Titanic Currency Destruction: How Central Banks Ruined Money

Below we track years of desperate yet deliberate central bank bubble creation (and can-kicking) to its ultimate end-game: titanic currency destruction.

The Bond Market is the Thing

When tracking markets and asset classes, one eventually accepts the Shakespearean reality that “the bond market is the thing.”

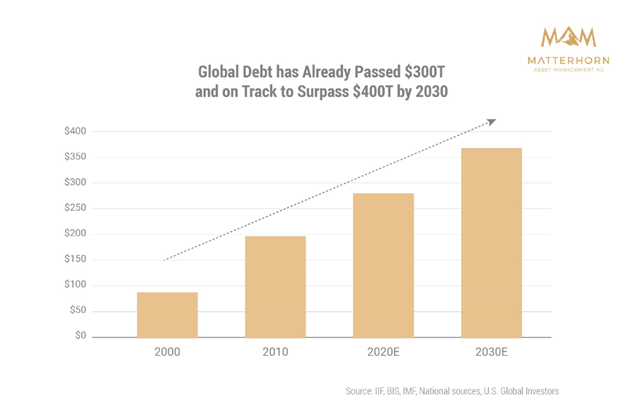

When a completely distorted global financial system is driven exclusively by the greatest credit bubble (and hence crisis) in history, the cost of that debt (i.e., the interest rate) becomes a primary protagonist.

When rates are low, for example, bubbles grow. When rates are high, they pop.

Of course, the bigger the bubble, the more fun the ride up; but conversely, the bigger the bubble, the more painful the pop.

And by the way: All bubbles (tech, property, credit and currency) pop.

We are now entering that pop-moment, and the central bankers know it, because, well: They created it…

Once Upon a Time—Natural Forces

Once upon a time, there was a concept and even a dream of healthy capitalism and natural market forces in which bonds were fairly priced on the basis of a now extinct concept once known as natural supply and demand.

Nod to Adam Smith.

That is, when demand for a bond was naturally high, its price rose and its yield (and hence rate) was naturally low; conversely, when demand was low, its price fell and its yield (and hence rate) rose.

This natural ebb and flow of yields and hence interest rates kept credit markets honest.

As rates climbed and the cost of debt rose, debt liquidity naturally slowed down and the system prevented itself from over-heating.

In essence, the bond markets had a natural pressure gauge which triggered a natural release of the hot air within a bubble.

Then Came the Un-Natural and the Dishonest

Then came the un-natural central bankers against which our founding fathers and Constitution warned.

Like everything centralized and human, as opposed to natural, these short-sighted bankers ruined, well: everything.

Rather than allow bonds, yields and hence rates to be determined by natural price forces, these banks had the arrogant idea that they could control such forces, the hubris equivalent of a sailor attempting to control the powers of an ocean.

Nod to John Smith of the Titanic.

The Fun Part

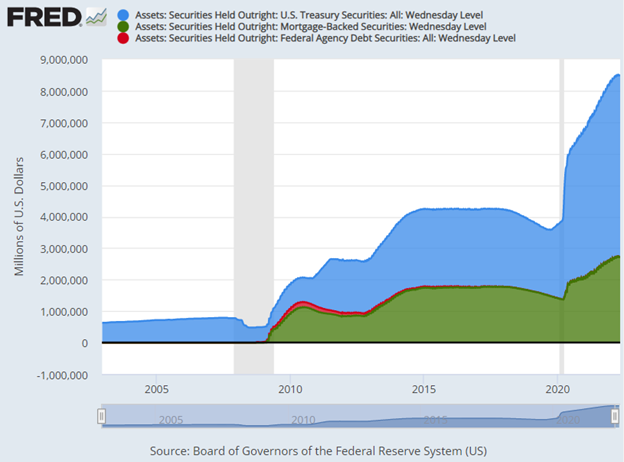

For years, central bankers have artificially supported sovereign bond markets by purchasing otherwise unwanted bonds with money created out of thin air.

This absurd yet popular “solution” of repressed rates created bubble after bubble. That was the fun part.

It is also the part which breeds a school of academic apologists and theories (nod to MMT) who justify and defend the same as an unsinkable market.

Remember Janet Yellen’s claim that we may never see another recession? Or Bernanke’s Nobel-Prize winning observation that we could print trillions at “no cost” to the economy?

Meanwhile market participants, enjoying the tailwinds of low rates and easy/cheap access to debt, ignore the bubble dangers (i.e., icebergs) ahead as they enjoy the admittedly fun part of a rising bubble.

And oh, what fun a cheap-debt-driven and artificially controlled series of cheap-debt-induced bubbles can be…

Like the tuxedo-clad 1st class passengers on the Titanic’s A-Deck, investors (the top 10% who own 90% of stock market wealth) pass cigars and brandy among themselves and speculate like children comparing portfolios, all the while ignoring the rising iceberg off the bow.

How Icebergs Are Made

When it comes to making icebergs, our central banks have a perfect record, and the leader of this pack is the U.S. Federal Reserve, a private bank which is neither Federal nor a reserve.

Just saying…

For those paying attention rather than passing cigars on the A-Deck, you’ve already noticed this pattern of bubble-to-bubble and hence debt iceberg to debt iceberg creation before.

The Fed, with the complicit support of the commercial bankers and policymakers, for example, “solved” the tech bubble of the late 90’s (kudos to Greenspan) which popped in 2000 by creating a real estate bubble which popped in 2008.

Through the same playbook of artificial rate suppression, the Fed then “solved” that housing bubble (kudos to Bernanke) by creating a global sovereign debt bubble/iceberg (kudos to Yellen and Powell), the very A-Deck upon which we all stand today.

Today’s Iceberg: A Global Credit Crisis

Having bought time and bubbles, from tech to housing to sovereign bonds, the Fed is now running out of places to hide its latest iceberg. This kind of can-kicking is more like sin-hiding.

Having squeezed a tech bubble into a real estate bubble, and then a real estate bubble into a sovereign debt bubble, where can the central bankers now hide their latest Frankenstein, bubble and iceberg? (I love metaphors.)

The Currency Bubble

For me, at least, the answer is fairly clear.

The only way to hide and “solve” the greatest sovereign bond iceberg (crisis) in history is to bury it beneath wave after wave of mouse-clicked, debased and hence increasingly worthless fiat currencies.

In short, the Fed will hide its latest credit bubble behind the last and only bubble it has left in a history-confirmed pattern used by all failed financial regimes, namely: Creating a currency crisis (i.e., debased money) to solve a debt crisis.

Of course, if you read that last line (as well as centuries of economic history) correctly, this just means there are no solutions left, just a choice of crisis options: drowning bonds or drowning currencies.

Pick Your Poison: Credit Crisis or Currency Crisis

Just like the officers at the wheel of the Titanic were the first to realize their ship was sinking, the central bankers from DC to Tokyo are equally aware that they were driving too fast in a sea of icebergs.

Now, they are struggling to “be calm” in voice as their crew scurries to count unavailable lifeboats and keep the passengers from panicking too soon.

Among this crew of policy sailors on the financial Titanic, two camps are forming. After all, even when a ship is sinking, there is always different expressions of the human instinct to survive.

One camp is hawks. The other camp is doves. In truth, however, both camps are doomed.

Hawks Squawking

The hawks are telling the passengers (investors) to fear not.

Yes, they are raising rates to fight inflation, but this, they calmly say from the shivering A-Deck, will not cause the global credit and hence financial markets to sink into a contagious recession/depression.

This is the camp of Larry Summers, William Dudley, Jerome Powell and the likes of James Bullard at the St. Louis Fed.

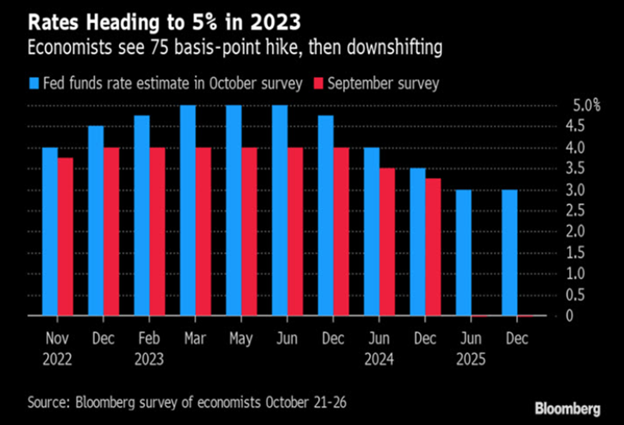

Bullard, for example, thinks a Fed Funds Rate of anywhere from 5% to 7% may lead to a mere “slowdown in growth” but by no means a recession.

Well, that’s rich. This coming from the same office that said inflation was “transitory” and a recession is not a recession.

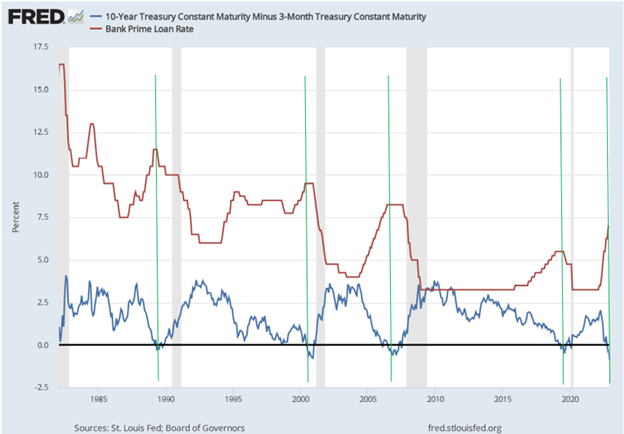

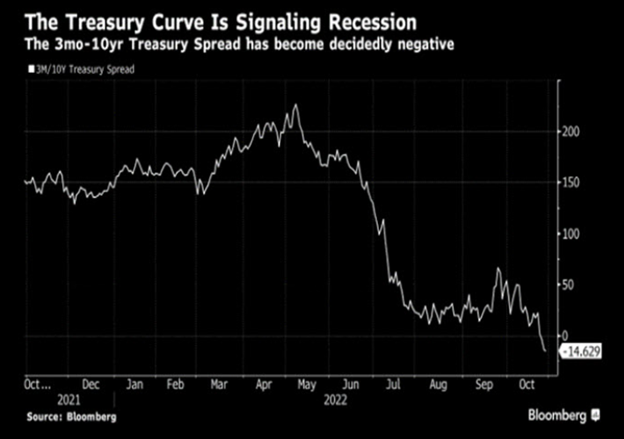

Based on prior GDP prints and the inverted 3m/10y yield curve inversion of late, I’d argue we are already in a recession, but then again, why let facts get in the way of a good lifeboat narrative.

As the Fed captains all know, when the truth hurts, just lie.

The hawks, it seems, somehow believe that they can raise rates (to as high as 7%) to kill mis-reported inflation (as high as 16%) [???] without killing the credit market.

Hmmm…

At the same time, however, Powell needs inflation to outpace interest rates to achieve a deep enough slope of negative real rates to inflate away the USA’s $31T public debt.

Like Captain Smith on the Titanic, Powell is trying hard to stay calm but knows the end game.

Dead Market or Dead Currency?

In short, Powell is in the mother of all conundrums, dilemmas and self-made corners. He literally has no good options left.

If he keeps raising rates to “fight inflation”—he risks sending the global credit markets below the cold-water line.

But if he pivots, eases or allows more liquidity (i.e., QE) back into the bond markets, he saves the bonds but kills/debases the currency and hence creates more rather than less inflation.

Again. Pick your poison: A dead bond market or a dead currency?

The Choice Has Been Made

But in case the suspense is killing you, I’d say the answer is already in front of us.

As hinted above (and shown below), the only and last option left for debt-soaked regimes is currency debasement.

History proves time after time after time that there are no exceptions to this sad rule.

Despite his words to the contrary, Powell will ultimately be forced to kill the currency to allegedly save the credit markets—thus once again squeezing one bubble (in credit) into another bubble (currency), which is what all the central bankers have been doing for years: Pushing one bubble into the next until the final one pops.

Stated otherwise: There just aren’t enough life boats for Captain Powell’s financial Titanic.

Facts Speak Louder Than Words

As I’ve argued all year, Powell may talk Volcker-tough, but he’s moving toward more fake liquidity and hence more inflationary money printing.

If you think otherwise, the evidence is already before us—and I’m not just talking about “moderating the pace of rate hikes.”

In order to survive, the credit markets need more balance sheet expansion (i.e., QE), which by definition, is inherently inflationary.

Nod to Milton Friedman.

Again: Powell will choose inflation (and currency debasement) over “fighting” inflation, because Powell secretly needs inflation and negative real rates to inflate away Uncle Sam’s bar tab.

Nod to Stan Fischer.

This eventually means letting the USD expand in supply and hence sink in value.

Or stated simply: A currency crisis.

Just Follow the Pattern/Banks

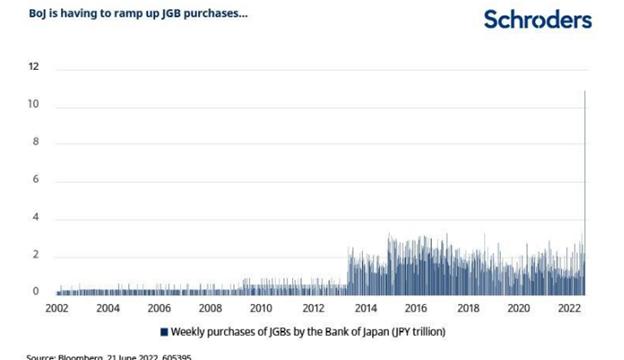

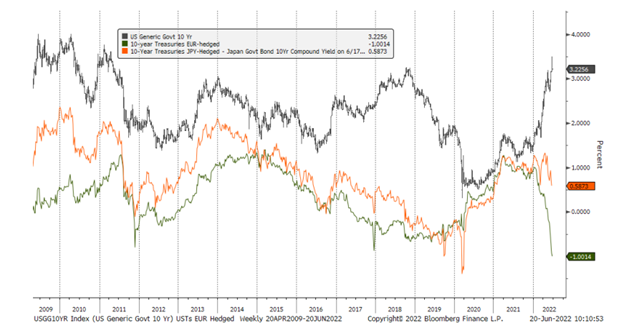

Toward this end, the other major central banks and currencies of the world are already doing this.

The yen, euro and pound of 2022, for example, have sunk to record lows to monetize local debts—the USD will eventually follow in 2023.

In fact, this unspoken preference for liquidity over “inflation fighting” is already evident rather than speculative.

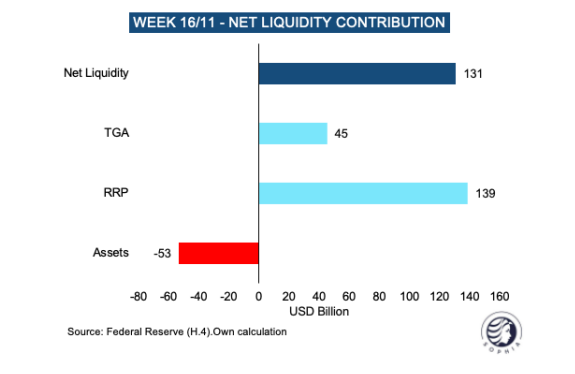

As per the chart immediately below, November saw $45B in Treasury spending and another $139B in repo liquidity—for a total of 131B in net liquidity into the market, a number which far overshadows the $53B of so-called “QT” tightening by Powell.

In short, one may speak like a hawk but act like a dove.

Meanwhile, stocks and bonds were falling together.

Can we all say: “Uh-oh”?

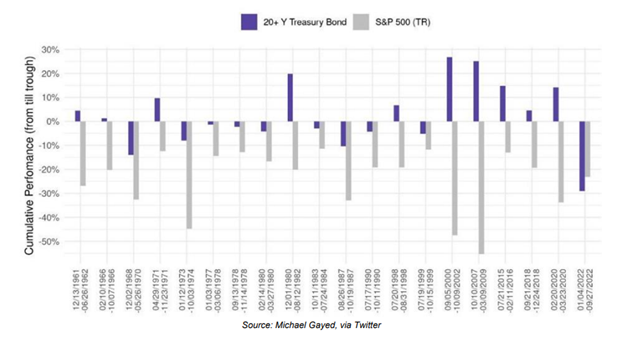

As per the bars at the far right of the graph below, for the 1st time in 60years, we saw a UST market (blue bar) fell faster and further than a top-20 stock market drawdown (grey bar).

Hmmm. Can we blame this historical fall in USTs on inflation?

Nope.

In the 1970’s, and as per chart above, we saw inflation, but never USTs (blue bar) falling further than stocks.

Why the critical difference today?

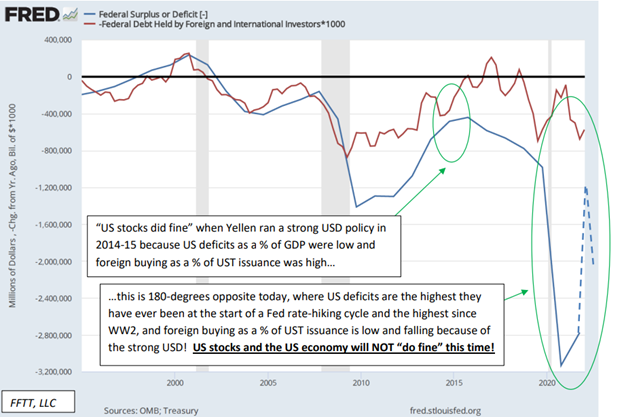

Easy. Bonds are falling in price because demand is falling in fact. This bond drop is not because of inflation, but because no one trusts the debtor—i.e., Uncle Sam.

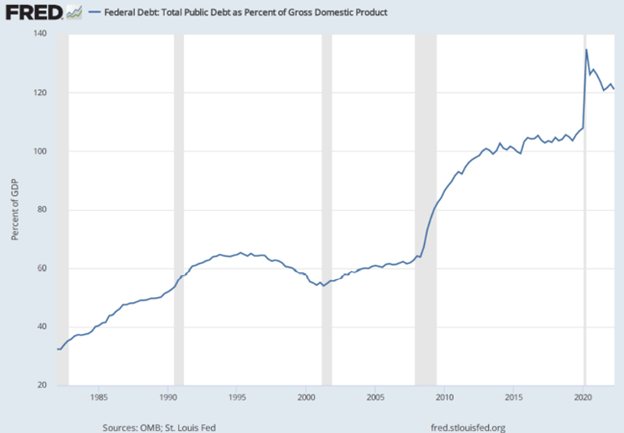

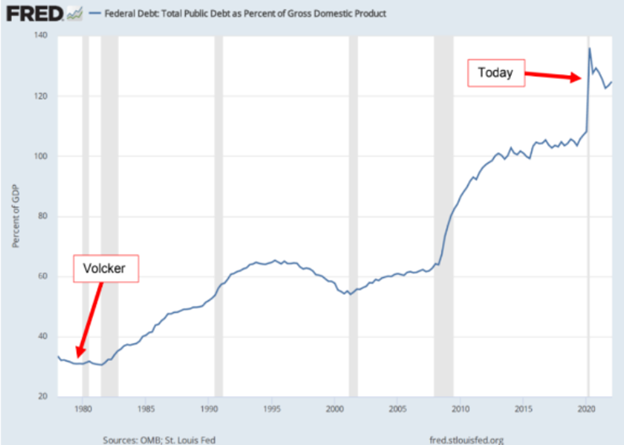

Unlike the 70’s, US debt to GDP today is at 125+%, and thus American IOUs today just aren’t what they were yesterday.

…and fiscal deficits are at 10% of GDP.

That’s what I call a debt iceberg…The bigger it gets, the lest investors trust the debtor beneath the surface.

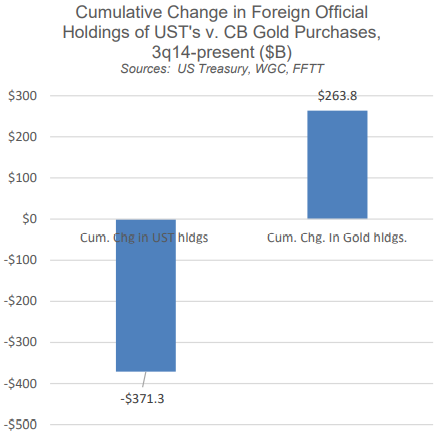

Toward this end, foreign banks are turning their backs on Uncle Sam’s unloved USTs (IOUs)…

Frankly, I’ve never seen such a grotesque convergence of debt icebergs heading for our economic bow.

Watch the Currencies—They’re Already Drowning

As global central banks debase their currencies (yen, euro and pound) to monetize their unloved and unpayable sovereign debts/bonds, we can expect more volatility in the FX markets and pairings as the current USD, like the bow of the Titanic, rises temporarily high above the waves before sinking deep, deep below them.

Can the Fed save that sinking dollar/Titanic by cranking up rates ala Powell at the expense of the US economy and markets as well as at the expense of its global friends and enemies who can’t pay back $14T worth of USD-denominated debts when the USD is too expensive?

I think not.

Nor am I alone in calling out this impossible dilemma of bad options and bad bonds. Druckenmiller and Dimon are saying the same thing.

Stated simply, the only way current central banks can keep their unloved bond market afloat is by drowning their currencies in more QE, which, needless to say, will be very good for gold…

This QE (currently hiding in the ignored repo markets) will be the last resort until the widely telegraphed and pre-planned “great [disorderly] reset” toward CBDC becomes the next embarrassing reality.

This collective lack of faith in USTs and USDs is why global central banks are swapping out USTs and buying physical gold…

As I’ve written and said before, it’s hard to imagine how we ever got to this obvious consequence of too much debt and too much artificial, centralized “capitalism.”

Were policy makers sinister (i.e., intentionally creating a red carpet toward CBDC and more total control) or just irretrievably stupid?

Either way, the end result is the same: The global financial system will sink, and though the USD may be the last to go under, under she will go.

Titanic Currency Destruction: How Central Banks Ruined Money

Gold’s price direction is explained below.

