OMINOUS MILITARY & FINANCIAL NUCLEAR THREATS COULD ERUPT IN 2023

The world is today confronted with two nuclear threats of a proportion never previously seen in history. These threats are facing us at a time when the world economy is about to turn and decline precipitously not just for years but probably decades.

The obvious nuclear threat is the war between the US and Russia which currently is playing out in Ukraine.

The other nuclear threat is the financial weapons of mass destruction in the form of debt and derivatives amounting to probably US$ 2.5 quadrillion.

If we are lucky, the geopolitical event can be avoided but I doubt that the explosion/implosion of the Western financial timebomb can be stopped.

More about these risks later in the article.

There is also a summary of my market views for 2023 and onwards at the end of the article.

CURIOSITY AND RISK

With a business life of over 52 years in banking, commerce and investments, I am fortunate to still learn every day and learning is really the joy of life. But the more you learn, the more you realise how little you really know.

Being a constant and curious learner means that life is never dull.

As Einstein said:

“The important thing is not to stop questioning.

Curiosity has its own reason for existing.”

There has been another important constancy in my life which is understanding and protecting RISK.

I learnt early on in my commercial life that it is critical to identify risk and endeavour to protect the downside. If you can achieve that, the upside normally takes care of itself.

Sometimes the risk is so clear that you want to stand on the barricades and shout. But sadly most investors are driven by greed and seldom see when markets become high risk.

The end of the 1980s was such an obvious period, especially in the property market. Stocks crashed in 1987 but if you are not leveraged, stock crashes normally don’t wipe you out. But in commercial property the leverage can kill a lot of investors and sadly did in the early 1990s.

The end of the 1990s was another period of very high risk in the tech sector. I was involved with a tech business in the UK and told the founder in late 1999 that we must sell the business for cash. This was the time when tech businesses were valued at 10x sales. Virtually none of them made a profit. So we managed to sell the business in 2000. We actually got shares as payment but were allowed to sell them immediately which we did. Thereafter the Nasdaq crashed by 80% and many businesses went bankrupt.

At those particular moments of extreme overvaluation, you do not have to be clever in order to get out and take profit. Super profits should always be realised when the valuation of businesses doesn’t make sense and the prospects don’t look good.

RISK OF MAJOR ESCALATION OF WAR

So let’s get back to the massive risks that are hanging over the world currently.

In my estimation this is not a war between Russia and Ukraine but between the US and Russia. Russia found it unacceptable that the Minsk agreement of 2014 was not kept to. Instead, the bombing of the Donbas area continued, allegedly encouraged by the US. As Ukraine intensified the bombing, Russia invaded in Feb 2022.

I won’t go into the details here of who is at fault etc. But what is clear is that the US Neocons have a major interest for this war to escalate. For them Ukraine is just a pawn and the real enemy is Russia. Why would the US otherwise lead the initiative to sanction Russia and send weapons and money to Ukraine but send no peace keepers to Russia?

Let us just remind ourselves that ordinary people never want war. The American people doesn’t want war, nor do the Russians or Ukrainians. It is without fail always the leaders who want war. And in most countries, even in the so called democratic USA, the leaders have total power when it comes to starting a war.

Most of Europe is heavily dependent on Russian oil and gas. Still Europe is shooting itself in the foot by agreeing to the sanctions initiated by the US. The consequences are disastrous for Europe and especially Germany which was the economic engine of Europe. Germany is now finished as an economic power. Time will prove this.

The global economic downturn started before the Ukrainian war butthe situation has now severely deteriorated with the European economy weakening rapidly. Still, Europe is digging its own grave by sending more weapons and more money to Ukraine much of which being reported to end up in the wrong hands.

The Ukrainian leader Zelensky is skilfully inciting the West to escalate the war in order to achieve total NATO involvement.

The risk of a major escalation of the war is considerable. Russia’s main aim is for the Minsk agreement to be honoured whilst the US Neocons want to weaken Russia in a direct conflict. Major wars are often triggered by a minor event or a false flag.

The Neocons know that a defeat for the US in this conflict would be the end of the US dollar, hegemony and economy. At the same time, Russia is determined not to lose the war, whatever it takes. This is the kind of background that has a high risk of ending badly.

THE CONSEQUENCES ARE UNTHINKABLE

Since there is not a single Statesman in the West, dark forces behind the scenes are pulling the strings. This makes the situation particularly dangerous.

The risk of a nuclear war in such a situation is incalculable but still very real.

There are 13,000 nuclear warheads in the world and less than a handful of these would wipe out most of the West and a dozen, a major part of the world.

Let’s hope that the West comes to its senses. If not, the consequences are unthinkable.

FINANCIAL WEAPONS OF MASS DESTRUCTION

The other nuclear cloud which is financial will fortunately not end the world if it detonates but inflict a major global setback that could last many years, maybe decades.

I have in numerable articles and interviews outlined that the global debt expansion will end badly.

This can be illustrated in a number of pictures so let us look at two self explanatory graphs.

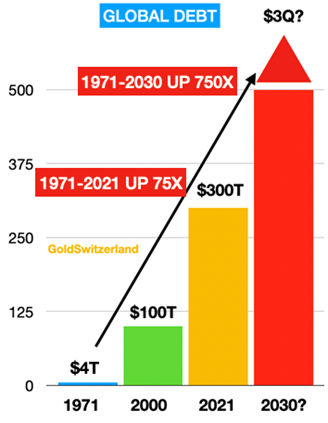

The first one shows how global debt has grown 75X from $4 trillion to $300T since Nixon closed the gold window in 1971.

The graph also shows that the world could reach debt levels of maybe $3 quadrillion by 2030. That sounds like a sensational figure but the explanation is simple. Derivatives were around $1.4 quadrillion over 10 years ago as reported by the Bank of International Settlement (BIS) in Basel. But with some hocus-pocus they reduced the figure to $600 trillion to make it look better cosmetically. The BIS decided just to take just one side of a contract as the outstanding risk. But we all know, it is the gross risk that counts. When a counterparty fails, gross risk remains gross. So as far as I am concerned, the old base figure was still $1.4Q.

Since then derivatives have grown exponentially. Major amounts of debt are now created in the derivatives market rather then in the cash market. Also, the shadow banking system of hedge funds, insurance companies and other financial business are also major issuers of derivatives. Many of these transactions are not in the BIS figures. Thus I believe it is realistic to assume that the derivatives market has grown at least in line with debt but probably a lot faster in the last 10+ years. So the gross figure is easily in excess of $2 quadrillion today.

When the debt crisis starts in earnest which could be today or in the next 2-3 years, major defaults in derivatives will become debt as central banks print money on an unprecedented scale in a futile attempt to save the financial system. This is how debt can grow to $3Q by 2030 as the graph illustrates.

US GDP GROWTH IS ILLUSORY

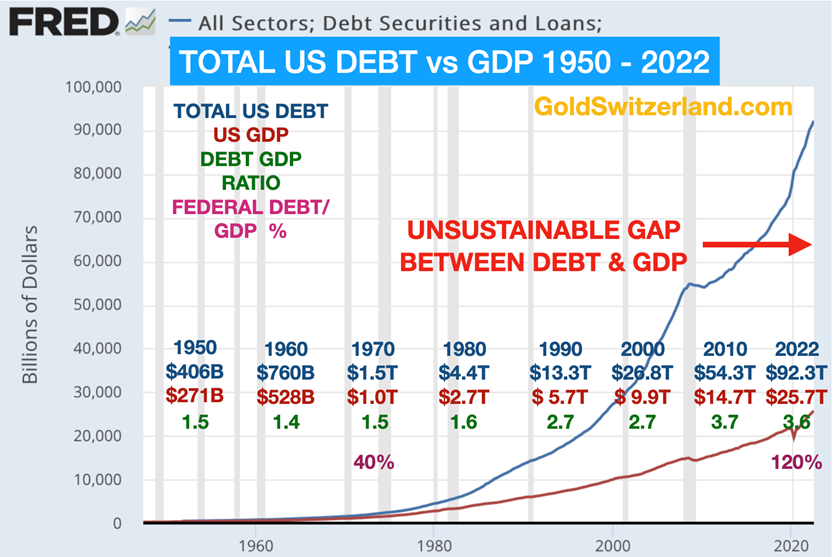

The second graph shows that the US, the world’s biggest economy, is living on both borrowed time and money.

In 1970 total US debt was 1.5X GDP. Today is is 3.6X. This means that in order to achieve a nominal growth in GDP, debt had to grow 2.5X as fast as GDP.

The conclusion is simple. Without credit and printed money there would be no real GDP growth. So the growth of the US economy is an illusion manufactured by bankers and led by the private Federal Reserve Bank. As the graph above shows, GDP can only grow if debt grows at an exponential rate.

The gap between debt and GDP growth is clearly unsustainable. Still with hysterical money printing in the next few years, in an attempt to save the US financial system, the gap is likely to widen even further before it is eroded.

There is only one way for the gap to narrow which is an implosion of the debt through default, both sovereign and private. Such an implosion will also lead to all assets inflated by the debt – including bonds, stocks and property – also imploding.

Temporarily the US has achieved this illusory wealth but sadly the time is now coming when the Piper must be paid.

THE END OF THE DOLLAR

The days of the dollar as reserve currency are counted. A currency that has lost 98% in the last 50 years hardly deserves the status of a reserve currency. A combination of military might, petrodollar payments and history has kept the dollar far too strong for much too long. Since there is no immediate alternative, it is possible that the dollar temporarily will remain strong for a while as the Ukrainian conflict continues. The economies of other currencies (Euro, Pound, Yen) are clearly too weak currently to be realistic reserve currency contenders.

The days of the Petrodollar are also counted.

Major moves are now taking place between the world’s biggest energy producers (excluding the US) which will gradually end the Petrodollar system.

A GLOBAL RECEPE FOR DISASTER

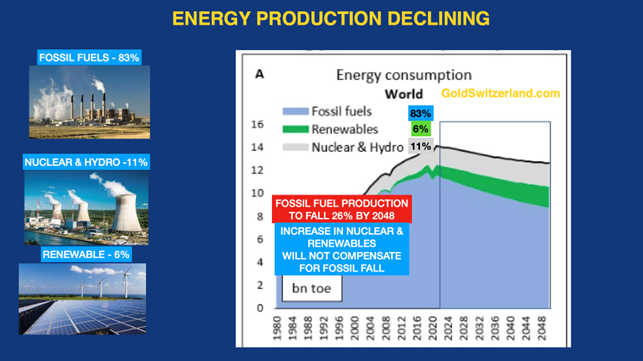

But firstly let’s understand that in spite of the climate zealots, there will be no serious alternative to fossil fuels for many decades. Fossil fuels account for 83% of global energy.

Global growth can only be achieved with energy. Since renewables today only account for 6% and are growing very slowly, there will be no serious alternative to fossil fuels for many decades.

In spite of that, Western governments in Europe and the US have not only stopped investing in fossil fuels, but also closed down pipe lines, coal mines and nuclear power plants. This is of course sheer political and economic lunacy and a very rapid method to achieve a collapse of the world economy. Add to that the Russian sanctions and we have a global recipe for disaster.

Without fossil fuels, the world economy will collapse. In spite of that, political pressure has slowed down fossil fuel production substantially. As the graph shows, fossil fuel production is likely to decline by 26% by 2048. Increases in nuclear and, hydro and renewables will not compensate for that fall. The effect will be a fall in global GDP and trade. But more about the energy side in another article.

Few people understand the importance of global trade. Rome conquered many countries from Europe to Asia and Africa. But during the Roman Empire, the various economies prospered due to free trade. The Romans were clearly superior thinkers compared to current Western leaders.

MAJOR SHIFT FROM WEST TO EAST

The GCC countries (Gulf Corporation Council) consist of Saudi Arabia, UAE plus a number of Gulf countries have 40% of the oil reserves in the world.

Another 40% of oil reserves belong to Russia, Iran and Venezuela all selling oil to China at a discount currently.

In addition there are the BRICS countries (Brazil, Russia, India, China and South Africa. Saudi Arabia also want to join the BRICS which represents 41% of the global population and 26% of global GDP.

Finally there is the SCO, the Shanghai Cooperation Organisation. This is a Eurasian political, economic and security organisation headquartered in China. It covers 60% of the area of Eurasia and over 30% of global GDP.

All of these organisations and countries (BRICS, GCC, SCO) are gradually going to gain global importance as the US, and Europe decline. They will cooperate both politically, commercially and financially. As energy and oil is a common denominator for these countries, they will most likely operate with the Petroyuan as their common currency for trading.

With such a powerful constellation, minor hobbyist groups like Schwab’s WEF will dwarf in significance and finally disappear as the WEF members including the political leaders lose their power and the billionaires their wealth.

MAJOR MOVES IN MARKETS

This article is already very long but I will still cover what I see in markets in 2023 and coming years. I have covered this in many articles so I will be brief.

Stocks have just had a major down year globally. This is the mere beginning of the implosion of the extreme overvaluation based on printed money. I would be surprised if stocks on average decline by less than 90% in real terms. The measure for real terms is of course gold.

It will not be a straight line fall and many investors will buy the dips until they have exhausted most of their wealth.

Bonds will probably perform even worse than stocks. Many borrowers, both sovereign and commercial, will default.

The 40 year decline in interest rates has finished. Central banks will lose control of the interest markets as investors panic out of bonds.

The combination of high inflation, collapsing currencies and defaults on a massive scale will turn the bond market into a historic horror story.

The bond equation is simple:

Hyperinflation + Currencies going to Zero + Defaults = BOND VALUES ZERO

Good luck to bond holders. They will need it.

Investment properties will also fare badly. Low interest rates and unlimited credit have created a bubble of historic proportions.

In many countries it has been possible to borrow up to 15 year money at 1% or less. Anyone who didn’t take advantage of free money will regret it badly. The risk reward calculation was obvious. At 1%, rates could only go to zero which is a 1% fall. On the other hand, rates could go to 20%+ like they did in the 1970s.

Falls of 75-90% in real terms will be commonplace in the property market.

If you have no mortgage or a low one at a fixed rate, don’t worry. But just look at it as an abode and not an investment.

Lastly and most importantly let’s look at GOLD.

We invested heavily into gold in early 2002 at $300 for ourselves and the investors we advised. This was based on our risk assessment of the financial system and a gold price which had declined for over 20 years. We were certain that gold was undervalued at the time and also that it was the ultimate wealth preservation investment.

Since that time we and our clients have not ever worried one day about our gold holdings. As a matter of fact, gold today in relation to money supply is cheaper than in 2002 and therefore represents superb value.

2023 will be the start of another gold era. The circumstances are perfect for this.

Back in mid September I tweeted that gold was bottoming when the price was $1665 and that we would see $2,000 at least in 2022. Well as I often say, forecasting is a mug’s game and we are “only” at $1,875 today. See graph below which was Tweeted in Sep 21.

Considering the two nuclear risks discussed above, the gold price becomes irrelevant. Physical gold is the ultimate wealth preservation investment. The value should be measured in ounces or kilos and not in ephemeral currencies.

Gold is likely to reach levels that no one can imagine today. But to forecast a price in paper money serves no purpose without defining the purchasing power of the fiat money at some future point.

Gold is the metal of kings and should be the primary wealth preservation holding. Silver has a massive potential but is much more volatile and much bulkier.

It is extremely important how gold is stored. The principal part of your gold holding should be outside your country of residency. You should be able to flee to your gold.

Do not store gold at home. With crime rates surging globally and likely to go up much further, it is extremely unwise to store gold at home. Add to that likely social unrest in most countries, whatever valuables you store at home are at risk however well hidden you think they are.

There is no perfect country to store gold today. The world has become a generally unsafe place. Our company has carried out a major review of the best countries to store gold globally. This will be published at some future point.

Switzerland is still one of our favourites. The combination of the political system, history and 70% of gold bars being refined in Switzerland plus most private gold being stored here, makes it an obvious choice.

Our company also has a major advantage in being able to offer the only private vault which is nuclear bomb proof and can operate fully under any such circumstances. We also offer full data backup even against EMP risks (Electro Magnetic Pulse). I am not aware of anyone in our industry that offers this protection. The location of this vault is confidential. Here is a brief video which shows the uniqueness of the vault:

To summarise, the risks today are greater than anytime in history. A full nuclear war between the US, Russia and China is the end of mankind and no one can protect against this kind of event.

But there are more limited situations, whether nuclear or with conventional weapons which necessitate the best protection possible of your wealth preservation asset.

Let’s hope that a major nuclear war will not take place. In any case, there is very little we can do about it.

The financial nuclear risk is very real and also very likely to be triggered in my view. Anyone who can has a responsibility to organise protection against this risk as discussed in this article.

Finally remember that in periods of crisis family and friends is your most important protection. Helping others will be essential in a coming crisis.

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD