Stocks, Bonds And Metals Will Shock Markets In 2017

We are now approaching the final mania in markets. The Dow seems to be on its last swansong. Investors have been determined to take it up to 20,000. So far, the market has been twelve points from this magic level. At the same time, treasury bonds are crashing. The 10-year yield has gone from a low of 1.4% 1 ½ years ago, to 2.5% now. Normally, stock market investors would worry about higher interest rates, but currently, the market is in a euphoric mode, so any bad news is ignored in this final crescendo. Memories are very short in markets. A few weeks ago, everyone was forecasting that a Trump win would be a disaster for stocks and for the world, but now he is clearly a godsend. A market that has gone up 3X since March 2009 is clearly no concern. A risky Shiller p/e of 27, and 56% above the average, is totally ignored by this exuberant market.

Also, the market is taking in its stride that Trump will take debt levels up by a minimum of $10 trillion or 50% in the next few years. Higher spending and lower taxes seem to be the perfect recipe for a higher stock market.

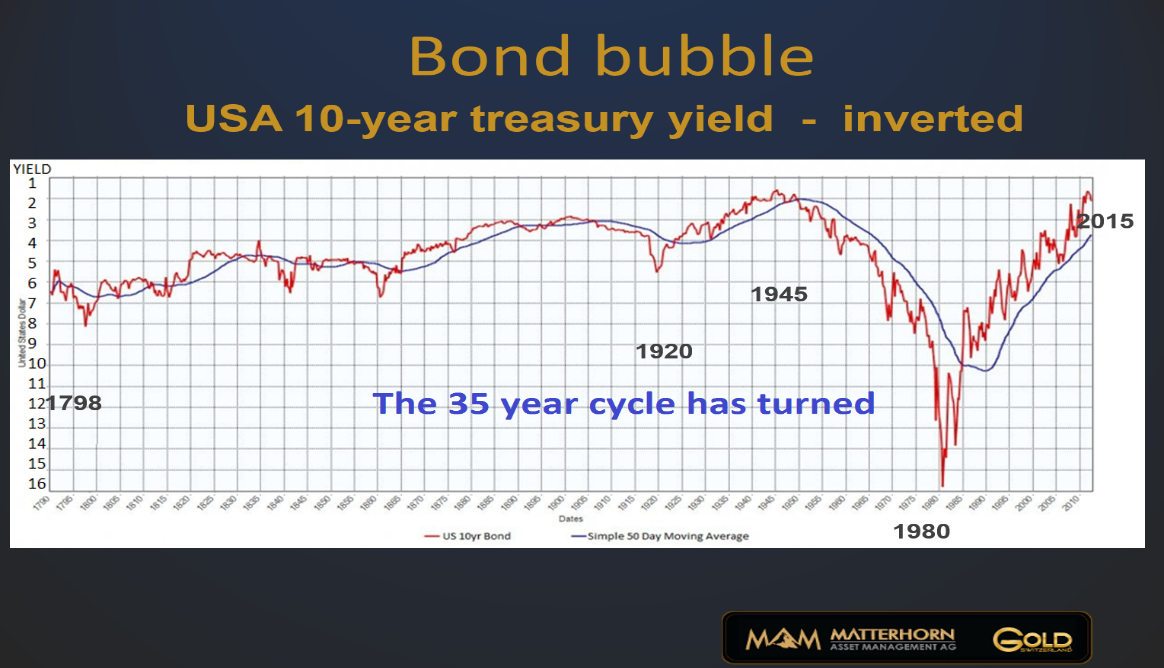

Interest rates to reach 1970 levels of above 15%

In recent articles, I have discussed the 35-year interest cycle turning, and this is clearly happening with a vengeance. Higher interest rates will lead to higher deficits and still higher borrowings. And so we have the perfect vicious circle that leads to the whole caboodle collapsing. But before we have interest rates as high as in the 1970s to 1980, when we saw rates in the high teens in many countries, including the US. This will, of course, mean that no one will be able to afford the interest costs on their house, car or credit card. And no government can pay the interest on their surging debt. But that won’t be a problem either because all they need to do is print more money to cover the interest. This would be the perfect perpetual motion financing model. However, the consequences are clear: collapsing currencies and inflation leading to hyperinflation.

Global stock markets diverging – a major warning signal

But the current stock market bonanza in the US is likely to be short-lived. It is not just the massive overvaluation which is pointing to that. Technical indicators indicate that we will soon see a major downturn.

If we look at every other market in the world, none of them confirms what is happening in the US. We must remember that the US is not an isolated economy and totally dependent on what is happening in the rest of the world. The time when a major economy can diverge from the rest of the world is gone. There can be a slight time lag but in the end, there will be a global convergence.

Performance of some major stock markets in relation to their respective highs:

US stocks to fall 90% like in 1929-32

In a converging world market, the divergences between the US and other major stock markets are a major warning signal that the overvalued US market is living on borrowed time. In real terms, the US market is likely to fall at least 75% in the next few years and probably 90% as it did in 1929-1932. The conditions and risks today in the US and the rest of the world are substantially worse than in the 1930s.

If the US market indices fall 90% in real terms, they will fall at least 95% against gold and probably a lot more. This is something that virtually no investor can see today, and that is why the shock will be of a magnitude that will shake the world and create a demand for physical gold that can never be met. We will reach a point when there will be “no offer” for gold. The trader or bank will have no physical gold to sell, and therefore, they cannot sell it at any price, regardless of what the buyer is prepared to pay.

Swiss National Bank – the world’s largest hedge fund

Looking at risk in the world and all the black swans circling above us, the Swiss National Bank (SNB) is clearly a potential black swan. In connection with the Swiss gold referendum two years ago, I forecast that the Swiss National Bank would not be able to hold the EUR/CHF peg at 1.20 (1 euro = 1.2 Swiss franc). Before the referendum, the SNB declared that it would be a disaster for Switzerland if the peg were to cease. As all central banks do, the SNB lied to its people as it let the peg go six weeks later at a cost of tens of billions of Swiss Francs.

The SNB, like the Swiss banking system, used to be a bastion of safety. But sadly, that is all in the past. Swiss banks are now taking the same unacceptable risks as all international banks with massive leverage and major off-balance sheet derivative positions. The SNB is no longer a central bank but the world’s largest hedge fund. Their balance sheet, as at 30 Sep 2016, is CHF 720 billion which is 10% above Swiss GDP. It is also CHF 80 billion above the 31 Dec 2015 level. As a comparison, the Fed’s balance sheet, which is much too big, is “only” 23% of US GDP. But it is not just the size of the SNB balance sheet which is a major concern, but also the constituents. Around 75% of the balance sheet is in foreign currency speculation. Most of it is in Euros and a bit in dollars. CHF 100 million is in stocks, mainly US. So, a problem in Euroland with a fall in the Euro and a US stock market crash would bankrupt the SNB. But like all central banks, they will have an elegant solution. They will just print additional billions of Swiss Francs. The consequence of that is for the Swiss to join all other currencies in the race to the bottom.

Swiss banking system – too big for the country

But it is not just the SNB which is a major problem. The Swiss banking system is too big for the country at 5X Swiss GDP. This is far bigger than any major economy, and in line with Cyprus when their banking system collapsed. But that’s not all, the total derivatives in the Swiss banking system, at CHF 25 trillion, is 38X Swiss GDP – a totally mindboggling figure. I am not saying that Switzerland is worse than any other country. The Swiss economy is better managed than most countries’. Also, as one of the oldest democracies in the world with strong traditions, an excellent political system and the rule of law, Switzerland is probably one of the safest countries in the world. But no one should believe the Swiss banking system and currency are superior to those of other countries. I would not recommend anyone to hold major wealth preservation assets, including gold, in any bank anywhere in the world, including the Swiss Banks.

But due to the best political system in the world and strong traditions in storing and refining gold, Switzerland is the safest country in the world to vault precious metals as long as they are held outside the banking system.

The physical gold market is very strong – the paper price is false

Talking about gold and silver, they are being pushed down further after the Fed decision. But the move in the last few days has mainly been a US dollar move. Gold in most other currencies has not moved much since the Fed move. As usual, we have seen major manipulation. The recent legal case with Deutsche Bank is proof of that. They got away with only $60 million fine which is ridiculous in relation to the damage they are doing to market participants. Next, we will see many other banks under attack, like Barclays, HSBC, UBS, etc. Deutsche is just the tip of the iceberg and the tape recordings of the traders’ conversations is clear evidence that there is regular and major manipulation of the precious metals as we have always known. This is another big black swan that will have major consequences for the gold and silver paper markets.

We have heard from the Swiss refiners that in recent weeks they have at times had to pay premiums to buy gold due to shortages. So no one should believe that the paper price has anything to do with the real gold and silver markets. We are getting nearer to the point when the truth will hit this market.

I would not like to be a holder of paper gold or silver at that point.

Stocks, Bonds And Metals Will Shock Markets In 2017

“Inflation” is guaranteed in the next few years. We will see in-flation, stag-flation, hyperinflation and de-flation. Many of these flations will happen simultaneously. Currently we have major monetary inflation combined with asset inflation. Credit growth and money printing have in recent years benefited the ailing banking system but have not yet reached consumer prices and therefore there is no ordinary price inflation.

This is why Italy, Greece, Spain, Portugal and many more EU countries are totally bankrupt. These countries have been forced to use a currency which has made them completely uncompetitive and unable to export or function. At the same time, Germany has benefited from a weak Euro which has made their export industries very successful.

The velocity of money will accelerate in 2017

In 2017, the velocity of money is likely to increase, leading to stagflation, which is higher prices without growth. But as the problems in the financial system deteriorate, hyperinflation in most major economies is virtually a certainty. The build-up of debt and derivatives in the last quarter of a century guarantees that desperate governments will print unlimited amounts of money in a frantic attempt to save the financial system. What has happened to the banking system in Italy in recent years makes the Medicis look like saints. Mismanagement and corruption have driven Italian banks to insolvency. The problem is the same in Greece, Spain, Portugal, France, Germany, etc, as I discussed in last week’s article (As Europe’s Financial System Fails, Gold Will Rise).

Hyperinflation will be fast and furious

But these problems are not limited to Europe. Banks in Japan and China will have the same pressures, and so will the financial system in the US and emerging markets. The last financial crisis started in 2006. Since then, global debt has gone from $140 trillion to around $240 trillion. Those extra $100 trillion should have led to massive hyperinflation already. Instead, all central banks are complaining about deflation and are doing all they can to create inflation. There is a misconception that inflation is good for the economy. Inflation is a disease that leads to the destruction of money and of savings. Lost central bankers have no other solution for a failing financial system. But to solve a problem with the same methods that created it in the first place is the road to ruin. And this is what will happen in the coming years, and most likely start in 2017. Hyperinflation, when it starts, normally accelerates very quickly and might last for only 2-4 years until the printed money becomes totally worthless. Hyperinflation affects mainly goods and services. In real terms, all the assets that have been financed by the credit bubble will deflate. Simultaneously, debt will implode, leading to banks defaulting. Eventually, hyperinflation will turn to a total deflationary implosion when all prices go down together with the money supply. This will be a devastating period for the world, since for a period there will be no money, and most people will have to revert to barter.

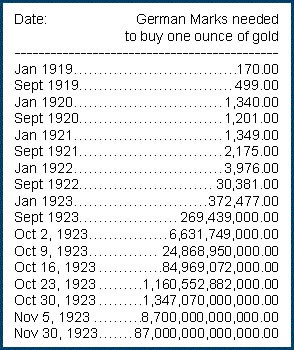

During the hyperinflationary period, gold will reach unimaginable levels in paper money terms, like in the Weimar Republic:

Gold in the Weimar Republic went from 170 Mark in 1919 to 87 trillion Mark in 1923

When hyperinflation ends and the deflationary implosion starts, gold will fall from the dizzy highs. But since there is likely to be an extended period without any paper currency in many countries, gold will be the only real money and will therefore be very highly valued in relation to rapidly falling prices.

Although there is no sign of hyperinflation in any major economy, there are countries like Argentina and Venezuela where it is already happening.

The Venezuelan Bolivar has been totally crushed since 2011. In August 2012, there were 10 Bolivars to the dollar. Today there are 4,250 Bolivars to one dollar in the unofficial market. As the graph shows below the fall of the Bolivar and the rise of the dollar is now exponential. In mid-2015 there were 700 Bolivars to $1 and today the dollar is 6x higher at 4,250. Since Aug 2012, the monthly inflation rate has been 16%.

In gold, 17,000 Bolivars bought one ounce in 2012. Today, one ounce of gold costs 5 million Bolivars.

A sign of things to come for many major economies in the next few years?

Physical Silver is now an attractive investment

As I have advocated since 2002, gold is the best way to preserve wealth and to ensure against the coming collapse of paper currencies as well as the financial system. We have, as a rule, advised clients to hold gold rather than silver for wealth preservation purposes. The volatility of silver has made it an unsuitable investment for normal investors. In 2001, silver was $4, in Feb 2008 it reached $21, and in Aug 2008, silver was down to $8. Then back to $50 in April 2011, to again fall precipitously to under $14 in December 2015. For anyone seeking a thrilling roller coaster ride, silver is perfect since these massive swings will give most investors the fright of a lifetime. Because silver is also much heavier in relation to its value, it is less convenient to store and carry than gold. In addition, there is VAT (value added tax) on silver in Europe, although this can be avoided legally by storing it in bonded vaults.

Silver will appreciate at twice the speed of gold

The risk/reward situation for silver changed at the beginning of 2016. Silver has now reached a point where, relative to gold, it represents excellent value. What is particularly interesting is that silver is now in a position to move twice as fast as gold.

The Gold /Silver ratio chart below shows how it has peaked 4 times in the last 20 years at or slightly above the 80 level (gold price = 80x silver price). The last time this happened was in February 2016. Since then the ratio has fallen to 68 but this is just the beginning. It is likely that before a major correction of the ratio, it could move down to 30 which we saw in 2011 when the silver price reached $50.

The ratio can move extremely fast. In September 2010, it was at 68, and in April 2011, it had reached 30. Once the current move down in the ratio accelerates, it could reach 30 very quickly. Longer term, the ratio is likely to reach 15, which is an important historical level, or it could even overshoot to 10.

If gold reaches $10,000 which I believe is a minimum without hyperinflation, that would give a silver price of $666 to $1,000. These are clearly levels that sound totally unrealistic currently, with silver at $17, but are likely to be achieved within 5 years or so.