From polo to hockey—it’s a known fact that the best players think three moves ahead.

Sadly, the same can’t be said of our financial elites…

But as playing conditions deteriorate across the bond, stock, property and currency markets, those with a “three-play- ahead” mindset will have the greatest advantage.

This is especially true for precious metal investors, regardless of their riding or skating skills 😉.

More Horse-Droppings from the Treasury Dept

One of the most important global players on today’s macro pitch is the credit market, and that horse is tired.

Last week, former Fed-Chair-turned-US-Treasury Secretary, Janet Yellen, told reporters that her office is “very focused” on Uncle Sam’s IOUs, and even confessed “concern” regarding “episodes of illiquidity” wherein it has been difficult to buy or sell US Treasuries, especially in large amounts.

Ultimately, however, the mule-riding Don Quixote, Janet Yellen, does not “see problems at this point in the U.S. Treasury Markets.”

Ahhhhh. That’s rich….

Apparently, Yellen has a very poor eye for the current playing field and is chasing windmills rather than the rules of a moving target.

Hiding Bond Liquidity with Verbal Liquidity

As we have been warning for months, these “episodes of illiquidity” are more than just a “concern.”

In fact, they serve as undeniable evidence that the world is running out faith in Uncle Sam’s bloated bar tab after years of monetary addiction to mouse-click money to pay for (monetize) the so-called “American way.”

In short, when GDP, tax receipts and good ol’ fashion productivity or trade surpluses no longer work, the US has become good at just borrowing and printing, a tactic (i.e., charade) that bought time, votes and even an appallingly ironic Noble Prize for Bernanke, but a ruse for which the rest of the world is now losing faith after years of importing American inflation.

In short, more and more of the world wants less and less of Uncle Sam’s sovereign debt, which means USTs are falling and hence yields and rates are rising.

And as previously reported, those rising yields are like rising shark fins approaching a debt-soaked global system already bleeding in the water.

Stated simply, when Yellen says she sees no problems, that’s precisely when you know there’s a problem.

Or as Otto von Bismarck (and Tree Rings) reminds: “Never believe anything in politics until it is officially denied.”

More Treasury Secretaries, More Mules Masquerading as Thoroughbreds …

Speaking of Treasury Secretaries (i.e., the worst players on the “cancha”), former Secretary Larry Summers is doing what he does best, namely: Causing problems behind the scenes (from repealing Glass Steagall to deregulating derivatives), denying/ignoring guilt, and then once those problems become obvious, making public warnings of the same to appear virtuous.

Like Minister Fouche under Napoleon, Summers blows in which ever direction the wind most suits his image.

Toward that end, he’s finally speaking of what most of us have known long ago: The US can’t afford rising rates in 2022 under Powell the way it could in 1980 under Volcker.

Thanks, again, Larry, for jumping on the band wagon long after it’s too late.

Given the foregoing realities, double-speak and just plain dumb out of DC’s lowest-goal but best-dressed players, the inevitable consequences of unloved Treasuries as a result of unimpressive Treasury Secretaries simply means an inevitable pivot toward more printed, debased and inflationary Dollars to keep Uncle Sam from defaulting on his bonds.

But politicians are clever foxes. They hide their addictions (and intentions) as cleverly as the BLS hides inflation facts.

Just More Backdoor QE Before the Real Thing

Just like politicos can deny a recession in a recession or deny inflation during inflation, they can pretend that QE is not QE, even when it is, well… QE.

Toward that end, we can expect the Treasury Department to start buying its own longer-dated bonds (USTs) by swapping them with shorter duration T-Bills.

Officially, this is not Quantitative Easing per se, but rather a “UST buyback.”

But why let fake semantics confuse honest math? The smart players are already three plays ahead of the Fed’s empty rhetoric and bad riding skills.

Like the daily repo support from the Fed, in the end, such “buyback” schemes are just QE under a different mask.

Powell’s Ruse Continues

Thus, as such shell games in DC continue to hide reality behind words, the Powell Fed will continue its ruse to fight inflation the “Volcker way” and likely announce and conduct additional (but 50 rather than 75 bps) rate hikes in the last chapters of 2022 and the early chapters of 2023 before the inevitable surrender to more QE.

Why the near-time rate hikes?

Powell knows that when the current recession becomes an official recession, he’ll need at least one tool in his ever-weakening toolbox.

In short: He’s only raising rates today so that he’ll at least have something to cut tomorrow.

And speaking of recession, the following (and inverted) yield curve is a screaming sign that a recession is coming, if not already here.

I See Serious Stagflation Ahead

As for fighting inflation, any short-term hopes of beating inflation will end once the money printers are spinning again at full speed to buy Uncle Sam’s increasingly unloved IOUs.

This will likely occur in 2023, but frankly, who the hell knows precisely when it will rain QE money? I don’t.

The key is recognizing the shark fins and getting a safe boat. And as warned previously, we are all gonna need a bigger boat.

Stated bluntly and simply, there’s no way to ever unwind the Fed’s balance sheet nor the nation’s $31T deficit in the face of a recession that will take that deficit many, many, many trillions higher.

These obvious and fatal inflationary realities will ultimately collide with the disinflationary forces of a long and painful (as well as Fed-engineered) recession.

Given that I see inflation as a monetary issue rather than just a bogus CPI print, the further and inflationary debasement of the USD under further QE ahead (despite the USD’s growing and ironic relative strength) will be a stronger force than a deflationary recession.

In simple terms, this means we need to prepare for (rather than debate) some serious stagflation ahead.

Toward that end, and as already implied by a number of DC insiders, we can expect the Fed to slowly alter its “target inflation” narrative from the comical 2% range to an equally comical 4% or higher range in the coming months and quarters—all of course, to be blamed on Putin or COVID rather than years of mouse-click money.

Powell, like most mediocre politicians (or polo players), is ego driven rather than Main Street responsible. His main fear today is not about keeping his post, but assuring his legacy.

Secretly, Powell fears looking like another Arthur Burns, who let inflation get too hot. Thus, Powell’s public image today is about fighting inflation.

But I’m not buying it. The real goal today is to inflate away debt.

Karma’s a B!7@#

In reality, and to repeatedly shout from the rooftops, the only way to handle $31T in US public debt is to “inflate it away” by eventually loosening rather than tightening monetary policy once it becomes obvious that US IOUs won’t find enough buyers unless there’s a money printer to do so.

Needless to say, such grotesque reliance on a money printer (i.e., money killer) is the economic Karma of far too many years living on debt rather than productivity, and far too many years of the US exporting its inflation to the world and clipping the wings of their own allies by making the USD too strong to repay, settle or compete.

By 2024, I expect a disorderly “reset” and central bank digital currencies as the USD loses what little respect it has left.

The World Turning a Slow Back on a Fast Dollar

Toward this end, and as forewarned too many times to count, the rest of the world (I.e., the BRICS) is either turning away from the steroid-ruined USD (slowly but surely) or turning toward their currency-debasing money printers (think Japan and the UK yesterday and the ECB and the Fed tomorrow).

Meanwhile, Saudi Arabia is looking more toward China and less toward Biden to improve energy cooperation.

As warned, the Petrodollar system, so critical to the USD’s eminence (i.e., forced demand) in the world, is going to slowly unwind as Saudi starts accepting yuan rather than USD for its oil.

So yes, the world (and Dollar) is changing, and fast…

Poor Germany

Over the weekend, for example, I was in Munich, where inflation is already at 11.6% in a country which is considered Europe’s most reliable creditor.

But even Germany can’t seem to find any buyers for its bonds as Olaf Scholz scurries to raise $200B to pay for rising energy costs due to its blind (forced?) support for American sanctions against Putin in yet one more example of a long list of U.S. proxy wars on other peoples’ land.

But who wants to buy a German bond when the inflation rate is running some 900 basis points above the average interest rate, which means buyers lose almost 9% of their return to inflation the moment they bid?

In short, the reality of negative real yields (the hidden trick of all broke nations) is not only hitting the face of the average US citizen, but Germany’s as well.

Gold: Play the Direction of the Ball

As introduced above, all of these trends point not to where the golden polo ball or hockey puck sits currently, but toward where the ball or puck is headed…

Right now, and as explained at length elsewhere, an engineered and only relatively strong USD is taking the shine off gold. The current inverse correlation between gold and the USD is undeniable.

But that is where the ball sits now. Where it is headed is another matter, and great players, as well as investors, are always three plays ahead of the moment…

Stated more simply, as more and more currencies (including, yes, even the USD) weaken in a backdrop of inflationary realities and debasing consequences, gold is headed for an historical move, which means central bankers are about to get hit with a golden puck…

Toward this end, investors around the world are always asking Egon and I what the gold price will be in a month, a day, a year etc.

But gold price measured in what? In USD? Yen? Euros? Pound Sterling?

Folks, the simple point is why measure a fixed asset in an increasingly dying currency? Gold’s real measure is in ounces and grams, not fiat paper.

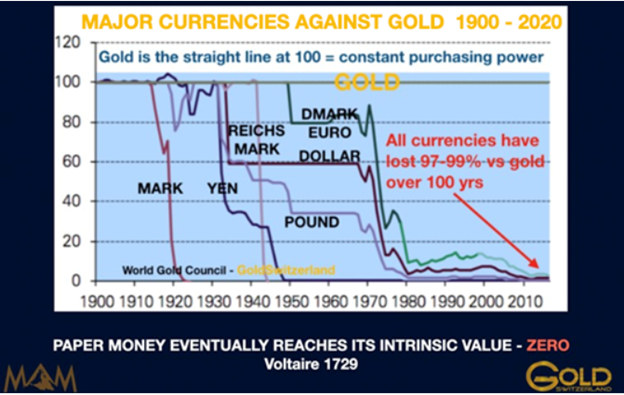

Or stated more simply: Gold doesn’t rise (see flat/constant top-line in graph below), it just holds its value as fiat currencies gyrate and then die like a fish flopping on the dock, which all fiat currencies have always done, throughout history, every time and without exception.

So, are you playing the ball where it lies now, or where it will be three plays ahead?

Titanic Currency Destruction: How Central Banks Ruined Money

Below we track how the Powell Fed serves as a contemporary weapon of mass destruction.

Powell’s so-called “war against inflation” will fail, but not before crushing everything from risk asset, precious metal and currency pricing to the USD. As importantly, Powell is accelerating global market shifts while sending a death knell to the ignored middle class.

Let’s dig in.

The Fed: Creators of Their Own Rock & Hard Place

In countless interviews and articles, we have openly declared that after years of drunken monetary driving, the Fed has no good options left and is literally caught between an inflationary rock and a depressionary hard-place.

That is, hawkishly tightening the Fed’s monthly balance sheet (starting in September at $95B) while raising the Fed Funds Rate (FFR) into a recession was, is and will continue to be an open head-shot to the markets and the economy; yet dovishly mouse-clicking more money (i.e., QE) would be fatally inflationary.

Again, rock and a hard place.

What’s remarkable and unknown to most, however, is that the Chicago Fed recently released a white paper during the Jackson Hole meeting which says the very same thing we’ve been warning: Namely, that Powell’s WMD “Volcker 2.0” stance (arrogance/delusion) is only going to make inflation (and stagflation) worse, not better.

To quote the Chicago Fed:

“In this pathological situation, monetary tightening would actually spur higher inflation and would spark a pernicious fiscal stagflation, with the inflation rate drifting away from the monetary authority’s target and with GDP growth slowing down considerably. While in the short run, monetary tightening might succeed in partially reducing the business cycle component of inflation, the trend component of inflation would move in the opposite direction as a result of the higher fiscal burden.”

In short, Powell can’t be Volcker.

Why?

Simple.

America Can’t Afford Powell (or His Rate Hikes)

This hard reality is economic and mathematical, not political or psychological, though Powell suffers from both political delusion and a psychological lack of self/historical awareness…

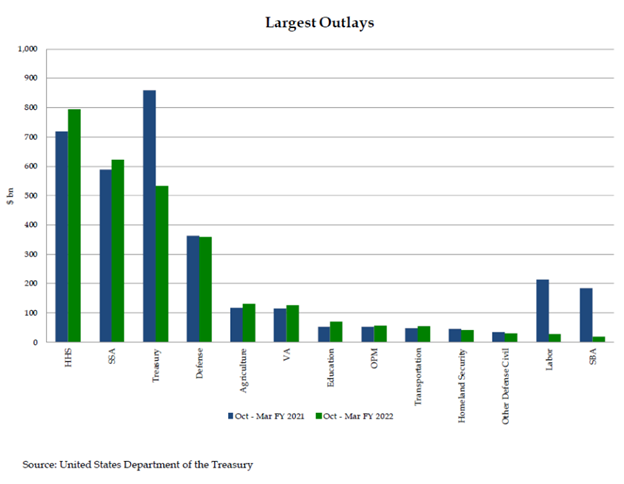

I’d like to ask Powell, for example, how the US plans to pay for its now rate-enhanced (i.e., even more expensive) debts and obligations regarding defense spending, Treasury obligations, social security and health care when just the interest payments alone on Uncle Sam’s current bar tab are unsustainable?

Powell, part of the so-called “independent Fed,”will now have to make a political choice (and trust me, the Fed IS political): Will he A) intentionally seek to crash the economy into the mother of all recessions to “fight” the inflation his own private bank’s balance sheet singularly created, or B) will he help turn America into the Banana Republic that it is already becoming by printing (debasing) trillions more US “dollars”?

The “inflation-fighting” Powell, embarrassed to go down in history as the next Arthur Burns, may just A) continue to hike rates and strengthen the USD (currently bad for gold), which is sending America to its knees, or B) sometime this autumn he’ll cave, pivot and let inflation rip (while the BLS, of course, under-reports inflation (i.e., lies) by at least ½).

In the meantime, we can only watch markets and economic conditions continue to tank as interest rates and the USD climbs toward a peak before the USD makes a record-breaking fall.

And why do I see a fall?

Easy.

The Credit Markets Are Screaming “Oh-Oh!”

To borrow/twist from Shakespeare: “The bond market is the thing.”

Everything, and I mean everything, hinges on credit markets. Even the cancerously expanding US money supply(M0-M4) is at root just 95% bank credit.

Understanding credit markets is fairly simple. When the cost of debt is cheap, things (from real estate to growth stocks) feel good; when the cost of debt is high (as measured by the FFR, but more importantly by the fatally rising yields on the US10Y), things collapse.

We saw the first (and media-ignored) warnings of this collapse in September of 2019 when the oh-so critical (yet media ignored) repo markets imploded, none of which can be blamed on COVID (2020), Putin (2022) or climate change.

As dollar liquidity dries up, so will markets, economies and lifestyles. Remember: All market crises are, at root, just liquidity crises.

A Summer of Credit Drought

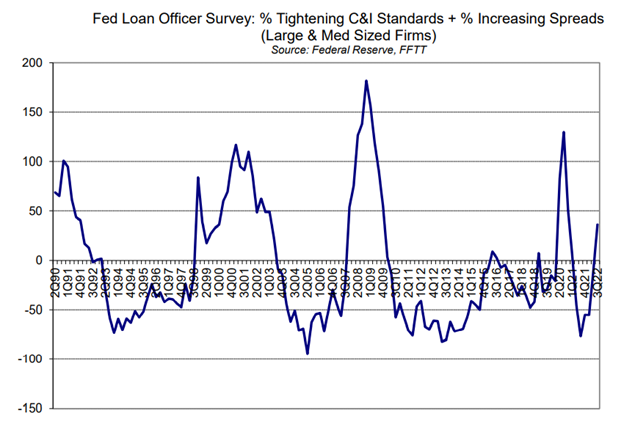

As previously warned, signs of this drying liquidity are literally everywhere. The Fed’s own Quarterly Loan Officer Survey confirms that banks are lending less.

And given that 70% of the US bond market is composed of junk, high-yield and levered loans (i.e., the worst students in the class hitherto priced as PhD candidates), the rigged game of debt roll-overs and stock buy-backs is about to end in a stock and bond market near you as rates rise to unpayable levels.

Furthermore, it’s worth noting that US banks (levered 10X) and European banks (levered 20X due to years of negative nominal rates), will now use rising rates as the long-awaited excuse to de-lever their bloated balance sheets, which is fatal to risk asset markets.

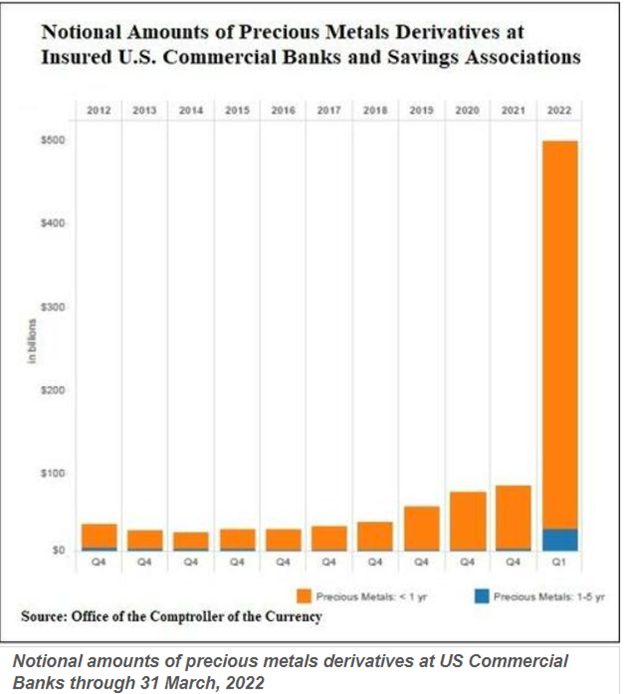

Even more alarming, however, is what this de-leverage will mean to that massive, USD-based and expanding (1985 to now) Weapon of Mass Destruction otherwise known as the OTC and COMEX derivative markets.

Rather that expand, this fatal market will contract—all of which will have massive implications for the USD as debt markets slowly turn from a past euphoria to a current nightmare.

The Dangerous USD Powell Ignores

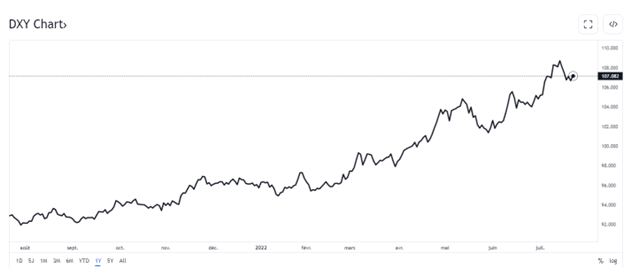

Measured by the DXY, the Dollar is ripping.

But you’ll note that Powell and his “data points” never address the Dollar.

Powell, like most DC-based Faustian deal-makers, lives in a US-centric glass house, which ignores the rest of the world (namely Emerging Markets, oil producers and mislead “allies”) who are de-dollarizing (i.e., repricing the USD) as I type this.

In case Powell never took an econ history class or read a newspaper that was not written in English, it might be worth reminding him that EM nations like Venezuela, Lebanon, Argentina, Turkey, and Sri Lanka, as well as, of course, the BRICS themselves, are tired of importing US inflation and paying trillions and trillions of Dollar-denominated debt or forced dollar-settled oil purchases.

As the Fed artificially strengthens the USD via rate hikes, debt-soaked nations are forced to either: A) debase their currencies to pay their debts (which might explain Argentina’s 69.5% official interest rate) or B) raise rates and look elsewhere for new trading partners or money.

Even “developed” economies are seeing their currencies at record lows vis-à-vis the rising USD (Japanese Yen at 50-year lows, UK’s currency at 37-year lows and the euro now at 20-year lows).

And as for those cornered EM nations, $650B of the IMF’s 2021 usurious (and dollar-based) loans to them have already dried up.

EM Markets Looking East Not West

So, where will EM countries go trade, survival, better energy pricing, and even fairer gold pricing?

The answer and trends are now open and obvious: East not West, and away from (rather than toward) the USD.

Russia and China are making trade and currency deals not only with the BRICS at a rapid pace, but with just about every nation not otherwise “friendly” (i.e., forced to be) with the USA (and which “friends” now face a cold winter on this side of the Atlantic.)

Even the notoriously corrupt LBMA gold market, which spends its every waking hour using forward contracts to artificially crush the paper gold price, is about to see a Moscow-based new gold exchange (the Moscow Gold Standard).

Of course, such a Moscow exchange makes sense given that 57% of the world’s gold comes from Eurasian zip codes where a post-sanction Putin sees yet another golden opportunity to fix what the West has broken.

Furthermore, and as stated above, as the derivatives markets de-lever, demand for the USD (and hence dollar-strength) will equally tank, as OTC settlements are done in USD, not Pesos, Yen, euros or Yuan.

As we warned within weeks of the failed sanctions against Putin, the world is de-dollarizing slowly yet steadily, and once the DXY inevitably slides from 108, to 107 and then below 106, the Greenback’s fall will mirror Hemingway’s description of poverty: “Slowly then all at once.”

For the last 14 months, the Dollar Index has been trading above its quarterly moving average, which as the always-brilliant Michael Oliver reminds, is like a runner who never exhales. At some point the USD’s lungs will collapse.

Gold: Waiting for the USD to Snap

The foregoing and seismic shifts in the derivative and EM markets portend the sick finale of the USD, and hence for the currently repressed gold price. In short: As the former tanks, the latter surges.

Many are nevertheless angry that gold hasn’t ripped in a world of geopolitical risk and rising/persistent inflation, but that’s because the artificially rigged USD has been their only (and short-lived) measure.

