AN AUTUMN WITH EPIC COLLAPSES OF STOCKS, DEBT, CURRENCIES, MUCH HIGHER INFLATION – LEADING TO POVERTY & SOCIAL UNREST

The world economy and especially the political and economic situation today consists of a potpourri of lethal ingredients which will have dire consequences.

Let’s look at what this deadly potion consists of:

- Debts at levels that can never be repaid – sovereign, corporate & private

- Epic global bubbles in stocks, bonds & property – all about to collapse

- Major geopolitical conflicts with no desire for peace – major wars likely

- Energy imbalances and shortages, most self-inflicted

- Food shortages leading to major famine and civil unrest

- Inflation, leading to hyperinflation & global poverty

- Political and economic corruption in US, Europe and most countries

- No country will afford social security, medical or pension payments

So what are governments around the world doing to solve these problems?

Nothing of course.

The only thing they know is to print more money. They have never understood that a debt problem cannot be solved with more debt. All they can try to achieve is to pass the baton to the next leader so it will be his problem.

This means that all the political, economic and financial mismanagement of the past 50 years will result in a global collapse never seen before in history.

The consequences will be both dire and unpredictable since the world has no experience of this magnitude and complexity of problems.

So what are global leaders doing?

What is clear is that Western leaders will not assume any responsibility for the coming calamities.

Covid will obviously be blamed although there is a lot of evidence that it was manmade and could have been controlled with simple and cheap existing medicines. And all the lockdowns and restrictions have certainly had a bigger impact than the disease itself. Sweden for example virtually had no lockdowns or mask requirements and did not suffer more deaths than countries in total lockdown.

Special interests like Big Pharma clearly had the politicians in their hands. They had trillions of dollars to gain and nothing to lose since they are immune against any prosecution.

Anyway, it has happened and we can’t go back. The future will tell us if, as many scientists believe, the people’s immune system will have been severely weakened by the vaccines.

Secondly, the Russians will be blamed for the current global economic problems of inflation, energy shortages and decline of global trade. The fact that these problems started well before the Russian invasion of Ukraine is quickly forgotten.

WILL THE WAR DRUMS BECOME LOUDER?

Since 3600BC, governments have fought 14,000 wars against each other. As far as I am aware, there is no period in history without an important war.

At the end of the 30-year war, European nations tried to put a stop to unprovoked wars with the 1648 Treaty of Westphalia. The peace conference in Muenster involved 194 states. The start of the war in 1618 was the Protestant Bohemians rising against the Catholic Holy Roman Empire. The major opponents to the Roman Catholics were the Habsburgs supported by Sweden and the Netherlands. Spain and France were also involved in the war together with many other nations.

Interestingly, my two home countries benefitted from the peace. Sweden by virtue of being a major military power at that time gained substantial territories around the Baltic and Switzerland gained formal independence from Austria.

But the major result of the Westphalian peace treaty in 1648 was:

- National self-determination

- Precedent for ending wars through diplomatic congresses

- Peaceful coexistence among sovereign nations

- Acceptance of the principle of non-interference in the affairs of other nations if there was not a clear present danger to the aggressor.

Almost all wars in history have been between neighbouring countries. But in the 20th century the US changed that.

Without provocation and far from its borders, the US invaded Vietnam, Serbia, Iraq, Libya and Syria. So the 300 year old Westphalian principle of non-interference was properly buried by the US on multiple occasions. But not only did the US break this principle but also failed in each single one of the aforementioned conflicts.

One could of course argue that Japan broke the treaty first with the Pearl Harbour attack. But like all aggressors they claimed self defence against potential US interference in Japan’s ambitions in the Pacific.

The Russians will of course argue that they haven’t broken the Westphalian treaty since Ukraine historically has been part of Russia. In the Maidan revolution in 2014, a US inspired coup ousted the Soviet friendly Ukrainian leader and replaced him by a Western friendly leader. Since then Russia has always warned the West that it cannot accept being surrounded by an increasing number of NATO countries just like the Russian missiles on Cuba in 1962 directed against the US.