Silver is extremely scarce

What makes silver particularly interesting is its scarcity. Around 170,000 tons of gold have been produced in history, and virtually all of this quantity is still around in one form or another. This is not the case with silver. There are no significant silver stocks anywhere in the world. Almost 60% of the silver produced is consumed, the rest goes to silverware, jewellery and investment. Central banks hold no silver stocks. The annual global silver production is 27,000 tons, which at $17 is $15 billion. As a comparison, annual gold mine production is $114 billion. More silver has been consumed globally than has been produced for a number of years. Investment demand for silver is only $2.5 billion annually. The total size of the silver market is minuscule in relation to world financial assets. That is why it has been very easy for Deutsche Bank, UBS, Barclays and a few other banks to manipulate this market. Deutsche has admitted to their rigging of the silver market, but since they have implicated a number of other banks, we haven’t seen the end of this story, which is very likely to spread to the gold market also.

Silver is normally the leading metal. It moves faster down in a bear market for precious metals, and when the market turns bullish, it outperforms gold. The fall of the gold/silver ratio indicates that the manipulation might soon come to an end, which will lead to increased physical demand. That, in turn, will put the paper silver market under severe pressure. As physical demand rises, the silver price will increase rapidly. Even today, it is difficult to find large quantities of physical silver, and as the price rises, there will be no silver available at current prices. Any surge in demand will only be satisfied at substantially higher prices.

Silver should not be bought for speculative purposes but for long term wealth preservation. Due to the volatility of silver, 15-25% of total precious metals holdings is the right level in our view. For any investor who doesn’t hold silver, it is my strong belief that now is an excellent time to buy physical silver at a price that will never be seen again and for a journey which will be extraordinary.

Stocks, Bonds And Metals Will Shock Markets In 2017

“The Die is Cast” for Europe and the EU. This is what Caesar said when he crossed the Rubicon in 49 BC, marching towards Rome, leading to a major change in Europe’s history. The Italian referendum, which took place on December 4, had a similar significance. The Brexit vote, in which Britain decided to divorce from the EU, started the breakup of the artificial construction of 500 million people being ruled by an unelected and unaccountable elite in Brussels. Even worse is an artificial paper currency, the Euro, which is used by 19 out of the 28 EU countries. All paper currencies are, of course, artificial constructions that eventually become worthless, but to have a currency for 19 countries with different cultures, different growth rates and productivity, and vastly different inflation rates is a total disaster.

This is why Italy, Greece, Spain, Portugal and many more EU countries are totally bankrupt. These countries have been forced to use a currency which has made them completely uncompetitive and unable to export or function. At the same time, Germany has benefited from a weak Euro which has made their export industries very successful.

A dire destiny for Europe

The referendum in Italy last Sunday changed the destiny not only for Italy but for Europe and also the world. The Brexit vote was the first indication that governments and the elite in the West are totally out of touch with the people. Trump’s win in the US presidential election confirmed the same phenomenon. In Italy, people are fed up with the Renzi government, which lost the referendum on the Italian constitution. In itself, the referendum is not that significant, but it is seen as a protest vote against the Renzi government. Interestingly, Renzi is the only European leader that officially backed Hilary Clinton and this is likely to cost him dear. Most of the European leaders hated Trump, but no one was stupid enough to officially back Clinton.

With Renzi losing the referendum and resigning, it will likely lead to an election in which the actor Beppo Grillo would win. His party is anti-globalism, anti-establishment, immigration and anti-EU and Euro. In Austria’s presidential election last Sunday, Norbert Hofer lost by a small margin. Hofer is on the far Right and also anti-immigration and anti-Muslims. Many European countries already have Eurosceptic governments like Hungary, Croatia, Poland and Slovenia. In 2017, there will be elections in France where Marine Le Pen’s National Front is well placed. In Holland, the Party for Freedom, which is anti-EU, is also well placed. And in Germany, there will also be elections in 2017. There is strong opposition to Merkel due to the major immigration problems that Germany is now suffering, all of Merkel’s making.

Italy’s insolvent financial system

Italy crossing the Rubicon is yet another confirmation that the trend has changed and that the people in Europe are now turning against the establishment and the elite. In addition to the unhappiness in Europe with politicians who are not in touch with the people, there are major problems in the financial system. One of Europe’s biggest banks, Deutsche Bank, is very much looking like Lehman. Both the share price and the derivative position are giving indications of a bank on its way to bankruptcy. And in Italy, the whole banking system is insolvent. It is not just Italy’s oldest bank, Monte dei Paschi, which is virtually bankrupt, but impaired loans for all Italian banks are at least €360 billion, which is around 20% of the Italian banking system. Monte dei Paschi is desperately trying to raise €5 billion, and UniCredit, Italy’s biggest bank, needs €13 billion.

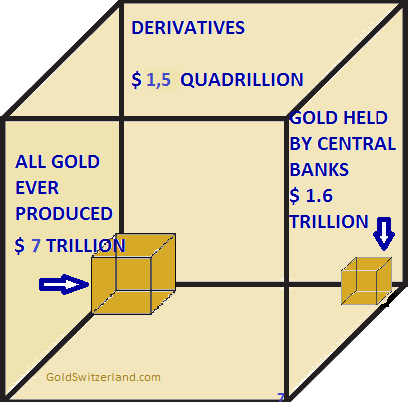

So Europe is in major trouble both politically and financially. When the difficulties start unravelling in Europe, the rest of the world should not feel confident that this is an isolated local problem. The global economy and financial system are totally interconnected, and a problem in a country like Italy will have repercussions around the world. Take Deutsche Bank’s derivative position of $50 trillion for example, which is around 20 times German GDP and 70% of global GDP. This is not just too big for Germany, it is too big for the world. A problem erupting in Deutsche would spread like wildfire throughout the global financial system. The five largest US banks have a derivatives portfolio of $1/4 quadrillion at least, and probably double that. That is 3.5 times global GDP and obviously too big for the global financial system.

$ 1.5 quadrillion of derivatives will implode

There are only two ways to deal with a problem in a financial system which has total derivatives of $1.5 quadrillion on top of already insolvent bank balance sheets.

The cube below shows the amount of global derivatives outstanding. $1.5 quadrillion is an astronomical amount in relation to all the gold ever produced or to the gold supposedly held by central banks. These derivatives are just illusory contracts with no underlying real value. The attributed gross value assumes that an endless chain of counterparties will all settle their part of the chain. It is sufficient that just a handful of major counterparties fail for the whole daisy chain to collapse. This will result in gross values of 70x global GDP disappearing into a black hole, never to be seen again. When this happens, no financial institution will survive. I would say that the likelihood of such an event is greater than 75%. The catalyst could easily be the European financial system. What happened in Italy last weekend could easily be seen as the shot in Sarajevo, an event that is the trigger for a change in history.

A false and corrupt financial system

In a futile attempt to stop the inevitable collapse, central banks will print unlimited amounts of money. This will lead to a short period of hyperinflation before the financial system, including the currency system, implodes. But since we are talking about a false and corrupt system that manipulates every single market, a collapse of this system will be a godsend and the only way to replace an irretrievably broken system. There is no chance for the world to grow soundly before the current financial system is wiped off the face of the earth. In my view, this must happen, and any attempt to save the system will just make the collapse bigger. The fall of the financial system will obviously cause misery and major upheaval for most people on earth, but it is guaranteed to happen and is also necessary for the world to start again with real markets and real growth.

To summarise, the changes that will take place in Europe over the next year or so, are likely to be one of the catalysts that will trigger the inevitable fall of the financial system as well as the world economy. Obviously at some point in the future, there will be a Phoenix coming out of the ashes of the present system which will hopefully lead to a better world over time.

Paper money is dying

In the meantime, as paper money dies, protecting your assets is now more vital than ever in history. All assets within the financial system will implode. Debt and derivatives will implode under their own weight. All the bubble assets that this debt has supported will also collapse. This includes stocks, bonds and property. Anyone who holds anything within the financial system is likely to lose a major part of their assets. And if anything remains of value, it will take a very long time before liquidators have sorted the mess out in order to pay out pennies on the dollar. Unencumbered assets in the system should eventually be released, but this could take many years, and there is a major risk that a bank under pressure has used these assets as collateral.

To preserve wealth, hold unencumbered real assets

The best way to preserve wealth in the coming years is to hold unencumbered real assets outside the financial system, such as property, land and mineral rights. The ultimate wealth preservation asset is, of course, gold. Gold is the only money which has maintained its value throughout history. Since paper money will either be very scarce, especially since most governments will ban it, or worthless, gold will become the only real medium of exchange. Gold will be used as money and for barter. The collapse of paper currencies and the financial system will make gold extremely desirable and valuable.

The current currency restrictions in India have had a major effect on the gold price. Prices as high as $3,000 per ounce have been seen, but currently, gold in India is $1,600-1,700. This is a premium of 35-45% on the current spot of $1,177. There are, of course, concerns that import restrictions will slow down demand. But according to my sources, the rampant corruption in India makes it easy to pay the right official to let the gold in. Indians are now likely to buy more gold rather than less as the Modi government has virtually destroyed the paper currency system. Obviously, there is no premium on paper gold in India. The Indians and the Chinese know that paper gold is worth zero since this market will totally collapse.

China’s insatiable demand for gold

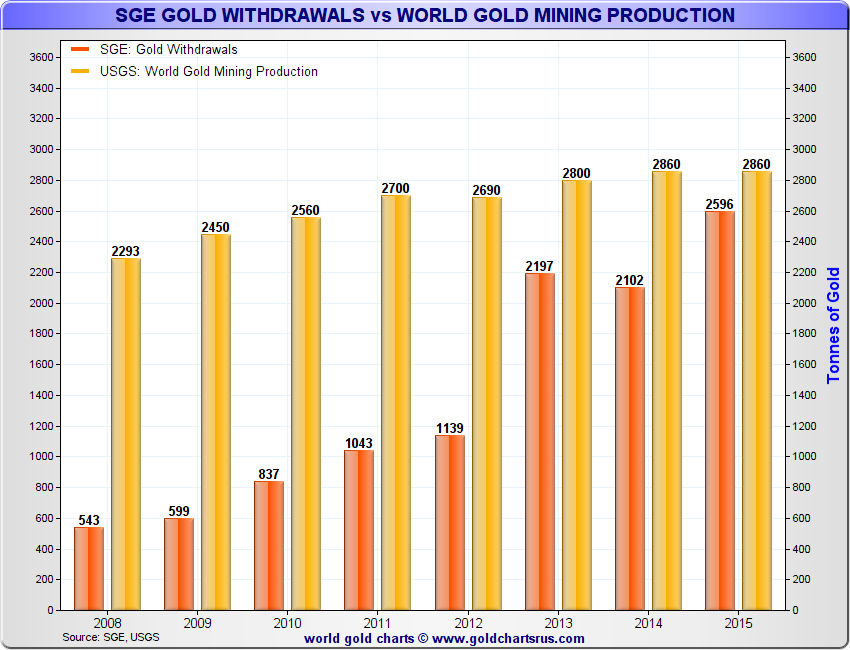

Also in China, premiums for physical gold have shot up and are at a three-year high. Gold in China is today traded at $24 above spot. The chart below shows the insatiable demand for gold in China which in recent years have absorbed a major part of world production.

Swiss refiners report strong demand

Goldmine production is today around 3,000 tons annually. By 2025, it will be down to 2,000 tons as we have currently reached peak gold. The refiners in Switzerland who refine most of the gold bars in the world, report strong demand currently. All the gold that is being produced is mainly bought by China, India, Russia and a few other buyers. There are no stockpiles of unsold gold in the world. But there are piles of paper gold that are at least 100 times greater than the physical gold available to settle the paper gold claims. The paper gold market is corrupt and manipulated by central banks and bullion banks. For the time being, this group has managed to keep gold $000s below the real price that physical gold would fetch without the paper gold manipulation.

As the problems in the financial system start unfolding, which could happen at any time, the paper gold market will fail and the real gold price for physical gold will be set by China. Once this happens, gold will climb quickly towards $10,000 in today’s money and then much higher in inflationary money.

Short-term, gold in the paper market can always be pushed down another $100. But with a very limited downside and an upside of many thousand dollars, at current levels of $1,175 physical gold is an absolute bargain. It is also the best way to protect your wealth against the coming destruction of asset prices and paper money.

Stocks, Bonds And Metals Will Shock Markets In 2017

Few people realise the coming bargains in all asset markets within the next five years or so. Stocks, bonds and property will be fractions of current prices. I discussed in last week’s article (Wealth Destruction Of 90% Is Next) how I expect stocks and property to decline, maybe as much as 90%. Most people will consider this as sensational speculation and impossible, but similar falls have happened in history before. And at no previous time in history has there been a credit bubble of a magnitude that the world is facing today. Previously, individual countries have experienced depressions, often preceded by hyperinflation. But never before has every single industrialised country had a century of exponential growth of credit, asset prices and inflation, which is likely to lead to a global collapse.

False growth based on fake money

It is, of course, impossible to time the end of a 100-year super cycle bubble. It has already gone on for much longer than many of us thought was possible. But governments, central banks, as well as commercial banks, have succeeded in pumping endless amounts of money into the system to keep the Ponzi scheme going. Most people do not understand what is happening to their money. They believe that their dollar, pound or euro is worth the same as it was 10 years ago, or 25 years ago. Since the creation of the Fed in the US in 1913, all major currencies have declined in value by 97-99%. This means that savings have been destroyed by the same amount. Savings are essential for an economy to grow soundly. Savings are the basis of investments for growth in all areas of the economy, whether it is manufacturing, housing or infrastructure. To achieve real growth, there must be savings. The growth that the world has experienced in the last few decades, especially since 1971 when the gold backing of the dollar was abolished, has been based on a massive debt expansion. Credit creation leads to currency debasement, and in real terms, virtually no growth is achieved. This is why real median wages for ordinary workers are not growing in many countries, like the USA or the UK.

The world will soon experience how false and dangerous global growth has been, as it is standing on a foundation of paper money. As this foundation collapses in the coming years, the world will realise that all the assets that have been inflated to bubble levels will lose most of their value.

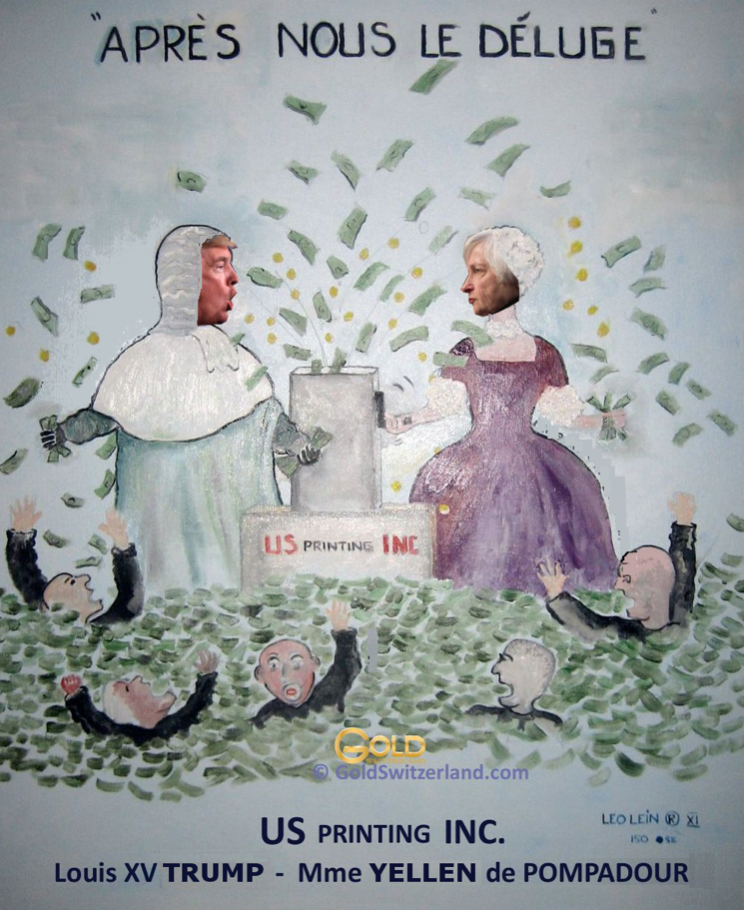

After Trump, the flood

Trump will continue the tradition of his predecessors and expand US debt by at least 9% annually (which is the average since 1981), but probably a lot more since he has promised major infrastructure spending. On top of that, he will most probably encounter a major economic downturn combined with problems in the financial system. This is very likely going to lead to money printing of astronomical proportions and hyperinflation.

The painting below was originally featuring Obama and Bernanke, who together managed to double the US debt. But Trump and Yellen are likely to achieve even more, leading to a deluge or flood of printed money. Après Nous le Deluge (After us the flood) is what Louis XV’s mistress, Madame de Pompadour, said to the French king after losing a battle against the Prussians in 1757. The subsequent decline of the French economy led to the French Revolution. The coming decline of the US economy could sadly lead to a similar outcome.

The effect of an implosion of the debt and additional massive money printing will give once-in-a-lifetime opportunities to the very few who are now taking the right measures to preserve wealth.

Loans will be inflation-indexed

Anyone buying a house in the US today or in Europe is going to pay a price which he will not see in his lifetime in real terms. Nominal prices might be higher due to hyperinflation. Nobody should believe that they will be able to repay their loans with hyperinflationary money. There are numerous risks; many will lose their jobs, and interest will be 15-20% or more. But the biggest risk is the indexation of loans. Banks will most certainly index loans by a percentage of inflation. There is likely to be some emergency legislation that supports this draconian measure.

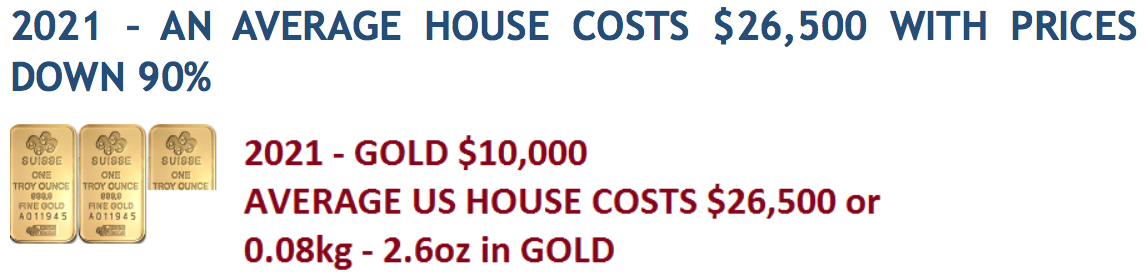

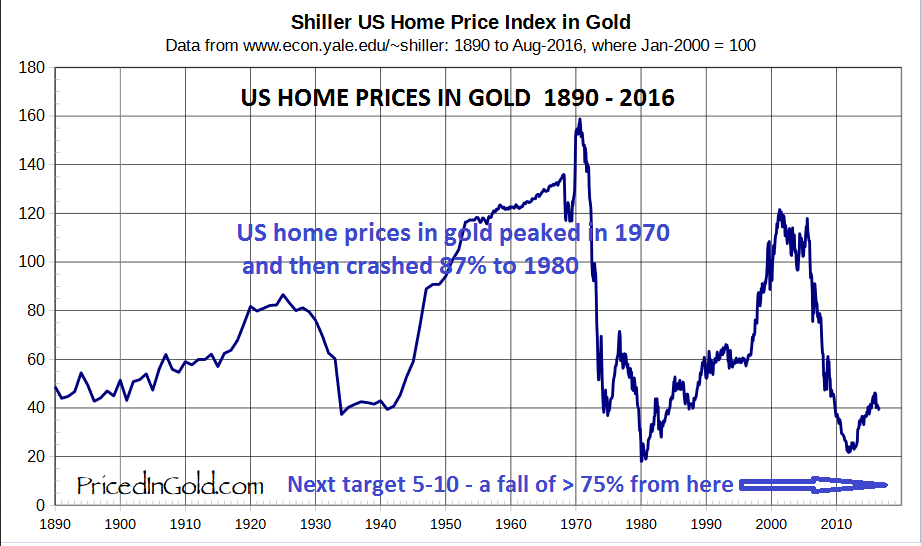

So if we look at what could happen to house prices in real money, which is gold, it could have consequences that few can see today.

Buy a house for 2.6 oz of gold

An average house in the US costs around $265,000 today. Not that you get much for $265,000 but that is the average. Measured in gold that becomes 7 kilos or 225 ounces.

As I outlined in more detail in my article last week, my forecast for gold in the coming years is at least $10,000 in today’s money. In hyperinflationary money, it will be many times higher. At the same time, I expect that the inflated housing bubble fuelled by credit will collapse. House prices will go down by at least 75% and probably by as much as 90%.

A 75% fall in house prices is very realistic and a likely minimum fall. At that level with gold at $10,000 a house doesn’t cost 7 kg or 225 oz but 0.2 kg or 7 oz. So in gold the price is now down 97% and costing 3% of what it cost in 2016. This sounds totally unrealistic but it has been the experience in countries with hyperinflationary depression like the Weimar Republic.

Let’s also look at a fall in house prices of 90%. Even more unrealistic, many would say. But let’s just remember that an average house in 1916 was under 1% of what it costs today,y at $2,000 against $265,000 now. So in a credit collapse, combined with interest rates at 15-20%, high unemployment and substantial economic contraction, a 90% fall could easily happen.

For someone who believes that this scenario is a possibility, which of course will be very few, he would be able to buy a house for 1%, in say 2021, of what he would pay today, if he held his money in gold. It sounds unreal, but the risk is such that buying a house today is likely to be a very costly and perhaps ruinous experience. So what should you do if you own a house already. If you are not worried about a potential price fall of 90%, you keep the house as a place to live rather than an investment. But if you have a mortgage on the house which you couldn’t service with substantially higher rates and especially if you lost your job, it would be better to sell now and buy gold. Renting then becomes a much better option.

Short term gold is under pressure and could decline a bit further. It is even possible that they try to push it down in the paper market to the 2015 December low of $1,050.

On December 4th, there is the Italian referendum,m which could have a major influence on markets. Also very important is the Fed meeting on 13-14 December. The whole world expects a US rate increase, and this has led to a surging dollar. If the Fed disappoints the markets, there will be a massive shock. But even if the Fed does what everyone anticipates, I would expect that Dec 14th is the latest that many markets would turn dollar down, stocks down and gold up.

Thus, gold investors should just ignore the manipulations in the paper gold price. Strong physical demand continues in China and Russia. If import restrictions continue in India, it will be circumvented by smuggling. Any restrictions will just lead to a much higher gold price, which India is currently experiencing with gold at $1,700 per ounce. Although the short-term trend is down, the many financial and economic risk factors and black swans circling around us can change that trend in an instant. The potential shock that the global economy will experience inthe coming months and years will make the current price under $1,200 seem a bargain of a lifetime.

Whatever the short-term moves, gold will reach at least $10,000 in today’s money. Gold is now the cheapest insurance anyone can buy against a rotten financial system.

Stocks, Bonds And Metals Will Shock Markets In 2017

Very few people realise the enormous wealth transfer that will take place in the next 5 years. Most will lose 75-90% of their wealth, and some 100%. What is interesting is that investors needn’t lose most of their money if they take a few measures to protect their fortune. I often speak to Family Offices that built fortunes from the $100s of millions to many billions. Without exception, they believe that it is their skill in building a business or investing that has created these fortunes. It clearly requires a lot of skill and a bit of luck to build a sizeable fortune. But the magnitude of wealth today is not due to investment skills but to the enormous growth of credit and money printing that the world has experienced since the creation of the Fed in 1913. This has caused a global explosion in asset values of unparalleled proportions.

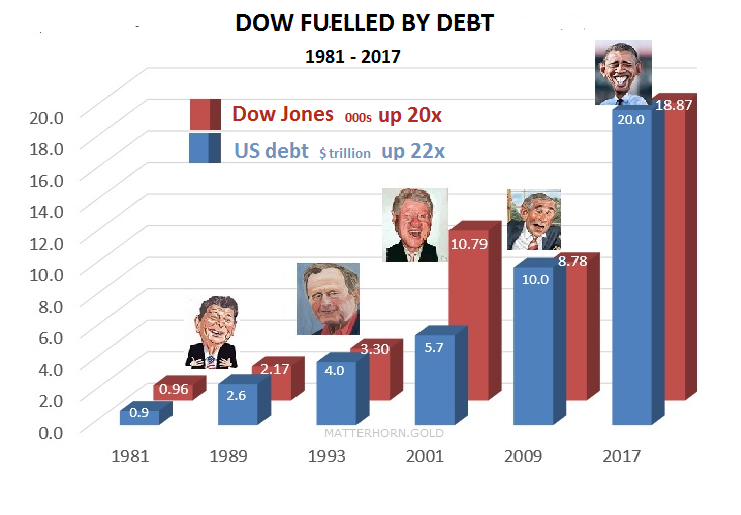

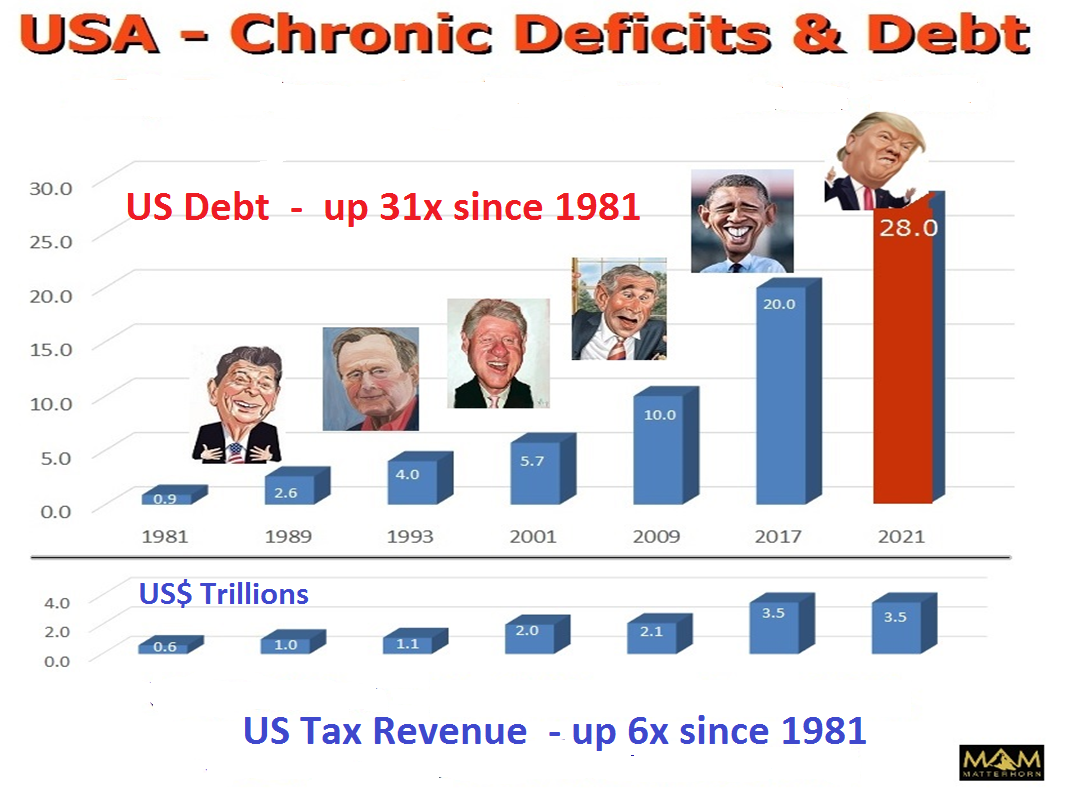

Growth in stock prices = Growth in debt

Stocks have been a massive beneficiary of the biggest monetary expansion that the world has ever experienced. If we look at the Dow since the last major economic cycle started in the early 1980s, we find the most remarkable rise. In early 1980, the Dow was at 850 and today we are 19,000. That is a rise of over 18,000 Dow points in 36 years. This means that the Dow has gone up by 9% per year on average since 1981. A 9% annual increase leads to the index doubling every 8 years. What a great investment. You buy stocks in 1980 for $10,000, and today in 2016, you have $220,000 without having to lift a finger. On top of that, there has been a dividend yield of around 2% on average. But this growth in the stock market has not just happened on its own accord. Stocks don’t grow at 9% annually for 36 years without some rocket fuel. And the explanation is very simple. Debt has provided the fuel. Because US debt has also grown by 9% annually since 1981. So the recipe for becoming a successful and loved president is just to print and borrow money. There is an absolute correlation between the increase in US debt and the growth in the stock market.

Reagan knew the secret. During his reign, he tripled the debt from $900 billion to $2.6 trillion, leading to the Dow more than doubling from 960 to 2,200. And so it continued. Clinton didn’t have to print as much money to get the market up, but Bush Jr had to almost double the debt, and still the market ended lower than when he took over eight years earlier. Obama doubled both debt and the Dow in line with the longer trend. The problem for Trump is that we are now at the point of diminishing returns, and this started with George W already. When Bush Jr took over, the Dow was 10,800, and now it is 18,800, a 74% increase. But to achieve that 74% rise in the Dow, debt went up by 250%. This means that Trump will have to print an awful lot of money to keep the stock market going up. Bearing in mind that the Dow is at record levels with p/e at over 20 and corporate profits falling, this is going to be virtually impossible to achieve. The chances for Trump to be re-elected after four years are very slim due to the present high level of the stock market, together with record debt. Much better to become president with a weak economy and weak market like Reagan did.

In 1929, the Dow peaked at 400 and then collapsed to 40 in 1932. This 90% fall occurred at a point when economic conditions in the US and globally were a lot more benign than they are today. Since 1981, the Dow has gone up 22x. With the world experiencing a historical asset and credit bubble of unprecedented proportions, an implosion of debt could easily see the Dow down 90%, like in 1929-32 or probably even 95% to get back to the 850 level where this bull market started. This would mean a fall of 95% in real terms. I say real terms because it is not unlikely that we will see the biggest money printing experiment in history with central banks worldwide printing trillions or even quadrillions of dollars in a futile attempt to save the financial system and the world economy. This massive money printing could lead to the Dow reaching much higher levels in nominal or hyperinflationary terms.

The Dow is expected to fall 90% in real terms

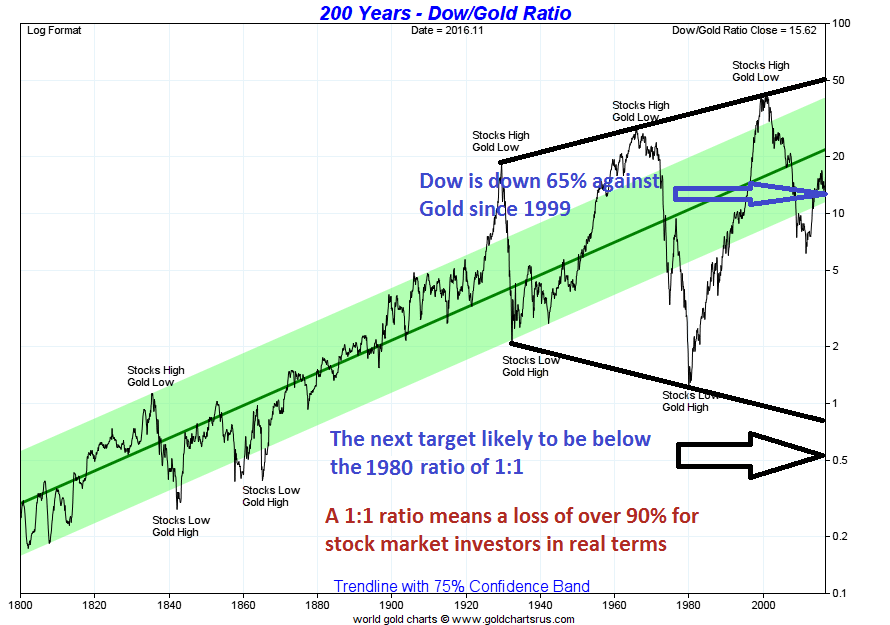

The best way to measure the Dow in real terms is against gold. Gold is the only money which has survived in the last 5,000 years and gold represents stable purchasing power. Over time gold doesn’t go up. Instead it is paper or fiat money that goes down until it reaches zero.

The Dow/Gold ratio peaked in 1999 and is now in a downtrend. Once the current correction is finished, the ratio will continue down towards the 1:1 level, like in 1980 when the Dow was 850 and Gold was $850. The only question is at what level the Dow and gold will be when they reach the 1:1 ratio. Will it be Dow 10,000 and Gold $10,000? Or will we see hyperinflationary levels of 100,000 Dow and $100,000 gold? The absolute level is really irrelevant. Because, at whatever level they meet, it will involve a catastrophic loss of real capital for a stock market investor.

When the ratio reaches 1:1 this means a loss of more than 90% in real terms for stock market investors – $ 1 million in stocks would be worth less than $100,000 in today’s money. And remember that the last time a 90% fall happened in the Dow in 1929-32, it took 25 years to get back to the previous peak.

The property market will lose more than 75%

Finally, the property market has also been fuelled by the credit explosion. I meet many wealthy investors who believe that property is the best form of wealth preservation. It is, of course, true that property has been a fantastic investment for the last 100 years. For hundreds of years before 1913, inflation remained stable at 1-2% per year. It was the same with property values. A house in the early 1700s did not move much in price for 200 years until the early 1900s. But the creation of the Fed led to credit growth and money printing of exponential proportions in most of the Western world. And this is why property prices have moved up 1,000s of per cent in the last 100 years. But to believe that property now represents real value after the biggest rise in history is very dangerous. In the last few year,s this bubble has additionally been fuelled by virtually free money with interest rates at zero or even negative.

In gold terms, US Homes peaked in the early 1970s. The fall of an average US home against gold has been 87% since then. It could seem that US housing will not fall much further from these levels. But when we look at the high level of lending in this market combined with low interest rates, it is likely that housing in the Western world will decline substantially from here. A minimum target is the 1980 level, which would involve a 50% fall in real terms, which is against gold. But bearing in mind the bubble nature of this market, it is more likely that we will see a 75-90% fall from here, which means down to at least 10 on the index in the chart below.

The fall in asset prices and the consequent increase in the value of gold could happen in the next five years. If that will be the case, investors in stocks and property will lose 75-95% of their assets in real terms. This should not be seen as sensational levels but only a healthy correction after the biggest asset and debt bubbles in history. Yes, it will involve misery and a major adjustment for most people. But this is a necessary adaptation for the world to start growing again without excessive debt. Because with debts of $250 trillion and derivatives in the quadrillions, there is no chance for the world economy to advance. All this debt must implode together with the assets that it has backed.

Gold best protection

Gold will clearly offer protection against the coming wealth destruction. But it must be physical, held outside the financial system and outside the country of residence of the investor. Gold must also be kept in a politically safe country with a gold ethos.

The current correction in the gold price should be totally ignored. It is due to manipulation and a dollar which is temporarily strong. It is critical to be covered against the risks that I have outlined above, and gold is the most important protection that anyone can own. People who don’t own gold are exposed to monumental financial and human risks.

Stocks, Bonds And Metals Will Shock Markets In 2017

There is a total misunderstanding of the role of gold and why it is so critical to own physical gold. Gold should not be bought or sold based on rumours or events. In connection with the US election, gold moved for totally the wrong reasons.

The whole Western world had forecast a Clinton victory. The Western media, which does no analysis but only reports what they are fed, spent no time trying to understand what the mood of the people was. It was exactly the same with Brexit. The elite in London, New York and the big metropolitan areas has totally different objectives to ordinary people.

Change in public mood

The trend change in public reaction, which we are seeing now, is not just a temporary phenomenon. Ordinary people are tired of a small elite of bankers, industrialists and politicians helping themselves to unlimited power and wealth whilst normal people are just getting poorer with lower incomes and more debt. And it is the masses who are ultimately responsible for repaying debt, which is increasing exponentially in most countries. They will, of course, not repay the debt because they can’t. Instead, they will suffer immeasurably when global debt of around $250 trillion implodes, leading to a severe depression. The gap between the rich and the poor in the West is wider than ever. In the US, the top 0.1% have 22% of total wealth. US top professionals have had an increase in real pay of 51% since 1973, whilst normal workers have seen a reduction of 4.6%. This is a very dangerous tren,d and when the economic downturn comes, it is likely to lead to violent protests and social unrest.

The Trump win was totally unexpected in the US as well as in other countries. Most politicians in Europe and around the world have ridiculed Trump and assumed that he would never be elected. They all certainly must eat humble pie now.

Investors must ignore paper gold volatility

Coming back to gold, we saw the most incredible volatility last week. As the Trump victory became clear, gold went from $1,270 to $1,335 in under 4 hours’ overnight trading. Then, the massive selling of gold futures pushed the price down to $1,270, where it started before the election. On Friday last week, it was pushed down further to $1,225, which is $110 from the euphoric election peak. Initially, heavy paper speculative buying of gold took place around the world, but very little serious physical buying took place. Some gold experts predicted that gold would go up by at least $100 if Trump won. Well, it did go up $65, but then declined by over $100 from there. A dealer in London ran out of physical stock due to panic retail buying. But when the stock markets turned around from down 4-5% to up, the paper longs in gold were liquidated, and speculative funds flowed into stock markets instead. Two years of gold production were traded after the election, all in the paper market.

As usual, when gold is dumped in the futures market, there is little selling of physical. Thus, the paper price of gold is totally false and in no way reflects what is happening in the physical market. It is likely that commercial gold buyers, who are already long, will add to positions at these suppressed levels. The paper market has 100-300 oz of paper gold for every 1 oz of physical gold. When the commercials add to positions at these artificially low levels, there is likely to be a major short squeeze.

Gold investors should totally ignore these short-term moves, as well as any news or events that temporarily move gold. Sadly, many investors buy gold when it goes up and sell it when it goes down. This behaviour shows a total ignorance of the role of gold and why it is so important to hold physical gold. Gold is not an investment and should definitely not be seen as a speculative commodity. But futures traders and the bullion banks have no interest in gold for wealth protection purposes. For them, it is just a commodity traded in the paper market with no intention of ever taking delivery.

Obama achieved in 8 years what took the US more than 200 years

When gold moves strongly based on events, the move is seldom sustained. Those moves are mostly speculative and in the paper market. Sustained moves in gold are due to the debasement of paper money and nothing else. Since the creation of the Fed in 1913, all major currencies have declined 97-99% against gold. The US has not had a real budget surplus since 1960, so the trend is very clear and unlikely to be reversed anytime soon. Since 1971, when Nixon abolished the gold backing of the dollar, US debt has grown by an average of 9% per year. This means that the US federal debt has doubled every eight years. And Obama is no exception. He duly complied with the trend of exponential debt increases and doubled the US debt from $10 trillion to $20 trillion. It took the US 232 years to go from zero debt to $10 trillion, and Obama managed to double it in just eight short years. What an achievement!

Neither Clinton nor Trump had any intention of breaking the trend of massive debt expansion. Trump’s proposed tax reductions and major infrastructure investments will add over $5 trillion to the debt. But with this expansive policy, there is absolutely no reason why debt in the next four years will grow by less than the 9% annual average. This would take the US debt to at least $28 trillion by 2021 and $40 trillion in 2025.

But it is likely to get a lot worse. Rising interest rates, higher unemployment, stress in the debt markets and major problems in the global financial system are likely to lead to substantially higher debt as well as massive money printing.

The 35-year interest rate cycle has turned up

Long-term US interest rates turned up earlier this year, with the 10-year Treasury yield up 63% from 1.4% to 2.28%. The 35-year rate cycle has now turned, and rates are likely to go back to at least the 16% we saw in 1980, but probably a lot higher as the biggest bond bubble in history bursts. Due to the massive size of this bubble on a global scale, the increase in rates could happen very quickly. This will not just affect debt markets and the ability of governments to pay the interest, but also the derivatives market. The $1.5 quadrillion of global derivatives are extremely sensitive to interest rate increases, and that market will not survive much higher interest rates.

And if we look around the world, the risks are unprecedented. Japan is totally bankrupt; China has a major debt problem, and the European banking system is unlikely to survive in its present form. Also, what started with Brexit is likely to continue in many European countries. Just like in the US, many Europeans are tired of an elite in Brussels ruling over 500 million people with little understanding of the resentment that this unaccountable and unelected elite is causing. The Italian election is next in December, and then we have France and Germany in 2017. The breakup of the EU and the end of the Euro is just a matter of time, and it could happen a lot faster than anyone expects.

Trump will not reverse the chronic trend of deficits and debts

With all these problems around the world, Trump will have major difficulties reversing the trend of debts, deficits and no real growth of the US economy. Global trade is already declining and is likely to deteriorate substantially in the next few years. With both global and US problems of unparalleled proportions, it is not the best time to become president of the biggest and most indebted economy in the world. Clearly, Trump is determined to succeed, but running an insolvent economy in a virtually bankrupt world will be a lot harder than building a property empire. But he has made it clear that he is hell-bent on expanding the US economy at all costs. The problem is that he will probably spend more money than anyone can imagine. But sadly, he will be pushing on a string since borrowing and printing money can never repair an economy which is fatally broken.

Reasons for holding gold are more compelling than ever

As the world enters a period with risk exponentially greater than in 2006, the reasons for holding physical gold as insurance and wealth protection are more compelling than ever. The continued debasement of the currencies will guarantee a higher gold price. During Obama’s eight years, gold went up by 36% only, whilst debt doubled, and Trump is likely to grow debt exponentially. In addition, the failure of the paper gold market could happen at any time. When this happens, there will be no physical gold available at any price until there is equilibrium in the physical market. At what price that will take place is impossible to forecast, but it is certain to be multiples of the current price.

Stocks, Bonds And Metals Will Shock Markets In 2017

$125,000 Gold Forecast By Clif High

Clif High’s very unique Predictive Linguistics system is forecasting hyperinflation starting in 2017 with gold reaching $125,0000 and the Dow a similar level. He used the same method to forecast a landslide win for Trump.

Clif High is probably the most interesting forecaster in the world today and a good friend.

A Dow 125.000 sounds sensational but as I have indicated before, this is not impossible in a hyperinflationary scenario. With gold also reaching $125,000, the Dow / Gold ratio would be at 1 to 1 which is where the ratio was in 1980 when both gold and the Dow were around 800.

The big difference is that whilst the Dow in this scenario would go up 7x, the gold price would increase 100x. Thus, whilst it might seem fantastic with a stock market going up 600%, this is just in hyperinflationary “funny money”. Because against gold, the Dow would actually fall by 93% if they both reach 125,000.