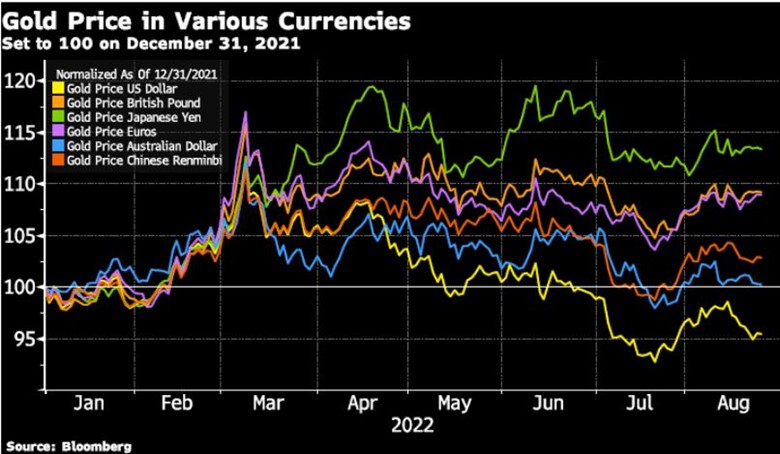

As risk assets in the US and around the world experience double-digit declines, gold in every major currency but the USD has been rising, not falling:

And even gold’s relative decline in US markets remains minimal compared to double-digit losses in traditional US risk-parity (i.e., stock/bond) portfolios for 2022.

A COMEX in Transition

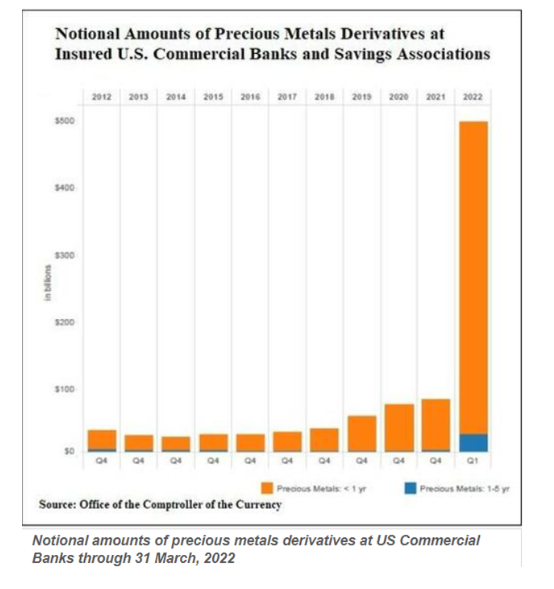

You also may have overlooked that those fat foxes over at the BIS recently unwound 90% of their gold swaps (from 500 to 50 tons) at precisely the same pace that JP Morgan and Citibank (which hold/control 90% of the US commercial banking gold derivatives) just expanded the notional value of their gold derivatives by 520% (!).

Anyone and everyone in the precious metals markets knows that the notional value of those contracts over-shoots the actual supply of the physical metal by 99%.

The COMEX is a nothing more than a legalized fairytale (fraud) whose non-fictional pains (and gold surges) are inevitable.

In the meantime, however, many players in the COMEX markets (the precious metal exchange in NY) are now (and increasingly) looking to take delivery of real rather than paper gold.

Why?

Because they see the writing on the wall.

Gold is a monetary metal not a paper card trick. The COMEX players want to get as much physical metal as they can before false idols like Powel and the global EM currents flowing East take down the USD’s post-Bretton Woods hegemony.

When/as that happens, gold does what it always does when nations and their debased currencies tank: It rises.

And you can be sure that JP Morgan and Citi will keep the paper gold price low until they have enough of the physical gold in hand when gold rips and the USD sinks.

For Now, More Lies, Empty Phrases and Distractions

In the meantime, Powell will act like the nervous captain of a sinking ship and play with rates and the USD as the DC information bureaus (i.e., BLS) spread more open fictions and false distractions on everything from the inflation and unemployment rate to suddenly forgotten viral threats (?), the freedom of Ukraine or the political theme of climate change.

And of this you can also be certain: Powell will continue the Fed’s historical role of crushing the US working class.

Translating Powell’s “Softening Demand”

As Powell wandered Jackson Hole, he warned Americans to prepare for “softening demand,” which is a euphemism for crushing the middle class via rising rates and long-term (rather than “transitory”) inflation ahead.

This rich.

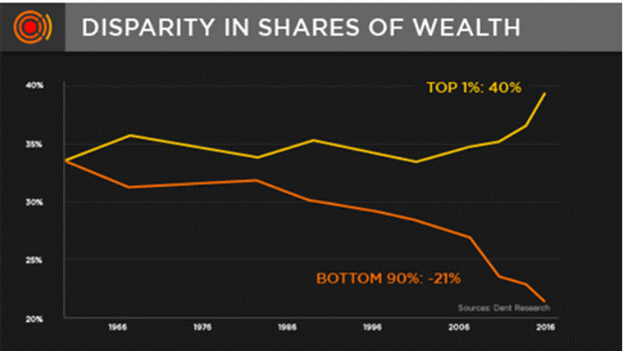

After being the sole tailwind for pushing equity markets up by hundreds of percentage points with mouse-click money since 2009, the Fed has made the top 10% (which owns 85% of the Fed-inflated stock market wealth) extremely rich.

Now, by deliberately cranking rates higher, Powell’s Fed is making the middle class (bottom 90%) even poorer.

Wealth inequality in the US has NEVER been higher, and this never bodes well for the future of an openly fracturing nation.

Indeed, inflation pains and rising rates certainly hurt all Americans.

For the wealthy, such inflationary pains sting; however, for the working class, they cripple.

And as far as this crippling effect of “softening demand” goes, we can blame that squarely on the narrow shoulders of such false idols like Greenspan, Bernanke, Yellen and Powell.

For years, they’ve been saying their mandate was to control inflation and manage employment.

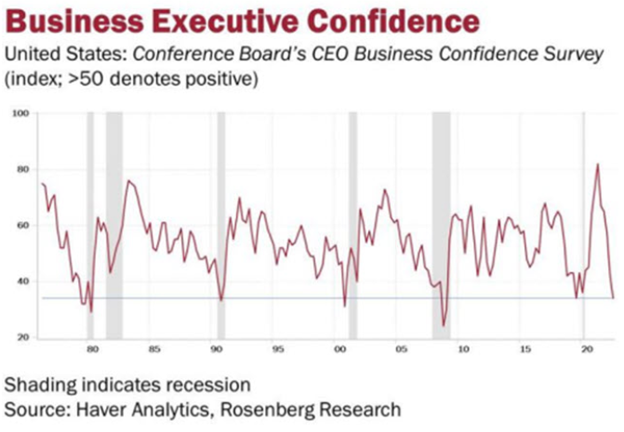

But that employment (as confirmed by PWC, household surveys and our own two eyes) is about to see hiring freezes, downsizing and lay-offs as debt-soaked enterprises with tanking earnings and confidence levels cut costs and jobs.

Again: That’s not “softening,” that’s crippling.

But as I’ve shown in Rigged to Fail and Gold Matters, the Fed’s real mandate is providing (now increasingly scarce) liquidity to credit markets (and hence tailwinds for the equity markets), which benefit a minority, not a majority, of the population.

This easily explains Andrew Jackson’s prescient warning that a central bank simply boils down to the “prostitution of our government for the benefit of the few at the expense of the many.”

Truer words were never spoken, and we are now seeing these warnings playing out in real time, and will see even more pain ahead in this surreal new normal of “softening demand” and a current America of central-bank created serfs and lords.

Powell’s words, of course, do not match his or the Fed’s deeds, a profile flaw that has been hiding in plain site since the Fed’s not-so-immaculate conception in 1913.

The more that investors understand where the decisions are made and why, and the more they track the market signals (bond yields, credit markets and currency debasements), the more they can prepare for what is already here and what lies ahead.

Titanic Currency Destruction: How Central Banks Ruined Money

With the USD losing influence, it would be the understatement of the year to say that we live in interesting times, for we certainly do.

But despite the inevitable attacks of appearing sensational, un-American or just plain cynical, I feel a more appropriate phrase boils down to this:

“We live in dishonest times.”

Below, I bluntly address the “Fed pivot debate,” the “inflation debate” and the USD’s slow global decline in the setting of a now multi-FX new normal in which gold’s historical bull market has yet to even begin.

These views are not based on biased politics, but honest economics, which for some odd reason, ought to still matter.

Let’s dig in.

The New Normal: Open Dishonesty

I recently authored a report showcasing a string cite of empirically open lies which now pass for reality on everything from the CPI inflation scale to the Cleveland Fed’s +1 real interest rate myth, or from official unemployment data to the now comical (revised) definition of a recession.

But a more recent lie from on high comes directly from the highest of all, U.S. President Joe Biden.

Earlier this month, Biden waddled to his podium and prompt-read to the world that the US just saw 0% inflation for the month of July.

Oh dear…

It’s sad when our national leadership lacks basic economic, math or even ethical skills, but then again, and in all fairness to a President in open (and in fact sad) cognitive decline, Biden is by no means the first President, red or blue, to just plain fib for a living.

A History of Fibbing

We all remember Clinton’s promise that allowing China into the WTO would be good for working class Americans, despite millions of them seeing their jobs off-shored to Asia seconds thereafter.

And let us not forget that little war in Iraq and those invisible weapons of mass destruction.

Nor should we ignore both Bush and Obama’s (as well as Geithner’s, Bernanke’s and Paulson’s) assurance that a multi-billion-dollar bailout (quasi-nationalization) of the TBTF banks and years of printing inflationary money (Wall St. socialism) out of thin air was, “a sacrifice of free market principles” needed to “save the free market economy.”

In reality, however, we haven’t seen a single minute of free market price discovery since QE1.

Thus, Biden’s announcement that there was NO inflation for July is just another clear and optically (i.e., politically) clever lie among a long history of lies.

That is, he failed to clarify that although there may have been LESS inflation in July, this hardly means “no” inflation, as any American who has a bill to pay already knows.

Setting the Stage (Narrative) for a Fed Pivot

What the July CPI decline does achieve, however, is yet another headline myth to justify an inevitable Fed pivot to more easy money by year-end (i.e., mid-term elections) or early 2023.

As we see below, the fiction writers, data-gatherers and fork-tongued policy makers in DC have already been gathering more official “data” to justify a Fed pivot toward more dovish money printing and hence more currency debasement ahead.

In addition to a decelerating CPI report for July, DC has also been checking the following, pre-pivot boxes to allow the Fed to get back to doing what it was truly designed to do, which is print debased money out of thin air to save the US Treasury market rather than working class citizens.

Specifically, DC is pushing hard on the following “data points” and narrative:

- Decelerating inflation expectations

- Declining online pricing

- Declining PPI (Producer prices)

- Declining oil prices (from their highs)

So, has inflation peaked? Are the above declines proof that inflation creates deflation by crushing consumer strength and hence price demand? Is the Fed’s work nearly done in defeating inflation?

My short answer is no, and my longer answer is that when it comes to market, currency and economic conditions, there’s…

…More Pain Ahead

One clear sign that there’s more pain ahead, and hence more reasons for the Fed to pivot from temporary hawk to permanent dove, is the credit tightening now taking place in the US.

As I’ve said too many times to recall, the credit—and bond—market is the most important market and economic indicator of all.

Earlier this month, the Fed’s quarterly Loan Officer Survey came out with some scary and telling news, namely that the credit markets are tightening.

It’s important to know that in the last 30 years, a tightening of credit has always preceded a recession, even if DC wants to pretend that we are not in a recession.

The hawks may argue, of course, that during the inflationary 1970’s, tightening bank credit did NOT stop Volcker’s Fed from a hawkish rate hike policy.

But let me remind again that 2022 USA (with a 125% debt to GDP ratio) isn’t the Volcker era, which had a 30% ratio.

So, I’ll say it once more: The US can’t afford a sustained (Volcker-like) hawkish (rate-rising) policy–unless you believe the Fed is under direct orders from Davos to destroy America, which, I suppose is a fair belief, but one I’m not ready to embrace (yet)…

Despite Powell’s fear of becoming another Arthur F. Burns who let inflation run too hot, and despite his failed attempts throughout 2018, and again now, to be the tough-guy at the Fed, I still feel the Fed, for all the narrative points/reasons set forth above (including falling US tax receipts in July), is waiting for more weak economic data to justify a dovish pivot toward more QE rather than less inflation.

Why?

Because the Fed’s Only Job is to Keep Uncle Sam’s IOUs from Drowning

The only way to keep US Treasuries from tanking (and hence bond yields and interest rates from fatally spiking), is for the Fed to print more money to buy Uncle Sam’s otherwise unloved debt.

And this can only be done with more, not less, QE down the road.

Of course, money created with a mouse-click is inherently inflationary and inherently fatal to the purchasing power of the USD, which is why gold is inherently poised to out-perform every fiat currency in play today, including the world reserve currency.

But as for gold’s rise, in addition to the dis-inflationary recessionary forces (which require a weaker dollar and lower rates to fight), there’s a lot going on outside the US which further points to gold’s pending rise.

Little Trouble in Big China?

Investors may have noticed that money is fleeing China in droves. Capital outflows are reaching levels not seen since 2015, which sent the Yuan to the basement by 2016.

Does this mean the FX jocks should start shorting the heck out of the Chinese Yuan (CNY)?

I think not.

In fact, the CNY is holding its own despite massive capital outflows.

But how?

China: Openly Mocking the U.S. Dollar and the Back-Firing Putin Sanctions

The openly back-firing, financially-inept and politically-arrogant Western sanctions against Putin’s war amounted to the biggest game-changer in the global currency system since Nixon closed the gold window in 71.

More to the point, and despite massive capital outflows, the CNY is remaining strong because its FX reserves (i.e., its national savings account denominated in foreign assets) are actually rising not falling.

Huh? Why? Where’s the money coming from?

Answer: Just about everywhere except for the dollar-led West.

That is, nations like China and Russia, who have been chomping at the bit for the last decade to de-dollarize, are now doing precisely that in the wake of recent moves by the West to weaponize the USD by freezing Russia’s FX reserves.

Myopic sanction chest-puffing by the West has given the East the perfect pretext to fight back financially and monetarily, and they are fighting to win a heating currency war.

No Dollars, Thank You

Specifically, countries wishing to purchase Chinese imports (i.e., commodities) now have to pre-convert and/or settle those purchases from local currencies into CNY rather than the once SWIFT-and-world-dominated USD.

In short, the USD is no longer the toughest guy in the room nor prettiest girl at the dance.

This is becoming more evident as headlines confirm Indian companies swapping USDs for Asian currencies, China and Saudi Arabia concluding energy deals outside the slowly dying (and forewarned) petrodollar, and the Russian Central Bank considering buying the currencies of friendly nations like Turkey, India and China.

As commodities like oil (priced-up 30% since 2018) leave places like China and Russia, they can now be purchased with local national currencies (Indian, Brazilian, Turkish) which are then converted into CNY.

This procedure adds massively to China’s FX reserves (especially when oil prices have been rising), thereby allowing its currency to stay strong despite massive capital outflows.

From Mono-Currency to Multi-Currency

In short, and despite Western attempts to flex its currency muscle via USD-driven sanctions, nations like Russia and China are now leading the charge from a one-currency world to a multi-currency world of import payments.

With its FX reserves frozen by the West, Russia, for example, can take its energy profits and Rubbles to purchase the currencies of friendly countries like China, India and Turkey to rebuild its reserves outside of the USD.

In this manner, and as I’ve repeatedly warned (in articles and interviews) since February of 2022, the West has shot itself and the world reserve currency in the foot.

The old world is slowly but surely turning irreversibly away from a USD-dominated currency system toward a multi-currency and multi-FX pricing model.

And as we head into winter, nations like the UK, Japan, Austria and Germany, who blindly towed the US line, will be feeling the cold pinch of backing the wrong policy as other nations stay warm/heated with oil and gas that can be bought outside of the old, USD-led system.

As energy prices continue to cripple the West, especially here in the EU, will such nations like the UK, Austria or Germany bend or stay firm?

Either way, the USD is the open loser over time, and will never be trusted as neutral currency again.

But agree or disagree, you may still be asking: What does any of this have to do with gold?

It Has Everything to do with Gold

As more nations turn away from the West (and the USD) and closer to the East (i.e., Russia) to meet their energy needs, how will they find the Rubles or Yuan to buy their oil, gas and other commodities?

After all, in the new, post-sanction, multi-FX importing model described above, Turkey can’t just buy Russian oil in Lira; it needs to first settle the trade in Rubles.

So, again, what currency will Turkey use?

From Petro-Dollar to Petro-Gold

John Brimelow, a consistently brilliant gold analyst, has given us a pretty obvious hint/answer: YTD Turkish gold imports are up 44% to nearly 70 tonnes, and can easily reach prior levels of 300 tonnes per annum.

In other words, Turkey could be dumping US dollars to buy gold at what we all know is a deliberately rigged (i.e., low) COMEX/LBMA price.

Turkey can then sell that gold to Russia’s central bank in exchange for Rubles “at a negotiated price” otherwise needed to purchase Putin’s oil.

Given that the physical oil market is nearly 15X the physical gold market, one can only imagine what further oil-for-gold transactions as per above will do for the rising price of a scarce asset like gold.

See the Sea of Change?

See how the USD is slowly losing its shine?

See why gold is slowly gaining in shine?

See how the US-led sanctions were the biggest political and financial policy gaffe since Kamala Harris tried to locate the Ukraine on a map?

See why the BIS/COMEX/OTC price fixing of gold earlier this year was the perfect (and artificial, legalized fraud) timing needed to keep gold cheap for other nations to buy?

Rhetorical Questions

Perhaps all this interest in gold rather than the USD explains Saudi Arabia’s recent push to refine gold within its own borders?

Perhaps this also explains why less-favored nations to the US (i.e., Nigeria and India) are launching a bullion exchange and opening gold trading?

Perhaps gold’s new roles are why the BIS, the biggest player (legalized scammer) in the paper price fixing of gold, has unwound nearly 90% of its gold swaps over the course of a year (from 502 to 56 tonnes)?

And perhaps gold’s stubborn significance further explains why the two biggest US gold price manipulators in the futures pits, JP Morgan and Citi, have been grotesquely expanding their gold derivative book (they own 90% of all US derivative bank gold) at the same time the BIS was unwinding their swaps?

Why?

Simple: To keep a boot to the neck of the natural gold price just a bit longer as they accumulate more of the same before the very currency system they helped ruin finally implodes?

Honest not Sensational: Gold’s Bull Market Has Yet to Even Begin

Given the dishonest times in which we live, and given all the mechanizations sited above, it would not be sensational to remind conventional investors what most gold investors already know: Gold is most honest and loyal when dishonest and disloyal markets implode.

Hedge fund managers and other candid analysts are collectively and already foreseeing massive market pain ahead, as Egon and I have been warning for years.

The big boys are now net-short US Equity futures:

Whether re-valued by oil, or simply re-valued by fiat currencies which have increasingly no value, gold can easily reach levels which current investors can’t imagine.

After Nixon’s debacle in 1971, gold surged 400% in just one year between 1973-74.

Watch the Foxes, not the Hen House

The TBTF banks have no morality in my mind. I’ve written of their open fraud for years.

Ever since folks like Larry Summers repealed Glass Steagall and turned banks into casinos and bankers into speculators (with depositor money), nothing the big banks do is either fair or fiduciary.

Ironically, however, it is fair to say that even these banks will be hoarding more physical gold (at currently repressed/rigged prices) as the world they created implodes under its own systemic sins.

And if JP Morgan or Citi is getting prepared, shouldn’t you?

After all, better a fox than a hen, no?

Titanic Currency Destruction: How Central Banks Ruined Money

Once again, the US is facing a recession which Main Street feels, Wall Street whistles past, and DC simply denies.

Below, we look at these recessionary forces and delusional policy makers in the context of blunt-speak rather than Fed-speak so that we can best prepare for what’s already felt but rarely spoken from on high.

De-Coding the Latest Fed-Speak: Hawks, Doves or Both?

As expected, and as already priced-in by the markets, the Fed raised the Fed Funds Rate (FFR) last week by 75 bps in what superficially appeared to be a hawkish assault on inflation but what in reality was nothing more than another monetary bluff.

Alas, there’s far more hidden dove than public hawk emanating from Wednesday’s latest Fed “guidance.”

As I’ve consistently argued, the Fed has wanted to exploit (rather than defeat) inflation as a classic means of secretly “inflating away” chunks of its embarrassing debt pile while publicly pretending to “combat” inflation with anemic (6.75% y/y) rate hikes (and a 2.50% FFR) which will never catch up with (and therefore never defeat) current inflation rates above the 9% level.

Everyone, including Powell, knows that Uncle Sam can’t afford rising rates or a perpetually strong USD.

So why the public ruse to “fight” 9% inflation” with 2.5% FFR?

Simple: The Fed sees a recession coming and needs to raise rates today so they’ll have something—anything—to cut tomorrow.

Dovish Pivot Translated

Thus, and as consistently argued, the Fed’s hawkish July chest-puffing will eventually (i.e., when the recession becomes official) lead to some dovish two-stepping as Powell has effectively telegraphed a future rate hike pause by using the magic words “depending on the data.”

In short, I believe the Fed is looking for an excuse to print more dollars and cap more yields/rates with more inflationary mouse-click magic money and hence more Main Street pain—all very bad for a debased yet relatively strong USD and all very good for real monetary metals like gold.

Stated simply, I feel last Wednesday was the first sign/hint of an inevitable Fed pivot from rising rates to pausing rates, and then eventually, falling (YCC) rates and a falling dollar over the coming months and quarters.

We’ll know more at the end of August when Powell scoots off to Jackson Hole as the rest of the US sinks deeper into a recessionary hole.

Recession Translated

And what’s the new excuse for the inevitable pivot to more artificial “accommodation” (i.e., QE) rather than the current and fake “inflation fighting” QT?

Powell described it in Fed-speak as “watching for a slowdown in economic activity.”

Translated into honest-speak, this just means that Powell’s narrative will be shifting from inflation semantics to recession realities, despite every current effort made from DC to deny a recession.

I’m always impressed by the Fed’s ability to pervert English, math and honesty in the name of fantasy, calm and policy.

As we’ve shown elsewhere with blunt math rather than sensational drama, the Fed, and its minions at the BLS, have literally invented a magical calculator which makes 2+2=1 on everything from CPI Inflation, and the M3 Money Supplyto the current metrics used to turn privately sought negative real rates into publicly positive real rates.

With so much dishonesty from (and hence distrust of) the policy makers, it thus comes as no surprise that even the definition of a recession is now being perverted to supplant reality with fantasy and thus keep the masses comfortably numb from the consequences of the Fed’s increasingly failed monetary policies—namely a Fed-engineered recession to deflate Fed-made inflation.

But can any of us remember the last time a central banker stood up and confessed: “Boy, we really screwed that up, got that wrong, and are now facing years of self-inflicted misery; sorry about that”?

Or can any of us imagine a central banker saying: “OK, we’ve been lying to you for years about true inflation levels, which we actually need to pay down the debts we’ve helped create and which we will now use a recession to quell. Sorry about that.”

A Lesson in Recessionary Realism

Luckily, we’re not interested in the Faustian bargain required to work in DC, so we can all enjoy some honest math and cold data when it comes to confessing recessions.

As most already know, two consecutive quarters of declining real GDP is how recessions are defined and have been defined for years.

Powell, Yellen and Biden’s press secretary, however, will nevertheless assert that the real definition of a recession is suddenly not as simple as that.

Hmmm.

Ok. So how about if we add the following facts (and leading indicators) to help our financial leadership in DC confess that a recession is precisely where we are headed and frankly already standing.

Toward this end, let’s share a few data points they might have overlooked when backpedaling on the “recession” question, namely

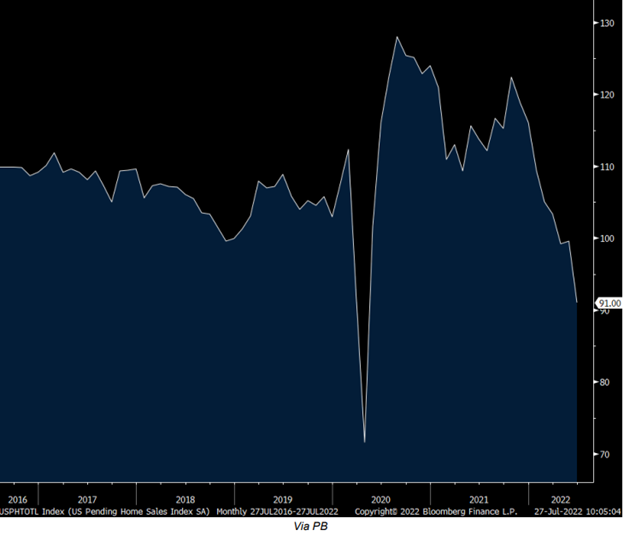

1. U.S. New Home Inventories are at the highest levels since 2018 and pending homes sales (reeling under the weight of rising mortgage rates) fell y/y by 20% in June.

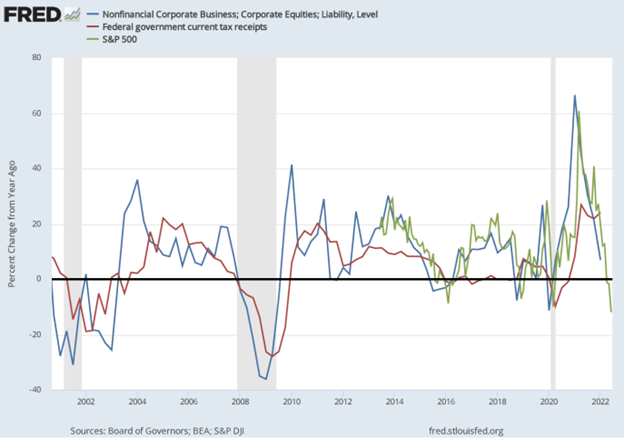

2. Housing data is directly linked to tax receipt data. That is, both fall together, and as tax receipt income falls, this too is a recessionary indicator, as falling US tax receipts are equally correlated to falling US stock prices.

3. Advertising budgets/spending policies are falling at places like Amazon, while inventories at places like Walmart are rising as their profits are falling, including names like Target whose stock price tanked by 24% on Q1 earnings misfires; and…

4. Hawkish rate hikes and a strengthening USD are a poison to the earnings flows of such enterprises already in debt up to their ears after years of “free debt” expansion in the backdrop of repressed rates and post-08 unlimited money printing.

By the way, such ad-spend cuts, falling earnings, tanking profits, and new-hire slowdowns seen across the US at retailers like Walmart, Target and Amazon are typical and leading recessionary indicators which often precede/portend future labor layoffs.

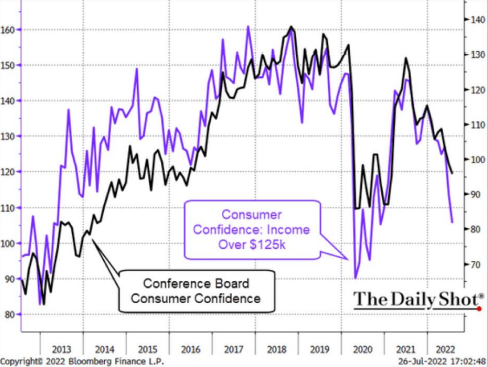

5. Consumer confidence among even the higher-income US population is sinking fast:

6. Rising rates and the strong USD policy pursued by Yellen and Powell has made the cost of US entitlements (i.e., health, social security etc.) painfully worse and ultimately unsustainable.

When Yellen was drunk-driving at the Fed, for example, those entitlements were 54% of US tax receipts in 2015; today, as spending increases and inflationary 10% “cost of living adjustments” (COLA) are honestly applied, annual US entitlement payments will very soon reach 90% of US tax receipts.

In short, the current and “hawkish” rising-rate-strong-USD policy at the Eccles building will bankrupt the federal government unless a pivot is made soon to fill the spending gaps and deficits with more fake fiat money—i.e., more QE.

After all, that needed money is certainly not coming from an anemic GDP, a topping and tanking market and hence declining tax receipts.

7. As to Uncle Sam’s embarrassing bar tab, he is facing $23T of outstanding IOU’s, 30% of which are poised to re-price at the end of this year at a higher (6.75%) rather than lower annual rate, which boils down to roughly $460B in additional spending (12% of tax receipts) just to cover those rising interest expenses.

Thus, unless the Fed hits the “QE-Button” very soon, Uncle Sam will be hiding from his creditors behind the Fed and its currently dim “happy hour” sign.

8. At the global level, nearly every major “developed economy” is little more than a glorified banana republicmathematically staring down the barrel of a sovereign debt crisis as governmental rates (i.e., the cost of borrowing) are rising at the very same time that economic growth and new export orders are sinking:

Meanwhile the Pravda-Like Denial Continues

Despite each of the foregoing hard facts, US Treasury Secretary, Janet Yellen, is leading the official DC chorus in a now openly pathetic effort to deny reality in ways reminiscent of the Soviet era circa 1963.

According to Yellen, and after back-to-back quarters of negative GDP growth, “there’s no evidence of a recession now.”

Such words once again confirm how central bankers are nothing more than word-smith politicians (propagandists?) dressed in banker clothing and broken (free-market) high heels.

Math and hard data are no longer the key focus of our central bankers. Like candor and ethics, they’ve replaced sincere numbers with political nouns and false narratives.

It seems today that along with science, culture, comedy, creativity and history, the very discipline of economics has itself been canceled.

What to Expect?

In such a distorted, desperate and frankly dishonest backdrop of form over substance and false narratives over honest math, what can the rest of us expect from our central planners on high and our real world experience on the ground?

As I recently argued, the Fed knows it will not beat inflation (which it secretly needs) via rising rates.

Instead, Powell will centrally engineer a currently “deniable” recession (which is dis-inflationary) to publicly “combat” otherwise deliberately sought inflation.

Toward this end, these fork-tongued bankers will also pull out their usual tricks and magical calculators to convince the world and markets that officially reported inflation levels are honest (despite being at least 50% under-reported) while simultaneously and deliberately pursuing a policy of negative real rates (i.e., inflation rates above interest rates) as they publicly and dishonesty report them as positive.

So yes, a recession is here, and a longer and deeper one is coming.

The Fed will use words and dishonest math to calm the cognitively dissonant from an abrupt market sell-off or a collective wising up.

As I see it, the Fed can postulate and chest puff a hawkish and rising rate policy for now and perhaps even into the fall.

But unless the Fed in particular, and the major central banks in general, wish to “defeat” inflation by catapulting the world into a global recession whose depth, duration and pain will be extreme, they will have no mathematical nor even political choice but to lower rates, weaken their currencies and fight recessions within their front yards.

As recently argued, no nation, regime nor system in history has conquered a recession by jacking up rates and strengthening their currency.

Given the evidence above, the US is heading straight into a recession and as such will be forced to confront that reality (however downplayed or officially postponed) by cranking out the mouse-click money in a way which will cap yields, debase the dollar and thus be a tailwind for precious metals across the board.

Unless, of course, you think all that data above is fake news and that the Fed has outlawed recessions, in which case all is fine and will always be fine, right?

Titanic Currency Destruction: How Central Banks Ruined Money

Many are asking about Gold’s rise, or better yet: When, how and why it will rise?

Toward this end, cold data in the face of historical facts and current recessionary realities will make gold’s rise easier to grasp.

Let’s start with the cold data, which centers around officially reported real rates and relative USD dollar strength, two current and key headwinds to gold’s rise.

Cold Data Point 1: Real Rates

As we’ve written previously, there is a clear inverse relationship (95% correlation) to real (inflation-adjusted) rates and the gold price.

Stated simply, when inflation outpaces the yield on the 10 UST, the net result is a negative real rate environment. Conversely, when rates (as defined by the yield on the 10Y UST) are above inflation, we have positive real rates.

Gold, as a real asset that produces no yields or dividends, shines brightest when real yields/rates are negative.

After all, when bonds produce negative returns, investors look more favorably toward real assets like precious metals.

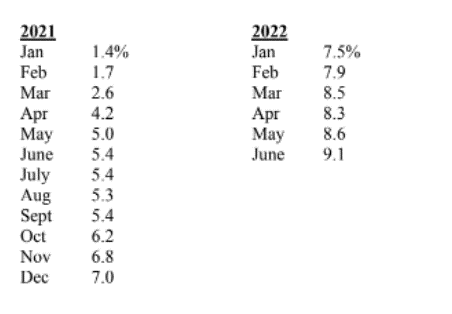

Today, one would think that soaring Year-over-Year (YoY) inflation in the U.S. at 9.1% (and closer to 18% using the more honest 1980’s CPI scale) against a 2.89% nominal yield on the 10Y UST would seem to be a screaming indicator of negative real rates and thus a profound tailwind for gold, right?

And as to inflation, we said over a year it ago it would skyrocket while Powell promised it was “transitory.”

After all, when a nation expands its money supply by 40% in a two-year period prior to COVID and Putin, one can’t just blame inflation (or a later Fed Balance Sheet expansion from $4.2T to $8.7T) on a virus or Russian bully.

Based on these cold facts and the subsequent (and monthly YoY) CPI figures, who was more candid (and accurate) about transitory inflation? See a trend?

