Matthew Piepenburg

Partner Matt began his finance career as a transactional attorney before launching his first hedge fund during the NASDAQ bubble of 1999-2001.Thereafter, he began investing his own and other HNW family funds into alternative investment vehicles while operating as a General Counsel, CIO and later Managing Director of a single and multi-family office. Matthew worked closely as well with Morgan Stanley’s hedge fund platform in building a multi-strat/multi-manager fund to better manage risk in a market backdrop of extreme central bank intervention/support. The conviction that precious metals provides the most reliable and longer-term protection against potential systemic risk led Matt to join VON GREYERZ.

The author of the Amazon No#1 Release, Rigged to Fail, Matt is fluent in French, German and English; he is a graduate of Brown (BA), Harvard (MA) and the University of Michigan (JD). Along with Egon von Greyerz, Matthew is the co-author of Gold Matters, which offers an extensive examination of gold as an historically-confirmed wealth-preservation asset.

Insights & Articles

Getting Ready for Gold’s Golden Era

Worried about gold sentiment? Don’t be. The mainstream view of gold right now is an open yawn, and sentiment indicators for this precious metal are now at 3-year lows despite the gold highs of last Au...

Matthew Piepenburg / March 15, 2021

Read More

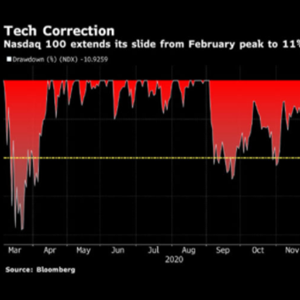

Rigged to Fail—From Musk to Powell

For quite some time we have been warning about the rising shark fin of rising yields and rates. As of this writing, one can almost hear John Williams’ orchestral theme song to Jaws ringing in the ear...

Matthew Piepenburg / March 12, 2021

Read More

The Fed’s Most Convenient Lie: A CPI Charade

Despite a penchant for double-speak that would make a politician blush, the Fed tells us that its primary focus is unemployment not inflation. Let me remind readers, however, that an openly nervous Mr...

Matthew Piepenburg / March 9, 2021

Read More

„KONTROLLIERTE“ ZINSERTRÄGE WEISEN RICHTUNG GOLD

Ungeachtet persönlicher politischer Ansichten dürften sich die meisten über Folgendes einig sein: Extrem komplexe Sachverhalte werden in der Regel in extrem irreführende Schubladen gesteckt.

Matthew Piepenburg / March 3, 2021

Read More

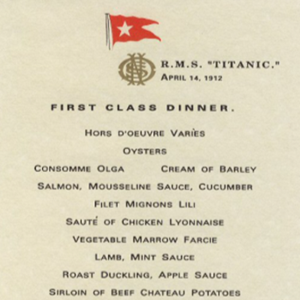

A TITANIC INDICATOR FOR GOLD’S RAPIDLY RISING FUTURE

I’ve often joked that fretting over delusional price moves in individual stock names in a market Twilight Zone is akin to fretting over the desert choices on the Titanic’s dinner menu.

Matthew Piepenburg / March 1, 2021

Read More

TOXISCHE BEZIEHUNGEN BEENDEN, ZURÜCK ZUM GOLD

Hier nehmen sich Märkte und Liebe nicht viel: Warum fällt es so schwer, Bekanntes hinter sich zu lassen, wenn es doch eindeutig nicht funktioniert?

Matthew Piepenburg / February 24, 2021

Read More

THE DEATH OF LOGIC

Just over four years ago, as Bitcoin was making its first big moves in both price and public perception, John Hussman of Hussman Investment Trust penned a lengthy as well as seminal report entitled, “...

Matthew Piepenburg / February 22, 2021

Read More

PHILOSOPHIE DER SCHULDEN, EDELMETALL-MATHEMATIK

Oft sind es die unerwarteten Quellen, die uns Markteinblicke gewähren. Einer der populärsten, ja innig geliebten Harvard-Professoren war beispielsweise kein Ökonom, sondern der brillante (und somit a...

Matthew Piepenburg / February 14, 2021

Read More

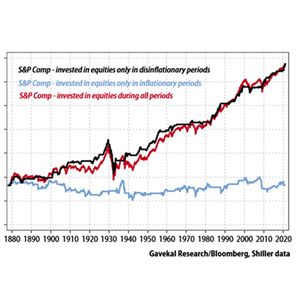

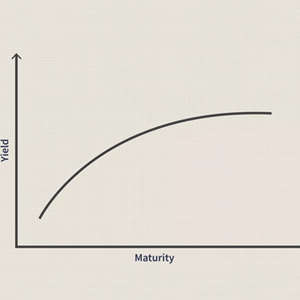

“CONTROLLED” YIELDS ARE CURVING TOWARD GOLD

Regardless of one’s politics, most would agree that extremely complex issues are typically given extremely misleading titles. Not all those of the extreme left, for example, are all that “woke” and no...

Matthew Piepenburg / February 12, 2021

Read More

FROM PITCH FORKS TO TRADING APPS: THE NATIVES ARE GETTING RESTLESS

Mark Twain once quipped that a lie can travel around the world faster than it takes the truth to put its boots on. But now the truth behind years and years of open lies masquerading as fiscal or monet...

Matthew Piepenburg / February 10, 2021

Read More

ENDING TOXIC RELATIONSHIPS, RETURNING TO GOLD

Breaking Up is Hard to Do - In markets, as in love, it’s obviously hard to let go of something familiar yet clearly not working; but as all sober romantics eventually discover: Toxic relationsh...

Matthew Piepenburg / February 8, 2021

Read More

Gold: Anklage und Verteidigung & Bitcoin

Die meisten Juristen eint die Fähigkeit, zwei Seiten eines Falls in Betracht zu ziehen, ungeachtet der ersten persönlichen Einschätzung.

Matthew Piepenburg / February 3, 2021

Read More