Insights

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

Politisiertes Geld und der Tod des Kapitalismus

Es ist weder ein Geheimnis noch eine große Überraschung, dass unser persönliches Vertrauen in Fiat-Geld (allgemein) und (speziell) Zentralbanker, die dieses Geld entwertet und den Tod des Kapitalismus...

Matthew Piepenburg / June 7, 2022

Read More

ANGRIFF AUF MITTELKLASSE: VW ABSATZ -37,8%

Für Arbeitnehmer auf der ganzen Welt hat die Inflation harte Konsequenzen. Die unsichtbare Steuer ist dabei, den Wohlstand breiter Schichten durch Reallohnverluste aufzuzehren. Verantwortlich sind die...

Matthew Piepenburg / June 5, 2022

Read More

IS GOLD HOBSON’S CHOICE?

All you need to do is to follow Hobson's simple rule for selecting a horse when you choose your investment in these very precarious times. This means you have a choice of one, which obviously is GOLD

Egon von Greyerz / June 1, 2022

Read More

Gold: Patiently Waiting for the Hangover in Global Markets

In this engaging interview with ParadePlatz’s Lukas Heassig, Matterhorn Asset Management principal, Matthew Piepenburg, sits down at MAM’s Zurich office to discuss gold ownership in an increasingly vo...

Matthew Piepenburg / May 30, 2022

Watch Now

BANKS IN CASE OF EMERGENCY BLOCK GOLD ACCESS

Increasingly institutional investors are recognizing the need to diversify their portfolios with gold. If they choose ETF's for this, they put themselves in danger of having no precious metals in case...

Egon von Greyerz / May 28, 2022

Watch Now

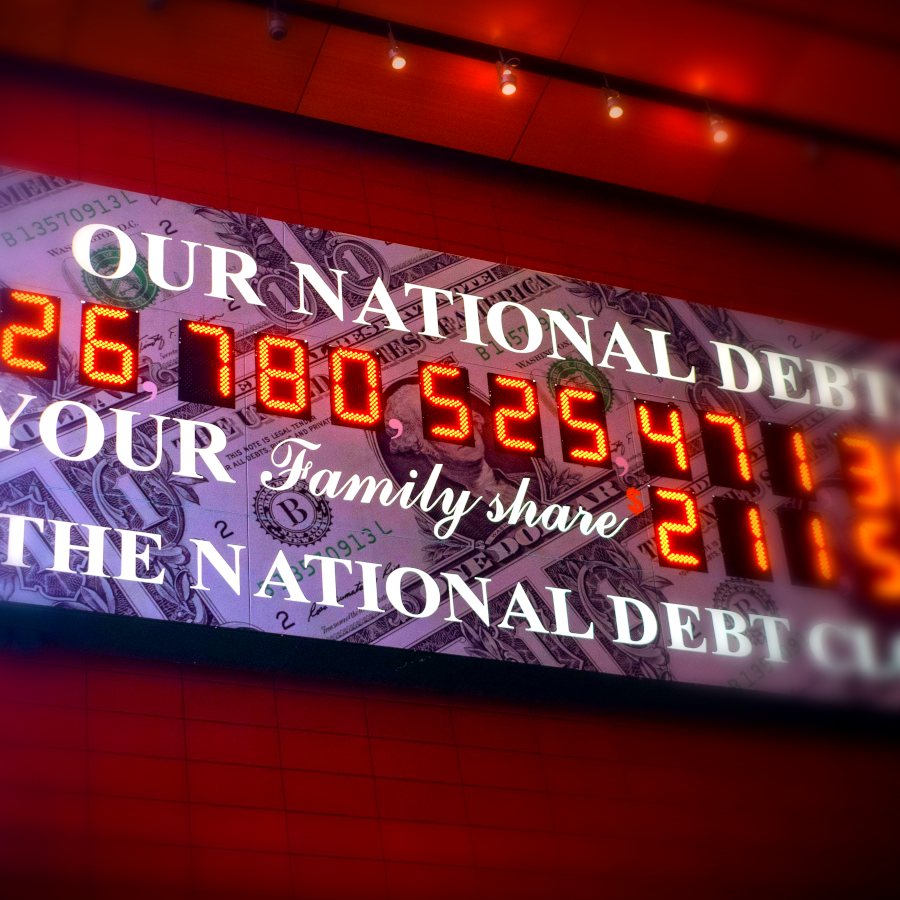

The Handbook for Debt-Soaked Nations: Lie, Print, Inflate & Finger-Point

As we have warned from the very onset of this otherwise avoidable war in Ukraine, the backfiring of Western sanctions against Putin (de-dollarization, inflationary tailwinds and increasingly discredit...

Matthew Piepenburg / May 24, 2022

Read More

GOLD AS CHEAP TODAY AS IN 1971 AT $35

As the world economy goes towards an inflationary depression, exacerbated not only by epic debts and deficits but now also by war, the significance of gold takes on a whole different dimension.

Egon von Greyerz / May 17, 2022

Read More

Politicized Money and the Death of Capitalism

Everything, including money, is politically-self-serving rather than economically free-market. Capitalism is dead. The folks in office to “save you” are mostly interested in saving their positions and...

Matthew Piepenburg / May 11, 2022

Read More

Gold: Timeless Chaperone to Openly Drunk Currencies

In this recent “Wiggins Session” with Consilience Finance’s Addison Wiggins, Matterhorn Asset Management principal Matthew Piepenburg takes a broad look at rapidly changing markets, geopolitics, curre...

Egon von Greyerz / May 6, 2022

Watch Now

THE WEST – A VICIOUS CYCLE OF SELF-DESTRUCTION

As the West is standing on the edge of the precipice, there are only unpalatable outcomes. At best the world is facing a hyperinflationary depression later followed by deflationary depression. But sad...

Egon von Greyerz / May 4, 2022

Read More

Announcing Gold Matters—The Timely New Book from Egon von Greyerz and Matthew Piepenburg

Matterhorn Asset Management principals Egon von Greyerz and Matthew Piepenburg are pleased to announce the release of their co-authored book, Gold Matters, now available on Amazon. The eBook will be a...

Egon von Greyerz / May 3, 2022

Read More

Gold Emerging as Key Player in a Post-Ukraine New Era

Matterhorn Asset Management founder, Egon von Greyerz, sits down with Silver Bullion TV to discuss the extensive market, currency and geopolitical ramifications of the war in Ukraine and the West’s mi...

Egon von Greyerz / April 25, 2022

Watch Now