What’s Next For Gold As Governments Become More Desperate

King World News – Nov 10, 2012

With gold and silver moving higher this week as stocks were trounced, today, Egon von Greyerz lets King World News readers know what to expect for the rest of this year as well as for 2013. Here is what Greyerz had this to say: “We are entering one of the most worrying times in history, maybe even for centuries or even for a millennia. I think we are going to see a turn in the world economic situation that is going to be long and extremely difficult.”

Read full Goldfinger article on KWN

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

What’s Next For Gold As Governments Become More Desperate

GoldSwitzerland News – Nov. 2012

Egon von Greyerz was recently in Sydney where he was a keynote speaker at the Gold Symposium. The title of the speech was “A Delusional Century”. Egon discussed why the last 100 years will be looked upon as an exception in history and the end of a major delusional era.

This excellent conference was attended by 600 enthusiastic precious metals investors.

During the visit Egon was interviewed by Financial News Network about the background to Matterhorn A M’s/GoldSwitzerland’s mission to assist investors in preserving wealth. Click here to view.

What’s Next For Gold As Governments Become More Desperate

Press: Release Nov 9, 2012

Matterhorn Asset Management/GoldSwitzerland has teamed up with Goldbroker.com to enable investors to buy and store physical Gold and Silver.

GoldSwitzerland, the Precious Metals Division of Matterhorn Asset Management, enables investors to buy allocated and segregated physical gold and silver stored outside the banking system from an starting value of approximately 200 oz of gold.

GoldBroker.com offers the same unique service for investors from Swiss Francs 5,000 (Euro or US$ 5,000). The Gold and Silver bars are allocated and segregated and held in name of the investor who has direct control over the precious metals holding in the vault.

Through GoldBroker.com, as with GoldSwitzerland, investors have personal access to their stored precious metals.

This new cooperation meets GoldSwitzerland’s desire to enable both smaller as well as larger investors to protect their wealth.

Goldbroker’s primary market is France. The company also operates in several other European countries and in the USA.

For Investment from 5,000 in CHF, USD or EUR:

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

What’s Next For Gold As Governments Become More Desperate

King World News : Nov 6, 2012

With gold, silver, and the entire commodity complex on fire today, Egon von Greyerz told King World News, “…the physical buyers are continuing their aggressive purchases.” Here is what Greyerz had this to say: “Eric, this is just the action that I’ve been predicting for a while. I expected the pressure to last until the election. It’s clear that November will be a strong month. This is the start of the big move. This is the start of the move that will last until at least next summer before a major correction.”

<a href=”http://archive.kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/6_Greyerz_-_The_Gold_Train_Is_Picking_Up_A_Head_Of_Steam.html”>Read Full Interview on KWN…..</a>

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

What’s Next For Gold As Governments Become More Desperate

King World News Nov 1, 2012

Part II

Earlier today King World News published the extraordinary chart sent exclusively to KWN by Egon von Greyerz. In part II of his interview, Greyerz, who is founder and managing partner at Matterhorn Asset Management, discusses the incredible chart, and gives readers a shocking price for gold which is based on that ‘cubed’ chart.

Here is what Greyerz had this to say in Part II, along with his comments about the fascinating chart: “I discussed the real over-the-counter derivatives earlier, which stand at $1.1 quadrillion, and this is worldwide. Every time there is a problem in a bank it seems to be derivatives related, such as what happened with JP Morgan which recently lost $5.6 billion, and UBS which lost $2.3 billion.”

<a href=”http://archive.kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/1_Greyerz_-_Gold_%26_The_Incredible_Financial_Destruction_We_Face.html”>Click to read full interview on KWN….</a>

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

What’s Next For Gold As Governments Become More Desperate

King World News , Nov 1, 2012

Part I

Today Egon von Greyerz sent King World News one of the most important charts you will ever see. Greyerz, who is founder and managing partner at Matterhorn Asset Management, demonstrated, in this one chart, the incredible danger facing the global financial system and why gold will explode higher in price.

This is the first of two interviews KWN will be releasing with Greyerz today. Here is what Greyerz had this to say in Part I, along with his chart: “If I look around the world, the problems continue. China has yet another round of QE totaling $60 billion. China is under real pressure. And if you look at ArcelorMittal, which is the biggest steel producer in the world, and for them China is a massive market, they had a 20% decline in sales in Q3.”

<a href=”http://archive.kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/11/1_Greyerz_-_One_Of_The_Most_Important_Charts_Ever.html”>Read The interview on KWN….</a>

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

What’s Next For Gold As Governments Become More Desperate

KWN (Audio) Interview Oct 26.

In this important King World News interview I talk about two of the main drivers which will catapult gold higher.

Central Banks worldwide are refusing to have public audits of their gold holdings. In addition many of the Central Banks don’t hold their gold in their home country. I have been saying for years that Western Governments are unlikely to hold anywhere near the 23,000 tons that they officially hold. And the reason why gold holdings of many countries are held in London or New York is that the gold has either been sold or leased to the bullion banks in order to depress the price. There is now more pressure in many countries for a full audit of gold holdings. Once the market realises that central banks don’t hold the gold they officially declare, there will be a total mistrust in the system. At that point very few will trust paper gold or even gold within the banking system which could be encumbered and owned by a central bank. This will have major upward pressure on the gold price.

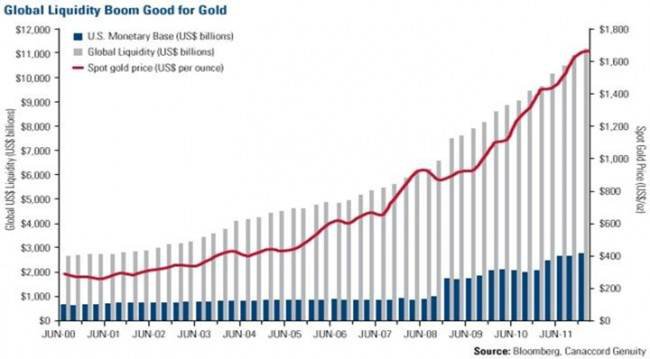

Government deficits spending and borrowings will continue to grow dramatically, worldwide, in the next few years. No government can or will introduce austerity measures. Firstly any party suggesting austerity will be thrown out and secondly the problem is now so big that an austerity program would have zero effect. There are two important graphs in the written interview. Both these charts show that government borrowings in the USA and worldwide have now entered a parabolic phase. And as the graphs clearly illustrates, the gold price is closely following the growth of debt. So as the deficits accelerate in the next few years, so will the physical gold price.

In conclusion, it is very difficult to see any factor that could stop a continued very strong rise of the physical gold price.

Click here to go to the KWN Audio interview

Click here to read the Interview on KWN

Egon von Greyerz

October 29, 2012

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

What’s Next For Gold As Governments Become More Desperate

THE MATTERHORN INTERVIEW – October 2012: John Butler

In this second October Matterhorn interview I am very pleased that Lars Schall had the opportunity to meet up with macro economist John Butler.

John Butler, who is founder and Chief Investment officer of the Amphora Commodities Alpha Fund, explains in this exclusive interview, inter alia: what he sees as the consequences of the global financial booms and busts; why the fraudulent environment of finance does not surprise him; what enhanced the “Great Depression 2.0;” and why both gold and silver experience a renaissance in the monetary system.

Egon von Greyerz

“Commodities represent a real alternative store of value”

By Lars Schall

John Butler, who studied economics, history, philosophy and international politics, has worked for over 15 years as an interest rate, currency and commodity strategist at major investment banks in North America and Europe prior to founding his own independent investment and advisory firm, Amphora Capital. He was Managing Director and Head of the Index Strategies Group at Deutsche Bank in London, and Managing Director and Head of European Interest Rate Strategy at Lehman Brothers in London. While at Lehman Brothers in the mid-2000s, he was ranked #1 for Interest Rate Strategy in the Institutional Investor Survey.

