Egon von Greyerz

Founder and Chairman Born with dual Swiss/Swedish citizenship, Egon's education was mainly in Sweden.Egon von Greyerz began his professional life in Geneva as a banker and thereafter spent 17 years as the Finance Director and Executive Vice-Chairman of Dixons Group Plc. During that time, Dixons expanded from a small photographic retailer to a FTSE 100 company and the largest consumer electronics retailer in the UK.

During the 1990s, Egon von Greyerz became actively involved with financial investment activities including mergers and acquisitions and asset allocation consultancy for private family funds. This led to the creation of VON GREYERZ as an asset management company based on wealth preservation principles.

VON GREYERZ is now the world’s leading company for direct investor ownership of physical gold and silver outside the banking system. Our vaults include the biggest and safest gold vault in the world, located in the Swiss Alps. Clients include High Net Worth Individuals, Family Offices, Pension Funds, Investment Funds and Trusts in over 90 countries.

Egon von Greyerz makes regular media appearances and speaks at investment conferences around the world. He also publishes articles on precious metals, the world economy and wealth preservation.

Insights & Articles

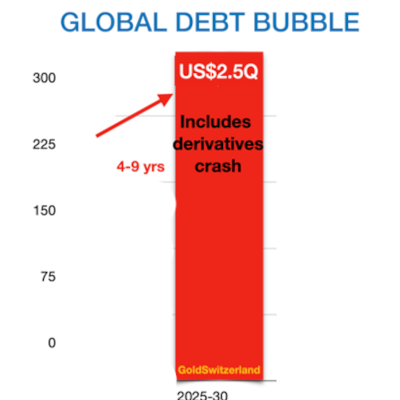

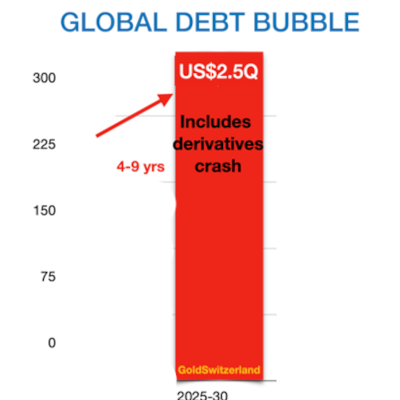

$2 QUADRILLION DEBT PRECARIOUSLY RESTING ON $2 TRILLION GOLD

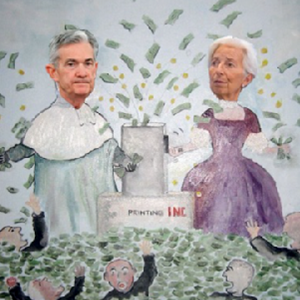

It is obviously debt creation, money printing and the resulting currency debasement which creates the inevitable fall of yet another monetary system. This has been the norm throughout history so “the...

Egon von Greyerz / October 28, 2022

Read More

WITH STOCKS AND DEBT UP 50X IN 50 YEARS HOW FAR WILL THEY COLLAPSE?

With stocks, bonds and property in major bear markets, investors are desperately hoping (and praying) that the Fed and other Central banks will come to their rescue. But this time it is different. (Yo...

Egon von Greyerz / October 14, 2022

Read More

Credit Suisse & USD Policy: Signposts of Systemic Implosion to Gold Explosion

In this latest MAMChat, Matterhorn Asset Management principals, Egon von Greyerz and Matthew Piepenburg, discuss a range of current yet undeniably important as well as converging themes. This, of cour...

Egon von Greyerz / October 7, 2022

Watch Now

GLOBALER FINANZSTURM VON EPISCHEN AUSMASSEN

Die dunklen Jahre rücken näher und die Welt geht in den Überlebensmodus über. Zugegeben, wer heute in ein gehobenes Restaurant in New York, London oder Zürich geht, wird dort keinen Hinweis auf Elend...

Egon von Greyerz / October 6, 2022

Read More

GLOBAL FINANCIAL STORM OF EPIC PROPORTIONS

As the dark years are approaching, the world is now approaching survival mode. Admittedly, if you go to a high class restaurant in New York, London or Zurich, there are no signs of misery but instead...

Egon von Greyerz / September 28, 2022

Read More

Is Moscow Changing the Chessboard of Gold Pricing?

In Part II of this two-part interview with Michelle Makori of Kitco News, Matthew Piepenburg addresses a range of ongoing shifts in a global financial system forever altered by Western sanctions again...

Egon von Greyerz / September 19, 2022

Watch Now

Rising Inflation, Falling Markets and False Facts All Point to Gold

In Part I of this two-part interview series with Michelle Makori of Kitco News, Matthew Piepenburg addresses the latest (and “official”) CPI inflation data. Higher than expected inflation figures sent...

Egon von Greyerz / September 15, 2022

Watch Now

30% STOCK CRASH NEXT WITH GERMANY KAPUT & US INSOLVENT

The current stock market crash has the potential to extend to a 30% fall in the next few weeks on the way to a 90% fall in coming years. That the Dark Years would be coming has been clear to me for m...

Egon von Greyerz / September 14, 2022

Read More

Historical Market Falls, Collapsing Currencies and Soft Statesmen vs. Rising Hard Assets

In this brief (20-minute) interview with Wall Street Silver, Matterhorn Asset Management founder, Egon von Greyerz, discusses US and global markets, precious metal pricing and the inevitable rise in h...

Egon von Greyerz / September 12, 2022

Watch Now

NO ELECTRICITY, NO MONEY, LITTLE FOOD – RESULT MISERY

The circumstances now are considerably more dire than in the 1970s. And the consequences will be exponentially worse. Everything is more serious today, debts, deficits, size of asset bubbles in stock...

Egon von Greyerz / September 2, 2022

Read More

The Era of Fake Money is Gone – Interview with Egon von Greyerz

In an interview with USA Watch Dog's Greg Hunter, Egon von Greyerz discusses his outlook for the world economy: "It appears clear to me we are going to see a 30% or so fall in the markets in the next...

Egon von Greyerz / August 31, 2022

Watch Now

AN AUTUMN WITH EPIC COLLAPSES OF STOCKS, DEBT, CURRENCIES, MUCH HIGHER INFLATION – LEADING TO POVERTY & SOCIAL UNREST

As generally is the case before major turns in markets, optimism is still high. But this autumn is likely to change all that as the unfortunate realities of our situation finally hit the world.

Egon von Greyerz / August 17, 2022

Read More