-known and critical issues surrounding the so-called “game changer” event when the BRICS+ nations convene this August in S. Africa.

Needed Context for the “BRICS New Currency” Debate

As made clear literally from Day 1 of the Western sanctions against Putin, the West may have been aiming for Putin’s (or the Ruble’s) chest, but it then shot itself in the foot.

After decades of DC exporting USD inflation from Argentina to Moscow, a large swath of the developing countries of the world who owe greater than $14T in USD-denominated debt were already reeling under the pain of rate-hike gyrations which made their own debt and currency markets flip and flop like a dying fish on the dock.

Needless to say, a 500-basis-point spike in the cost of that debt under Powell didn’t help. In fact, it did little good (or goodwill) for USD friends and enemies alike, from the gilt markets in London to the fruit markets in Santiago.

Adding insult to injury, DC coupled this strong-Dollar policy with a now weaponized-Dollar policy in which a nuclear and economic power like Russia had its FX reserves frozen and access to SDRs and SWIFT transactions blocked.

Like Napoleon at Moscow, this was going a step too far…

The net result was an obvious and immediate distrust of that once neutral world reserve currency, an outcome which economists like Robert Triffin warned our congress against in 1960, and even John Maynard Keyes warned the world against long before.

Heck, even Obama warned against such weaponization of a reserve currency as recently as 2015.

Thus, and as I (and many others) warned from Day 1 of the sanctions, the distrust for the USD unleashed by the sanctions in early 2022 was “a genie that can never go back in the bottle.”

Or more simply stated, the trend toward de-dollarization was now going to come at greater speed and with greater force.

This force, of course, is now being seen, as well as debated, under the highly symbolic as well as substantive example of the BRICS+ nations seeking to usher in a gold-backed trade currency to move openly away from the USD, a move which some maintain will soon de-throne the USD as a world reserve currency and send its value immediately to the ocean floor.

The Trend Away from the USD Is Clear, But It’s Pace Is Not

For me, the trajectory of this de-dollarization trend is fairly obvious; but the speed and knowable magnitude of these changes are where I take a more realistic (i.e., less sensational) stance.

But before I argue why, let’s agree on what we do know.

The BRICS New Currency Is Very Real

We know, for example, that Russian finance experts like Sergei Glasyev have real motives and sound reasons for planning a new (anti-Dollar) financial system which not only seeks a Eurasian Economic Union for cross boarder trade settlements backed by local currencies and commodities, but to which gold will likely be added as a “backer” to the same.

Glasyev has also made headlines with plans regarding the Moscow World Standard as a far more fair-playing and fair-priced gold exchange alternative to the Western LBMA exchange.

If we take his gold backing plans seriously, we must also take seriously the plan to expand such gold-backed trade currency plans into the Shanghai Cooperation Organization which would make the final tally of BRICS+ nations “going gold” as high as 41 country codes.

This could ostensibly mean greater than 50% of the world’s population and GDP would be trading in a gold-backed settlement currency outside of the USD, and that, well, matters to both the demand and strength of that Dollar…

China’s Motives Are Also Anti-Dollar

China, moreover, has invested heavily in the Belt & Road Initiative (152 countries) as well as in massive infrastructure projects in Africa and South America, areas of the world that are all too familiar with America’s intentional (or at least cyclical) modus operandi of developing nations enjoying low US rates and cheaper Dollars to create local credit booms which later crash and burn into a local debt crisis whenever those US rates and Dollars rise.

China therefore has a vested interest in protecting its EM investments as well as EM export markets in a currency outside of a USD monopoly.

Meanwhile, as the US is making less and less friends with EM markets, Crown Princes, French Presidents and EU and UK bond markets, China has been busy brokering peace between Saudi Arabia and Iran, as well as building a literal bridge between the latter and Iraq while simultaneously making Yuan-trade deals with Argentina.

Other Reasons to Take the BRICS+ Currency Seriously

Tag on the fact that Brazil, China and Iran are trading outside the USD-denominated SWIFT payment system, and it seems fairly clear that much of the world is leaning toward what Zoltan Poszar described as a “commodity rather that debt-based trade settlement currency” for which Charles Gave (and the BRICS+ nations) see gold as an “essential element” to that global new trend.

Finally, with a strong Greenback making USD energy and other commodity prices painfully (if not fatally) too expensive for large swaths of the globe, it’s no secret to those same large swaths of the globe (including petrodollar nations…) that gold holds its value far better than a USD.

Given this fact, it’s easy to see why BRICS+ nations wish to settle trades in a gold-backed local currency in order to ease the pressure on commodity prices. This gives them the opportunity, as Luke Gromen reminds, to buy time to pay down their other USD-denominated debt obligations.

In addition to the foregoing arguments, the fact that the BRICS+ nations are cloning IMF and World Bank swing loan and “contingency reserve asset” infrastructure programs under their own Asian Monetary Fund and New Development Bank, it becomes more than clear that a new BRICS+ world, trade currency and institutionalized infrastructure is as real as the trend away from a monopolar hegemony of the USD.

In short, and to repeat: There are many, many reasons to both see and trust the obvious and current trend/trajectory away from the USD as warned over a year ago, all of which, no matter what the slope and degree, will be good, very good for gold (see below).

But here’s the rub: The speed, scope, efficiency and ramifications of this trend in general, and the “BRICS August Game Changer” in particular, are far too complex, fluid and unknown to make any immediate (or “sensational”) funeral plans for the USD today.

