EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

Egon von Greyerz on Inside Paradeplatz (Switzerland’s Zerohedge)

In this lively 23 minute interview, Lukas Hässig of Inside Paradeplatz and Egon cover a wide range of subjects such as global risk, the Fed and their masters (the Investment banks), the SNB (Swiss National Bank) which is the world’s largest hedge fund, prosperity based on free money as well as poverty and hunger.

FULL INTERVIEW:

https://www.youtube.com/watch?v=J1QtSlPpvOQ?autoplay=1

| Selected highlights | Minutes |

| Part 1: Poverty and hunger | 2.05 |

| Part 2: Prosperity due to free money | 1.18 |

| Part 3: Swiss National Bank (SNB) as a big risk | 0.44 |

| Part 4: Federal Reserve (FED) serving Wallstreet | 1.06 |

| Part 5: Risks are my life | 0.31 |

| Full Interview – The world on the edge | 21.18 |

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

There are probabilities in markets and there are certainties. It is very probable that investors will lose a major part of their assets held in stocks, bonds and property over the next 5-7 years. It is also probable that they will lose most of their money held in banks, either by bank failure or currency debasement.

Who buys a bond that will go to Zero?

What is not probable, but absolutely certain, is that investors who buy the new Austrian 100-year bond yielding 2.1% are going to lose all their money. Firstly, you wonder who actually buys these bonds. No individual investing his own money would ever buy a 100-year paper yielding 2% at a historical top of bond markets and bottom of rates.

The buyers are of course institutions who manage other people’s money. These will be the likes of pension fund managers who will be elated to achieve a 2% yield against negative short yields and not much above zero for anything else. These managers will hope to be long gone before anyone finds out the disastrous decision they have taken with pensioners’ money.

But the danger for them is that the bond will be worthless long before the 100 years are up. It could happen within five years.

There are a number of factors that will guarantee the demise of these bonds:

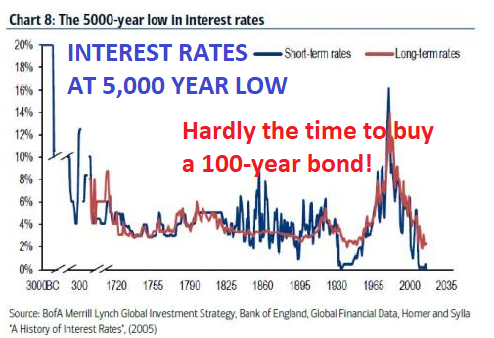

- Interest rates are at a 5,000-year low and can only go up

- Inflation will surge leading to hyperinflation

- Sovereign states are bankrupt and will default

- The Euro will go to zero not over 100 years but in the next 5-7

But pension fund managers will not be blamed for their catastrophic performance. No conventional investment manager could ever have forecast the events I am predicting above. (They are not that smart). Thus, they are totally protected, in spite of poor performance, since they have done what every other manager does which is to make the pensioners destitute. The average institutional fund is managed based on mediocracy. It is never worth taking a risk and do something different to your peer group. But if you do the same as everybody else you will be handsomely rewarded even if you lose most of the money.

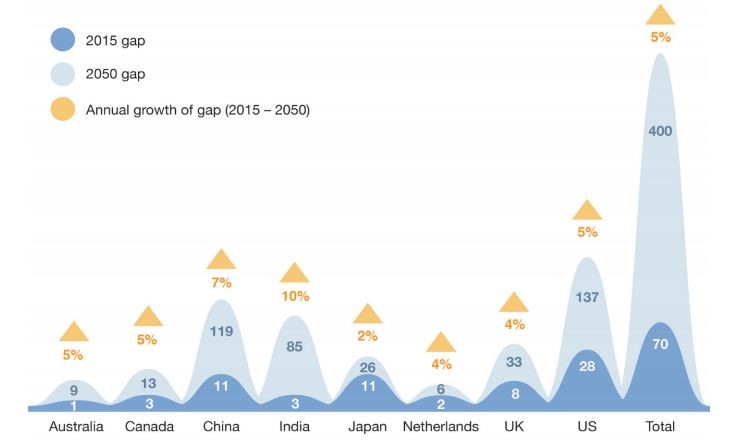

$400 trillion pension gap

Most people in the world don’t have a pension so they won’t be concerned. But for the ones who are covered by pensions, they won’t be much better off. Most pension funds are massively underfunded and the amount they are underfunded by is absolutely astounding. We are looking at a staggering $400 trillion gap by 2050 according to the World Economic Forum. The biggest gap is of course the US with $137 trillion. The 2015 US deficit was “only” $28 trillion which is 150% of GDP.

PENSION DEFICITS – There will be no pensions for anyone

The reasons are quite straightforward; an ageing population, inadequate savings and low expected returns. These calculations don’t take into account the coming collapse of all the assets that pension funds invest in such as stock, bonds and property. It is a virtually certain prediction that there will be no conventional pensions paid out in any country over in 5 to 10 years and longer. The consequences are clearly catastrophic. The only country with a well-funded private pension system is India. Most families in India hold gold and as gold appreciates, this will protect an important part of the Indian population.

$2.5 quadrillion global debt

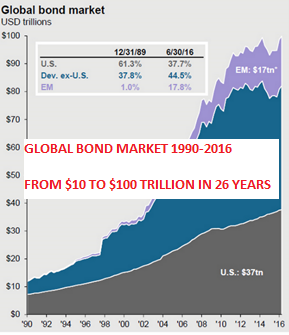

Global debt and unfunded liabilities are continuing to run out of control. With total debt at $240 trillion, pension liabilities at $400 trillion (by 2050), other liabilities such as medical care at say $250 trillion and derivatives at $1.5 quadrillion, we are looking at a total global debt including liabilities of around $2.5 quadrillion.

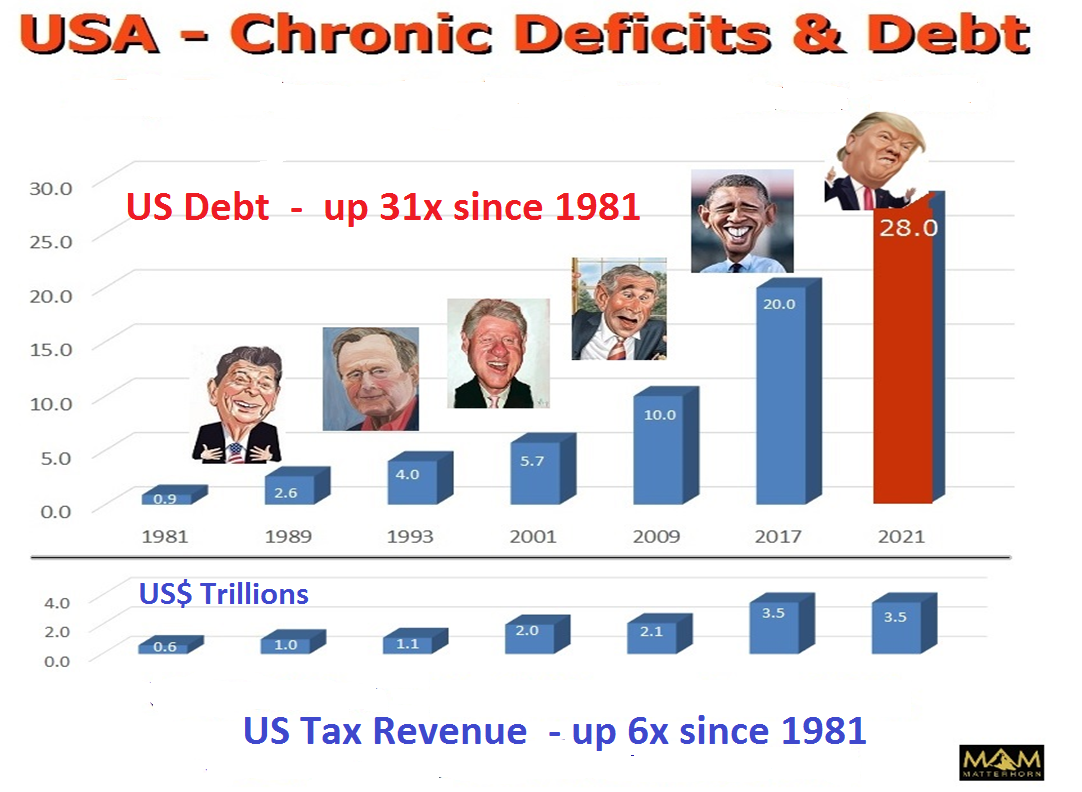

The US is doing its part to grow debt exponentially. With the debt ceiling lifted temporarily, US federal debt has swiftly jumped by $321 billion to $20.16 trillion. Over the last year US debt has gone up by $685 billion. Over the next few years, US debt is forecast by to increase by over $1 trillion per year. When trouble starts in financial markets in the next couple of years, we will see that debt level increase dramatically by $10s or even $100s of trillions. By 2020, the US will have run real budget deficits every single year for 60 years. That is an astounding record and will guarantee a dollar collapse.

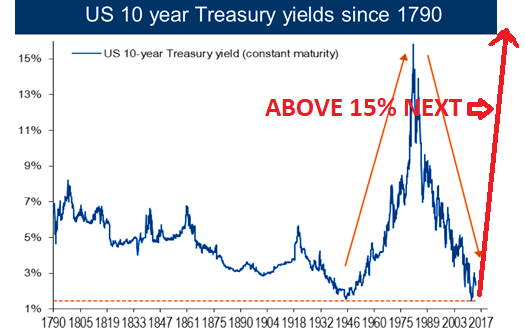

Interest rates will be 15-20%

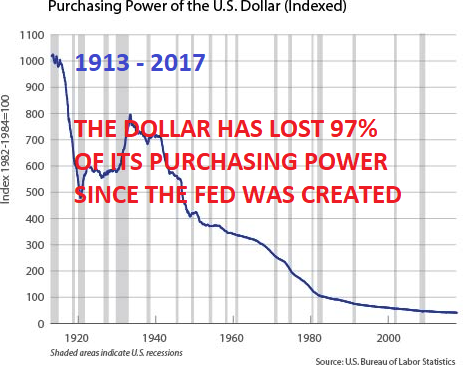

As the long-term interest chart above shows, rates are at a historical bottom and the 35-year cycle also bottomed last year. Rates are now in an uptrend and at some point, in the next year or two, will start to accelerate. Within less than 5 years, rates are likely to be in the teens or higher like in the 1970s. Bonds will collapse, including the 100-year Austrian issue, leading to major defaults. With global debt in the $100s of trillions, more and more money will need to be printed just to finance the interest costs. Still more will be printed to prop up failing banks and government deficits. And that is how hyperinflation will start. In parallel, currencies will collapse and finish their move to zero which started in 1913 when the Fed was created.

The Swiss National Bank – the world’s biggest hedge fund

The Fed is a private bank, created by private bankers for their own benefit giving them total control of money. The Swiss National Bank (SNB) is also a private bank, quoted on the Swiss stock exchange. But it is not owned by investment bankers but 45% is held by the Swiss Cantons (States) and 15% by the Cantonal Banks. The rest is held by private shareholders. The shares of the SNB have gone up 2.5x in the last 12 months.

This is the biggest hedge fund in the world with a balance sheet of CHF 775 billion ($808B). This is bigger than Swiss GDP. For comparison, the Fed’s balance sheet is 25% of US GDP. The SNB holds shares for almost CHF100 billion including $80 billion of US stocks. The rest of the SNB holdings is currency speculation with the majority in Euros and dollars. Hardly the purpose of a central bank to speculate in currencies or stocks. Their justification is that buying foreign assets keeps the Swiss Franc low. Imagine when the US stock market turns down and the Euro and dollar weaken. At that point, the chart of the SNB stock will look very different. This is likely to happen in the next few years. Swiss banking and particularly the National Bank used to be conservative, now they are as bad or even worse than the rest of the world. The problem with the Swiss banking system is also that it is too big for the country, being 5 times Swiss GDP. I wouldn’t keep any major capital in the Swiss banks, nor in any other banks for that matter. But the political system in Switzerland is by far the best in the world. Too bad that the banks are not!

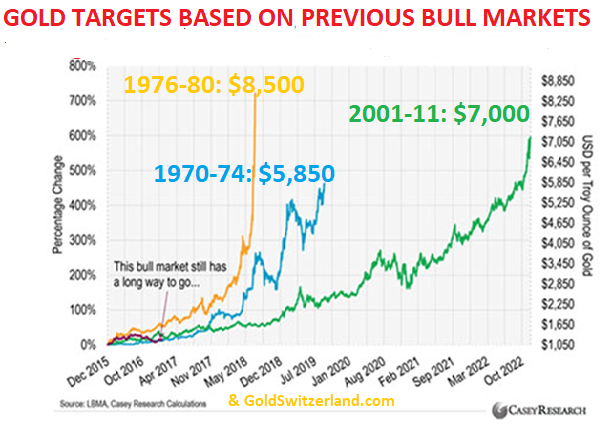

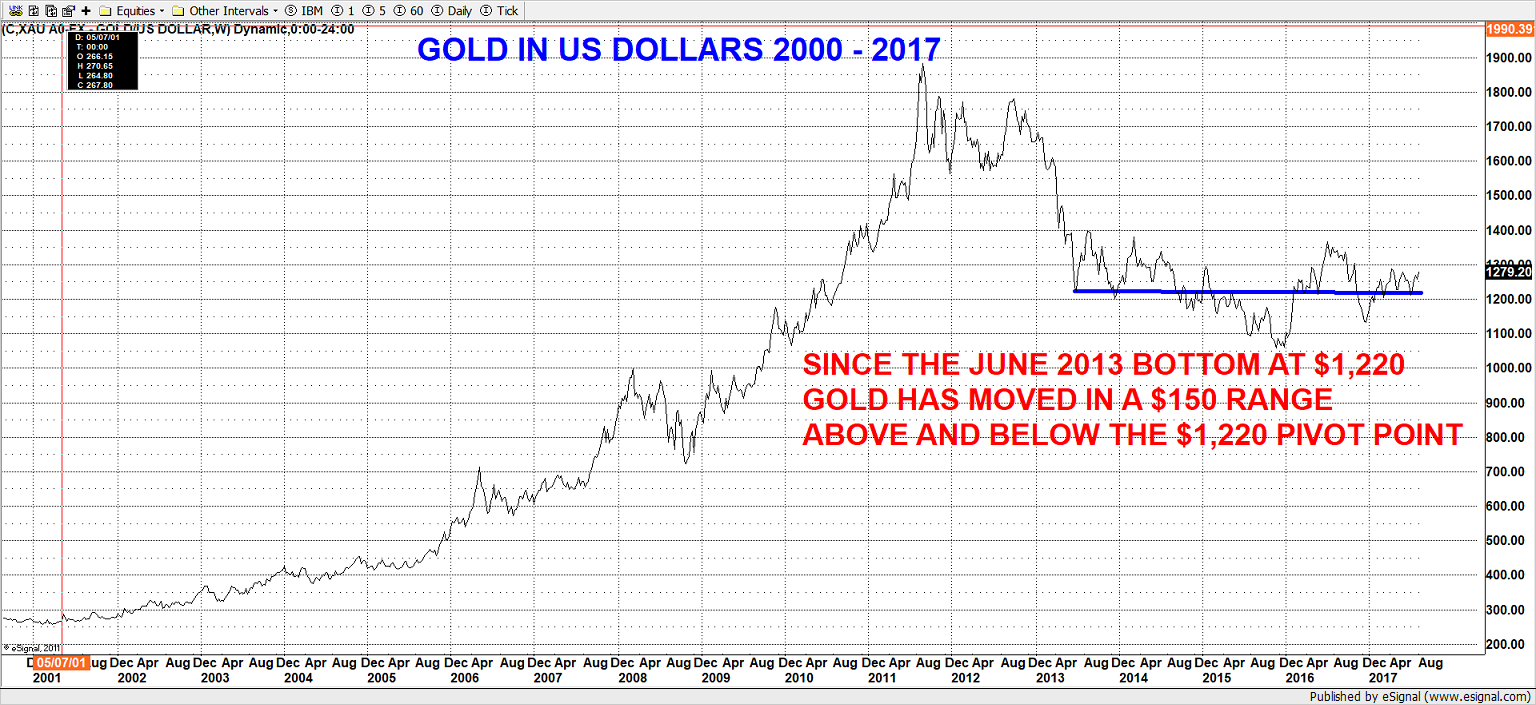

Gold $5,800 to $8,500 based on previous bull markets

Gold and silver are making a temporary pause. The uptrend is clear and acceleration is likely to start this autumn. The chart below shows various projection alternatives compared to previous gold bull markets in the 1970s and in the 2000s. Whichever option we choose, they all lead to a much higher gold price from here between $5,800 and $8,500. Those targets are still well below my long-standing target of $10,000 in today’s money. But as I have stated many times, we won’t have today’s money since with hyperinflation money will become virtually worthless. The eventual dollar price of gold is likely to be multiples of $10,000, depending on how much worthless money will be printed.

Jim Rickards talks about a massive dollar devaluation against gold to solve the US debt problem. He suggests that gold would be revalued to $5,000 which is 4x from today. That is of course one possibility although I doubt the Chinese like many of us believe that the US still owns 8,000 tonnes of gold. China would probably ask the Americans for proof of their holdings and at the same time declare the amount of gold that China holds. Whoever starts first doesn’t really matter. Because any official revaluation of gold, or just major market price appreciation, will lead to the paper shorts running for cover. At that point, $5,000 will just be a short-lived stop on the way too much higher prices.

Although all this sounds very exciting for gold and silver holders, we must always remind ourselves why we hold precious metals. We are not holding gold for spectacular gains. No, gold is held as insurance for wealth preservation purposes. The risks in the world today are unprecedented in history as I outlined in last week’s article. Therefore, we are holding gold to protect against these risks which are both economic, financial and geopolitical. We are facing the dual risk of a financial crisis with a failing banking system, as well as insolvent sovereign states, leading to all currencies being debased to zero. That is why investors must hold an important amount of physical gold and silver and not worry about daily price fluctuations.

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

“Risk involves the chance an investment’s actual return will differ from the expected return. Risk includes the possibility of losing some or all of the original investment.” (Investopedia)

So there we have it. Risk means that you can lose part or all of the investment. Normally valuations take risk into account. But is the world really valuing the following risks accurately:

A very risky world

Wars

- North Korea – South Korea – USA – Japan – China – Russia incl. nuclear war

- Ukraine – USA – Russia

- Syria – Israel – USA – ISIS – Al-Qaeda – Saudi Arabia, Yemen – Iran, Iraq etc.

- China – India – Pakistan – Afghanistan – USA

- Plus many more

Civil war and terrorism

- In most countries including USA and Europe

Economic risk

- Global debt $230 trillion – can never be repaid, nor financed when rates normalised

- Unfunded global liabilities $250 trillion – will never be honoured

- Central banks’ balance sheets $20 trillion – all insolvent

- USA insolvent – only supported by overvalued dollar and military

- China’s debt explosion from $2 trillion to $40 trillion since 2000 – massive bubble

- Most industrialised and emerging countries only survive with QE – untenable

- Interest rates at zero or below in 20 countries – unsustainable

- Paper money system – currencies going to zero.

Financial risk

- Global derivatives of $1.5 quadrillion – will all implode as counterparties fail

- Bankrupt European banking system – unlikely to survive

- Over-leveraged global banking system 20x to 50x leverage

- Bubbles in most asset classes – Stocks, bonds, property

Political risk

- USA has a lame duck president – risk of irrational or no actions

- EU elite – unelected and unaccountable – destroying Europe

- Trend of globalisation and socialism – very dangerous for global stability

The above list of risks is certainly not conclusive.

To summarise in one sentence: The world is facing risk of major (nuclear) wars, economic and financial collapse, as well as political and social upheaval. The realisation of just one of these risks would be enough to change the world for a very long time. We live in a totally interconnected world and the danger is that the domino effect will trigger one event after the next until all the risks become reality.

But the world has become totally immune to risk. No market has priced in these risks. If they did, we would not have stock, bond and property markets at historical highs and overvaluations. Central banks have succeeded in alchemy for such a long time that markets totally ignore risk. It seems that unlimited money printing, credit expansion, interest rate manipulation and currency debasement is the permanent solution for a world living above its means. But to totally fool the people, news must also be manipulated and this is where fake news comes in. Financial and economic figures must be massaged and the basis of the calculations constantly changed.

A new paradigm or the biggest crisis in history?

So here we stand in front of the biggest crisis that the world has ever encountered and no one is the slightest bit concerned. If market participants understood risk, they would already have taken cover in some deep (Swiss) bunkers. Instead the world is continuing to buy massively overvalued tech stocks, properties, crypto currencies and other assets. They will soon have the shock of their lifetime.

But this speculative mania is usually the norm at the end of a bubble era. Before the 1929 crash and 1930s depression, optimism was at a peak and both market participants and politicians were certain that this was a new paradigm which would continue for ever.

Currency markets reveal the truth

Whilst most financial markets are not worried about risk currently, the currency market is quietly reflecting the world’s view of the US economy and markets as well as the US political situation.

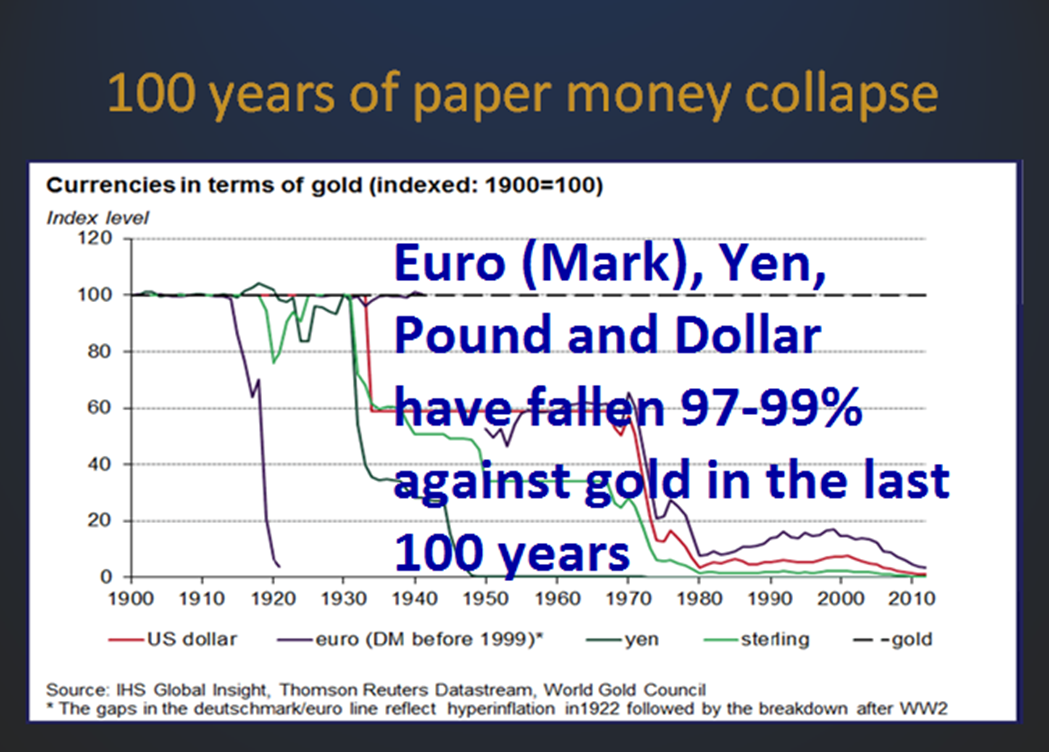

The Forex market is very difficult to manipulate. With daily global volume of over $5 trillion, no single central bank can move this market. Concerted central bank forex manipulation has worked in the past. But the days of cooperation are gone. Today every country wants to debase its currency. This is why we are seeing constant competitive devaluations in a race to the bottom. In the last 100 years, all currencies have lost 97-99% of their purchasing power. The final move to zero will probably take place in the next 5-8 years. And that involves another 100% loss from here.

Most Americans don’t worry about the value of their currency. Therefore they are not aware, for example, that if they visited Switzerland in 1971, they would have received 4.30 Swiss Francs for 1 dollar. Today they receive 0.95 Swiss cents. This is a loss of 80% in purchasing power against the Swiss Franc since Nixon stopped the gold backing of the dollar. Currency moves reveal the economic (mis-) management of a country. The constant loss of value of the dollar against most other countries in the last few decades clearly depicts that the US is on the road to ruin. The dollar tells the truth and it tells an ugly truth. The remaining days of the dollar as the reserve currency of the world are very limited. The world doesn’t need a reserve currency and certainly not one which is in a chronic decline due to economic mismanagement. The days of the petrodollar are coming to an end. China and Russia will see to that.

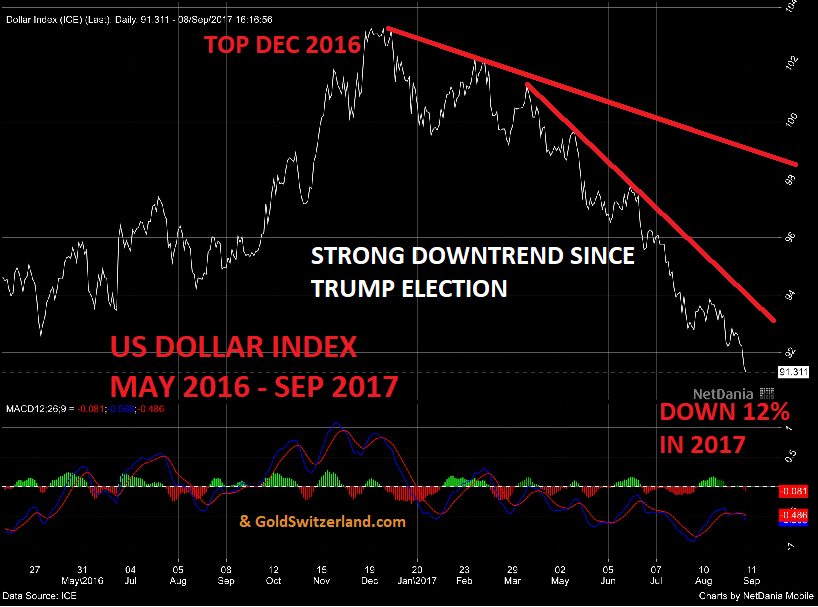

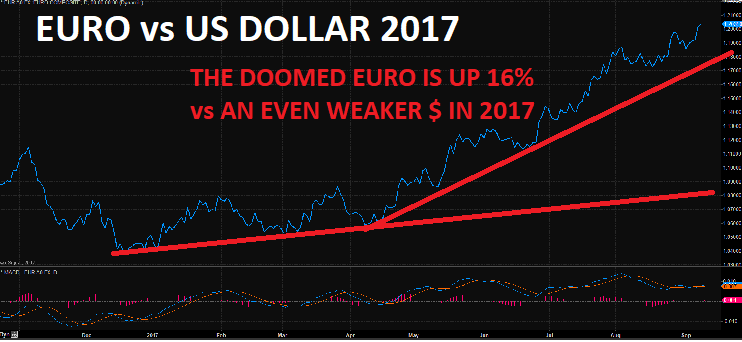

There is very little respect in Europe or in Asia for the current US political situation. There is even less respect for the economic situation in the US and its currency. Just after Trump was elected the dollar reacted in the opposite direction of US markets. The dollar peaked in December 2016 and is now down against all currencies. The dollar index for example is down 12% in 2017.

The EU and the Euro – a failed political experiment

The Euro is up 16% against the dollar in the last nine months. The Euro is the currency of a failed political experiment. A one for all currency was always doomed to fail, even before it was launched. How could Greece or Portugal ever have the same currency as Germany. The efficient Germans with their very strong industrial base have benefitted enormously from a relatively weak Euro whilst many inefficient Mediterranean EU countries have become debt laden and uncompetitive due to a currency which is too strong. But in spite of the problems in Euroland, the Euro has outperformed the dollar by 16% in 2017. As we know, there is no absolute value for a currency. They are all virtually worthless and only backed by debt. But it is a relative game. And relatively the world’s reserve currency, the dollar, is losing value fast against an artificial construction called Euro. The Euro has been doomed out for a number of years but is still winning the war against the dollar.

US empire is crumbling

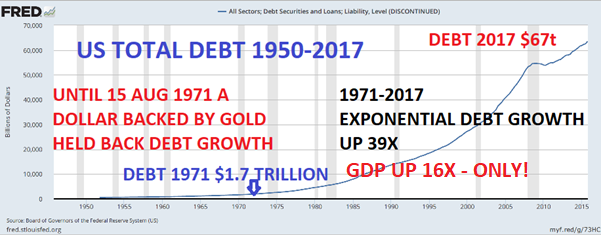

So what has the dollar got going for it? The US is the biggest financial empire in the world and the greenback was desired by most people around the globe for many decades. Like all empires, the US world dominance is now crumbling and so is the dollar. The dollar strength was based on the US being the mightiest industrial nation in the world with low debts and a balance of payment surplus. But that gradually changed, starting already in the early 1960s when the US couldn’t afford to make ends meet. Since then the US debt has gone up every single year for 56 years. Also, the US has had a trade deficit every year for the last 45 years. As the dollar came under attack in the early 1970s, Nixon took the fatal decision to back the dollar by nothing. When gold on August 15th was removed from backing the dollar and the world’s currency system, few realised the disastrous effects this decision has had for the world. Global debt has since grown exponentially and most currencies have fallen by 70-80% in real terms.

US investment returns underperforming

2017 has been a year when many US investors have lost money as well as purchasing power. So how can that be possible when most investments have been strong measured in dollars? Americans seldom worry about what happens to their currency since they measure their wealth in dollars. But on an international purchasing power basis, dollar investors are losing out in 2017. As an example, the chart below shows the Dow down 10% in Euros since March 2017.

Will the bubble grow bigger?

Since we are looking at the end of a major cycle, bubbles have a tendency to grow bigger than you thought would be possible. This is why we might still see strength in stocks for a few months yet and also credit markets continuing to ignore risk. But very few investors have become wealthy be holding on to the end of a major bull market. Look at the Nasdaq at the end of the 1990s. It went up 5x between 1996 and early 2000 and then lost 80%. Many Nasdaq stocks lost 100%. Between 2009 and 2017 we have seen the Nasdaq go up 5x again. Many leading Nasdaq stocks are now trading on stratospheric valuations. It would be surprising to see an 80% correction only this time. More likely is 90-95% in the next few years.

Whichever catalyst will trigger the next crisis in the world, we will only know afterwards. What is certain is that it will come. When is of course the big question. Will this bubble expand further or will it start imploding this autumn? No one knows the answer. What we do know is that we are dealing with unprecedented risk. The risk is also immeasurable.

When the next financial crisis comes, it will be bigger than in 2006-9. We also know that the tools that central banks applied then are unlikely to work the next time. Money printing no longer has any effect on stimulating the economy. It only creates asset bubbles. And the interest rate weapon no longer exists. In 2006 interest rates around the world were around 5-6%. Today there are 20 countries with negative rates and most of the rest are just above zero. This won’t stop central banks from a final round of unlimited money printing leading to hyperinflation and the final move of currencies to zero. The asset and wealth destruction will be catastrophic. In real terms, most assets will decline by 75–99%.

Most investors will not heed this warning and will not get out of markets until they have lost most of their money. But even for the people who consider these forecast as scaremongering, would it not be worth considering some insurance? If there is a high risk of a fire or a flood, most people would insure their house if they could. So why are so few insuring financial risk? Clearly because they can’t see it.

Buy risk insurance while it is still cheap

But even if investors don’t see any of these risk factors materialising, wouldn’t it still be worthwhile to own some insurance. Conventional financial insurance will not work when we are looking at systemic risk. Puts, swaps and other derivative instruments are unlikely to pay out due to counterparty failure. The best insurance is real assets, Normally, land and buildings have withstood most catastrophes as long as they are unencumbered. The problem with the property market today is that in most countries it is massively overvalued.

The best real assets are physical gold and silver as long as they are kept outside the banking system. As I showed in last week’s article, gold has now resumed the uptrend to new highs after a long correction. The same goes for silver. Silver broke out of a 5 year downtrend in 2016. As the chart below shows, silver has again broken out of a 1 year correction and is now ready to move up explosively.

Bubbles can always grow bigger than we expect. That could also be the case today. But if they grow bigger so will the risk of the bubbles imploding. The risk is massive today on a global basis. If markets continue to defy reality, that makes the reason for insurance even more compelling.

The best insurance is precious metals. For investors who don’t already own precious metals, this is the time to buy physical gold and silver. When you buy insurance, you must have enough cover to protect other assets and to be able to live comfortably off your insurance. I do realise that most investors are not in that fortunate position. But whether you buy a few ounces or a few tonnes of gold, it is absolutely critical to own some insurance cover. So what percentage of financial assets should be in gold and silver. It could be anywhere from 5% to well over 50% depending on the investor’s situation. We would say that 20-25% should be a minimum.

For all investors, owning proper insurance cover in the form of gold and silver, against what is probably the biggest risk situation in history, will prove to be an extremely wise decision.

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

The coming gold and silver moves in the next few months will really surprise most investors as market volatility increases substantially.

It seems right now that “All (is) quiet on the Western Front” as Erich-Maria Remarque wrote about WWI. Ten years after the Great Financial Crisis started and nine years after the Lehman collapse, it seems that the world is in better shape than ever. Stocks are at historical highs, interest rates at historical lows, house prices are booming again and consumers are buying more than ever.

Have Central Banks saved the world?

So why were we so worried in 2007? There is no problem big enough that our friendly Central Bankers can’t solve. All you need to do to fool the world is to: Print and expand credit by $100 trillion, fabricate derivatives for another few $100 trillion, make further commitments to the people in forms of pensions and medical, social care for amounts that can never be paid and lower interest rates to zero or negative.

And there we have it. This is the New Normal. The Central Banks have successfully applied all the Keynesian tools. How can everything work so well with just more debt and liabilities? Well, because things are different today. We have all the sophisticated tools, computers, complex models, making fake money QE, interest rate manipulation management and very devious intelligent central bankers.

Or is it different this time?

All these shenanigans by central banks have created fortunes for the top 1% and massive debts for the rest of the world. For some of us who spend considerable time studying risk, you can make two very distinct conclusions:

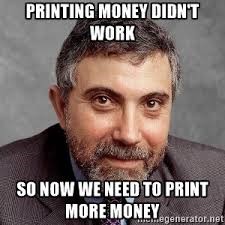

- On the one hand, central bankers have been extremely skilful in using all the tricks in the book, including some new ones, and saved the world by printing unlimited amounts of money, expanded credit exponentially and abolished the cost of borrowing by setting rates at zero or negative. This is the perfect scenario and the Krugmans of this world must be really pleased since this justifies receiving the Nobel Prize and confirms that they have found the perfect method which can be applied indeterminately with great success.

- On the other hand, for the ones of us who believe that trees can’t grow to the sky and that sound money always prevails, we know that we are in the last stages of a bubble of epic proportions. Fortunately, our side has also received a Noble prize through von Hayek, although it was back in 1974.

This has been a very long battle between the manipulators and the advocates of sound money. With free money and socialism, you can fool most of the people for a very long time. But sadly for the Keynesians, they will run out of ammunition when all the printed currencies return to their intrinsic value of zero. This means you can’t fool all of the people all of the time. As Margaret Thatcher said: “The problem with socialism is that you eventually run out of other people’s money (OPM).” And this is exactly where we are today. The world has run out of OPM. When our company went aggressively into gold and silver in 2002 for our investors and ourselves, we did not believe that the central bankers would be able to manipulate markets for over 15 years. Still, silver was $4 at the time and gold $300, so the manipulation has only been partially successful.

Money printing no longer works

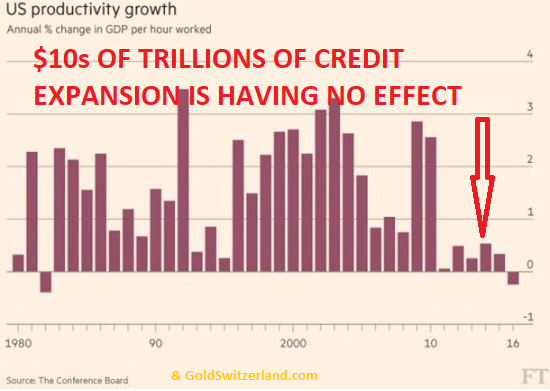

But the signs are now very clear that the money printing experiment is coming to an end very soon. Despite all the trillions of monies created in the world, real GDP has stopped growing.

As the chart below shows, all the money printing and credit expansion is no longer having an effect. Even a child could understand that you can’t grow an economy by printing paper and calling it money but for some reasons, the Keynesians seem to ignore the obvious.

Money printing has benefitted the 1%

The only area which is still very strong is stock markets, property and bonds. This is where all the money printing goes and the 1% believe that their riches are exploding due to their investment skills. Little do they realise that these skills will just vanish into a big black hole in the next 4-7 years as the exploding assets implode and all the global debt with it. Sadly this must happen in order to create a sane world again. We cannot build a world on fake values and fake money. Mankind will not survive in such a world. It will totally destroy itself. It will be hard enough to survive the coming collapse of the Ponzi scheme that has flourished in the last 100 years.

The transition from a false system based on an illusion to real values and real money will be painful for most of the world. The wealthy will lose at least 95% of their assets and many normal people will starve and live in misery. We will have wars, civil unrest, political upheaval and economic devastation. This is what the elite has caused by creating a dishonest system for the benefit of the 1% but to the detriment of 99% of mankind. The problems we will see in coming years are likely to reduce world population by at least 1/3rd which is more than 2 billion people. The combination of wars, civil wars, famine, disease and economic collapse is likely to lead to this. World population has exploded from 1 billion to 7.5 billion in the last 160 years. Statistically there have always been setbacks in history when population has declined substantially whether it is due to wars or disease. During the Black Death of the 14th century for example, World population is estimated to have declined by 50%.

So the risks are major even though we are only talking about probabilities. Things could take longer and they could be less severe. But with risks of this magnitude, the very privileged few who have the possibility to take precautionary measures must do so. Because at some point in the next few years, a financial and economic collapse is inevitable.

Gold has broken out

The autumn of 2017 has for some time looked precarious. The question is what catalyst will pop the bubbles in markets and the economy. Stocks look very vulnerable and overvalued on any criteria. Even though bubbles can always grow bigger, the risk is now unacceptable. At the same time, gold and silver have now finished the long consolidation period since 2013 and resumed the uptrend to new highs.

Explosive metals in the autumn

Moves in the metals could easily be explosive during the autumn. The strength the precious metals are now showing is a very strong indication that the manipulation by central banks, the BIS and the bullion banks is going to fail in the next few months.

I have previously pointed out that at current low demand, the entire mine production of gold and silver is absorbed. Less than 0.4% of global financial assets are invested in gold. The annual silver mine production of $15.5 billion is less than 0.01% of global financial assets. Since all gold and silver production is being easily absorbed currently, with negligible invest demand, there will be no physical gold or silver available at current prices for the coming increase in demand. In addition, the paper market in the precious metals is likely to have major disruptions and fail as the demand for physical metal increases. As institutions and funds start to focus on the physical precious metals and the PM stocks, they will only be able to invest at prices which will be many times higher than current levels. This is what will drive gold to my long-standing target of $10,000 and beyond. With a gold/silver ratio back to the historical level of 15, that would make silver $666. I believe that these levels can be reached in today’s prices and when hyperinflation takes hold we could see multiples of those levels.

If silver today was at the same level against the US monetary base as at the 1980 peak, the price would be 80x greater at $1,424. Although this sounds like fantasy today, it is not unrealistic. Just look at what is happening to Bitcoin. And remember that silver is real money whilst Bitcoin is just an electronic construction with no underlying asset. This won’t stop Bitcoin to go much higher in a Tulip bulb type mania.

Silver will outperform gold

Technically silver is likely to outperform in the next few years. We have always argued that wealth preservation investors should hold gold mainly, due to the volatility of silver. But at this point, silver looks extremely good value so an exposure of say up to 25% silver and 75% gold would be an excellent mix.

The gold and silver universe is miniscule compared to tech stocks

With annual mine production of $128 billion gold and $16 billion silver, this market is so small that it is totally dwarfed by the stock market. Just take some of the most well-known Nasdaq stocks, Apple, Google, Microsoft, Amazon and Facebook. Their total market cap is $3 trillion. Compare that to the annual gold and silver mine production ($143B) and the top 20 gold stocks ($150B) and the top 25 silver stocks ($30B). The total annual precious metals mine production and biggest metals stocks add up to $437 billion. That is only 15% of 5 of the biggest Nasdaq stocks and less than the smallest of those five which is Amazon, valued at $470B. Since these five stocks probably have topped, big investors will liquidate part of their holdings and look for new opportunities. The gold and silver universe is likely to get very crowded as funds and institutions enter.

Physical gold and silver and the precious metal stocks will be a crowded market

Gold in many currencies bottomed in 2013. In dollars, the bottom was in 2015. After the rally in the first half of 2016 and the subsequent correction until December 2016, gold and silver are now on their way to new highs. We obviously will not see a straight line move as there will be temporary stops on the way. But for the ones who are not fully protected against major global risk, now is the time to be fully invested in gold with an important allocation in silver. Precious metals will become an extremely crowded investment sector and the time to get in at reasonable prices is soon ending.

This is a totally unique situation. Seldom has a protective wealth preservation investment also had massive capital appreciation potential. Don’t be left behind. There is too much at risk.

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

There are lies damned lies and Central Bank Gold statistics. Total official global gold holdings are reported to be 33,000 tonnes. That is 19% of all the gold ever produced in the world. But how can anyone ever believe any of these figures. Because no central bank ever has a public audit of all its gold holdings. Since the gold belongs to the people, they have the right to know if the gold actually exists, especially since the gold reserves are backing the currency.

Why is the US gold not audited?

But no, the truth about these gold reserves are veiled in total secrecy. And why we may ask. Why are the people as well as the creditors of a country not told the true financial position? What do these central banks have to hide? Let’s take the US. The US is allegedly holding 8,100 tonnes of gold, stored in Fort Knox, Denver and New York. The last official audit was 64 years ago in 1953 when Eisenhower was president. Since then, the US Government claims that the US gold has been audited over a period from 1974 to 2008. But no proper figures have ever been published.

FORT KNOX – WHERE IS THE GOLD?

The first question to ask is of course how an audit can ever take 34 years!!!! Only a government organisation can take 1/3 of a century to audit their assets. I know of no company in the world that can take 34 years to report their assets to the shareholders. The stakeholders of the US gold are the US people and they certainly have the right to know if the country really holds $332 billion worth of gold. Steve Mnuchin, the US Treasury Secretary, spent an afternoon in Fort Knox last week. After having seen a few percent of the total gold held there, he confirmed that it was SAFE! Well that’s good to know but he obviously hasn’t got a clue how much is there.

Secondly, an audit carried out over 34 years cannot possibly be accurate. The movement in gold over that period would totally nullify the accuracy of the audit.

Thirdly an audit should be carried out by independent auditors. This audit was done by a Government Committee for Gold and the Treasury. The exact method of the audit has not been revealed but according to some sources, the methods were highly suspect.

Fourthly and just as relevant is the total balance sheet position of the US gold holdings. The physical gold is only one part. Central banks practice gold lending or leasing on a major scale. Thus, the US could lease its gold to another bank against a fee. Lending can take place without the physical position of the gold changing. Other banks accept to borrow gold from the Fed without having it in their possession. There can also be swaps, forward sales and other derivative transactions that reduce the holding.

German still holds 50% of its gold abroad

Germany used to store 70% of its gold abroad with the majority in the US. In 2013, they were under public pressure to repatriate the gold and declared that 674 tonnes would be repatriated from the US and France. They only received 5 tonnes in the first year because there was no gold available. It had probably been lent on to someone else. Finally, they just stated that the 674 tonnes are now in Germany. This means that around 50% of the German gold or 1,665 tonnes is still held abroad. The obvious question is of course why not hold it all in Germany. The official reason is risk spread and trading. It is dubious if the US or the UK are safer places than Germany. Financially Germany is clearly safer. All central banks trade part of their gold. To lease gold to someone, it doesn’t have to be held in New York or London. The leasing could easily be done from Germany.

Possibly, the 1,665 tonnes held abroad have been covertly sold or leased to a bullion bank which has sold it on to China. And China of course always takes delivery. They wouldn’t be so stupid to keep a major part of their gold in the US or London. If the German gold has been leased and shipped to China, all the German government has is an IOU from a bullion bank. So instead of physical gold they have a piece of paper.

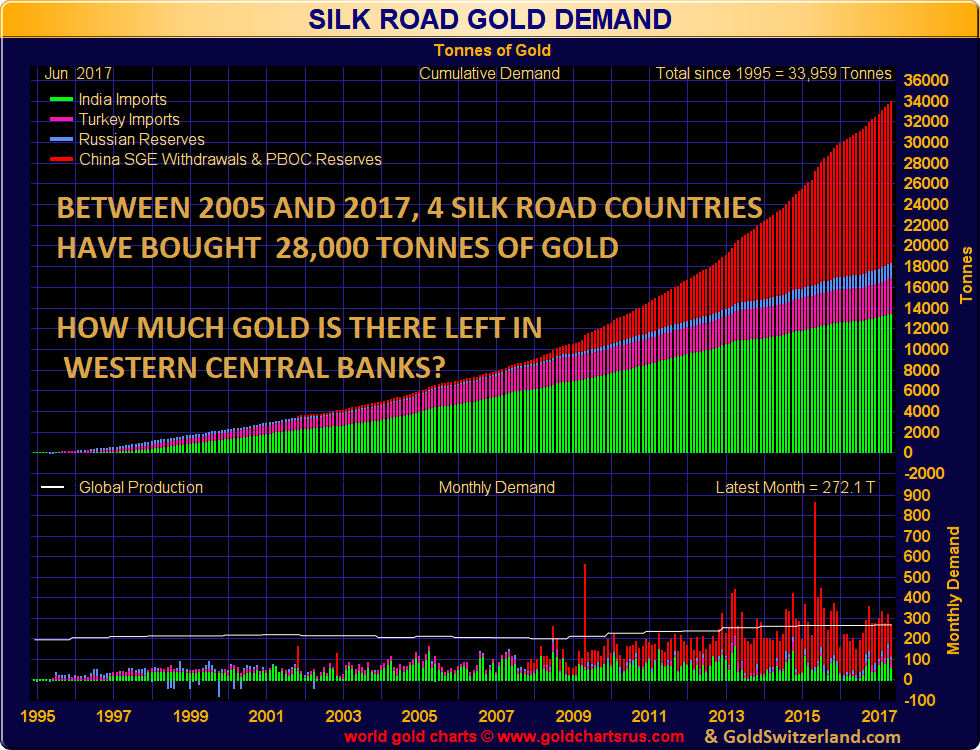

Silk Road nations are buying all the gold

The same could easily be the case with the US gold or other central bank gold. With the massive buying we have seen from Silk Road countries in the last 10 years, it would not be surprising that a major part of the gold has come from Western Central banks. Since 2005, four Silk Road countries have bought 28,000 tonnes of gold.

Many market observers estimate that official gold holdings could be as little as half of the reported figures. In my view, that is not unrealistic. As the chart above shows, there has been a major shift of gold from West to East. Four Silk Road countries have absorbed more than the annual gold production for the last 10 years. An important part of the sales to the East will most certainly come from Western Central bank holdings.

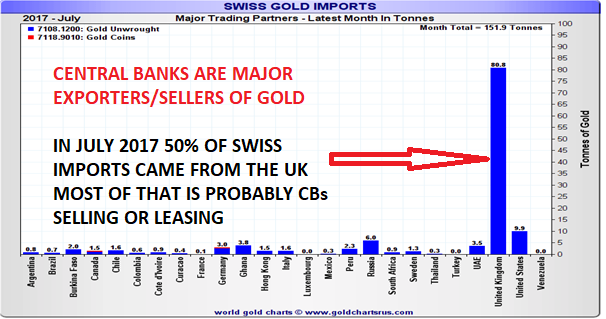

UK a major gold exporter

Switzerland publishes the monthly imports and exports of gold. These give a good indication of global gold trading since Switzerland refines up to 70% of the gold bars in the world. The chart below shows the Swiss gold imports from July. Of 152 tonnes imported, 80 tonnes came from the UK. The UK is certainly not known as a gold producer. The gold that the Swiss refiners get from the UK are 400 ounce (12kg) bars, most probably sold by central banks. The bars are broken down to 1 kilo bars and then shipped to China and India. These bars could either have been sold covertly by central banks or leased by them to the LMBA banks in London. In the past, the bars leased by central banks would have stayed in London.

SWISS GOLD IMPORTS JULY 2017

Since the Silk Road countries started to accumulate gold, the gold held by the LBMA banks in London has declined significantly. The Silk Road buyers are not content to keep their gold in London. They don’t trust the LBMA system where the same gold is lent many times over. Thus, they take delivery which shifts the gold power centre from West to East. Eastern countries and especially China understand that gold is the only currency that will survive the coming collapse of paper money. That is why they are accumulating substantial quantities of gold. China knows the Golden Rule: He who has the (physical) Gold makes the rules.

I added the word “PHYSICAL” before gold since physical possession is the only thing that counts. In the West, the vast majority of gold is paper gold which is leveraged several hundred times in relation to the physical. But even physical gold held by banks is sold many times over. We have experienced many times how clients who hold gold in major banks, realise that the gold isn’t there when they want us to transfer it to private vaults.

The day that gold investors holding paper gold or unallocated gold, ETF gold etc, realise that there is no gold to back their claims, the whole market will panic. At that point, the market will also understand that a lot of central bank gold has gone from West to East without anyone noticing.

We are seeing the beginning of the Dollar collapse

The dollar bottomed in 2011 at the same time as gold and silver peaked. In dollar index terms, the dollar rallied 40% until December 2016. That marked the end of the 5 ½ year dollar correction. In 2017 the dollar index has lost 10% so far but that is just the beginning. The major decline of the dollar has now started and will finish when the dollar has reached its intrinsic value of ZERO.

Gold on its way to new highs

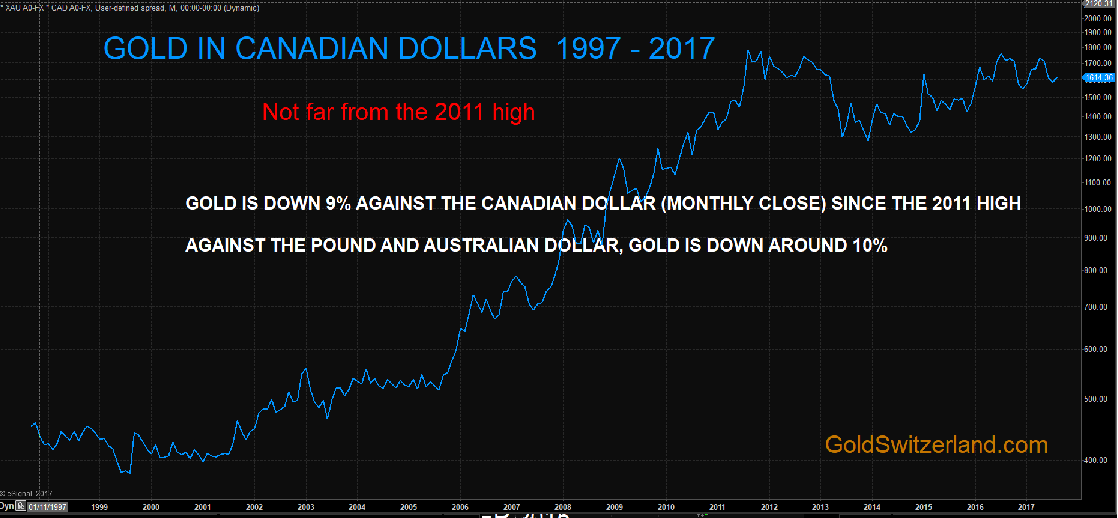

Gold peaked temporarily in 2011 at the same time as the dollar bottomed. Since 2013 gold has traded in a tight range. At $1,300, gold is 31% below the 2011 peak. But it is only when measured in dollars that gold looks weak. In pounds, Australian or Canadian dollars gold is only 10% from the top (monthly close).

In 2017 gold has outperformed the US stock market and rallied 12%. It is likely that we will see a major gold rally in the autumn on the way to a new high. So after a very long consolidation period, lasting six years, gold and silver will now resume the uptrend that started in 2000.

The coming rise of gold and silver in the next few years will not just be the reflection of the fall of all paper currencies. Major contributors to the rise will also be the failure of the paper market in the metals and the realisation that central banks possess much less physical gold than they have indicated.

Therefore, physical gold and silver will continue to be the best way to preserve wealth during the coming destruction of all bubble assets such as stocks, bonds and property. But the opportunity to purchase gold and silver at reasonable prices is soon ending. There just won’t be enough gold to satisfy the coming demand.

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

“America is now a dangerous nation.” This is the title of an article written by the journalist Gideon Rachman in the Financial Times last week. He goes on to declare: “Under Donald Trump, America looks like a dangerous nation.”

As I stated in my KWN article last week, the risk of a major war is now very high. The dilemma is that this is just one of many problems with potentially catastrophic consequences that the world is currently facing. Looking at total global risk, the current situation is probably graver than anything the world has faced in history. The world is now standing in front of a potential nuclear war between the US and North Korea, a war that easily could lead to a world war involving initially China and Russia and many more nations. The economic, financial and political consequences would obviously be catastrophic for the world.

As I stated in my KWN article last week, the risk of a major war is now very high. The dilemma is that this is just one of many problems with potentially catastrophic consequences that the world is currently facing. Looking at total global risk, the current situation is probably graver than anything the world has faced in history. The world is now standing in front of a potential nuclear war between the US and North Korea, a war that easily could lead to a world war involving initially China and Russia and many more nations. The economic, financial and political consequences would obviously be catastrophic for the world.

Ignorance is bliss

Ordinary people are very fortunate that they are never exposed to the real problems in the world. Between Facebook, Instagram, YouTube and some game shows on television, they are blissfully ignorant of the very precarious position the world is in. Luckily for most people, television news and newspapers report very little that touches on anything but local news or the latest divorce or affair by their favourite artist. Virtually no journalist today is capable of doing any analysis or objective reporting. They just report what they are being fed by government or a handful of media organisations that dominate the world.

Nine steps to the abyss

The average person is totally ignorant of the insoluble risks facing the world currently, namely:

- Record global debts of $225 trillion which can never be repaid and will bankrupt most nations in the next few years. This includes public as well as private debt.

- Their money, whether it is dollars, euros yen or yuan will become worthless within 5 or maximum 10 years as governments finish off the 100 year debasement of all currencies which are already down 97-99% since the Fed was founded in 1913.

- Most assets will decline by 75% to 99% in real terms. This includes the bubble markets financed by the credit boom and money printing such as stocks, bonds and property.

- Central banks will become insolvent. Most central banks are today hedge funds with massive leverage. The assets they hold, government bonds, stocks and other bonds will all become worthless. The demise of these banks will be a blessing for the world since they are the primary cause of the coming financial collapse.

- The banking system will fail and most assets held in a bank will disappear. This includes both money and securities.

- As nations go bankrupt and money printing has no effect, the state will become totally ineffective. This means that there will be virtually no money left to maintain the socialist system that the world has experienced for almost a century. A system which in most Western countries absorbs and wastes more than 50% of what the country produces. As the very wise Margaret Thatcher said: “The problem with socialism is that you eventually run out of Other People’s Money.” (abbreviated OPM).

And this is exactly what will happen next. As the world runs out of OPM, there will be no money or taxes to fund social security, medical care, pensions, defence etc. On the one hand, this will of course be devastating for most people who are totally dependent on the state and OPM. On the other hand, government tax departments will be decimated or disappear, and all the unproductive bureaucrats and civil servants will also be gone. This will be a very good thing. I do realise that the transition will be devastating for most people initially but hopefully the Phoenix that will come out of this will create a much stronger and sounder system based on personal initiative and self-reliance rather than destructive socialism. - The core of democracy and values are being totally torn down as a result of the socialist system. The family is for many no longer the kernel of society. In the West, the divorce rate is 50% or above in most countries. Many people are restless and less grounded. This is also linked to the earth’s magnetic field which is weakening significantly. Religion as well as moral and ethical values are waning. Heritage, history and culture is denied by the powers that be. Tearing down historical monuments is a sign of this. Everything must now be politically correct. And political correctness is determined by the minorities and not the majority.

- There will be political upheaval in most countries in coming years. The party in power will be pushed out or lose the next election since they can’t fulfil their socialist promises. The opposition party will gain power since they will promise the earth. But they will soon run out of OPM and also fail.

- We will see social unrest and also civil wars. People without money or jobs will revolt. There will be major clashes or civil wars between political phalanges.

Are Kim and Trump dangerous for the world?

So is the US now a dangerous nation based on the conflict with North Korea? Yes, this is certainly a high-risk event. Both Kim and Trump are impulsive characters. With over 28 resignations or firings in Trump’s administration over the last seven months, there are clear signs of instability and lack of harmony. As I said in an interview with Grant Williams after Trump had been elected in late November, that with Trump being a dominant individual and an entrepreneur, I expected him to change his mind constantly. Most entrepreneurs have no strong principles but the ability to change their mind frequently. It is this flexibility that makes them successful in business. But this doesn’t work in politics. I also predicted that Trump, being a very strong individual, would not be able to retain people with strong personalities. Hiring a number of very top people, including billionaires, was a high-risk strategy for Trump. The 28 people who have left so far proves that point.

The risk with a leader who is under tremendous pressure on the domestic front is that he turns outwards and starts a war. This is an extremely normal pattern in history. And nobody in the US can stop the President to push the nuclear button. In theory, the military could disobey orders from the commander in chief but normally generals are very keen to start wars. With three top generals in the White House as Trump advisors, the risk of war is significantly heightened. But hopefully Trump will understand the horrendous consequences of starting a nuclear war. Trump should avoid a desire to join former war hungry leaders such as Bush, Obama, Blair, Cameron, Sarkozy and others who through their ignorance and megalomania managed to change global history for the worse, for a very, very long time.

As regards Kim of North Korea, he would probably be very keen to prove his nuclear power. The biggest risk is that his missiles miss Guam, making him into a laughing stock. As an alternative, South Korea would be an easier target and therefore more likely. But let us hope and pray that we will not see a nuclear war. That would be the end of the world most of us know today.

A less safe world

The fact that many, especially in Europe, see the US as a dangerous nation is of course not new. Since WWII, the US has been involved in numerous wars, many of which were started by the US, assisted by other nations. The unprovoked attacks on Iraq and Libya are examples of US interference with dire consequences for especially Europe but also for the rest of the world. In Iraq, more than ½ million people died as a result of the war. But the serious and long term effect of these wars is the migration which Europe is now experiencing. Germany for example has had 1.5 million immigrants since January 2015. There are no jobs, nor housing or schooling for most of these migrants and the legal system cannot cope with all the asylum seekers. This will have long term and permanent social and cultural consequences of major proportions for most European countries. Europe will be a very different place in 2050. Also, the terrorism that the world is now experiencing is only the beginning. Even without a major war, the world as a whole will be much less safe due to terrorism and increase in crime. I was born at the end of WWII and have experienced a long period of peace and prosperity as well as safety. Sadly, my children and grandchildren are unlikely to be so lucky.

Time to act

I do realise that bearers of bad news are unpopular figures. If they are right, nobody will thank them and many people will blame them. If they are wrong they will be ridiculed. But as most readers know, I am not here to be a prophet of doom and gloom. No, my purpose is just to tell things as I see them and to warn people about the massive risks that the world is now facing. Some people will argue that ignorance is bliss. Yes, it could be, especially since we don’t know exactly when the end of an era is upon us. But it is very clear to me that the time for change is now very near, as I outlined in last week’s article.

So at least for the ones who are forewarned, they can take some preventive actions. But even the knowledge of major changes in the world would probably ease the shock.

For the privileged few who have assets to protect or the ability to move to a safer place, now is the time to seriously consider this. Big cities will not be the best places to live.

I think this autumn will be the autumn of market turmoil and shock. Over extended stock markets seem ready for major falls. Same with the dollar, the world’s reserve currency, only backed by gigantic debts. Property markets worldwide will first freeze and then fall hard. Central banks will try to hold interest rates down but will eventually fail, leading to major falls in bond markets.

Gold and silver shortages coming

Physical precious metals will be major beneficiaries of the coming global crisis. Gold should go to $1,360-70 quite quickly on its way to new highs. Due to a temporarily strong dollar, gold in US dollars is 29% below the 2011 high (monthly close). In most other currencies gold is down a lot less. See gold in Canadian dollars above.

Silver, albeit very volatile, will rise faster than gold. For anyone considering buying physical gold or silver, there will soon be a time when there will be major shortages. There just won’t be sufficient production or stocks to cover the coming demand. Also, we recommend that gold and silver should be held outside the country of residence. There will soon be exchange controls in many countries including the USA. So the option to transfer assets or money out of your country might not exist for much longer.

The risk that we will have major market turmoil this autumn is big. But remember that even if things take a bit longer to materialise, insurance must be acquired before the event.

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

Totally irresponsible policies by Governments and Central Banks have created the most dangerous situation that the world has ever experienced. Risk doesn’t arise quickly as the result of a single action or event. No, risk of the magnitude that the world is experiencing today is the result of many years or decades of economic mismanagement.

Totally irresponsible policies by Governments and Central Banks have created the most dangerous situation that the world has ever experienced. Risk doesn’t arise quickly as the result of a single action or event. No, risk of the magnitude that the world is experiencing today is the result of many years or decades of economic mismanagement.

Cycles are normal in nature and in the world economy. And cycles that are the result of the laws of nature normally play out in an orderly fashion without extreme tops or bottoms. Just take the seasons, they go from summer to autumn, winter and spring with soft transitions that seldom involve drama or catastrophe. Economic cycles would be the same if they were allowed to happen naturally without the interference of governments. But power corrupts and throughout history leaders have always hung on to power by interfering with the normal business cycle. This involves anything from reducing the precious metals content of money from 100% to nothing, printing money, leveraging credit, manipulating interest rates, taking total taxes to 50%+ today from nothing 100 years ago, etc, etc.

Governments doing god’s work

Governments will always fail when they believe that they are gods. But not only governments believe they perform godly tasks but also hubristic investment bankers like the ex-CEO of Goldman Sachs who proclaimed that the bank was doing God’s work. It must be remembered that Goldman, like most other banks, would have gone under if they and JP Morgan hadn’t instructed the Fed to save them by printing and guaranteeing $25 trillion in 2008. Or maybe that was God’s hand too?

We now have unmanageable risks at many levels – politically, geopolitically, economically and financially.

This is a RISK ON situation that is extremely dangerous and will have very grave consequences. There is one very small but important silver lining which I will return to later.

1. RISK ON – US Political Situation and War

When there are numerable risks that can all cause the collapse of the world economy, they all have equal relevance. However, the political situation in the USA is very dangerous for the world. This the biggest economy in the world, albeit bankrupt with debt growing exponentially and real deficits every year since 1960. Before the dollar has collapsed, the US will still be seen as a powerful nation although a massive economic decline will soon weaken the dollar and the country, burdened by debt at all levels, government, state, and private.

What makes the US particularly dangerous today is that the President is a lame duck. Both political parties are working against him and are trying every trick in the book to get him impeached. The Elite or powers that be are obviously also doing what they can to outmanoeuvre Trump and make him ineffective. But Trump is a fighter and will not give up easily. As he is virtually paralysed when it comes to any political or economic decision, what remains is military actions or war. As commander in chief, he has the ultimate say in pressing the nuclear button. He, like most of us, understands the catastrophic consequences of nuclear war. And we are not talking about just the US and North Korea. We would see China, Russia and many other countries involved. Wars are often started by an impulsive and power-hungry leader, which we certainly have in Kim and Trump.

Real power in the US comes from major sectors such as defence, energy, big pharma and investment banks. Their “contributions” to virtually all politicians is where the real power lies. When a leader is under major political pressure on the home front, starting a war quickly diverts the attention from domestic problems. And Trump would of course get total support from the military since their whole raison d’étre is war.

For Trump, a war would mean that he takes total control and all domestic squabbling is forgotten. He would be the king war maker and the “saviour” of the US.

Except for all the extreme consequences of a nuclear war, there will of course be serious economic implications such as stock and bond market collapses, dollar fall etc. There would also be massive money printing.

Hopefully it won’t come to this and Kim and Trump will realise the global catastrophe nuclear war would involve. But the risk is extremely high.

2. RISK ON – Global Stock Markets

Stock markets worldwide are all in bubble territory. With volatility at historical lows and valuation at historical highs, stock market investors are displaying a total disregard for risk and reason. No trees grow to heaven even if it looks like it right now. Yes, bubbles can grow even bigger like the Nasdaq in 1998-2000. But investors should not worry about missing the last few points on the way up when the subsequent fall is 80% as happened to the Nasdaq 2000-2.

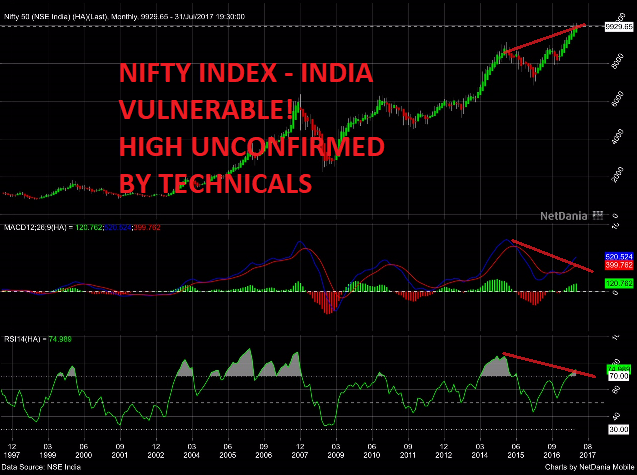

Virtually every stock market around the world is vulnerable. Below are monthly charts of the Nasdaq, TSX – Canada Nifty- India and Dax- Germany. All are showing a similar picture. They are severely overextended and have made new highs with bearish divergence. This means that the new highs are not confirmed by momentum indicators which are showing weakness. Other technical indicators are confirming that we are seeing long term tops in all stock markets and that the next major move will be a vicious and sustained fall. Thus, stocks are very high risk today medium to long term.

3. RISK ON – US Dollar, Currencies

With the coming economic collapse, all currencies will decline to zero due to unlimited money printing. The US dollar is substantially overvalued and has been falling against all currencies since December 2016. The graph below shows the dollar index which is down 10% since December last year. The initial target is the 2007 low of 70 which is a 25% fall from here. Eventually the dollar will fall a lot further. But so will of course all currencies which so far have fallen 97-99% in the last 100 years. The final fall of 1-3% from here is likely to take place in the next five years. This will happen as a result of unlimited money printing, undertaken by central banks in a final attempt to save the financial system. This is sadly very likely to fail.

4. RISK ON – Debt

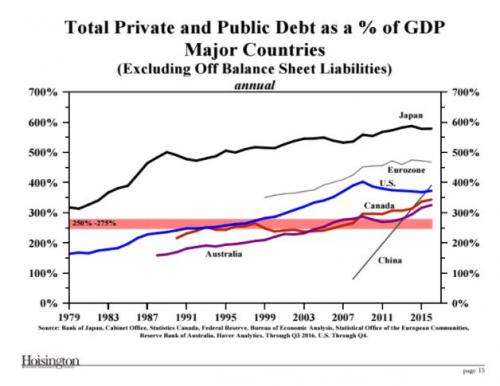

Global debt is growing exponentially. Since 1971 debt has exploded in most countries. As the graph shows, in Japan for example total debt has gone from 320% of GDP in 1979 to almost 600% today. And in the US, debt to GDP has gone from 160% to almost 400% in the same period.

Growing debt substantially faster than GDP over a sustained period means that the growth can only be “bought” with printed or borrowed money. Thus, the growth is not real but is achieved by artificial means. There is no difference between that method or an individual or company borrowing to survive. Eventually it leads to bankruptcy and this is where the world including the US is heading in coming years.

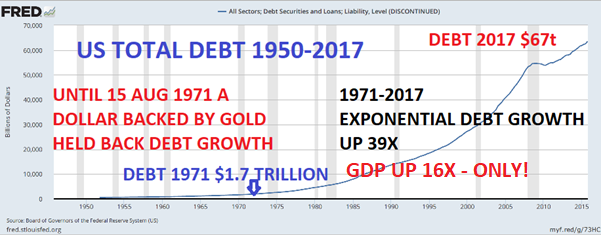

The US position is particularly bad. Since lifting the gold backing of the dollar in 1971, US debt has gone up 39x from $1.7 trillion to $67T. How can the Keynesians believe that this is prosperity and wealth? Debt is slavery and misery which soon will lead to immense suffering in the US and the rest of the world. And this only because governments have interfered in the natural economic cycles and bought votes at a cost which will be devastating for the world.

Rates at historical lows and bottoming as expected with the 35-year cycle in 2015-16 are now likely to go to highs similar at least to the levels in the late 1970s which is 15%+. The consequences of rates at that level will have a dramatic effect on record global debt financing as well as the $1.5 quadrillion derivatives. The vicious cycle of money printing, more debt and hyperinflation is next. Eventually that can only lead to a total failure of the system.

35-year interest cycle has bottomed

5. RISK OFF – Gold

Ray Dalio (Founder of the very successful hedge fund Bridgewater) just published an article on LinkedIn in which he states that the historically low volatility we are currently seeing in global markets is soon going to turn to much higher volatility. He also stated: “so if you don’t have 5-10% of your assets in gold as a hedge, we’d suggest that you relook at this. Don’t let traditional biases, rather than an excellent analysis, stand in the way of you doing this.”

5-10% in gold is of course substantially lower than we would recommend as we believe that 25% is a minimum. But if big investors and institutions put 5-10% of their assets into physical gold, the gold price will go up exponentially from here. Currently less than 0.5% of world financial assets are in physical gold and even if that went to 1.5% only, price would go up 5-10x at least. There is no stock of physical gold available and all current production is absorbed by China, India, Russia and a few other major buyers. From a production point of view, we have reached peak gold and mine production is expected to decline from 3,000 tonnes a year to 2,000 tonnes in the next ten years. The only way that new buyers will get their gold is by paying much higher prices thereby releasing gold held by reluctant sellers and gold currently in jewellery.

Gold is only as low as $1,295 per ounce due to manipulation in the paper market. This is likely to fail as demand increases and holders of paper gold ask for delivery. That is when gold will jump $100s or more in a very short period. What we have seen in cryptocurrencies in rapid price rises will also happen with the gold price. The big difference is that the higher gold price will be sustained whilst once the cryptocurrencies peak, that bubble will burst. You cannot compare gold which has been money for 5,000 years and which has an intrinsic value with an electronic entry on a computer which has been created out of thin air.

In the next 5-10 years, all bubble assets such as stocks, bonds and property will decline 75-95% in real terms which means versus gold. This is a totally natural finish to what Neil Howe, (co-author of “The Fourth Turning”) calls the fourth turning which is the final phase of the 80-year cycle. He states:

“The fourth turning is the final season of history, if you will, the final generation. And that is the period of crisis. That is the period when we tear down institutions that we’ve built, everything that’s dysfunctional. And we sort of rebuild things from scratch again. And it usually follows a period where—it’s bound up in a period where there’s complete disgust, complete distrust with what we have.”

“The risk of catastrophe will be very high. The nation could erupt into insurrection or civil violence, crack up geographically, or succumb to authoritarian rule. If there is a war, it is likely to be one of maximum risk and effort – in other words, a total war. Every Fourth Turning has registered an upward ratchet in the technology of destruction, and in mankind’s willingness to use it.”

According to Howe, the final 20-year phase, which is the Fourth Turning, started in 2008 and therefore has another circa 10 years to go. My views and Howe’s are very similar in many aspects and if we are anywhere near correct in our predictions, the coming years could be the most difficult in the history of mankind. It is obviously impossible to totally prepare for this, but the ones who prepare and plan in all aspects of their lives will more likely cope better than the ones who don’t. Remember that when we buy fire insurance, it is not because we expect our house to burn down but if it does, the insurance becomes critical.

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

“Risk greater than ever”

“Financial expert Egon von Greyerz (EvG) says the central bankers did not fix the problem that caused the last global economic meltdown. EvG points out, “Did they save the system? For ten years they did, but they didn’t save it. They made the problem a lot bigger. Global debt has gone from $120 trillion in 2006 to $225 trillion today.”

https://vongreyerz.gold/usawatchdog-risk-greater-than-ever-egon-von-greyerz/

FULL INTERVIEW:

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

Fake money has created a totally uneven playing field for most ordinary people.

Money used to represent a medium of exchange that would facilitate bartering. Instead of exchanging goods or services, people would receive a piece of paper that was equal to the value of their goods or services. This was initially an honest system when for each service or goods offered there was only one bank note issued. Eventually the banker started to cheat and issued a lot more money/paper than the counter value produced in kind. And that was the beginning of money printing. It just became too tempting and convenient for governments and bankers to simply create more money since nobody would really know. So if the value of a day’s work or a pig were both say $100, the money or paper issued for this should be $100 for each. But gradually governments/banks would issue more and more paper with nothing produced in return. All banks today lend at least 10x the money deposited so for every $100 received $1,000 is leant. But the leverage can be much greater like Deutsche Bank which is leveraged nearer 50x.

Money used to represent a medium of exchange that would facilitate bartering. Instead of exchanging goods or services, people would receive a piece of paper that was equal to the value of their goods or services. This was initially an honest system when for each service or goods offered there was only one bank note issued. Eventually the banker started to cheat and issued a lot more money/paper than the counter value produced in kind. And that was the beginning of money printing. It just became too tempting and convenient for governments and bankers to simply create more money since nobody would really know. So if the value of a day’s work or a pig were both say $100, the money or paper issued for this should be $100 for each. But gradually governments/banks would issue more and more paper with nothing produced in return. All banks today lend at least 10x the money deposited so for every $100 received $1,000 is leant. But the leverage can be much greater like Deutsche Bank which is leveraged nearer 50x.

The effect of this money creation is that the $100 pig will eventually cost 50x more or $5,000 for the same pig. The pig hasn’t gone up in price since there is no scarcity of pigs but the money has instead gone down in value to 1/50th. The same for a day of labour. The man who previously received $100 per day now gets $5,000 for his work. He is not working harder and the price of labour has not gone up in real terms. But the value of money has gone so he needs to work one day to buy a big which now costs $5,000. I do realise it is a very simplified explanation but in essence, it is the way the corrupt monetary system works.

And this is how governments destroy the value of money. As they mismanage the economy and can’t make ends meet, they just issue more paper which has zero real value since it just lowers the purchasing power of money.

The value of paper money has been totally decimated in the last 100 years since the creation of the Fed in 1913. The chart shows how paper money has declined in relation to “real money” which is gold. All major currencies have declined 97-99% against gold during this period. So there is only 1-3% to go until they reach ZERO. But from here to zero is another 100% fall which will be disastrous for the world and involve an economic collapse as well as hyperinflation.

The value of paper money has been totally decimated in the last 100 years since the creation of the Fed in 1913. The chart shows how paper money has declined in relation to “real money” which is gold. All major currencies have declined 97-99% against gold during this period. So there is only 1-3% to go until they reach ZERO. But from here to zero is another 100% fall which will be disastrous for the world and involve an economic collapse as well as hyperinflation.

In a final attempt to save the world governments will print unlimited amounts of money. This is what will make paper money totally worthless and reach zero. This is of course nothing new in history. Governments have always done it. The Roman did it and many governments since. I don’t know how many times I have quoted Voltaire in the last 17 years but it is worth repeating what he said in 1729:

“PAPER MONEY EVENTUALLY RETURNS TO ITS INTRINSIC VALUE – ZERO”

The problem with money printing is not just that it destroys the value of paper money, as creating money out of thin air also creates a totally uneven playing field. To produce goods or services requires a lot of hard labour for ordinary people. But governments and bankers have the upper hand because they just need some electricity which allows them to press a button to produce money. And this money that they produce has the same value that ordinary people struggle to earn.

The problem with money printing is not just that it destroys the value of paper money, as creating money out of thin air also creates a totally uneven playing field. To produce goods or services requires a lot of hard labour for ordinary people. But governments and bankers have the upper hand because they just need some electricity which allows them to press a button to produce money. And this money that they produce has the same value that ordinary people struggle to earn.

We are now not far from the point when the bubbles in stocks, credit and property will collapse. This will lead to a final futile attempt by governments to save the world by printing unlimited amounts of money. At that point, normal people will finally realise that the money they are holding is totally worthless. This will lead to protests, attack on government and bankers as well as social unrest.

In spite of a small move in the last few days, many holders of precious metals are getting restless. This is totally normal since we have seen a 6 year range of $150 above or below the June $1,220 bottom.

I often get the question if the paper gold manipulation will go on forever as seems to be the case since 2013. My very firm belief is that we are likely to see the end of this consolidation period right now. During the autumn of 2017, gold is likely to resume its uptrend to eventually much higher levels. That next strong uptrend in gold will also eventually break the paper gold market.

The reasons for the coming move are manifold. The risk situation in the world are more critical than ever both economically and geopolitically as I have outlined many times in my articles. Also, the supply situation physical gold is very tight. All the mine production of 3,000 tonnes are easily absorbed and no more can be produced.

In my recent audio interview with King World News I explain this in detail and that we have never seen sellers of physical gold in quantity and that bigger wealth preservation buyers are now buying again. We are likely to see many surprises in the coming months.

EGON VON GREYERZ ON INSIDE PARADEPLATZ (VIDEO)

Over the last 150 years, the West has gone from human slavery to debt slavery. Slavery was officially outlawed in most countries between the mid 1800s and early 1900s. In the British Empire, it was abolished in 1834 and in the US in 1865 with the 13th amendment.

But it didn’t take long for a different and much more subtle form of slavery to be introduced. It started officially in 1913 with the creation of the Federal Reserve Bank in New York. More than 100 years before that, the German banker Mayer Amschel Rotschild had stated: “Give me control of a nation’s money and I care not who makes its laws.” The bankers who gathered on Jekyll island in November 1910 were totally aware of the importance of controlling the country’s money and that was the objective of their infamous secret meeting which laid the foundations to the Fed. The Fed is officially the Central Bank of the USA but it is a private bank, owned by private banks and for the benefit of private banks and bankers.

Mortgage = Death pledge

So the Western world was free from human slavery for around half a century but is now subject to a form of slavery which most people are unaware of. It is a slavery which no law, no regulation or edict can abolish. Nor are there any magic financial tricks that can make this form of slavery disappear. I am of course talking about debt slavery which has gradually taken hold of the West in the last hundred years and now is enslaving many emerging market countries too. There is mortgage slavery. The word mortgage comes from Latin and French and means death pledge. And this is exactly what it will be for a lot of people who will neither afford the coming increase in interest rates nor the repayment of capital on their property which will collapse in value. We also have credit card slaves, auto loan slaves and student slaves. Virtually all of these loans will expire worthless as the enslaved borrowers default.

So the Western world was free from human slavery for around half a century but is now subject to a form of slavery which most people are unaware of. It is a slavery which no law, no regulation or edict can abolish. Nor are there any magic financial tricks that can make this form of slavery disappear. I am of course talking about debt slavery which has gradually taken hold of the West in the last hundred years and now is enslaving many emerging market countries too. There is mortgage slavery. The word mortgage comes from Latin and French and means death pledge. And this is exactly what it will be for a lot of people who will neither afford the coming increase in interest rates nor the repayment of capital on their property which will collapse in value. We also have credit card slaves, auto loan slaves and student slaves. Virtually all of these loans will expire worthless as the enslaved borrowers default.

US debt grows at 2x GDP

In 1913 global debt was negligible but grew steadily to 1971 when Nixon abolished the gold backing of the dollar. Since 1971, the debt enslavement has taken off at an exponential rate. Just looking at US total debt, it was $1.7 trillion in 1971 and is now $67 trillion. At the beginning of this century US debt was “only” $30 trillion so just in the last 16 years it has doubled.

Since 1971, US total debt has grown 39x whilst GDP has grown 16x only. This is more proof that perceived improvement in the standard of living and wealth can only be achieved with printed money and credit expansion. What the world is experincing today is a Fake prosperity based on Fake money and Fake growth. Hardly a recipe for a sustainable US or world economy.

Global debt $ 2 quadrillion

Debt slavery is now a chronic condition which the world finds itself in. The word debt has the same roots as death and clearly has very dark connotations. Slavery means being owned and controlled by someone. What the bankers started on Jekyll Island has now enslaved the world in a debt/death grip from which there is no escape. Global debt of $230 trillion plus unfunded liabilities and derivatives takes us to over $2 quadrillion debt and liabilities is just too big a weight to get rid of.

Debt slavery is now a chronic condition which the world finds itself in. The word debt has the same roots as death and clearly has very dark connotations. Slavery means being owned and controlled by someone. What the bankers started on Jekyll Island has now enslaved the world in a debt/death grip from which there is no escape. Global debt of $230 trillion plus unfunded liabilities and derivatives takes us to over $2 quadrillion debt and liabilities is just too big a weight to get rid of.

Krugman – Print more money

So how does the world attempt to solve this debt/death trap. We can of course ask Nobel prize winner Krugman and he will give us the Keynesian solution which the world has applied for ¾ of a century with catastrophic consequences – JUST PRINT MORE MONEY!

So how does the world attempt to solve this debt/death trap. We can of course ask Nobel prize winner Krugman and he will give us the Keynesian solution which the world has applied for ¾ of a century with catastrophic consequences – JUST PRINT MORE MONEY!

Money printing has created a massive debt problem, more printing exacerbated it, and even more merely postponed the inevitable collapse. Any further dose of this poisonous medicine will be like pushing on a string – it will have zero effect as a remedy but a disastrous effect when it comes to the destruction of money. And this is of course what is likely to happen in the next few years. I have for many years been clear that massive money printing is the only tool that central banks have left. This will lead to hyperinflation, the total destruction of paper money and to a deflationary asset and debt collapse. Only after that can the world grow again, but before that there will be a lot of pain in the world.

Sweden – An enslaved cashless society