Insights

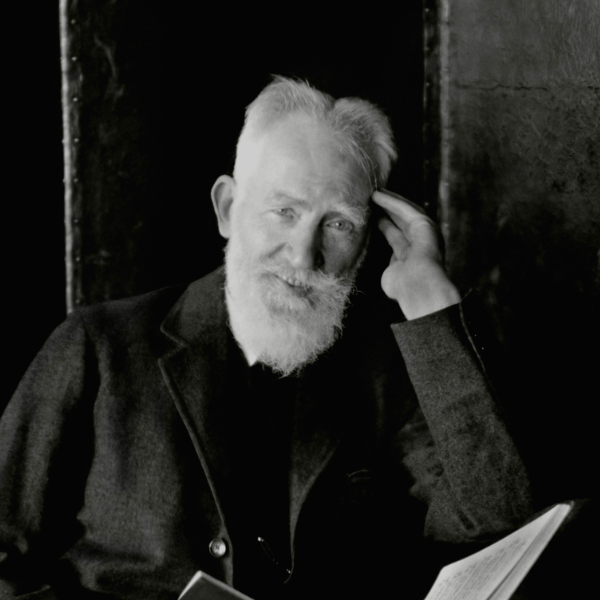

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

Gold: Working Generations Ahead as Headlines Miss the Big Picture

In this 20-minute MAMChat, Matterhorn Asset Management partners, Egon von Greyerz and Matthew Piepenburg, discuss the current disconnect between increasingly dark macro clouds (debt, currency, and rat...

Egon von Greyerz / June 30, 2023

Watch Now

Gold’s Patriotic Role in Thinking Critically as We March Toward Recession

In this extensive, 1-hour conversation with Jesse Day of Commodity Culture, Matterhorn Asset Management partner, Matthew Piepenburg, discusses his evolutionary understanding of precious metals as a we...

Matthew Piepenburg / June 29, 2023

Watch Now

Modern Currency Policy: Nations Compete, Citizens Suffer

Below we consider how modern currency policy may not be so good for, well, the people... This is why gold inevitably enters the conversation, for unlike policy makers, this old pet rock garners more...

Matthew Piepenburg / June 25, 2023

Read More

The Familiar Death Dance—Investors Out to Lunch as Macro Cracks Widen

In this twenty-minute conversation with Investor Talk’s Jan Kneist, Matterhorn Asset Management founding partner, Egon von Greyerz, soberly assesses the current calm (fantasy) before an inevitable sto...

Egon von Greyerz / June 23, 2023

Watch Now

Solid Gold In a Broken World

Below, we look at gold in a broke(n) world of hubris, debt, Realpolitik and a rising east. For well over a year, we’ve openly declared that the Fed is cornered. That is, Powell knows he needs higher...

Matthew Piepenburg / June 18, 2023

Read More

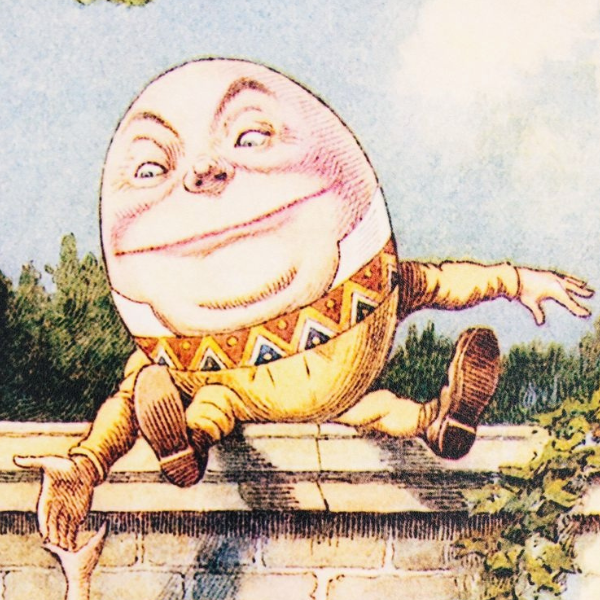

Stories for Children: The US Economic Fairytale

When Humpty Dumpty fell off the wall and took a big fall, “all the king’s horses and all the king’s men could not put Humpty-Dumpty together again.” I see a similar fate for the US debt egg, whose cr...

Matthew Piepenburg / June 11, 2023

Read More

The West Debt & Inflation Implosion

Tom Bodrovics from Palisades Gold Radio welcomes back Egon von Greyerz, Founder and Chairman of Matterhorn Asset Management AG based in Switzerland. The U.S. debt has doubled every eight years, and...

Egon von Greyerz / June 7, 2023

Watch Now

Think Smarter than the Policy Makers: Become Your Own Gold-Backed Bank

In this spritely conversation with The Market Sniper’s Francis Hunt, Matterhorn Asset Management, AG partner, Matthew Piepenburg, discusses a changing global landscape and gold’s critical role in a ma...

Matthew Piepenburg / June 6, 2023

Watch Now

Front-Running the Fed: How Gold & Chess-Players Beat a Rigged Market

We have hardly been the first nor the last to realize that rising rates “break things.” We’ve all seen the disastrous credit events in the repo crisis of late 2019, the UST debacle in March of 2020,...

Matthew Piepenburg / June 4, 2023

Read More

Changing Dollar, Competing Currency Blocks and Golden Common Sense

In this latest conversation with Elijah Johnson of Liberty & Finance, Matterhorn Asset Management Partner, Matthew Piepenburg, addresses the most recent trends in the global market and gold space—from...

Matthew Piepenburg / June 1, 2023

Watch Now

Facts vs. Fed-Speak: A Comical History with Tragic Consequences

Below, we look at simple facts in the context of complex markets to underscore the dangerous direction of Fed-Speak and Fed policy. Keep It Simple, Stupid. The simple facts are clear to almost anyon...

Matthew Piepenburg / May 28, 2023

Read More

Gold’s Key Indicator

After the recent bank collapses and string of interest rate hikes, Greyerz is deeply concerned for the U.S. monetary system. It's not that gold is getting incredibly strong by itself, it's that every...

Egon von Greyerz / May 23, 2023

Watch Now