And here’s a few reasons as to why.

Why the BRICS New Currency Is No Immediate Threat to the USD

First, we have to ask the very preliminary question as to whether the August BRICS summit will even involve an actual announcement of a new, gold-backed trading currency.

So far, all we have to go on is a leak from a Russian embassy in Kenya, not an official communication from the Kremlin or CCP.

Meanwhile, India, a key BRICS member, has openly denied such a new trade currency as a fixed agenda item for this August.

But notwithstanding such media noise, we must also look a bit deeper into the mechanics, economics and politics of a sudden “game-changer” new currency.

The BRICS New Currency: Many Operational Questions Still Open

Mechanically speaking, for example, who will indeed be the issuing entity of this new currency?

The new BRICS Bank?

What will be the actual gold coverage ratio? 10% 15% 20%?

Will BRICS+ member nations/central banks need to deposit their physical gold in a central depository, or will they enjoy (most likely) the flexibility of pledging their domestically-held gold as an accounting-only-unit?

Cohesion Among the Distrusting?

As important, just how much trust and cohesion is there among the BRICS+ nations?

Sure, this collection of nations may trust gold more than they trust each other or the US (which is why such a gold-backed trade currency may work, as it can’t be “inflated away”), but if a BRICS member country wishes to redeem its gold from say, Russia, years down the road, can it realistically assume it will happen?

What if Russia (or any other trade partner) is in a nastier mood tomorrow than they are today?

Basic Math

In addition, there are certain economic/mathematical issues to consider.

We know, for example, that the collective BRICS+ gold reserve (as of Q1 2023) is just over 5452 tones, valued today at approximately $350B.

Enough, yes to stake a new currency.

But measured against a net global amount of $13T in total physical gold, are the BRICS+ gold reserves enough to make a sizable dent (even at a partial coverage ratio) to tilt the world away from the USD overnight, when the USA, at least officially, has much, much more gold than the BRICS+?

That said, we can’t deny that the actual gold stores in places like Russia and China are far, far higher than officially reported by the World Gold Council.

Additionally, the historically unprecedented rate of central bank gold stacking in 2022-23 seems to suggest that the enemies of the USD are indeed “loading their guns” for a reason.

Expecting, however, all of the BRICS+ members to maintain the discipline to continue to purchase and store more physical gold despite the political temptations to redeem the same for later or unexpected domestic spending needs may be a naive assumption in a real world of ever-shifting national behaviors.

Geopolitical Considerations & the BRICS New Currency

Speaking of such shifting behaviors, we also can’t ignore the various pro and con forces within a geopolitical backdrop wherein much of the world, whether it loves or hates the US, still needs its USDs and USTs.

China, for example, may be letting maturities run and even dumping the USTs it now owns at a fast pace (only years away from total UST liquidation), but for now, China needs to keep the USD from growing too weak to buy all the Chinese exports of those American products made, in well…China.

That said, if the trend is indeed a new world of currency wars, rather than currency cooperation, which is a more than fair assumption, then all such liberal economic cooperation/trade arguments fall to the floor.

Nevertheless, with over $30T worth of USDs held by non-US parties in the form of bonds, stocks, and checking accounts, the collective desire (common interest) to keep those USDs alive and at least relatively strong is a major counter-force to the notion that the world and USD are coming to a sudden change this August.

Furthermore, in such an uncertain world of competing currencies as well as national and individual self-interests, the trillions and trillions of off-shored USTs/USDs tangled up within the foreign as well as US banking and derivative markets is important.

Why?

Because any massive dislocation in risk asset (and even currency) markets emanating from South Africa or elsewhere, in August or much later, would more than likely (and ironically) cause a disruption in foreign markets so dramatic that we could easily see a flow into, rather than away from, USDs for the simple (and again ironic) reason that the mean and ugly Greenback is still the best/most-demanded horse in the global fiat slaughter house.

In other words, even if all the BRICS+ plans for a gold-backed trading currency go flawlessly, the time gap between the accepted rise of such a settlement currency and the open fall of the USD is likely to be long, wide and unknown enough to see the USD actually get stronger rather than weaker before we experience any final fall in the USD as a global reserve currency.

The USD: Supremacy (Still) vs. Hegemony (Gone)

So, no, I don’t think that the USD will fall entirely from grace or even supremacy in August of 2023, even if the trend away from its prior hegemony is becoming increasingly undeniable.

It will take more than sensational BRICS headlines to make such a rapid change, but yes, and as the Sam Cooke song says, “change is gonna come.”

My only point is that for now, and for all the reasons cited above, the trajectory and speed of those changes are likely not as sensational as the trajectory and speed of the current headlines.

No Matter What: Gold Wins

The case for gold, of course, does not change just because the debate about the speed and scope of the new BRICS+ trade currency rages today.

No matter what, the very fact that such a gold-backed trade settlement unit will inevitably come to play will be an equally inevitable tailwind for global gold demand and hence global gold pricing in all currencies, including the USD.

The Dollar Will Die from Within, Not from Without

Furthermore, and despite all the hype as well as substance behind the BRICS headlines, I see the evolution of such a gold-backed trade currency as a reaction to, rather than attack upon, the USD, whose real and ultimate threat comes from within, rather than outside, its borders.

The world is losing trust in the USD because US policy makers killed it from within.