Gold: Chomping at the Bit for a Surge

Like a powerful horse tied to a post, gold is chomping at the bit to make a surge.

Farsighted metal investors are patiently anticipating the macro equivalent of a starting pistol to announce gold’s run.

There are others, however, with less faith.

Bitcoin’s Latest Highs

Intoxicated by BTC’s latest price spike (then sudden fall…) or tired of waiting for precious metals to reflect what seems like now obvious inflation, speculators see the already galloping (or bucking?) cryptos as the better stallion to bet on.

But therein lies the critical distinction: Gold is not for betting, it’s for investing. It’s a wealth preservation asset, not a get-rich mania/speculation trade.

And though we see no reason to criticize BTC in order to prioritize gold (they both have their roles and profiles), we are, as we’ve written elsewhere, tired of comparting apples to oranges, and hence gold to crypto.

When assets hit new highs, sentiment will always follow price. Valuation never matters, until suddenly, it does…

BTC is getting attention now, just as gold will as well. Both share tremendous scarcity (and hence room to grow) as a percentage of global financial assets.

Meanwhile, for the minority (and it’s always a minority) of informed investors watching open-mouthed at the open unraveling of the global financial system, such observations are by now axiomatic and repetitive.

Long-term metal investors already know why gold will rise, even if none of us can say precisely when.

“Why” — Far More Important than “When”

As for gold’s “why,” the evidence, which we’ve been tracking week after week, is all around us.

In an increasingly surreal financial world of staggering debt levels, tanking economic growth, dying currencies, rising social division, central-bank-inflated risk assets and a steady trend toward decreased political honesty and increased governmental controls over our financial and personal lives, gold is more than just an asset discussion—it’s a growing and obvious necessity.

As a critical bulwark against this unprecedented convergence of risk factors, gold’s golden era has yet to fully begin: Its price surge is just a matter of patience and confirmations, not hope or headlines.

How can we know this?

Because the hope (as well as hype, manipulation, stimulus and double-speak) that has kept this openly un-natural market (and debt) bubble growing (while gold was deliberately tethered to a COMEX post) never gets the last word against the natural market forces favoring this equally natural (and precious) metal.

In other words, and for over 5000 years of one cyclical debt-party to debt (and currency) implosion after the next, gold has always, and we mean always, gotten the last laugh.

As for these natural (yet oft forgotten) market forces which favor gold, let’s keep this clear and blunt despite an otherwise embarrassingly opaque and deformed market setting.

Inflation—More than Just a “Debate”

Inflation, of course, is the most recent and obvious tailwind favoring gold.

From Paul Tudor Jones and Karl Icahn to the local grocery clerk, it’s fairly clear that inflation is now real rather than “transitory,” a warning we have been making for a long time.

And yet the majority of retail investors (see below) still cannot or will not accept inflation’s reality.

However, for those who bother to track expanding money supplies and contracting honesty from central bankers, the inevitability as well as current reality, of inflation comes as no surprise.

Again, this is because natural facts and forces are as simple to track as their lessons are simple to see, namely:

- Nations can’t spend and borrow to the tune of trillions without commensurate GDP growth and then call that a “recovery;” and

- Policy makers who subsequently pay for that debt by mouse-clicking trillions of dollars out of thin air while simultaneously denying the inflationary consequences of the same are literally lying to us.

False Hope Selling a False Monetary and Market Experiment

Sadly, however, there are many who still hang tightly to the hope that inflation will subside and that we’ll return to what Biden and Powell have described as a pre-COVID, “normalized inflation rate.”

How nice.

But rather than deconstruct such views or re-visit an already tired inflation-debate (or the real possibility of dis-inflationary—i.e., recessionary forces), it’s simply worth considering that the debate is no debate at all.

Why?

Inflation as Fact Rather than “Debate”

Because high inflation has already been the norm for years—the experts simply lied about it.

The pre-COVID, 2% inflation rate carefully engineered by the CPI magicians at the Bureau of Labor Statistics (BLS) was itself an open, long-lasting and quantifiable fiction.

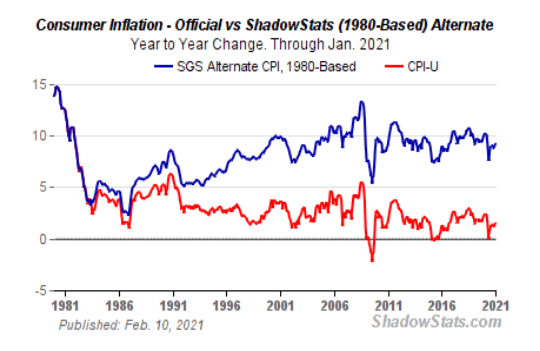

For years, and even prior to a “COVID-justified” monetary expansion gone-wild, actual consumer price inflation was far closer to 10% (see blue line below) than the falsely propagandized 2% data (red line below) which has been perennially spun out of DC’s statistical hallways and double-speaking Fed chairmen (and woman).

Let me repeat: Inflation was already here long before its debated arrival-date became the recent topic de jour among economic pundits.

Markets Prefer Fiction to Reality—But for How Long?

Yet throughout this inflationary reality, our liquidity-addicted financial systems turned a blind eye to such openly dishonest behavior (and reporting).

Like lovers who prefer sweet little lies over deceptive truths, markets loved the “low inflation reporting” (i.e., lies) from the policy makers for the simple reason that the fantasy of low inflation justified ever-more money printing and hence ever-more risk-asset pumping.

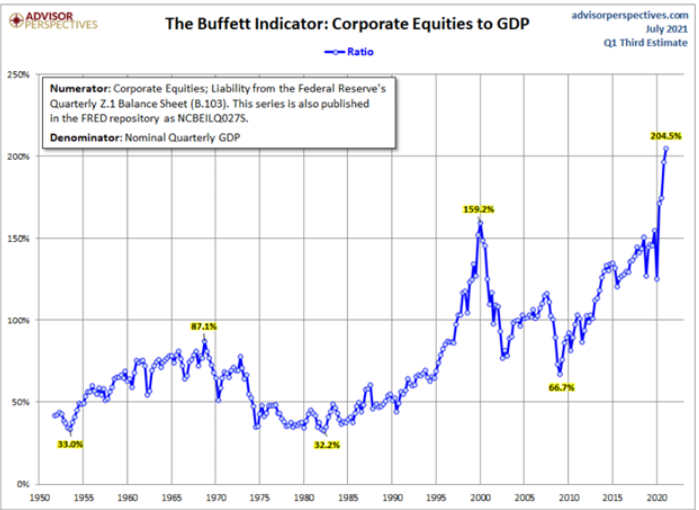

And as most already know, such liquidity “pumping” creates the greatest disconnect between bloated stock market valuations and tanking GDP ratios ever seen.

Instead of robust and rising economies, we get bloated stock markets. That is QE in a nutshell.

The extreme as well as unprecedented wealth generation, transfer and disparity from such bloated stock markets explains why policy makers allowed the BLS to convince themselves and the public that when it comes to reporting inflation, 2+2=1.

Fantasy Is Running Out of Faith

In recent months, however, even the Fed and the math tricksters in DC can’t entirely ignore (nor twist) the inflation facts (such as a 30% rise in apartment rentals…) evidenced by a year-over-year CPI rate of 5.4%.

Meanwhile, as Biden, Powell and other truth-challenged policy makers were telling the world this inflation was “transitory,” their colleagues over at the Social Security Administration were already planning a 6% cost-of-living-adjustments for 2022 based on rising rather than temporary inflation.

In short, and despite what DC reports or what Wall Street says (or hopes for), Main Street can already feel what the “experts” won’t confess, namely: Inflation is here.

What then, does that mean for the economy and markets in general and a potential gold surge in particular?

Inflation & The Economy

When the Atlanta Fed cuts its Q3 GDP forecast from 6% growth to just 0.5% growth, that suggests things are slowing down dramatically.

If you combine flat-lining economic growth with rising inflation, that boils down to stagflation ahead rather than a hopeful return to a delusional pre-COVID “normalcy,” which was never even close to normal anyway…

Meanwhile fiscal policy extravagance (aka “stimulus”) is creating even more inflationary wind speeds. There is now talk of paying illegal immigrants $450,000 to $1M per family as a result of indignities endured when crossing borders.

It’s worth noting that the families of soldiers who die for our country get only a $100,000 by comparison…

Whether DC’s proposed reconciliation and infrastructure bills tally $1.5T or $3T, when you add such staggering figures to the fiscal spending already passed in March and December, the undeniable consequences of such extravagance boils down to more fiscal-policy-driven inflation.

Period. Full stop.

As consumer prices rise, consumers spend less. If we tack on supply disruptions, that just sends inflation higher not lower.

Meanwhile, the Fed can do very little but print more money (also inflationary) to get increasingly less growth (stagflationary) for each new and debased dollar it prints.

And speaking of money printing…

What Can the Fed Do to Fight Inflation? The Non-Tapering Taper Ahead

It is expected, and even directly signaled by Powell, that in early November, the Fed will announce a gradual “tapering” of its $120B/month money printing.

I have said many times that a taper won’t happen because the Fed can’t afford to see bond yields (and hence interest rates) rise if the fed loosens its support for otherwise unwanted Treasury bonds.

As we’ve recently seen in Australia, any kind of taper send bonds tanking and yields/rates spiking…

But Powell, as usual, says not to worry, as the Fed will keep the Fed funds rate repressed at the same time it lightly tapers its support for longer-term Treasuries.

How nice.

But Powell is conveniently omitting to mention that despite being able to control the Fed funds rate, he can’t (at least for now) fix the yield on the longer-term bonds, whose yields rise when the money printing falls.

Rising yields, we remind, means rising rates; and at $28.5T and counting, Uncle Sam’s bar tab (like most of the debt-drunk companies on the S&P) can’t afford rising rates.

But as I also reminded in prior reports, taper or no taper, the Fed has other liquidity tricks up it sleeves to keep credit markets greased via the standing repo facility.

Thus, Powell’s half- disclosures are at least semi-accurate: He will taper yet keep rates near the floor.

This combination of more rate repression and more hidden liquidity (and hence higher inflation) despite an optic “taper” is ultimately quite bullish for our golden horse still waiting to surge out of its current price range.

The “Taper” & Stocks

A taper headline, however, will be less kind to most stocks, whose gross over-valuations have not mattered for years.

A taper, however, will change this…

We don’t think the proposed taper (and subsequent taper tantrum) has been fully priced into this insanely over-priced stock bubble.

As inflation from extreme fiscal spending and glacially “tightening” money printing continues, PE multiples on the most grossly over-priced (i.e., highest PE ranges) stocks will contract rather expand.

Since 2010 (and with the exception of the “COVID crash), every single market dive in this otherwise central-bank-driven (and entirely artificial) market occurred whenever the Fed i) tapered its money printing or ii) attempted a rate hike.

Every dive. Every time.

The “Taper” & Precious Metals

But what about gold, and of course silver too?

Why are they so uniquely and perfectly poised to gallop ahead of a tanking economy and precariously bloated market?

Many, including the crypto-crowd, are enjoying the recent BTC moves and frowning upon that barbarous relic gold, which has been yawning this year as cryptos like BTC jumped to (+66K) yet fell within 10 days (to $58K) in price swings that give entirely new meaning to vertigo.

Ironically, however, such crypto price swings (as opposed to “consolidation periods”) are precisely why comparing gold to cryptos as a store of value is simply, well, silly.

Gold doesn’t bounce to the moon nor sink to the basement with such stomach-churning speed for the simple reason it’s a real asset rather than a speculative ping-pong ball.

But for those bemoaning the current pause in precious metal pricing, it’s worth reminding that gold rose by 25% (and silver by 40%) in 2020, and we are more than confident (see below) that a similar, as well as steady, move north is as inevitable as the sun rising in the east (or a horse sprinting out of an open gate).

For now, precious metals are not racing north for the simple yet ironic reason that 2/3 of investors, according to a Bank of America poll, still think (hope) that the above-described inflation is transitory.

Unfortunately, hope is not a wise investment plan.

Rising Rates, Rising Gold

Additionally, there are many who think that rising rates (yields) from a pending “taper” will make the dollar stronger and hence gold weaker.

That too is a misunderstanding of history and math—as well as gold.

In fact, gold can surge even as rates rise, so long as inflation outpaces rates, which, as we’ve explained many times, is the deliberate trend going forward.

Despite words to the contrary, the harsh reality is simple: Debt-soaked sovereigns need negative real rates to inflate their way out of unprecedented debt levels.

Stated simply: Broke nations seek inflation rising higher than rates.

Thus, despite rate hike fears as well as realities, we maintain that gold has been finding its bottom, with no where to go but considerably upwards.

That is, when markets fear a rate hike (as in December of 2015 when the Fed pursued rate hikes for the first time in seven years), gold bottomed before ripping northward.

Similarly, in the 1970’s, gold rose as rates rose, because inflation was outpacing the rate hikes.

Years later, when the Fed funds rate leapt from 1% to 5.25%, gold doubled in price as rates rose.

The Perfect Setting for a Gold Surge

Such a setting, of course, is precisely where we are now and where we are heading even faster tomorrow: Inflation rising well ahead of rising rates.

Once markets accept (rather than hope away) this inflationary realpolitik, gold will surge to easily surpass its 1980 trends, whose prior highs when adjusted for inflation, will soon put gold well above $2500—with lots of track space to run faster and further.

In short: Those riding the golden horse are about to experience a lot of speed, range and strength.

Saddle up.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD