Massive policy change means the beginning of the fall of Japan

King World News Audio interview- Dec 21, 2012

In this 2013 outlook interview Egon von Greyerz discusses with Eric King the important monetary developments and experiments in recent years that have become major catalysts for today’s politically, financially and socially crumbling societies.

Egon explains how and why Japan, being the third largest economy in the world, will join the currency race to the bottom by printing unlimited amounts of money.

The next important area that Egon raises is the US fiscal cliff which he says is like rearranging the deck chairs on the Titanic whilst the boat is sinking.

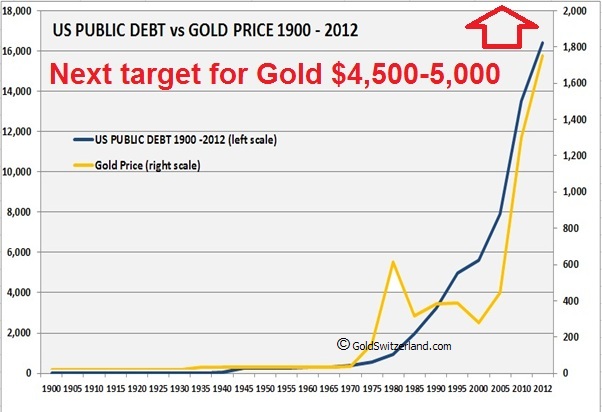

The USA Fiscal cliff policy note is about saving 1.2 trillion dollars over ten years. This is an average of 120 billion dollars per year, most of it back loaded. Saving 120 billion a year is an insignificant amount compared to the US deficit including unfunded liabilities having gone up by 7 trillion in 2012 alone. They are tinkering around the edges as the country is sinking.

Egon also mentions LIBOR, derivatives and the manipulation of markets which have a major influence on world events. UBS has just been fined 1.5 Billion for manipulating the LIBOR rate. LIBOR is used to calculate the value of many financial products including all derivatives. It is just the tip of the iceberg as market manipulation is seen everywhere.

Some pension funds in Japan are already increasing their gold holding to between 1.5 and 3% against an institutional worldwide average of only 0.3%. Institutions will need to increase their holding in Gold to protect against inflation. And as long as governments continue to print money, which is guaranteed, this will be reflected in the price of gold.

Physical Gold outside the banking system is the only option for full protection.

Click here to listen to the interview as published by KWN on Dec 25.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

Massive policy change means the beginning of the fall of Japan

THE MATTERHORN INTERVIEW – Review 2012: Alasdair Macleod

“We are quite likely to have a failure on COMEX in the silver market”

Matterhorn Asset Management is very pleased that the Christmas 2012 Matterhorn Interview is with Alasdair Macleod. We know Alasdair as a man with a lot of common sense based on a long time hands on experience in the largest financial center of the world. So here it is; straight from the horse’s mouth. Enjoy the interview.

The renowned economist and financial analyst Alasdair Macleod looks back through the rear window of twenty-twelve and comments important events and developments such as “QE to infinity.” Moreover, he gives his expectations for 2013 in general and the gold and silver markets in particular.

Alasdair Macleod started his career as a stockbroker in 1970 on the London Stock Exchange, and learned through experience about things as diverse as mining shares and general economics. Within nine years Macleod had risen to become a senior partner at his firm. He subsequently held positions at director level in investment management, fund management and banking. For most of his 40 years in the finance industry, Macleod has been de-mystifying macro-economic events for his investing clients. The accumulation of this experience has convinced him that unsound monetary policies are the most destructive weapons that governments can use against the people. Accordingly, his mission is to educate and inform the public, in layman’s terms, what governments do with money and how to protect themselves from the consequences.

Alasdair Macleod started his career as a stockbroker in 1970 on the London Stock Exchange, and learned through experience about things as diverse as mining shares and general economics. Within nine years Macleod had risen to become a senior partner at his firm. He subsequently held positions at director level in investment management, fund management and banking. For most of his 40 years in the finance industry, Macleod has been de-mystifying macro-economic events for his investing clients. The accumulation of this experience has convinced him that unsound monetary policies are the most destructive weapons that governments can use against the people. Accordingly, his mission is to educate and inform the public, in layman’s terms, what governments do with money and how to protect themselves from the consequences.

By Lars Schall

Lars Schall: Shall we do a review of 2012 by season?

Alasdair Macleod: Yes.

L.S.: Let’s look for the big stories last winter, spring, summer and fall. So, what in your experience was the big story last winter at the start of 2012?

A.M.: The short answer is the Federal Reserve Board extending zero interest rates until 2014, which was unheard of before. We have now got used to zero rates. And also the ECB started to abandon all sound money in order to support the Eurozone banking system and the weaker members. And that to me sets the tone for an eventual complete paper money collapse.

L.S.: Maybe you tell us a little bit about zero interest rates and what usually happens?

A.M.: Well, usually what happens is that the Central Bank manages interest rates at a level which it thinks is appropriate for the economy. In the case of the Federal Reserve Board, it is meant to balance the level of unemployment and the prospects for inflation by managing the interest rates. Now, in practice, that probably means that it sets it below what the market would normally be comfortable with or what the market would decide on its own.

But here we have a situation where the Federal Reserve Board has turned around and said, “We are going to keep interest rates frozen at zero until late 2014 at least. So, that basically means that the cost of borrowing is tied to that zero bound and there is no way that interest rates can go any lower. It is the end point of lowering interest points. Obviously, if you’re going to keep interest rates at that very low level, you’ve got to do two things: Firstly you’ve got to pump money into the system to keep rates at zero and secondly the Central Bank must satisfy any demand for money at that zero bound. And of course, the FED has been doing this, by buying government treasuries and injecting the money in payment for them into the banking system. The banks, where they have drawn down on their lending capacity, have not lent it into the economy but they have used it for financial speculation. So that’s why huge amounts of derivatives have been piling up. And the US banking system, believe it or not, is also exposed quite significantly to the Eurozone area.

L.S.: How did this exposure to the Eurozone arise?

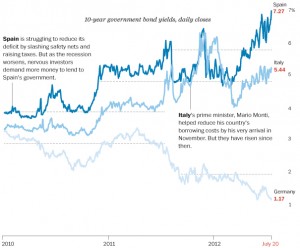

A.M.: Well, it goes back to the beginning of this year when it was only people like you and I perhaps who worried about the possibility that Greece and Italy and Spain might be bankrupt. The average banker just looked at guarantees from the ECB, allowing them to turn 3 per cent or more on a Eurozone sovereign loan. So you end up with bank exposure to the Eurozone and the Eurozone banking system. At mid-year, according to the Bank for International Settlements, the BIS, the total was about $1.5 trillion. This was a very, very important development from the beginning of this year. The ECB at that time was insisting they were not going to print money, and they were going to be conservative in their lending policy. But under Draghi they’ve responded to a systemic banking problem and to politicians unable to deal with government finances in individual countries. And so it became obvious the ECB is the only institution in the Eurozone which can keep this show on the road. So the ECB has started to abandon all pretence at sound money. The hard-money Germans have either resigned or been basically over-ruled in the ECB. The euro, like the US dollar, is now a story of print, print, print. And then of course we had the Greek bail-out in January. The first of two bail-outs this year at least as far as I can recall.

L.S.: Yes.

A.M.: So that’s the first quarter. In the spring what caught my eye was the Target 2 settlement system. Suddenly Germany was on the wrong end of something like Euro 500 billion, reflecting capital flight into Germany from countries such as Greece, and also increasingly out of Spain, Italy and Portugal. Ordinary citizens in those countries began to worry about the safety of leaving money on deposit in their banks. The imbalances from capital flight today are reflected in the Bundesbank with 715 billion Euros, or one trillion dollars owed to it by other Eurozone national Central Banks. Total imbalances from capital flight within the Eurozone are now one trillion euros. So that to me was the second quarter’s feature. I think the third quarter was notable for the LIBOR manipulation story.

L.S.: Yes, we had.

A.M.: And that started with Barclays Bank and it was clear at the time, it wasn’t just Barclays but all the other major banks could well be implicated in this, from UBS to Royal Bank of Scotland. All sorts of big banks had an interest in supporting the value of their derivatives at artificial levels, otherwise their solvency margins looked bad. This is actually a major, major scandal, but it’s nothing compared with the economic damage from manipulation of interest rates by the Central Banks, with zero interest rate policies. We now have LIBOR manipulation on top. The thing that upsets people is the banks pursuing what is obviously a vested interest in keeping their asset values, the price of the bonds and other things that they have on their balance sheets, high by manipulating LIBOR interest rates down. And that I think is a very, very big scandal. It is a global scandal that implicates central banks, which I am sure knew it was happening and knew how important a low LIBOR was to commercial bank balance sheets.

L.S.: Okay. So we enter again the fall and winter season.

A.M.: Yes. There are so many systemic dangers now but I think the story I’m going to alight on is one I wrote about recently about gold and silver on the COMEX. The bank participation report came out on the 4th of December, and I was able to complete the figures for this year. Bank shorts are at or near record levels. And what is interesting is that with the prices of gold and silver well below the all-time highs there are no profit-takers in the market to sell contracts to close their shorts. And in silver it is very, very alarming. This leads me to think that we are quite likely to have a failure on COMEX and in the silver market in particular.

If you have a failure in silver on COMEX then that is going to affect the gold futures market as well. The West’s central and commercial banks have suppressed the price of both gold and silver by supplying central-bank gold and increased short positions, making prices far too cheap. The result has been a massive transfer of gold and silver to Asia. This is the relevance of the point that you have been raising about Central Banks gold holdings, and it is also going to bring into question the solvency of the bullion banks who are short.

So, I think that while it may not be obvious to many people at the moment, when we look back at the fourth quarter we will see that the conditions were in place for a huge bear squeeze, for silver in particular. I would assume that the short position in gold is more controllable so long as Western Central Banks continue to make bullion available to the bullion banks that are short either on COMEX or with LBMA. But silver is different, nobody has it for sale. There is no silver around.

L.S.: Yes, there is no stock.

A.M.: No, exactly.

L.S.: And that’s the big difference?

A.M.: Yes, and this silver position could actually destabilize other derivatives in financial markets. I blame complacency on this matter on Keynesian economists and monetarists saying, “Oh well, gold is just a commodity”. It’s absolute nonsense, we are talking about the most important money to all mankind. If you go into Asia and you ask what is money you will be told, ”Gold and silver”, not rupees, not any paper currencies issued by governments. Gold and silver, that’s what they regard as money, that is where they put their savings. And that is why we are short of it.

L.S.: Can I interrupt you because I would like to bring it both together. The Yuan in China, there’s now a lot of talk about the Yuan being the next reserve currency and we see the Chinese buying gold like crazy. Do you think they have something in mind with backing up their currency with gold?

A.M.: Yes, I do. I think they do have a plan and we don’t know what it is, but we can guess. My starting point in this is that all the Chinese and Russian Marxian economists were taught that capitalism destroys itself. Now, whether you believe that or not isn’t the point, but the Chinese economists actually have this in mind. And they can see the dangers of the way the US dollar is going. We must also understand that the dollar is for security reasons not something they want to use for their international trade settlements. Remember that every dollar transaction done in the world is reflected in a bank account in New York. So, the Chinese want to get away from the potential control and the intelligence information that it gives America. They want to use a different settlement medium.

Now, they agreed about 10 years ago with the Russians to set up the Shanghai Cooperation Organisation (SCO), and the last unsatisfied objective of the SCO is to have a common trade settlement system between the members of the SCO, which at the moment are Russia, China, and the various “stans” in middle-Asia. But interestingly, the next wave of members who will join are India, Iran, Pakistan, Mongolia and Afghanistan (as soon as NATO has left). So you’ve really got the bulk of Asia’s four billion people and they’re going to be settling cross-border trade not with the dollar but with something else. They need to be gold-rich to give confidence to their currencies. I suspect that the Chinese Yuan will play a big role in Asia. What they’re doing with Iran is interesting. They’re settling net balances in gold and gold is being re-monetized in that sense. And I think that China has accumulated a lot more gold than they officially tell us. So they have the potential to use gold as money. I can see gold being re-monetized in the loosest sense for the largest internal market the world has ever seen. Believe me, it’s happening now.

L.S.: Okay, let me then connect another thing with this question. Do you think the Chinese will get paid in gold for perhaps helping out in the euro crisis. So they’re helping to prop up the euro and they get in turn some of the European gold?

A.M.: I don’t think China is going to get sucked into supporting the Euro, no, I don’t see that at all. What I think is possible is they would very much like to cash in Euro’s for gold. I am sure they would consider taking physical gold as collateral for Eurozone loans. But for now every time a Eurozone country goes to China and says “we’ll be very grateful for some of your money, the Chinese listen very politely and then just show them the door. China is not in that role as they’ve got enough of their own problems.

L.S.: Yes.

A.M.: And look at it also this way, the average European has a standard of living, perhaps ten times better than the average Chinese. China is not interested.

L.S.: Let us then talk about the three big stories in gold this year, and I think the one thing out of the different campaigns for repatriation of gold reserves into the respective countries.

A.M.: Yes. That was going to be my overall story for 2012, and that owes much to the work that you have done. Teasing out of the German authorities, exactly how much gold they think they have got and where, was a great achievement, a journalistic scoop. And what I particularly liked was not only did you manage to do that but you have encouraged others to do the same thing elsewhere. The journalist in Mexico who has got the Mexican Central Bank to talk. We now discover from Austria that the bulk of their gold is in England and not only that, but they earned 300 million Euro in leasing fees. What a mistake to tell us that!

L.S.: Yes, but can you elaborate on this. Why was it a mistake?

A.M.: Well, I think it was a mistake because the sensible thing for a Central Banker to do when asked questions about this, given that a lot of the gold has probably disappeared through leasing, is actually to say as little as possible. The real reason for having gold as part of your foreign reserves is to have the ultimate protection of it for your country and currency. Are you telling us, central bankers, that you have compromised that role by leasing it with the risk that it won’t come back? You know that must be the next question you journalists will ask.

L.S.: Yes.

A.M.: And of course, to that they all clam up. So I think it was a mistake for the Austrian Central Bank to admit it. And the most recent story has been the Netherlands where it has just been revealed by the Central Bank after lots and lots of pressure that they have got 50 per cent of their gold in New York, they’ve got 20 per cent in Canada, 20 per cent in London and 10 per cent — only 10 per cent — in Amsterdam.

L.S.: So we come to the question what is a gold reserve. I would say a gold reserve is gold that you have in your possession and at your disposal at any time?

A.M.: Yes, a central banker has actually got to be able to go down into the basement, into the strong room, and count it.

L.S.: Yes.

M: It’s as simple as that.

L.S.: In Germany for example this is not the case. So what do they have. They have no gold reserve, what do they have, what kind of hybrid?

A.M.: There was a time when it made sense, with the Russian bear on the doorstep, for Germany to store her gold in New York or London or Paris. But things have changed, that’s no longer the case and they really should move it back. And I just can’t see the circumstances that have occurred or should occur for Germany whereby she needs to dispose of any of the gold, nor to keep any of it near the markets. It looks like the Bundesbank instead of physical gold has counterparty promises from the Fed, Bank of England and the Banque de France. This should be clarified.

Now, if you ask me about France I would say that France is theoretically bust, I can certainly see them selling gold in order to pay some of their debts or for emergency funding or something. Perhaps using it as collateral for loans. But for Germany it doesn’t make any sense at all, let alone have gold in any form in Paris. And I suspect that the Central Bankers in Germany have also had quite a tough time keeping gold out of the hands of various German chancellors, but that is another story.

L.S.: The argument now is, for example, that you have the gold in New York to trade with it. When you are trading with your gold reserve, what does this say?

A.M.: Well, it tells me that you’re not actually looking after it or keeping it for what it’s meant for. And if you are leasing it, then you’re being a party to a scheme which keeps the gold price, and therefore the value of your gold reserves low. Central Banks that go into leasing have lost sight of the whole point of having gold reserves.

L.S.: Why is it interesting for some parties to have a low gold price and what is the connection between the gold price and the bond market and the setting of interest rates.

A.M.: Okay, there’s quite a long story to that aspect.

L.S.: Can I challenge you?

A.M.: Yes, if we go back to the Nixon shock in 1971, the Americans decided that the Bretton Woods system of gold convertibility only for Central Banks (and the IMF and the World Bank) had to come to an end because they did not have enough gold to stem the losses resulting from dollar repatriation by the Banque de France and various other Central Banks. So, from that moment the US Treasury and the Federal Reserve Board tried to demonetize gold completely and they ran a campaign of saying that gold was old-fashioned; it was not money anymore. The dollar is king, the dollar is money and you can ignore gold.

And initially, they tried to hit the gold price to persuade speculators that gold is yesterday’s money. That failed spectacularly when the Bull Market in gold easily absorbed all the bullion the Americans sold. After that in the 1980s and 1990s, leasing developed. Gold leasing was the basis of the carry trade. A bullion bank gets a Central Bank to lease it some gold for an annual rate about a half, maybe three-quarters of a per cent. The Bullion Bank sells it into the market and with the proceeds goes and buys government short-dated bonds which at that time yielded say 5 or 6 per cent, so they got a very nice turn on that money. And they were meant to cover themselves through the London market from a producer who wanted to sell the gold forward so that he could fix the cash flow for his operations.

But what we don’t know other than by indirect analysis is to what extent these leasing operations were actually closed out by mine deliveries. Most of the gold that they sold in the 1980s and 1990s from this leasing ended up being fabricated into jewellery. And I think it was estimated that up to 90 per cent of the gold sold into the bullion market was actually going into jewellery in one form or another. That was the “raison d’être” if you like for the Central Banks trying to remove gold entirely from the financial system. I guess that the gold carry trade is now considerably reduced, because the interest rate spread is no longer there.

The other aspect of the relationship with bond yields is that physical gold doesn’t yield any interest. So, if bond yields are high, then there is a penalty for holding gold. If on the other hand interest rates are low there is no penalty and gold becomes more attractive. And that basically I think would sum up the relationship of gold with bonds.

L.S.: But now we see a move to declare gold a non-risk asset.

A.M.: Yes.

L.S.: Is this maybe also one of the big stories this year?

A.M.: Yes, it’s a very interesting one, because I think they’re trying to stop regulatory arbitrage, bearing in mind that derivatives markets have already accepted gold as collateral for margin purposes. And this was after some lobbying by the London bullion market. If they did nothing to stop regulatory arbitrage from bank balance sheets, it would encourage growth in shadow banking, which for regulators is not desirable. And now that the banks in America have been asked the question as to whether they think it will be a good idea to have gold as a collateral with zero or minimum haircut then of course they are bound to say yes. So I think it’s a done deal.

L.S.: It’s very important for the price, right?

A.M.: Well, I think in time it will be, because I would expect a number of bankers to begin to worry about the value of fiat currencies and it therefore makes sense to have a certain amount of asset allocation on their balance sheets in gold, just to give them protection. Gold will be on every banker’s radar screen.

L.S.: So gold will then also become a big story in 2013?

A.M.: I think it will be a story of 2013. But how important; I don’t know Lars. At this stage what I see is a potential failure in the precious metals markets. I think it’s far more important to worry about that. You know, they’re not going to get their gold and silver if this happens.

L.S.: Yes, sure. And then let us switch to the third big story in gold for 2012, and this has everything to do with Iran. They were kicked out of the SWIFT system and what did they do then?

A.M.: Well, I found this interesting because it first started with America banning the use of dollars for Iran’s payments. And that meant that no Iranian Bank and no other bank trading with Iranian counter parties could operate a dollar account because under the Nostro/Vostro correspondent system, all those dollar accounts are actually in New York, and they can be vetted and banned from that point. So the Americans turning around and saying, “No dollar settlements for Iran” is a done deal. But then you have the SWIFT system based in Brussels, which does all international currency transfers, and that was stopped.

So you have a situation where Iran, a future member of the Shanghai Cooperation Organisation and major exporter of oil to China India and Turkey, cannot be paid for its oil in dollars or any other currency. So, Iran has had to resort to external settlements in gold. This is bound to spur China on to increase her own desire for gold over dollars. She’s probably producing more gold than the World Gold Council figures actually reflect. Anyway, I am sure that not only has she been accumulating all her own production but we know China and her citizens have been buying gold whenever it is offered from elsewhere. We also know that they have invested in gold mining capacity outside China, both in Australia and also Africa. Here we have a country which is quite evidently preparing itself for the time when gold comes back as money and paper money, at least in the West, becomes useless. And all China’s suspicions that this is going to happen have not been diminished by American’s treatment of Iran.

L.S.: Yes, exactly. And so India is now paying for Iranian oil with gold.

A.M.: Yes. As I understand it India’s trade with Iran works on a net settlement basis in gold. But having said that, the collapse of the Iranian rial must have dampened Iran’s imports substantially, so Iran is probably earning a lot of gold from its oil, some of which it’s not having to give up against foreign imports.

L.S.: Now we come to your expectations for 2013, and let us begin with silver. Would you agree with me that this is the most explosive market there is, not just compared to gold but compared to all other markets?

A.M.: Absolutely. You’ve got the banks’ short position on COMEX which cannot be covered. According to the most recent bank participation reports, the banks are short of nearly 300 million ounces of silver. When you bear in mind this is an industrial metal, the vast bulk of silver consumption from mining and recycling supply goes into biocides, solar panels, electronics, et cetera. You have only 100 million ounces annually left over for investors. The short position for the banks on COMEX is three times that 100 million ounces.

There’s no way this can be covered without a price rise sufficient to kill off significant industrial demand, because there are no strategic reserves to draw on. The only country which might have strategic reserves is China but otherwise there are no reserves. And I think that the only way in which the banks’ shorts could be closed out is after a price hike which would lead to billions of dollars of losses for these banks. There will be a market crisis, and I think that they will have to suspend trading in silver and agree a settlement procedure for long and short contracts. And if that happens, it will be well over $50 an ounce. But remember, other exchanges will continue to price silver if Comex suspends, which will not help Comex resolve the problem if the price continues to rise elsewhere.

L.S.: It’s also a very difficult situation for the European banking system, right?

A.M.: Yes, it is. Last year the election of President Hollande added to this crisis because he has taken France away from the path of austerity and reverted to old-fashioned central planning and socialism. The result is that very quickly the French economy is beginning to collapse. And France in my view is at least as bust as Greece, Italy or Spain and it’s only a matter of time before that is realised in the markets. I think that is certainly an important development for 2013. At some stage in 2013, I expect Eurozone residents to turn away from the euro in favour of gold.

More generally, I would say that the systemic risks for next year are the Euro-zone, Japan (which might surprise you but note that in Japan the dissaving from elderly savers is now getting to the point where it’s reflected in a trade deficit which will lead either to higher interest rates or a lower yen). So, those are two problems for the banks – you’ve also got the precious metals market which we have already mentioned and I think is going to be the big surprise for everyone. And I know that the response to the Eurozone and Japanese problems is central banks around the world will print whatever it takes to stop this affecting their banks and bringing the banking system down. The US economy, with higher taxes, seems certain to disappoint as well. Going into 2013 I do not see progress, only problems, and a global banking system that is constantly on the verge of collapse. And if the banking system goes down, you bring down the currencies as well.

L.S.: That’s likely for sure. Okay, and with this background, what do you expect for the gold market in 2013?

A.M.: I expect it to be considerably higher because I would expect it to reflect the increased systemic risks and the quickening pace at which the systemic risks are likely to develop. I think it is going to be truly frightening or could be truly frightening. That is the outlook; but in the short run we also have a systemic shortage of bullion in the West which can only be resolved with higher prices, far higher prices in the case of silver.

L.S.: One last question; one gold story of 2012 was of course that we saw much more discussion about the gold standard in comparison to the past. Do you think this will increase and how do you view this debate?

A.M.: I think the people who are pushing for a gold standard are just indulging in wishful thinking. I really do not see a gold standard working at all, because the fact of the matter is the central banks want the flexibility to continue to issue currency without any restrictions whatsoever. As soon as you bring in a gold standard, if it’s going to mean anything at all, you impinge on that flexibility. It won’t happen, I think you can forget it.

L.S.: Do you think in 2013 we’ll go further down the road of decline?

A.M.: I’m very, very pessimistic about where we’re going, Lars. I think eventually we’re going to have a complete breakdown in value for paper currencies. I think they will become valueless and it will give me no pleasure at all to be sitting on my savings in gold and silver at a time when everyone else is impoverished. That appears to be the prospect as we go through 2013 and beyond.

L.S.: That’s the sad truth. Nevertheless, I thank you very much for this interview!

A.M.: No, not at all, it’s my pleasure!

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Moreover, he is a Senior Fellow at the GoldMoney Foundation

Massive policy change means the beginning of the fall of Japan

The more things change, the more they stay the same

Dec 19, 2012

No, nothing new. More QE and gold goes down. In addition, another downpour of economic news that confirms the total inability of central banks and governments to provide any credible solution to what is a guaranteed road to perdition.

Investors worldwide are continuing to buy debt that yields nothing or virtually nothing from bankrupt issuers. The only thing that is guaranteed is that the bond market, which is the most over overvalued market in the world, will default. (more…)

Massive policy change means the beginning of the fall of Japan

Gold and Silver poised for major move.

December 10 2012

The major operators of the paper market in precious metals are using all the ammunition they have available to suppress the price of gold and silver. But they have an extremely powerful opponent in China which continues to increase the gold imports at a remarkable rate. In 2012 China has so far imported 500 tons of gold against 375 tons for 2011. Total Chinese production and imports for 2012 is 900 tons against 750 last year. (chart courtesy Nick Laird of chartsrus.com) (more…)

Massive policy change means the beginning of the fall of Japan

Advance to 12 minutes and 28 seconds into the video for this Max Keiser interview with Ned Naylor-Leyland of Cheviot Asset Management.

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

Massive policy change means the beginning of the fall of Japan

THE MATTERHORN INTERVIEW – December 2012: Ambrose Evans-Pritchard

“Europe and America will not allow deflation to take root”

We are extremely pleased to publish this ‘must read interview’ with the international business editor of The Telegraph, Ambrose Evans-Pritchard. I consider Ambrose to be one of the top financial journalists in the world and one of the few who really understands what is happening. In this exclusive Matterhorn interview with Lars Schall he talks about, among other things; his conviction that the United States isn’t dead yet; ; that China might not make it to the big league, the destructive nature of the EU against democracy; the upcoming bond massacre; why it is significant that central banks have become net-buyers of gold; the German gold reserves; his objections to a gold standard and his support for a “catallaxy of money” and much, much more. It is a long interview but it is packed with so many incredible insights that once you start reading you will not stop until the end.

Egon von Greyerz

Ambrose Evans-Pritchard, who was born in 1957, is the international business editor of the British newspaper The Telegraph. He was the Telegraph’s Washington bureau chief in the 1990s. In 1997 he wrote a controversial book about the Clinton administration, “The Secret Life of Bill Clinton: The Unreported Stories” (Regnery Publishing). In the same year he left Washington. Until 2004 he served as the Telegraph’s EU correspondent in Brussels. Before joining the Telegraph, he has worked for The Spectator (in Washington under Reagan/Bush I) and The Economist (in Latin America). Mr. Evans-Pritchard attended Malvern College, Trinity College, Cambridge University, and La Sorbonne.

Ambrose Evans-Pritchard, who was born in 1957, is the international business editor of the British newspaper The Telegraph. He was the Telegraph’s Washington bureau chief in the 1990s. In 1997 he wrote a controversial book about the Clinton administration, “The Secret Life of Bill Clinton: The Unreported Stories” (Regnery Publishing). In the same year he left Washington. Until 2004 he served as the Telegraph’s EU correspondent in Brussels. Before joining the Telegraph, he has worked for The Spectator (in Washington under Reagan/Bush I) and The Economist (in Latin America). Mr. Evans-Pritchard attended Malvern College, Trinity College, Cambridge University, and La Sorbonne.

By Lars Schall

Lars Schall: Mr. Evans-Pritchard, you have been a correspondent in Washington DC during critical years. With what kind of feelings and thoughts did you have when you finally left the US in 1997?

Ambrose Evans-Pritchard: Well, I have a great affection for the United States. I spent a large part of my early career in the 1980s into the 1990s in the United States, and also going back there a lot when I was working in Latin America, so there were times I was sort of becoming an American, very nearly did in fact decide to stay there.

I feel there a tremendous reserves of dynamism in the country and it is always a great mistake to write off the American people. We did it in the end of the seventies, early eighties with the Carter Malaise. I was there in the early eighties and the early Reagan administration. People thought Japan was going to take over the world, would be the dominant economy, and America was finished.

It proved completely untrue, there was a huge recovery and the US went on to become the sole world superpower by 2000. And now people are once again talking about America being finished and I think that’s very unwise, I think America will be the dominant superpower in the world in 2050. Probably throughout this century. I think the 21st century will be the American century just like the last one for all kinds of reasons.

L.S.: How important were the Clinton years that you have witnessed?

A.E.P.: In a way Clinton was symptomatic of a sort of moral decay that went on. I think this instant gratification culture of the baby boom generation which he so represented – reflected in the debt binge that occurred, with debt reaching incredible levels only achieved once before in US history at the end of the 1920s.

He represented that it was as if there were no consequences to your actions, that you could just do whatever you wanted, and the future would worry about itself. This was a president caught on camera committing perjury. He was testifying under oath, and there were no consequences to it. The senate decided not to convict him. They acquitted him basically, after the house impeached him, so there was no consequence to it.

He represented that it was as if there were no consequences to your actions, that you could just do whatever you wanted, and the future would worry about itself. This was a president caught on camera committing perjury. He was testifying under oath, and there were no consequences to it. The senate decided not to convict him. They acquitted him basically, after the house impeached him, so there was no consequence to it.

The feeling was, well, you can get away with anything. I think that was a very insidious era in America and they have sort of recovered from it; they are finding their moral bearings again. So he represented a baby boom era where you are not really answerable for what you do. But this of course went beyond America. We had the same kind of credit bubbles in Europe and in many different countries. It wasn’t just him, but he represented that.

L.S.: Should a major event that took place after you departed from the US, the repeal of the Glass-Steagal Act, be reversed?

A.E.P.: I think that was a terrible mistake. I think you should separate the ordinary high street banking that regular people use from the casino banking by the prop desks of these financial institutions. It was introduced in the 1930s precisely because this sort of concentration effect had been so destructive and you wanted to create fire walls.

So I think that was a huge mistake, but I would also say that I don’t really share the view that the banks were the cause of the great crisis of 2008/09 and the worldwide stagnation that we’ve had ever since. There are much deeper causes to it. The banks are simply the agents of this. The real cause of the massive imbalances is in the capital and trade flows that occurred under globalisation over the last twenty years – the China effect if you like. The surplus countries were building up huge foreign reserves and instead of recycling their surpluses as demand and buying goods, they were recycling it as capital and it was flooding the world economy. That is why there was so much money pouring into Spain and pouring into Iceland with no questions being asked.

You could get capital for nothing, and you could get capital for nothing because the emerging economies were accumulating ten trillion dollars of excess reserves, and it had to go somewhere. Furthermore, you had the Japanese leaking about a trillion through the carry trade into the system. You had all these sources of capital.

Part of the problem of globalisation was that it was slowly undermining the position of the workers in the developed world, in Europe and in America, and was causing a deflationary effect in these economies. The central banks of the western countries felt they could cut interest rates safely and hold them very low, at negative real interest rates in America, in Europe. That’s what caused the huge bubbles.

Part of the problem of globalisation was that it was slowly undermining the position of the workers in the developed world, in Europe and in America, and was causing a deflationary effect in these economies. The central banks of the western countries felt they could cut interest rates safely and hold them very low, at negative real interest rates in America, in Europe. That’s what caused the huge bubbles.

So this combination of this flood of capital coming from Asia, negative real interest rates by the Fed and by the ECB, and the combined effect of that was to create a massive credit bubble.

But if you go then into the roots of this, the real cause of our crisis is — and I hate to say this because people don’t really react very well — is excess savings. There’s too much savings in relation to consumption in the world, and when those two get out of balance as they did in the 1930s: you get into a slump/depression and you can’t get out of it until you put it back into balance

L.S.: Do you see indications for a change of thinking and action?

A.E.P.: None whatsoever. I mean, some of the imbalances are slowly being closed. The Chinese, the massive Chinese surplus, trade and current account surplus, is shrinking. China could even be in deficit within a couple of years which is an incredible thought. Nomura says their current account will be in deficit in 2014. So that part of it sort of solving itself.

The problem in Europe is that the big surplus states – and actually that’s Germany, it’s the Netherlands, outside the Eurozone that’s Sweden, it is Switzerland – are not recycling their surpluses, so they are still accumulating large surpluses that are not going back into the system. That is becoming incredibly destructive within monetary union where the surplus states are not recycling money back into the south to balance the currency system. The currencies have to balance. The whole system has a contractionary bias at the moment. All the burden of adjustment is being put on the southern states: essentially Spain, Italy, Portugal; they are all cutting and cutting and cutting. You’ve got this austerity spiral going downwards, but the northern states, the creditor states, are not offsetting this by stimulating demand.

So you have exactly the same situation you had with the gold standard when the gold standard went badly wrong in interwar years, when the surplus states did not recycle their surpluses and forced all the burden of adjustments on the deficit states, particularly Germany at that time; they suddenly cut off funding to Germany in 1928 and we all know what happened. Germany went spiralling into a depression, the reason being that America and France at that time were not balancing the system, they were not stimulating to offset it, that’s exactly what’s happening internally in the Eurozone right now.

So Germany is doing to Spain exactly what the US and France did to Germany in 1928 to 1933. They pushed Germany into five years of depression and ultimately the democratic system blew up as we all know. We had the famous Reichstag elections of July 1932, when the national socialists and the communists won half the seats; you had an unworkable government. Unfortunately exactly the same is now being done to Spain where you’re putting Spain into a five year depression. Basically, the system is going to blow up. They are repeating all the errors of the 1930s.

It’s not a Keynesian argument by the way. It is simply a mathematical argument that the currency union within itself has to balance, and if you force all these deficit states to contract and contract and contract then the whole system will contract, and that is what we are seeing. That’s why the Eurozone has gone back into a double dip recession, it is getting deeper and deeper and deeper, and why unemployment has reached 25.8pc in Spain, 25.4pc in Greece – and is going up and up and up. It could reach thirty percent in some of these countries by next year.

L.S.: We’ll come back to the eurocrisis in a minute. But before that: would a tougher regulation of the financial industry be the order of the day? And why don’t we see “sweeping reforms“ that would be worth that description?

A.E.P.: There are certain things you need to do for reasons of social equity. You need to control the bonus structure of the banks, the payoff systems they get when they screw up, and the golden handshakes of vast sums of money; this is undermining popular consent for free market capitalism, the political consent for our economic structure. If the bankers screw up they should basically have, whatever it is, six months severance pay or whatever you get under the normal system, same as any other citizen, same as any other worker for an ordinary company, they shouldn’t get the special golden handshakes, they shouldn’t get vast bonus structures written into their contracts regardless of what their annual performance is. The whole thing needs to be sorted out, yet I didn’t think that this solves the problem. That deals only with one aspect of it, which is people feel the whole system is unfair, is rigged in favour of these banking elite, it is operating as a cartel.

I think that does need to be dealt with.

However, you will not solve the global economic problem by cracking down on banks. I’m sorry, the opposite is the case right now. One of the reasons why we are not recovering from this slow motion depression is because banks are being forced to boost their capital ratios. The EU regulations are forcing them to put aside more and more capital – it is going up and up and up. That means they have to shrink lending basically. They are selling of assets and de-leveraging. I’m all in favour of doing that, but you do it during a boom, you don’t do it during a bust. You should be counter cyclical, not pro cyclical. This is a fundamental error.

They should have been doing this in 2005 and when the boom went on, we should have done it more in 2006 and then more in 2007. They should have done what’s called in central banking “leaning against the wind”. So as the growth of credit gets out of control, you should be stepping in there and fighting it. You throw everything you’ve got at it. Singapore, Hong Kong and others have been very good at this. What they’ve learned to do with their property markets is that they cut the loan to value ratio on mortgages – it goes to eighty percent then to seventy percent to sixty percent, fifty percent, until you basically can’t borrow anymore to get a mortgage because they simply shut it down. You can do these things, but these sorts of controls are for booms. When you’re in a bust, you do the opposite: you loosen up, you actually make it easier for banks. What they are doing right now is classic: they are closing the stable door after the horse has bolted, it’s too late.

They have so screwed up. The whole regulatory culture has made a total mess of it. They didn’t see the crisis coming, they allowed rampant credit growth, they allowed the shadow banking system to get out of control, they made so many mistakes – and then suddenly in panic they swing to the other extreme, they go wild and go do overkill at the worst possible moment, which is right now. That is another reason why the Eurozone is being tipped straight back into a recession. It is because the banks are cutting and cutting and cutting to meet their new targets.

There seems to be no joined up thinking about this; people are not thinking through what are the implications of the banking regulations for the rest of their economic policies. So you’ve got fiscal policy, you’ve got fiscal austerity, you’ve got monetary policy, you’ve got banking regulation, and they are all being pursued independently of each other. Nobody is sort of thinking how do these interrelate, and this is the critique I have. So yes, I’m all in favour of having a very tough enforcement of excess credit and this crazy casino banking stuff that goes on during booms, but you do it in a boom and only in a boom.

L.S.: Is it fair to call the City of London, as some people do, a cesspit of financial fraud?

A.E.P.: I think whenever you’ve got three hundred and fifty thousand people thrown together in one place whose main function is to make money, it is going to happen, isn’t it. This is the sad bit, I guess it was ever thus. But there were also periods of incredible dynamism for the global economy. That’s why the agricultural revolution began in England. It’s why the industrial revolution began in England and then spread around into Europe and around the world. It was the motor of all of this incredible growth, yet you could also call it financial excess.

If you subscribe to Schumpeter’s theory of creative destruction, you have big booms, and these big booms generate quantum leaps as in technology investment, and in the way an economy functions, and then you have a big bust and you clear away the dead wood – and then you start again. In aggregate it is a very brutal way to do things and on the whole I’m not in favour of big busts, but that sort of system has been quite successful over the centuries.

I get the feeling now people want to eliminate it. They think because there is a boom and bust therefore it is bad; well, it can be, but the booms and busts are actually a hell lot better than stagnation, which is the alternative if you’re overregulated. So I’m suspicious of the overregulation drive frankly. I need to be careful what I say here but I detect a little bit of a kind of scapegoat hysteria going on with the bankers, and there’s a side of me, as soon as I hear that, as soon as I feel people are targeting certain groups of the population and sort of blaming them for things in an indiscriminate way, it makes me think of pogroms, and it makes me uncomfortable. Therefore, I’m not really willing to join this jihad against the banks. I’m suspicious of it. I think what lies behind it obviously often is a human emotion that shouldn’t be unleashed.

L.S.: Let us go back to the United States. What are your thoughts nowadays vis-à-vis the US? Do you see the country as a declining power, or do you believe that for example the developments in the US oil industry can be taken as a sign that there’s life in the old dog yet? (1)

A.E.P.: Yes, I think there is a lot of life in the old dog yet. They had the shock of their lives in 2007/ 08, when they had the huge energy and oil price rise, when it got to $147 a barrel, they suddenly felt incredibly exposed. Their current account deficit was huge, much of that was imports of fuel; they became very reliant on essentially unfriendly countries that supply them with the energy and it just freaked them out. So they are really throwing everything at it now to achieve energy independence, they are doing everything; windmills, solar power, shale gas, whatever it takes, they don’t care. It is not religious, anything will do the job and they are really going for it massively.

The Energy Department there has all kinds of projects going on, and yes the Americans, when they put their minds to something, and they throw resources at it, they tend to deliver. They can be complacent, they can be slow, but finally when the penny drops and they realize there is a big problem, when they throw all their weight behind it, then they deliver and we are seeing it now with energy.

We just heard the International Energy Agency saying the United States would overtake Saudi Arabia by 2017, which is only five years away, to become the world’s biggest oil producer, essentially because of the shale gas and shale oil revolution. Because of shale gas they will be very soon self-sufficient in gas and they will probably become a net exporter of gas before long– so the whole energy structure of the world is changing. Natural gas prices in America are about a third or a quarter of prices in Europe, and about a fifth or sixth of prices in Japan. That gap will narrow, but because there aren’t enough plants to ship liquefied natural gas you can’t transport this gas very easily, this gap is going to remain for a long time. This could be a huge advantage to the American chemical industry, the American plastics industry and the American glass industry, to half a dozen industries where America will have a structural advantage for probably ten to fifteen years over competitors in Asia and in Europe.

We just heard the International Energy Agency saying the United States would overtake Saudi Arabia by 2017, which is only five years away, to become the world’s biggest oil producer, essentially because of the shale gas and shale oil revolution. Because of shale gas they will be very soon self-sufficient in gas and they will probably become a net exporter of gas before long– so the whole energy structure of the world is changing. Natural gas prices in America are about a third or a quarter of prices in Europe, and about a fifth or sixth of prices in Japan. That gap will narrow, but because there aren’t enough plants to ship liquefied natural gas you can’t transport this gas very easily, this gap is going to remain for a long time. This could be a huge advantage to the American chemical industry, the American plastics industry and the American glass industry, to half a dozen industries where America will have a structural advantage for probably ten to fifteen years over competitors in Asia and in Europe.

We’re seeing ethylene plants being built in the United States now in Texas, Pennsylvania, places in old Rust Belt, they are being re-industrialised even as these ethylene plants are being shut down in Asia. I saw that the head of BASF, one of Europe’s great chemical companies, saying that they simply can’t compete with the US any longer on shale gas prices. It’s becoming a huge problem for Europe.

Europe needs to sort itself out. It does not have a proper energy policy. It has a sort of incoherent wish list. In Germany in particular they are taking a huge gamble by shutting nuclear plants and relying on wind. German industry faces very high electricity prices for the next ten to fifteen years that will frighten away investment. The US shale revolution is cascading right through the manufacturing industry. There are probably three million extra jobs that will be created in the next six years as a result of this energy advantage in the United States. You will get re-industrialisation.

I think that when historians stand back and look the damage the US suffered in 2008/09 with the Lehman crisis and financial bubble, they’ll see it wasn’t as deep as people thought. In fact the property market, I think, has already cleared. I mean, prices are now back below normal levels of affordability in the US. Price to income ratios have fallen right back. At the same time the dollar has come down to levels where it is really quite competitive, so I don’t see anything that will hold the US back.

Their public debt is much too high, that is a big problem. But their private debt is coming down very fast, unlike Europe where it is not coming down at all. We have an interesting laboratory experiment going on right now on over the best way to bring down debt. Do you bring down debt by just having massive austerity? Or do you bring down debt by maintaining enough growth to grow your way out of your debt? is actually that more efficient way to do it? We’re seeing this tested on each side of the Atlantic at the moment, it is a very interesting debate but it is kind of complex.

L.S.: There’s another complex problem, and that is the relationship between the US and China. Do you think the days of “Chimerica“ are coming to a close?

A.E.P.: I do actually. I think it’s quite worrying. When Obama took over, he decided to make a big effort to bring China into the global system as an equal partner at the G20, bringing China into the World Bank and the IMF as equal players, basically make them stakeholders in the whole system, and working very closely with them, and I thought it was basically the right policy actually. I know many people in America wanted a much more confrontational style but I thought that would be foolish.

The great risk is doing to China what Britain and others did to Germany before the First World War when you had this great rising force, this huge industrializing Germany – I mean, Germany’s growth levels in the period from about 1880 to 1910 was comparable to China today. It was an incredible growth period, I mean, really explosive levels of growth, and the correct way to handle that should have been to draw Germany as much as possible into the family of – well, it was already part of the family of nations, but draw it into the governing system — and we all failed. They didn’t handle Germany well, and they created misunderstandings which fed on themselves, and eventually flew out of control. We all know what happened, and I think the risk is that this would be repeated with China.

What concerns me right now is the dispute that China is having with all its neighbours basically over islands and territorial claims in the South China Sea and the East China Sea. I was told by a Chinese professor that you are starting to see some of the `Japanese officer’s syndrome’ in the Japanese army in the 1930s when these militant, quite aggressive officers were simply slipping control of the political authorities, and famously invaded China without the authorization in 1931; they got bit between their teeth and just charged off and essentially launched an invasion. The difficulty is you are starting to see some of these attitudes creeping into the mid-levels of the Chinese army and navy, and that is a problem, as they rise to higher ranks. For fifteen years you’ve a deliberate policy of `patriotic education’ by the communist authorities in China essentially trying to sort of revive their legitimacy by switching from Maoism, which had lost its potency, towards nationalism.

What concerns me right now is the dispute that China is having with all its neighbours basically over islands and territorial claims in the South China Sea and the East China Sea. I was told by a Chinese professor that you are starting to see some of the `Japanese officer’s syndrome’ in the Japanese army in the 1930s when these militant, quite aggressive officers were simply slipping control of the political authorities, and famously invaded China without the authorization in 1931; they got bit between their teeth and just charged off and essentially launched an invasion. The difficulty is you are starting to see some of these attitudes creeping into the mid-levels of the Chinese army and navy, and that is a problem, as they rise to higher ranks. For fifteen years you’ve a deliberate policy of `patriotic education’ by the communist authorities in China essentially trying to sort of revive their legitimacy by switching from Maoism, which had lost its potency, towards nationalism.

Unfortunately it has now become something that is very hard to control. We are seeing these kind of orchestrated showdowns in the East China Sea, and Japan has got an extremely tight defence alliance with the United States. The US is bound by treaty to defend Japan if those islands are attacked. So this is where it is getting very, very dangerous.

Two things could go wrong here: firstly, you’ve got Japanese nationalists, who could over play their hand and just drag America into a conflict that America does not want. Secondly, the Chinese are using this dispute to test America’s resolve. They are trying to see how will America react: will America stand behind Japan or will it sort of take a much more nuanced position? So they are testing America, they are testing America’s resolve in the region and whether America will stand behind its allies. I think this is all potentially very dangerous and I think it is much more dangerous than anything happening in the Middle East.

L.S.: But then again we saw that the Chinese and the Japanese are now trading in their own respective currencies. (2) Do you see that as significant?

A.E.P.: The Chinese have been buying Yen bonds for quite a long time. They have been wanting to diversify their holdings and diversify their trade patterns away from the dollar. The fact that trading in different currencies takes place, I don’t think it is necessarily that tells us that much. We’re seeing a complete collapse in Japanese car sales in China. I mean, it’s dramatic. There was a 40pc to 50pc collapse in Honda and Toyota sales for October.

Essentially you’ve got a boycott of Japanese cars in China, you’ve got people in provincial cities in China driving Japanese cars being pulled out and being beaten up by mobs. To what degree this is being encouraged or at least to what degree are the authorities acquiescing and turning a blind eye, I don’t know; but it is going on and you’ve got a de-facto economic war between the two countries. So this to me is what is in front of our eyes, it is undeniable. Is it just a temporary flare up or is it something deeper? I don’t know, but it shows is how volatile and dangerous this is and how it can very quickly get out of control.

L.S.: Will China remain the economic engine for growth in the world, or do you expect a hard landing for the People’s Republic?

A.E.P.: I think they already had a hard landing. I think it occurred in 2012. I think they jammed on the breaks. They had this massive property bubble, as you know, in the East coast cities like Beijing, Shanghai. They jammed on the breaks. I might add by the way that the credit growth in China as recorded by the IMF was about a hundred percent of GDP in five years from 2006 to 2011. Now that is twice the level of credit growth to GDP that occurred in Japan in the five years before the Nikkei bubble burst in 1990 and in the five years in the US before the sub prime bubble burst in 2008. So this is a huge level of credit growth. I mean they had an explosive bubble in China and a lot of people leapt on this thing and thought it was going to go on forever; it’s not.

We have a combination of two things; a classic catch-up growth story as they took away years of blockages under the old communist system, and unleashed all this massive energy. It was based on cheap labour and imported technology, it’s classic. They then pushed it in a latter phase by massive credit boom. It’s fairly conventional catch-up story. Its not some special Chinese way; they haven’t found some miracle cure; we’ve seen it before in many countries, and then they hit the rocks. China started to face infiltrate. It hit the brakes in late 2011, and then in 2012 we’ve had basically a hard landing. Probably growth is negative if you look at electricity use, freight, rail freight, what is actually going on in China rather than the official data.

Probably you are going to get some kind of temporary recovery, they are stepping up a lot of spending now on infrastructure projects, stepping up banks are lending again and massive investment in the railways is picking up again, in all the regions they are spending a lot of money like confetti to try and stimulate their economies. So there’s going to be another spurt of growth for a while.

The question is, over the long run, can they sustain anything like the kind of growth rates they had for the last thirty years, I don’t believe so. There is a report that came out earlier this year by the World Bank and China’s development research council, which is the Bible of reformers such as China’s Premier Wen Jiabao, and they warned that China was going to fall into the `middle income trap‘, the trap that has ensnared so many countries that seemed to be on the cusp of a breakthrough into the upper league before they faltered and hit this invisible glass ceiling and just fell back. They warned that China has reached this moment now, the thirty year growth model they had – relying on exports, massive investment, not enough consumption at home, imported technology – has basically run its course. Its low hanging fruit has been picked already, and basically if they are going to make it to the next level, the breakthrough that Korea has made and Japan has made, then they need a second economic revolution, they need to open up the system, they can’t be top down. Creativity at the technology frontier is a completely different game.

You can’t do it by central planning. You have to unleash market forces and no authoritarian state has done it yet. It was quite a dramatic report and the new Premier who has just come in in the last few days, Li Keqiang, said he offered his unwavering support. Unfortunately we’ve just seen the line-up of the new standing committee and it’s backed with conservatives. By conservatives in China I mean dinosaurs. I mean people who want to maintain the old behemoths, the big state enterprises. It’s a way for party bosses to control their regions. Many of them are loss making, they are very unproductive, fantastically wasteful of investment; they are a dammed disaster basically. They worked for China’s development ten to fifteen years ago; now they’ve become the problem. China has to get rid of them. Unfortunately it looks as if they’ve promoted people who want to protect that whole system, so I’m afraid that the message we had from the eighteenth party congress in Beijing, which has just finished, was not optimistic at all.

I believe that China’s economic destiny is in doubt now. For the next 20 years, the decisions they make today will determine whether they make the breakthrough to the big league, with per capita income sort of reaching western levels, or whether they just get stuck in the trap. I think it is still open, it can still go either way, but if they continue with the current system and get away with tinkering, I don’t think that they are going to make it. Then they are never going to close the gap with the United States, and then they will grow old with a massive demographic crunch hitting later this decade and then accelerating in the 2020s; they will get old before they get rich.

L.S.: The BRICS nations are increasingly unsatisfied with the international monetary system. Is this justified?

A.E.P.: I don’t have much sympathy for this. China pegs its currency to the dollar, it doesn’t have to peg it’s currency to the dollar. It could do what other countries do and have an independent floating currency and then it wouldn‘t have any of these problems, it wouldn’t then be importing American monetary policy which was too loose for them 2009/2010 when America cut rates to zero; it basically imported this monetary policy, causing a huge inflationary surge in China. Well, that is their own policy and they didn’t have to do it. Countries that peg their currency to the dollar and then complain about the Federal Reserve cutting interest rates; frankly, I have no sympathy for that whatsoever.

A.E.P.: I don’t have much sympathy for this. China pegs its currency to the dollar, it doesn’t have to peg it’s currency to the dollar. It could do what other countries do and have an independent floating currency and then it wouldn‘t have any of these problems, it wouldn’t then be importing American monetary policy which was too loose for them 2009/2010 when America cut rates to zero; it basically imported this monetary policy, causing a huge inflationary surge in China. Well, that is their own policy and they didn’t have to do it. Countries that peg their currency to the dollar and then complain about the Federal Reserve cutting interest rates; frankly, I have no sympathy for that whatsoever.

And then the case of Brazil, for example, where Montega, the Finance Minister, is always going on about currency debauchery, or currency wars. It’s a complete cop-out. The reason why the Real in Brazil was much too strong was because of the completely inappropriate policies in Brazil. Essentially they were running a fiscal policy, budgetary policy that was much too loose, and therefore, to avoid inflation, the Central Bank was having to ramp interest rates up into the stratosphere to double digit levels to choke off the inflationary consequences of the government’s overspending. That caused a lot of money pouring into the country under the carry trade to take advantage of the high interest rates in Brazil. It was an entirely self-generated problem. So no, in answer to your question, I have no sympathy whatsoever for these people complaining that the currency system in the world is not working for them. They are simply deflecting blame from their own internal mismanagement.

