Egon von Greyerz

Founder and Chairman Born with dual Swiss/Swedish citizenship, Egon's education was mainly in Sweden.Egon von Greyerz began his professional life in Geneva as a banker and thereafter spent 17 years as the Finance Director and Executive Vice-Chairman of Dixons Group Plc. During that time, Dixons expanded from a small photographic retailer to a FTSE 100 company and the largest consumer electronics retailer in the UK.

During the 1990s, Egon von Greyerz became actively involved with financial investment activities including mergers and acquisitions and asset allocation consultancy for private family funds. This led to the creation of VON GREYERZ as an asset management company based on wealth preservation principles.

VON GREYERZ is now the world’s leading company for direct investor ownership of physical gold and silver outside the banking system. Our vaults include the biggest and safest gold vault in the world, located in the Swiss Alps. Clients include High Net Worth Individuals, Family Offices, Pension Funds, Investment Funds and Trusts in over 90 countries.

Egon von Greyerz makes regular media appearances and speaks at investment conferences around the world. He also publishes articles on precious metals, the world economy and wealth preservation.

Insights & Articles

ALL HELL WILL BREAK LOOSE FOR HUMANITY

We are now at the end of an era of economic and moral decadence in a debt infested world built on false values, fake money and abysmal leadership. All hell will break loose, and the consequences will...

Egon von Greyerz / March 22, 2022

Read More

A GLOBAL MONETARY & COMMODITY INFERNO OF NUCLEAR PROPORTIONS

With the war in Ukraine raging, western sanctions against Russia are setting off a commodity crisis the likes of which this generation has never seen. In the face of an already-faltering financial sys...

Egon von Greyerz / March 7, 2022

Read More

Golden Insights in a Dark Setting of Ukrainian War and a Pivot in Swiss Neutrality

As the world continues to keep its eyes on Ukraine, Matthew Piepenburg and Egon von Greyerz sit down to discuss the unfolding situation as well as one of the most surprising developments of all: Switz...

Egon von Greyerz / March 1, 2022

Watch Now

Von Greyerz: Cool Perspective on a Heated Ukraine Crisis

As Russia invades Ukraine, Egon von Greyerz sits down with Lynette Zang to discuss the conflict, its implications, and what it means for gold investors and the global economy. Whatever the ultimate ou...

Egon von Greyerz / February 25, 2022

Watch Now

GOLD ABOUT TO ACCELERATE BUT AVOID TRUDEAU’S FASCIST KLEPTOCRACY

Trudeau has given himself the right to seize bank accounts, but there is no reason why he wouldn’t go further and grab other assets, such as stocks or the content of bank deposit boxes--including gold...

Egon von Greyerz / February 23, 2022

Read More

All False & Corrupt Systems Implode— Are You Prepared & Insured?

Egon von Greyerz sits down with Wall Street Silver to remind us that all false and corrupt systems implode. In the face of rising yields, the big banks will have no choice but to do what they always d...

Egon von Greyerz / February 17, 2022

Watch Now

FED WIZARDS – THE MEGA MANIPULATORS

In a free market, without manipulation, the cost of borrowing after the Great Recession would have risen to the levels in 1980-81 i.e. near 20%. Instead, the Fed Wizards are performing their hocus poc...

Egon von Greyerz / February 9, 2022

Read More

Egon von Greyerz: Is Deflation Around the Corner?

As the market experiences withdrawal from its addiction to cheap credit, cracks appear all through the foundations of finance. Are we looking at a full deflationary panic? Will the Fed walk back on it...

Egon von Greyerz / February 7, 2022

Watch Now

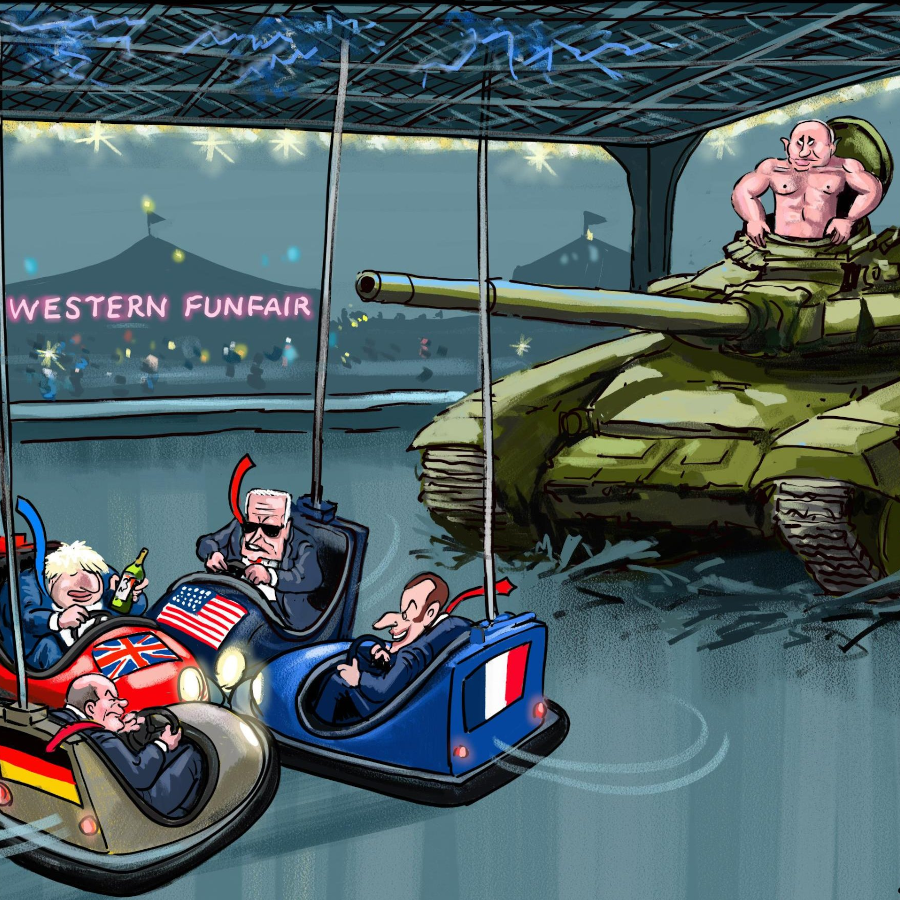

STRONG PUTIN & WEAK BIDEN TO TRIGGER HISTORICAL WEALTH DESTRUCTION

With the world on the verge of a major geopolitical conflict that has a high likelihood of developing into a war, the US certainly doesn’t have the statesman who could take them through such a confli...

Egon von Greyerz / January 26, 2022

Read More

Von Greyerz: A Long List of Ignored Yet Obvious Risks Ahead

Egon von Greyerz sits down with Tom Bodroviks of Palisades Gold Radio to discuss a long list of open risks ahead—from derivative, property and currency markets to risk asset bubbles, unfunded liabilit...

Egon von Greyerz / January 22, 2022

Watch Now

COMING MARKET MADNESS COULD TAKE 70 YEARS TO RECOVER

After the crash of 1929 and subsequent depression, the Dow did not surpass previous highs in real terms until 2000, meaning it took 70 years (almost a lifetime) for the market to recover. In 2022, as...

Egon von Greyerz / January 12, 2022

Read More

History’s Chaotic Warnings vs. Gold’s Future Solutions

A careful study of history yields clear lessons. No currency in history has ever survived the chaos which consistently follows massive debt bubbles. In our modern word, where debt has trebled to over...

Egon von Greyerz / January 7, 2022

Watch Now