Matthew Piepenburg

Partner Matt began his finance career as a transactional attorney before launching his first hedge fund during the NASDAQ bubble of 1999-2001.Thereafter, he began investing his own and other HNW family funds into alternative investment vehicles while operating as a General Counsel, CIO and later Managing Director of a single and multi-family office. Matthew worked closely as well with Morgan Stanley’s hedge fund platform in building a multi-strat/multi-manager fund to better manage risk in a market backdrop of extreme central bank intervention/support. The conviction that precious metals provides the most reliable and longer-term protection against potential systemic risk led Matt to join VON GREYERZ.

The author of the Amazon No#1 Release, Rigged to Fail, Matt is fluent in French, German and English; he is a graduate of Brown (BA), Harvard (MA) and the University of Michigan (JD). Along with Egon von Greyerz, Matthew is the co-author of Gold Matters, which offers an extensive examination of gold as an historically-confirmed wealth-preservation asset.

Insights & Articles

Gold: Patiently Waiting for the Hangover in Global Markets

In this engaging interview with ParadePlatz’s Lukas Heassig, Matterhorn Asset Management principal, Matthew Piepenburg, sits down at MAM’s Zurich office to discuss gold ownership in an increasingly vo...

Matthew Piepenburg / May 30, 2022

Watch Now

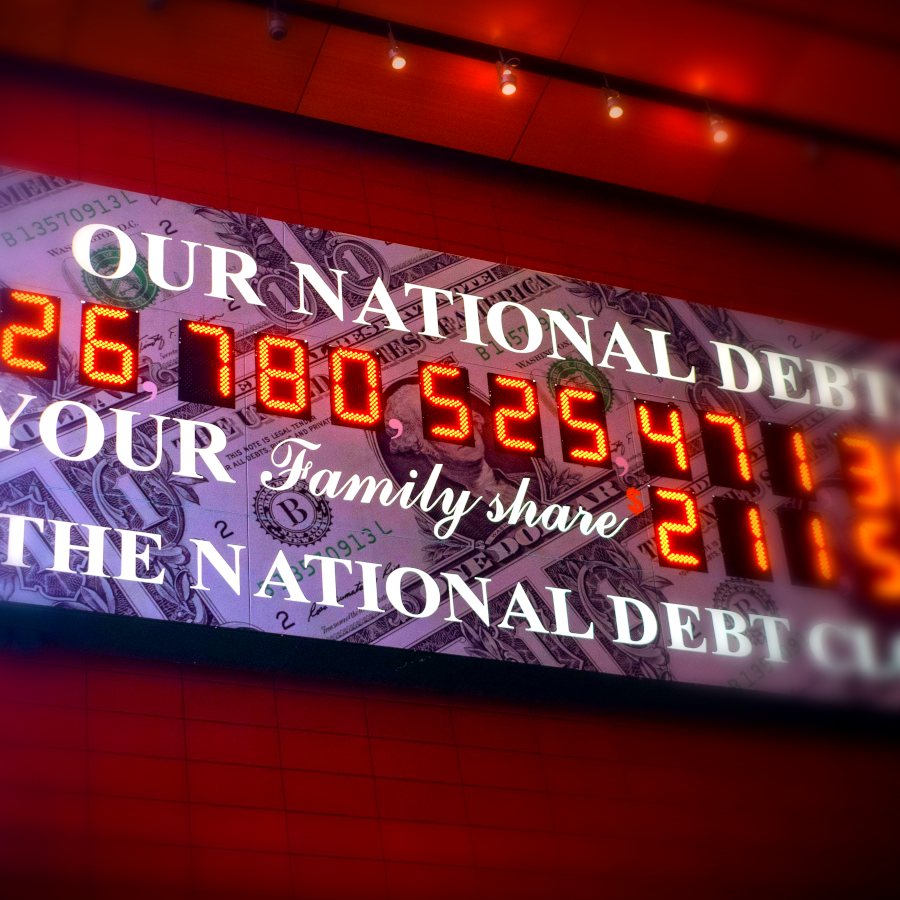

The Handbook for Debt-Soaked Nations: Lie, Print, Inflate & Finger-Point

As we have warned from the very onset of this otherwise avoidable war in Ukraine, the backfiring of Western sanctions against Putin (de-dollarization, inflationary tailwinds and increasingly discredit...

Matthew Piepenburg / May 24, 2022

Read More

Politicized Money and the Death of Capitalism

Everything, including money, is politically-self-serving rather than economically free-market. Capitalism is dead. The folks in office to “save you” are mostly interested in saving their positions and...

Matthew Piepenburg / May 11, 2022

Read More

Dark Forces, Plain Speak, Brighter Gold & The Fed’s Sick End Game

As usual, the end game will boil down to yield curve controls and more money printing, which means more currency debasement and a central bank system that secretly (and historically) favors inflation...

Matthew Piepenburg / April 22, 2022

Read More

Gold vs. An Openly Failing/Changing World

As central bankers play checkers on a global debt chessboard, we see below how policy hypocrisy, worsening monetary options, failed diplomacy, tanking bonds, rising rates, debt addiction, mismanaged s...

Matthew Piepenburg / April 13, 2022

Read More

Sanctions Spur a Massive Decline in Western Hegemony as the World De-Dollarizes

Matthew Piepenburg, sits down with Tom Bodrovics of Palisades Gold Radio to discuss the seismic shifts in the global financial system now emerging in the wake of Russian sanctions and the implications...

Matthew Piepenburg / April 1, 2022

Watch Now

How the West Was Lost: A Faltering World Reserve Currency

Debt destroys nations, financial systems, markets, and currencies. Always and every time. The inflationary financial system is now failing because its debt levels have rendered it impotent to grow eco...

Matthew Piepenburg / March 30, 2022

Read More

Why Gold Will Rise — The Financial System Has Changed

As the world focused keenly on Ukraine, few noticed the extent and magnitude to which the entire world financial system changed overnight. The consequences of this titanic shift are difficult to overs...

Matthew Piepenburg / March 16, 2022

Read More

Ukraine War Headlines: Tough Talk + Real Math = Bad Options

Taken as a whole, all the chest puffing—from Boris to Biden—ignore the colder realities of the USD’s teetering reserve status, oil market realism (and inflation), Sino-Russian chess skills and record-...

Matthew Piepenburg / March 2, 2022

Read More

Swiss Safety in a World of Market Bubbles, Distorted Currencies and Global Saber Rattling

As geo-political fires burn around the world, we are reminded of the importance of safety and stability in the jurisdictions of gold investment. If private gold holdings are subject to political whim...

Matthew Piepenburg / March 1, 2022

Watch Now

How Markets Tank & Gold Rises

One of gold’s many attributes is its historical honesty, and as far as we see it, as gold rises, it calls “BS” on the recent tough-talk from on high. Markets, for example, expected gold to fall hundre...

Matthew Piepenburg / February 18, 2022

Read More

Goldman Sachs & Bridgewater: Virtue-Signal as Implosion Looms

Although it may seem refreshing to see folks at Goldman or Bridgewater taking public swings at the Fed, it’s far too little and far too late. The warnings they are making today are the very same we’ve...

Matthew Piepenburg / February 2, 2022

Read More