Getting back to real rates, a 2.9% nominal yield minus the above 9.1% inflation rate = negative 6.21% real yields.

Easy-peasy and good for gold’s rise, right?

Well, nothing is that simple in our new central bank normal…

Fudged Math

Whether you believe in central banks or “official” inflation data (and we certainly do not), this doesn’t change the equally cold fact that central banks (or central controllers) are nevertheless always right, even when they are empirically wrong.

According to the Fed, for example, the Real Rate on the US 10Y UST is +1.06%.

See for yourself.

Huh?

How does a negative 6% become a positive 1%?

Short answer: Clever Fed math (mixed with deflationary expectations priced into the duration of the bond).

Huh?

As indicated in many prior reports, the Fed, much like Al Capone’s accountants, are masters at manipulating, downplaying, obfuscating or just flat-out non-reporting embarrassing facts, including severe inflation realities, to create fictional calm.

Thus, when publicly charting otherwise embarrassing real rate data, they employ a spiders-web of clever math and proprietary models to come up with a downplayed inflation rate against which they measure nominal rates to derive a fictional “inflation-adjusted” real rate.

In other words, they fudge the numbers.

In the example above, rather than using the otherwise simple 9.1% YoY inflation rate, the Federal Reserve Bank of Cleveland offers us an official mash of “expectations”, “risk premiums,” “real risk premiums,” the “real interest rate,” as well as a “model” that mixes “data, inflation swaps” and even “surveys” just to avoid stating what is already abundantly clear: Real rates today are -6.21 not +1.06.

In essence, the foregoing Fed math hides the blunt reality of current inflation by saying they foresee deflation ahead over the duration of the 10Y UST.

And as we discuss below, they may ironically be correct but for all the wrong reasons…

For now, and given the “official facts” as presented by the never-wrong Fed, current real rates on the 10Y UST are often mis-presented as slightly positive rather than honestly reported as deeply negative.

And as stated above, this fiction has been a clear, deliberate (and temporary) headwind for gold’s rise.

Cold Data Point No 2: Rising (but Short-Lived) U.S. Dollar Strength

The USD, of course, has been rising at astronomical levels (7% in Q2), and this too is often a headwind to gold’s rise, as a rising dollar appears/appeals to many investors (foreign and domestic) as a safer haven than precious metals.

In fact, a rising USD and rising rate environment was immediately (and predictably) bad for just about every asset class, though far less so for gold’s rise. There were few places to hide.

Percentage declines across asset classes for 1H 2022 proved this point:

NASDAQ 100 Down 29.3%

S&P 500 Down 20.0%

Emerging Markets Down 17.2%

US Govt Bonds (TLT) Down 21.9%

Real Estate (XLRE) Down 20.1%

HY Bonds (HYG) Down 13.8%

Muni Bonds (MUB) Down 7.8%

Gold Bullion Down 1.2%

We’ve explained this dollar rise in prior reports as a desperate yet explicable attempt by Yellen and Powell (and Biden and Summers) to attract foreign inflows into U.S. markets wherein the USD is seen as a relatively superior “safe haven” when compared against other global currencies, like the Euro, whose debt levels (and non-reserve currency status) can’t endure equally hawkish rate hikes.

That is, by pursuing deliberate and well-telegraphed rate hikes (50 bps in May, 75 bps in June and potentially more to come in July), the Fed, for now, has made the USD the best currency horse in the international fiat glue factory.

This deliberate policy to make the USD stronger is a temporary tool to “fight” inflation, as it reduces the cost of import prices within the U.S.

A German toaster, after all, costs less when the USD reaches parity with the Euro.

But a stronger USD also strangles U.S. export competitivity and adds to increased U.S. trade deficits longer term, which is one (but not the main) reason the strong USD policy will be short-lived (see below).

Why short-lived?

Because as indicated above, historical facts and current realities all converge toward a recessionary landscape in which weaker currencies and lower rates are the only path forward.

What makes us think so?

The Historical Facts and Cold Math of Recessions

Despite the post-2008 Fed’s valiant yet vain (really vain) attempts to convince the world that recessions have been made extinct by mouse-click monetary policies, the simple yet common-sense reality is that recessions have not been outlawed (but merely postponed) by such fantasy fiat dollars.

Deep down, we all know this, even the market bulls: You can’t solve a debt crisis with more debt paid for with money created by a computer rather than GDP.

The other simple yet common-sense and historical reality is that no recession (not one, not ever) can be defeated in a backdrop of high rates and a strong currency, the very policies which the US is currently and temporarily pursuing.

Despite the fatal hubris and immense power of the Fed, the U.S. will be no exception to these recessionary realities and consequent policy shifts.

The markets (from the NASDAQ to Muni-bonds) can’t afford rising rates and will continue to fall as Powell pretends to be a rate-hiking Volcker despite forgetting that Volcker was facing a 30% debt to GDP in 1980, not 125% ratios in 2022.

Powell may want to believe he’s a Volcker, and I’d like to ride a horse like Adolfo Cambiaso or throw a fast ball like Nolan Ryan, but it ain’t gonna happen.

In short: Powell will pivot as the grotesquely over-heated bubble markets the Fed created start tanking further.

Tech stocks (of which we consider BTC to be) are uniquely poised for further pain…

Like the Q1-Q4 2018 rate-hikes to the predictable 2018 Q4 market beat-down (and hence 2019 pivot), the Fed will reduce rates and the USD will weaken in a QT to QE pivot once the recession off (or already under) our bow slams into our debt-soaked and sinking Titanic economy and markets.

Current Realities: Recession Ahead (or Already Here?)

Recessions become official (and lagging) once the number-crunchers (i.e., fiction writers) in DC officially tell us so, namely, once they report 2 consecutive quarters of negative GDP (i.e., too late for most retail investors who still trust the Fed).

Thankfully, there’s no need to hold our breath. Despite already feeling like we are in a recession, the Atlanta Fed GDPNow data has confirmed a negative Q1 GDP (-1.5) and foreshadowed a 0 to negative Q2 GDP.

In short, we are likely already in recession, and this neither bothers nor surprises the Fed. After all, the same bankers who built the inflationary bubble will trigger the deflationary recession to follow.

Stated more simply, and when it comes to market bubbles, the Fed giveth and the Fed taketh away.

The Fed’s Real Anti-Inflation Weapon: A Deflationary Recession

Despite pretending to fight inflation with rising rates, the Fed knows its nervous rate hikes (be they at 50, 75 or even a 100 bps) won’t defeat current inflation, which is considerably much higher than officially reported. Negative rather than positive real rates are already (albeit unofficially) in play to deliberately “inflate away” some of Uncle Sam’s embarrassing debt.

By lying about (i.e., “fudging”) the inflation data, the Fed therefore gets to have its cake and eat it too; namely it can privately exploit extreme inflation while publicly pretending/reporting it lower than it actually is, even at these embarrassing levels.

(Of course, another way to calm inflation fears is to intentionally repress the paper price of gold on the COMEX, of which we’ve written extensively.)

Yet looking ahead, the historically most accurate tool for fighting inflation (and crushing Main Street), of course, is a recession, wherein economic growth and consumer demand weakens and hence prices (and inflation) fall—i.e., deflationary forces.

The Fed knows this too. Nothing fights a Fed-created inflation like a Fed-induced recession. Thanks Mr. Powell.

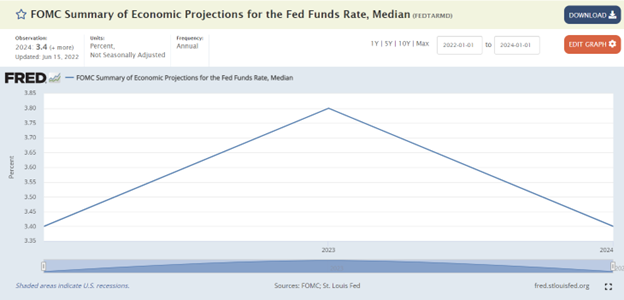

The current chest-puffing claims by the Fed to send the Fed Funds Rate to a “projected” 3.8% by 2023 is, in my opinion, just another Fed ruse, as nearly all its “projections” have been in the past.

At $30T+ in public debt, Uncle Sam (or Mr. Market) can’t afford such “projections.”

For every 1% rise in rates, the cost of servicing Uncle Sam’s $30T+ bar tab rises by $27 million per day.

And WHEN not IF the recession hits the U.S., the Fed knows all too well that there is no way out of that dis-inflationary (and long-term) recession other than lower rates and a weaker USD—all good for gold’s rise.

As our advisory colleague, Ronni Stöferle recently observed: “The current cycle of interest rate hikes could go down in history as the shortest and weakest in recent decades.”

Why?

Because, 1) economic activity and growth is slowing (and has been for years), 2) indebted nations can’t afford meaningfully higher rate hikes, 3) inflationary debt relief is counter-acted by increased government spending, and 4) markets are already pricing-in inevitable rate cuts.

The Return of the Money Printers—Just a Recession Away

And what’s the best method to 1) cap or cut rates (as Japan’s current YCC confirms), 2) weaken the currency and 3) spur “growth” in a recession?

Easy: A money printer to artificially suppress bond yields and weaken (debase) the currency.

Again, this means the inevitable pivot from current hawkish tightening to future dovish easing is just a recession away.

For now, and as stated elsewhere, the Fed’s (and Canada’s) hawkish rate hikes today have been engineered not to fight inflation, but simply to have room to cut rates tomorrow when the recession our central banks have been postponing with mouse-click dollars comes painfully home to roost.

Gold Price Reaction, Gold’s Rise

This inevitable shift from a rising dollar and rising rate setting to a falling dollar and repressed (but still negative) rate reality in a recession will be an extreme catalyst for gold’s rise, now currently and intentionally suppressed by: 1) an openly rigged COMX market, 2) a disingenuous “anti-inflationary” rate hike policy and 3) a short-term strong dollar policy to fight mis-reported (i.e., much higher) inflation.

My colleague, Egon von Greyerz, would remind that gold’s rise is based on more than just inflation and deflation fluctuations or rising or falling rates.

Indeed, gold’s rise in the past has occurred in environments of a strong dollar, a weak dollar, a rising rate and a falling rate.

There are many specific reasons and contexts for this, too numerable and nuanced to unpack in an article, which is why we’ve authored a book (Gold Matters) to explain the same in greater detail.

There’s More to Gold’s Rise than a USD

Furthermore, and as anyone owning gold in currencies other than the USD already knows, gold’s rise has been considerably stronger against currencies who don’t have the bullying power of the USD—namely the power to export inflation or pivot from Hawk to Dove to Hawk because of a world reserve currency status.

The EU and its central bank, for example, are so thoroughly debt-strapped and dependent upon USD-based markets, debts and settlement policies that even an ECB rate hike move from 25 bps to 50 bps has LaGarde shaking in her designer boots.

France, from where I sit, has a total debt to GDP ratio of over 350% and Italy, whose debt and political coalition confusions are no mystery to European citizens, is an early warning sign of future economic and political fracturing in the EU.

Germany, meanwhile, will soon (2023) have to pay the bill for the inflation-adjusted bonds it issued in prior years, the cost of which will be 25% of the nation’s total debt.