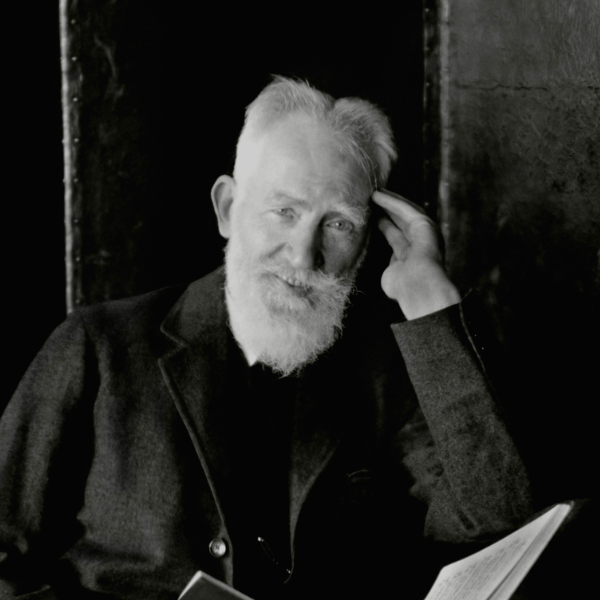

Matthew Piepenburg

Partner Matt began his finance career as a transactional attorney before launching his first hedge fund during the NASDAQ bubble of 1999-2001.Thereafter, he began investing his own and other HNW family funds into alternative investment vehicles while operating as a General Counsel, CIO and later Managing Director of a single and multi-family office. Matthew worked closely as well with Morgan Stanley’s hedge fund platform in building a multi-strat/multi-manager fund to better manage risk in a market backdrop of extreme central bank intervention/support. The conviction that precious metals provides the most reliable and longer-term protection against potential systemic risk led Matt to join VON GREYERZ.

The author of the Amazon No#1 Release, Rigged to Fail, Matt is fluent in French, German and English; he is a graduate of Brown (BA), Harvard (MA) and the University of Michigan (JD). Along with Egon von Greyerz, Matthew is the co-author of Gold Matters, which offers an extensive examination of gold as an historically-confirmed wealth-preservation asset.

Insights & Articles

Iconic America vs. Debt-Soaked America: Hard Landing Ahead

In this extensive presentation by Matterhorn Asset Management partner, Matthew Piepenburg, we separate the iconic America from the current and debt-soaked America to better prepare investors with fact...

Matthew Piepenburg / August 30, 2023

Watch Now

Much Harder Landings and Centralized/Inflationary Policies Ahead

In this brief yet engaging conversation at the recent Rick Rule Symposium in Florida with Charlotte Mcloed of Investing News Network, Matterhorn Asset Management partner, Matthew Piepenburg, calmly se...

Matthew Piepenburg / August 24, 2023

Watch Now

When Baseballs & Guitars Say More Than Pundits

Before I got the invite to a swank prep-school out East, I used to spend my Spring afternoons on a baseball diamond not too far from the home field of Derek Jeter, who was still playing local ball in...

Matthew Piepenburg / August 20, 2023

Read More

Centralization & the Death of Capitalism, the Middle Class and Democracy

In this latest conversation with Tom Bodrovics of Palisades Gold Radio, Matterhorn Asset Management partner, Matthew Piepenburg, offers his latest assessments on the American economic and political de...

Matthew Piepenburg / August 15, 2023

Watch Now

Discovering the Power of Gold: De-Dollarization and its Impact

Matthew Piepenburg, Partner at Matterhorn Asset Management, discusses the growing trend of de-dollarization and the weaponization of the US dollar. He highlights the ripple effects of Western sanction...

Matthew Piepenburg / August 8, 2023

Watch Now

Keeping Your Head Amidst Debt-Blind Madness

I recently blew the dust off an old Rudyard Kipling poem, “If,” which many have castigated as a bit overly romantic, despite its high praise from Mark Twain and T.S. Eliot to India’s Khushwant Singh....

Matthew Piepenburg / August 6, 2023

Read More

The BRICS Won’t Kill the Dollar, US Policy Will

Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.” Net conclusion: The real death of the USD will be domestic not foreign.

Matthew Piepenburg / July 24, 2023

Read More

Markets & Main Streets Are “Suffering from the Sins of Our Central Bankers”

In this lengthy discussion with Ivor Cummins of Ivor Cummins Science, Matterhorn Asset Management, AG Partner, Matthew Piepenburg, speaks intentionally broadly of the macroeconomic, debt and currency...

Matthew Piepenburg / July 20, 2023

Watch Now

Jerome Powell: Misunderstood Angel or Open Devil?

Becoming Powell’s (and the Devil’s) Advocate? I’ve been thinking, and re-thinking, Powell. It’s no secret that in numerous interviews and articles, Jerome Powell has been on my critical mind. I cal...

Matthew Piepenburg / July 9, 2023

Read More

Gold’s Patriotic Role in Thinking Critically as We March Toward Recession

In this extensive, 1-hour conversation with Jesse Day of Commodity Culture, Matterhorn Asset Management partner, Matthew Piepenburg, discusses his evolutionary understanding of precious metals as a we...

Matthew Piepenburg / June 29, 2023

Watch Now

Modern Currency Policy: Nations Compete, Citizens Suffer

Below we consider how modern currency policy may not be so good for, well, the people... This is why gold inevitably enters the conversation, for unlike policy makers, this old pet rock garners more...

Matthew Piepenburg / June 25, 2023

Read More

Solid Gold In a Broken World

Below, we look at gold in a broke(n) world of hubris, debt, Realpolitik and a rising east. For well over a year, we’ve openly declared that the Fed is cornered. That is, Powell knows he needs higher...

Matthew Piepenburg / June 18, 2023

Read More