Search results

EVERYTHING IS ON FIRE

“Everything is on fire” - Heraclitus (535-475 BC)

What Heraclitus meant was that the world is in a constant state of flux. But the...

Egon von Greyerz / May 19, 2021

Read More

Bitcoin vs. Gold: A Tired Debate

We’ve written elsewhere about the ironic over-use of logic to justify otherwise illogical biases. As Swiss-based precious metals professionals who see physical gold and silver as currency protection...

Matthew Piepenburg / May 17, 2021

Read More

Keep It Simple: Gold vs. a Mad World

Psychologists, poets and philosophers have written for centuries that many who have eyes refuse to see, and many who can think, refuse to think clearly--all for the simple reason that some truths, lik...

Matthew Piepenburg / May 10, 2021

Read More

BIDEN’S MMT – MORE MONEY THEORY

The number one objective of a US president is to be reelected. To achieve that, it is not enough to be good looking or to speak well. No, the only way to be reelected is to buy votes. The price of v...

Egon von Greyerz / May 5, 2021

Read More

Gold is Laughing at Powell

Recently, my colleague, Egon von Greyerz, and I had some unabashed yet blunt fun calling out the staggering levels of open hypocrisy and policy desperation unleashed by former Fed Chairman, Alan Green...

Matthew Piepenburg / May 1, 2021

Read More

FED HEADS LOSE THEIR HEAD

Read my lips: No New Taxes” Bush Sr said in his acceptance speech for his nomination in 1988 when he promised no tax rises. As most politicians, he didn’t keep his...

Egon von Greyerz / April 28, 2021

Read More

Patient Zero of the Bubble Pandemic: Alan Greenspan

Below, we consider two well-known names in modern markets, former Fed Chairman Alan Greenspan, and current value investing legend, Jeremy Grantham, co-founder of GMO Investment Strategies. Years ago,...

Matthew Piepenburg / April 24, 2021

Read More

EVERY PHYSICAL SILVER OUNCE HAS BEEN SOLD UP TO 1000X

The silver price is today half of the January 1980 level. That was the peak at $50 which silver reached again 31 years later in 2011. But alas, the bullion banks, aided by the BIS (Bank for Internati...

Egon von Greyerz / April 21, 2021

Read More

US Money Supply: More Lies from On High

Upton Sinclair famously observed that, “it is difficult to get a man to understand something, when his salary depends on his not understanding it.” After decades navigating among Wall Street sell-side...

Matthew Piepenburg / April 19, 2021

Read More

Banking Risk—The Real Killer Virus

When it comes to the topic of banking risk, well…one can only lean back in a chair, sigh and say: “Where to begin?”

Matthew Piepenburg / April 10, 2021

Read More

ABSOLUTE MAYHEM IS COMING

MAM founder, Egon von Greyerz, sits down with Silver Bullion TV to discuss a wide range of current topics, from the global response to the COVID pandemic and the paradox of balancing human safety agai...

Egon von Greyerz / April 9, 2021

Watch Now

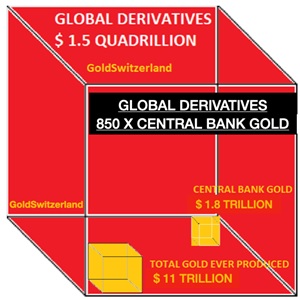

ARCHEGOS & CREDIT SUISSE – TIP OF THE ICEBERG

Bill Hwang, the founder of the hedge fund Archegos that just lost $30 billion, probably didn’t realise when he named his company that it was predestined for big things. Archegos is a Greek word whic...

Egon von Greyerz / April 8, 2021

Read More