Are We Headed for Recession? Signposts and Realism

Below we look at recessionary, inflationary, and stagflationary signposts to determine the probability of whether we are headed for recession. The potential outcomes, in the backdrop of rising debt as real rates slide inevitably deeper into negative depths, are a perfect tailwind for gold.

With these forces objectively rather than theoretically in motion, informed investing is less about lofty debates and more about simple preparation.

Let’s consider the cold facts.

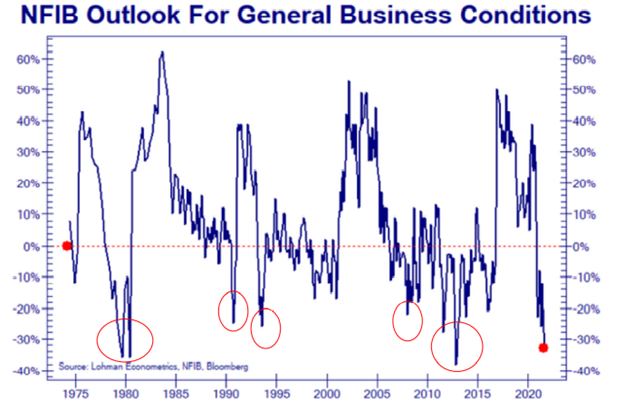

Small Business Signpost–Recessionary

The latest Small Business survey from the National Federation of Independent Business (NFIB) is in, and the report is, well… a bit scary.

Specifically, it reveals general business conditions at the 3rd lowest levels in the last 50 years.

Such lows have consistently operated as reliable leading indicators for whether we are headed for recession ahead.

Still Buying the Taper Talk?

It’s worth noting that each and every time business conditions sank this low, the Fed’s reaction was to push interest rates down not up—i.e., “loosen” rather than “tighten” (or “taper”) its Fed money printing.

In this backdrop, the Fed’s increasingly and optically hawkish signal of a QE “taper” ahead makes even less sense, but then again, asking the Fed to make sense, or even tell the truth, was never part of its ever-expanding mandate.

But as we’ve written and spoken elsewhere, the Fed’s “taper talk” is ultimately a smokescreen colliding with double-speak.

From the left corner of its mouth, the Fed signals a “taper” of the QE/money printing while its right hand is silently reaching for the red-button of emergency liquidity from the Standing Repo Facility.

In short: Taper or no taper, the Fed will find ways to pump ever-more fiat dollars into a dollar-starved financial system.

More liquidity, ultimately means more inflationary tailwinds, not less.

That said, any headline optics of an actual Fed taper in a backdrop of rapidly increasing recessionary indicators would be a major policy mistake, as the spiking yields and rates which stem from any taper headline would send risk asset markets into an immediate and bearish tizzy.

Sentiment Signpost–Recessionary

In this context, not only is the foregoing data from the NFIB scary, but it comes in tow with a sinking US Consumer Confidence/Sentimentindicator of which we’ve reported in recent weeks.

Based upon these indicators alone, the likelihood of the US headed for a recession is the highest since last March, when markets tanked, only to be “accommodated” (i.e., bailed out) by trillions of more rather than less frantic money printing.

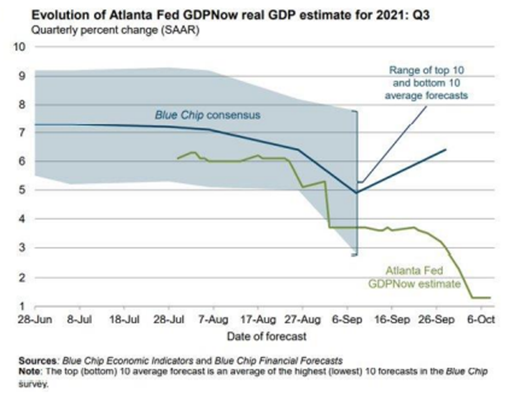

GDP Signpost

If we then tack on the Atlanta Fed’s dismal GDPNow index to the foregoing recessionary indicators, our blunt recessionary prognosis only gets worse:

Mandate Madness–Recessionary

Keep in mind, moreover, that such depressing productivity outlooks from Atlanta don’t even take into consideration the ongoing COVID disruptions to the labor force.

Such disruptions are poised to get worse, not better, if Biden’s monarchical yet optically humanitarian vaccine mandate passes, despite its blatant illegality, as plainly opined by nearly half of the attorneys general of the 50 divided states of America.

Our guess, and it’s only a guess (based on a growing fluency in translating “Fed-Speak”), is that the Fed will not “tighten” or “taper” it’s addiction to QE, but continue to loosen and expand it.

And should even a taper occur, the Fed will likely reverse course quite quickly, as they did in 2019.

Commodity Signposts–Inflationary

Continued monetary expansion, of course, will be an obvious boon for precious metals, BTC, and commodities.

Speaking of commodities as a recessionary (and inflationary) indicator, it’s worth noting that the prices of “non-financed” print cloth, rosin, wool, hides, tallow, cotton copper, steel, and lead scrap, along with rubber, zinc and burlap are trading (off the exchanges) at all-time highs.

Meanwhile, across the pond (or channel) in England, lobbyists for the British steel industry are warning of plant shutdowns in the backdrop of spiking energy prices.

Even the IMF can’t ignore the inflationary realities stemming from these and other supply-chain disruptions, which again, only confirms the utter and duplicitous comedy of the “transitory inflation” meme(i.e., lie) which DC has been telegraphing (and we mocking) from the moment they said it.

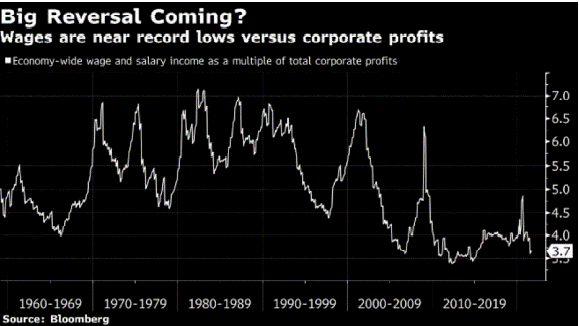

Wage Signposts–Inflationary

Soon, even the grotesquely over-paid CEOs of history’s most “supported” bull market will have to actually start paying their employees/serfs a fairer (i.e., higher) wage (imagine that?), as the current disconnect between corporate profits and wages are nearing record lows in the new feudalism passing as capitalism.

Wage inflation, long overdue, is yet another inflationary headwind.

As we see from the data above (rather than debates before us), signs of us headed for recession (and a stagnating economy) are colliding with signs of inflation, which boils down to a pretty solid case for stagflation ahead, as we’ve been warning since well before 2021.

Fatal Corners—Predictable Options

As for the convergence of inflation, recession and surging doublespeak from DC, we have also been consistently blunt, as well as correct and early, in reminding investors that the central banks in general, and the Fed in particular, have backed themselves into a fatal corner of either more inflationary policies or a certain market catastrophe.

As such, this makes their options, and hence actions, predictable.

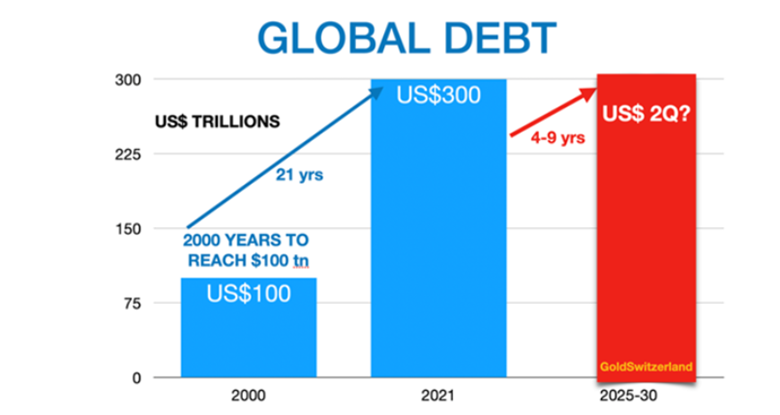

Or stated more simply: unprecedented debt of their own creation makes money created out of thin air a necessity rather than debate.

With public debt levels skyrocketing beyond any hope of sustainability, the Fed, like other guilty central banks, has no choice but to expand the money supply (i.e., QE to the moon) just to pay interest expenses on sovereign bonds.

