This Will Devastate People All Over The World

Since Reagan came to power in 1981, the US has had a total of five presidents who have spent ever-increasing amounts of money to hang on to power and buy votes. This has resulted in the most extraordinary money printing venture in history. It is not just central banks that print money. Governments that borrow vast amounts of money are also performing a printing function since money is created out of thin air. And even worse than that, the US government neither has the intention nor the ability to ever repay the debt with real money. Thus, the US debt can only vaporise when the country defaults. Since there is no other way of eradicating this debt, a default by the US is guaranteed to take place in the coming years. But before that, the Fed and the US government will flood the market with jumbo jet money since helicopter money won’t suffice. Jumbo jet money will create hyperinflation, but it will never repay the debt since all it does is to increase the amount of debt outstanding from trillions of dollars to quadrillions.

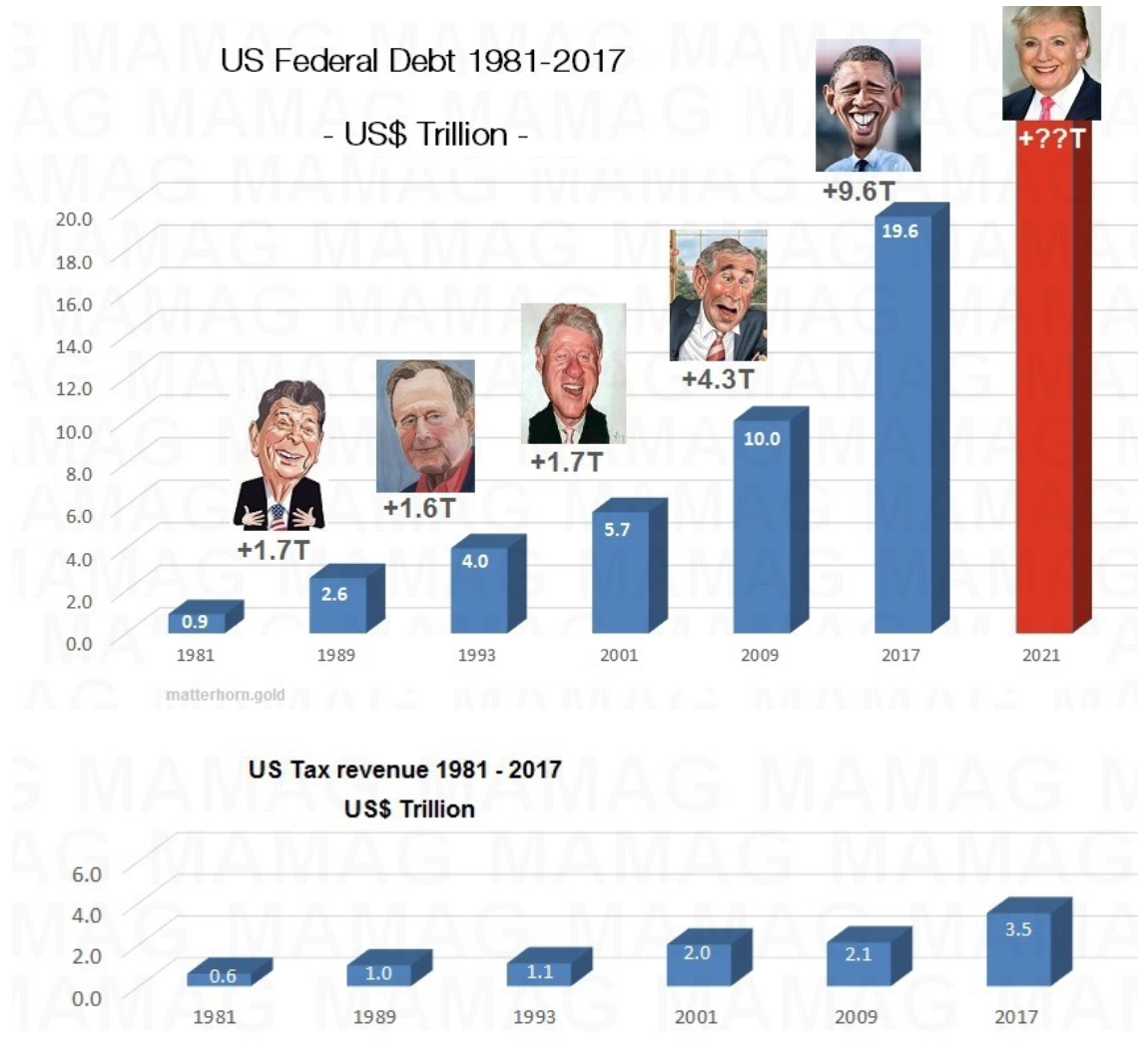

After 55 years of US deficits, debt has grown from $ 286 Bn to $19.6T

The US economy showed natural growth without deficit spending until 1960. At that point, heavier involvement by the US in the Vietnam war created the initial deficits. As Eisenhower handed over to Kennedy in 1961, US debt was only $286 billion. Then 20 years later during the first year of Reagan’s presidency, US debt reached the staggering sum of $1 trillion.

Reagan was hailed as a superb president primarily because he (like Thatcher in the UK) assumed power at the bottom of the economic and stock market cycles. So they were lucky to get in at the right time. But few people realise that Reagan achieved this by almost tripling the debt from $0.9 trillion to $ 2.6 trillion. So, in eight years, Reagan incurred $1.7T of debt, which is almost twice what all the presidents before him had incurred since 1789. And from then on, every single president continued on the neck-breaking deficit course. Most people believed that Clinton managed the US economy particularly well and created surpluses for the first time in 35 years. But what the Clinton administration succeeded particularly well with was to cook the books rather than to create surpluses. Because in every single year of the Clinton administration, federal debt increased in spite of the fact that budget surpluses were shown. And by the time Clinton left in 2001, he had managed to add another $1.6T in debt to make the total $ 5.7 T.

