Inflation

INFLATION DEFLATION AND GOLD

The current debt and asset deflation will not lead to a Japanese 1990’s style deflationary period. It is more likely to lead to hyperinflation in the US, the UK and many other countries. H...

Egon von Greyerz / August 3, 2009

Read More

THE DARK YEARS ARE HERE

In this newsletter, we will outline what is likely to be the devastating effect of the credit bubbles, government money printing and the disastrous actions that governments are taking. Starting in the...

Egon von Greyerz / July 14, 2009

Read More

WHERE IS THE GOOD NEWS?

The only reason why there has been an air of optimism in the world economy in the last couple of months is that the bearers of these false rumours of recovery all have a vested interest. They are eith...

Egon von Greyerz / June 26, 2009

Read More

UK JOINS THE PIGS – GOLD IS YOUR ONLY PROTECTION

We have told investors that the rating of US and UK sovereign debt is a farce and that they both will be downgraded. Today, the UK is on its way to joining the PIGS countries as Standard and Poor̵...

Egon von Greyerz / May 21, 2009

Watch Now

Gold gains against all major currencies in Q1 2009

This week there will be a meeting between G20 leaders and central bankers in London to save the world economy. Let us make it very clear – the meeting is bound to fail. There is no chance that t...

Egon von Greyerz / April 9, 2009

Read More

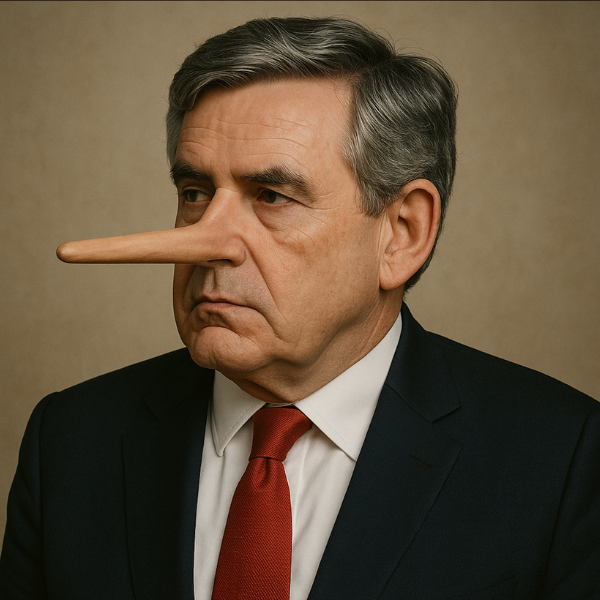

G20 – Lies, Damned Lies & Gordon Brown Lies

Gordon Brown has really surpassed himself in creative alchemy. He has turned $100 billion of G20 new commitments into $5 trillion of air! Take $100 billion of committed new money, add $500 billion of...

Egon von Greyerz / April 3, 2009

Read More

Quantitative Easing = Unlimited Printing

The Fed decided yesterday to spend another $ 1.15 trillion to try to save the financial system. They will spend $ 750 billion to buy mortgage-backed securities and $ 300 billion to buy long-term Treas...

Egon von Greyerz / March 19, 2009

Read More