Search results

“Lions Led by Donkeys:” The Irrevocable Decline in US Hegemony

In his latest conversation with WTFinance’s Anthony Fatseas, Matterhorn Asset Management principal Matthew Piepenburg answers the question: Is the worst behind us? The short answer is: No. The reaso...

Matthew Piepenburg / April 12, 2023

Watch Now

Golden Question? Is the Petrodollar the Next Thing to Break?

As we warned throughout 2022, the Fed’s overly rapid and overly steep rate hikes would only “work” until things began breaking, and, well…things have clearly begun to break, including the petrodollar....

Matthew Piepenburg / April 6, 2023

Read More

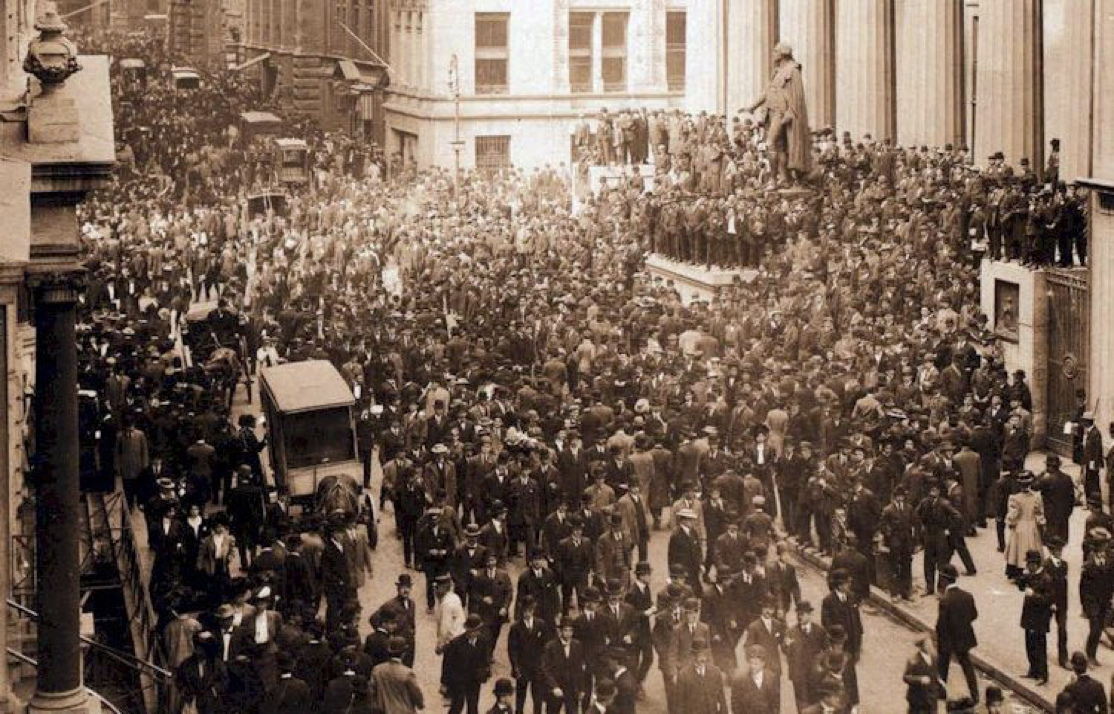

Today & Tomorrow: Volatility Worse Than 1987, September 11th and the 2008 Crisis

In this 30-minute conversation with Elijah Johnson of Liberty Finance, Matthew Piepenburg addresses the escalating ripple effects of the U.S. banking crisis and the growing distrust of gasping bond ma...

Matthew Piepenburg / April 4, 2023

Watch Now

THE EVERYTHING COLLAPSE

“Don’t wish for gold to go up substantially for when it does, your quality of life will deteriorate remarkably.” Let me be clear, now is the time to protect whatever assets you have in order to avoi...

Egon von Greyerz / April 2, 2023

Read More

Bond Destruction, Banking Waste and the Tilt Toward CBDC

In this extensive and now English-translated, interview with Jan Kneist of Investor Talk, Matterhorn Asset Management principal, Matthew Piepenburg, addresses the critical themes of the ongoing bankin...

Matthew Piepenburg / March 29, 2023

Watch Now

Je T’Accuse: To Bond Killers & Other Villains Destroying Our World

From bond markets to border wars, the world is openly and objectively tilting toward disaster. Many of us already know this, but what can be done? As I look back on just the latest and entirely predi...

Matthew Piepenburg / March 26, 2023

Read More

The Importance of Wealth Preservation in Today’s Economy

Grant Williams interviews Egon von Greyerz about the importance of wealth preservation in today's economy, emphasizing that global debt has tripled in the last 20 years. He warns against inflated prop...

Egon von Greyerz / March 21, 2023

Watch Now

THIS IS IT! – THE FINANCIAL SYSTEM IS TERMINALLY BROKEN

Anyone who doesn’t see what it happening will soon lose a major part of their assets either through bank failure, currency debasement or the collapse of all bubble assets like stocks, property and bon...

Egon von Greyerz / March 19, 2023

Read More

Silicon Valley Bank Collapse: Just how safe is the banking system? Matthew Piepenburg shares his views.

On Wednesday 8th March 2023, Silicon Valley Bank (SVB) announced a loss $1.8B from sale of investment securities. Investors and Depositors got spooked, withdrawing estimated $42B+ in cash within a f...

Matthew Piepenburg / March 15, 2023

Watch NowMaking Common, Golden Sense of the Next Senseless Bank Crisis

Two Failed Banks. The tech-friendly SVB story (i.e. FDIC shutdown) is actually preceded by another failed bank, namely the crypto-friendly Silvergate Capital. Corp, now heading into voluntary liquidat...

Matthew Piepenburg / March 13, 2023

Read More