Insights

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

THE ICARUS WAX OF THE EVERYTHING BUBBLE IS MELTING

When will the wax melt that holds up the global economy and everything bubble? Hubris is driving humans and markets ever higher and closer to the sun. The higher everything goes, the greater the risk...

Egon von Greyerz / June 23, 2021

Read More

One Mad Market & Six Cold Reality-Checks

Fact checking politicos, headlines and central bankers is one thing. Putting their “facts” into context is another. Toward that end, it’s critical to place so-called “economic growth,” Treasury market...

Matthew Piepenburg / June 21, 2021

Read More

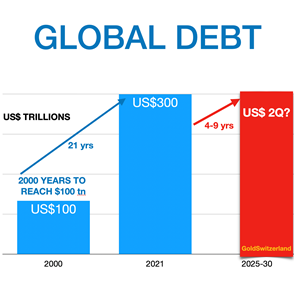

GLOBAL DEBT FROM $300 TRILLION TO $2 QUADRILLION IN NEXT 5-10 YEARS

The coming 5-10 years are likely to see asset prices decline by at least 90% in real terms. Yes stocks, bonds and property prices will in coming years collapse. But that’s not enough, the whole struct...

Egon von Greyerz / June 16, 2021

Read More

FROM YELLEN’S TWEETS TO BASEL III, GOLD CAN ONLY TREND NORTH AS CURRENCIES CAN ONLY GO DOWN

In this 20-minute MAMChat, Matterhorn Asset Management principals Egon von Greyerz and Matthew Piepenburg address the current and ever-evolving inflation narrative as well as its inter-relationship wi...

Egon von Greyerz / June 14, 2021

Watch Now

Translating Yellen-Speak into Golden-Speak

Given the increasingly politicized interplay (cancer) of central bank policy and so-called free market price discovery, it’s becoming increasingly more important to track the actions of central banker...

Matthew Piepenburg / June 14, 2021

Read More

“Transitory” Inflation? — Sublime Yet Ridiculous

History is a funny thing, almost as funny as human nature. The policy makers, including their latest meme of “transitory inflation,” are no exception to such psychological tragi-comedy. In short, we d...

Matthew Piepenburg / June 7, 2021

Read More

HOCUS – POCUS SCHEME TO CAUSE DRAMATIC GOLD SURGE

“The scholar does not consider gold and jade to be precious treasures, but loyalty and good faith.” - Confucius

This article will disc...

Egon von Greyerz / June 2, 2021

Read More

BANK VAULTED GOLD: GONE WHEN NEEDED MOST

Institutional investors are increasingly adding gold to their portfolios as a currency and inflation hedge. Those, however, who chose ETF’s for such an allocation face massive delivery risk of the ass...

Egon von Greyerz / June 1, 2021

Watch Now

Gold’s Middle Finger to Lying Currencies

Sensationalism, like central bankers and policy makers, has many faces, views and voices. This may explain why so many want to hold their ears, hug their knees and beg the heavens for a beacon of guid...

Matthew Piepenburg / May 30, 2021

Read More

EXPONENTIALITY LEADS TO FINALITY

As technological developments and markets go parabolic, we observe many market “experts”, even intelligent ones, forecasting that we are now in an exponential economic era. Thus many believe that this...

Egon von Greyerz / May 26, 2021

Read More

Pick Your Fed Poison: Tanking Markets or Fatal Inflation?

Below we look at the dark corner in which the Fed has placed themselves and investors: A one-way path toward tanking markets or crippling inflation. Alas: Pick your poison. For us, the antidote is as...

Matthew Piepenburg / May 24, 2021

Read More

How Long Can Lies & Control Supplant Reality & Free Markets?

The facts of a surreal yet broken (and hence increasingly controlled and desperate) financial system are becoming harder to deny and ignore. Below, we look at the evidence of control rather than the w...

Matthew Piepenburg / May 19, 2021

Read More