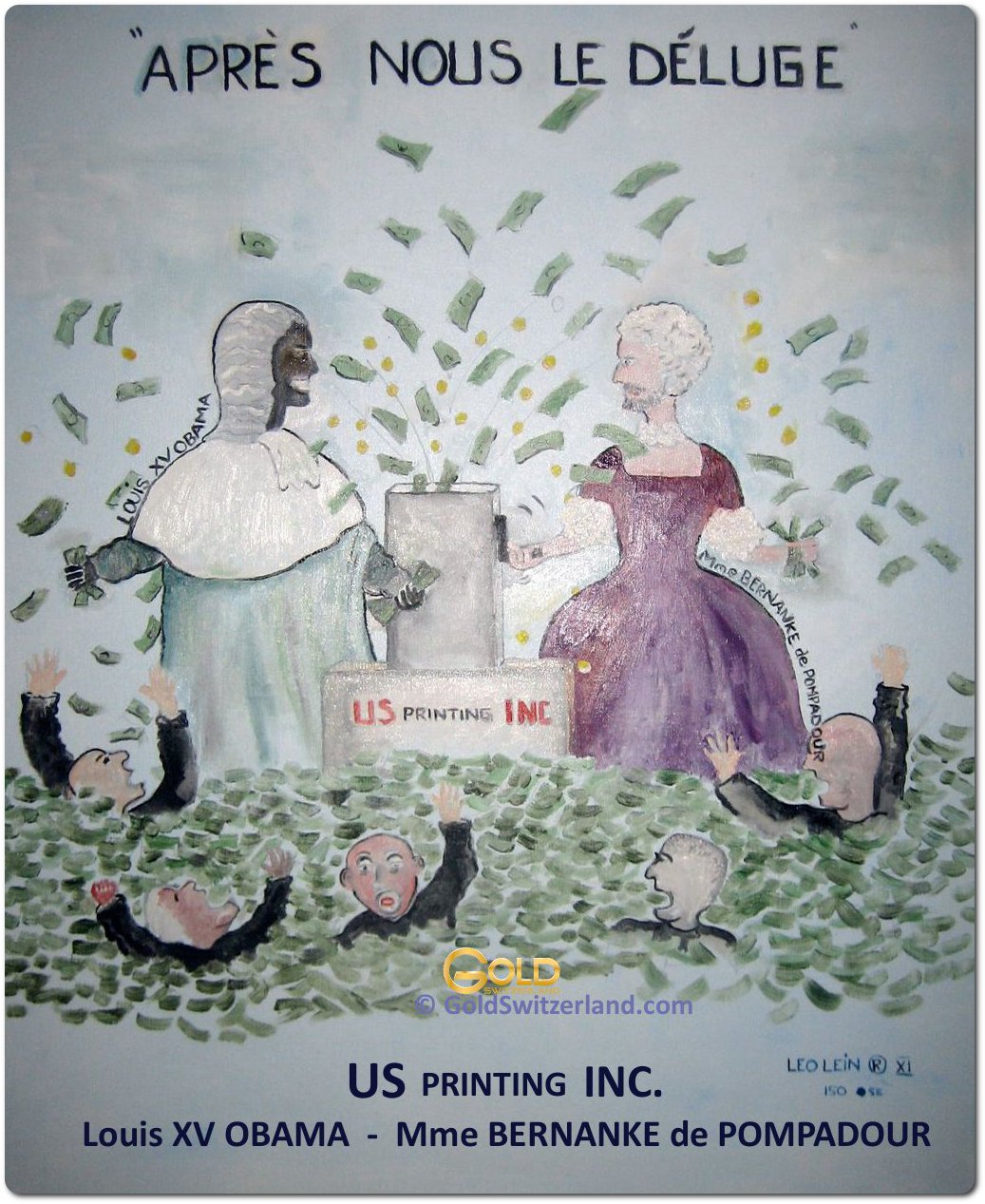

The next record breaker was Bush Jr, who increased the debt by $4.3T from $5.7T to $ 10 T. But Obama has been the most productive of all presidents so far. Remember that it took the US 219 years to go from zero debt to $ 10 T. Then, “Après nous le Deluge” (after us the deluge), Obama took over, and before he finishes, the US debt will be around $ 20 T. That is the most astonishing increase in national debt in history, excluding hyperinflationary economies. And remember that this figure does not include the Fed’s money printing or unfunded liabilities, nor personal or corporate debt, which all have grown exponentially. With all of that, we can add at least $250 trillion!

US Debt will never be repaid

The first chart below shows how debt has gone from $900 billion in 1981 to $19.6 trillion currently. By the time Obama hands over to Clinton/Trump, he will have doubled US debt from $10T to $20T during his reign, and he has also presided over a cumulative budget deficit of $7 trillion.

Thus in the last 36 years, US debt will have increased 22 times. It took 220 years to reach $10 trillion debt and Obama has achieved to double this in only 8 years. Having already received the Nobel peace prize, he should perhaps also be awarded the Noble Prize in Economics as the most productive president in world history.

The second chart above shows US tax revenue from 1981 to date. Tax receipts have gone from $900 billion to $3.5 trillion, a 5.8 times increase.

SINCE 1960, THE US HAS NOT PRODUCED A REAL BUDGET SURPLUS IN ANY SINGLE YEAR. WITH DEBT UP 22X SINCE 1981 AND TAX REVENUE UP ONLY 5.8X, IT IS TOTALLY CLEAR THAT THE US DEBT CAN NEVER BE REPAID, WITH THE ONLY REALISTIC SOLUTION BEING DEFAULT AND BANKRUPTCY.

Neither presidential candidate will solve the US debt catastrophe

It is just unbelievable that the world’s biggest economy, with the world’s reserve currency, is being run into the abyss by a succession of presidents, with each one exacerbating the problem exponentially. What is even more astonishing is that in the current presidential election campaign, neither of the candidates devotes any serious campaign time to the most pressing of all problems, which is “the economy, stupid”! The reason for this is simple. They don’t dare to seriously discuss a problem that they know they can’t solve. To run for president at a time when it is almost guaranteed that the US economy and the dollar will collapse in the next 4 years is certainly a daunting prospect.

Even under normal circumstances and without major recessions, the US deficit is forecast to grow substantially in the coming years. The promises of Clinton/Trump will also contribute to escalating deficits. Add to that a serious recession, increasing interest rates and a derivative debacle and we will see deficits not only in the dollar tens but in the hundreds of trillions. Thus Clinton/Trump are likely to preside over a US default.

A country that for 55 years has not managed its finances properly is on the road to perdition. It is only a matter of time before the US economy implodes. And as the country implodes, so will the US dollar. A currency that is just supported by worthless debt and by a weakening military power does not qualify for the role as a reserve currency. And that is why the hegemony of the US and the dollar is now coming to an end. The country will clearly not give up this role without putting up a massive fight. This could sadly involve starting major military conflicts, even of nuclear proportions. It is also guaranteed to involve money printing of a magnitude never seen before in history.

After us the deluge

Clinton/Trump and Yellen will all continue Obama’s / Bernanke’s record of producing money printing.

It is not only the US which will experience escalating deficits, massive money printing and a collapsing currency. Virtually every major economy including Japan, China, EU and Emerging Markets will go through the same thing. The big difference is that the US has the biggest debt and deficits as well as bigger bubbles in stocks, bonds, property, car loans, student loans etc. than any other country.

There will be dark clouds around the world in the coming months

Dark clouds are now moving in fast across the world, and this coming autumn could be very troublesome both for the world economy and geopolitically and socially. The combined risks are now higher than at any time in world history. When risks are high, it is advisable to stay away from bubble markets. But sadly, the investment world loves owning things priced high, ignoring the massive loss potential.

Gold – the only money which will survive

The best insurance against financial or economic risk is real assets such as gold and silver, as long as they are held safely outside the financial system. Precious metals will reflect the unending destruction of paper money. Before the coming crisis is over, gold is likely to reach at least $10,000 in today’s money and silver $500. In hyperinflationary terms, we could see multiples of these targets. So if gold reaches 100 trillion, like in the Weimar Republic, that is only funny money. But compared to holding money in the bank or cash, the gain in the gold price becomes very real and will be actual life insurance. And at $1,350 per ounce, there is no better insurance to own.

This Will Devastate People All Over The World

The more things change, the more they stay the same. The financial world loves focusing on some future event that they think will change everything. There is always some economic data, an important meeting like G20, the Fed, the ECB or a speech by Yellen or some other central bank head who hasn’t got a clue what is happening or what will happen. So now, at the end of August, markets have all been focusing on Yellen’s speech at Jackson Hole, Wyoming. Jackson Hole is, of course, a very befitting name since what the Fed is staring into is a massive black hole into which major parts of the financial system will disappear.

Central banks speak with a forked tongue

The Fed, like all central banks, is speaking with a forked tongue. They have talked interest rates up since December 2015, and for a long time, the market has believed them. So this time again, Yellen obliged and made the market believe that there would be one or two interest rate increases in 2016. To me, it has always been clear since last December that there is no chance of further rate increases at this moment. But the Fed has a problem with not losing face. That’s why Fisher, the vice-chairman of the Fed, last Sunday delivered an upbeat speech about the US economy, saying that the Fed was “close to meeting its targets” of full employment and price stability. Obviously, when you base your assessments on false data and thus make false statements, you can tell the markets anything. And this is what the Fed does together with all other central banks. Anyone who studies the economic figures critically knows that they bear no resemblance to reality. Real unemployment in the US is not 5% but 23%. The difference is changing the method of calculation since the 1980s, and to assume that anyone who has stopped looking for a job after 6 months never wants to work again. Isn’t it strange that 95 million people capable of working are not working and that the labour participation rate has gone from 66% to 62% since 2006! Is that full employment when 95 million people, most of whom need a job, can’t get one?

Same with inflation. Most of the things that people spend money on every year like food, insurance, health, education etc are up 5-20%. Electronic products, clothing and cars are not up but most of these are bought once every few years. So the Fed is definitely not looking at real inflation but a manipulated figure that suits their purpose.

I thought it would be fun to look back at some of my previous comments on these high profile meetings of global heads. These are meetings that market participants look to with great anticipation but in reality no decisions are ever taken.

Here is what I said in March 2009 during the great financial crisis:

This week there will be a meeting between G20 leaders and central bankers in London to save the world economy.Let us make it very clear – the meeting is bound to fail. There is no chance that the G20 leaders will reach an agreement that will save the world economy. Even two world leaders can’t agree on how solve the biggest global financial crisis that the world has ever encountered, never mind twenty. Each one of twenty leaders has a different political agenda and they will all blame each other, so there is no possibility whatsoever that the meeting will result in more than the normal platitudes about cooperation to solve the crisis. Both Merkel and Sarkozy have already rejected Gordon Brown’s proposed stimulus package and that is before the meeting has even started.

But the main reason why the meeting will fail to reach a result is the worthless derivatives of over $ 1 quadrillion and unlimited amounts of toxic debt which will never be repaid with real money.

In September 2009, the Pittsburgh Summit announced the G20 as the premier forum for international economic cooperation. So, from that time, the G20 is, in theory, another “powerful” group of world leaders that discusses all the catastrophic problems that the member countries inflict on the world economy, but achieves nothing in the form of solutions.

Yes, the world economy stabilised and stock markets did pick up after 2009. But this had nothing to do with real improvements, but was merely due to the fact that panicking central banks printed, guaranteed and lent at least $25 trillion to temporarily stop the financial system from falling into the black hole. In 2006, when the Great Financial Crisis started, global debt was $140 trillion. Today, ten years later, global debt is up a staggering 60% to $230 trillion.

But as I repeatedly say, you cannot create wealth by printing worthless pieces of paper and you cannot solve a problem by the same means that caused it in the first place.

There is another G20 meeting in China this coming weekend. But we shouldn’t hold our breath. The world leaders can’t even see that the world economy is on the point of collapsing all around them. And if you can’t see or recognise a problem, there is very little chance that it can ever be solved. As I have stated many times, only Deus ex Machina could solve this problem but that is a very unlikely outcome.

Unlimited debt and negative rates – the ultimate Ponzi scheme

So here we are in 2016 with most sovereign states being bankrupt with no ability to ever redeem their debts. But even worse, they can’t even service their debts without negative interest rates. Talk about a sick world. First, bankrupt nations issue worthless debt that they have no intention of repaying. And then, since they have no chance of paying any interest on their debt, they demand that the borrowers pay them interest instead for the pleasure of holding their worthless paper! This must be the ultimate Ponzi scheme in financial history.

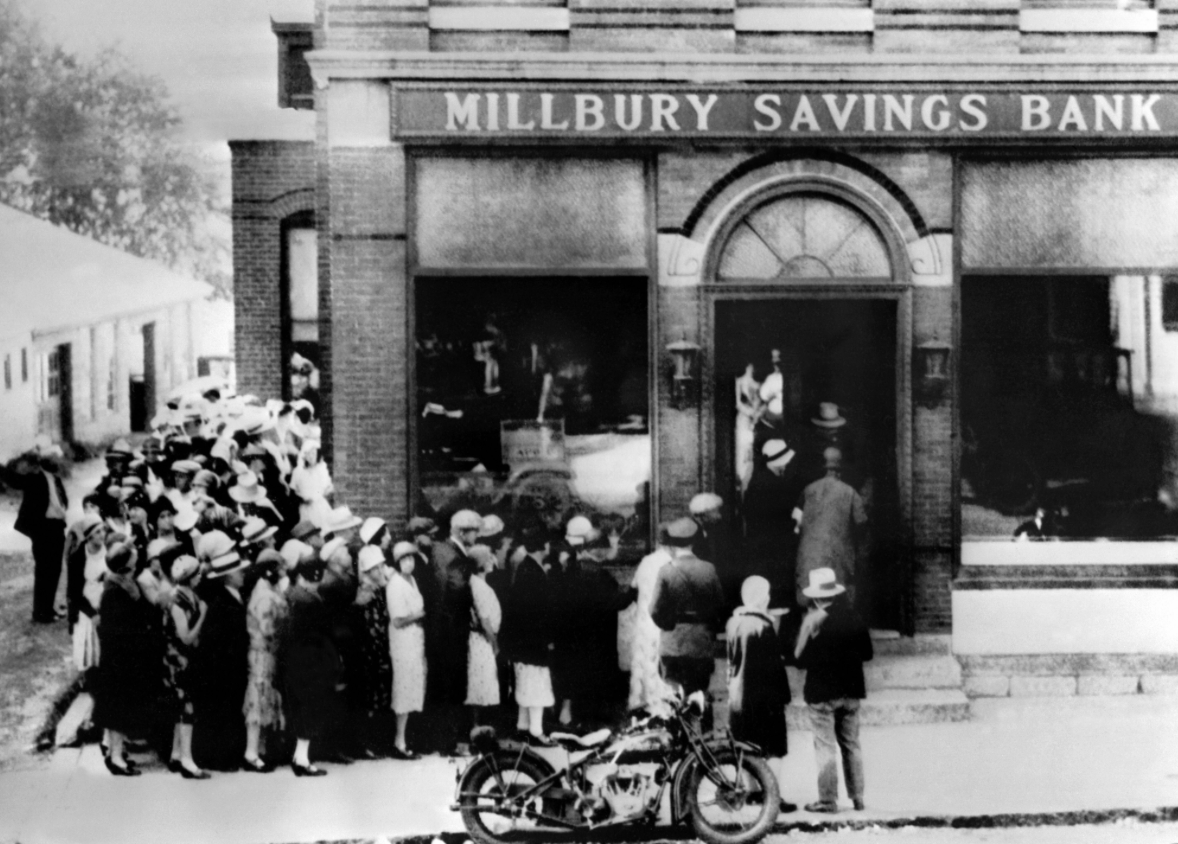

When this mega bubble of all bubbles collapses, there won’t just be the wealthy experiencing a massive destruction of their wealth but the masses will lose their jobs, social security and pensions. Sadly, the inevitable consequence of this will be major global civil unrest.

Gold – the only money which will survive

Gold certainly will not be the only solution to the coming problems. But just like in the last 5,000 years, gold will be the only currency which survives the coming global catastrophe.

Looking back at what I wrote about gold in April 2009, when gold was $950, this is what I said:

Back in 2002 we told investors to buy physical gold for up to 50% of their liquid assets at $300. Since then gold is up between 220% and 280% depending on base currency.

Thus it was very clear to us back then what the effect of the disastrous mismanagement of the world economy would be. But it is even clearer what will happen next. We are now going into the phase of recognition. This is the phase when the world at large is slowly waking up to the fact that printing unlimited amounts of money will make many currencies – and in particular the US dollar – worthless. We have repeatedly stated that you cannot solve a problem by making it bigger – i.e. to print colossal amounts of dollars, pounds etc. will only add fuel to the fire and exacerbate the already insoluble credit/derivative bubble.

So we already told investors what to buy years ago. Now as we are approaching the point of recognition when investors are starting to wake up to the fact that they need to protect themselves. Gold is the only currency and asset which will give protection against collapsing currencies and assets. Within the next two months the investment world will wake up to this fact and gold is going to exceed $ 1,000 and never look back.

Right now is likely to be the last chance to buy gold under $ 1,000. We expect gold to go up quickly in the next few months and never look back. So today is probably the last chance to buy gold under $ 1,000 for many years and maybe for ever. But remember that for wealth preservation purposes it must be physical gold in your own possession and stored safely outside the banking system.

Gold has resumed its uptrend to new highs

Gold closed at $1,100 in December 2009 and then temporarily topped at $1,900 in September 2011. Since then, we have seen a very long correction that ended in December 2015 at $1,050. But gold in most other currencies bottomed in 2013. Gold in many currencies, like Canadian and Australian dollars, is back near the 2011 high, and in pounds and euros, gold is around 10% from the peak (all monthly closing rates). It is totally clear that the correction in gold, which has taken place in a manipulated paper gold market, is now finished. Just like I forecast in 2009 that it was the last chance to buy gold under $1,000, I now believe that gold will soon resume its uptrend to new highs.

But investors must remember that gold is not bought for capital gains but to preserve wealth in a world economy and financial system which is totally rotten. Physical gold is insurance and also money when conventional paper money becomes worthless due to unlimited printing.

Gold is for the wealthy as well as for the less wealthy

I regularly get emails from people who don’t have major assets to invest and wonder what they can do to protect themselves. Wealth protection is all relative. Many people can afford to spend, say, $40 per month or more to buy 1 gram (1/30 of an oz). If you do this every month for a few years, you will have built up a nice little nest egg as the gold price goes up many times from here. Thus, there is no excuse not to save in gold even for people with less capital.

The risks in the financial system and world economy are now at an extreme, and it is most likely that one of several of these risks will turn into serious problems for the world in the next few months.

This Will Devastate People All Over The World

The fate of the global economy was decided decades ago as deficits, debts and derivatives started their exponential growth and reached the time bomb phase that we are now in. This final chapter of this 100-year era will end in “a final and total catastrophe of the currency system” as von Mises succinctly articulated.

It started on Jekyll Island

It all started in 1910 when a few senators and bankers, led by JP Morgan, secretly met on Jekyll Island with the purpose of setting up the Federal Reserve and so controlling the banking system. Thus, the Fed was a creation by private bankers and for the benefit of these bankers. Few of them could have imagined the enormous success of their venture, as the control of the financial system led to vast fortunes for a very small elite. The back side of these fortunes is global debt of $230 trillion plus unfunded liabilities and derivatives. The total, which is in the quadrillions, is what the poor masses in the world are liable for. Not that they will ever be able to repay it, but the implosion of these debts will lead to misery for the majority of people for generations to come.

Critical to protect yourself against these events

Sadly, things have now gone too far to stop the inevitable currency collapse and implosion of the financial system, but that doesn’t mean that it is too late for individuals to protect themselves. As we enter this final phase, there will be panic in financial markets with governments and central banks taking draconian measures. Below are some of the potential risks that all investors must protect themselves against today:

- Currency collapse – leading to the destruction of capital

- Capital controls – making it impossible to take money out of the bank or the country

- Bail-ins – the bank will steal your money in order to try to save itself

- Forced investments – compulsory purchase of treasuries with your bank or pension assets

- Custodial risk – stocks and bonds will be hypothecated by the bank, leaving you nothing

- Bank failures – all your investments will disappear as the bank becomes insolvent

The above list is not exhaustive, but it contains the most likely events that will take place in the next few years. Most private investors don’t see these risks and have zero protection against them. And professional money managers haven’t got a clue about real risk, nor do they see any need for protection or insurance. When you manage OPM (Other People’s Money), you take maximum risk in order to benefit from the upside. The downside is not your risk, and thus it can be ignored. This strategy works extremely well until the music stops. But as long as money printing and credit creation inflate markets, these professionals will never spend a second worrying about the total destruction of clients’ money.

So, how likely are the above risks, and how do you protect against them? Anyone who has followed some of my work will know that I consider all the above risks as guaranteed to materialise.

- Currency collapse is already happening, with all currencies down 97-99% in the last 100 years. The final 1-3% will happen in the next few years as governments print unlimited amounts of money. But remember that the last 1-3% fall is 100% from here and thus a total destruction of money. So whatever cash you have will be totally worthless in the coming hyperinflationary phase.

- Capital controls are likely to start within 12-18 months in many countries, including the US. As deficits increase and currencies fall, governments will stop anyone from taking money out of the bank as well as out of the country. This is just the next step in total control of money. We have lately seen FATCA (Foreign Account Tax Compliance), cash bans and the OECD AEOI (Automatic Exchange of bank Information). Capital controls will be the next logical step in an attempt to virtually confiscate money. Governments on the road to bankruptcy will take any desperate measure to control the people and their money.

- Bail-ins are guaranteed and in the legislation of most Western Countries. The average person has no idea what a bail-in is or its consequences. Simply, it means that for insolvent banks, which will be the case with most banks, governments will not bail them out, but instead, depositors’ money and assets will be used to cover the banks’ losses. Since banks are leveraged 10-50 times, all the money belonging to the bank customers will be gone. At that point, after the bail-in, governments will need to step in with bailouts. But any government intervention will be futile since they will just create more debt to solve a debt problem.

- Forced investment in treasuries will happen as governments issue an ever-increasing amount of debt. At that point, the government will be the only buyer, as we are seeing in Japan currently. Therefore, governments will force people to put their bank assets into treasuries to shore up the country’s finances. But then it will, of course, be too late, and all the money going into government bonds will be totally worthless as these bonds go to zero.

- Custodial risk means that it is not just the clients’ cash which is at risk. Any asset deposited in a bank carries the same risk as cash. In theory, stocks, bonds, or physical gold should not be in the balance sheet of the bank and therefore not be part of a bankruptcy. Firstly, it could take years for the receiver to sort that out. But more importantly, as banks come under pressure, they will use client assets in order to shore up the assets of the bank. This was the case for MF Global for example. We often see banks not actually having the allocated physical gold that they have told the customer they possess. When banks come under pressure, they will take any desperate measure to save themselves, and this will definitely include client assets. And don’t believe that the government will help you, since they are bankrupt too.

- Bank failures will be commonplace in the coming years as banks’ irresponsible lending will be exposed. Collapsing asset prices will exacerbate this problem dramatically. Most people believe that money or assets in the bank will be totally safe. Personally, I wouldn’t deposit any major amounts of money or assets in a bank. And if I did, I would ask for collateral. Banks today are totally untrustworthy borrowers of depositors’ money, and anyone hoping to get their money back will soon learn that they won’t.

So if you can’t trust the banks, what do you do with your money? In uncertain times, it is essential to avoid counterparty risk. Therefore, no assets must be held with a counterparty that is heavily exposed financially. Directly controlled assets are the best way to control investments. This can be property, land, direct ownership of companies, including direct registration of stocks.

The best insurance money can buy

The best and cheapest insurance against the risks outlined above is to hold physical gold and silver. But it is not enough just to own gold and silver, but just as important is how they are held. It is a sine qua non to hold metals in physical form, outside the financial system and outside your country of residence. It is also critical to have direct access to your wealth preservation asset, which should not be held through a counterparty.

Gold and silver will not protect investors against all the problems that the world will experience in the coming years. But if they are held in the right way and place, precious metals will be the best insurance against the massive wealth destruction that will take place in the next few years.

This Will Devastate People All Over The World

This coming autumn, we are likely to see the beginning of the hyperinflationary phase of the sovereign debt crisis. Hyperinflation normally hits an economy very quickly and unexpectedly and is the result of the currency collapsing. Hyperinflation does not arise as a result of increasing demand for goods and services.

The course of events in a hyperinflationary scenario can be summarised as follows:

- Chronic government deficits

- Debt issuance and money printing are escalating rapidly

- Bonds falling – interest rates rising fast

- Currency collapsing

The above process turns into a vicious circle that accelerates quickly. The more money the government prints, the faster the currency will fall and the faster the currency falls the more money the government must print. Once the hyperinflationary spiral has started, it will feed itself like we have seen in the Weimar Republic, Zimbabwe, Argentina and many other places.

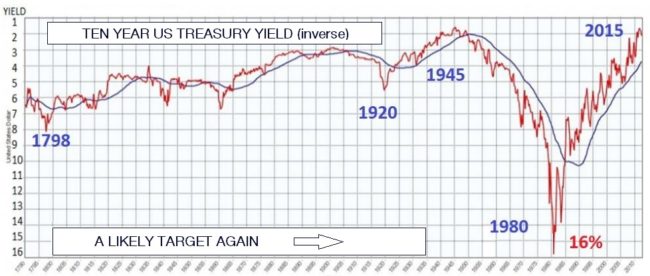

Rates will go to 15-20%

What will exacerbate this process is a financial system which is totally bankrupt in all but name. If banks valued their toxic assets at market instead of at maturity, no bank would be standing today. As longer-term government bonds start falling, this will also put upward pressure on short-term rates, with Central Banks losing control of their manipulation of rates. This will lead to rates going into the teens in the next 2-3 years, like in the late 1970s. Virtually no borrower, whether public or private, can afford rates just two or three per cent higher and definitely not rates of 15% or 20%, which we are likely to see – at a minimum. Also, with higher rates, the whole derivatives market of $1.5 quadrillion will blow up since these instruments are all interest rate sensitive.

In a world of exponentially growing sovereign deficits and debts, the outcome of the biggest credit bubble in history has always been guaranteed. But the road there has been laborious. Through financial repression combined with lies and propaganda, governments and central banks have managed to extend the suffering for ordinary people for the benefit of a small elite who have built incredible wealth. The average person is, directly through personal debt or indirectly through sovereign debt, responsible for the $230 trillion global debt, but can of course never repay it. On the other side of the balance sheet, these debts have all accrued in the form of assets or wealth of a similar amount to an extremely small elite. This massive inequality is what creates social unrest and eventually revolution, and the problems we now see emerging around the world are most likely the start of that.

Fed policy has totally failed

Governments have, since the 1987 crash and the early 1990s property bubble, desperately tried to avoid the inevitable. In a panic, Greenspan lowered US short-term rates from 8% in 1990 to 2.5% in 1992, thus fuelling the beginning of the final phase of the Fed’s 100-year destruction of the world financial system. Bernanke took over in 2006 when the subprime crisis started, and he became the most profligate Fed chairman in history. During his reign, US Federal debt went from $8 trillion to $17 trillion, and rates went from 5% to zero. It took the US over 200 years to go from zero debt to $8 trillion

This Will Devastate People All Over The World

Welcome to the wonderful world of illusions. This is a world where few people can see the difference between reality and fantasy. And maybe there is no difference. Just looking at the US election and the candidates, it seems like total fantasy from this side of the Atlantic. It is difficult to take the whole election process as well as the candidates seriously. But this is the world we live in today. Having, in the last week, seen people in many European countries run around the countryside and cities chasing Pokémon Monsters, you wonder if the presidential candidates might also be part of the same game.

Global stock markets are out of sync

It seems like markets are also an illusion. How else can the Dow be 63% above the 2000 high whilst the Euro Dow 50 stocks are down 45% in the same period and with Emerging Markets down 36%, Brazil and Hong Kong down 35%, Nikkei down 25% and Shanghai down 49% all since 2014-15. We live in a totally interconnected global economy, but there just seem to be more skilled illusionists in the US who can defy reality. With corporate profits declining fast, with current account and budget deficits for half a century, with 95 million people not in the workforce, almost 50 million on food stamps, with Q2 GDP at 1.2% (if real inflation rate was applied GDP would be negative) and with exponentially growing debts of over $200 trillion (incl. unfunded liabilities), you wonder what US investors are smoking.

The illusory Dow finished July at an all-time monthly high. Stock markets in general tend to totally ignore reality, and US stocks in particular are living on a different planet. The Schiller P/E is now 27 with the average at 16, the US market is in bubble territory.

Stocks to decline by over 95% against gold

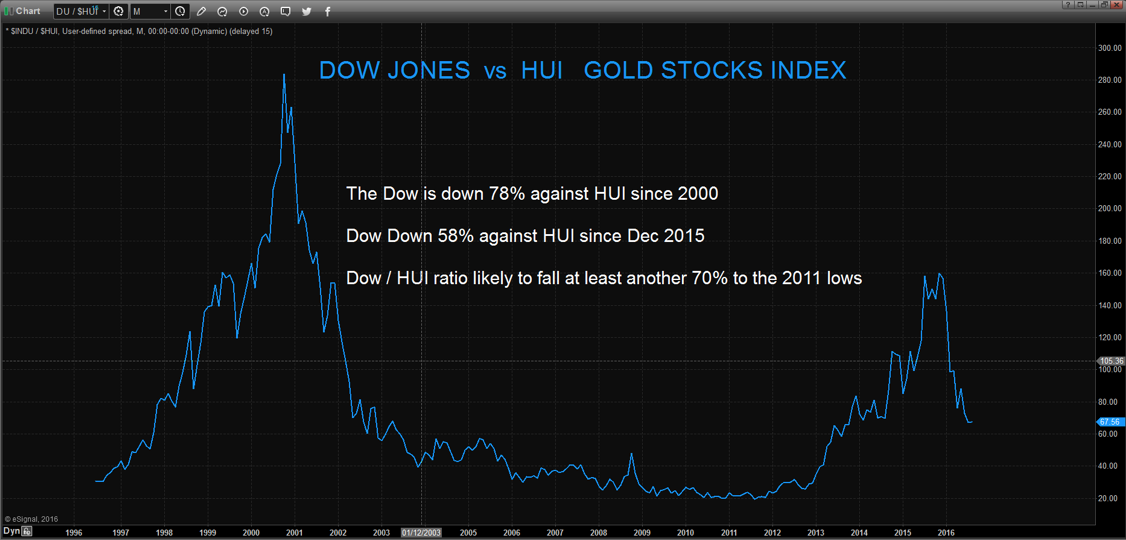

In spite of the manipulation of gold and gold stocks, gold will always, over time, reveal the truth. And the truth is that the massively inflated US stock market is underperforming in real terms in spite of making new highs. Since December 2015, the Dow is down 19% in real terms, which of course is against gold. This puts the Dow/Gold ratio at 13.6. The Dow is in a long-term downtrend against gold since 1999 and is down 70% in 17 years. But it won’t end there, this ratio will at least reach the 1980 low of 1/1, but probably overshoot to at least 0.5/1. Will this mean gold at $10,000 and the Dow at 5,000, or will it reach Martin Armstrong’s hyperinflationary level of 40,000 Dow, which would make gold at least $80,000? In either case, the Dow is likely to decline at least 95% against gold.

And against gold stocks, the Dow is down a massive 58% over the last 7 months. We are likely to see this index reach the 2011 level at least. This means that the Dow will come down another 72% against the HUI gold index.

Global debt is 30 times GDP

But the illusion doesn’t stop with stock markets. The global banking system is an even bigger illusion. The financial system was bankrupt in 2006, but governments and central banks around the world managed to patch it up by injecting $25 trillion and by allowing banks to value all toxic assets at maturity instead of at market. Here we are 10 years later, and the financial system is now in a much worse state than it was in 2006. Global debt has grown exponentially since then by 65% from $140 trillion to $230 trillion. And this figure doesn’t even include unfunded liabilities and derivatives of another $2 quadrillion or so. We are looking at a total debt of over 30 times global GDP. But that is a false comparison. Let’s say that 5% of GDP could be saved annually to reduce debt, and that would be very optimistic. Anyway, with 5% of GDP, it would take over 600 years to get rid of all debt. However you calculate it, the world is bankrupt and will never repay its debts. Nor will the debt be serviced at any rate of interest above zero.

Bank stress test a farse

Global banks have just had an illusory stress test. Countries like Portugal and Greece were naturally excluded as their banks are bankrupt. The criteria were set so that every bank would pass, except for Monte dei Paschi in Italy. Since the whole world knew that this bank was bankrupt, it was impossible to cheat. Otherwise, in the illusory world, all banks were considered to be in decent health. The top-performing banks were the Swedish ones, with Swedbank and Nordea shining. This is particularly fascinating since only a few weeks ago, the regulator in Sweden, in an internal report, had expressed particular concern that Nordea was severely undercapitalised to the extent of SEK 50-80 billion. This report was quickly hushed down and clearly ignored in the stress test.

The total failure of the IMF has just been exposed by the IEO (IMF Independent Evaluation Office). IMF stands for International Monetary Fund, but International Manipulative Fund would be more accurate. The IMF is a political entity that serves the political aims of its masters. The recent IEO report has just condemned the IMF for total misjudgment and complacency in connection with Greece. All projections and actions of the IMF have been a total failure, according to the report, and have contributed to the demise of Greece. In other words, the report confirms that the IMF hasn’t got a clue. The IMF seems more interested in political manipulation than monetary assistance. The IMF’s verbal intervention in the Brexit referendum on the Remain side confirms this.

Central banks worldwide are really struggling in their futile attempts to get out of the mess which they have created. In Japan, Abenomics is totally failing in spite of unlimited money printing and negative interest rates. Before the Japanese economy sinks into the Pacific, there will be perpetual bonds with no or negative interest and more helicopter money. Japan is doing all it can to win the currency race to the bottom, but currently, with the yen strengthening, the world is making the race difficult for Japan. The Fed has, since 2015, left the world with the illusion that rates would go up in 2016. Already back in December when the Fed raised rates and indicated several more increases, I stated that the US would also go to negative rates, and it still seems probable that this will happen in 2016.

Gold will be the only money standing

Turning to the US dollar, it looks particularly sick currently. It seems likely that the dollar will soon start a major secular downturn. The world’s reserve currency is greatly overvalued, and due to the state of the US economy, discussed above, with ever-increasing debts and current account and budget deficits, the dollar will soon start the final leg to its intrinsic value of zero. It has been a 100-year race, but it now looks clear that the dollar will be first to the bottom of the major currencies. This will have significant effects on both debt and stock markets.

Gold and silver will be major beneficiaries of the dollar’s decline. US dollar based investors still have a window to get out of dollars and out of the US. But soon there will be exchange restrictions that will prevent this.

It is very important not to own illusory or paper gold. It must be physical gold and silver which is stored outside the fragile banking system. ETFs are not recommended. Most ETFs don’t hold the metals free and clear, whatever they say. Also, they store the gold and silver, if they have it, in banks, which is not where investors want to hold it. In addition, the ownership is subject to counterparty risk since it is signified by a piece of paper held within the financial system. Physical precious metals, held correctly, are the best insurance investors can own against a totally rotten financial system.

This Will Devastate People All Over The World

In a world full of bubbles that will all burst, it is, of course, impossible to forecast which will be the first ones to cause havoc for the world economy. One of the biggest bubbles that would clearly bring down the financial system is the bond market. Here, we have a $100 trillion market which has grown exponentially in the last 25 years and which has virtually gone vertical since the 2006-9 crisis.

Desperate governments are raising money as if there was no tomorrow in the hope that they can keep the world afloat for another few years. But as I have stressed so many times, you can create neither economic stability nor wealth by printing money or increasing the debt burden.

Under normal conditions governments would be totally insolvent with the high levels of debt they are raising. But Japan solved that problem over 20 years ago by setting rates at zero. That trend has accelerated in the last couple of years and there are now around $8 trillion of government bonds with negative yield around the world. But governments, of course, never have a problem paying the interest since they will just issue more debt to pay it.

As governments around the world compete to lower interest rates, the Fed in the US continues to threaten rate increases. But we are in a global financial system which is totally interdependent. Therefore, the biggest economy in the world cannot raise rates without major consequences for the financial system and for the dollar. Also, for the US itself, raising rates at this stage goes totally against the trend of the real economy. Company profits are declining, and so is industrial production together with many important indicators such as freight, transport and container traffic. And real unemployment is not 5% but 23%. More importantly, US federal debt, now at $19 trillion, is forecast to increase to at least $28 trillion by the Central Budget Office in the next ten years. But debt could easily grow to $35 trillion or more by 2025 if US growth is sub-par, which is likely to be the case. With these pressures, it is unlikely that the US government will hike rates in June in spite of the noise they are making currently.

The dilemma for the world is that with $230 trillion in debt, higher interest rates are guaranteed to lead to defaults and helicopter money. This, in turn, will accelerate the currency race to the bottom, leading to hyperinflation and much higher interest rates.

Currently, the world doesn’t see the risk of hyperinflation. But this is an obvious consequence of the debt folly created by governments. They are unlikely to let the world economy go into a global deflationary implosion before first throwing unlimited amounts of worthless printed money at the problem.

It is totally incomprehensible that anyone can lend money to governments at zero or negative yields when it is totally clear that no government will repay this debt in today’s money. It is even more difficult to understand how anyone can lend money to insolvent governments for 50 or 100 years. Countries like Belgium, France, Spain and Italy have all issued 50-year bonds. We can be quite certain that the last two countries will definitely not be able to repay these loans and probably not the other two either. But that doesn’t really matter since the ECB (if it is still around) will just issue funny money to buy these bonds as it becomes the only buyer of bankrupt Eurozone debt.

Then we have Mexico, Belgium and Ireland, which have all issued 100-year bonds! Ireland, for

example, was virtually bankrupt a few years ago, and only back in 2011 they paid 14% on their 10-year bond. Now they have just raised 100-year money at 2.3%! It is absolutely guaranteed that the value of the Euro, as well as the value of this bond, will have gone to zero long before the 100 years are up. How, then, can any sane investment manager buy this bond? He is obviously not worried since he won’t be around at maturity, but the likelihood is that the bond will be worthless during his active professional life.

The chart below shows the 10-year US treasury bond but shows the yield rather than the price of the bond. The very steep rise of the bond (fall in the yield), from 16% in 1980 to 2% today, takes the rate back to the record low at the end of WWII. This is a 36-year cycle that is likely to top sometime in 2016. The rise in the yield could be very swift due to massive money printing and a collapsing dollar. I would expect the yield to reach at least 16% in the next 5-7 years and possibly a lot higher.

In the next 12-18 months, there will be two forces pulling yields in different directions. Governments and central banks will continue to keep short rates at zero or negative. But this is a battle that they will lose since holders of long-term bonds will realise that not only won’t the 50 or 100-year bonds be repaid, but neither will the shorter maturities. Big holders of US debt, like Japan, China and Russia, will compete to get rid of their rapidly deteriorating paper. There is clearly a first-mover advantage here before panic sets in.

The consequences of much higher rates will, of course, not just affect lenders and borrowers. The $1.5 quadrillion derivatives market is totally linked to interest rates, and once rates increase, most derivatives will become totally worthless. And this is a problem of a magnitude that even helicopter money cannot solve.

This brings us back to risk. As I have stated many times, economic, financial and geopolitical risk is greater than ever in the world today. Let us hope that the worst-case scenario doesn’t materialise because if it does, life on Earth will be very different for a very long time. We must remember that since we have had the biggest bubble in history over the last 100 years, the end game is likely to lead to the biggest implosion in the history of the world economy and financial system.

Whatever the outcome of the crisis that the world will find itself in over the coming years, it is absolutely essential to ensure wealth against these risks. The best financial insurance available and by far the cheapest is physical gold and silver stored outside the banking system. This is the only insurance available where the premium, invested in metals, doesn’t have to be paid annually at higher rates but instead appreciates as risk increases.