Is BTC a Better Investment than Gold?

The short answer is yes.

And the longer answer, for now, is ABSOLUTELY YES.

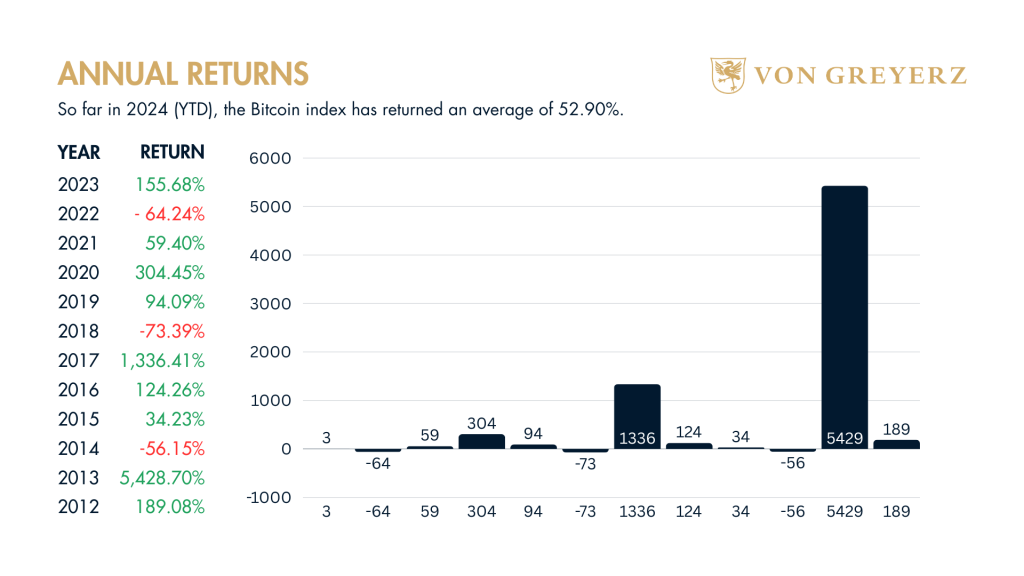

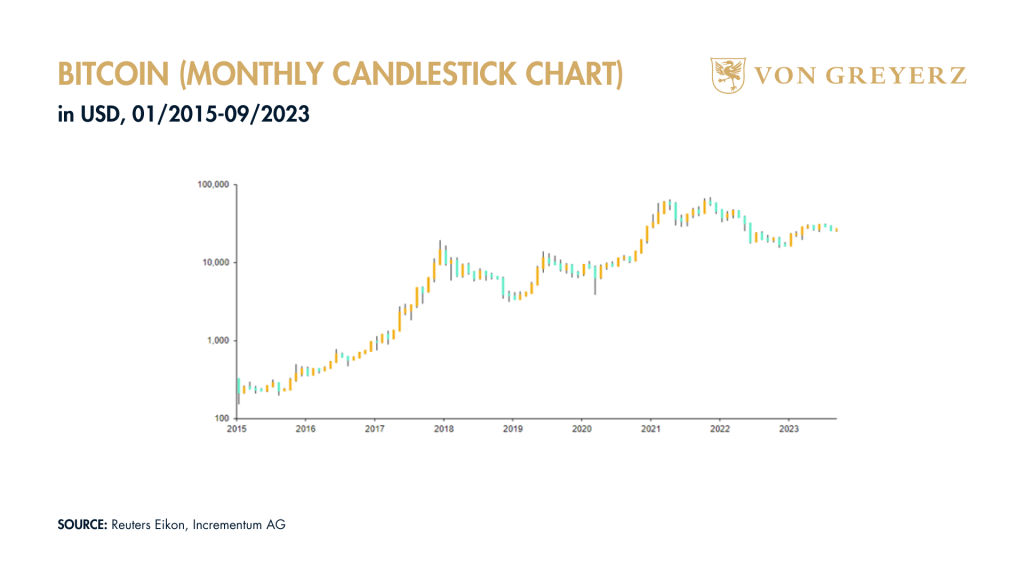

In the last 10 years, BTC has posted an average annual return of 63.6% (thanks to 5423% in 2013), whereas gold has annualized at 12.44%.

But Then Again…

…gold is not an investment, it’s a store of value.

And unlike BTC, Gold has never had an annual return above 5000%, nor an annualized loss of -64% (2022), -73% (2018) or -56% (2014).

This matters to sophisticated individuals, families and institutions who have historically understood the timeless as well as universal rule of wealth: The key to achieving it rests in not losing it.

According to many BTC critics, and despite every promotional effort by BTC (from Superbowl ads and celebrity endorsements to the forced SEC approval of BTC Spot ETFs in 2024) to digitally replicate gold’s properties and reputation as real money, BTC remains a store of, well: Nothing.

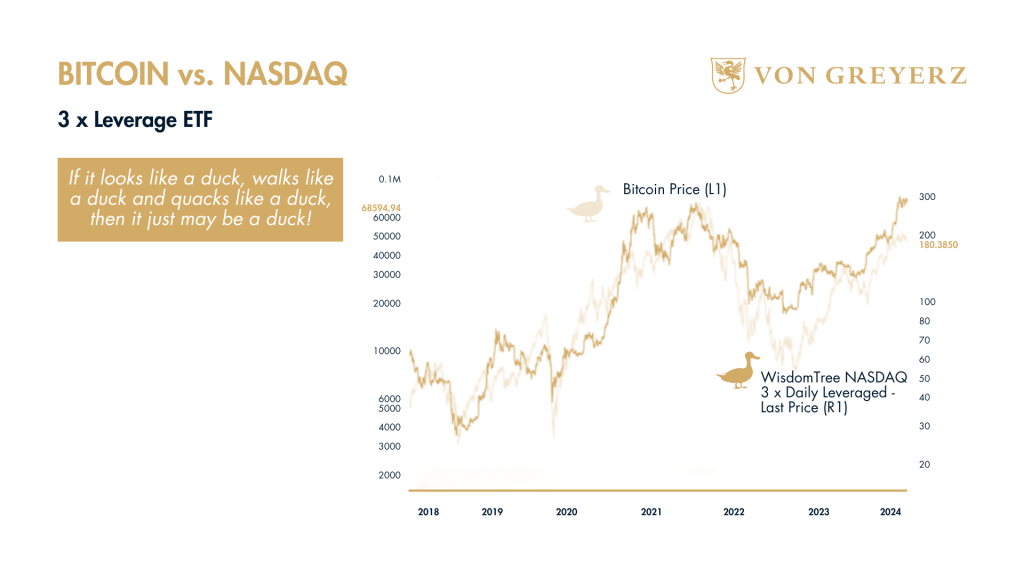

BTC is technology. We agree. Its price, therefore, moves like a triple-levered NASDAQ Index far more than a reserve asset or store of value:

Whatever one’s bias or belief, BTC is not “digital gold;” its profile and behaviour mirror speculation in “digital bytes” whose intrinsic value does not come from a hard asset but invisible mining, and yes, its price and projected use.

This makes BTC, with a standard deviation of 156% (vs. 14% for gold), the penultimate risk-reward bet—for each to make at one’s discretion. We do respect this.

BTC has made early adopters (buyers) wealthy, but many (not all) would at least agree that BTC “wealth” is as fragile as the BTC market is volatile.

BTC has made a fortunate class wealthy (entry points matter), but will it protect or guarantee the duration of that wealth?

We don’t know. No one does.

Such questions and candour will anger the BTC camp. But rather than declare they are at risk (we already admit the reward), let’s discuss rather than attack.

Gold Bug Bias?

The sceptical elephants in the room will rightfully scoff at any discussion of Gold vs BTC coming from the desk/perspective of the world’s largest private gold enterprise for HNWIs outside of the commercial banking system.

The argument can be made that vested “gold bugs” lack objectivity (as well as sophistication) when addressing the extraordinary technology, efficiency and historical innovation/direction which cryptos in general and BTC in particular represent.

Perhaps the traditional “pet rock” proponents just refuse to accept the modern world is going digital; like those who refused to see the evolution from cassette tapes to video-streaming, is the gold camp just stuck (stubbornly/blindly) in the past?

Fair point.

However, the BTC vs. Gold debate should be less of a debate than a discussion; our aim should be clarity and choice, not a zero-sum declaration of victory or invective.

Neither side has a monopoly on intelligence, and many of the BTC arguments are compelling and valid.

In the end, gold and BTC have very important but very different roles, profiles, uses and end-games.

BTC & Gold: A Common Concern

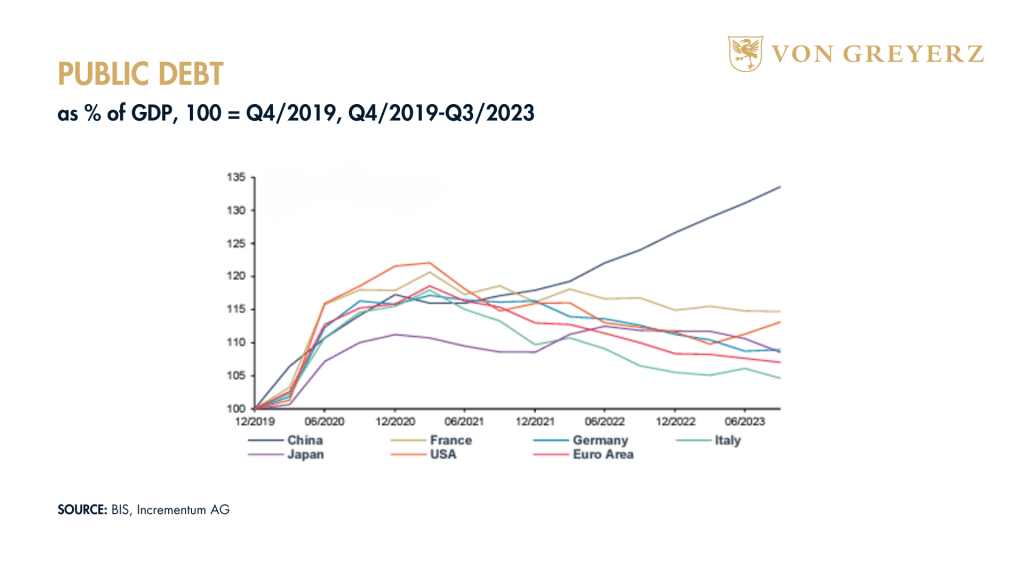

At least at the macro-economic level, there is almost zero disagreement among the precious metal and crypto circles that global debt levels have passed the Rubicon of rational.

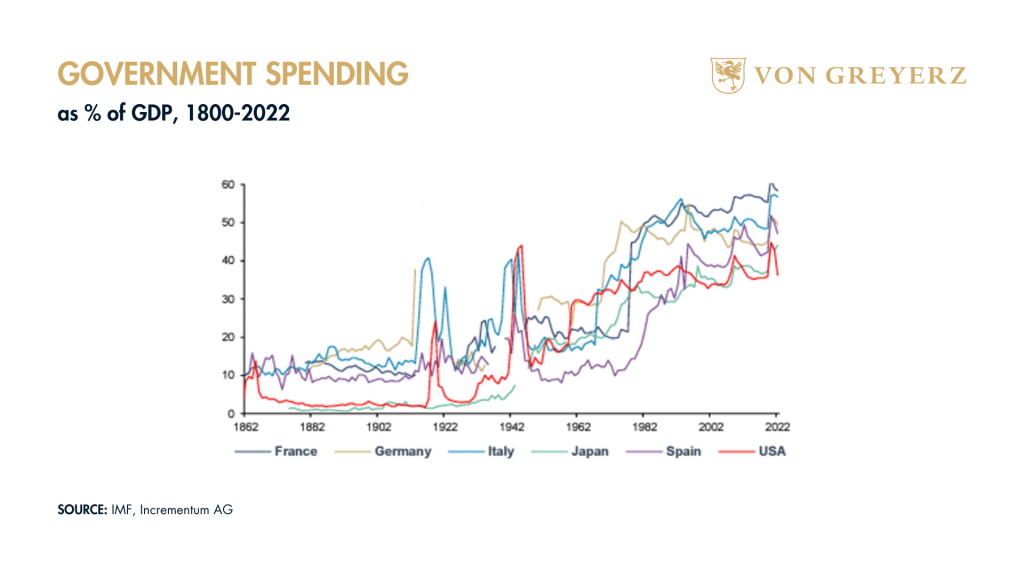

Broken and desperate monetary regimes across the globe have little choice (save for default, drastic spending cuts or a global “reset”) but to monetize the grotesque delta between their unsustainable debt and relatively paltry income/GDP levels with debased fiat money.

In short, broke nations can’t stop spending beyond their means:

Printing money out of thin air to fill a global debt-to-GDP mismatch of greater than 1/3 is inherently inflationary, a mathematical fact from which Milton Friedman and von Mises to David Hume and Ernest Hemingway agree.

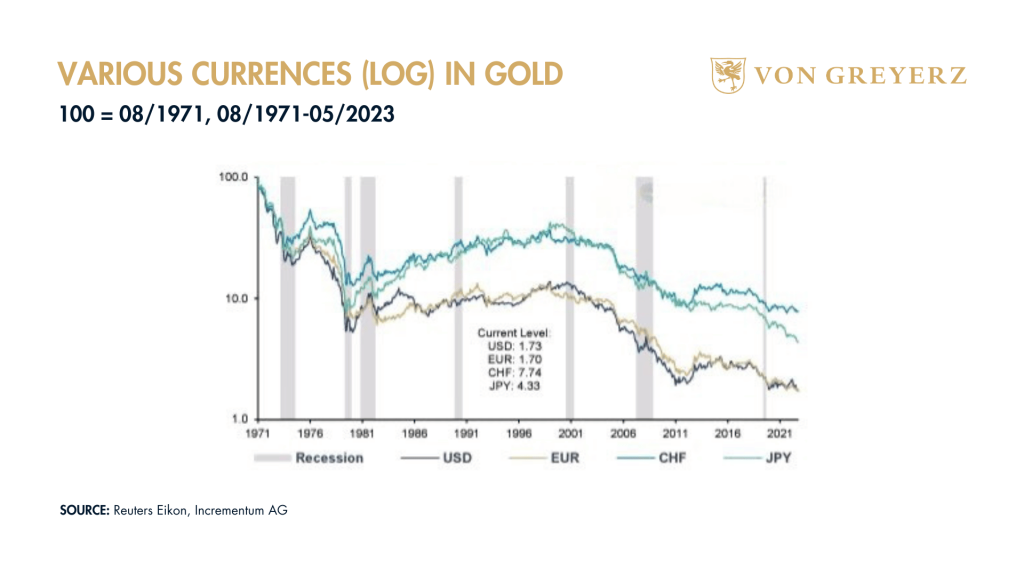

All fiat currencies, including the world reserve currency, will be increasingly debased, which means paper wealth will be increasingly diluted within a global monetary system which is little more than a global Ponzi scheme.

As a wise BTC advocate, Larry Lepard rightly observed: “You can’t taper a Ponzi scheme.”

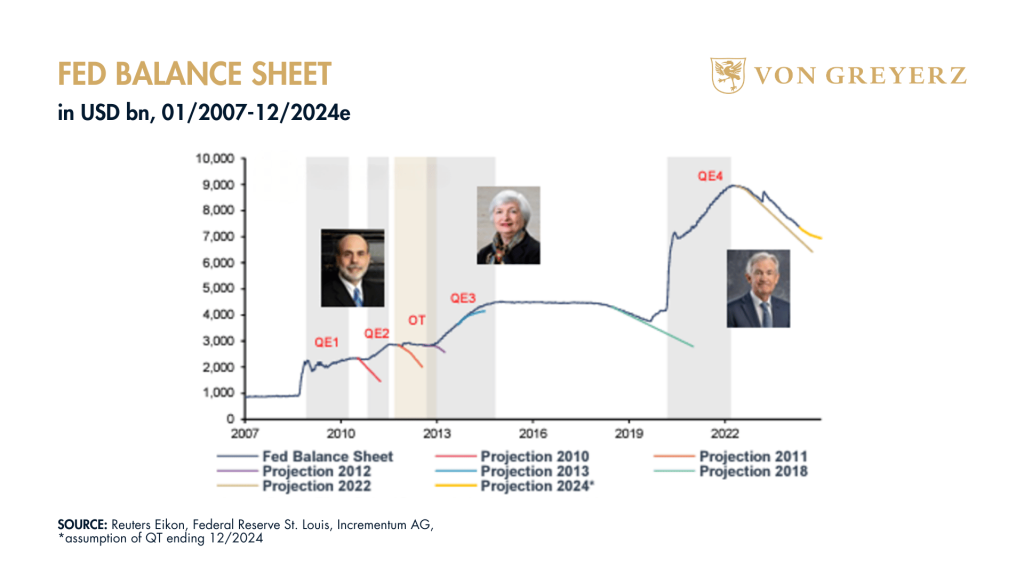

Despite Powell’s (2022-24) feint of QT and “higher-for-(no)-longer,” the Fed will (and now has) inevitably cut rates and will soon print billions again in the next recession (grey vertical below)—the trend/addiction is clear:

Anthony Scaramucci, another prolific BTC proponent, reminds that the compounding effect of inflation, however misreported, still means the USD has lost more than 25% of its purchasing power in the last four years.

This has led to a US middle class, which has devolved from what he correctly describes as “aspirational” to “desperationdesperational..”

We couldn’t agree more.

The future of the US and other leading economies is inflation, debasement or default, and since default is political suicide, debasement is the likely (and historically confirmed) direction/future of paper money.

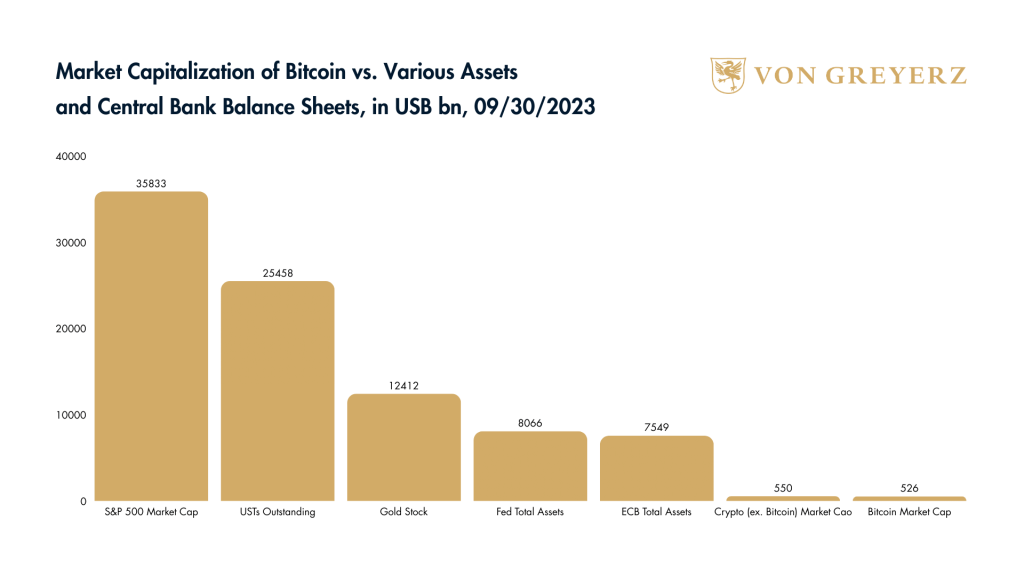

In short, both gold and crypto circles see the need for an anti-fiat alternative in a world of objectively disintegrating fiat money.

But which is the better anti-fiat money?

BTC, after all, is not money. And since 1971, neither is gold.

BTC’s Answer to the Fiat Money Disaster

Jack Mallers, another key figure in the BTC camp, argues that BTC has all the properties and characteristics of superior money.

He points to BTC’s embedded scarcity (blockchain & hashing), portability, divisibility, neutrality and credibility.

Mallers further argues that, unlike gold, BTC is decentralized, inherently censorship-resistant and, much like Google’s network effect, can’t be replicated.

Furthermore, and equally unlike gold, BTC is not reliant on governments and is a genuinely free-market asset.

Even when China outlawed BTC, miners were moved, and BTC transactions remained intact.

In addition, BTC, unlike gold, has no counterparty risk and no intermediary custodians. It’s also more trusted, Mallers argues, as no one has really done an audit of how much gold any nation actually holds.

The global monetary system, we agree, is opaque and corrupted, and hence Erik Voorhees, another key BTC voice, passionately argues that he owns BTC as a modern way to opt out of an archaic and “crap” global monetary system.

Fair point.

As Voorhees further reminds us, he can send $1M worth of BTC anywhere in the world in less than 5 minutes. You can’t do that with gold; and you certainly can’t do that within the international SWIFT banking systems.

That’s another fair point.

BTC’s Technological Superiority – Future Adoptive Rather than Backward-Looking

Just like emails have replaced stamped letters and obsolete post offices, BTC, in particular and blockchain in general, is the future of money—at least according to the BTC circles.

The BTC camp will remind people that blockchain is used by governmental agencies, gaming platforms, and agricultural commodity desks for shipping, letters of credit, and settlement.

Let’s also not forget BTC’s adoption by the nation of El Salvadore and Trump’s campaign promise to createthe US BTC Strategic Reserve. Is this a new trend?

Perhaps.

And what about Blackrock or Fidelity? Even the big names are building (exploiting?) ETFs around this modern new crypto.

Why? Because the BTC circles maintain that an immutable digital ledger is enormously valuable. In short, it’s the future.

Again, fair points, all.

BTC: The Proof is in the Pricing

BTC proponents will also point out its staggering (demand-driven) price rise as further confirmation of its current and future role as a superior anti-fiat option and perhaps even global alternative currency.

Since its electronic birth in 2009, BTC has gone from zero to all-time highs of over $100,000 as of this writing, and according to BTC bulls like Michael Saylor, BTC at $1M is just a matter of time and just a beginning.

Larry Lepard, himself an experienced VC investor, makes a convincing case that the rapid adoption/consolidation curve (and price) of BTC mirrors Metcalf’s law that a network’s value increases with its growth, and BTC’s growth story is undeniable.

As to BTC’s price volatility, BTC investors argue that such implied volatility is to be expected from a fixed-supply asset, especially as demand increases with adoption, which makes BTC’s volatility an opportunity rather than a risk.

In 2022, for example, on the heels of the FTX fiasco, when BTC’s price tanked by 70%, its adoption went up by 40%.

For those who attack BTC as a “tulip” or bubble asset, Voorhees reminds them that “tulips don’t rise, fall and then make newer highs.”

BTC has been declared dead at least 5 or 6 times, and yet it keeps coming back. This, according to the BTC camp, means BTC is consolidating and building and not just another shooting star or unicorn.

Fair, very fair points.

Fair Rather than Critical

In responding to such arguments, it’s not helpful to dismiss them (or their proponents) as delusional or just plain “wrong,” as many otherwise well-known figures in the gold circles have openly/wrongly done.

For us, BTC investors are no more universally “delusional” than gold owners are universally “obsolete.”

Even Ray Dalio, who respects both speculation and preservation, observed: “I would take gold and sprinkle a little bitcoin on top.”

But that doesn’t place us in full agreement with many of the foregoing defences of BTC’s properties, adoption, technology, price or role.

There are critical issues –and risks – still unresolved when it comes to BTC.

Gold’s Properties: Real Rather than Digital Use

Unlike BTC, gold’s properties lie not just in natural scarcity (a Monet painting or drop of mercury is scarce too), but in actual use—including 10% industrial use, which the BTC circle decries as minimal.

In fact, gold is the most valuable metal on the periodic table and would be used far more (from industry, medicine and tech to outer space and military applications) if it were more plentiful and cheap—but its scarcity is natural rather than coded, and its use is actual rather than projected.

That’s precisely why gold is so globally and historically trusted (as opposed to obsolete).

Gold is a store of value because it has something of value to store. One can discount its future value a century into the future because its physical properties never change or degrade.

This is also why gold has been used as money for millennia, including in the US until 1971.

And we think gold will be money (unit of account/medium of exchange) again, and certainly, a current and future global trade settlement asset, which is undeniable NOW and trending into tomorrow.

The fact, moreover, that the world’s central banks are stacking physical gold (and not BTC) at record levels suggests we are not alone in this “archaic” belief in gold’s current and future monetary use, trust and role.

Price Is Value?

Mallers, however, argues that BTC’s store of value lies in its price—or “what the market says!”

But anyone who understands risk-asset and currency markets (from Graham to Buffett) knows that price is a very, very dangerous way of measuring (or predicting) value…

It’s also worth noting that BTC only made all-time highs in gold in 2013, 2017, and 2020.

BTC defenders fairly argue that it’s too short a timeframe to compare BTC’s price to gold’s price, as such asymmetry is normal in an adoption curve.

That is a fair point, but this also assumes (rightly or wrongly) that the BTC adoption cycle is a curve rather than a cliff.

We don’t know. No one does. That’s the risk.

Even Trump’s promise of a US BTC “stockpile” ignores the broader reality that BTC is likely being intentionally inflated (as oil was in the 1970’s) as means toward enticing greater adoption of stable coins, which are backed by USTs and hence a way for a broke government to get investors to buy unloved US bonds via stable coins.

One can acknowledge that risk or deny it as one chooses. But unlike BTC, gold’s “adoption curve” dates back millennia, not a decade.

This is not sarcasm but fact.

Technology & Time

Furthermore, gold is not an “outdated” alternative to BTC’s “monopolistic” technology—but a compliment to a digital tomorrow.

That is, gold can be tokenized in the near or distant digital future as an asset-backed basis for digital money.

Even the IMF’s scary yet inevitable vision for a global CBDC has physical gold as the basis for its new money—because new or old—any new and “legitimate” anti-fiat digital money has to be based upon a physical asset with an actual use to derive global credibility, price stability and adoption.

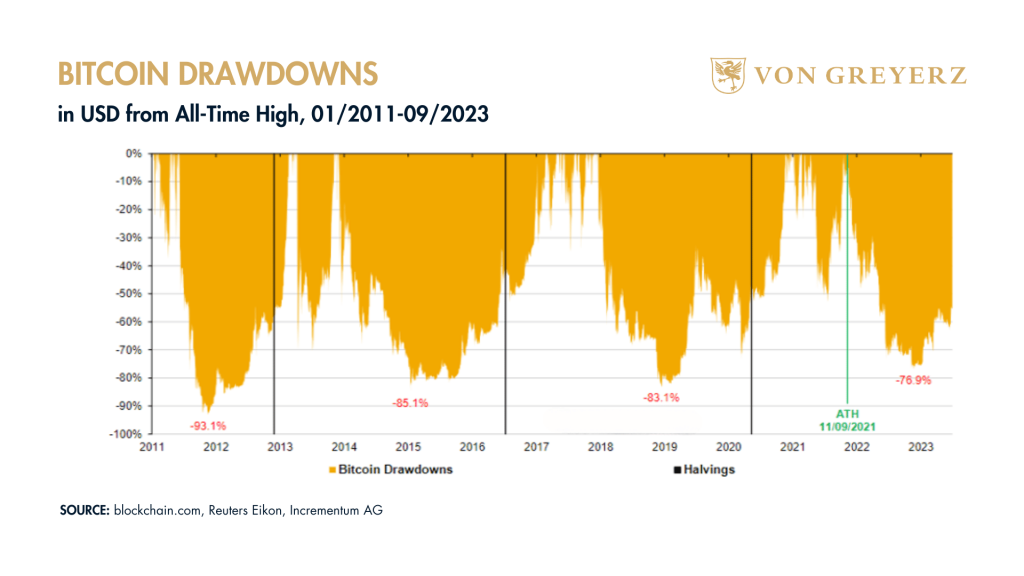

Although we get the “consolidation” defence for BTC’s infamous price volatility, that doesn’t change the fact that its price volatility (BTC has seen four 80% drawdowns since inception) effectively makes BTC exempt from immediate or even very distant adoption as a sovereign or global alt-currency or reserve asset.

Even El Salvadore’s BTC example omits the fact that BTC’s actual “use” as a medium of exchange is less than 1% in the very nation that adopted it.

Nor is BTC truly decentralized, as evidenced by the recent rise of BTC ETF custodians. Trump’s “backdoor” stablecoin tricks and BTC reserve promises also make BTC very political, as opposed to apolitical—which is a direct contradiction to BTC’s original “decentralized/anti-government” narrative.

BTC is also not without counterparty risk, as its potential for total loss (however unimaginable to BTC investors) is a real rather than unimaginable form of counterparty risk—one for which gold is immune due to its physical rather than digital properties.

Many BTC holders, including Mallers, argue that price volatility (standard deviation) is not the same as risk (total loss).

That is wrong. Volatility has been a measure of risk since the inception of open market analysis.

But even if one were to make the assumption that market price is proof of value and that “vol is good,” then BTC investors have to be aware that unless they were early adopters/buyers, many BTC investors (its current average ownership price is $70K) have lost rather than made money on BTC’s “price”/value.

Of course, if BTC goes to $1M, there will be more winners as of this writing.

But IF BTC’s story weakens rather than strengthens (we don’t know), there will be far more losers.

70% of the Bitcoins are eerily static; this implies a possibility (we don’t know) that a few BTC whales with the vast majority of its market cap are pushing the BTC “money” narrative to entice more minnows into the trade.

If so, this would make BTC the fattest, least-regulated and potentially most corrupt “prop desk” for the biggest greater-fools trade in the history of the world.

But again, we don’t know.

Actual Use?

In terms of use, the very few vendors—from AMC cinemas and Tesla cars to even BTC conferences themselves–who once considered using BTC as “money” have all reneged.

Why?

Because the price action of BTC, which mirrors a triple-levered tech index more than it does any unit of account or medium of exchange, makes BTC an untenable option as “money” …

This can change. Yes. But again: We don’t know.

For now, BTC can be bought and sold. But failing that, it is not being used as money nor a strategic reserve asset:

But as Jamie Dimon cryptically reminds us, BTC does have a use case for “criminality, drug-trafficking, money laundering [and] tax avoidance.”

Hmmm.

Technology & Use

BTC defenders say this is just a temporary glitch in the BTC adoption matrix.

Its use lies in its technology and de-centralized profile as an alternative to fiat money.

Eventually, they argue that BTC will be used in more common transactions and stored in greater volume by banks and nations.

That prediction, of course, is for each investor to decide for themselves.

However, the current facts, volatility, and history suggest that BTC as eventual “money” is a good story, but objectively (and for now and tomorrow), only that is a story.

As currently used, BTC (and BTC ETFs) are for momentum trading, speculating and gambling—not as a store of value for savings or spending. Most of our BTC contacts confess as much “off the record.”

This will anger many BTC investors who see (or promote) BTC as the new gold.

If you want to speculate with BTC—we totally understand, as long as you totally understand the risks (and not just rewards) of speculating.

Crypto trades can be massively profitable and, hence, seductive when their story is trending—but an absolute nightmare if and when the story wanes or ends.

Will the BTC Story End?

Unlike gold, we can’t say if BTC will be here tomorrow. No one can. Truly.

And that is further reason for us to see it as a speculative risk asset rather than a store of value.

This is not an insult to BTC but merely a fair clarification.

We’ve often said that BTC could go to $1M or zero.

Again, no one really knows. The same can never be said of gold.

This is why the BTC “debate” can’t be won or lost, but either trusted or not trusted, engaged or not engaged, traded or not traded. But this makes BTC a far less attractive choice (yesterday & today objectively and tomorrow reasonably) as a store of value or wealth preservation asset.

For now, however, there is no doubt that the Trump administration has and is making headlines for BTC as a powerful tool (the ironies abound?) in addressing the USA’s otherwise appalling public debt levels. We see this as more a sign of desperation than as an actual “solution.”

Even more alarmingly, we see this a slow drip toward more centralization—which is the very opposite of BTC’s original a-political, de-centralized narrative. Again, for more on this contradiction (and risk), please read our full article, here.

BTC: TBTF?

For now, one can nevertheless respect Metcalf’s Law and BTC’s massive, “Google-like” consolidation/adoption growth.

After all, perhaps BTC is “too big to fail.”

But the same might have been said about Yahoo, Polaroid, Kodak, Myspace, Facebook, TikTok or any other “tech idol” that once seemed immortal but was (or will be) eventually replaced.

BTC defenders say that will never happen to BTC.

We don’t know that. No one does…

The same, however, can never be said of gold.

Digital Hegemony?

As for technology and the world going digital, we respect this. Everyone does.

But even gold can go digital, so technology is no threat to old-fashioned “gold bugs.”

BTC’s technology and digital narrative is exceptional, but it’s nothing intrinsic.

In fact, 99% of financial assets are already digital. AI, stripe payments, peer-to-peer lending—all of this involves extraordinary fintech that has nothing to do with blockchain.

The BTC camp will say fine, but only BTC is truly decentralized.

But that’s just not truly, well…true.

BTC ETFs are centralized. BTC miners are centralized.

Furthermore, we have no real idea who “centrally” controls BTC, where its “board” meets, or even who (or what) founded it (and why, really), which should concern all of us, no?

A BTC World

But even if BTC truly were benevolently de-centralized (it isn’t), let’s nevertheless play that out to its logical conclusion.

In what kind of world will we be living in whereby BTC is allowed to travel freely through the global stratosphere as an alternative currency with no interference or “centralization” from those pesky little things we otherwise call sovereign governments?

We are as cynical as the best when it comes to governmental stupidity, but that doesn’t equal governmental extinction.

As for governmental adoption of BTC—real rather than projected—we hear the form of this argument but have yet to see its substance.

To quote Jamie Dimon again: “The other thing that annoys me about BTC is governments are going to crush it one day. Governments like to know where the money is, who has it and what you’re doing with it.”

The BTC camp understandably disagrees. This is fine, but this doesn’t make BTC’s reserve asset or monetary profile real, immediate nor even inevitable.

The same cannot be said of gold.

Instead, gold has already been adopted as a reserve asset and as money for centuries; it is being used now as a reserve (Tier-One) asset by central banks (36kt worth), and its future role as a net trade settlement asset (and money) is not “promised” but already well in motion—from oil and BRICS+ net settlements to a rapidly rising Shanghai exchange.

Why? Because gold is not a “pet rock” of the past nor an uninvited guest to the future.

As a wealth preservation asset, it is not natural, historical, or coded equal.

And yes, even gold’s speculative price direction and optionality are also exceptional. Its stable yet trusted price has moved from $1400 to $2700+ in the last 5 years, which confirms this.

Gold will continue to rise in price because the purchasing power of fiat money will continue to decline, something the BTC camp will agree is true.

Yet we all agree that gold’s speculative price profile can’t even come close to that of BTC’s price profile (or risk).

Nothing can.

Why Own Either?

We don’t own gold to chase price moves or get rich. We own gold to stay rich.

This is because gold is, has been – and always will be – the most stable asset in a world historically prone to destroying paper money.

Speculate with BTC, and speculate even with gold. But if your aim is wealth preservation, it’s not a debate at all to compare gold to BTC.