THE FINANCIAL SYSTEM HAS REACHED THE END

The world is now witnessing the end of a currency and financial system which the Chinese already forecast in 1971 after Nixon closed the gold window.

Again, remember von Mises words: “There is no means of avoiding the final collapse of a boom brought about by credit expansion.”

History tells us that we have now reached the point of no return.

So denying history at this point will not just be very costly but will lead to a total destruction of investors’ wealth.

POLITICIANS LIE WITHOUT FAIL

History never lies but politicians do without fail. In a fake system based on false values, lying is considered to be an essential part of political survival.

Let’s just look at Nixons ignorant and irresponsible statements of August 15, 1971 when he took away the gold backing of the dollar and thus all currencies.

Later on we will show how clearsighted the Chinese leaders were about the destiny of the US and its economy.

So there we have tricky Dick’s lies.

- The suspension of the convertibility of the dollar in 1971 is still in effect 52 years later.

- As the dollar has declined by almost 99% since 1971, the “strength of the economy” is also declining fast although using fiat money as the measure hides the truth.

- And now to the last lie: “Your dollar will be worth as much tomorrow”. Yes, you are almost right Dick! It is still worth today a whole 1% of the value when you closed the gold window.

The political system is clearly a farce. You have to lie to be elected and you have to lie to stay in power. That is what the gullible voters expect. The sad result is that they will always be cheated.

CHINA FORECAST THE CONSEQUENCES ALREADY IN 1971

So in 1971 after Nixon closed the gold window, China in its official news media the People’s Daily made the statements below:

Clearly the Chinese understood the consequences of the disastrous US decision which would destroy the Western currency system as they said:

- Seriousness of the US economic crisis and decay and decline of the capitalist system

- Mark the collapse of the monetary system with the US dollar as its prop

- Nixon’s policy cannot extricate the US from financial and economic crisis

I am quite certain that the US administration at the time ridiculed China’s official statement. As most Western governments, they showed their arrogance and complete ignorance of history.

How right the Chinese were.

But the road to perdition is not immediate and we have seen over 50 years the clear “decline of the capitalist system”. The end of the current system is unlikely to be far away.

Interestingly it seems that a Communist non-democratic system is much more clairvoyant than a so called Western democracy. There is clearly an advantage not always having to buy votes.

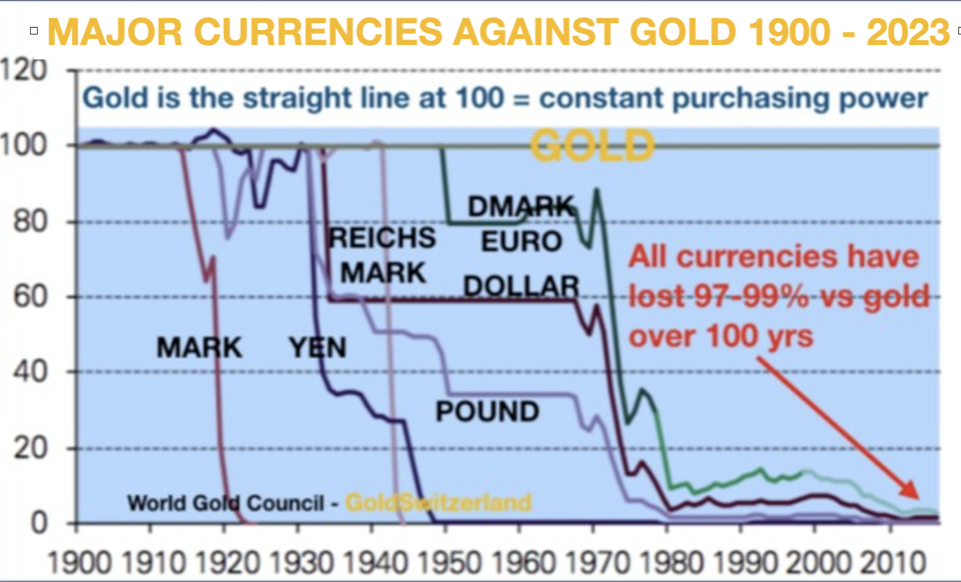

IRRELEVANT WHICH CURRENCY WINS THE RACE TO THE BOTTOM

As the whole currency system is about to implode, it is in my view totally irrelevant where the US dollar is heading short term measured against other fiat currencies.

The dilemma is that most “experts” use the Dollar Index (DXY) as the measure of the dollar’s strength or weakness. This is like climbing the ladder of success only to find out that the ladder is leaning against the wrong building.

To measure the dollar against its partners in crime (the other fiat currencies) misses the point as they are all on the way to perdition.

So the dollar index measures the dollar against six fiat currencies: Euro, Pound, Yen, Canadian Dollar, Swedish Kroner and Swiss Franc. The Chinese Yuan shines in its absence even though China is the second biggest economy in the world.

But here is the crux. The dollar is in a race to the bottom with 6 other currencies.

Since Nixon closed the gold window in 1971 all 7 currencies, including the US dollar, have declined 97-99% in real terms.

Real terms means constant purchasing power.

And the only money which has maintained constant purchasing power for over 5,000 years is of course gold.

So let’s make it clear – the only money which has survived in history is GOLD!

All other currencies have without fail gone to ZERO and that without exception.

Voltaire said it already in 1729:

PAPER MONEY EVENTUALLY RETURNS TO ITS INTRINSIC VALUE – ZERO

And that has been the destiny of every currency throughout history.

Every single currency has without fail gone to ZERO. And this is where the dollar and its lackeys are heading.

To debate if a currency, which has fallen 98.2% in the last 52 years, is going to strengthen or weaken in the next year or two is really missing the point.

It is virtually 100% certain that the dollar and all fiat money will complete the cycle (which started in 1913 with the creation of the Fed) and fall the remaining 1-3% to ZERO.

But we must remember that the final fall involves a 100% loss of value from today.

BRENT JOHNSON & MATT PIEPENBURG DEBATE THE DOLLAR

So to debate whether the dollar index which today is 103, will reach 150 first as my good friend Brent Johnson argues in his Dollar Milk Shake Theory or that it will fall from here as my colleague Matt Piepenburg contends, really misses the point.

There is no prize for coming first to the bottom. The dollar is down almost 99% in real terms since 1971. So it has a bit over 1% to fall to reach ZERO.

And history tells us that the final fall is INEVITABLE.

So why worry if the Dollar or the Euro becomes worthless first? It really is a moot point.

Brent Johnson and Matt Piepenburg recently had a debate on Adam Taggart’s new platform “Thoughtful Money”. Adam is an outstanding host with great speakers and both Brent and Matt were superb in their presentation of the arguments for or against the dollar. But even though they both like and understand gold, they got a bit too caught up in the dollar up or down debate rather than focusing on the only money which has survived in history. Still, I know that they both appreciate that gold is the ultimate money.

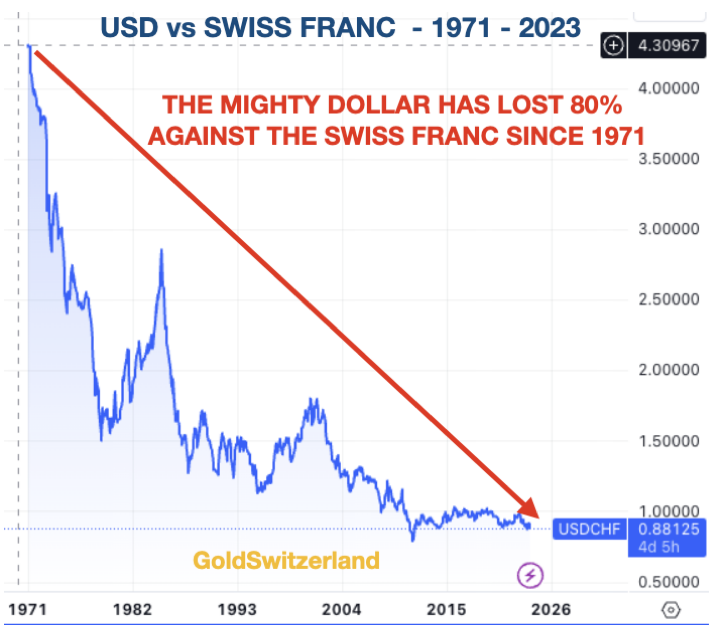

NOT ALL CURRENCIES ARE BAD

The world’s reserve currency has had a sad performance based on lies, poor real growth, all due to a mismanaged economy based on debt and printed money.

So although most currencies have lost 97-99% in real terms since 1971 there are shining exceptions.

When the gold window was closed in 1971 I was working in a Swiss bank in Geneva. At the time, one dollar cost Swiss Franc 4.30. Today, 52 years later, one dollar costs Swiss Franc 0.88!

This means that the dollar has declined 80% against the Swiss Franc since 1971.

So a country like Switzerland with virtually no deficits and a very low debt to GDP proves that a well managed economy with very low inflation doesn’t destroy its currency like most irresponsible governments.

The Swiss system of direct democracy and people power is totally unique and gives the people the right to have a referendum on almost any issue they choose.

This makes the people much more responsible in their choices as a winning vote on any issue becomes part of the constitution and cannot be changed by government or parliament. Only a new referendum can change such a decision.

THE US BANANA REPUBLIC

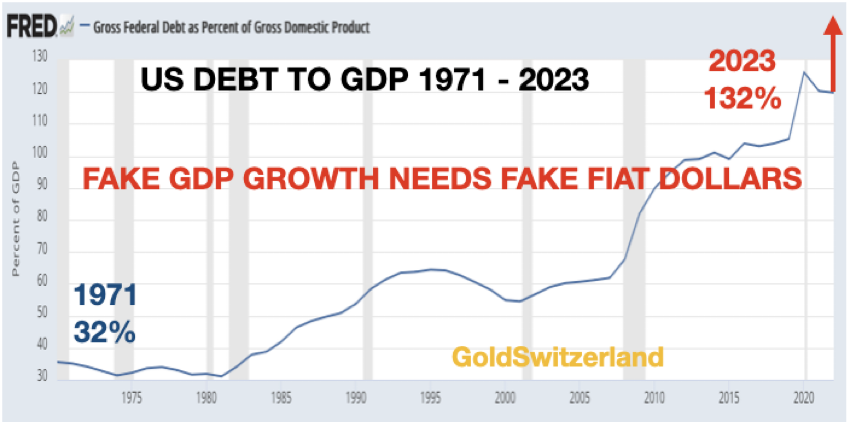

Swiss Debt to GDP is around 40%. This was the level of US debt back in 1971 before the gold window was closed.

As the graph below shows, US debt to GDP is now 132%. In 2000 it was 55%.

132% debt to GDP is the level of a Banana Republic which is frantically trying to survive by printing and borrowing ever increasing amounts of worthless fiat money.

So debt to GDP is now reaching the exponential phase. I have explained the final phases of exponential moves in many articles like here.

Since there is no intent or possibility to reduce the US deficit, the likely deficit for next fiscal year is most probably in excess of $2 trillion and that is before any bad news like higher inflation, higher interest rates, bank failures, more war, more QE etc.

As I discussed in a recent article,“THE CYCLE OF EVIL”, the world is today facing unprecedented risks of a magnitude never before seen in history.

THE TIME TO PRESERVE WEALTH IS NOW

The combination of geopolitical and financial risk makes wealth preservation an absolute necessity.

Most asset markets look extremely vulnerable be it stocks bond or property. Few investors understand that current asset prices are in cloud cuckoo land as a result of an unprecedented credit expansion.

