Dollar Illiquidity — The Ironic Yet Ignored Spark for the Next Crisis

In October of 2019, I began writing/warning of the ignored yet ominous signals coming out of the repo and Eurodollar markets and what the illiquidity (i.e., lack of availability) of U.S. Dollars portended for our markets in the coming years.

Well, those years have since arrived.

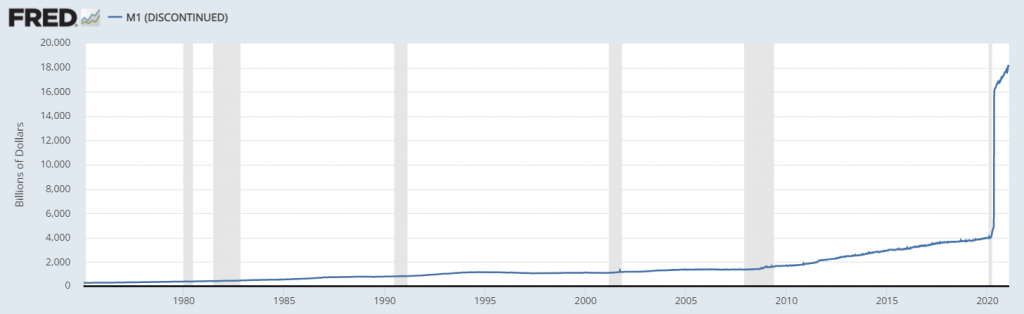

Such dollar illiquidity may seem hard to imagine in a world otherwise awash in printed currencies and expanding money supplies.

But what I warned then is no different than what is happening now: The Fed is gonna need to print a lot more dollars.

In other words, today’s hawks will once again become tomorrow’s doves.

Why?

Because there were and are just not enough liquid dollars today to meet the fantastic array of nuanced and complex dollar demand in both U.S. and global markets.

The First Tremors—2019 Repo Woes

As Egon von Greyerz and I have said many times, the first overt signs of this danger in the cash-poor (i.e., illiquid) repo market which reared its “repo head” in September of 2019.

This was a neon-flashing signal of long-term trouble ahead. And it had nothing to do with COVID…

Informed investors in the autumn of 2019 had sifted through all the confusing minutia and noise behind the September panic in the otherwise open-fraud scheme that is the U.S. repo market (i.e., private banks levering GSE deposits for guaranteed payouts from Uncle Sam which the U.S. taxpayer funds).

Despite all this noise, and despite being completely ignored (and deliberately downplayed) by an otherwise teenage-savvy mainstream financial media, the entire repo story simply boiled down to this: There weren’t enough available dollars to keep it (and the banks) going.

As a result, the 2019 Fed printed more dollars and immediately dumped a $1.5 trillion rollover facility into the repo pits.

Much, much more followed.

After all, there’s nothing a money printer can’t temporarily solve.

Unfortunately, however, this gaping wound in the repo markets was not an isolated event, but rather a symptom of a much larger and systemic problem that was equally responsible for the crisis of 2008, namely: Not enough dollars.

More importantly, such dollar illiquidity will be the key factor in the next financial crisis.

Second Tremor: The Misunderstood Eurodollar Market

This percolating liquidity crisis has a lot to do with the Eurodollar market, an ignored little corner of the global financial cesspool which very few investors understand.

This is because the Fed and the U.S. Treasury are still perceived as the official overseers of U.S. Dollar supply.

Many investors still assume that these institutions know what they are doing and are “in control.”

If only this were true…

In reality, the Fed is becoming increasingly cornered and dysfunctional when it comes to managing U.S. Dollar liquidity.

Why?

Because the Fed is not in fact in control of the supply of U.S. Dollars; instead, more of the power lies in the media-ignored Eurodollar markets.

THE Ticking Time Bomb

Almost no one gets the Eurodollar “thing.” Almost no one sees it, yet it’s a ticking time bomb.

So, what is the ticking time bomb that almost no one is publicly touching upon?

What is the silent poison lurking beneath our national and global market system which no one at the Eccles Building, the White House, or the Treasury Department is discussing, let alone fully understanding?

How the Eurodollar System is Quietly Killing U.S. and Global Markets

In basic terms, a Eurodollar is just a U.S. Dollar held on deposit anywhere (not just in the Eurozone) outside of the U.S.

