Insights

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

The Latest Lie from on-High: An “Independent Federal Reserve”

The Federal Reserve, we are told, is "independent" from political pressures and forces. Nothing could be farther from the truth. The Fed is increasingly another branch of the White house, and our econ...

Matthew Piepenburg / July 30, 2021

Read More

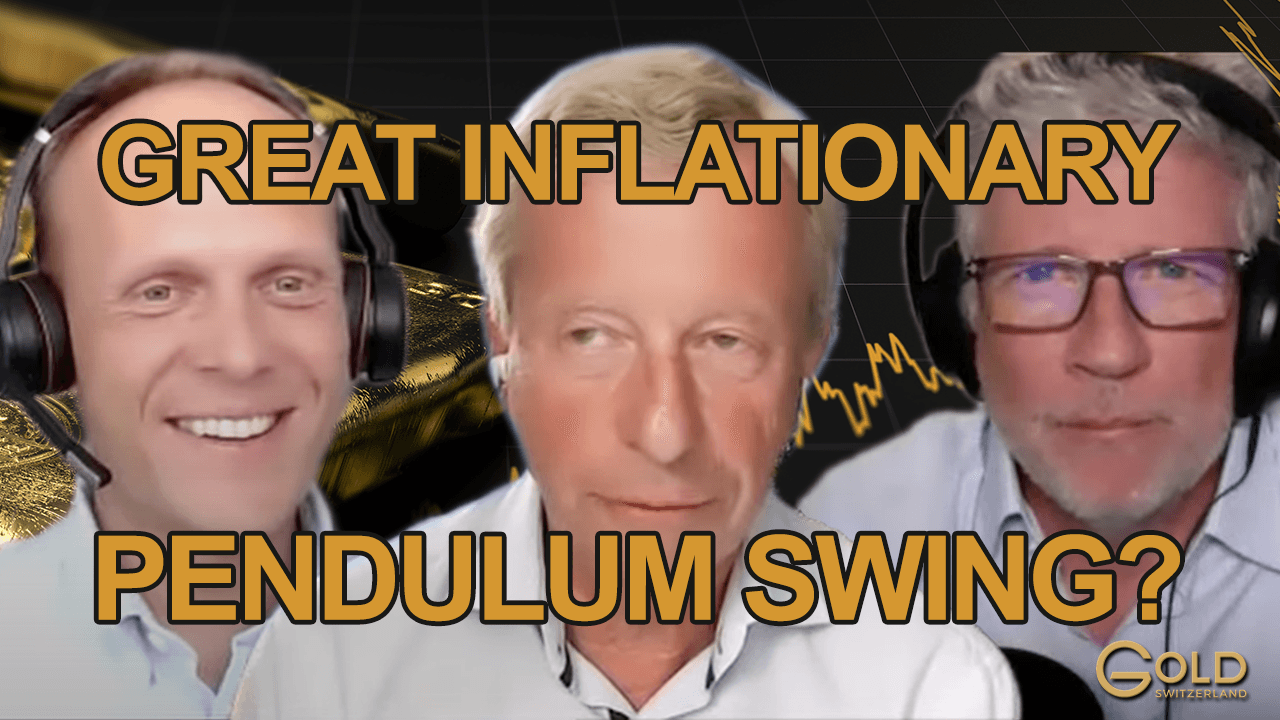

Grant Williams, Egon von Greyerz, and Ronnie Stoeferle: The Crack-Up Boom

Watch some of the brightest minds in finance, Grant Williams, Egon von Greyerz, and Ronnie Stoeferle discuss fiscal policy, the "crack-up boom," inflation, liquidity, and of course gold and silver in...

Egon von Greyerz / July 28, 2021

Watch Now

The Death of Truth & the Rise of Centralized Government Control

Centralized government control has resulted in distortion of the reality of our economy and our future. Conditions will further unravel as the truth continues to be suppressed.

Matthew Piepenburg / July 25, 2021

Read More

THE PAPER GOLD TAIL WAGGING THE GOLDEN DOG

Paper gold controls the gold market, but this cannot last forever. Eventually, the golden dog will take control of his own tail. When fiat currencies inevitably fail, Physical gold reigns supreme.

Egon von Greyerz / July 21, 2021

Read More

Liquidity Crisis: Wells Fargo & Repo Markets Sound Alarms

Recent news of Wells Fargo suspending personal lines of credit and continued volatility in the repo market portend a coming liquidity crisis. In an era when deep cracks in the financial system are ban...

Matthew Piepenburg / July 16, 2021

Read More

Gold Storage in Banks? Think Again.

For informed investors who have successfully traversed the tired Bitcoin vs. Gold debate and recognized the critical importance of owning physical (as opposed to paper/ETF) gold as an obvious antidote...

Matthew Piepenburg / July 12, 2021

Read More

GRANT WILLIAMS, RONNI STOEFERLE, AND EGON VON GREYERZ SPEAK TO GOLD’S INFLATIONARY END-GAME

As large swaths of the world gather to follow the best names in “round-ball” football, we’ve gathered three of the best names in the global financial and precious metal playing field to discuss critic...

Egon von Greyerz / July 10, 2021

Watch Now

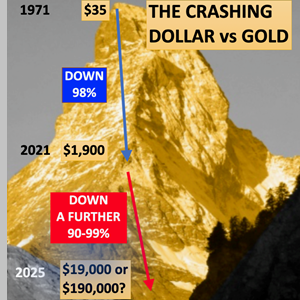

THE DOLLAR’S FINAL CRASH DOWN A GOLDEN MATTERHORN

Was Richard Nixon a real gold friend who understood the futility of tying a weakening dollar to gold which is the only currency that has survived in history? So was Nixon actually the instigator of th...

Egon von Greyerz / July 7, 2021

Read More

Basel III and Gold: The Trillion-Dollar Question

June 28th has come and gone, which means the much-anticipated Basel III “macro prudential regulation” to make so-called “safe” banks “safer” has officially kicked off in the European Union (as it will...

Matthew Piepenburg / July 1, 2021

Read More

VON GREYERZ: BASEL 3 – GAME CHANGER FOR PRECIOUS METALS OR NON-EVENT?

The FOMC caused turmoil last week, but the statements have only short-term effects. In the past, the FED could not predict anything correctly, but only react. It will be the same this time. Real inter...

Egon von Greyerz / June 30, 2021

Watch Now

THE ICARUS WAX OF THE EVERYTHING BUBBLE IS MELTING

When will the wax melt that holds up the global economy and everything bubble? Hubris is driving humans and markets ever higher and closer to the sun. The higher everything goes, the greater the risk...

Egon von Greyerz / June 23, 2021

Read More

One Mad Market & Six Cold Reality-Checks

Fact checking politicos, headlines and central bankers is one thing. Putting their “facts” into context is another. Toward that end, it’s critical to place so-called “economic growth,” Treasury market...

Matthew Piepenburg / June 21, 2021

Read More