Personally I think we are now at a point when asset markets could tank.

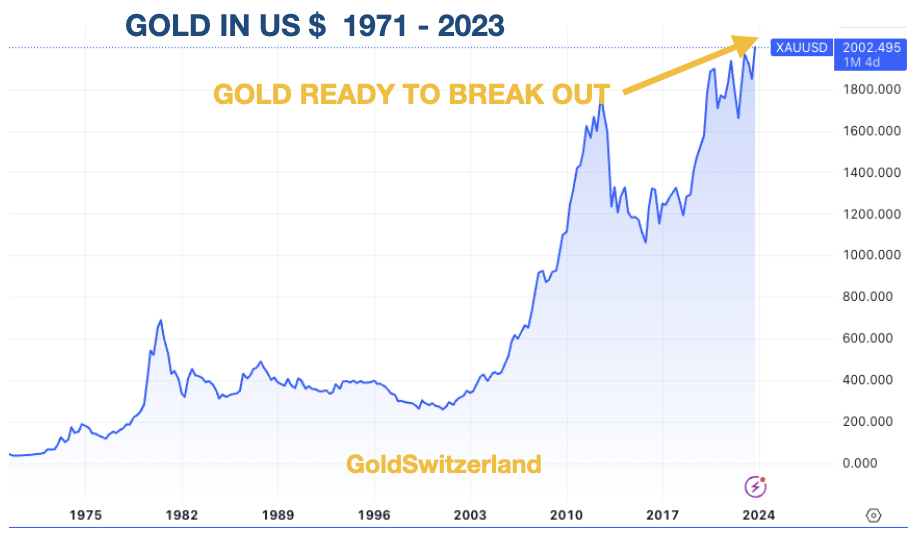

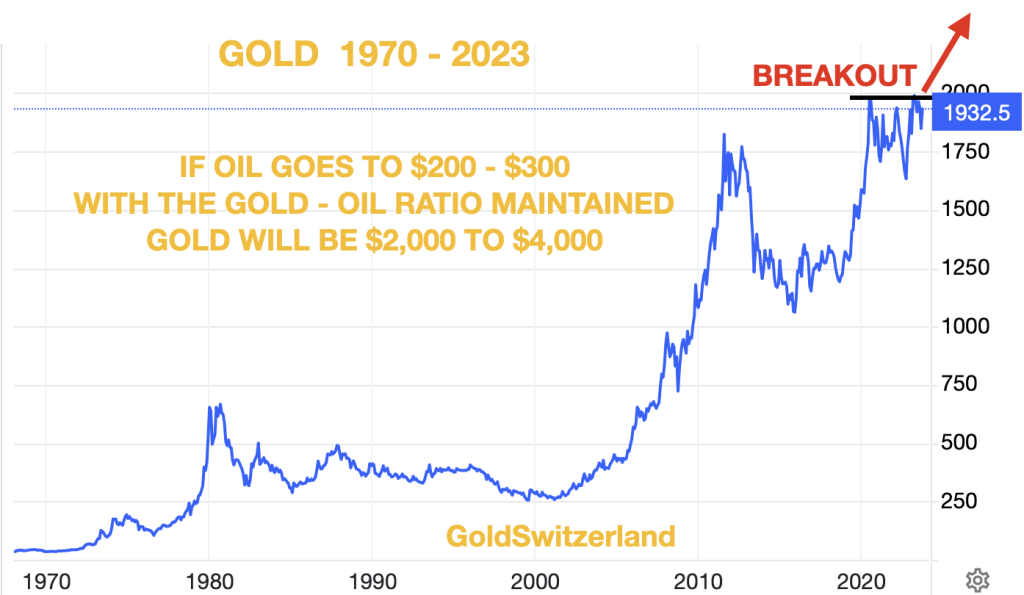

At the same time gold looks ready to soon break out of its consolidation since 2020.

Once gold leaves the $2,000 level behind, the move is likely to be fast.

Silver will most probably move twice as fast as gold.

But this is not a question of price and speculation. No, it is all about risk and wealth preservation.

So short term timing is irrelevant. The next few years will be about financial survival.

Sadly most investors will buy the dips in conventional asset markets like stocks and lose most of their gains in the last few decades.

As gold is insurance against a rotten financial system it must be acquired and owned outside a fragile banking system which is unlikely to survive in its present form.

Here are a few of the SINE QUA NON (indispensable conditions) for gold ownership:

- Gold must be held in physical form. No funds, ETFs or bank held gold.

- The investor must have direct access to his own gold bars/coins.

- Any counterparty must be eliminated whenever possible.

- Gold must be stored in ultra safe vaults outside the banking system.

- Gold should not be stored in a major city.

- Gold must be insured.

- Only gold that you are prepared to lose should be stored at home.

- Gold should be stored outside your country of residence and in a gold friendly jurisdiction.

- The country where the gold is stored must have a long history of democracy, political stability and peace.

As we are approaching one of the most precarious times in history both financially, socially, politically and geopolitically, Wealth Preservation in the form of gold and some silver will make the difference between financial survival or ruin.

As always, most important in life is looking after family and helping friends.

And remember that in the difficult times ahead there are many wonderful things that are free like nature, books, music, sports etc.

THE FINANCIAL SYSTEM HAS REACHED THE END

Matterhorn Asset Management partner, Matthew Piepenburg discusses the future of the USD with Brent Johnson of Santiago Capital in this thoughtful “debate” hosted by Adam Taggart of Thoughtful Money.

As the author of the compelling “Milkshake Theory,” Brent Johnson is known for his logical argument that despite all of the USD’s extraordinary flaws, over-creation, and inflation-exporting “bully power,” its relative strength today and tomorrow is undeniable, and that a case for a stronger USD (DXY at 150?) is the most likely path forward.

Piepenburg and Johnson in fact agree on many of the primary forces (Euro Dollar demand, derivative market demand, SWIFT dominance etc.) in play which create a profound demand “tailwind” for the USD, and hence all but assure its relative strength over other fiat currencies. They further agree that gold will rise significantly in the coming years.

Where they disagree is the end-game for this world reserve super currency, which Piepenburg argues, will eventually grow too strong for even US policy makers, whose constant and increasingly addictive need to create more liquidity to monetize record-breaking debt levels, combat recession and improve its trade imbalance will necessitate a weaker USD in the end.

Johnson argues that if so much fake liquidity, which has already reached unprecedented levels, will eventually weaken the USD, then how can one explain the Dollar’s 25% rise from the days before QE even began some 15 years ago? Meanwhile Piepenburg asks where would interest rates be with a DXY at 140. Unfortunately, time prevented a full discussion of either question.

Piepenburg sees extreme and extraordinary QE (or YCC, more Swap lines, TGA “emptying”) and other synthetic “backdoor” liquidity measures (weakening the USD) as inevitable, short of a second Plaza Accord or an already IMF-telegraphed Bretton Woods 2.0 to further prevent a soaring USD.

Ultimately, Piepenburg argues that all debt-soaked regimes, without exception, debase their currency to save their “system,” while Johnson argues that the USD, with its unique world reserve currency status and extreme sources of external demand, will avoid a dramatic fall. In the end, however, both agree strongly that gold will be a key asset regardless of who wins the “DXY” debate.

Of course, 60+ minutes is never enough time to fully address all the salient questions and concerns raised here. For example, even if the USD (or DXY) were to spike to record new highs (Johnson), this ignores the far more salient issue of the Dollar’s inherent purchasing power, which has lost greater than 98% against gold since 1971.

In short, percentages, theories and data matter, but regardless of where the USD goes relative to other broken fiat currencies, its inherent purchasing power has been falling faster than its relative strength.

Perhaps in the next conversation, this key point can be more directly addressed. Meanwhile, as the debates continue, so too does the rise in gold.

THE FINANCIAL SYSTEM HAS REACHED THE END

Matterhorn Asset Management, AG partner, Matthew Piepenburg, sits down with David Lin of the David Lin Report to help end a number of false debates and narratives currently making the headlines.

Piepenburg begins by squarely addressing the so-called GDP “surge” in the U.S. as little more than a deficit-spending contradiction, as more debt-based “growth” is not genuine growth, but, well…just more debt. Piepenburg describes the trio of rising yields, rising GDP and rising deficits in the US as little more than the profile of an EM nation rather than a leading developed economy. He further explains how rising yields/rates just add more pressure to an already over-burdened consumer’s debt costs as the invisible tax of grossly under-reported inflation pours salt on the wound.

Turning to bonds, Piepenburg warns against the so-called lure of bond “value” and rising yields. He argues that stress in the bond market is far from over. The only way to support/lift sovereign bond prices and hence compress yields would and will require more magical Fed money, which means even a “saved” or rising bond market will be superficial, as such gains will be eaten away by debased money and rising inflation and negative real rates. In short: No easy way out of the Fed’s debt spiral. It’s either save the bonds or kill the currency, and the direction ahead, he argues, is historically clear.

With the Fed (Powell) supporting higher rates while the Treasury Dept (Yellen) grossly expands public debt, the net and comical result is more debt at higher cost/rates, all of which will require more inflationary liquidity to pay. Alas: Powell’s war/policy against inflation will end in more inflation.

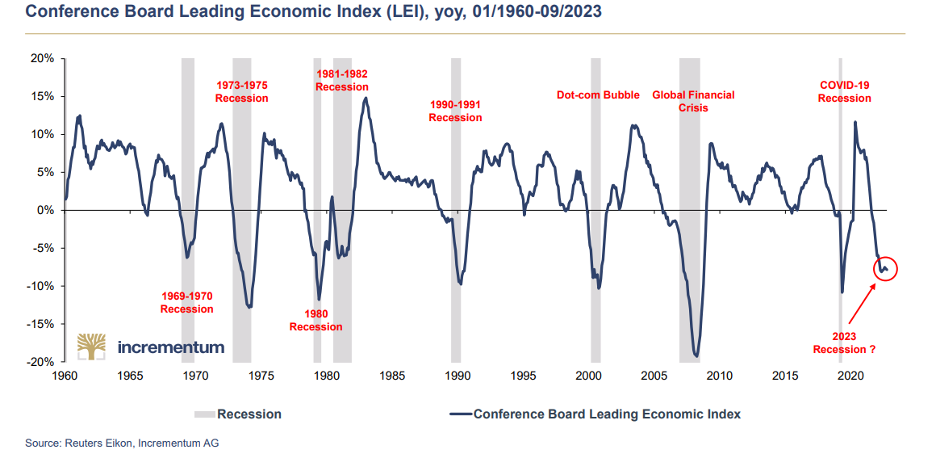

Piepenburg also addresses what he describes as the false debate over hard vs. soft landings when the evidence of a hard landing is literally and abundantly right before our eyes. The conversation then turns to the reality rather than hype of de-dollarization, the questioned performance of gold vs. equities or other assets in an inflationary setting and the ultimate role of precious metals in far-sighted portfolios.

THE FINANCIAL SYSTEM HAS REACHED THE END

It doesn’t require decades of financial expertise to balk at the notion of selling retail air conditioning units in Siberia or lemonade stands in the heart of the Arctic.

That is, even a high-school freshman would foresee the likely mis-match in supply and demand. After all, unwanted assets, including USTs, can often have more supply than demand.

In other words: Common sense matters.

But in the land of twin deficits, pathologically dishonest/lobbied politicians, negative net international investment positions, chronically obese Fed balance sheets, the Paul Krugman-like blue pill of solving every debt problem with more debt and a Noble prize granted to a central banker who pays that debt with money created out of thin air, common sense appears to be the latest concept to be cancelled in DC.