Without such “accommodation” from mouse-click money, bond markets tank, interest rates spike, stock markets sink and nations default en masse on their debt.

In short, and once again: It’s either print to the moon (inflationary) or watch markets and economies sink to the ocean floor (political suicide), followed, of course, by an already well-anchored (and openly bogus) “re-set” and/or “Bretton Woods No 2.”

Want to guess which option the Fed and other policy makers will likely take?

Open, Obvious and Inevitable: Print to the Moon or Sink to the Ocean Floor

We are hardly alone in seeing this. Market veterans recognize the smell of burning currencies and the sound of ticking debt bombs.

Like us, the folks over at Bridgewater, for example, are seeing the same writing on the wall as to the dilemma which policy makers have put us and themselves.

Dalio’s team of smart, unlike DC’s cabal of dunces, know that despite US tax receipts at all-time highs from a grotesquely over-bought (i.e., Fed-driven) stock market, these incoming revenues are still not enough to cover even the interest expense on Uncle Sam’s bar tab.

Unfortunately, the vast majority of retail investors are not seeing this income vs. expense elephant in the room.

Frankly, the “print to the moon” scenario, as sickening as it is, is the only option that makes sense in this otherwise twisted (and senseless) new-abnormal handed to the world by our so-called “expert policy makers.”

But as corrupt as they are, these “experts” aren’t stupid; they know that such screaming inflationary policies are the quickest way for them to inflate away portions of their embarrassing debt and minimize the risks of heading into recession.

Behind closed doors and a clueless media, the policy makers see inflation as a policy not a feared reality—so long as they repress rates while letting inflation rip.

Of course, the fact that inflation cripples the middle class and crushes economic growth is only of secondary concern to these private bankers operating under a “federal” nameplate.

Remember: The Fed is about self-preservation, banking liquidity, market accommodation and increasing centralized power, not the guy on the street or sound money policy.

Negative Real Rates—The Only (Rotten) Path Forward

In this dark light, political self-interest involves higher inflation running simultaneously with artificially “supported” sovereign bonds (i.e., repressed bond yields).

“Supporting” (buying) those bonds, of course, requires trillions of printed dollars, and more printed dollars just means more debased dollars.

It’s really that simple.

Of course, when you combine rising inflation with repressed bond yields, you get increasingly negative real (i.e., inflation-adjusted) rates, which is the secret yet timeless playbook of every broke sovereign seeking to inflate away their own debt sins.

Gold: Inflation Hedge or Rate Hedge?

As for precious metals and other real assets, they do extremely well as real rates get increasingly negative.

Thus, it’s more accurate to describe gold specifically as a hedge against negative real yields rather than broadly classifying the metal as an “inflation hedge.”

This is a critical distinction/point to remember as we are headed for recession.

Gold, for example, doesn’t always rise when inflation rises. We know this from certain periods in the 1980’s when inflation was rising yet gold was falling.

Why?

Because rates/yields matter too.

During those bearish periods for gold, yields were higher than even already high inflation (i.e., “positive real yields”), and thus gold was not a stellar inflation hedge.

Stated more simply, gold rises (and “hedges”) when inflation rates rise above prevailing yield rates.

In such instances, investors suddenly realize that buying a yield-less bar of gold is an infinitely superior asset than a negative yielding government IOU.

Twice in the 1970’s, for example, gold saw its greatest spikes when real yields went the most negative.

Golden Signpost in an Upside-Down World

And that, folks, as we are headed for recession, is precisely where the financial system will land—more negative rather than positive real yields.

How can we be so sure?

Easy: The crazies masquerading as experts have spent the last 20 years creating the greatest global debt bomb in history.

Frankly, that $300T figure is staggering, terrifying and all-defining.

Such debt makes debtors predictable.

Negative real rates (i.e., higher inflation and repressed rates) are now the policy makers’ last desperate tool for inflating away portions of that debt at the expense of, well—just about everyone else.

Imagine that?

In such a twisted reality and backdrop, assets (like gold) that favor such an upside-down world of negative real rates become essential rather than debatable.

About Matthew Piepenburg

Matthew Piepenburg

Partner

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD