Gold, Oil & Global Currencies Entering a Watershed Moment

Below we look at the math, history and current oil environment in the backdrop of a global debt crisis to better predict currency and gold market direction without the need of tarot cards.

Seeing the Future: Math vs. Crystal Balls

Those looking forward only need to look at current and backward math to make relatively clear forecasts without risking the mug’s game of deriving crystal ball predictions.

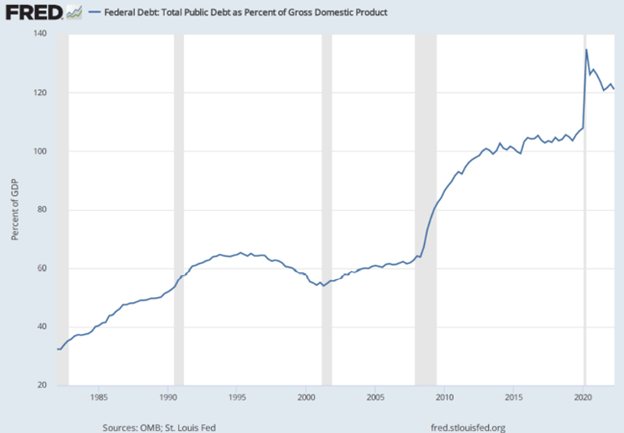

Not surprisingly, the theme and math of simple (as well as appalling) US debt levels makes such forward-thinking almost too simple.

The Oil Issue: Is Anti-Shale Anti-American?

Although not as fluent as others in the oil trade or the green politics of the extreme US left, I’ve argued in prior reports that the current administration’s anti-shale policies make for some good (debatable?) environmental chest-puffing while ignoring the math, history and science of sound national as well as well as global thinking.

(But then again, the entire woke fiasco of current US policy seems to be on a crusade to cancel such things as math, history and science; so, thinking contextually or globally is beyond their sound-bite-driven stump-speeches.)

Oil, however, still matters.

And when understood in the broader context of the macro-economic themes we’ve tracked for years–namely debt, currencies, inflation, gold, a cornered Fed and a weaponized USD–the current and future trends are already in motion.

And as for the endless debate as to global warming, butterfly-friendly energy policies and the simple reality of fossil fuels as a part of, rather than threat to, our planet, I’m certainly not here to answer or solve the same.

Certainly the Germans (and their solar powered ideas in a part of Europe with very little sun) are not getting it… In fact, they are getting much of their (nuclear) energy from France and are now forced to burn coal to get through the winter.

I am here, however, to lay down some objective facts and ask some blunt questions.

Oil Politics

Biden, it seems fairly clear to all, is not in charge of US policy.

That’s a scary fact. Even more scary, however, is determining who is in charge?

Again, not something I can answer.

But if he were in charge, we’d all be amused to ask how he expected Saudi Arabia to welcome him and his embarrassing pleas for Saudi production increases (to ostensibly ease inflated US fuel costs) after previously telling the world he considered Saudi Arabia a pariah state…

We all remember that embarrassing fist-pump with the Crown Prince.

Meanwhile, Saudi is now spending far more time with the Chinese and Iran…

We’d also love to hear the White House explain how it expects increased US shale production to reduce energy inflation when it has been simultaneously seeking to legislate oil off the American page.

Furthermore, it would be worth reminding Americans and politicians tired of inflated fuel prices that the vast majority of those inflated pump costs are due to US taxes per gallon, not Saudi production cuts.

But I digress.

Oil Math

At the current levels of US oil production and exploration, the US (according to its own Dallas Fed) will have to engage in annual energy price inflation levels of 8-10% just to keep the oil industry’s lights on at a breakeven price level.

Such conservative inflation figures for oil/fuel pricing, when seen in the context of over $31T in US Federal debt, basically means that Uncle Sam’s ability to cover his ever-increasing public debt burden will weaken by at least 8-10% per year at a moment in US history where Uncle Sam needs all the help, rather than weakness, he can get.

Fighting Inflation with Inflation, and Debt with Debt?

Needless to say, the only “solution” to these inflated debt burdens will be the monetary mouse-clicker at the Eccles Building, whose doom-loop (yet now ossified) “solution” to addressing inflated oil prices is the even more inflationary policy of printing more fake money to “fakely” cure an inflation crisis.

You really can’t make this stuff up.

Fed monetary policy, ever since patient-zero Greenspan sold his soul (and sound-money, gold-backed academic thesis) to Wall Street and Washington, boils down to this: We can solve a debt crisis with more debt, and an inflation crisis with more, well…inflation.

Does this seem like “sound monetary policy” to you?

Or, Just Export Your Inflation to the Rest of the World?

But as I’ve warned for years, Uncle Sam’s first instinct (as holder of the world reserve currency) whenever handed a hot-potato of self-inflicted inflation, is to hand it off to the rest of the world—i.e., to export his inflation to friends and foes alike.

Global energy importers in Europe, emerging markets, India, China, and Japan, for example, are facing what accountants call a balance of payments crisis, but what I’ll bluntly call by its real name: A currency crisis.

That is, under the current, but potentially dying petrodollar system, these countries will need more USDs to buy oil.

But that’s where the problem lies.

Why?

Simple: Those USDs are drying up (unless more are printed).

How Long Will Global Currencies (& Leaders) Remain Prisoner to the USD?

Regardless of whether you believe in the perpetual hegemony of the USD as a payment system or not, we can all agree that USD liquidity is drying up (whether it be from the milk-shake theory absorption in euro-dollar and derivative markets or from post-sanction de-dollarization).

Nations facing the double whammy of needing more USDs to pay for inflated oil prices and inflated USD-denominated debts around the globe are going to being crying “uncle!” rather than just “Uncle Sam.”

What can these nations do in the face of that bullying hot potato known as the USD? How can they service these increased USD payment (oil and debt) burdens?

How the US Creates a Global Currency Crisis

Well, short of turning their backs on the USD (not yet), the only current option other nations have is to devalue (i.e., inflate and debase) their own currencies at home, which is how Uncle Sam makes his problem just about everybody else’s problem…

As I often say, with friends like the US, who needs enemies?

Something, however, has to give.

How Physical Gold Offers Better Pricing than Fiat Dollars

This clearly broken system of the US exporting its inflation upon a world forced since the 1970’s to import oil under a broken and inflationary Greenback has a genuine potential to implode.

Already, countries like Ghana have realized that it’s better to trade oil in real gold rather than fake fiat dollars.

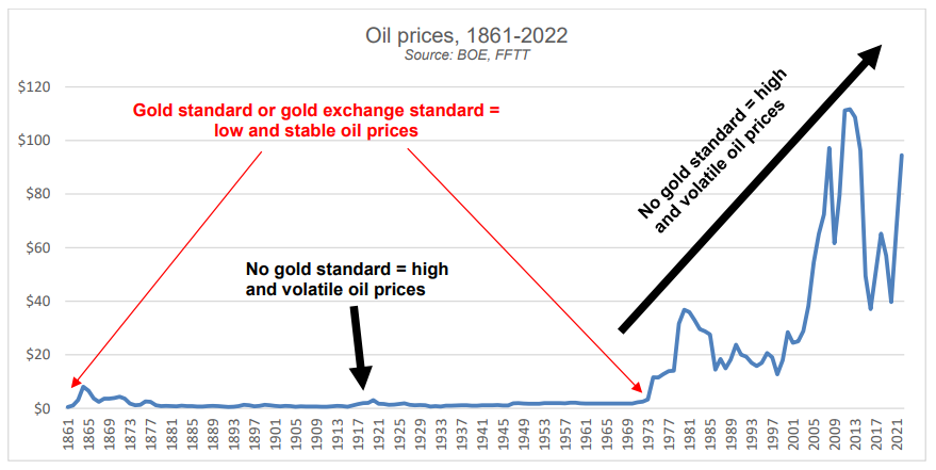

Long before the petrodollar became the mad king, for example, history recognized that physical gold was a far better instrument of payment to settle stable oil pricing.

See for yourself.

As more and more of the world recognizes the currency crisis slowly in play now, and then steadily in greater pain tomorrow, this “Balance of Payments” (i.e., currency) crisis can easily evolve into a “change of payments” reality in which gold re-emerges as a superior payment system for oil.

Think about that.

More Tailwinds for Gold

As of this writing, the physical oil markets are greater than 15X the size of the physical gold markets on an annualized (USD) production basis.

If the world turns slowly (then all at once?) toward settling oil in gold (partially or fully) to avoid a global currency crisis, gold will have to be repriced at levels significantly higher than current pricing.

Hmmm.

Something worth tracking, no?

Well, the Zeitgeist suggests that we are not the only ones tracking these trends…

The Central Banks Are Catching On to (and Stacking) Gold

A recent pole of over 80 central banks holding greater than $7T in FX reserves indicated that 2 out of 3 polled strongly believe that central banks will be making more, not less, purchases of physical gold in 2023.

Again: Are you seeing a trend? Are you seeing the context? Are you seeing why?

As I’ve said countless times and will say countless times more: Debt matters.

Debt matters because debt, once it crosses the Rubicon of insanity and unsustainability, impacts everything we market jocks were supposed to have been taught in school and in the office—namely bonds, currencies, inflation and recessionary cycles follow debt cycles.

In short: It’s all tied together.

Once you understand debt, the policies, reactions, weaknesses, truths, lies, and cycles are far easier to see rather than just “predict.”

The increasing loss of faith in the world reserve currency and its embarrassing IOUs (i.e., USTs) is not merely the domain of “gold bugs” but the simple and historical consequence of the blunt math which always follows broken regimes, of which the US is and will be no exception.

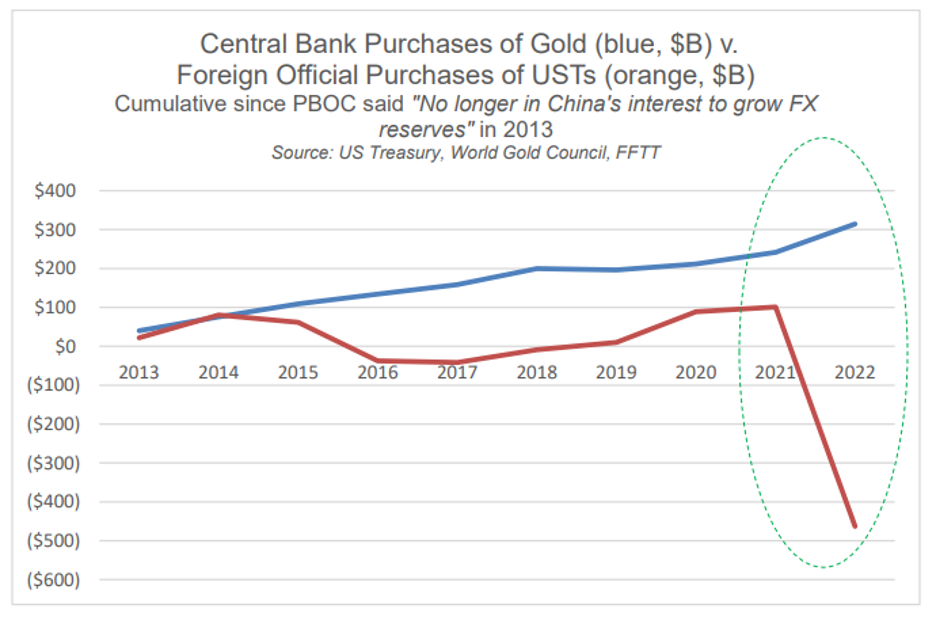

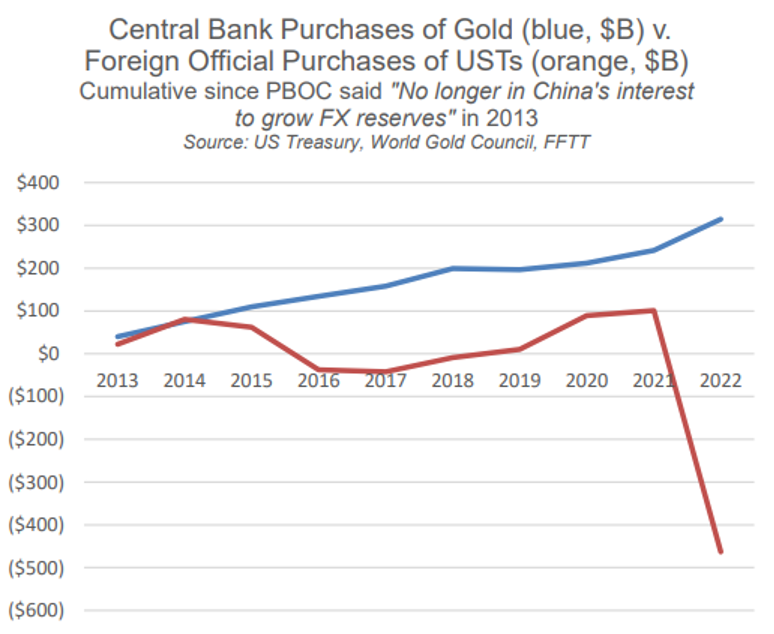

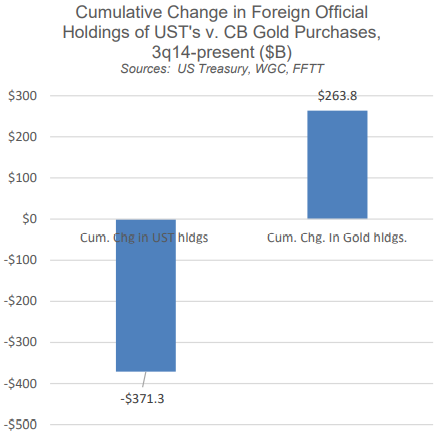

The graph below, is thus worth repeating, as the world is clearly turning away from Uncle Sam’s drunken bar tabof debased dollars and IOUs toward something more finite in supply yet more infinite in duration.

Again: See the trend?

Gold, Oil & Global Currencies Entering a Watershed Moment

From oil markets to treasury stacking, backdoor QE, investor fantasy and hedge fund prepping, it’s becoming more and more clear that the big boys are bracing for disaster as gold stretches its legs for a rapid run north.

Recently, I dove into the cracks in the petrodollar as yet another symptom of a world turning its back on USTs and USDs.

Gold, of course, has a role in these headlines if one looks deep enough.

So, let’s look deeper.

Diving Deeper into the Oil Story

The headlines of late, for example, are all about “surprise” OPEC production cuts.

Why is this happening and what does it say about gold down the road?

First, let’s face the politics.

As noted many times, it seems US policy, on everything from short-sighted (suicidal?) sanctions to the “green initiative” makes just about zero sense in the real world, which is miles apart from the “keep-me-elected” fantasy-world of DC.

After all, energy, matters, which means oil matters.

But the current regime in DC has been losing friends in Saudi Arabia and cutting its prior and once admirable shale production outputs (think 2016-2020) in the US despite a world that still runs on black gold fighting against green politics.

The DC attack on shale may make the Greta Thunbergs happy, but let’s be blunt: It defies economic common sense.

Saudi, by cutting production, is now showing a still very much oil-dependent world it is not afraid of losing market share to the USA in the face of rising oil for the simple reason that the USA just aint got enough oil to fill the gap or flex its energy muscles.

In the meantime, Chinese demand for crude is peaking while Russian oil flows to the east (including to Japan) are hitting new highs at prices above the US-led price cap of $60/barrel.

If DC has any blunt realists (wrongly castigated as tree-killers) left, it will have to re-think its anti-oil policies and get back toward that recent era when US shale was responsible for 90% of total global oil supply growth.

If not, oil prices can and will spike, making Powell’s war on inflation even more of an open charade.

Speaking of inflation…

Ghana Oil-for-Gold Beats Inflation

When it comes to oil and the decades-long bully-effect of a usurious USD (See: Confessions of an Economic Hitman), we have argued countless times that a strong USD and an imposed petrodollar was gutting developing economies around the world.

We also warned that developing economies (spurned by global distrust of the Greenback in a post-Putin-sanction era of a weaponized reserve currency) would respond by turning their backs on US policies and its dollar.

In the old days, the US could export its inflation abroad. But those days, as we warned as early as March 2022, would be slowly but steadily coming to a hegemonic end.

Again, this does not mean (nod to the Brent Johnson) the end of the USD as a reserve currency, just the slow end of the USD as a trusted, used or effective currency.

Toward that slow but steady end, it’s perhaps worth noting that Ghana’s inflation rate has fallen from 156% to just over 60% since it began trading oil for gold rather than weaponized USDs.

Hmmm.

Gold Works Better than Inflated Greenbacks

The most obvious conclusion we can draw from such a predictable correlation is that gold seems to be working better than fiat dollars to fight/manage inflation, a fact we’ve been arguing for well…decades.

From India to China, Ghana, Malaysia, China and 37 other countries engaged in non-USD bilateral trade agreements, the inflation-infected USD is losing its place in more than just the critical oil trade.

Nations trapped in USD-denominated debt-traps (thanks to a rate-hiked and hence stronger and more expensive USD) are now finding ways to tie their exports (i.e., oil) to a more stable monetary asset (i.e., GOLD).

This, of course, makes me that much more confident that as the world moves closer to its global (and USD-driven) “Uh-Oh” moment, that the already-telegraphed Bretton Woods 2.0 will have to involve a new global order tied to something golden rather than just something fiat.

This, again, explains why so many of the world’s central banks are loading up on gold rather than Uncle Sam’s IOUs.

Gosh. Just see for yourself:

Ouch.

Uh-oh?

US Investors: Still High on Past Fantasy Rather than Current Reality

Sadly, however, the US in general, and US investors in particular, remain trapped in a spiral of cognitive dissonance and still believe today and tomorrow’s America is the America of magical leaders, deficits without tears and the balanced-budget honesty of the Eisenhower era.

That’s why the vast majority (and their consensus-think, safety-in-numbers advisors) are still huddling in correlated 60/40 stock bond allocations rather than physical gold according to a recent BofA survey of wealth “advisors.”

This always reminds me of a phrase circling around Tokyo just before the grotesquely inflated Nikkei bubble lost greater than 80% of its hot air in the crash of 1989, namely: “How can we get hurt if we’re all crossing the road at the same time?”

Well, a large swath of US investors (and their “advisors”) is about to find out how.

Doubling Down on Return Free Risk

This may explain why US households (a statistical term of art which includes hedge funds) have upped their allocations to USTs by 165% ($1.6T) since Q4 of 2022 at the same time that the rest of the world (see above) has been dumping them.

But in all fairness, this does make some sense, as higher rates in the US give investors in USTs (especially in short-duration/money market securities) a greater return than their checking or savings accounts.

Unfortunately, where the masses go is also where bubbles go; but as I like to remind: All bubbles pop.

Of course, when adjusted for inflation, these poor US investors are still getting a negative return on USTs.

Foreigners, of course, have stopped falling for this, but when Americans themselves get suckered en masse into this same bond-trap, they’re basically just paying an invisible tax while chipping away at GDP growth and unknowingly helping Uncle Sam finance his debt for free (namely: at a loss to themselves).

Crazy?

Yep.

Negative Returning IOUs—The Lesser of Evils

But why are hedge funds (i.e., the “smart money”) falling for this? Why are they loading up on USTs?

Because they see trouble ahead, and even a negative returning UST is safer (less evil) than a tanking S&P–and that’s exactly what the pros are bracing for/anticipating.

Waiting for a Market Bottom

In short: The big-boys are safe-havening today in negative-USTs so that they’ll have dry powder at hand to buy a pending and massive market bottom tomorrow.

Once they can buy a bottom, they too will dump Uncle Sam’s IOUs as the QE (along with inflation) kicks back to new highs thereafter.

And speaking of QE…

Backdoor QE: Coordinated and Synthetic Liquidity by Another Name

I have always endeavored to simplify the complex with big-picture common sense.

Toward this end, let’s keep it simple.

And the simple truth is this: With US debt at unprecedented and unsustainable levels, it is a matter of national survival to prevent bond yields—and hence bond-driven rather than Fed- “set” interest rates–from spiking.

Such a natural, and bond-driven spike, after all, would make Uncle Sam’s embarrassing debt too expensive to function.

Survival vs. Debate

Thus, and to repeat: Keeping bond yields controlled is not a matter of pundit debate but national survival.

Since bond yields spike when bond prices fall, it is thus a matter of sovereign survival to keep national bond prices at reasonably high levels.

This, however, is naturally impossible when bond demand (and hence price) is naturally sinking.

This natural reality opens the door to the un-natural “solution” wherein central banks un-naturally print trillions (“synthetic demand”) to buy their own bonds/debt.

Of course, this game is otherwise known as QE, or “Quantitative Easing”–that ironic euphemism for un-natural, anti-capitalist, anti-free market and anti-free-price-discovery Wall Street socialism whose inflationary consequences cause Main Street feudalism.

In short: QE has backstopped a modern system of central-bank-created lords and serfs.

Which one are you?

See why Thomas Jefferson and Andrew Jackson feared a Federal Reserve, which is neither “federal,” nor a solvent “reserve.”

The ironies, they do abound…

How Can there be QE if the Headlines Say QT?

But the official narrative and headlines are still telling us only stories of QT (Quantitative Tightening) rather than QE, so what’s the problem?

Well, as with just about everything from CPI data and transitory inflation memes to recession re-defining, the official narrative is not always the truthful narrative…

In fact, back-door or “hidden QE” is all around us, from the Fed bailing out/funding repo markets and dead regional banks to central banks making secret deals behind the scenes.

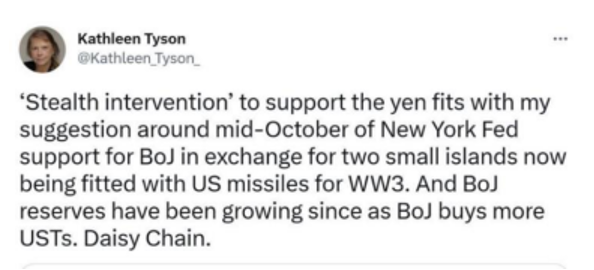

Although it’s not officially QE when the central bank of one country is buying the IOUs (bonds) of another country, it is more than likely that leading central banks are acting in a coordinated way to “QE each other’s debt,” a system which former Fed official, Kathleen Tyson, describes as a “Daisy Chain.”

And if we look at the IMF’s own data, we can connect the dots of this Daisy Chain with relative (rather than tin-foil-hatted) clarity.

Since Q4 of 2022, for example, overall FX reserves are now up by over $340B, the equivalent of over $100B per month of central bank QE by another name.

Toward that end, the math is simple, with: 1) GBP reserves up 10% (no surprise given the gilt implosion of Oct. 2022), JPY reserves up nearly 8%, EUR reserves up 7% and USD reserves only up only 0.5%.

Not only does this look like backdoor QE masquerading as “building excess reserves,” it looks to me, at least, like a coordinated attempt by DXY central banks to collectively weaken the 2022 USD which Powell’s rate hikes had made painfully too high for the rest of the world, a fact/pivot of which we warned throughout 2022.

Since the above G7 policies kicked in, the USD has fallen 11% into 2023 as the other DXY currencies (JPY, EUR and GBP) gave themselves a little backdoor/QE boost.

It seems, in short, that the need for artificial liquidity in a world thirsty for USDs found a clever way to weaken the relative strength (and cost) of that USD (and confront/tame skyrocketing volatility in USTs) without overtly requiring Powell to mouse-click dollars from his own laptop.

Why Markets Rise into a Recession

This unofficial but likely coordinated play to constructively weaken the USD among the big boys helps explain why the S&P has been rising into 2023 despite open indicators that the country is itself marching toward a recession.

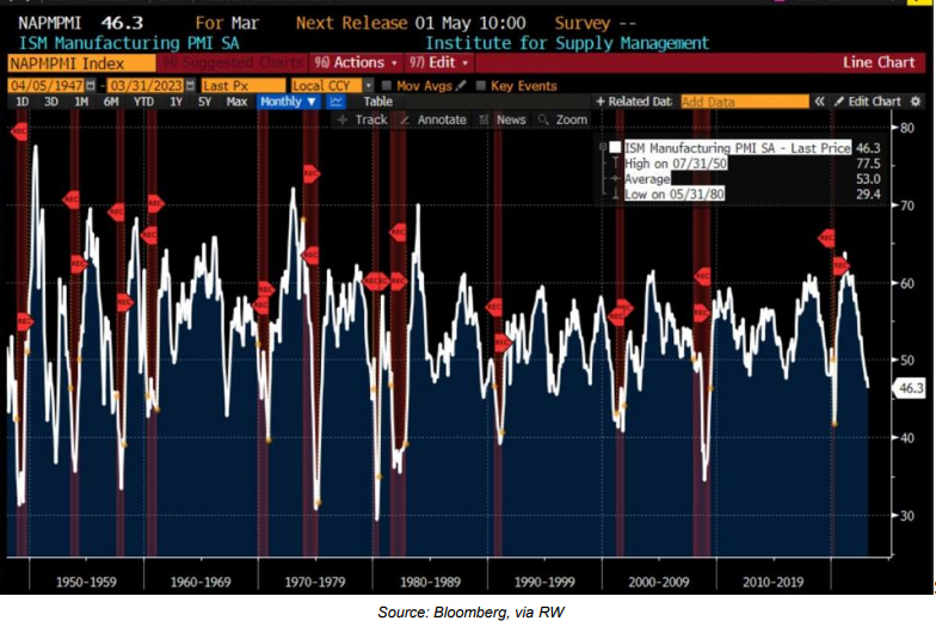

US Manufacturing data (ISM) is now at levels consistent with a recession…

Again: The ironies (and un-natural manipulations) abound.

Meanwhile, the Atlanta Fed’s GDPNow is down 1.5% from March’s 3.2% figure.

But hey, who needs growth, productivity, tax receipts or even a modicum of national economic health to keep a liquidity-supported stock market from defying reality—at least for now…

Waiting to Pay the Debt Piper…

Ultimately, of course, debt will get the last, cruel laugh, and with the US heading toward a deficit that is greater than 50% of GLOBAL GDP (!), I personally believe the Fed will need to return to its own money printer in a big way once this market charade ends in an historical “uh-oh” moment.

This seemingly inevitable return to mouse-click trillions (inflationary) will likely come after a deflationary implosion in equity assets currently supported by the foregoing tricks and fantasy rather than earnings and growth.

In the interim, and like those hedge fund jocks discussed above, we can only wait for things to get S&P ugly as gold, often sympathetic in the first hours of a market crash, rips toward all-time highs thereafter.

Gold, Oil & Global Currencies Entering a Watershed Moment

The latest headlines, of course, are all pointing toward the ripple effect of Silicon Valley Bank (SVB), and they should be.

This banking metaphor for the tech sector in particular and the previously described disaster in California as a whole or the matter of banking risk as a theme, require understanding and attention, provided below.

Once we get past a forensic look at the data and forces which explain SVB’s demise, we quickly discover that SVB is itself just a symbol of a much larger financial (and banking) crisis which ties together nearly all of the major macro forces we’ve been tracking since Powell began his QE to QT quest to be Volcker-reborn.

That is, we confirm that everything comes back to the Fed and bond market in general and the UST market in particular. But as I’ve argued for years, and will say again now: The bond market is the thing.

By the end of this brief report, we also discover that SVB is just the beginning; contagion inside and outside of the banking sector is about to get worse. Or stated more bluntly: “We aint seen nothing yet.”

But first, let’s look at the banks in Silicon Valley…

Two Failed Banks

The tech-friendly SVB story (i.e. FDIC shutdown) is actually preceded by another failed bank, namely the crypto-friendly Silvergate Capital. Corp, now heading into voluntary liquidation.

Because SVB was a much larger bank (>$170B in deposits) than Silvergate (>$6B in deposits), it got and deserved more headlines as the largest bank failure since well, the 2008 bank failures…

Unlike Lehman or Bear Stearns, the recent disasters at SVB and Silvergate were not the result of concentrated and levered bets/loans negligently packaged as investment-grade credits, but rather the result of a good ol’ fashioned bank run. Bank runs happen when depositors all want to get their money out of the banks at the same time—a scenario of which I’ve warned for years and compared to a burning theater with an exit door the size of a mouse-hole.

Banks, of course, use and lever depositor funds to lend and invest at risk (which is why Henry Ford warned of revolution if folks actually understood what banks actually do). Thus, if a mass of depositors suddenly wants their money at the same time, it’s just not gonna be there.

So, why were depositors in a panic to exit?

It boils down to crypto fears, tech stress and bad banking practices.

No Silver Lining at Silvergate

At Silvergate, they provided loans to crypto enterprises, which were the belle of the speculation ball until Sam Bankman-Fried’s FTX implosion made investors weary of crypto exchanges. Nervous depositors withdrew billions of their crypto-linked deposits at the same time.

Silvergate, of course, didn’t have the billions needed to meet depositor requests, because, well… banks by their operational (fractional reserve) nature never have the money when needed at the same time.

Thus, the bank had to quickly and desperately sell assets, which meant selling billions worth of non-mature Treasuries whose prices had tanked in the interim thanks to the Powell rate hikes.

(See how the Fed lurks, head down and silent, as the source behind nearly every crisis?)

This was selling bank assets at the worst time imaginable and immediately sent Silvergate into the red and toward the cold dark ocean floor.

Once DOJ investigations end and the FDIC insurance runs out, we’ll discover just how “whole” the bigger depositors at Silvergate will be—but this will take time and end in some degree of pain for many of them.

Death Valley for Silicon Valley Bank

As for the bigger disaster at SVB, they mostly serviced start-ups and technology firms with a major focus on life sciences start-ups—i.e., yesterday’s unicorns and tomorrow’s donkeys.

These unicorns, of course, were not only under the cloud of the FTX fears in particular and falling faith in tech miracles in general, but equally under the pressure of Powell’s rate hikes, which made funding (or debt-rollovers) harder and more expensive to obtain for tech names.

In short, the keg party of easy money for questionable tech enterprises was beginning to unwind.

SVB’s slow and then rapid demise came as depositors (at the advice of their VC advisors) withdrew billions at the same time, which SVB (like Silvergate) could not match after selling UST assets at a massive loss to save the first withdrawals while burning the later movers.

In short, and like all Ponzi schemes, banks suffering a bank run can’t and won’t make everyone whole—just the first money out—i.e., the fastest runners in the burning theater.

Burn Victims, Recovery?

Banks, ironically, can’t technically go bank-rupt. Silvergate plans to eventually make all depositors whole as they sift through their assets in liquidation. Hmmm. Good luck with that.

SVB, however, waited too long for voluntary liquidation procedures and was instead taken over by the FDIC as a receiver to manage the sale of assets to return investor deposits as a dividend over time.

Furthermore, the FDIC “insures” investor deposits up to $250K, but that won’t help the vast majority of SVB deposits (95.5%) not covered by this so-called insurance.

The Contagion Effect?

Notwithstanding the pain felt by depositors at Silvergate and SVB, the fear there has spread to the broader banking sector (big bank to regional), which saw expected sell-offs at the end of last week and has prompted the inevitable question, namely: Is this another Lehman moment?

For now, we are talking about bank runs rather than banks failing ala 2008 due to massive derivative exposures and bad loans. In short, this is not (yet at least) a 2008-like banking crisis.

That said, and as we’ve reported countless times, post-2008 banks are still massively over-levered and over-exposed to that toxic waste dump otherwise known as the COMEX and derivatives market.

Each day, the headlines change.

Signature Bank, this time in New York, was just shuttered by New York regulators.

The Fed then announced over the weekend that they will make depositors whole, which is tantamount to confessing yet another Fed bailout of bad banks under the new name of the $25B “Bank Term Funding Program”—or BTFP, an acronym which spurs reminders of the 2009 TARP days…

Such a bailout policy makes the odds of further Fed rate hikes in 2023 a bit less likely, and already the traders on Wall Street are renaming BTFP as “Buy The F***ing Pivot.”

As I’ve written for months (and show below), Powell’s QT plan would last until something inevitably broke, and it would seem that day has come, as expected.

Many are suggesting that the BTFB will need to be funded to at least $2T, not $25B, to backstop further banking risk.

Easy Prognosis

Based on context and current data, however, we can begin to make certain objective and early conclusions.

- Cash flow from VC into tech is about to get a lot tighter, as we’ve been warning for the last 2 years.

- SVB depositors may eventually get some or much of their money back over time once the bank’s assets (Treasuries, loans etc.) are sold off by the FDIC. Despite my very, very low opinion of bank regulators, at least SVB, unlike FTX, was regulated.

- As to a full-on crisis across all banks, it’s a bit early to say that the foregoing regional cancers will spread across all banks of all flavors, though our blunt reports on banking risk in the past suggest that banks as a whole are anything but safe.

- Cryptos, already under the cloud of FTX and now SVB, saw more pain, as the sell-offs in this space last week confirm. However, as banking fears prompt a more dovish Fed in Q2, many cryptos could rise.

The Bigger, Scarry Picture

In the still evolving nature of the current banking crisis, we see reasons to be concerned, very concerned, about systemic risk in the banking sector.

Banks, and banking practices, are complex little beasts. Just across town at that gasping entity known as Credit Suisse, for example, they have been too afraid to publicly report their cash-flow statements as the bank’s stock fell yet another 60%. So, yeah, things are complex…

But returning to the US in particular and banks in general, one can still derive the simple from the complex, which is simply scarry.

Keep It Simple

At the most basic level, banks fail when the cost of funding their operations rises dramatically above the returns or yields on their performing/earning assets.

It is our view that such a set-up for further pain across the banking sector is real, a set-up made all the worse by—you guessed it—that entirely un-natural destroyer of natural markets forces, free price-discovery and honest capitalism otherwise known as the U.S. Federal Reserve.

Central Bankers and Broken Bonds

As I’ve written and spoken, everything is connected, and everything eventually takes it signals from the bond market, which was long ago hijacked by the Fed.

Powell’s rate hikes, for example, don’t just occur in a vacuum to fight his bogus war on an inflation nightmare which he once promised was only “transitory.”

Fed QT and QE, for example, are more than just words, experiments or theories, they are un-natural, artificial and powerful toxins which can’t be contained to just making central bank balance sheets thinner or fatter and bogus CPI data higher or lower.

Instead, the Fed’s little tweaks, tricks and madness impact just about everything, and always end up screwing everything up.

Why? Because markets were designed to be managed by natural forces of supply and demand not artificial forces of fake money from central bankers.

By raising the Fed Funds Rates toward 5% and above at rapid pace, for example, Powell has done more than just make a tiny $300B dent in the Fed’s nearly $9T balance sheet. He has engineered a dis-inflationary recession and sent combined nominal returns in stocks AND bonds to levels not seen since 1871.

But when it comes to banking risk, Powell has also gut-punched that sector with criminal negligence.

How so?

Even the Banks Can’t Fight the Fed?

When the Fed began raising rates, it sent bonds to the floor and hence yields to the moon (yields and bond price are inversely related).

This impacts bank balance sheets because banks make a living by paying depositors at rate X while earning X+; but now those banks are in a deadly corner of the Fed’s own mis-design.

That is, the Fed has sent bond yields higher than the rates/yields which commercial banks offer depositors, which is why many depositors are questioning the advantage of being, well…depositors.

This mis-match, of course, will likely require banks to raise depositor rates to compete with rising UST yields, a costly tactic which cuts their profits and reddens their balance sheets.

Alternatively, banks could offer/issue more bank shares to increase their capital, but this dilutes existing share counts and value, which is how bankers are paid.

To add insult to injury, banks (and bankers) are also facing the real risk of rising or at least persistent inflation, which means that the real return on even “enhanced” depositor rates is ultimately a negative return when adjusted for the invisible tax of inflation.

All Conversations Return to Gold

So, no, we hardly think the commercial banking system, the massive and compounding risks of which we have reported for years, is anything remotely healthy, safe or credible.

All frowns and inevitable (yet increasingly empty) gold-bug critiques notwithstanding, we think holding a physical bar of segregated, allocated and non-levered gold in one’s own name in the world’s safest private vaults and jurisdictions makes a lot more sense than trusting your increasingly worthless paper or digital money to the world’s increasingly fractured banks, be they SVB, Credit Suisse or JP Morgan.

Just saying…

Gold, Oil & Global Currencies Entering a Watershed Moment

Below we consider the State of California as the metaphor of a failed state as well as the failing state of the American Union, which is anything but a dream.

Metaphors

For those already familiar with my articles, interviews or even daily banter, I have an admitted affinity for metaphors and analogies, as they help draw the simple from the complex.

Toward that end, I’ve 1) compared policy makers to failed generals, 2) debt and currency bubbles to Titanics, 3) macro investing to polo matches, 4) monetary policy to drug addiction and 5) the love of bloated bond markets to toxic romances.

As for politicians and political issues, there is always the risk of partisan bias and offending those who cling to only one perspective.

Fortunately, my take on the left or the right of current politics is fairly agnostic, as I view nearly all politicos as crooked as a dog’s hind leg.

Thus, as I turn my lens toward the state of California and its failed governor, I hope readers of the left or right can dispense with politics and just stick to math so that we can all get past the swamp of red vs. blue opinions and respect the objective facts of red vs. black balance sheets.

And when it comes to the State of California, she’s deeply in the red, and serves, ironically, as yet another broader yet applicable metaphor of the world economy in general and the United States in particular.

So, let’s dig in.

California Dreaming?

Oh, how I have loved California. It is home to some wonderful personal memories as well as personal wipeouts—and not just the surfing kind.

Its sunny appeal, however, is universally seductive, and like that famous Eagles song, one indeed feels like you can check in any time you’d like, but you can never really leave California’s tempting horizons and mythical spell where dreams come true.

Nevertheless, folks are leaving California, and have been doing so to the tune of over 500,000 exits in the last 2 years alone.

Why?

For those on the political right, California’s big-headed Gavin Newsom is an easy target.

His over-the-top COVID hysteria (similar to other failed experiments in Seattle, Chicago or Portland…) and unsustainable tax policies coupled with San Francisco’s soft-on-crime nightmare (car-jacking capital) and L.A.’s recent fall from City of Dreams to Tent City are all classic symbols of a failed state.

I once lived on this beach…

But let’s leave that issue, debate and fall to the woke, the left, the right, the angry and the smug.

For me, the math of California (whose nominal GDP ranked as the 5th largest in the world) makes the discussion far easier to sift through.

The Hard Reality of Simple Math

Like nearly all cornered politicians, Newsom is driven by obfuscating the obvious and trivializing the momentous (Chicago’s recently failed mayor of the nation’s “murder capital” comes to mind…).

For example, his January projected budget deficit of $22.5B (an already embarrassing figure which he nevertheless tried to downplay) was in fact off.

Way off.

It turns out that even Newsom’s “sunny” forecast and optimistic math had overlooked a few pesky facts.

First, the state’s monthly tax revenue for January was almost $14B less than the revenue for the month prior.

Secondly, California’s fiscal year, which started last July, is moving at a pace of $23B in less income than the previous year.

In short: California’s income stream is running toward an emptiness equivalent to Newsom’s IQ, despite sunsets as consistent as his immaculate wardrobe and “Hollywood” smile (smear?).

But as many Californian’s know—it’s not how things feel, but how they look which counts.

For the top income bracket, however, California’s tax bills (and revenues) aren’t looking good.

Even those wealthy and beautiful (from Topanga to Belvedere Island) are starting to squirm under a state tax structure that feels and looks anything but “dreamy.”

State tax for Californians earning over $1M is 13.3%, and the top 0.5% of California’s tax payers are responsible for over 40% of the state’s total tax income.

Many, of course, are getting sick of paying taxes for increasingly expensive sunsets, even from Orange County’s row of waterfront mic-mansions.

Furthermore, for those wealthy left-coasters who’ve lost their jobs or capital gains at Google, Amazon, Facebook and countless other Silicon Valley enterprises of late, that tax income is openly drying up, which means so are the state’s revenues.

Fantasy Land

California, of course, is home to Hollywood and fantasy-like conversations of making dreams come true over cocktails at Shutters on the Beach or an overpriced vegetarian meal at The Ivy.

Fantasy, of course, is fun, and even necessary at times. (I always loved Shutters…)

It was fantasy, for example, that made an Austrian body-builder into a former Governor of California. How’s that for the American/Californian dream?

Unfortunately, that same Austrian never studied Austrian economics in between barbell sessions, and the last time I heard him speak, he was saying “screw your freedom,” suggesting that the unvaccinated were all anti-science “schmuks… “

What a guy. What a dream.

But had some of Cali’s former leaders indeed studied any form of economics, they’d likely understand that rising deficits and falling revenues is the opposite of a dream—it’s the historically-confirmed prelude to a nightmare.

Even the once-reliable WSJ has confessed that California’s budget has imploded and that January revenues are poised to be down by 40% y/y.

Uh-oh?

One wonders how long the top 0.5% of California will want (or be able) to pay that ever-increasing bill as profits in their tech-heavy portfolios creep ever closer toward a cliff steeper than Malibu’s Point Dume.

Fantasy Politics—Lipstick on a Pig

In the interim, Californian leadership sure knows how to put lipstick on a pig.

They’d tell us, for example, that despite revenues falling from prior peaks, that the state expects revenues for 2023-24 to “remain about 20% higher than before the pandemic.”

In other words, nothing to worry about.

Really?

First, those “projections” already have a ring of good ol’ Californian fantasy to them.

But even if we assume they are accurate and that California’s “revenue problems” are solved, those same budget wizards are ignoring the spending (i.e., the aforementioned budget deficit) problem which is mounting.

California as Metaphor

Unfortunately, California’s embarrassing combination of tanking revenues, increased spending and expanding deficits is not happening in a vacuum.

In fact, California serves as a mirror to a broader problem within the United States as whole (or debt hole) …

Like the failed state of California, the equally failed state of the US government has a problem with incoming tax revenues, an issue I’ve been tracing throughout 2022.

Like the Californian wealthy 0.5%, the wealthy 1% of the United States taken collectively are the ones paying 40% of the national taxes.

And like California’s wealthy in general, the nation’s wealthy in particular get a lot of that wealth from a bubbling risk asset market whose best days are largely behind us and whose worst days (and hence weaker capital gain receipts) are still ahead.

In short, and like California, the United States is facing less tax revenues combined with greater deficits and increased spending, making the Cali crisis a leading indicator of a national crisis.

The Math of Recessions

Recessions, even the kind the DC crowd seeks to redefine, deny, postpone or ignore, have patterns and facts which we can use to foresee coming trends, weaknesses and even opportunities.

For example, recessions mean less tax receipts and higher deficits.

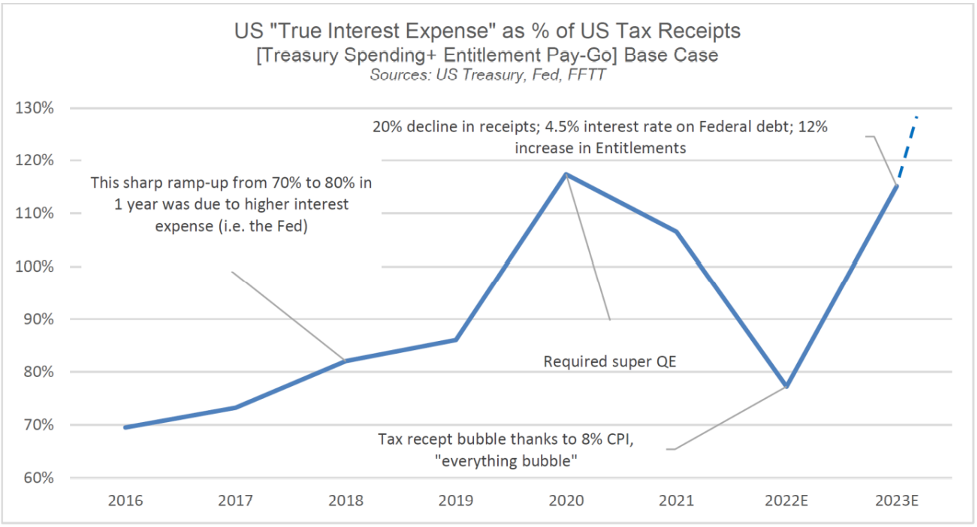

If we assume even a 20% decline in tax receipts (conservative), tagged on to rising deficits estimated at a 12% increase in Entitlement Pay-Go’s (also conservative) in the backdrop Powell’s current rate hike policy, Uncle Sam’s bar tab (i.e., True Interest Expense) returns to Covid crisis/pain levels reminiscent of a seemingly forgotten yesterday:

In other words, the United States (along with California…) are mathematically heading toward a bar-tab (i.e., interest expense bill) as painful as the one we saw in March of 2020, when markets tanked and the Fed was required to print trillions in less than 8 months just to keep Uncle Sam’s nose (and Treasury market) above water.

For now, however, the Fed is not printing trillions via QE, but tightening ala QT.

Or stated more simply, US debt obligations are sailing toward yet another debt iceberg, only now the issue is not about too few lifeboats, but no life boats at all.

As I see it, and have said many times prior, the US is trapped with no easy solutions as debt levels are rising and revenues falling.

The end result is obvious, even if the precise timing of the iceberg is not.

Whether Powell’s Fed continues to tighten into a debt iceberg, or eventually seeks to temporary melt (monetize) that iceberg with more QE, the nation is doomed either way in a Hobbesian choice between tanking markets (QT-driven) or skyrocketing inflation (QE-driven).

No One Likes Bears, and Even Fewer Understand Gold

Unless you are a talented short-trader or volatility option jock, no one likes bears or bear markets, and hence very few like to hear data-driven bears (mathematical realists) like myself constantly reminding us of the debt elephant in the room–and all that this toxic debt inevitably implies.

Once debt levels become fatal, the direction of credit, stock, property and finally currency markets are easy to diagnosis, though the time of death is not.

Gold, of course, loves dying currencies.

The price of gold today, or the strength or weakness of the USD tomorrow, are frankly silly questions in the short term for any who understand the broader context of the long-term.

Currencies are always the last bubble to pop, and given that gold is a store of value rather than an instrument of speculation, gold investors (i.e., those whose aim is wealth preservation not asset speculation) recognize that gold never rises, currencies just fall.

Investors in physical gold therefore measure their wealth in ounces, grams and kilos, not highly toxic, increasing debased and (forever debated) fiat currencies whose race to the bottom is literally happening right before our eyes in real time.

To dismiss such simple deductions from admittedly complex market forces as just “gold bug” thinking ignores math, history and gold cycles.

But again, no one likes to see bears, even when they’re staring at them from the Californian state Capital.

Based on all the debt destruction (and coming consequences) I see in California, the United States and the world in general, I suppose I’ll still just be a “bear” and a “bug” to most.

But both are better than a sitting duck.

Gold, Oil & Global Currencies Entering a Watershed Moment

Below we track years of desperate yet deliberate central bank bubble creation (and can-kicking) to its ultimate end-game: titanic currency destruction.

The Bond Market is the Thing

When tracking markets and asset classes, one eventually accepts the Shakespearean reality that “the bond market is the thing.”

When a completely distorted global financial system is driven exclusively by the greatest credit bubble (and hence crisis) in history, the cost of that debt (i.e., the interest rate) becomes a primary protagonist.

When rates are low, for example, bubbles grow. When rates are high, they pop.

Of course, the bigger the bubble, the more fun the ride up; but conversely, the bigger the bubble, the more painful the pop.

And by the way: All bubbles (tech, property, credit and currency) pop.

We are now entering that pop-moment, and the central bankers know it, because, well: They created it…

Once Upon a Time—Natural Forces

Once upon a time, there was a concept and even a dream of healthy capitalism and natural market forces in which bonds were fairly priced on the basis of a now extinct concept once known as natural supply and demand.

Nod to Adam Smith.

That is, when demand for a bond was naturally high, its price rose and its yield (and hence rate) was naturally low; conversely, when demand was low, its price fell and its yield (and hence rate) rose.

This natural ebb and flow of yields and hence interest rates kept credit markets honest.

As rates climbed and the cost of debt rose, debt liquidity naturally slowed down and the system prevented itself from over-heating.

In essence, the bond markets had a natural pressure gauge which triggered a natural release of the hot air within a bubble.

Then Came the Un-Natural and the Dishonest

Then came the un-natural central bankers against which our founding fathers and Constitution warned.

Like everything centralized and human, as opposed to natural, these short-sighted bankers ruined, well: everything.

Rather than allow bonds, yields and hence rates to be determined by natural price forces, these banks had the arrogant idea that they could control such forces, the hubris equivalent of a sailor attempting to control the powers of an ocean.

Nod to John Smith of the Titanic.

The Fun Part

For years, central bankers have artificially supported sovereign bond markets by purchasing otherwise unwanted bonds with money created out of thin air.

This absurd yet popular “solution” of repressed rates created bubble after bubble. That was the fun part.

It is also the part which breeds a school of academic apologists and theories (nod to MMT) who justify and defend the same as an unsinkable market.

Remember Janet Yellen’s claim that we may never see another recession? Or Bernanke’s Nobel-Prize winning observation that we could print trillions at “no cost” to the economy?

Meanwhile market participants, enjoying the tailwinds of low rates and easy/cheap access to debt, ignore the bubble dangers (i.e., icebergs) ahead as they enjoy the admittedly fun part of a rising bubble.

And oh, what fun a cheap-debt-driven and artificially controlled series of cheap-debt-induced bubbles can be…

Like the tuxedo-clad 1st class passengers on the Titanic’s A-Deck, investors (the top 10% who own 90% of stock market wealth) pass cigars and brandy among themselves and speculate like children comparing portfolios, all the while ignoring the rising iceberg off the bow.

How Icebergs Are Made

When it comes to making icebergs, our central banks have a perfect record, and the leader of this pack is the U.S. Federal Reserve, a private bank which is neither Federal nor a reserve.

Just saying…

For those paying attention rather than passing cigars on the A-Deck, you’ve already noticed this pattern of bubble-to-bubble and hence debt iceberg to debt iceberg creation before.

The Fed, with the complicit support of the commercial bankers and policymakers, for example, “solved” the tech bubble of the late 90’s (kudos to Greenspan) which popped in 2000 by creating a real estate bubble which popped in 2008.

Through the same playbook of artificial rate suppression, the Fed then “solved” that housing bubble (kudos to Bernanke) by creating a global sovereign debt bubble/iceberg (kudos to Yellen and Powell), the very A-Deck upon which we all stand today.

Today’s Iceberg: A Global Credit Crisis

Having bought time and bubbles, from tech to housing to sovereign bonds, the Fed is now running out of places to hide its latest iceberg. This kind of can-kicking is more like sin-hiding.

Having squeezed a tech bubble into a real estate bubble, and then a real estate bubble into a sovereign debt bubble, where can the central bankers now hide their latest Frankenstein, bubble and iceberg? (I love metaphors.)

The Currency Bubble

For me, at least, the answer is fairly clear.

The only way to hide and “solve” the greatest sovereign bond iceberg (crisis) in history is to bury it beneath wave after wave of mouse-clicked, debased and hence increasingly worthless fiat currencies.

In short, the Fed will hide its latest credit bubble behind the last and only bubble it has left in a history-confirmed pattern used by all failed financial regimes, namely: Creating a currency crisis (i.e., debased money) to solve a debt crisis.

Of course, if you read that last line (as well as centuries of economic history) correctly, this just means there are no solutions left, just a choice of crisis options: drowning bonds or drowning currencies.

Pick Your Poison: Credit Crisis or Currency Crisis

Just like the officers at the wheel of the Titanic were the first to realize their ship was sinking, the central bankers from DC to Tokyo are equally aware that they were driving too fast in a sea of icebergs.

Now, they are struggling to “be calm” in voice as their crew scurries to count unavailable lifeboats and keep the passengers from panicking too soon.

Among this crew of policy sailors on the financial Titanic, two camps are forming. After all, even when a ship is sinking, there is always different expressions of the human instinct to survive.

One camp is hawks. The other camp is doves. In truth, however, both camps are doomed.

Hawks Squawking

The hawks are telling the passengers (investors) to fear not.

Yes, they are raising rates to fight inflation, but this, they calmly say from the shivering A-Deck, will not cause the global credit and hence financial markets to sink into a contagious recession/depression.

This is the camp of Larry Summers, William Dudley, Jerome Powell and the likes of James Bullard at the St. Louis Fed.

Bullard, for example, thinks a Fed Funds Rate of anywhere from 5% to 7% may lead to a mere “slowdown in growth” but by no means a recession.

Well, that’s rich. This coming from the same office that said inflation was “transitory” and a recession is not a recession.

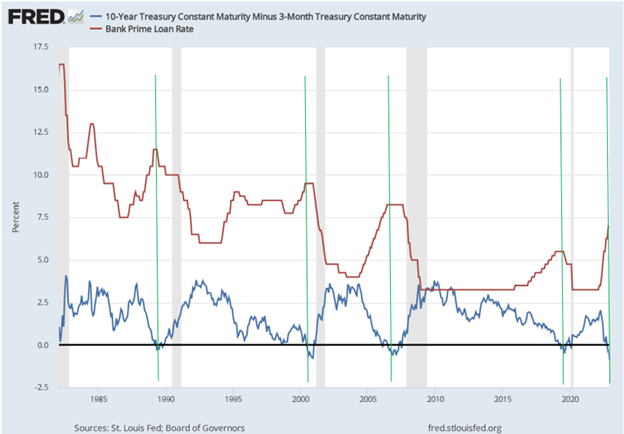

Based on prior GDP prints and the inverted 3m/10y yield curve inversion of late, I’d argue we are already in a recession, but then again, why let facts get in the way of a good lifeboat narrative.

As the Fed captains all know, when the truth hurts, just lie.

The hawks, it seems, somehow believe that they can raise rates (to as high as 7%) to kill mis-reported inflation (as high as 16%) [???] without killing the credit market.

Hmmm…

At the same time, however, Powell needs inflation to outpace interest rates to achieve a deep enough slope of negative real rates to inflate away the USA’s $31T public debt.

Like Captain Smith on the Titanic, Powell is trying hard to stay calm but knows the end game.

Dead Market or Dead Currency?

In short, Powell is in the mother of all conundrums, dilemmas and self-made corners. He literally has no good options left.

If he keeps raising rates to “fight inflation”—he risks sending the global credit markets below the cold-water line.

But if he pivots, eases or allows more liquidity (i.e., QE) back into the bond markets, he saves the bonds but kills/debases the currency and hence creates more rather than less inflation.

Again. Pick your poison: A dead bond market or a dead currency?

The Choice Has Been Made

But in case the suspense is killing you, I’d say the answer is already in front of us.

As hinted above (and shown below), the only and last option left for debt-soaked regimes is currency debasement.

History proves time after time after time that there are no exceptions to this sad rule.

Despite his words to the contrary, Powell will ultimately be forced to kill the currency to allegedly save the credit markets—thus once again squeezing one bubble (in credit) into another bubble (currency), which is what all the central bankers have been doing for years: Pushing one bubble into the next until the final one pops.

Stated otherwise: There just aren’t enough life boats for Captain Powell’s financial Titanic.

Facts Speak Louder Than Words

As I’ve argued all year, Powell may talk Volcker-tough, but he’s moving toward more fake liquidity and hence more inflationary money printing.

If you think otherwise, the evidence is already before us—and I’m not just talking about “moderating the pace of rate hikes.”

In order to survive, the credit markets need more balance sheet expansion (i.e., QE), which by definition, is inherently inflationary.

Nod to Milton Friedman.

Again: Powell will choose inflation (and currency debasement) over “fighting” inflation, because Powell secretly needs inflation and negative real rates to inflate away Uncle Sam’s bar tab.

Nod to Stan Fischer.

This eventually means letting the USD expand in supply and hence sink in value.

Or stated simply: A currency crisis.

Just Follow the Pattern/Banks

Toward this end, the other major central banks and currencies of the world are already doing this.

The yen, euro and pound of 2022, for example, have sunk to record lows to monetize local debts—the USD will eventually follow in 2023.

In fact, this unspoken preference for liquidity over “inflation fighting” is already evident rather than speculative.

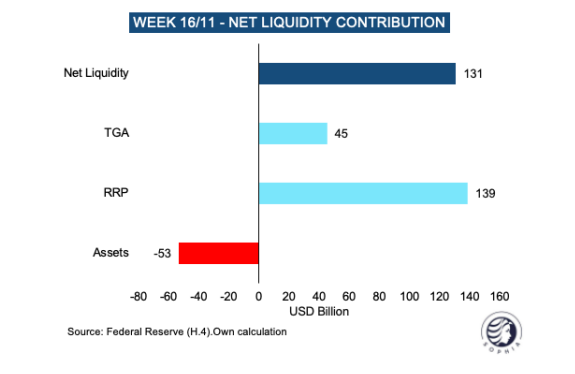

As per the chart immediately below, November saw $45B in Treasury spending and another $139B in repo liquidity—for a total of 131B in net liquidity into the market, a number which far overshadows the $53B of so-called “QT” tightening by Powell.

In short, one may speak like a hawk but act like a dove.

Meanwhile, stocks and bonds were falling together.

Can we all say: “Uh-oh”?

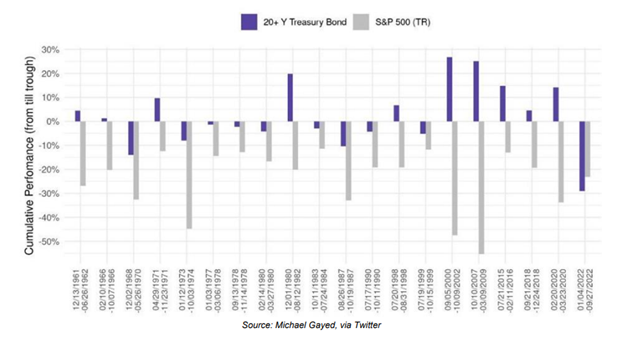

As per the bars at the far right of the graph below, for the 1st time in 60years, we saw a UST market (blue bar) fell faster and further than a top-20 stock market drawdown (grey bar).

Hmmm. Can we blame this historical fall in USTs on inflation?

Nope.

In the 1970’s, and as per chart above, we saw inflation, but never USTs (blue bar) falling further than stocks.

Why the critical difference today?

Easy. Bonds are falling in price because demand is falling in fact. This bond drop is not because of inflation, but because no one trusts the debtor—i.e., Uncle Sam.

Unlike the 70’s, US debt to GDP today is at 125+%, and thus American IOUs today just aren’t what they were yesterday.

…and fiscal deficits are at 10% of GDP.

That’s what I call a debt iceberg…The bigger it gets, the lest investors trust the debtor beneath the surface.

Toward this end, foreign banks are turning their backs on Uncle Sam’s unloved USTs (IOUs)…

Frankly, I’ve never seen such a grotesque convergence of debt icebergs heading for our economic bow.

Watch the Currencies—They’re Already Drowning

As global central banks debase their currencies (yen, euro and pound) to monetize their unloved and unpayable sovereign debts/bonds, we can expect more volatility in the FX markets and pairings as the current USD, like the bow of the Titanic, rises temporarily high above the waves before sinking deep, deep below them.

Can the Fed save that sinking dollar/Titanic by cranking up rates ala Powell at the expense of the US economy and markets as well as at the expense of its global friends and enemies who can’t pay back $14T worth of USD-denominated debts when the USD is too expensive?

I think not.

Nor am I alone in calling out this impossible dilemma of bad options and bad bonds. Druckenmiller and Dimon are saying the same thing.

Stated simply, the only way current central banks can keep their unloved bond market afloat is by drowning their currencies in more QE, which, needless to say, will be very good for gold…

This QE (currently hiding in the ignored repo markets) will be the last resort until the widely telegraphed and pre-planned “great [disorderly] reset” toward CBDC becomes the next embarrassing reality.

This collective lack of faith in USTs and USDs is why global central banks are swapping out USTs and buying physical gold…

As I’ve written and said before, it’s hard to imagine how we ever got to this obvious consequence of too much debt and too much artificial, centralized “capitalism.”

Were policy makers sinister (i.e., intentionally creating a red carpet toward CBDC and more total control) or just irretrievably stupid?

Either way, the end result is the same: The global financial system will sink, and though the USD may be the last to go under, under she will go.