L.S.: Since you’re very familiar with South America, what do you think about the “estrangement” of some major countries there (Brazil, for example) towards the US?

A.E.P.: Brazil is kind of losing its way, and I think people who deal with Brazil are quite concerned about this protectionist lurch that occurred. We’re returning from a period where they had a lot of free market reform towards policies that I think are entirely self-destructive. Brazil has not gone nearly as far down that road as Argentina, Venezuela and Ecuador, but it is beginning to edge into areas that are going to hold back Brazil and ensure that Brazil also gets stuck in the middle income trap.

The truth is they had a huge growth rate surge over the last ten years during the commodity boom, which is partly over for the time being. Iron ore prices have come right down, so it’s not quite as glorious for Brazil any more. They didn’t use that money very well; they didn’t spend it on dealing with the massive infrastructure problems, which in many respects are still third world, and now they are turning protectionist to deal with the consequences, they didn’t become properly competitive during that period. So I’m slightly concerned about the way they are developing.

I suppose what I’m saying is the whole BRICS story is overblown. I’m old enough to remember the 1970s when Latin America was doing really well and it was all due to the oil boom and the commodity boom and it looked for a while as if they were going to sort of catch up the west, catch up Europe and America and per capita levels of income, but then it all just fizzled up, price of oil came down, commodities came down, it all fizzled up and then they had to deal with the consequences for ten years and they had a lost decade in the eighties and it all came down to earth.

I don’t think it is going to be that bad this time, but I think they are coming back to reality. People got ahead of themselves on the BRICS story. They thought something profoundly new had occurred and it hadn’t. It was just one of those cycles, you have commodity cycles through economic history and then it settles down. In terms of your political question, I’m not quite sure I understand what you were driving at there.

L.S.: Well, some countries such as Venezuela do not have the kind of close relationships with the US that they used to have, and I think the same is true for Brazil.

A.E.P.: Yes, I mean, America’s relationship with Latin America has always been schizophrenic; you know the Monroe doctrine. They sort of basically declared it to be their backyard and no other country should interfere, and then at different times when they took over of those countries – Nicaragua, Honduras, Panama. In Mexico we’ve had this conflictive history for two hundred years; the US actually seized a large part of Mexican territory in 1848, the famous treaty of Guadalupe Hidalgo, and the whole of California and New Mexico and so forth all became part of the United States.

And so these wounds are still there and frictions continue with a very strong anti-immigrant movement as you know in the United States. It has become quite aggressive and it seems to be directed against Latinos because that is where a lot of the immigration is coming from. It has created this cultural hostility. It is the big brother syndrome and resentment against being pushed around, it is always there, it will always come back until such a time as Brazil fully gets its act together and claims it’s place, which it is perfectly capable of doing, as a complete equal of the United States.

L.S.: Now we are coming back to the Euro crisis. Is this problem the biggest danger for the global economy right now?

A.E.P.: Absolutely. I mean this thing has not been resolved. They’ve been buying time. The fundamental issue is that several of these countries in my opinion are not solvent. There’s been a pretence that somehow this is going to be solved without anybody taking any losses, but it can’t be, I’m afraid, and the reality is that at some point Angela Merkel is going to have to go to the Bundestag and explain why she has lost fantastic amounts of German tax payer’s money. The same is going to happen in the Netherlands and so forth and the parliaments of these creditor countries in the Eurozone. At the moment everybody is trying to deny, they are trying to kick the can down the road a little bit longer, but the essential problem is currency misalignment between North and South Europe; they should not be in the same currency.

That is a fundamental problem, there is a huge competitiveness gap, they are trying to solve it by enforcing austerity on the South through what is known as internal devaluations. That is an incredibly destructive way to do it because the way an internal devaluation works is to push up unemployment levels to such excruciating levels that you break the back of labour resistance to pay cuts, but to do that first of all you have to create a massive social crisis, and in democracies people don’t take very kindly to that. And secondly an internal devaluation forced upon countries with a very high debt level means you are shrinking the underlying economy, but the debt remains the same, so the debt to GDP ratio continues to rise. It’s been absolutely classic in Greece. The more they cut, the bigger their debt gets, the opposite effect of what was intended.

Normally with an IMF program, when they go into a country, they say right, there are three things. One, we have big austerity, fine. Two, we have devaluation of 30pc or 40pc. Three, we have a debt restructuring, we cut back some of the debt and on that basis we can rebuild a country. In the case of the Eurozone the IMF wasn’t allowed to do that so they had to keep Greece in the Eurozone. They couldn’t violate the sanctity of the Euro Project, so they had to keep Greece in the Eurozone. There could be no devaluation. They had all the austerity, but without the cure which is the 40pc devaluation that Greece needed, and we didn’t even have the debt restructuring for a long time. Eventually we had part of it in the private sector but they didn’t do enough, it wasn’t big enough. The public creditors, the governments in northern Europe, have not taken any haircut yet, and until they do you are not going to solve Greece’s problems.

But Greece is just the first of these countries; it went into this downward spiral two years before Portugal. I’m not yet convinced that Portugal is different. The thing to remember about Portugal is that its total Debt/GDP level, private debt + public debt, is actually more than 100% higher than that of Greece. Company debt in Portugal is enormous. Household debt is enormous. The Greeks are actually quite frugal in comparison. Greece’s combined debt level when this crisis began was one of the lowest in Europe, don’t forget that.

So I don’t think the situation is being resolved in Portugal at all, and then you get the big ones of Spain and Italy. I think it could have been perhaps manageable if the policy settings of the whole Eurozone had been much more expansionary, in other words if they had QE from the European Central Bank early on. You wouldn’t have had the same level of contraction, you wouldn’t have had the same level of the debt crisis, you would have made the whole thing much easier. But we are where we are right now.

The people in the City (of London) who are tracking this very closely think Spain is going to need debt restructuring because it got many of the same problems as Greece. It is going into the spiral where despite all the cuts Spain’s budget deficit is hardly coming down at all. It is down to be about eight percent, but nowhere near what they originally thought. They keep miscalculating.

What they misunderstood and what the IMF has now come out to clarify, is that the fiscal multiplier is much higher than they thought. For every one percent of fiscal austerity you are going to get 1.5pc of contraction. This is self defeating and that is the problem. They are in a self-defeating downward spiral and I think the IMF, if you look at their new work on fiscal multiplier, have undercut the whole intellectual underpinnings of the Eurozone’s response to this crisis. If you tighten your belt with a fiscal multiplier so high you are actually making it worse, you are not making it better. In Brussels and Berlin they are still in denial about it.

L.S.: Why do you view the EU project per se with very critical eyes?

A.E.P.: Well, first of all, I’m not against having an EU doing certain things. The problem is that the historic nation state is the natural forum of democracy in Europe. It has tried and tested institutions, institutions that are understood by the citizens and command their respect. You don’t achieve democracy by switching this to Europe. The problem is that they are concentrating more and more power in a structure that does not have any viable, working democratic institutions. You can try and pretend, you can create a European parliament, but in reality the European Commission, the executive arm of the EU, is not accountable to the European parliament, and nor is the European Council accountable to European parliament.

You’ve got a completely undemocratic structure, accumulating more and more power, and I don’t see how that could ever be made to function. You could make the whole leap forward to complete political union, you could replicate the United States with a genuine European parliament and an elected European president and so forth, but I think it is unworkable because there is no unified European people. There is no single language, there is no single way of looking at things, there is no shared political culture, it is a completely absurd project, and highly destructive for democracy.