In fact, if DC’s open incompetence (or blatant corruption) wasn’t otherwise so tragic, it could almost make anyone burdened with self-awareness laugh out loud.

Almost.

The Not-So Funny Facts

But there’s nothing funny about a nation living at historical levels above its means and drowning in an openly ignored 120% debt/GDP debt spiral.

Meanwhile, emotional-heavyweights (yet evidence-free-lightweights) openly signal their virtue – pandering to safe consensus (and voters) about everything from trans-gender bathrooms and the original sin of white privilege to an increasingly vocal chorus bent on slowly eradicating each of our ten Bill of Rights, from free-speech to due process.

In other words, the divided are squawking as Rome burns…

Nor is there anything funny about debating “hard vs. soft landings”with a middle-class suffering record-high credit card debt at 20% interest rates while repo men collect delinquent autos at a pace higher than the Great Financial Crisis of 2008.

And let us not forget, of course, pundits debating about a recession or “looming” recession when the inverted yield curve, YoY M2 declines, the Conference Board of Leading Indicators and ignored illiquidity in the repo markets make it factually clear that America is already in a recession.

At the same time, the U.S. is approaching year-end with over 400 bankruptcies and rising lay-offs as its debt-driven S&P 7 pretends “resilience” while ignoring the over $750B in corporate bonds beneath those stocks about to roll-over at higher (Powell-made) debt costs in 2024, and another $1.2T more roll-overs coming in 2025.

Given that the now distorted American Dream lives off debt, when the cost of that debt rises, the “dream,” as well market, dies.

Dying Beyond Our Means

This hidden skunk in the debt roll-over woodpile of a nation in slow decline (as all debt-soaked nations do) is only made worse when we realize that the pattern of marching toward a rate-hike cliff is even worse for US government debt (racing toward $34T and counting).

Folks, unless the Fed pivots toward QE, rate cuts, and likely YCC, 30% of that already unpayable public debt is about to be re-priced at higher (Fed-made) rates in the next 36 months.

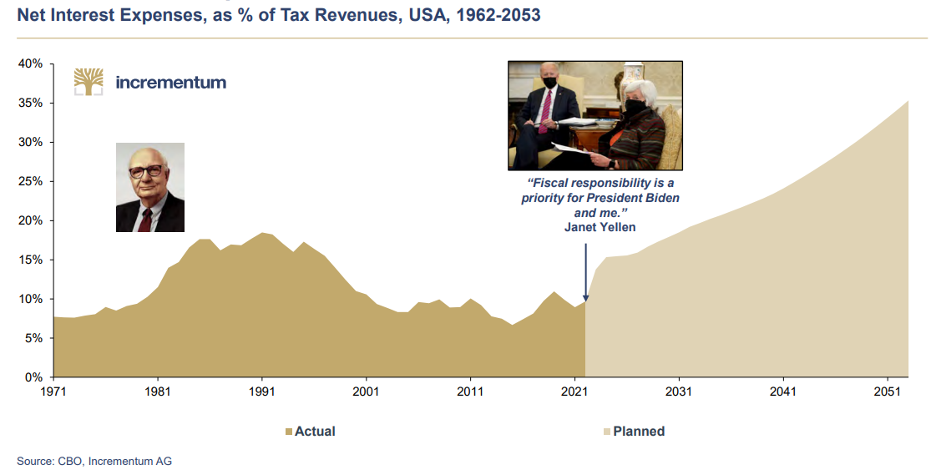

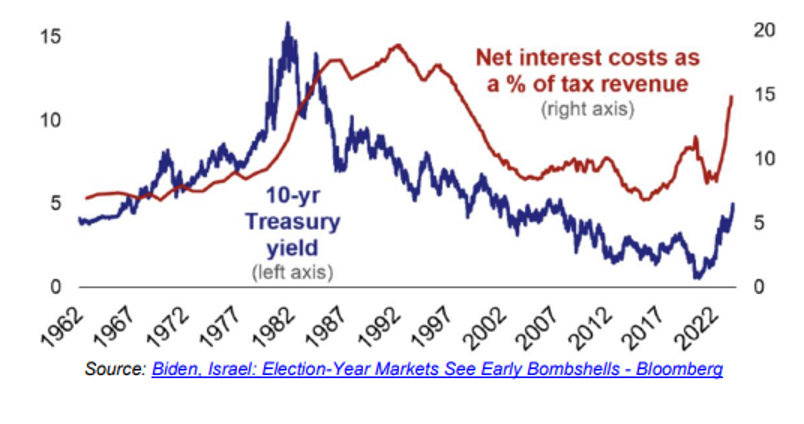

This means that more than 40% of US tax receipts (which will be even less if markets tank) will be allocated to just paying down the interest expense on Uncle Sam’s openly grotesque bar-tab.

Such debt, interest rate and credit market realities prove that America is not living beyond its means, but actually (as an impoverished Oscar Wilde moaned from his death bed in a Parisian hotel) “dying beyond its means.”

This slow death, of course, may sound sensational, but facts (and basic math) are stubborn things, no?

Our Own Opinions, Not Our Own Facts

Although we are all entitled to our own opinions, we are not entitled to our own facts, despite our “data dependent” Federal Reserve forever seeking to re-engineer the “data” of our so-called CPI/inflation scale, recession metrics and unemployment rates.

The ironies just abound as each of us struggle to thread the needle of information vs. misinformation on everything from vaccine efficiency to George Santos’ college volleyball stats… (assuming he went to college?)

In sum, it’s getting increasingly hard to perceive the lighthouse of truth or the little voices of our own common sense among an ever-thickening fog of top-down distortion and bottom-up resignation.

Which brings me back to my opening thoughts of lemonade stands in the Arctic and the need for resurrecting our common sense.

A Foreseeably Bad Treasury Auction

Toward this end, let’s consider the otherwise “boring” but oh-so seminal importance of the sovereign bond markets in general and the UST market in particular, for as I’ll say nearly every chance I get: The bond market is everything.

It’s very likely, given the Sturm und Drang of current headlines, that some of you may have missed Uncle Sam’s recent attempt to sell 30-Year Treasuries at auction in November.

Like that lemonade stand in the Arctic, there were very few buyers at Uncle Sam’s garage sale…

This, of course, is no shocker to those (both within and outside America’s borders) who already know that Uncle Sam is little more than a bad credit issuing a declining and increasingly unloved asset (UST).

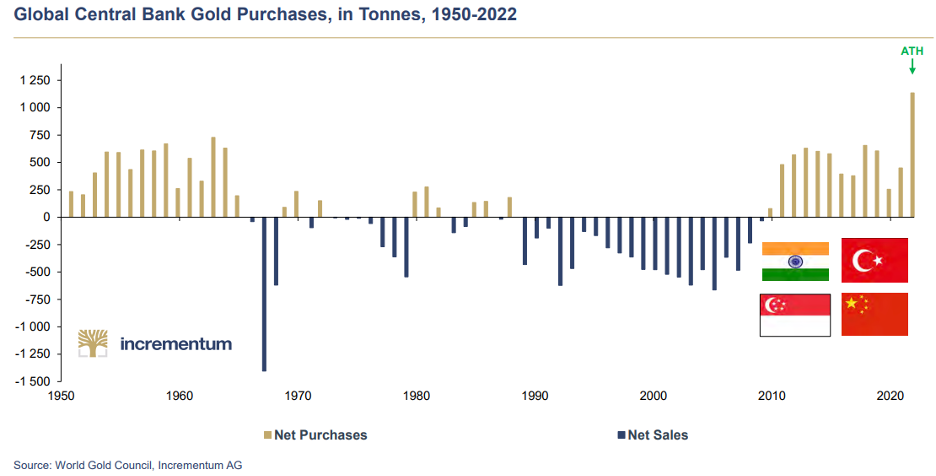

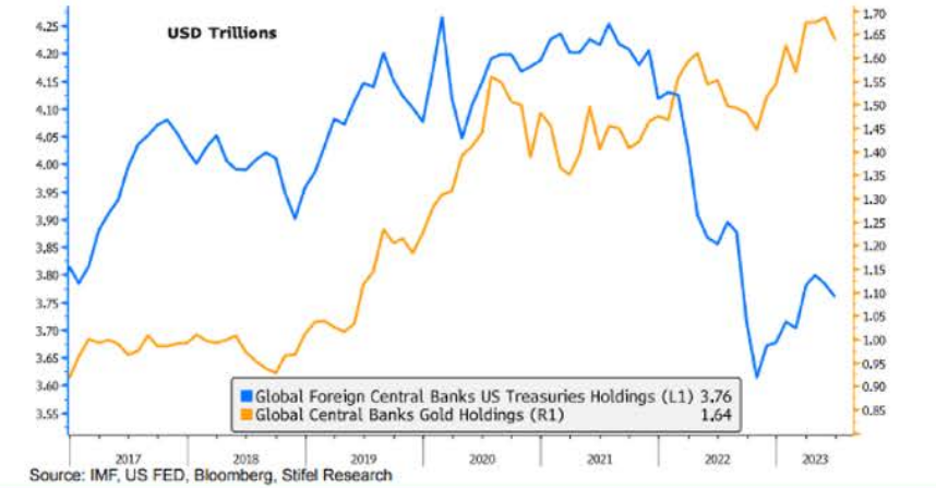

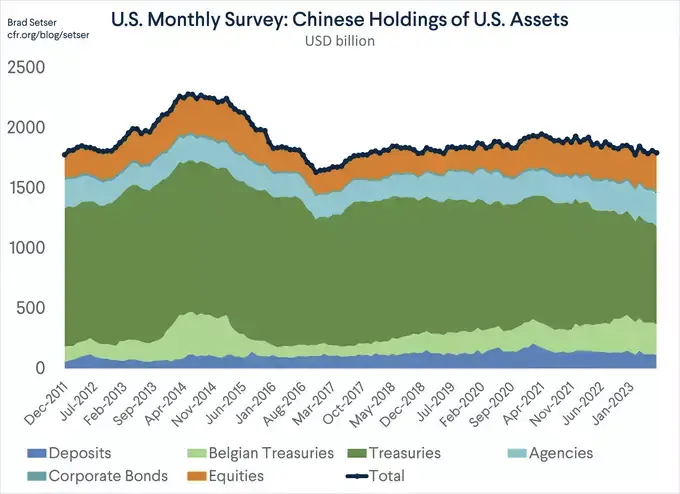

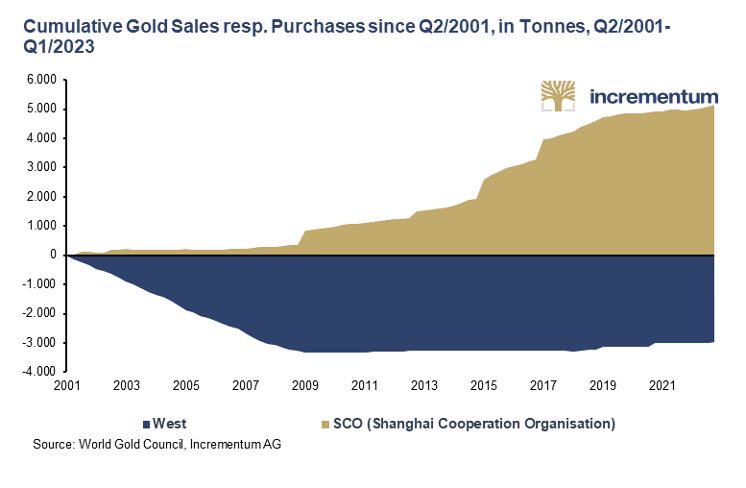

The evidence of this tanking demand is most evident among global central banks, who ever since 2014, have been net sellers of USTs, and in recent years, record-breaking buyers of physical gold.

