Paper Gold Price Manipulation—Rigged to Fail

The current and open fraud regarding the paper gold price in the COMEX market is now as plain to see as the open desperation in the global financial system, which is unraveling in real-time all around us.

As risk assets tumble foreseeably into bear territory before a headwind of deliberately rising rates, precious metals have seen headline-making falls as well.

Below, we explain why.

Tracking the Paper Gold Price —The Standard Answer

In prior reports, we’ve noted that precious metals typically behave sympathetically when markets tank; thereafter, gold then surges north. We saw this pattern in October of 2008 and March of 2020.

Furthermore, when a Hawkish Fed pursues a temporary yet face-saving policy of rate hiking and quantitative tightening, this makes the USD the relatively stronger horse in the global currency glue factory.

And a relative rise in the USD, of course, is a headwind to gold.

Explaining the Paper Gold Price —The Rigged Answer

But let’s get to the real heart of the matter, namely: Legalized paper gold price manipulation (i.e., fraud) in the COMEX market, a topic we’ve addressed more than once, here and here.

As we’ve openly argued for years, nothing embarrasses an otherwise discredited fiat currency like a rising gold price.

As I’ve described it, rising gold prices are a middle finger to debased currencies whose declining purchasing power are the DIRECT result of the failed and drunken monetary policies (i.e., mouse-click trillions) of a central bank near you.

Or as Ronan Manly more distinctly observed: “Gold to central bankers is like sun to vampires.”

And that, folks, is precisely why the big banks (under the direction of the BIS) are deliberately (and if law school serves me correctly) as well as fraudulently manipulating the paper gold price.

Facts vs. Manipulation

In the first quarter of 2022, we saw record high purchases of ETF gold, physical gold and central bank gold. Even Goldman Sachs’ head of commodity research was targeting $2400 gold this year.

Instead, the gold price has been falling as gold demand has been rising.

Huh?

It reminds me of 2008 when mortgages were defaulting en masse yet the ABX index for sub-prime mortgages was rising.

In short, complete (and temporary) manipulations were going on behind the curtains of a few wayward banks, including Morgan Stanley.

Today’s gold behavior (i.e., surreal manipulation) is no different and no less of an insult to the natural forces of supply and demand, which central bankers have attempted to destroy for well over a decade.

But the jig will soon be up on these masters of open fraud and Wall Street socialism.

The Paper Gold Price & The Horse’s Mouth

For now, and in case you fear I’m just acting as a “gold bug” apologist, let’s go straight to the horse’s mouth and examine the confessions and facts of open price manipulation in the precious metal markets.

And I swear, you really can’t make this stuff up, it’s just that obvious and distorted.

In a recent article by Peter Hambro published by the British news site, Reaction, a 3rd generation gold insider (Petropavlovsk, Bank Hambros) made the open secret of paper gold price manipulation abundantly clear and incontrovertible.

It’s also worth adding that Mr. Hambro’s entire career was that of an heir to a banking dynasty all too familiar with the insider machinations of the London bullion markets and London Stock Exchange.

In short, when Mr. Hambro discusses gold price manipulation, it’s worth listening.

A Chart Says a Trillion+ Words

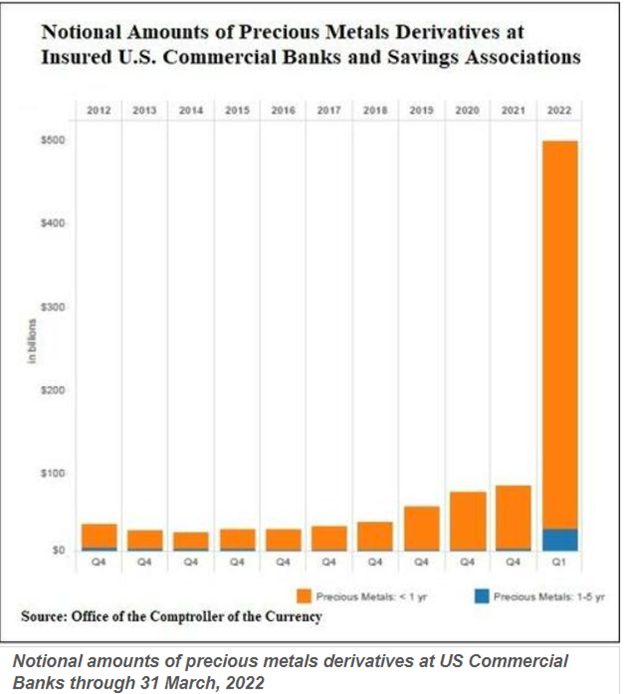

More importantly, and for those who prefer facts over human confessions or “gold bug whining,” the following chart from the U.S. Office of the Comptroller of the Currency (OCC) clearly reveals the extreme extent by which just a handful of highly pocketed (and central bank supported) banks like JP Morgan and Citi can use extreme turns of derivative-based leverage to short (i.e., keep a permanent boot to the neck of) the paper gold price:

That rising bar on the far right is nothing more than crime scene evidence.

As Hambro remarks, a long history of media and bank supported mis-information has tried to keep a lid on the desperate attempts by just a small number of BIS minion banks like JP Morgan and Citi to effectively prevent free market price discovery on the paper gold price.

Despite thousands of daily long contracts (i.e., buy orders) in the OTC forward contract markets, if just 7-8 banks wish to use massive leverage (rising bar on the right) to short the same metal, they can effectively fix the gold price via artificial manipulation of derivatives contracts, to which only a small number of banks have access.

All of this open yet legalized fraud is managed by the central-banks central bank, namely the Swiss-based Bank for International Settlements.

As Hambro states, and as taken from a recent article published by Ronan Manly:

”[s]ince 2018 the Financial Stability Desks at theworld’s central banks have followed theBank for International Settlements’ (BIS) instruction to hide the perception ofinflationby rigging the gold market.”

Hambro further observes:

“With the help of the futures markets and the connivance of the Alchemists, the bullion traders – yes, that includes me, I was Deputy Managing Director of Mocatta & Goldsmid – managed to create an unshakeable perception that ounces of gold credited to an account with a bank or bullion dealer were the same as the real thing. ‘And much easier, old chap! You don’t have to store or insure it’”.

So, there you have it: Banks acting badly, very badly.

No shocker there…

The Greenlight from Big Brother

In essence, a handful of 7-8 LBMA institutions creates an almost limitless amount of synthetic paper representing unallocated gold (i.e., gold they don’t actually own) to short the paper gold market.

Why?

Again, because the central bankers mouse-clicking and hence destroying trillions worth of sovereign currencies (since Nixon took the gold chaperone away in 1971) are utterly terrified of a neutral and relatively fixed/scarce monetary metal like gold—i.e., real money.

Indeed, gold is money, the rest is just debt and toilet paper masquerading as currency.

Furthermore, the policy makers (or central controllers) are embarrassed to confess the inflationary consequences of their absurd money printing, and nothing reveals those consequences more than a naturally rising gold price.

Solution?

Easy: Lie about inflation and rig the paper gold price with leverage, derivatives and a greenlight from the BIS, aka: “Big Brother.”

In Rigged to Fail, I revealed how central bankers rig the bond and hence stock markets. Here we are just showing you how the same bankers rig the gold price to hide a failed currency market.

And if you want to put a handsome face to the farce, here’s an unforgettable one:

What About Don’t Fight the Fed?

Of course, most of you may be angry yet not the least bit surprised to see such rigging hiding in plain sight.

And even if your eyes have been (or now are) wide open, you’re also likely to say, “great, thanks for the news, but how the heck can we (or gold) fight all the central banks?”

Fair question.

As I’ve said, even if you know about a dirty cop, there’s almost no point in fighting one, right?

The Jig (Rig) is Up

We may be a bit jaded and realistic, but that doesn’t make us naive. Gold will get the last and honest laugh over such a corrupt and dishonest “policy.”

As central banks continue to lose more and more credibility, and as investors become more and more fluent in, and aware of, the absurdity of the lies that have been sold to us for years by central bankers and MMT midgets who claim that a debt crisis can be solved with more debt, which is then paid for with trillions created out thin air, the system unwinds.

As the inevitable inflation crisis emerges from precisely such absurd “policies,” the central bankers can no longer blame the obvious and long-dated/repressed inflationary consequences of their drunken monetary policies on a virus or Putin.

Nor can they continue to peddle the lie that inflation was merely “transitory,”a fact we made clear long before Powell confessed it was not so.

Stated otherwise, more and more folks are catching on to the fraud.

The math plainly shows that expanding the broad money supply (and central bank balance sheets from $6T to $36T in just over a decade) is the real cause of the inflation in your neighborhood and the debasement in your wallet.

The First Cracks & the Last Straws

Geopolitical shifts, assassinated prime ministers, fired prime ministers, angry truck drivers, stormed capitals and Sri Lankan protestors are just the first tragic cracks in a growing social unrest driven by declining wealth and growing wealth disparity, all classic and historic symptoms and patterns of when a debt crisis leads to a political crisis, and sadly (and ultimately) more centralized controls over our markets and lives.

But as even Hambro observes, eventually the last straw breaks the back of a rigged camel, and the “straws blowing in the wind are often said to presage great tempests and I believe that {the chart above] shows just such a straw.”

Years of distorted, rigged and entirely reckless debt-and-print polices have made global economies and currencies weaker, not stronger.

The weaponized USD in the wake of the failed Putin sanctions is just further proof of how weak Western economies have become.

Dying Faith, Rising Gold

After years of profligate central bank policies, the so-called “developed economies,” which are now little more than glorified banana republics, are losing credibility, options and most importantly public faith.

This is critical.

In the end, when faith in a system ends, so does its currency.

We’ve written before how impossible it is to market time “the end of faith,” but charts like the one featured herein help to point out the rigging and hence accelerate the inevitable end to derivatives-based fraud, centralized price-fixing and, eventually, the OTC casino in particular.

Meanwhile, the current buy window for repressed precious metals is remarkable, and once central banks cripple the markets to their deflationary pain points, chaos will return, along with the inflationary money printers—all of which will send precious metals higher and fiat currencies and markets to their mean-reverting lows.

Paper Gold Price Manipulation—Rigged to Fail

What the U.S. in particular, and the West in general, are failing to confess is that today’s so-called “Developed Economies” are in actual fact more like yesterday’s debt-straddled Emerging Market economies, and like a real banana republic, the only option ahead for our clueless elites is inflationary (and intentionally so).

Titanic Ignorance

I’ve often cryptically joked that listening to investors, mainstream financial pundits or downstream politicians debating about near-term asset class direction, inflation “management” or central bank miracle solutions is like listening to First Class passengers on the Titanic debating about desert choices on the menu in their hands rather than the debt iceberg off their bow.

In short: The real issues are right in front of us, yet ignored until the economic ship is already dipping beneath the waves.

Rising Debt + Declining Income = Uh-Oh.

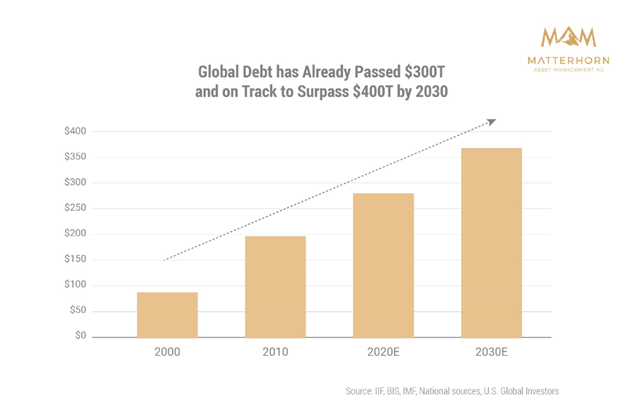

As for such hard facts (i.e., icebergs), the most obvious are fatal global and national debt levels rising at levels which can never be repaid….

Meanwhile, national income from GDP and tax receipts are falling, which means debts are grossly outpacing revenues, which any kitchen-table, boardroom or even cabinet meeting conversation should know is a bad thing…

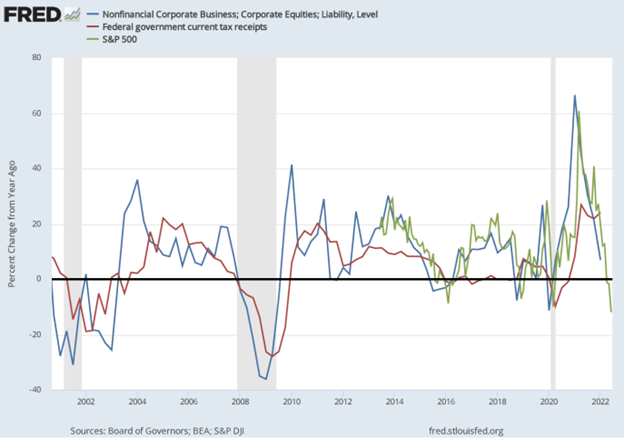

Toward this end, it’s worth lifting our eyes above the A-deck menu and taking a hard look at the following iceberg scrapping the bow, namely: Tanking US tax receipts:

What Biden and Powell might wish to remind themselves is that U.S. tax receipts have fallen YoY by 16%, and are likely to fall even further as markets continue their trend South at the same time the US steers toward a recessionary block of ice.

No Love for Uncle Sam’s IOUs

What’s even more alarming is this stubborn fact: as U.S. Federal deficits are rising, foreign interest in Uncle Sam’s IOU’s (i.e., U.S. Treasuries) are tanking.

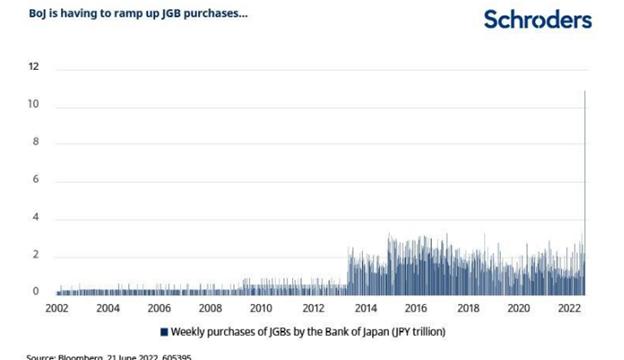

China’s interest in U.S. Treasuries, for example, has hit a 12-year low and Japan, as I’ve warned elsewhere, is too broke (and too busy buying its own JGB’s with mouse-klick Yen) to afford bailing out Uncle Sam.

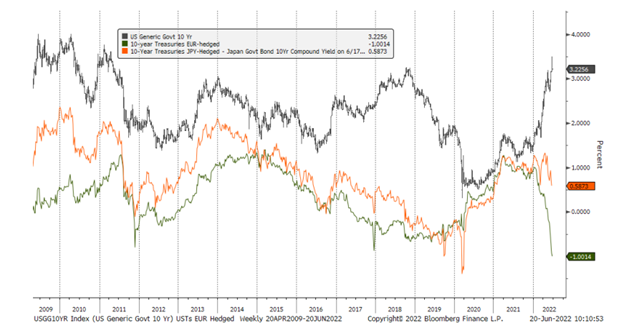

The level of magical Yen creation (reminiscent of the Weimar era) coming out of Japan to “support” its pathetic bond market is simply mind-blowing:

Given the artificial and relative current strength of the USD and the fact that FX-hedged UST yields are negative in EUR, it’s fairly safe to conclude that there will be more sellers than buyers of UST’s. That means rising yields and rates near-term.

Ouch.

That’s a bad sign for Uncle Sam’s bloated and unloved bar tab. Who but the Fed (and hence more QE) will buy his IOUs by end of August?

Filling the Deficit Gap: Print or Default?

In the past, the spread between rising debts and declining faith in U.S. IOUs was filled by a magical money printer at the not-so-federal “Federal” Reserve.

But with a cornered Fed still tilting toward QT rather than QE, where will this magical money come from, as it sure as heck aint coming from tax receipts, the Japanese, China or Europe?

As I see it, the Fed has only two pathetic options left if it wants to fill the widening gap between its growing deficits and declining faith from foreign bond buyers (or even US banks, see below).

Namely: It can 1) default on its embarrassing IOU’s and send markets over a cliff, or 2) pivot from QT to QE and create more magical (i.e., inflationary and toxic) money.

When it comes between embarrassment or toxicity, my bet is on option #2, which means expect more rather than less QE and inflationary currency debasement ahead.

Why?

Saving the Politico’s, Drowning the Citizen

Because neutering one’s currency is the classic/desperate policy taken by all debt-soaked regimes to create a negative-real rate lifeboat for themselves while leaving the average Joe Citizen shivering in an inflationary ocean of pain.

As I’ve said countless times, the Fed WANTS INFLATION to inflate away its debt nightmare and only pretends to fight it.

Rising rates are simply no option as higher rates are simply too expensive for Uncle Sam.

YoY interest payments alone on Uncle Sam’s bar tab were already at $666B by end of May. If one tacks on the extra interest owed on Treasury Bills and maturing notes, that interest expense climbs to just under $900B.

Again, that’s just the interest expense. Do you really think Uncle Sam wants to (or can afford) to charge himself more (i.e., by raising rates) for his own (and otherwise unpayable) debt?

I Could Be Wrong?

But one must hedge even one’s own highest convictions, and I suppose the Fed could try to increase demand for UST’s (as a so-called “Safe-Haven”?) by lifting rates and crashing the stock market rather than re-heating its money printer.

Anything is possible in a world bereft of good options and riddled with bad financial leaders.

But such an equally pathetic option (i.e., an induced market implosion) just means less capital gains tax receipts from the stock-rich and hence places the Fed right back where it started: Starring down the barrel of even less incoming cash, even less consumer spending and hence even less GDP.

In short: I just don’t see anyway around the pathetic QE and pro-inflation end-game ahead, which the Fed pretends to ignore and the feckless corporate media can’t even fathom.

Seeking Rather than Fighting Inflation

And so, I’ll say it again and again: The Fed is not fighting inflation, it wants inflation.

Or in plainer English, and as no surprise to Fed-watchers like me: The Fed is, once again, simply lying to the public.

The West: Just Another Banana Republic

Today, whether we wish to admit it or not, the so-called “Developed Economies” in the U.S., Europe and Japan are really nothing more than debt-broke economies, veritable banana republics.

This means their economic profiles, and hence economic policies, more resemble those of “Emerging Markets” rather than “Developed Markets.”

And what have we learned of the EM policies from Argentina to Yugoslavia and every other debt-strapped nation in history?

It’s simple: INFLATION MUST BE KEPT ABOVE INTEREST RATES TO REDUCE DEBT BY “INFLATING IT AWAY.”

The Volcker Option is Dead

This means inflation levels in the West can eventually reach a base-case similar to that of the 1970’s, but unlike that Volcker era, today’s drunk central bankers can’t induce a recession (i.e., raise rates above the inflation rate) when the public debt is above $30T rather than $900B level of the Volcker era.

Folks, US debt to GDP is 122% today, under Volcker it was 30%. There is no going back to a Volcker (i.e., rate hike) option. Period.

Stated simply: Short of outright default, the US is in too much debt to conduct anything but an inflationary policy.

The Endless Larry Summers

Meanwhile, an increasingly tired (and let’s be honest, failing) President Biden stands on a Delaware beach and pretends we are good hands, telling reporters he has just been on the phone with none other than Larry Summers to create a plan to fight inflation.

Oh, how the ironies do abound.

Larry Summers, the de-regulating patient-zero of the 2008 derivatives debacle and co-signer to the two most destructive pieces of financial madness since World War II (i.e., the repeal of Glass-Steagall and the 2000 Commodities Modernization Act—aka: Enron “loop hole”), is gonna save us?

From what most know of Larry, he’s always looking for an angle to appear like an expert and be at the center of power, while forgetting to remind anyone, including Ray Dalio, that he has been at the very eye of more than one financial hurricane.

In fact, there’s no one I’d trust less to “solve” any financial problem, including the Harvard endowment, which former University President Summers helped crush in 2008 by filling it with the very same toxic derivatives which he had “de-regulated” a decade prior when I was limping around Harvard Yard.

For now, the endless Larry Summers somehow feels a stronger USD and rising bond yields will give foreigners positive real returns and hence attract badly needed foreign interest in U.S. credit markets, when such a plan is likely to have the opposite effect (as per usual with effectively all of Larry’s “plans”).

Big names like China, and broke names like Japan, as noted above, are selling, not buying our debt.

Instead, by raising rates/yields and tightening rather than easing, the “Summers Solution,” like the Powell policy, will merely hasten the demise of the U.S. economy while simultaneously increasing the risk of a U.S. default.

Why?

Because Larry seems to have forgotten that current US debt levels can’t endure rising yields/rates.

Simple History Lesson: Gold Rises as Currencies Debase

Again, the only option left for a debt-soaked banana republic like the U.S. is to look in the mirror and act like the banana republic that it truly is—which just means more QE will re-appear, and more inflation and more currency debasement lies ahead.

Even commercial banks (Goldman, Citi, JP Morgan, Deutsche Bank) are now extremely risk averse, with bond desks recently refusing to execute client trades if it means holding client collateral (i.e., increasingly toxic bond hot potatoes) for even a brief period.

Without central bank “support” for these toxic bonds, no one wants to touch them—not even the big boys. When liquidity dries up, QE will have to replace current QT.

When that happens, cue the inflation warning bells as more fiat liquidity floods an already-drowning financial system.

See why gold’s golden era has yet to even begin?

Eventually, the rising tide of more debased fiat currencies will be impossible to hide and gold’s openly repressed and manipulated pricing levels will rise from the ashes of a broken financial system and an increasingly neutered/debased USD.