The Biggest Bubble In History Will Lead To An Even Bigger Collapse

The Biggest Bubble In History Will Lead To An Even Bigger Collapse

By Egon von Greyerz

In a world full of bubbles that will all burst, it is of course impossible to forecast which will be the first ones to cause havoc for the world economy. One of the biggest bubbles that would clearly bring down the financial system is the bond market. Here we have a $100 trillion market which has grown exponentially in the last 25 years and which has virtually gone vertical since the 2006-9 crisis.

Desperate governments are raising money as if there was no tomorrow in the hope that they can keep the world afloat for another few years. But as I have stressed so many times, you can create neither economic stability nor wealth by printing money or increasing the debt burden.

Governments cannot afford interest rates above zero

Under normal conditions governments would be totally insolvent with the high levels of debt they are raising. But Japan solved that problem over 20 years ago by setting rates at zero. That trend has accelerated in the last couple of years and there are now around $8 trillion of government bonds with negative yield around the world. But governments of course never have a problem paying the interest since they will just issue more debt to pay it.

As governments around the world compete in lowering interest rates, the Fed in the US continues to threaten with rate increases. But we are in a global financial system which is totally interdependent. Therefore the biggest economy in the world cannot raise rates without major consequences for the financial system and for the dollar. Also, for the US itself, raising rates at this stage goes totally against the trend of the real economy. Company profits are declining, and so is industrial production together with many important indicators such as freight, transport and container traffic. And real unemployment is not 5% but 23%. More importantly, US federal debt, now at $19 trillion is forecast to increase to at least $28 trillion, by the Central Budget Office in the next ten years. But debt could easily grow to $35 trillion or more by 2025 if US growth is subpar which is likely to be the case. With these pressures it is unlikely that the US government hikes rates in June in spite of the noise they are making currently.

Interest rates of 15-20% will lead to mass defaults

The dilemma for the world is that with $230 trillion in debt, higher interest rates are guaranteed to lead to defaults and helicopter money. This in turn will accelerate the currency race to the bottom, leading to hyperinflation and much higher interest rates.

Currently the world doesn’t see the risk of hyperinflation. But this is an obvious consequence of the debt folly created by governments. They are unlikely to let the world economy go into a global deflationary implosion before first throwing unlimited amounts of worthless printed money at the problem.

100 year bonds will mature worthless

It is totally incomprehensible that anyone can lend money to governments at zero or negative yields when it is totally clear that no government will repay this debt in today’s money. It is even more difficult to understand how anyone can lend money to insolvent governments for 50 or 100 years. Countries like Belgium, France, Spain and Italy have all issued 50 year bonds. We can be quite certain that the last two countries will definitely not be able to repay these loans and probably not the other two either. But that doesn’t really matter since the ECB (if it is still around) will just issue funny money to buy these bonds as it becomes the only buyer of bankrupt Eurozone debt. Then we have Mexico, Belgium and Ireland which have all issued 100 year bonds! Ireland, for example, was virtually bankrupt a few years ago and only back in 2011 they paid 14% on their 10 year bond. Now they have just raised 100 year money at 2.3%! It is absolutely guaranteed that the value of the Euro as well as the value of this bond will have gone to zero long before the 100 years are up. How then can any sane investment manager buy this bond? He is obviously not worried since he won’t be around at maturity but the likelihood is that the bond will be worthless during his active professional life.

Long rates will turn up in late 2016

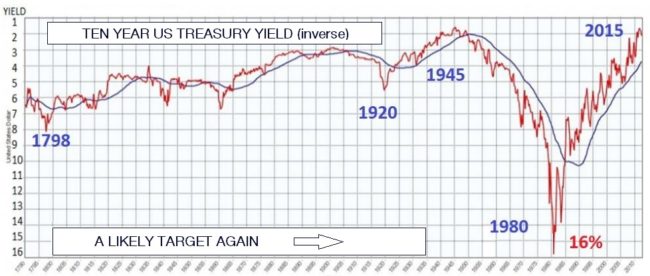

The chart below shows the 10 year US treasury bond but shows yield rather than the price of the bond. The very steep rise of the bond (fall in the yield), from 16% in 1980 to 2% today takes the rate back to the record low at the end of WWII. This is a 36 year cycle that is likely to top sometime in 2016. The rise in the yield could be very swift due to massive money printing and a collapsing dollar. I would expect the yield to reach at least 16% in the next 5-7 years and possibly a lot higher.

In the next 12-18 months there will be two forces pulling yields in different directions. Governments and central banks will continue to keep short rates at zero or negative. But this is a battle that they will lose since holders of long term bonds will realise that not only won’t the 50 or 100 year bonds be repaid but nor will the shorter maturities. Big holders of US debt like Japan, China and Russia will compete in getting rid of their rapidly deteriorating paper. There is clearly a first mover advantage here before panic sets in.

The consequences of much higher rates will of course not just affect lenders and borrowers. The $1.5 quadrillion derivatives market is totally linked to interest rates and once rates increase, most derivatives will become totally worthless. And this is a problem of a magnitude that even helicopter money cannot solve.

The end game will lead to the biggest implosion in history

This brings us back to risk. As I have stated many times, economic, financial and geopolitical risk is greater than ever in the world today. Let us hope that the worst case scenario doesn’t materialise, because if it does, life on Earth will be very different for a very long time. We must remember that since we have had the biggest bubble in history over the last 100 years, the end game is likely to lead to the biggest implosion in history of the world economy and financial system.

Whatever the outcome of the crisis that the world will find itself in over coming years, it is absolutely essential to insure wealth against these risks. The best financial insurance available and by far the cheapest is physical gold and silver stored outside the banking system. This is the only insurance available where the premium, invested in metals, doesn’t have to be paid annually at higher rates but instead appreciates as risk increases.

Egon von Greyerz

Founder and Managing Partner

Matterhorn Asset Management AG

matterhorn.gold

goldswitzerland.com

About Egon von Greyerz

Egon von Greyerz

Founder and Chairman

VON GREYERZ AG

Zurich, Switzerland

Phone: +41 44 213 62 45

VON GREYERZ AG global client base strategically stores an important part of their wealth in Switzerland in physical gold and silver outside the banking system. VON GREYERZ is pleased to deliver a unique and exceptional service to our highly esteemed wealth preservation clientele in over 90 countries.

VONGREYERZ.gold

Contact Us

Articles may be republished if full credits are given with a link to VONGREYERZ.GOLD