Egon von Greyerz

Founder and Chairman Born with dual Swiss/Swedish citizenship, Egon's education was mainly in Sweden.Egon von Greyerz began his professional life in Geneva as a banker and thereafter spent 17 years as the Finance Director and Executive Vice-Chairman of Dixons Group Plc. During that time, Dixons expanded from a small photographic retailer to a FTSE 100 company and the largest consumer electronics retailer in the UK.

During the 1990s, Egon von Greyerz became actively involved with financial investment activities including mergers and acquisitions and asset allocation consultancy for private family funds. This led to the creation of VON GREYERZ as an asset management company based on wealth preservation principles.

VON GREYERZ is now the world’s leading company for direct investor ownership of physical gold and silver outside the banking system. Our vaults include the biggest and safest gold vault in the world, located in the Swiss Alps. Clients include High Net Worth Individuals, Family Offices, Pension Funds, Investment Funds and Trusts in over 90 countries.

Egon von Greyerz makes regular media appearances and speaks at investment conferences around the world. He also publishes articles on precious metals, the world economy and wealth preservation.

Insights & Articles

CHAOS AND THE TRIUMPH OF SURVIVAL

Pieter Bruegel's work "The Triumph of Death" functions as a perfect metaphor for the economy's impending rendezvous with reality. Nonetheless, we must understand the risks and protect ourselves for th...

Egon von Greyerz / December 22, 2021

Read More

Von Greyerz & Piepenburg: Challenges, Forces and True Wealth for 2022

As 2021 draws to a close, the risks and uncertainties mount in the macroeconomic landscape. In this year-end MAMChat, Egon von Greyerz and Matthew Piepenburg discuss the key issues affecting markets a...

Egon von Greyerz / December 21, 2021

Watch Now

Egon von Greyerz–Misery or Fortune: The Choice is Yours

As markets become more distorted and the globe's monetary systems become openly farcical and comically mismanaged, nations, companies, investors, and individuals face a binary choice in the near futur...

Egon von Greyerz / December 6, 2021

Watch Now

EVIL IS THE ROOT OF ALL FIAT MONEY

You may have heard money is the root of all evil, but what is at the root of all money? Seeing the outright theft of living standards through skyrocketing inflation and the mounting financial house of...

Egon von Greyerz / December 2, 2021

Read More

Part II. A Climate Change in Candor: Von Greyerz and Stoeferle Address Ignored Fissures in Global Rate, Bond & Currency Markets

In the final part of their two-part discussion, Egon von Greyerz and Ronni Stoeferle discuss rate, currency, and bond market forces. These markets have been dominated by unreality and magical thinking...

Egon von Greyerz / December 1, 2021

Watch Now

Part I: All Taboos Broken—von Greyerz & Ronni Stoeferle Discuss Gold’s Role in a Changing Financial System

In part I of this unique two-part discussion, Matterhorn Asset Management founder, Egon von Greyerz, joins Ronni Stoeferle, author of the internationally acclaimed In Gold We Trust Report to exchange...

Egon von Greyerz / November 29, 2021

Watch Now

“Great Reset” With a Cyber-Attack, Then Expropriation?

Die Aktienmärkte sehen stark aus, Gold schwächelt. Probleme wurden nicht gelöst, sondern mit Impf-News werden die Märkte bewegt. Buffett verkauft einen Teil seiner Barrick-Aktien und sorgt für Verunsi...

Egon von Greyerz / November 27, 2021

Watch Now

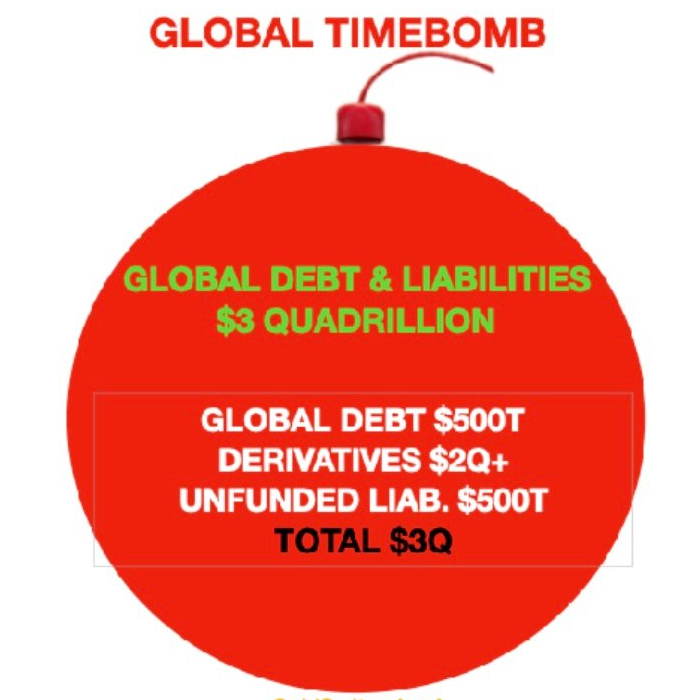

Cambridge House Chat with Egon von Greyerz and Jay Martin Part II: Triggers, Symptoms & Solutions for the Next Financial Implosion

In Part II of the chat between Egon von Greyerz and Jay Martin, Egon discusses potential triggers for a global financial catastrophe, the ever-increasing symptoms of our economic decay, and solutions...

Egon von Greyerz / November 24, 2021

Watch Now

Cambridge House Chat with Egon von Greyerz Part I: Why Physical Gold, Why Matterhorn Asset Management and Why Now?

In Part I of this 2-Part discussion with Cambridge House CEO Jay Martin and Egon von Greyerz discusses MAM’s precious metal approach to preserving generational wealth in the backdrop of an increasingl...

Egon von Greyerz / November 20, 2021

Watch Now

GOLD-O-MANIA IS COMING

In the midst of manias all around the market, gold remains unloved and undervalued, but as central banks race to debase, this will soon change. As the reality of non-transitory inflation digs in, Gold...

Egon von Greyerz / November 17, 2021

Read More

CENTRAL BANKERS & COP26 BUREAUCRATS TO CAUSE HYPERINFLATION

As world leaders gather in Glasgow at COP26, the world economy deteriorates. It is much easier for these politicians and bureaucrats to focus on lofty, nebulous goals 30 years away than to focus on im...

Egon von Greyerz / November 3, 2021

Read More

Wall Street Silver & Egon von Greyerz: Shortages Will Worsen

Make no mistake: The shortages we are seeing are not a temporary, fleeting condition. They will continue and worsen. Egon von Greyerz sits down with Wall Street Silver to discuss the implication of th...

Egon von Greyerz / October 27, 2021

Watch Now