Simple enough.

One can therefore think of foreign banks like SocGen or Deutsche Bank making simple, clean, and direct loans to foreign companies denominated in these “Euro” dollars – i.e., U.S. Dollars held overseas.

But nothing the big banks do ever stays simple, clean, or direct for very long.

These bankers just can’t help themselves when it comes to leverage, short-term profits and long-term distortions. This is particularly true of what they’ve done with the Eurodollar.

A Brief History of Distortion

In fact, Eurodollars have been floating around the world in greater force since the mid-1950s.

But banks (and bankers) always come up with clever ways to make simple Eurodollar transactions complex, as they can easily hide all kinds of greed-satisfying and wealth-generating schemes behind such deliberate Eurodollar complexity.

Specifically, rather than foreign banks using U.S. Dollars overseas (i.e., Eurodollars) to make simple, direct loans to corporate borrowers that can be easily tracked and regulated on the asset and liability columns of offshore bank balance sheets, these same bankers have spent the last few decades getting more and more creative with the Eurodollar – which is to say, more and more toxic and out of control.

Rather than using Eurodollars for direct loans from Bank “X” to Borrower “Y,” offshore financial groups have been busy using these Eurodollars for complex inter-bank borrowing, swap schemes, futures contracts, and levered derivative transactions.

In short, and once again: More derivative-based poison (and extreme banking risk) at work.

The Fed Losing Control of Its Own Dollar

These mind-numbingly complex Eurodollar transactions have acted as extreme dollar multipliers entirely outside the purview or control of regulatory bodies like the Fed and now exist at what is essentially infinite leverage multiples.

When U.S. banks like Bear Sterns or Lehman Brothers, for example, were leveraging U.S. Dollars in subprime derivative landmines at leverage multiples of 60:1, that was a problem.

A big problem. Remember?

Unfortunately, what we have been seeing (and the media ignoring) in the unregulated Eurodollar market is a leverage ratio of U.S. Dollars that is much, much, much higher – and makes the Bear Sterns of 2008 seem like child’s play by comparison today.

And what this basically boils down to is that the actual amount of U.S. Dollars in overseas, shadow banking Eurodollar transactions is massively beyond the pale of what the Fed thinks it is, and, more importantly, is massively beyond the pale of anything that even the Fed can control.

How Can There Be a Dollar Shortage?

But wait, you’re probably asking: Matt, you just warned there’s not enough dollars, but now you’re saying that such Eurodollar schemes have dramatically increased (i.e., levered) the amount of dollars in circulation.

What gives?

Well, stick with me.

You see, all those complex derivative schemes in Eurodollars increases their amount, but then tangles them up into so much non-liquid confusion that the end result is far fewer dollars in actual circulation.

Crazy but true.

Thus, as Powell tinkers with adjusting interest rates and printing or tapering more money here in the U.S. to ostensibly “control” the amount and price of U.S. Dollars, he is effectively chasing windmills, or playing chess as Rome burns.

There are now trillions in uncontrollable/unregulated U.S. Dollar liabilities floating around (and clogging up) an uber-complex international banking and Eurodollar based derivatives system.

Unfortunately, this system is so interconnected and beyond the measures of complexity theory that trying to untie these Eurodollar financial knots and counter-party complexities would be akin to untying the knots of 1,000,000,000 fly-fishermen all at once.

In other words, impossible.

With all these U.S. Dollars (trading as “Eurodollars”) tied up in countless and unregulated banking schemes and derivative instruments, the actual amount of available U.S. Dollars is inextricably tied up in all these toxic “knots.”

As a result, there are simply less dollars available for use (including emergency use) in these over-levered/risk-high markets – which is what the fancy lads call a “liquidity problem.”

In fact, despite all the well-deserved attention subprime mortgages received for being the cause of the 2008 Great Financial Crisis, here’s a little secret from inside Wall Street:

The subprime instruments were the “patient zero” of the 2008 disaster, but the real killer in 2008 was dollar illiquidity, much of which was tied up in these Gordian Eurodollar knots of which almost no one understands, discusses or knows how to control.

In short: Today we have a similar ticking time bomb. A Eurodollar time bomb.

Defusing the Eurodollar Liquidity Crisis?

