Insights

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

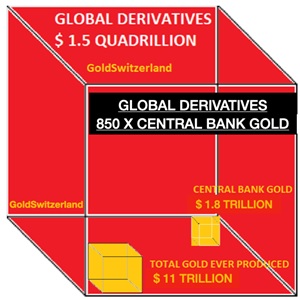

THE $2.3 QUADRILLION GLOBAL DEBT TIMEBOMB

Credit Suisse is hours from collapse and the consequences could be a systemic failure of the financial system. Disappointingly, my dream last night stopped there. So...

Egon von Greyerz / April 16, 2021

Read More

Banking Risk—The Real Killer Virus

When it comes to the topic of banking risk, well…one can only lean back in a chair, sigh and say: “Where to begin?”

Matthew Piepenburg / April 10, 2021

Read More

ABSOLUTE MAYHEM IS COMING

MAM founder, Egon von Greyerz, sits down with Silver Bullion TV to discuss a wide range of current topics, from the global response to the COVID pandemic and the paradox of balancing human safety agai...

Egon von Greyerz / April 9, 2021

Watch Now

ARCHEGOS & CREDIT SUISSE – TIP OF THE ICEBERG

Bill Hwang, the founder of the hedge fund Archegos that just lost $30 billion, probably didn’t realise when he named his company that it was predestined for big things. Archegos is a Greek word whic...

Egon von Greyerz / April 8, 2021

Read More

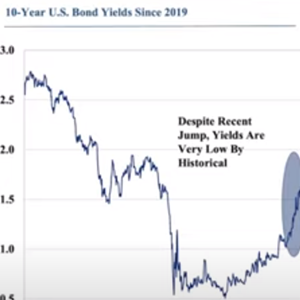

Gold Rises as Financial Faith Weakens

In recent weeks, I’ve authored many reports pointing toward the certainty of both current as well as rising inflation ahead, which, of course, is favorable to the long-term price direction in gold. Th...

Matthew Piepenburg / April 4, 2021

Read More

DISORDER WILL COME – AS CONFUCIUS WARNED

When bubbles burst, we will discover how very few superior men there actually are - as defined by Confucius: “The superior man, when resting in safety, does not forget that danger may come. When in a...

Egon von Greyerz / March 31, 2021

Read More

ES WIRD ERNST BEI ANLEIHEN UND SILBER

Die C19-Situation führt zu einer immer schneller steigenden Verschuldung, was von den Märkten noch nicht realisiert wird. Anleihekurse am langen Ende steigen schon und bescheren große Verluste, die ku...

Egon von Greyerz / March 30, 2021

Read More

WARUM GOLD KAUFEN, WENN ES AUCH BITCOIN & TESLA GIBT?

Eine Sache treibt die Welt und besonders die Anlagemärkte um: Der Wunsch nach sofortiger Befriedigung. Ich höre oft Beschwerden, dass Gold ein nutzloses Investment sei, weil es nicht schnell genug ste...

Egon von Greyerz / March 28, 2021

Read More

Things That Make Me Go Hmmm: Inflation, Crypto, Command Economies and Gold.

Over the years I’ve written almost ad nauseum about the crazy I see (and saw) around me as a fund manager, family office principal and individual investor. The list includes

Matthew Piepenburg / March 27, 2021

Read More

FINDING GOLD SAFETY IN A COMMAND-CONTROL NEW ERA OF INFLATIONARY POLICY

In this 15-minute MAMChat, Matterhorn principals Egon von Greyerz and Matthew Piepenburg look bluntly at the increasingly incontrovertible direction of rising inflation in concert with relatively lowe...

Egon von Greyerz / March 25, 2021

Watch Now

WHY BUY GOLD WHEN THERE IS BITCOIN & TESLA

Instant gratification is what drives the world and especially investment markets. I often hear complaints that gold is a useless investment since it doesn’t go up fast enough. We have invested hea...

Egon von Greyerz / March 24, 2021

Read More

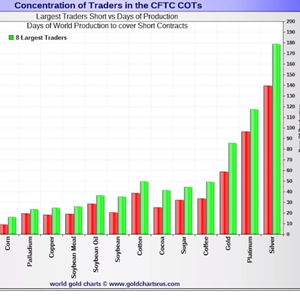

MAKING SENSE OF COMEX INSANITY

We certainly live in interesting times. Yet be you bear or bull, left or right, optimist, cynic or pessimist, one would be hard pressed to pretend that anything is, well, normal.

Matthew Piepenburg / March 20, 2021

Read More