Insights

Egon von Greyerz has built a global reputation as one of the leading voices of precious metal ownership as a critical wealth preservation asset. For decades, he has written and presented internationally on gold topics and themes.

Partner, Matthew Piepenburg, compliments this legacy via an extensive background in risk asset markets - the fractures, risks and signals of which greatly inform his own and shared conviction for precious metal ownership. Together, von Greyerz and Piepenburg are the co-authors of Gold Matters, Real Solutions to Surreal Risks.

A 100 Trillion Bubble Is Ready To Explode

In a world full of bubbles that will all burst, it is, of course, impossible to forecast which will be the first ones to cause havoc for the world economy. One of the biggest bubbles that would clearl...

Egon von Greyerz / February 4, 2016

Read More

Podcast Interview with Egon von Greyerz on King World News

In the aftermath of the US election, Brexit and increased market volatility, in this week’s audio interview, Egon talks about the end of an era of false wealth creation fuelled by corrupt govern...

Egon von Greyerz / January 12, 2016

Tune In

Nothing is Real in Markets Anymore

In my interview with Eric King of King World News on February 12, I discussed that we live in an unreal world. Whether we look at stocks, bonds or property these markets are not real. And nor are most...

Egon von Greyerz / February 13, 2013

Read More

Why QE Will Accelerate & Gold Will Follow

Some investors are disappointed as gold only went up 7% in USD in 2012. After having compounded at over 19% p.a. over 11 years, gold certainly should be allowed to just gain 7% without some people cal...

Egon von Greyerz / January 17, 2013

Read More

Plus ça change, plus c’est la même chose

The more things change, the more they stay the same No, nothing new. More QE and gold go down. In addition, another downpour of economic news confirms the total inability of central banks and governm...

Egon von Greyerz / December 19, 2012

Read More

What Catalyst Will Trigger Gold’s Parabolic Rise

Seldom in history are investment decisions self-evident. But today we have such a situation. Gold is the only real and the only honest money. Gold reflects governments’ deceitful actions in destroying...

Egon von Greyerz / November 27, 2012

Read More

Two Absolutely Incredible & Key Gold Charts

Central Banks worldwide are refusing to have public audits of their gold holdings. In addition, many of the Central Banks don’t hold their gold in their home country. I have been saying for years that...

Egon von Greyerz / October 29, 2012

Read More

Printing Money – Price of Gold – Preservation of Wealth

Egon von Greyerz / October 9, 2012

Read More

Concerted QE – The Beginning of HYPERINFLATION

We are living in unprecedented times. The perceived prosperity that the world has enjoyed in the last 100 years, and in particular the last 40 years, is coming to an end. The debt-based wealth that ha...

Egon von Greyerz / September 21, 2012

Read More

Gold & Silver Off To The Races

Last week was the 41st anniversary of one of the most disastrous days in world history. The 15th of August 1971 was a fatal day for the world economy and is likely to lead to more human misery than an...

Egon von Greyerz / August 22, 2012

Read More

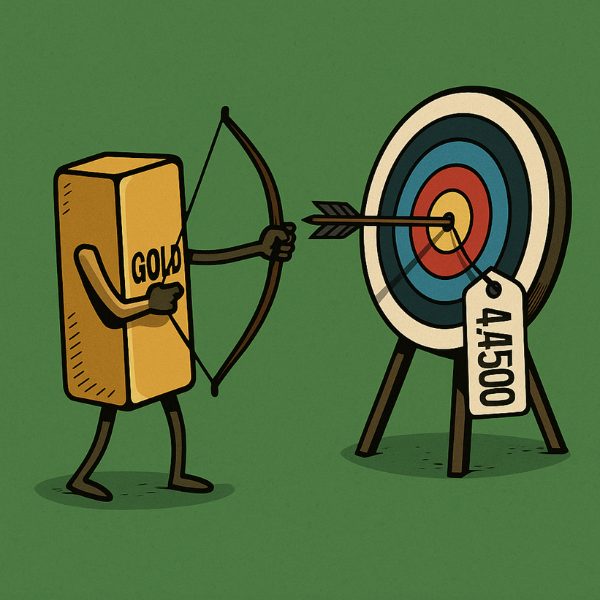

Alf Field Confirms Next Gold Target As $4,500

Alf Field, the most eminent gold forecaster, has issued a new article in which he confirms that gold has now finished its correction and that the next move will be a “violent upside action…...

Egon von Greyerz / July 31, 2012

Read More

Why Gold Will Erupt Right Now

All the king’s horses and all the king’s menCould never hold gold down, Amen! Intervention, manipulation and suppression We have gold intervention, manipulation and suppression by governments, banks a...

Egon von Greyerz / July 18, 2012

Read More