Of course, as demand for Uncle Sam’s IOUs falls, so too does their pricing, which explains why their yields (which move inversely to price) have been rising like nasty little shark fins among a credit sea of frothy chum.

Earlier this month, yields on the 30Y UST climbed from 4.65% to 4.8% after $24B in US bonds saw less love/demand from investors than Uncle Sam had otherwise hoped.

(Apparently, the policy makers in DC were still hoping that lemonade in the Arctic was a great deal…)

Who Wants a Declining Asset from a Bad Credit?

But when fewer and fewer buyers show up at those Treasury auctions, the primary dealers (i.e., big banks) are forced to finance the leftovers (i.e., fill in the demand gap).

In fact, these “branch office banks of the Fed” had to buy nearly 25% of those unloved bonds themselves.

This level of “gap purchasing” by the primary dealers is now more than double the average rate, which means interest in Uncle Sam’s 30Y UST is openly tanking at a similar rate.

When Billions Are No Longer Enough

What is far scarier, however, is the fact that the US Treasury Department’s recent sale of $24B in bonds bought Uncle Sam only 5 days (as opposed to months) of liquidity and US deficit “coverage” otherwise essential to keep the government on its respirator of seemingly endless deficit spending.

By the way, once DC finally confesses the US is officially in a recession (always months after the fact), such US deficit spending, already beyond the pale of common sense, will only increase, which will mathematically push the US fiscal deficit (now at 8% of GDP) to well over 10-15% of GDP.

Such simple math places unbearable pressure on the traditional/forced buyers (suckers?) of Uncle Sam’s debt (banks, pension funds, and foreigners), who will become increasingly thirsty for USD liquidity (nod to Brent Johnson) and hence be forced to sell more of those very same USTs to obtain that “sucking straw” of Dollar liquidity.

Of course, more UST selling only puts more downward pressure on UST pricing, and hence more upward pressure on UST yields and interest rates.

And that, dear readers, is how a debt spiral looks, functions and corrupts economies. As yields rise, more and more of US tax revenues will be wasted on just paying interest expenses on DC’s IOUs…

That is, the more the US goes into debt, the more it costs and the more it breaks things, from banks and middle-class car owners to an ever-dwindling small business sector and a rightfully angry guitar player in Farmville, Va.

The Open Need for More Inflationary Liquidity

As importantly, given the now empirical fact that billions of IOUs per auction only buys Uncle Sam days rather than months of deficit coverage, it seems fairly clear to me, at least, that Uncle Sam is going to need more than just primary dealers to keep his bond market alive (and debt-based “growth” model in motion).

As I’ve consistently argued, the only place/buyer where Uncle Sam can eventually turn to support his unloved bond markets is a money printer (digital currency mouse-clicker) at the Fed.

This means at some point, the only option left (short of a Plaza Accord/Bretton Woods 2.0) for America is QE to the moon, which will send the USD’s purchasing power to the ocean’s floor.

In the interim, as Powell’s higher-for-longer (or even “pause”-for-longer) policies collide with rising deficits and declining UST demand, the only charts about to go up in the near-term are yields, the USD, gold and BTC, each of which has been doing precisely that.

Gold & the USD

Many will say, of course, that gold does best only when the USD is weak and rates and yields are low.

Yet gold is nearing record USD-priced highs despite rising rates and hence a rising USD.

Why?

It’s simple: Faith in a broke(n) USA is falling.

Trapped within a debt bubble, currency crisis and global policy corner as thoroughly distorted and beyond the pale of natural supply and demand as the current DC now finds itself, the world’s central banks are positioning themselves for an eventual and inevitable pivot toward trillions in more fake liquidity from an equally discredited Fed.

This means the USD’s relative strength and days of current (yet artificial) glory are indeed numbered.

This positioning is easy to see.

Just as armies preparing for an invasion bring their horses, troops, canons and men nearer to their borders for protection, central banks and BRICS+ nations are stacking physical gold day by day, month by month and year by year in anticipation for the kind of emergency (and bogus) liquidity that drowns all fiat currencies—including a world reserve currency.

Differing Opinions, Shared Facts

This liquidity end-game, which involves an inevitable debasement of the USD, is, in MY opinion, how the foregoing debt facts play out.

That is, the USD will be sacrificed to save the UST—and all that flows therefrom, i.e., equity markets, pension funds, tax receipts etc. In short: The “system” can only be “saved” by trillions of fake, new Dollars.

This is nothing new.

Throughout history, and without exception, all debt-soaked nations sacrifice their currencies to temporarily save their broken “systems.”

As mentioned above, we are all entitled to our own opinions, just not our own facts.

Toward this end, it is equally important to consider contrary opinions on the same facts, and I have enjoyed, as well as respected, other informed opinions on these same facts, including my recent discussions/debates with Brent Johnson.

Like myself, Brent Johnson is a powerful supporter of physical gold as a patient yet ultimate victor (and asset) as the foregoing debt endgame approaches its final hour.

But we don’t agree on everything.

He argues that entrenched global demand for the USD (via trade agreements, Euro Dollar and derivative markets, global USD-denominated debt contracts etc.) will continue to offer tailwind support to America’s otherwise distorted currency (DXY at 140+?) as per the admirable logic of his famous “milkshake theory,” which is not only rich with data, but common sense as well.

The Same Common Sense

But whether my opinion or Brent Johnson’s opinion as to the near-term direction of the USD prevails (I don’t see a 140 DXY), the stubborn reality of a paper and now weaponized currency losing its trust, respect and legs longer-term is as easy to see as the growing shine (and open demand) of physical gold as a far superior preserver of generational wealth than a corrupted Greenback.

For both Brent Johnson and myself, this end-game is not just evidence-backed, but simple common sense—a quality DC may have cancelled but which most of us still proudly possess.

Regardless then, of the USD’s relative strength (or weakness) in the months ahead, its inherent purchasing power is dying by the day.

Gold is one historically-confirmed way of addressing this reality with common sense.

THE FINANCIAL SYSTEM HAS REACHED THE END

Below, we consider just how far America has fallen from its founding vision (and something we can do about it).

Union Matters—Poor Ol’ Jefferson

When sitting down to “channel the people’s will” through his own pen, the author of the American Declaration of Independence, Virginian Thomas Jefferson, had one key principle and theme in mind, namely: Union.

According to University of Virginia scholars, Garry Gallagher and John Nau, this concept of Union was premised upon the ideals (and “experiment”) of: 1) equality (despite, of course, can-kicking the slavery issue…); 2) compromise and 3) a fundamental disdain for any form of coercion (or “capture”) by a centralized body (or bodies) within an otherwise fragile republic based upon a federalist structure.

Here, of course, is not the place to unpack or debate the myriad concepts of a republic, federalism, or even constitutional democracy.

However, one issue of economic relevance worth raising today is the core and defining fear shared by America’s founding fathers, namely the fear that critical notions of equality and our three branches of government could one day be captured/coerced by bad actors and hence destroy the experiment of striving/evolving toward equality and union, however imperfect its growing pains.

Captured by a Private Bank

Which brings us to our central bank, whose power over the price (interest rate controls) and supply (balance sheet size) of the world reserve currency, has effectively and constructively become a fourth branch of government.

This centralizing central bank has not only been the direct and empirical cause of historical wealth inequality in America, but has now fully “captured” (i.e., taken centralized control of) the American economy in general and the price control of global bond and currency markets in particular.

The entire world, most of which is directly or indirectly pegged to the price and supply of the USD, literally sits on the edge of its seat to see what the FOMC will (or will not do) with the price and supply of a now weaponized and entirely “captured” USD.

In other words, Jefferson, whose admirable memorial stands just a few blocks from the Treasury Department and an easy walk from the impressive Eccles Building, would be shaking his head in despair if he were alive today.

Or stated more simply, America has sunken, irrevocably it seems, from its original and enlightened ideals of equality.

After all, when a post-08 central bank creates a zero-rate-driven and QE 1-4+ equity bubble, 90% of whose riches were enjoyed by only the top 10% of its population, we see just how “unequal” such coercive institutions can be…

Needless to say, no one in DC, and certainly not Powell, will confess that such centralization of power (and “free” markets) by unelected private bankers is a mark of feudalism rather than capitalism, and a carefully veiled symbol of authoritarianism hiding in “Federal” clothing.

[The Federal Reserve, I’ll remind again, is neither federal nor a reserve, nor even constitutional, despite its address on Constitution Ave…]

No Profiles in Courage

Nor are our lobbied politicians, who collectively know less about history, economics or basic math than just about any college freshman, asking themselves “what they can do for their country” …

Instead, they have been doing a heck of a lot of thinking about how to brand themselves for re-election and maintaining their power.

Toward this end, these “profiles in zero courage” (although Santos will likely claim he also has a PhD in applied math from MIT) have been making promises their budgets can’t pay for.

Thereafter, they blindly fill this deficit “gap” with trillions of annual IOUs (i.e., USTs) per year which are then paid for with inflationary money clicked out of thin air by the IT wizards at the Fed.

Farce After Farce After Farce

Of course, it is such magical money, and not COVID, Putin, global warming or little green men from Mars, which explains our farcically under-reported (i.e., openly dishonest) inflation rate, which if measured by the same CPI scale Volcker used, would place US inflation at well above 11% today, and not the open lie of headline 3.7%.

Such actual rather than “official” inflation means that every single IOU issued by Uncle Sam is a negative-yielding bond, and hence by definition, puts them technically and already in default.

Others Are Catching On

The rest of the world, including the growing BRICS+ nations, knows this, which explains why central banks have been net-sellers of USTs since 2014 and why de-dollarization is not just a concept but a steady reality today.

In short, demand for, as well as trust in, the great “risk free return” of the most important sovereign bond in the world (which is now mathematically “return free risk”) has been tanking while central bank gold-purchasing has been breaking records.

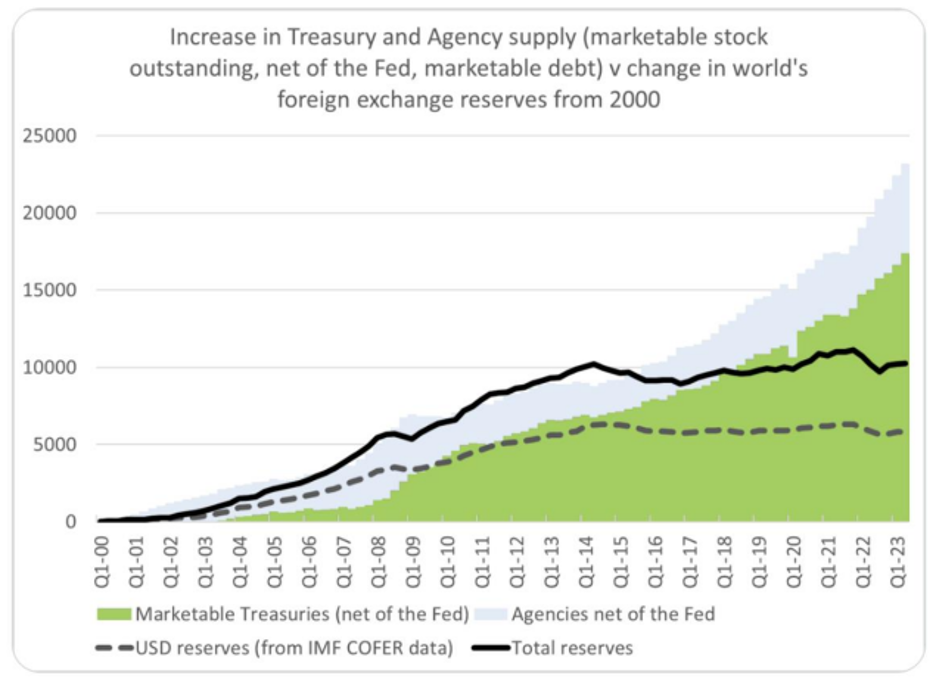

But as the graph immediately below confirms, this lack of love for US Treasuries has not stopped Uncle Sam from issuing trillions and trillions worth of more such IOUs, creating a perfect disaster (i.e., mismatch) of over-supply and under-demand.