What we do know is that sadly wars are an integral part of history and as long as there are people on earth, there will be wars

The risk is that what now seems a local conflict in eastern Ukraine will become a major international conflict.

This is not a war between a small innocent country and a superpower. No this is a major conflict between the US and Russia. And since China has declared it is supporting Russia, this is a conflict between the three major super powers in the world.

And since the US has coerced the EU to join against Russia with weapons, money and sanctions, this is a conflict of major proportions.

GERMANY BITING OFF THE HAND THAT FEEDS THEM

The lack of statesmen and strong leadership in the US and EU has created an absurd situation with the EU not just biting the hand that feeds them but actually biting it off totally.

With many European countries being dependent on Russian gas, oil, cereal and fertilisers, EU’s left hand doesn’t know what the right one is doing. Not only is this a human and economic catastrophe of major proportions but one which will have major implications for Europe for a long time. Germany used to be the economic and financial engine of Europe but is now on the way to becoming a basket case. But sadly they haven’t discovered it yet.

Scholz inherited ludicrous Marxist policies from Merkel. For example to close down both nuclear energy and coal was always a recipe for disaster with no medium term viable alternatives. And her immigration policy will not only be economically ruinous for Germany but also lead to major social unrest.

The demographics of Germany is also another irreparable problem. With the lowest fertility rate in Europe combined with the highest life expectancy, Germany is entering a long term cycle of economic contraction.

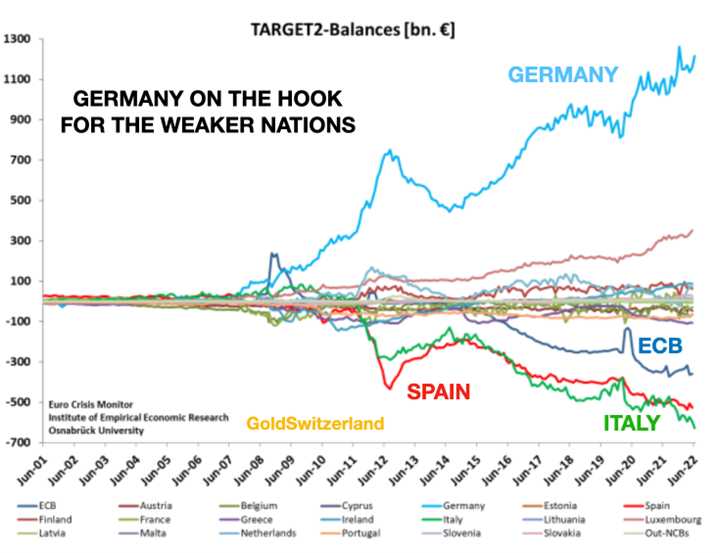

Add to this that Germany has financed a major part of the Mediterranean EU countries’ woes through the Target2 transfer payment system.

As the Target2 graph shows below, the transfer payments to Italy of €596 billion, Spain €526b, to the ECB €358b, Greece €107b and Portugal €69b have been mainly financed by Germany to the extent of €1.2 trillion.