Lars Schall: Mr. Butler, why did you become interested in finance, and how did you eventually ended up being a professional in that industry?

John Butler: My interest in finance was originally academic. While studying economic history I found that international finance was not well covered or understood. How were major industrial innovations and developments financed? What about wars or revolutions? The history books tend to gloss over this. Yet finance is absolutely central to history, to the modern, global economy and, by extension, international politics.

My academic interest in finance became a professional interest when I made the decision not to pursue an academic career. It was the early 1990s and the real world opportunities in finance seemed much better. So I found the best job I could, at Bankers Trust in New York, and from that point forward took the best opportunities that came my way. By 1995 I had moved to Germany, then I moved back-and-forth between banks in Germany and London for nearly a decade before settling in London. My primarily responsibility was for investment strategy but I also became involved in product development.

Along the way, however, I became highly disillusioned with the financial industry, observing numerous examples of what I believed to be myopic, excessively risky or even unethical behaviour. By the time the financial crisis hit in 2008 I had already decided to take leave from the financial industry in order to consider how I could use my knowledge and experience to become part of the solution, rather than remain part of the problem. My Amphora Report newsletter, and book, The Golden Revolution, are my most important contributions to date although I have more in the works.

L.S.: Is our current situation very different from anything you have seen in the past?

J.B.: Well my direct experience of finance only goes back into the early 1990s, although I do have an academic background in economic history. A historical perspective reveals a number of interesting parallels with today. There have been documented financial booms and busts going back centuries. There have been experiments with paper money, with leverage and securitization, with what we call today ‘financial engineering’, and with many forms of speculative excess. But while there are certain parallels, what is happening today is truly global in nature. The boom and bust of modern times, and the policy responses thereto, extend across the entire world. The linkages are massive and, for those concerned, there is not really anywhere to hide.

L.S.: Is the world marching into a Great Depression 2.0 – and if so, why?

J.B.: When future historians chronicle and analyze our era my guess is that 2008 will be seen as similar to 1929 and 2012-13 will be compared to 1931-32. So depending on how you define ‘Great Depression 2.0’, you could argue that we are already there. Things may not get dramatically ‘worse’ now from an economic growth standpoint–in the US of the 1930s the nadir in industrial production was reached in 1933–but the period of generally weak economic performance will be prolonged and huge elements of society will discover that their standard of living has declined substantially. That will be a rude shock for most.

L.S.: Could it still be prevented – and if this is the case, how?

J.B.: An economic de-leveraging of historic proportion cannot be prevented. It is necessary to correct imbalances, re-allocate previously miss-allocated resources and rebuild savings. This will take years regardless of whatever policies are in place. The damage already done is great, both prior and subsequent to 2008. The best thing that policymakers could do from this unfortunate point forward would be to acknowledge the failure of neo-Keynesianism–debt- and consumption-led growth–and to tear up those institutions and policies that have made the disaster possible, namely modern central banking (money manipulation, often for political purposes), huge hidden subsidies for financial leverage (embedded in the regulatory structure) and huge disincentives to save (in the tax code).

L.S.: Is the fraudulent environment of finance nowadays something that surprises you?

J.B.: No. When you look at history you find that essentially all financial booms and busts are associated with unusually high degrees of fraud. During a bubble, the evidence of fraud is obscured by monetary manipulation and a generally rising asset price level. Indeed, those inclined to fraud are lured into ever more aggressive forms when they sense that their activities are being ‘cloaked’ by the bubble. And the leadership of financial institutions becomes populated with those individuals who take the greatest risks, as they temporarily reap the greatest rewards and receive rapid promotion through the ranks. They may not engage in fraud per se but they do take excessive risks with their institutions and then end up lobbying for taxpayer bailouts when times get tough, denying their own responsibility in the matter. As I argue in my book, regulations won’t solve this moral hazard problem. Indeed, regulations, including notably central banking itself, create this moral hazard problem!

L.S.: How do you think about the bailouts of investors by taxpayers?

J.B.: If there is a single development that made 2008 the beginning of a ‘Great Depression 2.0’ rather than just an unusually severe recession, it is the bailouts of investors by taxpayers. Given the scale involved, this is the single most damaging thing that has ever been done by policymakers to the global economy. A huge portion of present and future resources–labour and capital–has been diverted from potentially productive uses to failed financial institutions and governments, concentrating wealth in those institutions that took excessive risks and are now sitting on bad legacy assets.

The future worker, entrepreneur or saver, who could have contributed to a resumption of healthy growth in future will now need to be taxed (directly or via inflation) more heavily than before and will not be able to contribute to future economic progress to as great a degree. It is a great tragedy both at the individual level–where so many middle-class dreams are becoming nightmares–and at the societal level, where potentially large future economic advancements will be delayed indefinitely.

L.S.: Why did you become increasingly involved in the commodities sector?

J.B.: When central banks make it a matter of policy to debase their currencies as required to reliquefy their financial systems and bail out failing institutions, currencies can no longer function as stores of value. They might provide liquidity and be useful for day to day transactions but they no longer constitute a legitimate savings vehicle. The same is true of their bond markets. These might provide a basis for temporary interest-rate speculation but not for real wealth preservation: A future currency devaluation could wipe out all gains in bonds in a single day.

Commodities represent a real, alternative store of value, one that cannot be arbitrarily printed or devalued by governments. Gold and silver were long used as money because they could be trusted as stores of value but to some extent this characteristic is shared by essentially all commodities, some others of which have also been used as money from time to time. The glory days of what I like to call ‘phantom finance’ not linked to actual, real economic production are over. In future, wealth is going to be generated primarily by real economic activities, most of which require commodity input in some form.

L.S.: What drives the prices in commodities? Is it really supply and demand, or are there other things involved?

J.B.: Fundamental supply and demand are certainly the most important factors but there are others, such as occasional speculation or changes in taxes, subsidies or various regulations pertaining to commodities production and trading. However, as a general rule, commodity prices are less prone to direct manipulation by economic policy authorities because the authorities tend to work primarily through central banking and the financial system, that is, at the ‘macro’ level, and they can’t ‘print’ commodities into existence no matter how much they might like to. So commodities, long regarded as more ‘speculative’ than traditional financial assets such as bonds or stocks, actually provide a ‘safe haven’ against market manipulation and counterproductive economic policies, such as those that abound today.

L.S.: Could you describe the investment strategy you follow at Atom Capital, please?

J.B.: The ‘Amphora’ strategy that resides at the heart of our investment process is one that seeks the maximum possible amount of commodities diversification across metals, energy, agriculture, etc, and then systematically de-correlates these positions to the financial markets, thereby isolating that aspect of commodity price movements that has essentially nothing to do with stocks, bonds and other instruments whose prices are being arbitrarily manipulated by policymakers. It is an answer to the investment challenges posed by deleveraging, by counterproductive economic policies and by pervasive market manipulation.

L.S.: Why are gold and silver reemerging in the monetary system?

J.B.: As gold and silver have the strongest historical claim to use as money and as reliable stores of value, when investors sense that fiat currencies are at growing risk of debasement, they seek out ‘insurance’ in the form of gold and silver. As the supply of gold/silver is relatively fixed, however, higher insurance demand implies higher prices. The bull market in gold and silver is primarily a bull market in financial insurance. And by this I mean proper insurance, not synthetic insurance, such as that provided by financial companies such as AIG, which can and do go bankrupt right when insurance is most needed. Commodities, owned outright and unencumbered, carry zero credit risk, something that can never be the case with banks or insurance companies.

L.S.: You think a significant signal in that regard is the proposal to treat gold as a zero risk asset. (1) Why so?

J.B.: While still a somewhat obscure, technical issue, this one perhaps best highlights the extent to which policy responses in the wake of the financial crisis are counterproductive and inconsistent. On the one hand, policymakers want banks to lend. On the other, they want them to hold more capital. The problem is, these are contradictory policies, although they prefer not to admit this. There is, however, a subtle solution to this dilemma, which would be to increase the range of assets against which banks need not hold any regulatory capital.

At present this so-called ‘zero-risk’ basket only includes cash and highly-rated government bonds. Following numerous ratings downgrades, however, the available volume of highly-rated government bonds has shrunk. The IMF has written a paper about this development, arguing that there is now a shortage of collateral that is exacerbating the contraction in bank lending to the private sector.

As it happens, however, there is a discussion under way as to whether gold should be included in the zero-risk basket. To the extent that banks hold gold, or lend against positions collateralized by gold, this gold currently consumes some portion of their capital. Eliminate that capital charge and, voila, banks’ effective capital ratios improve, enabling some expansion of lending. This partial ‘remonetisation’ of gold could thus be one step toward improving bank solvency, in particular in distressed euro-area countries, where the accumulated bad debts are enormous.

L.S.: The financial advisor Henry C.K. Liu told me in an email exchange related to this:

“NPRs are merely proposals the solicit comments. The final rules are generally much watered down after comments. At any rate, most of the new Basel III capital requirements will take effect January 1, 2013, but are subject to lengthy transition arrangements consistent with the Basel III framework. Thus, full compliance with most aspects of the new capital requirements would not be required until January 1, 2019. Notably, the second NPR, which contains the standardized approach, would not take effect until January 1, 2015, although banks could elect to apply it earlier. Bank reform moves at snail pace.”

What are your thoughts?

J.B.: Yes, these sorts of changes normally occur only very gradually. But where there is compelling political pressure for action, things can speed up. In any case, financial markets are concerned about the future, not the past, and any anticipation that gold is going to be de-facto remonetised as a zero-risk bank capital asset would almost certainly trigger a substantial rise in price

A key reason why the price of gold currently rises and falls along with risky assets generally is that available bank credit to finance gold positions is impacted by the same capital constraints that finance risky asset positions. Reclassify gold as ‘zero risk’ and this relationship will break down and gold will outperform in relative terms.

L.S.: Are the heydays of the US dollar over? And what do you think about the meme of a “currency war”?

J.B.: In retrospect, the heydays of the dollar were already over in the early 2000s. From that point forward, the global investor base, including central banks, has gradually diversified away from dollars as a store of value. The dollar remains the dominant global currency for reserves and transactions but is not as dominant as before.

As I am fond of saying, the dollar is in process of becoming a ‘normal’ currency, one that does not enjoy a lower risk premium–a lower real interest rate–than most other developed economies’ currencies. Global currency arrangements are thus becoming ‘multipolar’, where multiple currencies will be competing. This competition can indeed be characterised as a ‘war’ of sorts, a term popularised by Brazilian Finance Minister Guido Mantega and also Jim Rickards, author of the book ‘Currency Wars’, who kindly gave me permission to use material from his book when preparing my own.

L.S.: A prime factor of the dollar hegemony since the 1970’s is the fact that crude oil is solely priced in US dollars. Do you see evidence that this is changing, for instance related to gold?

J.B.: Possibly around the edges. There are reports that Iran is avoiding US-led economic sanctions by selling oil for gold rather than for dollars or other currencies through the banking system. If so, this sets an important precedent and demonstrates an important limit to US economic power. But it is far too early to conclude that for the global oil trade generally, gold is replacing the dollar.

When it comes to oil producing nations storing value however, rather than transacting in the oil market, there is more evidence that gold is displacing the dollar and indeed has been doing so for years. As I argue in my book, a confrontation between the BRIC countries and the US over Iran could be the tipping point that ‘dethrones’ the dollar as the world’s pre-eminent reserve currency, triggering a huge US economic crisis larger than 2008.

L.S.: Do you think that a price mechanism “oil for gold” would make sense?

J.B.: It is interesting that you ask this question as the relationship between the oil price and gold price has been stronger than that between many other commodities through the years. It is as if there has in fact been an informal ‘oil for gold’ mechanism in place all along, within a ‘trading band’ of sorts, perhaps the result of the oil producing nations periodically purchasing gold with their accumulating dollar revenues. Therefore I would not be surprised if, in future, oil producing nations were to implement a more formal ‘oil for gold’ arrangement.

L.S.: Is the gold market a free market (whatever that is), or do central banks and their commercial bank agents intervene in it like they do in other markets? If this is the case, why?

J.B.: I have no privileged evidence that central banks currently ‘intervene’ in the gold market in the sense that they seek to manage the price as an instrument of policy. This was the case under Bretton Woods, however, when there was an explicit link between the dollar and gold. The ‘London Gold Pool’ of the 1960s was an arrangement by participating central banks to suppress the price of gold. After France withdrew from the pool, it eventually broke down and the US was forced to formally abandon the gold price peg in 1971-73.

However, just because I have no evidence does not mean that central banks are not intervening. Clearly they are active in the gold market, buying, selling and swapping, as your own research and that of others indicates. And clearly it would be in the interest of central banks in overindebted countries such as the US or most of the euro-area to prevent gold from displacing their government bond markets as a preferred store of value.

If that were to happen, it would drive interest rates higher and prevent governments from running deficits. In an extreme scenario, it would result in a wave of national bankruptcies and currency devaluations. Policymakers have a strong, arguably existential interest not to allow that to happen. So they have the means and the motive to try and suppress the gold price. But are they doing it? I don’t know. And if they are, will they succeed indefinitely? History suggests not. So if we’re patient we will eventually learn the truth in this matter.

L.S.: What are your thoughts on the so-called “Conflict-Free Gold Standard”? (2)

J.B.: As with many policy initiatives, what sounds good on paper may not work in practice. Worse, it may be outright counterproductive. I would place the ‘Conflict-Free Gold Standard’ in this category. Why? There is the problematic definition of what is ‘conflict-free’, as only ‘unlawful’ conflict is included. Well who is to decide what that is? The UN? The US? Should we be confident that a ‘conflict-free’ standard can be fairly enforced? Or would it just be manipulated to the benefit of those adjudicating on what conflicts are lawful, and which are not?

Also, the entire point of gold as an alternative store of value is that it cannot be arbitrarily manipulated by governments, at least not in the long run. Only allowing ‘lawful’ gold to be traded and not other gold is just another form of market manipulation or financial repression, regardless of whether it sounds well-intentioned or not. It is an invitation to abuse. For gold to provide a proper store of value it must be fungible. Gold must be gold, it must be free to flow from place to place, be it mined or traded in conflict zones or not.

L.S.: What do you think in that regard in general that “policy makers are finding it tempting to pursue ‘financial repression’ — suppressing market prices that they don’t like”? (3)

J.B.: Financial Repression is a euphemistic term for wealth confiscation from the private sector to public and financial sectors. While monetary inflation in any form (QE, etc) is arguably wealth confiscation, at least in a free capital market savers can find effective ways to protect themselves from it. But financial repression is the limitation or removal of effective inflation protection from those who would desire it.