This mismatch, as even a high-school econ student knows (but our politicians do not), creates massive downward pressure on the price of those bonds.

And given the fact that bond prices move inversely to bond yields, those yields are now screaming north, which means interest rates, and the cost of debt (for individuals, corporations and even Uncle Sam), are now at record-breaking, bank-breaking and economy-breaking levels.

Meanwhile, the pundits and politico’s will still have you/us debating about hard-landings or soft-landings, despite the open evidence that our economic plane has already crashed…

Just Follow the Debt

Thus, and with simple candor, it’s high time we stop arguing over desert choices on the Titanic’s A-lounge menu and start considering the implications of the debt iceberg off our bow.

Our mental midgets in DC, for example, have placed American public debt at a 120% ratio to its GDP, which mathematically makes growth impossible rather debatable, as such debt ratios are the equivalent of swimming with a cannon ball chained to each foot.

Ultimately, however, the bond market in the USA, which is the key to our nationalized equity markets (which live or die based on bond yields and debt pricing) need to be understood plain and simply.

And I just can’t say this enough: Everything hinges on bonds in general and yields in particular.

When rates/yields are low, things work; when they are high, things break.

This is because cheap debt has been the core of America’s debt-based “growth” model for years, and this alone explains the survival of our respirator-economy and its otherwise bankrupt pension system.

When Too Big to Fail = A Desperate Rescue

Given this plain fact, the US sovereign bond market is indeed, and literally, “too big to fail.”

But given that tax receipts, GDP and foreign interest in Uncle Sam’s IOUs are not nearly enough to “accommodate” this sovereign debt market/bubble, the money needed to “save” it will have to come from somewhere.

And that “somewhere,” in my view, is going to be a money printer, which in turn means an eventual expansion of the money supply and thus an eventual end-game of currency destruction.

Such currency destruction means greater rather than less inflation ahead, with a likely dis-inflationary market crash in the interim.

Again, the rest of the world knows this, which explains why central banks are dumping USTs and stacking physical gold at record levels.

Alternative Views?

The milk-shake theory, however, makes credible counter-arguments to my current view of the US bond and currency forces.

It holds that when and as the world sinks deeper into recession, even that wart-covered USD and unloved UST will become the ironic and superior safe-havens of last resort.

After all, the USD is not about to be replaced by the Rubel, CNY, peso, yen, franc or euro any time soon, or frankly, perhaps any time ever…

I actually agree.

Furthermore, given that “great straw sucking sound” from global derivative and euro-dollar markets which survive off collateralized USTs, the embedded and systemic demand for the USD may very well maintain its relative supremacy for a long while, right?

Nor should we forget the embedded demand for the USD in the form of that oh-so important petro-dollar, which Kissinger made his swan song in the 1970’s.

In sum, there are many sound reasons why one could argue that the USD, in cohorts with the UST, is, and always will be, the best horse in the global glue factory.

But What About History, Math & Tomorrow?

But… and as I’ve argued and written elsewhere, such hubris and faith in the relative superiority of the USD assumes that history doesn’t matter, that math is optional and that tomorrow always looks like yesterday.

The petro-dollar, for example, is no longer a sure thing, as I and others have argued at length elsewhere.

And the belief that the world will just “flow” into USTs when the next storm hits is a belief which ignores the dumping rather than buying of USTs in the most recent market disaster of 2020.

In short, maybe that “flow” has already come and gone?

Other Bad Scenarios

Equally worth considering, of course, is the possibility that DC can save its bond market by just cutting entitlement and military spending by say, 70%, but I wouldn’t hold my breath for that…

Or perhaps America can just look forward to a massive crash in the stock market on the tailwind of rising rates to “scare” bloodied investors back into the UST market and thereby “save” Uncle Sam’s IOUs by killing its stock market (as well as capital gain tax income?).

Hmmm.

Or Just Kill the Currency

More likely, and more politically expedient yet more disastrous to the people, will be the destruction of the currency to save the credit markets, a monetary cancer which now defines our debt-soaked “democracy.”

I’ll say this again and again and again: History confirms that every debt-soaked nation kills its currency to save its @$$ by inflating away their debt with debased money.

Thereafter, those same “wizards” then resort to controlling their inflation-exhausted (i.e., angry) citizenry with more centralized controls.

Jefferson & Gold?

In short, and returning to our sad, old friend Jefferson, America is already “captured” by a financial system and an unelected fourth branch of government which has coerced its nation into a corner with no exit.

At least no exit other than a currency trap whose Dollar’s inherent purchasing power, when measured against that barbarous relic, gold, has lost greater than 95% of its relative strength since Nixon welched on America’s golden chaperone back in 71.

Gold, of course, can not prevent the usurpation (i.e., nefarious “capture”) of power which Jefferson so feared would one day destroy the American “union.”

Sadly, and as wise individuals have known and warned for centuries, debt destroys nations. Not just sometimes, but every time.

Nor can gold act as a Talisman against branded rather than visionary politicos, left or right, American or global, from the dark shadows of Davos to the open comedy of DC.

This is why history-wise, math-competent and financially informed investors, burdened by critical-thinking rather than the partisan or “koo-koo,” have always (and will always) protect their own sanity, their own wealth and even their own private “union” of family (which Jefferson defined as the foundation of freedom) with a healthy allocation of that barbarous relic, that so-called “pet rock.”

In other words, just because political opportunists may have taken away the gold standard to buy votes while slowly destroying nations (and national unity) in all too familiar patterns of debt and centralization, this does not prevent us gold “stackers” from being far smarter than our so-called “leaders.”

It’s time, in sum, that we back our own currencies with gold rather than wait for others to do it for us.

THE FINANCIAL SYSTEM HAS REACHED THE END

We are on the inevitable road to perdition for the world economy & financial system, ending in a potential global conflict of uncontrollable proportions.

Evil begets evil as The Cycle of Evil hits countries at the end of an uncontrollable debt expansion.

The pattern throughout history has always been the same – countries and empires, without fail, become victims of their own success -failure, whether it was the Mongols, Ottomans or the British.

As real growth ceases, a country starts to finance expansion with debt until it cannot even afford the interest on the debt, never mind the capital which it has no intention to repay.

At some point, the people, fearing a war or terrorist attack will approve of the leader’s fear mongering by supporting unlimited debt issuance. This is now happening in the US with regard to Ukraine and Israel.

Neither the US nor Europe is taking a single step to remedy the situation. Both are now in the Cycle of Evil of more deficits, more debt, higher interest costs, leading to more deficits, more debt higher interest costs, leading to ……………..

The Cycle of Evil is also accompanied by decadence and moral decline where leaders invent problems that are not real such as climate change, ESG (environmental, social and governance), forced vaccines and incarcerations, 25 new genders and other woke issues etc.

Few Americans understand that the next stage of the Cycle of Evil is about to hit them.

And even fewer Europeans have a clue that they will be dragged down into the same debt collapse quagmire.

The next stage will involve many banks failing, more than the FDIC or government can afford to save without destroying both the Currency and the Bond Market,

A collapsing currency and sovereign debt paper that no investor wants to touch with a bargepole is hardly the right climate for massive debt issuance.

Most sovereign investors have already realised that they don’t want US debt at any interest rate.

So that means even higher interest rates, more debt issuance as the Cycle of Evil eventually turns to a “Final Collapse” as von Mises described:

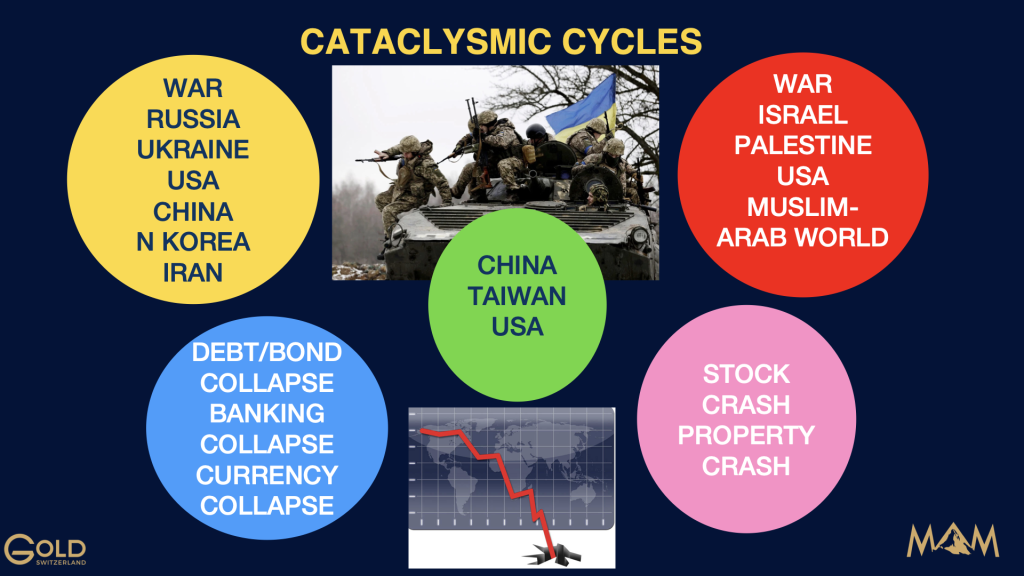

THE CYCLE OF EVIL CONTAINS MORE CATACLYSMIC COMPONENTS THAN ANY SIMILAR CYCLE IN HISTORY.

Let us summarise where the world is:

GLOBAL CONFLICT

We have two wars both capable of leading to a major global conflict plus high risk of terrorism and jihads in the West. Just as with most global/world wars, there is no attempt at finding peace solutions.

To make things worse, there is not a single Statesman in the West capable of taking a lead in solving the conflicts.

DEBT COLLAPSE

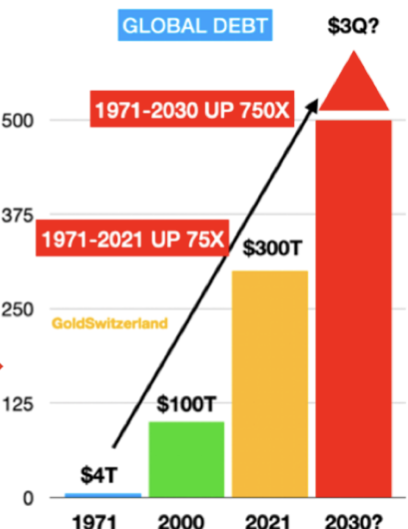

We have a global debt burden of $330 trillion plus derivatives totalling $1.5-3 quadrillion with debt growing exponentially, especially in the US. This will very soon develop into a debt crisis and collapse of a heavily leveraged Western world plus Japan and China and also emerging markets.

CIVIL UNREST and CIVIL WAR

The downturn and eventual collapse in the global economy will lead to poverty, famine and misery for a great number of people in the West and Emerging Markets.

UKRAINE WAR –

This war started as a local conflict but with a US backed putsch in 2014, throwing out the democratically elected Russian friendly leader, this was the beginning of a war between Russia and the US and not a local war.

The Minsk agreement brokered by Germany and France was supposed to settle the matter but as Merkel recently admitted, the intent was never to create peace but to give enough time for Ukraine to arm with the help of the US.

The US forced Europe to take sides, in spite of Europe’s (especially Germany’s) dependence on Russian energy.

We can blame Russia for invading or we can blame the US for provoking Russia.

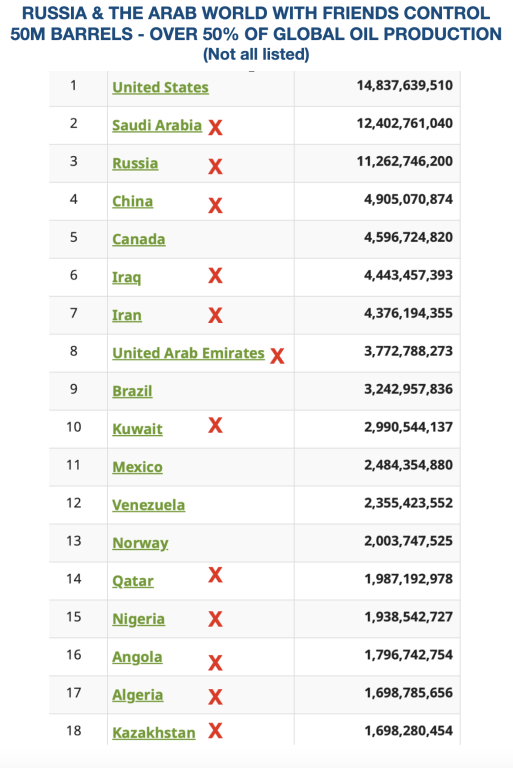

Rather than to go into all the arguments who is right and who is wrong, best to accept that we now have a global conflict stemming from the Ukraine situation. The US has a reluctant Europe on its side – a Europe which is militarily and economically weak. Russia has China, Iran, North Korea and a few others, most probably a militarily superior group.

A bankrupt USA just sends more money and weapons but has zero intent to send peacekeepers.

Thus there is no end in sight but the independent reporting tells us that Ukraine is unlikely to have a chance against the superior Russian war machine.

In the meantime an estimated 500,000 troops in total have died plus many more wounded and civilian casualties.

And still no peace attempt.

If the warring country’s leaders led from the front, which has been common in history, they would probably be less inclined to sacrifice more lives including their own.

ISRAEL – PALESTINE WAR –

This region has had ongoing conflicts throughout history. It was insoluble before 1948 and has become even more complex since 1948 when Israel was created.

Again, we have major powers involved with primarily the US and Europe supporting Israel and Iran, Turkey and major parts of the Arab-Muslim world supporting Palestine and also Russia.

The US is sending two aircraft carriers to the Mediterranean to assist Israel. But as a military expert pointed out, these are in modern warfare just two floating bathtubs which can be taken out easily by two missiles from for example Iran.

In this conflict there are also many casualties on both sides plus a massive number of Palestinians being homeless with little food or even medical help.

What makes this conflict even more serious is the major support in the West for the plight of the Palestinians. Massive protests in many countries can easily escalate to serious clashes or even civil war.

In addition, we can be certain that the massive migration from Muslim countries to the West will also contain many militant cells which could easily create havoc in the US and in many European countries.

Both Europe and the US basically has an open border policy for any migrant who wants to enter. But neither continent has the ability to properly take care of the migrants. This will risk both continents to be destabilised with both migrants and the native population not accepting the other side.

CHINA – TAIWAN

It is unlikely that China will abandon its claim that Taiwan rightfully belongs to them.

The US is already busy with two wars, assisting with an array of military equipment plus $100s of billions of financial aid. A third conflict with major US military involvement would be extremely unwelcome to the US government.

But that is exactly the right time to strike from China’s point of view.

China knows of course that seizing Taiwan, is likely to involve major US sanctions leading to reduced or no US imports from China leading to a major fall or collapse of global trade. It is doubtful that Europe or the rest of the world would comply with these sanctions.

It would also lead to freezing of China’s assets in the US of $1.7 trillion, including treasuries of $850 billion offset by US direct investments in China.

But if China seizes Taiwan, they would control 60% of the world’s semiconductor production and more importantly 90% of advanced semiconductors. This would be a very serious blow to US strategic industries including military equipment.

THE CYCLE OF EVIL HOLDS ALL COMPONENTS TO CREATE HELL ON EARTH

It is intellectually fascinating but humanly depressing to watch how all the pieces fall into place for a global conflict of a magnitude greater than WW1 or WW2.

It is frightening to see how one component after the next falls into place in the Cycle of Evil.

Nobody realised that the shooting of the Archduke of Austria-Hungary Franz Ferdinand in 1914 would be the catalyst for WW1.

Nor did anyone understand that Germany’s invasion of Sudetenland in Czechoslovakia in 1938-9 and of Poland on September 1, 1939 would lead to WW2.

The two major conflicts in Ukraine and Israel-Palestine today with Taiwan looming combined with no attempt of peacemaking plus a likely collapse of the global financial system and world economy is more than enough to create devastation for the world for the next decade or more.

Let us sincerely hope that all these events in the Cycle of Evil will not develop into global havoc.But even if that were to be avoided, it is absolutely certain that global risk today is higher than at any time since the 1930s.

WEALTH PRESERVATION

Most of us have little influence over the geopolitical or global economic situation.

Nor do most people have the flexibility to move to a lower risk area in regards to a conventional or nuclear war.

But anyone who has savings however small or big can at least protect some of their liquid assets.

As we have pointed out in many articles, physical gold and some silver is the only money which has survived and maintained its purchasing power for thousands of years.

Thus gold and silver are the perfect insurance and wealth preservation asset to protect against the coming problems.

It is critical to hold gold and silver outside a fractured financial system in the safest jurisdictions preferably outside your country of residence. It is important to be able to flee to your wealth preservation asset if there are problems in your own country.

It must also be kept in the safest vaults with direct personal access. Nuclear bomb proof vaults are an additional important protection but hard to find. We offer this in Switzerland for bigger investors.

As I have stressed in recent articles, WILL THIS FALL BE THE FALL OF FALLS, gold just fulfilled the technical projection of a small dip and is now on its way to much, much higher levels.

With Central Banks likely to switch their reserve assets from US dollars to gold, we will see a major revaluation of gold to probably multiples of the current price. See my important article: A DISORDERLY RESET WITH GOLD REVALUED BY MULTIPLES

HUMAN SUFFERING – HELP FAMILY AND FRIENDS

Sadly the coming conflict will lead to major human suffering both economically and humanly.

So helping family and friends is very important.

Also, remember that some of the best things in life are virtually free. In addition to family and friends, life offers so many wonderful things like nature, music, books, sports etc.

THE FINANCIAL SYSTEM HAS REACHED THE END

In this extensive conversation with Cambridge House CEO, Jay Martin, Matterhorn Asset Management partner, Matthew Piepenburg, shares his insights on the historical interplay of war, over-indebted nations, broken bond markets, currency debasement and their inflationary consequences, all of which lead toward (and confirm the importance of) physical gold investing.

Martin and Piepenburg step back from the near-term shock of headlines from the Middle East to address the broader issue of war as a component of deteriorating debt and financial conditions. Piepenburg addresses clear evidence of political, financial and social fracturing in the world in general and the US in particular. Unfortunately, such stress-points are part of an historical pattern that often involves the evolution of military conflicts, the risks of which are expanding daily. Particular attention is given to specific signs (economic, political, and social) that the “American empire” is experiencing a clear and downward turning point.

An open symptom of this decline is the post-sanction rise of the BRICS+ nations and the ever-increasing evidence of a shift from a USD-driven mono-polar world to a multi-polar, real-asset-driven world. Piepenburg offers a number of reasons (in currency, energy, credit and trade circles) why this foreseeable trend away from USD hegemony will continue despite the still obvious power/supremacy of the world reserve currency. Ultimately, Piepenburg maintains that currency debasement is the inevitable end-game.

The conversation then turns to what Piepenburg describes as the “absurd” notion that inflation has been contained. He offers numerous and compelling arguments as to why inflation is rampant and growing rather than controlled or defeated. The overt as well as hidden evidence of a recessionary trend toward more synthetic liquidity, and hence inflation, are unpacked in detail. All of this is derived from unimaginable sovereign debt levels which ultimately demand monetization as the Fed loses control of grotesquely inflated bond markets. As more “fake money” is created to “save” these sovereign IOUs, the collapse in purchasing power and hence the case for gold becomes incontrovertible.

THE FINANCIAL SYSTEM HAS REACHED THE END

In his first interview with Dunagun Kaiser of Liberty & Finance, Matterhorn Asset Management founder, Egon von Greyerz, offers his insights on the latest geopolitical and financial headlines.

Von Greyerz opens by discussing the patterns and parallels of debt, currency, geopolitics, oil and gold. Specifically, von Greyerz squarely addresses the historical use of war as a disturbing policy tool to excuse debt and justify further expansion of the same. Oil, of course, is often a protagonist in such an historical stage, and von Greyerz considers the various ways in which current conflicts within the Middle East and the Ukraine can escalate into a more global danger. Western policy, he maintains, has a woeful lack of statesmen. US leadership, in particular, remains mysterious, weak and marked by sending money and weapons rather than sophisticated peace negotiators.

War, of course, has immense implications on financial conditions, at home and globally. Wars, von Greyerz reminds, are costly. But where will the money come from given US debt levels? Sadly, the answer is “out of thin air,” a pattern for which markets and central banks are all too familiar. Ultimately, this makes sovereign bonds and currencies in general, and USTs and USDs in particular, increasingly weaker and unloved. This trend, as well as distrust, away from the Dollar has only been accelerated by the weaponization of the USD following the war in Ukraine. Eastern central banks are thus selling USTs and stacking physical gold as confidence in, and trust for, the world reserve currency openly unwinds. This places pressure on credit markets already cracking under the immense weight of grotesquely over-levered derivative markets.

Taken together, these debt, currency and geopolitical risks have created a setting of risk unlike any von Greyerz has seen before. Money printing can no longer solve this convergence of open deterioration. Informed individuals, however, can protect their own financial conditions by doing what their leaders and 99.5% of their peers have failed to do—namely: Protect their purchasing power via direct investment in physical gold, a timeless asset whose real journey has yet to even begin. History, of course, confirms such a minority of investors are always rewarded for thinking carefully, wisely and differently; but as Egon concludes, gold’s rise will be significant, yet sadly because the fall in global welfare will be equally so.

THE FINANCIAL SYSTEM HAS REACHED THE END

Below, we follow the breadcrumbs of simple math and bond market signals toward an oft-repeated pattern of how once-great nations become, well…not so great any more.

Debt Destroys Nations

Debt, once it passes the Rubicon from extreme to just plain madness, destroys nations.

Just ask the former Spanish, British or Dutch empires. Or ask the inter-war Germans. Ask the Yugoslavians of the 1990’s or ask a historian of Ancient Rome or a merchant in modern Argentina.

It’s all pretty much the same story, just different a different stage or curtain call.

Like Hemingway’s description of poverty, the process begins slowly at first, and then all at once.

Part of this process involves currency debasement needed to pay down more desperate issuance of IOUs, a process evidenced by rising rather than “transitory” inflation.

Thereafter, comes increased social unrest, and hence increased centralization from the political left or right in the name of “what’s best for us.”

Sound familiar?

Centralization—The Last, Failed Act

Centralization never works in the long run, but that has never stopped opportunists from trying.

Just look at our central bankers.

In a centralized rather than free market, the very name “central bank” should be a dead give-away as to their real role and profile.

As private central banks have been slowly increasing their hidden power and control over national markets and hence national welfare, the very notion of free price discovery in bonds, and indirectly in stocks, is now all but an extinct financial creature in the neo-feudalism which long ago replaced genuine capitalism.

How the Central Game is Played—From Temporary Prosperity to Permanent Ruin

When central banks like the Fed repress rates and print gobs and gobs of money, bonds are artificially supported, which means their prices go up and their yields are compressed.

When yields are low, rates are low, which means the cost of credit is cheap, allowing otherwise profitless names in the stock markets to borrow money and time for years of temporary prosperity—like a 600% rise in a post-08 S&P…

In short: central bank repressed rates are a profound tailwind for otherwise mediocre risk assets.

But when central banks like the Fed raise rates (ostensibly to “fight inflation”), the opposite effect happens—and things break. I mean really break.

I’ve written and spoken ad nauseum about what has broken, is breaking and will continue to break; furthermore, I’ve written and spoken at length about the quantifiable irony that Powell’s so-called war on inflation will only end in more inflation.

Yep, the ironies just abound in this world of so-called experts, which is little more than an island of misfit toys.

Postponing Pain Only Heightens It

In normal, free-market cycles devoid of central bank “support,” bonds and hence rates rise and fall naturally based on natural demand and natural supply.

Imagine that?

This leads to frequent but healthy moments of what von Mises and Schumpeter described as “constructive destruction”—i.e., a cleaning out of debt-soaked and crappy enterprises in naturally occurring recessions and naturally occurring market drawdowns.

But central banks somehow thought they could outlaw recessions by printing money out of thin air to support bonds and repress yields. You know—solve a debt crisis with more debt. Brilliant…

This was hubris at the highest level, and the stupid just became a habit and even received a fancy name to justify it—Modern Monetary Theory.

Natural Market Forces Are Stronger than Central (Bank) Forces

But the longer central banks postponed pain to win Noble Prizes and ego-lifting acclaim from the un-informed, the greater the natural pain (ticking time bomb) these central planners created as they now slowly realize that the bond market, like an ocean, is more powerful than a band of unelected market stewards.

In fact, a bunch of FOMC officials (Kashkari, Bostic, Waller et al.) are now running around like headless chickens and declaring that higher bond yields may now be more powerful than the Fed Funds Rate.

In other words, after months of hawkish chest-puffing, they are saying that perhaps enough is enough with the “higher for longer” meme…

Central bankers, it seems, are beginning to realize what informed credit market jocks have always known, viz: The bond market is stronger than any central bank.

Price Matters

That is, eventually central bankers lose control of artificial bond pricing.

Which means that eventually the great weight of sinking bonds and hence rising yields and rates becomes more powerful than central bank money printers to keep those bonds artificially “supported.”

I’ve been saying this for years despite “journalists” at the WSJ and Financial Times calling math-based realists like me “kooks.”

But recently even the fine folks at the WSJ or Financial Times (FT) are beginning to worry out loud as UST supplies far outstrip natural demand, causing bond prices to fall and yields and rates to rise fatally higher than central bankers once thought safely under their control.

We’ve warned of this for years—and this grotesque supply and demand mis-match has only risen exponentially in recent months.

America: Running Out of Takers/Suckers for Its Ever-Increasing IOUs?

The trillions in spending forecasted for year-end and into 2024 just don’t have any real money behind it, which means more IOUs will be spitting out of DC with less and less love/demand for the same.

This, of course, has been a real problem hiding in plain site for a long, long time.

As supply outpaces demand for sovereign bonds, their prices sink, their yields rise and hence interest rates—the cost of debt—becomes fatal rather than just painful.

The journalists at the FT, most of whom never sat at a trading desk, however, still have a very hard time imaging the unspeakable—i.e., a total implosion of sovereign bonds, and hence a total implosion of the financial system.

Thinking About the Unthinkable

They still see the UST as too big to fail—or to use their own words, any failure of this sacred US Sovereign bond is “unthinkable.”

Well…think again.

But at least the main-stream-financial pundits are crying that any real threat to Uncle Sam’s IOUs “would force the state to act.”

For once, I actually agree with these “journalists.”

But let’s clarify what “forcing the state to act” really means—i.e., in simple speak.

When There’s No Good Acts Left to Take

In short, this means the “state” would have to “act” by saving the bond market in particular and the global financial system in general via trillions and trillions of printed dollars to purchase otherwise unloved IOUs from Uncle Sam.

In other words, the only way to save bonds is to kill currencies.

This, by the way, is a now familiar trajectory to any one paying attention (think of the September 2019 repo crisis, the March 2020 Covid crash or the 2022 Gilt crisis in the UK) the implications of which we’ve been warning well ahead of the pundits.

Such “state action,” of course, slowly kills the USD—but as I’ve also warned for years, the last bubble to pop in every centralized, debt-soaked financial failure throughout history is always the currency.

The once exceptional USD, sadly, is no exception. It just takes longer, a lot longer, to bring down a world reserve currency.

This, by the way, is not “gold bug sensationalism” but simple history supported by simple math—two disciplines our leaders, financial journalists and even bankers either don’t grasp or do their best to ignore, cancel or dismiss.

Again, with the ironies.

Even the Media Can’t Deny the Obvious

But at least the main stream pundits are catching on. This is only because the problem of unprecedented deficits alongside rising bond yields and hence debt costs are now too obvious to ignore.

The WSJ recently wrote that “deficits finally matter.”

Hmmm. They have mattered for a long time—just saying…

Telegraphing a Weaker USD?

In the end, and as warned over and over and over (and as confirmed, it seems, even by the squawking Fed officials above), the facts and Fed-speak all point toward a talking down of the USD in favor of Uncle Sam’s broken IOU.

That is, the media is already planting the seeds for the USD’s painful endgame.

This comes as ZERO surprise, despite the Greenback’s relative status as the best horse in the global glue factory.

And, at least for now, that USD is breaking well off its prior uptrend…

This weaker USD will provide needed liquidity relief for an over-stretched UST market.

But the USD (and DXY) will have to come down much further, in my opinion, to buy sovereign bond markets needed time.

Pick Your Poison: Busted Financial System or Neutered USD?

Eventually a choice will have to be made between saving the system (of which sovereign bonds are the foundation) or sacrificing the currency.

In other words, get ready for more dollar-destroying “state action” from that non-state/private enterprise otherwise known as the Fed—all in the form of direct magical mouse-click money.

The Postponed Pivot Already Began

For over a year, this inevitable Fed pivot toward QE was delayed by back-door QE-like measures from Yellen’s Treasury Department (i.e., refilling the Treasury General Account with T-Bills) or the dual (and multi-trillion) accounting tricks of BTFP bank-bailout (by which Uncle Sam guaranteed par value return to the banks but market value losses to the suckers on Main Street…)

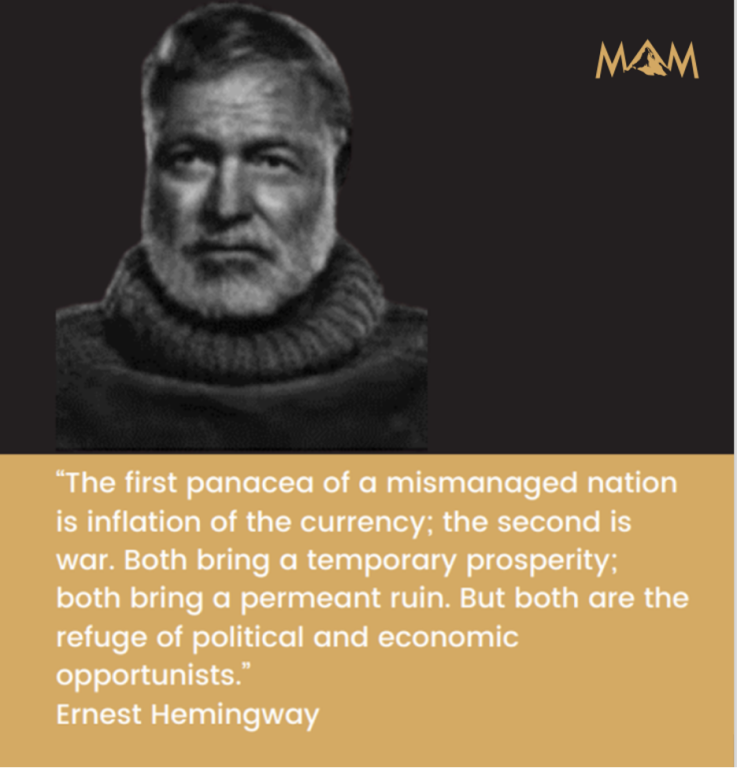

Or War Might Be in Order? Ask Hemingway

In fact, the only thing that could publicly justify (and partially absorb) another massive dose of 2020-like money printing (and hence currency debasement) would be a big, fat, ugly war with war-like “emergency measures” whereby our leaders can blame decades of debt-addiction on battle smoke (or COVID, Putin, and men from Mars) rather than their own bathroom mirrors.

Again, Hemingway was likely onto this trend long before the WSJ or FT:

Around and Round We Go

But with conflicts now red hot in both the Ukraine and Israel, Biden and his broken bond market are hitting an inflection point where the USA just can’t really afford more war support to its allies without thinning the USD and over-stretching its UST.

And so, folks… around and round we go in the ultimate vicious circle within which all debt-soaked nations throughout history ultimately find themselves.

That is: 1) poorly managed nations get too drunk on debt, and then 2) debase their currency to pay their debt; thereafter, 3) inflation comes, followed by 4) rising rates to fight that inflation, which in turn means 5) higher debt service costs, which means 6) more inflationary currency creation is rolled out to pay those higher rates.

Stated more simply, the USA has hit the Fiscal Dominance arc of the debt-cycle vicious circle wherein fighting inflation just creates more inflation.

The World Is Catching On…

We, of course, are not the only ones who see this.

In fact, pretty much the entire world is catching on, with the BRICS+ nations making the first steady moves (de-dollarization) as eastern and other central banks continue to stack physical gold at record-levels in preparation for the slow but steady decline (not death, nod to Brent Johnson) of the World Reserve Currency.

As I recently wrote, just like kings bring horses and canons to their borders to defend against an approaching invader, central banks are stacking physical gold to defend against a debased USD.

It’s just that obvious.

This may explain why gold continues to rise in London and NYC despite so-called “positive real rates” and a still relatively strong USD.

That is, the world, including the Shanghai gold exchange, is seeing the golden lighthouse through the smoke of burning currencies.

Are you?

THE FINANCIAL SYSTEM HAS REACHED THE END

Egon von Greyerz joins his dear friends and Matterhorn Asset Management advisors, Grant Williams and Ronnie Stoeferle, to address the unique risks—economic, geopolitical, military—making headlines at an alarming rate.

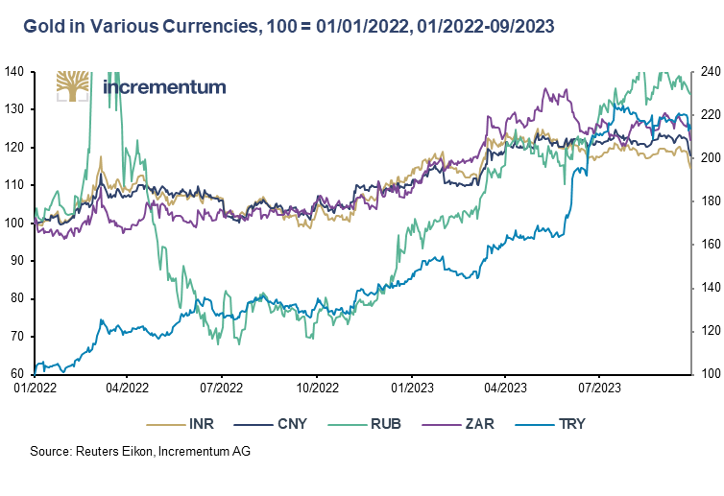

This timely and highly important conversation opens with the financial, political and trade moves from West to East as evidenced by the growing BRICS momentum and its near and longer-term impact on the price of gold as prosperity moves from West to East. Consumer gold demand from India and China, increased central bank demand in the East and rising gold premiums on the Shanghai Exchange suggest that the LBMA hegemony over gold pricing is shifting, as Ronnie discusses.

As to rising gold prices, Grant reminds that gold does nothing, currencies just continue to weaken. Strangely, however, investors continue to erroneously wait for gold price spikes before investing in gold, a point which Egon addresses.

Grant unpacks the failure of Western sanctions and the weaponization of the world reserve currency as the key driver away from USDs/USTs and toward physical gold. We are entering a period of tremendous geopolitical shifts for which gold’s role will be central as a wealth preservation asset, a role which Egon has steadily maintained for more than two decades. Despite such a clear direction, many Western individuals fail to make physical gold a core part of their portfolios, an issue which Ronnie addresses at length—giving particular attention to misunderstood bond markets and the total return losses therein.

Grant adds his thoughts on gold allocation percentages in the context of gold’s global market share, which is finite despite fiat money’s infinite (and hence inflationary) range. The West, unlike the East, has not fully understood inflation risk and portfolio reactions to the same.

Egon then asks if we are looking at an existential crisis given increased global conflicts, to which Grant and Ronnie add their insights/concerns. Grant sees a complete failure of diplomacy before, during and after events in Ukraine and Israel made headlines. As Egon argues, it seems the US policy is little more than sending money and weapons at every problem, not statesmen.

Of course, gold can’t protect investors from every risk making headlines today, but it has a clear role in protecting against financial risk, a point which Ronnie, Grant and Egon address at length in the closing minutes of this spirited discussion.

THE FINANCIAL SYSTEM HAS REACHED THE END

What a bloody mess! Well, economic collapses and wars always are.

But sadly it will become a lot messier!

We now have two dangerous wars, maybe we will have a global war. We have a coming collapse of stock markets and debt markets and a banking system which probably will not survive in its present form.

But there is always another side of the coin.

There will be opportunities of a lifetime not just to preserve your wealth but also to amass an incredible fortune. More later.

WHERE BLACK GOLD GOES YELLOW GOLD WILL FOLLOW

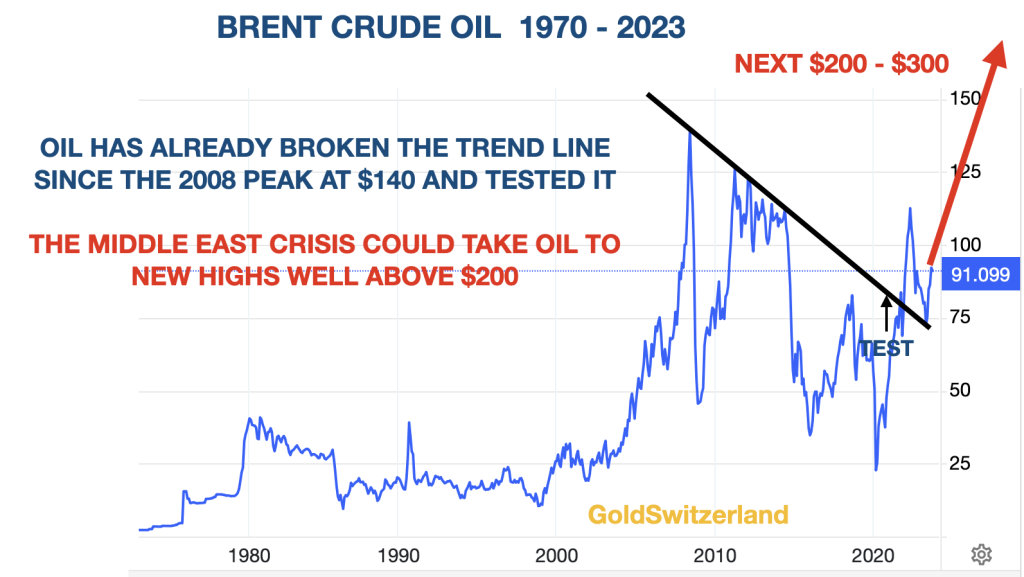

Oil and gold are best friends. As the chart of the Gold – Oil ratio for 50 years shows, below, gold and oil move very much in tandem within a narrow range. So if oil now goes up due to the Middle East crisis, gold will follow.

AS IF CLIMATE CHANGE, VACCINES, LOCKDOWNS, WOKENESS, STOLEN ELECTIONS, CBDC, DEBT etc WASN’T ENOUGH

As if all the above wasn’t bad enough, adding a Middle East war to this makes the crisis properly global and the step toward a Global or World War is very short even dangerously short.

We thought we had enough trouble with climate change, ESG (Environmental, Social, Governance), wokeness with 27 genders and canceling history, forced vaccines and lockdowns, high taxes, high inflation and debt that can never be repaid.

Hard to understand what happened to the world since I was born 78 years ago.

Add to that incompetent governments in the entire Western World and not a single statesman around. All of that is more than most people can cope with.

The US government and Biden have no policy, no ideology. They have also lost their manufacturing base and their military power is declining rapidly.

On top of that, the US is also spending money like a drunken sailor who will never sober up but only spend or drink more to drown his ever increasing debts and sorrows.

And then we started to get used to the “local” war in Ukraine which the poor Ukrainians could never win against a superpower.

We are now talking about the greatest uncertainties in my 78 year lifetime which started at the end of WWII 1945.

No one can predict where the current two wars will lead, although our worst fears can sadly be realised sooner than anyone could believe.

At this stage we cannot say if these crises will lead to a major destruction of the fabric of the world and the death of many, many people.

But what we can say with much greater certainty is that economic and financial risk is now at a level which is likely to lead to the destruction of wealth on a level never before seen in history.

I was born right in between the end of WWII in Europe and before it ended in the Far East. So I naturally don’t remember anything from that era. My father was an officer in the Swedish army at the time and Sweden unofficially assisted Norway which was occupied by the Germans.

But I can well remember my early life in Sweden which was a prosperous and stable country with a homogenous population. The 1950s were a period when church doors were open and the church silver could be left unprotected. Today, the copper roof, the gates and anything of value is long gone. Obviously the silver is either locked in or stolen. Police and teachers were greatly respected with ethical and moral values very high. Now people swear and spit at them.

But the stability of the early 1950s (except for the Korean War) soon led to wars in Vietnam, Middle East etc with the invasion of Hungary and Czechoslovakia and Yom Kippur in 1973 being the first Palestine conflict I can remember. Petrol prices in the UK where I lived at the time were 7.5 pence per litre.

That was the first major oil crisis I experienced. Today petrol in the UK is £1.90 per litre and unlikely to stay that low for long. But a 26X increase in the last 50 years of petrol (US gasoline) is probably going to be seen as a bargain in a few years time.

let’s start with your most important decision which you need to take toDAY

Buy as much physical gold as you can afford and then buy much more.

We have warned investors for some time that the Everything Bubble will turn into the Everything Collapse.

Well that time is now coming very soon.

The current pattern of the Dow looks very similar to October 1987. If that is correct, a stock market crash could be imminent.

Stocks will be down 70-90% or more, in real terms, before this crisis ends.

Most bonds will become worthless, even Sovereign bonds.

Higher rates and defaults will see to that.

So get out of all general stock and all bond investments if you want to have any money left at the end of the coming calamity.

Interest rates will continue the long term, 20-30 year uptrend, obviously with corrections. No one will want to lend to a drunken sailor who can never get sober. Defaults and a banking crisis will lead to higher debts and higher rates. But the US with record borrowings can’t afford the rising interest costs. The dollar will be sacrificed.

So in all a perfect but vicious debt and currency cycle leading to guaranteed perdition.

The only question is how long it takes.

GOLD WILL BE YOUR SAVIOUR

We have been advising investors to hold important amounts of physical gold for wealth preservation purposes since the beginning of 2002. Since that time gold is up 6-8 times in most major currencies and much more in weaker currencies.

But as I keep telling colleagues and investors, gold’s real journey hasn’t started yet.

What I often tell our clients is that they mustn’t wish for gold to go up substantially.

Because when gold goes to the levels which I now feel certain it will, the quality of our lives will be considerably worse than today.

The factors that will fuel gold’s rapid rise to new substantially higher levels are obvious:

WARS

It is both fascinating and frightening to follow how regional disputes lead to superpowers quickly taking sides and lobbying or forcing its allies to follow suit.

There are always two sides to a dispute. One of my very important principles is that before you judge someone, you must walk three moon laps in his moccasins. (An old American Indian saying). But sadly most people including superpowers totally ignore such advice. The Russian argument is that the Minsk agreement was meant to avoid a deepening of the dispute and should have been followed. The US side is that Russia must be stopped at any price and Germany separated from a dangerous rapprochement with Russia. And Europe was given no choice but to follow the US.

As Bush Jr said to congress in 2001:

“Either you are with us, or you are with the terrorists!”

The sanctions are severely affecting Germany and most of Europe but the worst consequences are still to come this winter. The Middle East conflict is likely to make the consequences exponentially greater.

Like with all wars, ordinary people on either side don’t want it. And democracy doesn’t exist when a nation goes to war. Both Ukraine and the US went to war without the consent of either the people or their parliaments.

THAT IS HOW WARS AND WORLD WARS START – Idiosyncratic leaders with sycophantic lieutenants take erratic decisions without understanding the consequences.

WHO IS ACTUALLY RUNNING THE US?

And when the leader is past his sell by date it makes the whole process utterly dangerous.

Everybody gets old and I am no spring chicken either. But if for whatever reason I don’t have the wits to resign when I should, I hope that my wife and my team will tell me so.

IT IS EXTREMELY DANGEROUS FOR A SUPERPOWER TO BE LEAD BY SOMEONE WHO IS NOT CAPABLE OF LEADING.

Even more dangerous when an unaccountable and unidentifiable group takes all the decisions.

UKRAINE AND PALESTINE – REGIONS UNDER CONSTANT STATE OF CHANGE

As Heraclitus, the greek philosopher said 2,500 years ago:

“Change is the only constant in life.”

Modern Ukraine was occupied by a number of different people throughout history like the Scythians, Greeks, Romans, Goths, Huns and the Slavs as well as the Mongols. Later Poland and Lithuania and the Ottomans were involved. In 1709 the Swedish King Charles the XII lost against Peter the Great of Russia due to the Great Frost (the coldest winter in 500 years) which weakened the Swedish Army just like during the Napoleon and Hitler invasions.

So Ukraine is hardly a stable country with deep roots and a homogenous people.