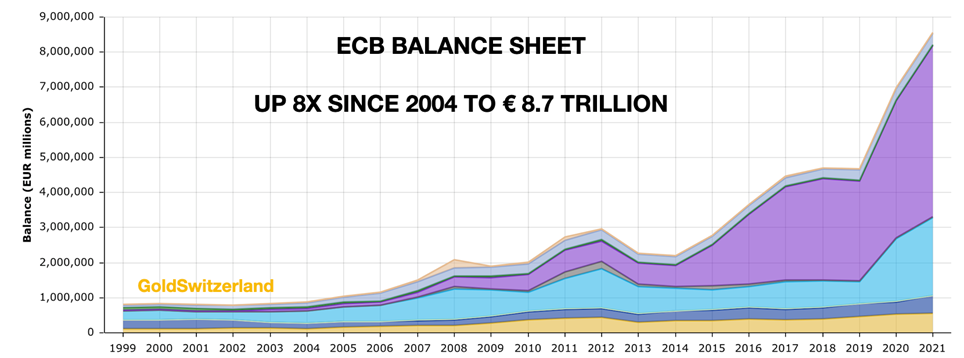

Add to that the balance sheet of the ECB which has grown more than 8X since 2004 to €8.7 trillion GRAPH and we can confidently state that the whole European Economic Community -ECB- has now become -EDC- or the Economic Debt Community.

It is clear that the old basket cases of Greece, Italy and Spain which were forced by Brussels to change leadership and to take on more debt are the immediate danger to the EU and the Eurozone.

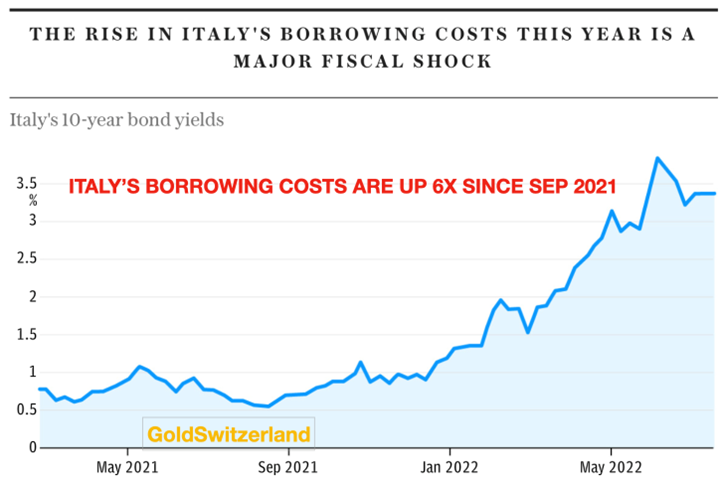

If we just take Italy, their debt has doubled since 2000 to €2.7 trillion which at 150% of GDP means that the country is on the verge of bankruptcy.

But it is not only Italy’s debt that has surged, but even worse, the cost of financing it. Since September 2021, 10 year Italian bond yields have gone up 6X from 0.5% to 3.4%.

This is obviously more than Italy can afford!

GREECE AND ITALY SHOULD LEAVE THE EU NOW

The head of the Bundesbank Joachim Nagel has made it clear that it would be fatal for the ECB to hold borrowing costs down for ill-disciplined Eurozone states. He declared that such action would be “treacherous waters”. So Italy and Greece can no longer expect subsidised rates from the EU.

Italy needs to roll over €300 billion of debt annually plus finance its annual deficit of €100 billion, a real Sisyphean task. When Germany was the rich uncle of the EU, these debt levels were tolerated just to keep this dinosaur from falling apart. But with the coming severe German economic downturn combined with insoluble debt and structural problems in all EU countries, the inevitable collapse of the European dream is now reality as I have predicted for over 20 years.

Politicians always learn too late that political dreams and economic reality are as far apart as heaven and hell. If these politicians ever studied history, they would have learnt that all these illusions of grandeur always end not just in tears but in total collapse.

If I were in charge of Greece and Italy I would quickly default on the debt and create new Drachmas and Liras. That would give these countries a short term relative advantage rather than to sink in the general quagmire of the EU at a later stage. If they stay in the EU, Brussels will force Greece and Italy to take on more debt and impose unacceptable conditions. No country will ever repay their debt anyway or be in a position to finance it so better to run for the exit now rather than to wait for the EU’s total collapse.

So with Germany, Greece, Italy and Spain all having their problems, so does Macron in France. Having lost a working majority, he can no longer afford to be arrogant and will find it hard to reduce the French budget deficits, a condition to get German agreement for joint debt issuance.