So how can we diffuse this ignored and misunderstood time bomb?

Well, even the grandfather of debt, John Maynard Keynes, warned about this in 1944; the head of the People’s Bank of China warned about this in 2011; and in the summer of 2019, Mark Carney, the Governor of the Bank of England, warned about this at the Fed’s little banker retreat in Jackson Hole.

What was the suggested option from the head of England’s central bank?

Simple – we need to replace the U.S. Dollar as the world’s reserve currency with a neutral, electronic currency to settle international payments with a new, floating system that replaces the dollar.

That’s a big deal. And yet it never made the headlines. Big shocker, eh?

The sad but hidden and otherwise undeniable truth of the matter is that the U.S. Dollar is no longer under the control of an increasingly clueless Federal Reserve.

Every Crisis is a Liquidity Crisis

When the supply of dollars tightens/shortens, crisis always follows, every time, for every market crisis is, at root, a liquidity crisis.

Again, we saw a brief taste of this dollar shortage during the repo scare of September 2019.

But that was mere child’s play compared to what prior crises of dollar illiquidity can and have done to markets, as we saw in 2008, when our markets suffered over $2 trillion (!) in U.S. Dollar shortages (aka, “funding gap”).

How was this “gap” filled?

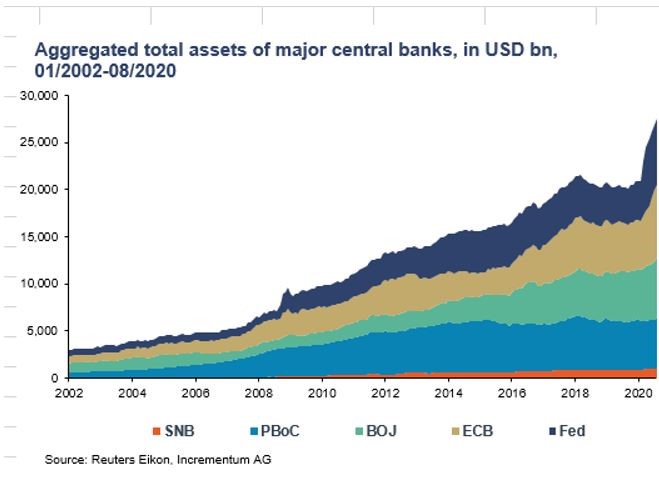

You guessed it: Global money printing gone wild.

Going forward, and with the recent (and completely downplayed) tremors of the cash-poor repo market still in our rear-view mirror, the insiders in D.C. and Wall Street are bracing themselves for further crises of dollar illiquidity – i.e., major market disasters driven by “funding gaps” – aka a lack of enough dollars.

The Fed knows this as well – but just barely. They certainly are in no position today to simply release the U.S. Dollar from its global reserve status.

That takes years, but the IMF has effectively telegraphed that it’s coming.

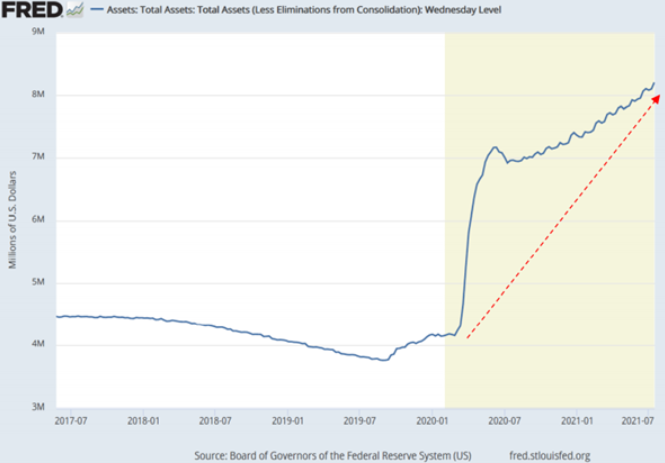

In the interim, this means that the only current tool available to the Fed when the next dollar-liquidity crisis sends our markets and economy over yet another cliff will be more desperate and last-minute money printing, despite the fact that they are now signaling a taper for early 2022 (!).

Longer term, such inevitable money printing will be good for gold.

Told You So…

In 2019 and 2020, I warned of this. I warned of massive, unimaginable money printing and full-on debt monetization ahead due to massive dollar illiquidity.

In case you don’t believe me, just see for yourselves in this re-published, ad-hoc warning originally released in March of 2020, here.

Since that warning, the Fed’s balance sheet has more than doubled.

Facts really are stubborn things, no?

Investing in the New Abnormal

Of course, such measures have nothing at all to do with capitalism or free markets.

Central and commercial banks have kissed those old values and systems goodbye.

Today, we now live, invest, and trade in a centralized market in which central banks have and are losing control over the supply of the U.S. Dollar in offshore, shadow banking Eurodollar schemes who’s embedded, levered, illiquid and complex risks, dangers, and extremes are understood by only a handful of insiders and would frankly require hundreds of more pages here to fully unpack.

What YOU need to take away from all of this complexity is quite simple: Normal business cycles are now extinct, replaced instead by central bank liquidity cycles which ultimately destroy currencies.

Natural supply and demand forces, including for dollars, has been replaced by money printing from the central banks.

More and more dollars will be printed down the road, not because we “think so,” but simply because there is literally no other way to keep this now totally rigged-to-fail system afloat.

As for market volatility and the safety and growth of your money in such a toxic and complex backdrop, we admit that it is becoming increasingly hard to rely upon old predictive measures of market risk or even recession timing to fully make sense of the Twilight Zone in which we now find our capital markets.

We truly are in uncharted and completely distorted waters, where risk outweighs reward at nearly every turn.

This is new terrain for all of us.

The Current Landscape – Hawkish Hubris

Thus, if you are wondering why the USD is up (relatively, as opposed to purchasing-power) despite insane levels of mouse-clicked money creation and broad money supply expansion, it’s simple: Those dollars are tied up in a derivative-based Eurodollar ball of knots.

With not enough liquid dollars available, dollar-demand is up, and hence so is the USD.

Needless to say, for those nations who owe USD-denominated debts, finding and paying for the owed dollars is getting harder, which explains why the Turkish lira is tanking, dropping 30% vs. the USD in November alone…

Other cracks as well as signals in this distorted, Dollar-thirsty financial landscape include more volatility now and ahead.

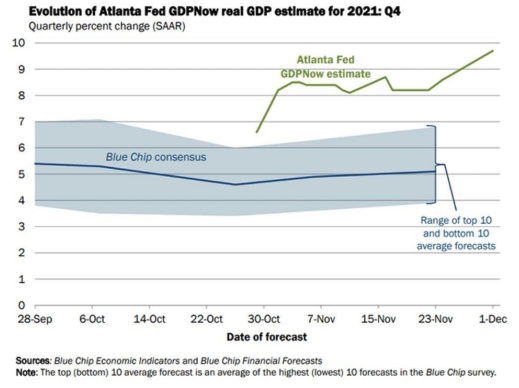

Recent swings in the S&P 500 (worst quarter since 2011) and BTC’s 20% drop in perfect tandem with the Wall Street sell-off are obvious examples, as well as harbingers of more pain to come, despite Jim Cramer’s pathetic (December 9th) cry that the U.S. is “the strongest economy ever seen,” and a “marvel to behold.”

Poor Cramer was likely referring to the Atlanta Fed’s bullish GDP estimate for Q4:

But cheerleaders like Cramer are overlooking the flattening U.S. yield curve which suggests the bond market feels such strength is temporary at best.

The Future Landscape—Doves (and Pain) Ahead

Meanwhile, as dollar illiquidity rises, and pandemic benefits fade, the Fed stubbornly sticks to its hawkish plan to taper/tighten liquidity into 2022—thereby adding gasoline to a risk asset fire and fiscal cliff crushing just about every asset class but the USD, UST and the VIX.

With the U.S. debt/GDP at a ratio of 122%, any hope for sustainable GDP growth and the delevering of US debt in such a backdrop without causing markets to tank is pure fantasy.

In other words: tic toc, tic toc…

In short, if the taper collides with the aforementioned yet hidden dollar illiquidity, get ready for an extremely bumpy and unpleasant 2022 and hence a sudden reversal of the Fed’s now hawkish stance.

When the doves and extreme money printing (and hence currency debasement) return, gold will be waiting, as always, to get the last word.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD