Egon von Greyerz

Founder and Chairman Born with dual Swiss/Swedish citizenship, Egon's education was mainly in Sweden.Egon von Greyerz began his professional life in Geneva as a banker and thereafter spent 17 years as the Finance Director and Executive Vice-Chairman of Dixons Group Plc. During that time, Dixons expanded from a small photographic retailer to a FTSE 100 company and the largest consumer electronics retailer in the UK.

During the 1990s, Egon von Greyerz became actively involved with financial investment activities including mergers and acquisitions and asset allocation consultancy for private family funds. This led to the creation of VON GREYERZ as an asset management company based on wealth preservation principles.

VON GREYERZ is now the world’s leading company for direct investor ownership of physical gold and silver outside the banking system. Our vaults include the biggest and safest gold vault in the world, located in the Swiss Alps. Clients include High Net Worth Individuals, Family Offices, Pension Funds, Investment Funds and Trusts in over 90 countries.

Egon von Greyerz makes regular media appearances and speaks at investment conferences around the world. He also publishes articles on precious metals, the world economy and wealth preservation.

Insights & Articles

AS WEST, DEBT & STOCKS IMPLODE, EAST GOLD & OIL WILL EXPLODE

As Rogoff said: “We were very fortunate that we didn’t have a global systemic event in 2022, and we can count our blessings for that, but rates are still going higher and the risk keeps rising.” But...

Egon von Greyerz / January 27, 2023

Read More

Gold’s Rise as Freedoms Decline—The New Centralized Normal

In his most recent discussion with Tom Bodrovics of Palisades Gold Radio, Matterhorn Asset Management principal, Matthew Piepenburg, weaves together the various threads of historical cycles, political...

Egon von Greyerz / January 23, 2023

Watch Now

2023: As Markets Implode, Gold is Poised to Explode

In this 20-minute MAMChat, Matterhorn Asset Management principals Egon von Greyerz and Matthew Piepenburg open 2023 with an informal yet blunt look at the twin nuclear risks of: 1) a rising geopoliti...

Egon von Greyerz / January 11, 2023

Watch Now

OMINOUS MILITARY & FINANCIAL NUCLEAR THREATS COULD ERUPT IN 2023

The world is today confronted with two nuclear threats of a proportion never previously seen in history. These threats are facing us at a time when the world economy is about to turn and decline preci...

Egon von Greyerz / January 10, 2023

Read More

Egon von Greyerz Answers the Big Questions as the World Tilts Towards Even Bigger Risk

In this compelling and timely Q & A exchange with Investor Talk’s Jan Kneist, Matterhorn Asset Management (MAM) founder, Egon von Greyerz answers a wide range of the most pressing investor questions a...

Egon von Greyerz / December 23, 2022

Watch Now

US DOUBLESPEAK WILL NOT STOP GOLD’S IMMINENT SURGE

Propaganda, lies and censorship are all part of desperate governments actions as the economy disintegrates. We are today seeing both news and history being rewritten to suit the woke trends that perm...

Egon von Greyerz / December 14, 2022

Read More

From Broken Macros to Precious Metals: von Greyerz, Williams & Stoeferle Highlight Gold’s “Light Bulb Moment”

In this compelling and timely MAMChat, Matterhorn Asset Management (MAM) founder, Egon von Greyerz, along with reputed MAM advisors, Grant Williams and Ronni Stoeferle, share unique insights on the mo...

Egon von Greyerz / December 10, 2022

Watch Now

IN THE END THE $ GOES TO ZERO AND THE US DEFAULTS

With US and Global debt exploding prior to both assets and debt imploding, let us look at the disastrous consequences for the US and the world. Debt explosion leading to the currency becoming worthle...

Egon von Greyerz / December 1, 2022

Read More

TIME TO GET OFF THE CRASHING CRYPTOWAGON AND JUMP ON THE GOLDWAGON

Is the $32 billion collapse of the crypto exchange FTX the catalyst for the fall of the financial system? We will soon know but at least the GOLD - CRYPTO debate was settled last week for the ones wh...

Egon von Greyerz / November 15, 2022

Read More

Von Greyerz, Stoeferle & Piepenburg Agree: “Gold Is Just Fine”—Here’s Why

In this special MAMChat “trio” recently recorded in Munich, Matterhorn Asset Management (MAM) principals, Egon von Greyerz and Matthew Piepenburg, exchange thoughts on the latest market and gold devel...

Egon von Greyerz / November 11, 2022

Watch Now

$2.5 Quadrillion Disaster Waiting to Happen – Egon von Greyerz

In this interview with Greg Hunter's USAWatchdog Egon von Greyerz explains, “Credit has increased dramatically through derivatives. All instruments being issued now by banks, pension funds, stock fun...

Egon von Greyerz / November 2, 2022

Watch Now

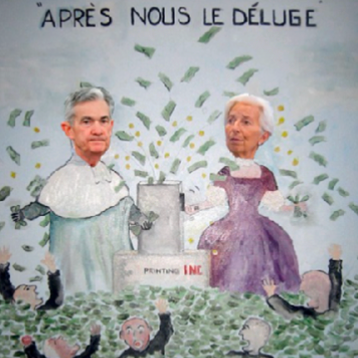

HOW GLOBAL MARKETS FAIL AND GOLD SUCCEEDS: DEBT, DERIVATIVES & POLITICIZED (I.E., DISHONEST) CENTRAL BANKS

Egon von Greyerz joins Darryl and Brian Panes of As Good as Gold Australia for an in-depth discussion on the state of global financial markets and the inevitable demise of paper currency and rise of p...

Egon von Greyerz / October 31, 2022

Watch Now