It is normally cloaked in regulations or guidelines of some kind but it is a confiscation of private wealth regardless. As the very wealthy tend to have much greater flexibility with respect to their financial affairs, including access to multiple jurisdictions and high-level politicians within them, they can normally escape such repression and perhaps even profit from it. Thus the burden tends to fall primarily on the middle class, which is hardly surprising as that is where the negative consequences of failed economic policies in general tend to concentrate.

L.S.: You think that “much official US data are misleading in some way, if not manipulated.” (4) How did you come to that conclusion?

J.B.: The evidence here is overwhelming for those who care to look but most simply don’t bother. US labour market and inflation data are particularly bad. Perhaps that is understandable as these data are somewhat ‘political’. The headline unemployment rate, even if accurate, represents such a narrow part of the labour market that it is borderline useless. Broader measures are better but they too may be inaccurate as most of the data are based on surveys, estimates and theoretical models rather than on hard inputs.

Moreover, the data are frequently heavily revised a year or more later, showing just how misleading the original data were. With respect to inflation, the methodology used has changed dramatically through the years and in each and every instance has always resulted in measured inflation being materially lower rather than higher. Coincidence? I think not. Two particularly abusive statistical methods are so-called ‘hedonics’ and substitution effects. This is where you adjust prices for quality improvements and for consumers substituting less expensive for more expensive goods.

Now think about this for a minute. Who is going to judge quality? How? And at what point are consumers substituting lower quality for higher quality goods? Finally, note that these hedonic effects only work in one direction, not in reverse. They can never contribute to higher inflation, only lower. But we all know that quality per unit currency spent can decline as well as increase, in particular for services such as education, healthcare and transportation.

L.S.: To what extent will the price of gold rise as it becomes remonetized?

J.B.: A full remonetisation of gold, where savers could exchange currencies on demand for gold as an alternative store of value, would require a huge rise in price. A common refrain from the pro-fiat crowd is that there is too little gold to provide a sufficient money supply. At current prices that is true. So were gold to be used as actual money, competing with dollars or euros, the price would have to rise to the point where supply and demand were in equilibrium.

To be credible, this would require a substantial gold backing of the narrow money supply, that is, central banks would need to hold sufficient gold reserves to back a large proportion of cash in circulation + bank reserves. This implies a gold price of about $10-15,000/oz or EUR6-8,000/oz (The eurosystem currently has proportionately more gold backing proportionately less narrow money, thus the price would not need to rise by as much). But in fact the price could be higher still because these prices assume that the narrow money supply would not continue to grow in the interim, for example, to monetise excessive government debt.

Given that central banks are desperate to reflate their economies rather than to restructure their debt (default), most probably the gold prices eventually reached will be even higher. But note that these price increases would not imply an increase in the purchasing power of gold. Rather, they would represent a huge inflation, in which the purchasing power of fiat currencies would decline spectacularly. This would not necessarily lead to a hyperinflation, however, as long as the intent of policy was clear, that currencies were being devalued with the specific purpose of enabling the remonetisation of gold. If that happens, then from that point forward, you would have a remarkably high degree of price stability, perhaps even mild price deflation, not hyperinflation, as is the historical experience of gold standard economies.

L.S.: Related to the ongoing crisis of the euro, the economist Guido Preparata told me a few months ago the following:

“The idea of the Euro is as follows: first, assign the lead to Germany as chief partner / banker / accomplice of the plan, chief economic force of the Union, and chief exporter; then let all the other weaker players (PIGs, Spain, Italy), who produce virtually nothing, indebt themselves vis-à-vis Germany and Anglo-American banks, which, in turn, make good money from the yield on these Euro-bonds (the debt spiral). Concomitantly, any kind of manufacturing / artisanal potential on the part of Europe’s minor partners is systematically wrecked and incapacitated by the flood of Chinese imports (China: the other key accomplice in this triangular crippling of Europe), which are themselves crafted by laborers slaving for wages that are less than a tenth of the West’s.” (5)

Is Mr. Preparata heading with this analysis in the right direction?

J.B.: He does offer an explanation of what has happened in Europe although I doubt that this is what Germany or France intended. The history of the euro goes way, way back. In large part it is a response to the dollar hegemony of the 1950s-60s. While France took the lead, most European nations had determined by the late 1960s that the Bretton Woods arrangements, with the dollar as the sole reserve currency, were not in their best, long-term economic interest.

Meanwhile, economic integration was under way, to some extent spontaneous and to some extent top-down, as a result of the common market. However, notwithstanding this process of integration, what was not occurring was convergence: The Germany economy was stronger and more competitive than most and the Bundesbank favoured a strong currency to maintain relative price stability. Other countries would periodically devalue to restore competitiveness, something that was disruptive for Germany.

In time, France came to embrace a strong currency as well, and from that point forward monetary policy convergence became a Franco-German political force that eventually resulted in the euro. The problem was, the political push for convergence ran ahead of real economic integration. Mitterrand and Kohl wanted their places in the history books and so they forced the issue, putting the single currency (cart) in front of the economic horse (integration). And so the seeds of a great crisis were sown. Was that the intent all along? Did France decide to embrace a strong currency in order to cause a huge crisis threatening its banks down the road? Didn’t Germany merely intend to extend the benefits of a stable currency not only to France, but to the rest of Europe? Or did both Germany and France risk the survival of their own banks and health of their own economies in order to serve Anglo-American banking interests? I doubt it.

Regarding the role of China, this idea that Chinese ‘slave-labour’ threatens Europe is logically inconsistent. Do Europeans want to pay more or less for the products they consume? Most would say less. Do they want higher or lower paying jobs? Most would say higher. But of course the only way in which we can both pay less for products we consume and receive higher wages for those we produce is through increased productivity, enabled by technology, specialisation and trade.

To blame China for Europe’s declining competitiveness is unfair and I detect an elitist, almost racist tone in much of the China-bashing. No, the blame should be placed squarely where it belongs: At the uncompetitive European welfare state. If a welfare state is economically competitive it must be able to grow without accumulating debt. It is no coincidence that every welfare state in existence today has been accumulating debt, with Norway and a handful of other small, resource-rich countries providing notable exceptions.

L.S.: What do you think about the solutions that are offered to solve the euro crisis?

J.B.: Bureaucrats are naturally drawn to bureaucratic, policy-driven solutions to the problems created by bureaucratic policies. Creating problems to solve is a nice way to stay in business but it hardly serves the interests of society. Rather, it is self-serving. Thus I am not at all surprised by the proposed ‘solutions’ to the euro crisis being primarily various forms of bailouts, guarantees, and forced financial, fiscal and economic integration–to be managed by the bureaucrats of course. But these are not solutions at all.

The fundamental problem with the euro is not the euro. It is the lack of natural (rather than artificial) economic integration combined with the unserviceable debt accumulated by dysfunctional, inflexible welfare states that consume more resources than they produce. If you want to save the euro you must reform the welfare state bureaucracy and restore economic competitiveness. For economies to be fully competitive they must spontaneously trade and integrate as broadly as possible. So the natural economic integration necessary for the success of a single, strong currency would be achieved if the bureaucrats would just get out of the way. Sadly I see little chance of them doing so until the economic situation becomes much worse.

L.S.: What advice would you like to give our readers at the end of this conversation in order to survive the hard times we’re going through?

It is important to remember that we are going through these times. They will pass. History has dealt us a difficult hand to play and we have limited options for how to play it. There is no ‘solution’ other than to focus our efforts on the long-term and confront short-term challenges with a healthy degree of stoicism and basic human virtue. It is frightening but also enlightening to learn that the system is broken and that to the extent it still functions at all it does so not in our interest but that of a financial and government elite.

While the coming decade is a historical write-off–there is just no way that our standard of living is going to increase materially in that time frame–thereafter we may be able to make great progress, if we start from a solid, deleveraged economic foundation including sound money and personal liberty. All the great technological innovations of modern times–communications, microengineering and health care to mention but a few examples–will eventually contribute to a great economic boom, as I argue at the end of my book. Just be patient and do your part to embrace the changes that are required in the meantime, even if they imply a degree of personal hardship or sacrifice. As a father of four children ranging in ages from eleven to one year in age, such thoughts are constant in my mind.

L.S.: Thank you very much for taking your time, Mr. Butler!

John Butler is now the Chief Investment Officer of Amphora Commodities Alpha Fund, an independent investment and advisory firm in London. He has written extensively on financial topics, and his work has been cited in the Financial Times, the Wall Street Journal, and the Frankfurter Allgemeine Zeitung, among other publications. He is also the author and publisher of the popular Amphora Report newsletter and is an occasional speaker at global investment conferences. In April 2012 he published the highly recommended book “The Golden Revolution: How to Prepare for the Coming Global Gold Standard,” published by John Wiley and Sons. An archive of his writings is provided at Financial Sense under this link:

http://www.financialsense.com/contributors/john-butler.

Sources:

(1) Compare John Butler: “Breaking News: Regulators to Classify Gold as Zero-Risk Asset”, http://www.financialsense.com/contributors/john-butler/breaking-news-regulators-to-classify-gold-as-zero-risk-asset#increase

(2) World Gold Council: “Conflict-Free Gold Standard”,

http://www.gold.org/about_gold/sustainability/conflict_free_standard/

(3) Kevin M. Warsh: “The ‘Financial Repression’ Trap”, The Wall Street Journal, December 6, 2011, http://online.wsj.com/article/SB10001424052970204770404577080181384917926.html

(4) Compare John Butler: “A Tweet Too Far?”, http://www.financialsense.com/contributors/john-butler/a-tweet-too-far

(5) Lars Schall: “ The Business As Usual Behind The Slaughter”, Interview with Guido Preparata, http://www.atimes.com/atimes/Global_Economy/NF30Dj03.html

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

What’s Next For Gold As Governments Become More Desperate

Disregard current manipulation of precious metals

Every day 5,000 tons of silver and 650 tons of gold are traded in the paper market. This is an astonishing 25% of annual production of each metal that is traded daily. Currently there is clearly intervention to hold down the price of gold and silver at every important level. Like all interventions, this one will fail too. The paper market is massively short and would be incapable of delivering even a small fraction of physical gold or silver against their commitments.

So what we are seeing is a short-term correction in the continuous rise in gold and silver against paper money. The correction is likely to be short-lived and eventually lead to new highs.

But investors should not really be concerned. Gold will continue to reflect the escalating deficits and the never-ending money printing by governments.

We know that no government is capable of maintaining any serious level of austerity. This will automatically lead to rejection by the voters and loss of power. So governments worldwide will continue to spend money they don’t have and print endless amounts of it. The situation is the same in the US. Neither candidate is capable of taking any measure that will cut the escalating deficits. Since Bernanke became chairman of the Fed in 2006, the Federal Debt has doubled from $8 trillion to $16 trillion! This makes Bernanke the most productive person in history. But this is only the beginning. There is nothing that will change the trend (as shown in the chart above) of rising deficits and rising gold.

We are reminded every day of the fragility of the financial system. The failure of the bigger names (Lehman, MF Global, Sentinel) are well-known but we hear of smaller brokerage houses failing around the world that is not publicised.

In the next few years, many institutions will fail. And it always happens totally unexpectedly. This is why it is absolutely critical to preserve wealth by holding major assets outside of the financial system. Major fortunes will be lost and it will be a question of who loses the least. One of the few assets that will continue to reflect the destruction of paper money is gold. But it must be physical gold only stored outside the banking system in the name of the investor with personal access to the gold.

Switzerland now has two gold initiatives. One of them is to create a Gold Franc which will be accepted as legal tender in parallel with the paper franc. Switzerland has a long-standing tradition in gold both from the point of view of private ownership and refining of gold. Four of the top six refiners in the world are Swiss. This gold tradition makes it more probable that this initiative is passed by parliament. Initial soundings are positive. If gold is accepted as a parallel currency, this would eliminate any small risk of confiscation of gold in the future in Switzerland.

I cover the above important areas in-depth as well as other topics in an interview with King World News on Oct 18, 2012.

Click here for the Written interview on KWN.

Click here for the Audio interview on KWN.

Egon von Greyerz

Matterhorn Asset Management is dedicated to wealth preservation through safe and secure silver and gold storage in Switzerland. Protect your gold in the world’s safest vaults. To become a client, click here.

What’s Next For Gold As Governments Become More Desperate

THE MATTERHORN INTERVIEW – October 2012: Keith Weiner

The Ultimate Bubble is Paper Money

Keith Weiner, President of The Gold Standard Institute USA, explains in this exclusive interview for Matterhorn Asset Management, among other things: why he sees a permanent backwardation in gold coming; the role of gold as the cornerstone of investor’s portfolios; and the specific kind of gold standard he envisions for the future.

Keith Weiner, President of The Gold Standard Institute USA, explains in this exclusive interview for Matterhorn Asset Management, among other things: why he sees a permanent backwardation in gold coming; the role of gold as the cornerstone of investor’s portfolios; and the specific kind of gold standard he envisions for the future.

By Lars Schall

Keith Weiner has been a technology entrepreneur. He was the founder of DiamondWare, a VoIP software company, which he sold to Nortel in 2008. He is an adherent of Ayn Rand’s philosophy of Objectivism, and a student at the New Austrian School of Economics. Recently, he received his PhD under Professor Antal E. Fekete. Mr. Weiner is currently a trader and market analyst in precious metals and commodities.

Lars Schall: A few days ago you received your PhD from The New Austrian School of Economics. What have you done for it?

Keith Weiner: That’s a good question to start with, thank you. For several years I’ve been studying with Professor Fekete in monetary science and developing my own ideas. The school, as you may know, emphasises spreads more than prices and spread is the difference between two prices. For example, if you distribute eggs, you buy eggs at the farm and you pay the ask at the farm and then you bring them into the city. And you sell them in the city on the bid. So, the bid in the city minus the ask at the farm is the spread that you as the entrepreneur, as the distributor can earn.

And so if you look at the world as a landscape of different spreads, one of the things that you realise is that first of all, that very process of that arbitrage will tend to compress the spread, who is trying to profit in the market is decreasing the spread from which he profits. Which means, sooner or later he has to move on and find something else to profit from because the spread is squeezing. But you can almost define economic coordination as a process of spreads that are becoming more narrow. And one of the things – my thesis covered a number of different topics and I looked at government interference and government distortion as a result of that interference. You can almost look at it as absent distortion and interference, economic coordination is increasing which is the same thing as saying that spreads are decreasing.

So, every time an entrepreneur discovers a new way of doing things, he’s now making the spread more narrow. And so, one of the things that I did was I looked at a number – I’m going to say maybe eight or ten or 12 different ways that governments can interfere in markets. So, they can pass a tax on profits, a tax on wages, a tax on capital, they can set a minimum quota, they can set a minimum price, a maximum price and I went through each example and showed through looking at different spreads how whenever the government does something which they always do in the name of helping people, they force the spread wider, which as we already proved means that they are decreasing economic coordination and creating distortion. And so, the ultimate example of distortion would be if somebody is over here who is hungry, if somebody is over here who has farmland that is fallow and this person is unemployed, you have a person who wants to eat, you have a person who wants to produce food and they cannot make a deal. And that is the result of distortion that without the government trying to manipulate the economy, that distortion would not occur.

L.S.: Why does big business love government intervention in the economy?

K.W.:: That’s also an interesting question. The motivation I think is fairly simple and I don’t think it’s a function of bigness. First of all, I think any business – so, you have to have a minimum size in order to have access to the government. A one lone person who is running a pizza restaurant doesn’t have the money to get to government, but there are much smaller businesses that play this game as well, particularly defence contracting for example. They go to the government and they say, ‘We would like you to help us take money’ and I will not use the word, ‘Make money’ but ‘take money’ by giving us a special subsidy or a protection or go destroy our competitor with anti-trust or a lawsuit or environmentalism or whatever it is. And so they get money as a result of this government interference into the economy.

L.S.: One of your specialities is the examination of backwardation in gold and especially permanent backwardation. Do you see this ahead for us?

K.W.: I do see it ahead. Shall I define for your readers backwardation?

L.S.: Yes, please do so.

K.W.: The simplest example to think of would be the market in wheat, although the concept applies to any commodity. And so the wheat harvest I’ve been told arrives around early August. So, imagine if you drove a truck out to the farm area in late July and said, ‘I would like you to fill out my truck with wheat. Right, today, how much will it cost?’ Well, first of all they will laugh at you because there is no wheat, you know, two weeks before the harvest, all the wheat has been consumed. But, if you insist, eventually they’ll go to every bakery and everywhere else and they will renege on their contracts and buy their way out of their contracts so that they can put wheat on your truck. If a normal price of wheat is $8 per unit, you may pay $20 per unit.

If, instead, you are happy to take a contract for wheat to be delivered in September, you will pay $6. So, backwardation is very obvious here, you have to pay $20 to have the wheat today, right now as we say, ‘Cash on the barrel head’ in the US. But if you can take delivery in five weeks, then the price is $6. So, the price today is much greater than the price is five weeks, that is backwardation. And what it means is shortage or scarcity, so in wheat, obviously, there is no wheat a week before the harvest, the wheat is about to come in, all of the grain elevators are depleted.

Now, if you take a look at gold or silver these are metals that have been accumulated for thousands of years. We use the concept of stocks to flow ratio, which is the amount of inventories that we have accumulated divided by the annual production. For gold it is estimated around 80 years, so at the current rate of mine production it will take 80 years to accumulate the stocks that we have in inventory now. For silver, I think it’s a little bit less but it’s still many, many decades versus wheat which is three or four months. And so, in gold where we have 80 years of stocks to flows the concept of shortage is meaningless. There’s plenty and plenty and plenty of gold around the world and so, if gold goes into backwardation this is very serious.

That doesn’t mean that there’s a shortage of gold per se it means that there is a shortage of gold in the market, and the reason why this is serious is that gold is money and the process of going into backwardation is the process of gold withdrawing or money withdrawing out of the system. Even though the Keynesian economists that run the financial system deny that gold is money and they can pretend that the paper bill can replace gold, it’s not true. And so, I encourage everybody to think of a market crisis. Again, with the emphasis on ‘Bid’ and ‘ask’.

When you think of a market in crisis, think of it as always the bid that withdraws, it’s never the ask; it’s always the bid. And so, the example I like to use, Los Angeles California is known for earthquakes and so far, the earthquakes have been relatively small, but it’s on one of the major faults in the world, the San Andreas fault. So, imagine if the United States Geological Survey, the USGS said that before January we will have an earthquake in Los Angela, 13 on the Richter scale, nothing taller than a dollhouse will survive. What will happen to the real estate market in Los Angeles? There will not be a lack of offers to sell Real Estate – there will be no bids.

L.S.: You think that permanent backwardation in gold is the earthquake?

K.W.: Well, I’m just using the earthquake as an analogy, it’s the bid that goes away. After the USGS announces this there will be no bids. There will be plenty of offers to sell real estate but no bids to buy real estate, the bid will be zero. Now, I want to use that analogy as gold is money and paper is credit. Gold is withdrawing its bid on the US dollar, little by little the process of withdrawing the bid can also be called the process of moving to permanent backwardation.

As those that own the gold become reluctant to buy the paper with it, those that own the gold will hold the gold close to their chest and say, ‘I am comfortable standing where I am, I have no need for that paper’. The problem comes from the fact that those who have paper are still very eager, ‘Please would you give me a little bit of gold? Here’s more paper, how much do you need?’ and they will open their wallets for more gold. This is obviously a process of rising price but in the new Austrian School we’re more interested in spread; what’s happening here. Well, many people in the gold world realise gold is the only commodity where rising prices can lead to reluctance to sell. If this happened in crude oil, if this happened in copper, commodities would come out of the woodwork and the price would correct. But in the case of gold, not so.

So, let’s take this a little further and say that we get to a point at the end – permanent backwardation leads to a point where there is no longer a gold bid on the dollar, the euro, the yen, the pound, the frank and so forth, that’s it. the gold people say, ‘We’re not selling anymore’. Here’s where the collapse occurs. The people with dollars are still interested with euros and with franks, they still want gold. How do they get it? Well, they say, I can trade my dollars or my euros for crude oil or wheat or copper or any liquid commodity that has a market. And then once I have the copper or the oil I can then trade that for gold. And so this will be a process of trading paper for commodity, commodity for gold, paper for commodity, commodity for gold. Paper to commodity, commodity to gold without limit and this will push the price of the commodity up to any arbitrary – we’re just doing an interview here. That will drive the price of the commodity to arbitrary high levels.

Picture $10,000 per barrel of crude oil or $1 million per barrel of crude oil. But in dollar terms and it will push the price of the commodity in gold terms lower and lower and lower. So, the price in dollar terms for all the commodities will rise exponentially and the price in gold terms will be falling exponentially. And the only end to this process is when people officially say the paper currency is no more. And so, I don’t think that the collapse of the currency will be due to the quantity of the currency being printed like in Weimar or Zimbabwe where they just kept printing more and more zeros onto the notes. I think it will be because of this arbitrage the last desperate holders of dollars trying to get a few more ounces of gold will drive the prices. Does that make sense?

L.S.: Yes sure. – Why do you think that gold in this environment is especially attractive and why should it be – where have I written it, why should it be the cornerstone of everyone’s portfolio?

K.W.: I think very simply, gold is money and that process took thousands of years to decide and gold became the most marketable good which mean it has the smallest bid spread and that spread widens the least as you go to a larger quantity. So, in any other commodity if you want to sell $10 million worth of copper, you will crash the price of copper temporarily in order to sell that but in the case of the gold market, the liquidity is always there. This means that gold has the highest stocks to flow as we’ve talked about and this means that gold has a marginal utility that either declines the least or maybe does not decline at all. So, gold has been selected over thousands of years as money.

We are now close to a point of the collapse of the paper monetary systems and so, you don’t want to hold – so the problem with paper money is it is debt. If you think you have money ‘In the bank’, you actually have a credit obligation, you are a general creditor, unsecured creditor of the bank and the bank owes you the money. And what does the bank do? Well, they buy the government bond which means the government owes the bank the money. And so it’s just debt to debt to debt.

The problem is when somebody defaults, that means the debt is no longer good. The creditor now has a hole in his balance sheet and the creditor may default. And once the defaults begin to cascade, they will wipe through the system like dominoes tipping and falling and tipping and falling one into the other. And so, anybody who thinks about this should want to not be in that chain of dominoes holding paper credit, they want to hold money, not as an investment, I would not call it an investment, I would say it’s simply holding money because everything else will be falling in terms of real money.

L.S.: Since you’re the president of the Gold Standard Institute in the U.S., I think you envision a specific kind of gold standard. Could you define it, please?

K.W.: Yes, absolutely. So, I talk about the term, ‘The unadulterated gold standard’ and I use the definite article ‘The’ because there is one kind of unadulterated gold standard. Although we have many different kinds of gold standards that have been used throughout history usually involving some degree of government intrusion into the market where the government has said okay, you can’t use gold coins circulating, we will have these 400 ounce bars in the Bank of England vault in London and we’ll print all this paper that represent claims against those bars and so that’s the gold bullion standard. And then the gold exchange standard was after 1933 and especially after 1944 the United States government had most of the gold after World War II certainly and said you can use these dollars as if they were good as gold and they will be redeemable but only to Central Banks. This was the gold exchange standard.

And so the Central Banks then created credit in their own local currencies, you know, the Deutsche Mark, the French Franc, the Italian Lire and so forth and that that was ultimately backed by dollars. The dollars were backed by gold. Well, that collapsed in 1971. So, today as we think about going forward to a gold standard, I think what we want to be very, very clear on is that the unadulterated gold standard means it is not adulterated. Now we have to be clear what is it not adulterated with; coercion, force. So, what we mostly want is for the government to not interfere in the market for money and credit. We want an end of what is called, ‘Legal tender laws’ that force creditors to accept the government’s paper script. We repeal the laws that nullify gold clauses and contracts. So, a landlord can sign a long-term lease in gold and not have to worry what will the ounce of gold be worth in 30 years or 50 years. We repeal the laws, most people don’t think about this, there are laws that force tax payers to keep their books, their profit and loss statement and their balance sheet in dollars or euros or francs or pounds or whatever, allow the tax payer to keep their books in gold or silver or in some combination, aggregate unit if they want and to pay their taxes in gold or silver or some aggregate.

Finally, you know, eliminate the laws that control banks and control what people can do, allow people to hold the gold coin directly in their hands. Allow people to either hoard that at home if that is their choice or to bring them into a bank and deposit it if the bank offers terms and interest that are attractive to that consumer. And the reason why this is important is because the rate of interest is set by two forces. There is arbitrage by the marginal saver who either deposits into the bank or withdraws from the bank based on the rate of interest. If the rate of interest is too low, I might as well hold the gold coin in my pocket, the bank isn’t paying me enough to take the risk. If the interest rate rises I’m happy to earn a yield in the bank. And this will set the floor under the rate of interest.

The ceiling in the rate of interest is set by the marginal business. You cannot borrow money at a higher cost than your rate of profit. If you’re making 5 percent by selling your product in the market, you cannot borrow at 6 percent. By having a free market and money in credit, the rate of interest will be set in a narrow range and if you take a lot at a graph of the United States government 10-year treasury bond, let’s say from after the war of 1812 which almost destroyed the United States, from 1812 to 1913 the rate of interest was incredibly stable and there was a spike for the civil war and there were one or two other glitches. But basically, very, very stable. And it’s important to have a stable interest rate because when the interest rate moves, that destroys capital and that’s part of the problem that we have today. The rate of interest has been falling for 31 years.

L.S.: One part of the bashing against gold is that it isn’t an earning asset, that it does not pay dividends. What is your argument against this argument?

K.W.: Well, obviously and I want to address a deeper issue there because I agree with the underlining issue although I think it’s misapplied today. Today, the problem is the death of paper money. So, I would use the analogy of picking up pennies in front of a steam roller to earn 2 percent on your paper money while the entire paper money system is going over the cliff into the abyss. To me it’s misguided, but the broader issue is absolutely correct. We cannot have a gold standard if everybody buys gold to hoard it and take it home and burry it under the floor or bury it under the mattress. It is absolutely essential to the process of moving forward toward a gold standard that there be gold bonds that pay a yield not in paper currencies but that pay a yield in gold and that if the world could have a way to buy a gold bond and earn a yield in gold, then I think the adoption rate of gold would accelerate exponentially but in a way, that would not be to permanent backwardation, in a way, that would lead towards a solution to the problem that we have in paper money today.

L.S.: Do you have a price target for gold?

K.W.: To my way of looking at things, the price of gold will continue to rise and I use a computer software term, I’m going to use the expression, ‘A race condition’. So, on a computer if you have two different processes that are both not really controlled with respect to one another. One is moving forward on one track and one is moving forward on the other track and you don’t really know which one is going to hit first. Will gold hit $3,000 an ounce first or will it go into permanent backwardation? Which basically means there is no offer to sell gold in terms of dollars or in terms of euros. So, at some point, gold will not be quoted on the board anymore, so I use the analogy in the last you know six or 12 months of Zimbabwe there was no quote for gold in Zimbabwe dollars, so what is the price? The price is undefined, you might as well call it infinite. So, what happens first is gold hit $3,000 or $5,000 or does gold simply seize to be available. Which one happens first is anybody’s guess.

L.S.: Yes, and we also hear a lot about that people argue that gold is in a bubble. Is gold in a bubble?

K.W.: I think the ultimate bubble is paper money that people have built up an enormous stock of faith and faith is the only word that I can think of in paper money. And as paper money collapses, then the price of gold in terms of paper money becomes meaningless. Gold is restored to the same role that it always was which is gold is money. Long before we had the paper dollar or the paper euro people accumulated gold without regard to price. In any other commodity, if the inventories rise, we call it a glut and then the production stops and we work off the inventories until the price falls. In the case of gold, that does not occur. So, I would say in a certain sense, it’s not possible to have a bubble in gold, it’s a meaningless term.

L.S.: Then there’s another topic, and that’s Sandeep Jaitly’s interview on the Keiser Report, which caused a lot of buzz in blogosphere. Do you have any comment on this?

M: So I’m the president of the gold standard institute USA. I was not involved in the decision that was made by Phillip Barton. My only comment is that as the gold standard institute we’re looking to be open and encouraging friendships with the people of the Mises Institute, the libertarians, the fans of Ayn Rand and Objectivism. These are the logical people that today, before the Gold Standard Institute, advocate a return to or going forward to a gold standard.

So, we want to be their friends, we want to encourage them to join the Gold Standard Institute to read our materials, to learn more about a proper gold standard, to encourage them to write so that our journal will become an active forum and a place for it where ideas can be shared. And so we don’t want to issue statements to deliberately antagonize them and say that, you know, Ayn Rand is bad and is phony and Mises was not an Austrian School economist. We don’t want to create this controversy, we want to say, ‘Welcome to our tent. We have a common goal, let us pursue our goal’. Let’s keep aware one thing, the world faces a deadly crisis right now. If we do not solve the problem of irredeemable paper money and the collapse that’s coming, this collapse is not going to look like 1929, not at all. I would encourage people to look, to read about the collapse in 472 AD when Rome fell. We’re talking about starvation, exposure, disease, war, strife, death.

I think we just have to focus on, we have this problem, there are not very many of us that understand the problem let alone the solution and we have to, you know, set aside whatever differences we may have to work together. This is the problem. And the enemy is the Central Bank not, you know, different flavours of people that support Gold.

L.S.: When one would have an unadulterated gold standard, there would be no need for Central Banks, right?

K.W.: Correct. Let’s have a free market in money and credit. The government will have no more involvement in the market for gold or money or credit or banking as it should have in computer software. Let people decide if people want to take the gold coin home, they take it home. If they want to put it in the bank, they put it in the bank.

L.S.: Yes, one last question because you’re talking about banks. Mark Faber said recently that he fears a confiscation of gold in the US again. What’s your take?

K.W.: That’s a very interesting topic and I have to preface my remark by saying that now we’re not talking strictly monetary science where conclusions can be definite. I can say I’m certain that the dollar and the paper currencies will collapse. Now we’re talking about speculation as to what the politicians might do in the future. That said, I do have an opinion and I actually don’t think that the US government will confiscate gold. And the reason why – I have several reasons why.

First of all, in 1933 when they did it, they had a very obvious goal which was they had to demonetize gold. People were used to – people actually had gold coins and they could make purchases in gold coins and most people would have one or two, you know, at least gold coins at home. My grandfather who was not a wealthy man in 1933 and he was a young man, he was born in 1909 so that would have made him 24 years’ old, he was working very hard and not educated I don’t think he was by any means wealthy. He had at least one gold coin which came down to me through inheritance. So, everybody was used to having them and the government had to change the perception that gold is money. Today we don’t have that issue, nobody, at least in America thinks that gold is money.

I think you are fortunate in the German-speaking world that people are more sophisticated and they understand gold a little bit better. I think most Americans really don’t. That’s the first thing. The second thing is the other reason why they would seize the gold is because they’re desperate for the money. I think in the United States there is about $7 trillion, $8 trillion in retirement accounts, IRA, 401K and other government regulated retirement accounts. Part of the regulation is that all of these retirement accounts are held in the custody of a small number of highly regulated you know, government approved custodians.

So, if they want to get their hands easily on $7 trillion they could pass a new law that says in order to keep the tax deferred status of your retirement account, you have to put, you know, for example, 50 percent into a special new government retirement bond that we’re going to issue. And this avoids the problem in the United States you can’t take somebody’s property without due process and the Courts are decaying but they’ve still got respect for this. So if you’re saying you’re going to take somebody’s gold, you might have a problem in the Court. But if Congress changes the law for a tax deferral for an account, I think the courts will accept that.

So, all they have to do is to say, ‘Well, to start with 25 percent of your retirement account has to be in a government bond and then they can raise that next year to 40 percent, 50 percent. And so I think there’s $7 trillion that they could sweep off the table and take to spend and that will keep the game going for two or three more years, three or four more years of the current deficit rate depending on the assumptions. Also in the United States there’s another difference between Europe which is gun ownership. It is both easy and very pervasive. There are not that many people that own gold in the United States. However, amongst those who do own gold, gun ownership is probably close to 100 percent. So, if you actually tried to take the gold from the people, you’re taking it from people who have guns and there would be a lot of bloodshed if you tried to do this.

L.S.: Yes.

K.W.: In 1933 I think people were much more trusting of the government. The government said, ‘We promise to give it back to you, this is temporary’. I think a lot of people were very naïve and said, well, okay, you know, we’ll do this. Today I don’t think anybody will say that.

L.S.: Now, we’ve had already the final question but I think it is essential to add another question here, because when you would have no need for a Central bank and you’re against central banks, isn’t it then logic that the Central Banks will do whatever they can to fight you and the guys in your camp?

K.W.: Yeah, absolutely.

L.S.: And the Central Banks are one of the most powerful forces in this world.

K.W.: So, I’m an entrepreneur and I look at it as an analogy of a disruptive new business start-up and so, I’m sure you’re familiar with Skype. When a start-up comes into the market and tries to compete against a big business doing the same thing that the big business does, the start-up will never be successful. There are 100s of companies that have tried to produce a car with rear wheel drive and a gasoline or a diesel engine that you’ve never heard of because they did not succeed. Skype succeeded because they created disruption. And a way of thinking of disruption is if you have a lever, where do you move the fulcrum point under the lever.

So, if you think of the market for a voice, you know, phone communications and you have AT&T over here and you have Skype over here. What Skype did is they positioned the fulcrum right over here and now it’s very easy for them to pull on this end of lever and they can control what happens. And so AT&T in the United States has a declining business other than for mobile phones. With mobile phones people need wireless service and AT&T is a very big provider obviously. So in the case of gold is money, I think if we structure this right and frame the conversation right and we trigger the right dynamics with the gold bonds for example, obviously the trend is people are buying gold to hoard it and take it home. So the Central Bank is going to be destroyed by permanent backwardation. Once the currency collapses and crude oil is $1 million per barrel, the Central Bank is finished.

Alternatively, I propose to bring back the gold bond in a way that would allow a graceful change. The Central Bank, there are plenty of precedents and I can think of New Zealand where state-owned enterprises are sold at auction to the highest bidder and then the Federal Reserve and maybe the ECB I’m not as sure about that, the Bank of England probably could be sold and become a private bank that obviously has a lot of advantages to start, you know, in a free market. So I don’t think they necessarily disappear if we do this right with a gold bond, but they become privatised and then they become a private actor in a free market. That’s what I would like to see.

L.S.: Yes, but isn’t the Fed a private bank?

K.W.: I don’t believe so. Obviously that’s a very controversial statement. I’ll just simply point to the fact that it’s CEO is appointed by the president, it’s federalreserve.gov as its website. It behaves and acts as a branch of the US government in all regards.

L.S.: Yes, but who are the shareholders?

K.W.: They call it shareholders but if you take a look, they pay a dividend that’s a function of the original paid in capital in 1913, so, you know, JP Morgan gets a cheque for $80,000 a year and then, you know, $800 billion a year is remitted to the treasury. So, they have – the process – when the federal reserve was set up, it was a very different entity than it is today and every step along the way they either took power for themselves that was not originally granted by law, and so Professor Fekete points out the law allowed the Federal Reserve to own only Real Bills to back the dollars that they issued. But by the mid 19-teens the Federal Reserve was buying US government bonds. And so it took until I think 1935 I don’t remember the exact date before congress retroactively passed a law that said that the Federal Reserve can own treasury bonds.

So, there’s been many, many changes to the Federal Reserve from its original origin as the re-discounter of bills into the Central planner and regulator that we all know and hate today. Somewhere along the way whatever vestige of private – you know being private that it may have had in 1913, today it’s a government agency, it behaves as a government agency, it’s arm of the government and institutes government policy.

L.S.: Yes, but didn’t the Fed reveal by its actions that it protects the interest of the private banks and that it is willing to throw the citizens of the United States or maybe the citizens of the world under the bus?

K.W.: I’m not sure if they would have quite said that openly. I certainly agree while we have – people call it a free market, in my opinion probably the greatest damage done by Ellen Greenspan is to convince people that what we have is a free market today. If you look at Benito Mussolini and how he defined fascism, he said it’s corporatism, it’s government and business working together. So, we have a perverse currency and monetary and financial system today in which the private banks such as JP Morgan, Bank of America, Wells Fargo, in Europe Deutsche Bank and so forth, have a partnership with the government and they get all sorts of special privileges, special immunities, special subsidies and, of course, bail-outs, especially after – but actually no, I was going to say after 2008 but, of course, bailouts are not new, they had bailouts in 1987, they had bailouts in 1991 to 1992 in the US and elsewhere in the world at different times.

So they have a very crony fascist corporatist system where the survival and prosperity of JP Morgan is integral to the success of the currency. If JP Morgan were to fail, the dollar will fail. JP Morgan has too many liabilities to too many counter-parties. If they default then all of those counter parties will be destroyed and in their default everybody else who wasn’t destroyed by JP Morgan’s default, everybody else will be destroyed at that point as well. And so they’ve built a web or a net that’s inter-connected in a way that no one party can be extricated and that’s why the concept too big to fail. If there’s a legitimate core to it or a truth to it I should say, is that they are too big to fail and if they fail the whole system fails. And so all the politicians and I have to remind the people reading this interview, all of the voters would not be in favour of allowing the system to collapse.