Insights

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

A GLOBAL MONETARY & COMMODITY INFERNO OF NUCLEAR PROPORTIONS

With the war in Ukraine raging, western sanctions against Russia are setting off a commodity crisis the likes of which this generation has never seen. In the face of an already-faltering financial sys...

Egon von Greyerz / March 7, 2022

Read More

Ukraine War Headlines: Tough Talk + Real Math = Bad Options

Taken as a whole, all the chest puffing—from Boris to Biden—ignore the colder realities of the USD’s teetering reserve status, oil market realism (and inflation), Sino-Russian chess skills and record-...

Matthew Piepenburg / March 2, 2022

Read More

Golden Insights in a Dark Setting of Ukrainian War and a Pivot in Swiss Neutrality

As the world continues to keep its eyes on Ukraine, Matthew Piepenburg and Egon von Greyerz sit down to discuss the unfolding situation as well as one of the most surprising developments of all: Switz...

Egon von Greyerz / March 1, 2022

Watch Now

Swiss Safety in a World of Market Bubbles, Distorted Currencies and Global Saber Rattling

As geo-political fires burn around the world, we are reminded of the importance of safety and stability in the jurisdictions of gold investment. If private gold holdings are subject to political whim...

Matthew Piepenburg / March 1, 2022

Watch Now

Von Greyerz: Cool Perspective on a Heated Ukraine Crisis

As Russia invades Ukraine, Egon von Greyerz sits down with Lynette Zang to discuss the conflict, its implications, and what it means for gold investors and the global economy. Whatever the ultimate ou...

Egon von Greyerz / February 25, 2022

Watch Now

GOLD ABOUT TO ACCELERATE BUT AVOID TRUDEAU’S FASCIST KLEPTOCRACY

Trudeau has given himself the right to seize bank accounts, but there is no reason why he wouldn’t go further and grab other assets, such as stocks or the content of bank deposit boxes--including gold...

Egon von Greyerz / February 23, 2022

Read More

How Markets Tank & Gold Rises

One of gold’s many attributes is its historical honesty, and as far as we see it, as gold rises, it calls “BS” on the recent tough-talk from on high. Markets, for example, expected gold to fall hundre...

Matthew Piepenburg / February 18, 2022

Read More

All False & Corrupt Systems Implode— Are You Prepared & Insured?

Egon von Greyerz sits down with Wall Street Silver to remind us that all false and corrupt systems implode. In the face of rising yields, the big banks will have no choice but to do what they always d...

Egon von Greyerz / February 17, 2022

Watch Now

FED WIZARDS – THE MEGA MANIPULATORS

In a free market, without manipulation, the cost of borrowing after the Great Recession would have risen to the levels in 1980-81 i.e. near 20%. Instead, the Fed Wizards are performing their hocus poc...

Egon von Greyerz / February 9, 2022

Read More

Egon von Greyerz: Is Deflation Around the Corner?

As the market experiences withdrawal from its addiction to cheap credit, cracks appear all through the foundations of finance. Are we looking at a full deflationary panic? Will the Fed walk back on it...

Egon von Greyerz / February 7, 2022

Watch Now

Goldman Sachs & Bridgewater: Virtue-Signal as Implosion Looms

Although it may seem refreshing to see folks at Goldman or Bridgewater taking public swings at the Fed, it’s far too little and far too late. The warnings they are making today are the very same we’ve...

Matthew Piepenburg / February 2, 2022

Read More

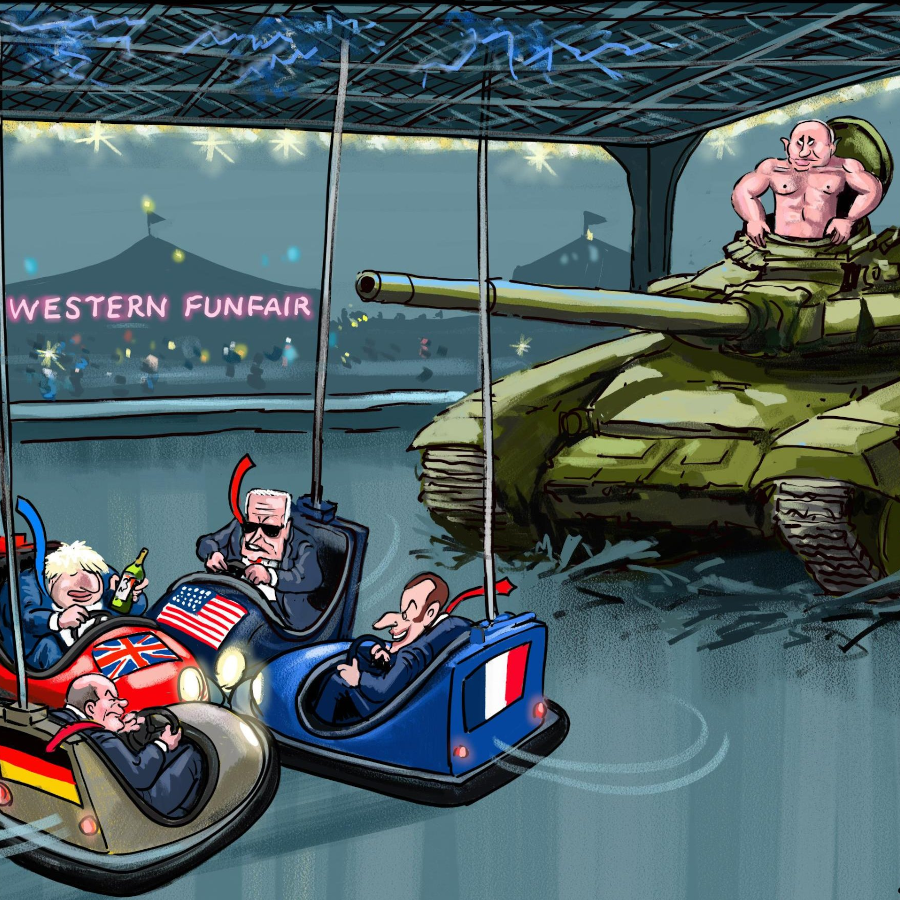

STRONG PUTIN & WEAK BIDEN TO TRIGGER HISTORICAL WEALTH DESTRUCTION

With the world on the verge of a major geopolitical conflict that has a high likelihood of developing into a war, the US certainly doesn’t have the statesman who could take them through such a confli...

Egon von Greyerz / January 26, 2022

Read More