So the EU and the Euro is now entering a final chapter. Like all political monstrosities, the fall will take a number of years. Brussels and government leaders in especially Germany and France will remain on the barricades for a long time although everything around them will fall apart. The only thing that could precipitate the fall is a debt default by the ECB when investors instead of buying the worthless debt paper will use it for fuel as they have run out of energy sources.

The only problem is of course that the debt is electronic and therefore unsuitable for burning- Hmmm.

US & GLOBAL INFLATION

Going across the pond, the US elite has never hated someone more than Trump. They tried all they could during his reign and now he is the first ex-president who is being raided by the FBI.

The US regime shot themselves in the foot with the sanctions against Russia. The Russians are still selling their energy to Germany, China, India etc and instead the suffering parties are the US, Europe and the rest of the world with high inflation and energy shortages.

With already high support for the Republicans and Trump, this raid is likely to have the opposite effect of the one desired by the regime. How many times can you shoot yourself in the foot before it really hurts?

UN AGENDA 2030 – THE (UN-)SUSTAINABLE DEVELOPMENT GOALS

This UN programme, supported by Schwab and the WEF (World Economic Forum) was always going to fail.

Starting in 2016, bureaucrats with no understanding of the real economy created this programme signed by 194 nations. There are 17 admirable but unrealistic goals like No Poverty, Zero Hunger, Good Health, Clean Energy, Climate Action etc.

Today almost half way into the programme, every single goal is hopelessly behind schedule with no chance of achieving the target.

How could anyone believe that 194 nations could jointly achieve these 17 goals when not even one single country can do it?

More about Agenda 2030 and Schwab’s attempt to take over the UN in a later article.

MARKETS

As generally is the case before major turns in markets, optimism is still high. But this autumn is likely to change all that as the realities outlined at the beginning of this article finally hit the world.

Stock markets are now extremely near finishing the correction and to resume the downtrend in earnest. It is possible that the real falls in markets will wait until September but the risk is here now and very dangerous.

What we know with certainty is that the world is facing a wealth destruction and wealth transfer of major proportions.

Most paper assets will die a relatively quick death and that includes paper money.

This will obviously include stocks, bonds, property and all derivatives. Falls of 75-95% in the next few years will not be uncommon.

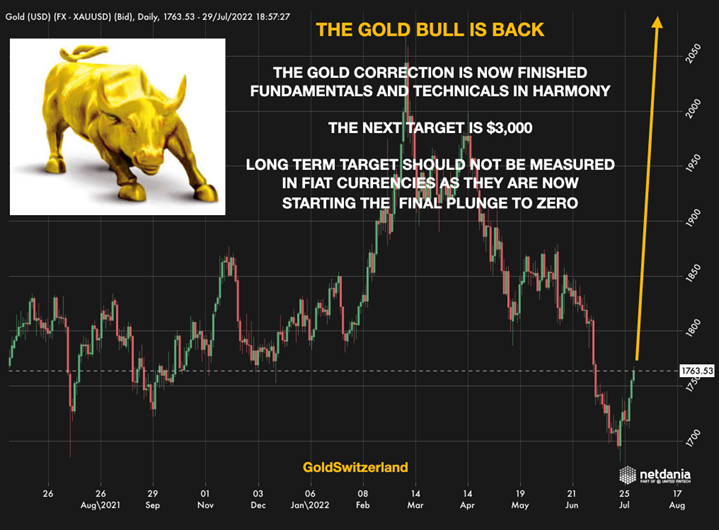

As currencies finish their journey to ZERO (they are already down 97-99% since 1971) no use betting on the horse that comes last to the bottom whether it is the Dollar or the Euro.

They will all get there!

Instead, the only money which has survived in history is gold and silver and these metals will continue to maintain their purchasing power or even enhance it as all fiat money is killed off by governments and central banks by the creation of an unlimited supply.

It is so simple really but still only 0.5% of financial assets are in physical gold in spite of the metal’s golden 5,000 year record. That percentage is about to change drastically.

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD