Egon von Greyerz

Founder and Chairman Born with dual Swiss/Swedish citizenship, Egon's education was mainly in Sweden.Egon von Greyerz began his professional life in Geneva as a banker and thereafter spent 17 years as the Finance Director and Executive Vice-Chairman of Dixons Group Plc. During that time, Dixons expanded from a small photographic retailer to a FTSE 100 company and the largest consumer electronics retailer in the UK.

During the 1990s, Egon von Greyerz became actively involved with financial investment activities including mergers and acquisitions and asset allocation consultancy for private family funds. This led to the creation of VON GREYERZ as an asset management company based on wealth preservation principles.

VON GREYERZ is now the world’s leading company for direct investor ownership of physical gold and silver outside the banking system. Our vaults include the biggest and safest gold vault in the world, located in the Swiss Alps. Clients include High Net Worth Individuals, Family Offices, Pension Funds, Investment Funds and Trusts in over 90 countries.

Egon von Greyerz makes regular media appearances and speaks at investment conferences around the world. He also publishes articles on precious metals, the world economy and wealth preservation.

Insights & Articles

The World is on the Edge of a Deflationary Black Hole

The world economy is now at its most dangerous point in history. In virtually every major country or region, there are problems of a magnitude which individually could trigger a collapse of the financ...

Egon von Greyerz / September 29, 2016

Read More

As Euro, Yen And Dollars Fall Investors Will Turn To Gold

In my King World News audio interview early this week, I discussed with Eric King how investors will flee from the major currencies into gold as the currencies start reflecting the imminent major mone...

Egon von Greyerz / September 23, 2016

Tune In

Gold Is The Ultimate Wealth Preservation Against Reckless Governments

The autumn of 2016 has for some time looked like a period when dark clouds will move in over the world economy. Therefore, it was not surprising to see the first sign of things to come in the next few...

Egon von Greyerz / September 16, 2016

Read More

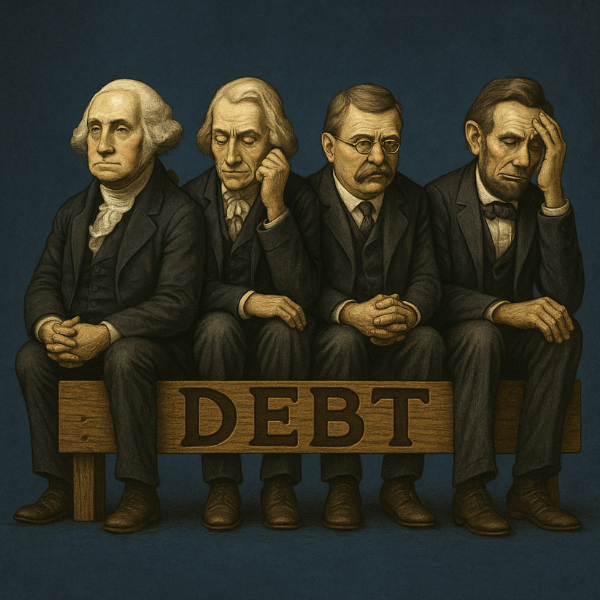

The Six Presidents Causing US Bankruptcy

Since Reagan came to power in 1981, the US has had a total of five presidents who have spent ever-increasing amounts of money to hang on to power and buy votes. This has resulted in the most extraordi...

Egon von Greyerz / September 9, 2016

Read More

As The World Economy Is Burning Central Bankers Are Clueless

The more things change, the more they stay the same. The financial world loves focusing on some future event that they think will change everything. There is always some economic data, an important me...

Egon von Greyerz / September 1, 2016

Read More

Final Catastrophe of the Currency System

The fate of the global economy was decided decades ago as deficits, debts and derivatives started their exponential growth and reached the time bomb phase that we are now in. This final chapter of thi...

Egon von Greyerz / August 25, 2016

Read More